Power Device Analyzer Market by Type (Both AC and DC, AC and DC), Current (Below 1000A and Above 1000A), End user (Automotive, Energy, Telecommunication, Consumer Electronics and Appliances, Medical) and Region - Global Forecast to 2027

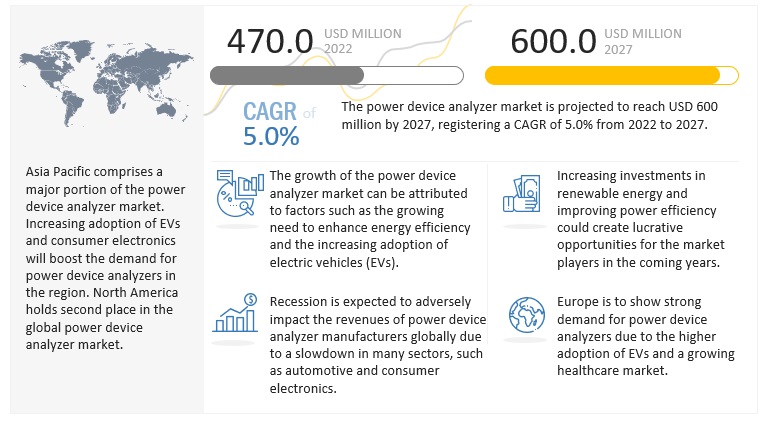

[193 Pages Report] The global power device analyzer market in terms of revenue was estimated to worth $470 million in 2022 and is poised to reach $600 million by 2027, growing at a CAGR of 5.0 % from 2022 to 2027. Power device analyzer is been widely used in various industries and is having a robust growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Map

To know about the assumptions considered for the study, download the pdf brochure

Power Device Analyzer Market Dynamics

Driver: Increasing adoption of power-efficient devices across various industries

Energy savings is a major concern for every industry. Thus, there has been a constant development of technologies across all industries to achieve greater efficiency and save energy. Furthermore, there is an emerging demand for integrating new-age technologies with the industries to get real-time data and achieve greater efficiency, ultimately saving energy. For example, emerging economies such as China, India, and Brazil are witnessing growth in consumer electronics products with the advent of Internet of Things (IoT) and 5G technologies. The increased demand for smart technology-enabled electronic devices with improved functionalities has led to the development of power-efficient and high-performance consumer electronic products. New age power device analyzers come with detection technology that can provide harmonic distortion readings, comprehensive power quality readings, and three-dimensional charts. These features help ensure a better power supply, thus protecting equipment from future damage and increasing their lifetime. The power device analyzer market thus leverages the increasing adoption of high-efficiency systems.

Restraints: Expanding grey market

The supply of the power device analyzer is very much strong in the gray market as the cost of the branded device is more than the one which is manufactured locally. Because of this major players in the power device analyzer market face a competition from unknown players who sell in the gray market. These unknowns players in the market are gray market and the local players. These gray market players usually import the goods and sell it through an unauthorized dealer, whereas local players manufacture goods in house and sell it with their local name. Big players face problems such as price, competitiveness, and local supply from these unknown players as it is difficult for them to maintain and achieve. Apart from this many small scale and medium scale industries prefer to buy goods from local players mainly in developing countries because of the reduced cost. This reduces the opportunities for global players. These factors affect the growth of the branded power device analyzer manufacturers

Opportunities: Growing market for IoT devices to boost the demand for power device analyzers

In the past five years, global internet penetration has risen at a tremendous pace. The emergence of IoT and smart applications platforms is an important factor for the general growth of the power device analyzer industry. With the help of technologies, the variation has been created in IoT-enabled devices, such as smartphones, smart TVs, smart ACs, and other electronic gadgets. These emerging IoT technologies require proper testing and equipment measuring facilities. Therefore, IoT-enabled devices are driving the growth of the power device analyzer market as devices based on these technologies need to be tested to ensure that they can communicate and interoperate seamlessly. IoT-enabled devices are expensive and are used in various end user sectors, such as automobile, healthcare, and aerospace and defense. The use of IoT-enabled devices at these end user industries present significant growth opportunities for the test and measurement companies due to specific and strict standards of accuracy, reliability, latency, and availability to be met by them.

Challenges: Requirement of skilled personnel to operate power device analyzers

Power device analyzer requires high skilled personnel with a strong technical background to operate and access the testing or optimize the power conversion system. These analyzers test devices that transform, generate, or consume electricity and measure parameters, such as current, voltage, power, harmonics, and phase. These will require a technically skilled person to understand the methodologies to conduct the tasks. According to the Talent Shortage Survey, ~44% of employers worldwide report that they cannot find the skills they need in people to employ them. So, developing and underdeveloped countries such as Madagascar, Central African Republic, Niger, Nigeria, Cuba, Ecuador, and Guyana from Africa and South America that have a shortage of skilled personnel in the industries will restrain the market’s growth. For instance, in January 2018, according to the Department of Labor, the US economy had 7.6 million unfilled jobs, but only 6.5 million people were looking for work. This shortage of skilled workers is a major restraint for the growth of the power device analyzer market.

Market Trend

By type, Both AC and DC segment is predicted to have the highest CAGR of 5.1% in the power device analyzer market in the period of 2022 to 2027.

Both AC and DC type segment is predicted to have the highest growth rate in the power device analyzer market by type in forecasted period of 2022 – 2027. It is also estimated to account the greatest share in the market. The factors such as rising government initiatives for implementation of energy audits and mandatory regulations , increased demand for Electric Vehicles are positively influencing the both AC & DC segment in type of power device analyzer market.

By current, the below 1000A segment is predicted to have the highest CAGR of 5.2% in the power device analyzer market in the period of 2022 to 2027.

The below 1000A segment is estimated to have a highest growth rate by current in the power device analyzer market for the forecasted period 2022 – 2027. They also account for the greatest market share. Most of the industries uses below 1000A power device analyzers. Industries like Energy, aerospace & defense, automotive, healthcare equipment manufacturing and wireless communication. The automotive industry widely uses power device analyzers of below 1000A.

By end user, the consumer electronics and appliances segment is predicted to have the highest CAGR of 5.2% in the power device analyzer market in the period of 2022 to 2027.

The consumer electronics and appliances is predicted to have the highest CAGR in the power device analyzer market. Top companies witnessed an increase in demand for consumer electronics, such as air conditioners, smartphones, refrigerators, laptops, smart TVs, and smartwatches, reflecting significant growth in the consumer electronic sector. According to India Brand Equity Foundation (IBEF), the consumer electronics and appliances industry is expected to double to reach USD 21.18 billion by 2025. Thus, an increase in sales of the consumer appliances will require power device analyzers Thereby driving the power device analyzer market.

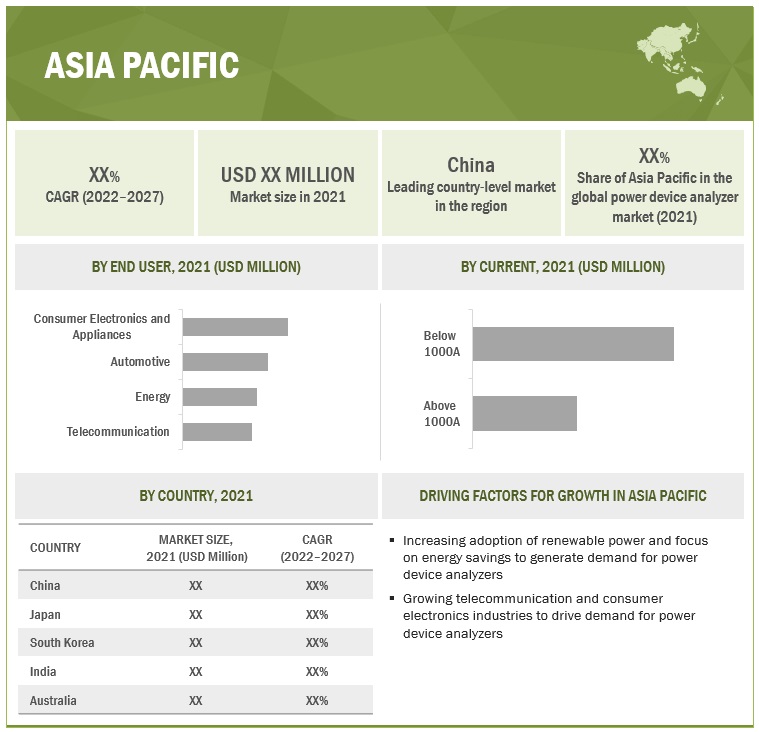

Asia Pacific has the highest market share in the power device analyzer market

Asia pacific is predicted to have a highest CAGR among other regions with the highest market share of 54.3%. The increased adoption of clean energy and focus towards energy savings are driving the power device analyzer market in this region. The growth of industries such as consumer electronics and automotive are expected to influence the market.

Key Market Players

The major players in the power device analyzer market include Keysight Technologies (US), Fluke Corporation (US), Yokogawa (Japan), Iwatsu (Japan), and Hioki E E Corporation (Japan).

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Type, Current, and End user |

|

Geographies covered |

Asia Pacific, North America, Middle East & Africa, South America, and Europe |

|

Companies covered |

Fluke Corporation (US), Keysight Technologies (US), Yokogawa Electric Corporation (Japan), Iwatsu Electric (Japan), Hioki E E Corporation (Japan), Newtons4th (UK), Rohde & Schwarz (Germany), Carlo Gavazzi (Switzerland), Vitrek (US), Circutor (Spain), ZES ZIMMER Electronic Systems (Germany), Texas Instruments (US), PCE Instruments (UK), Extech Instruments (US), Dewetron (Austria), Magtrol (US), Dewesoft D O O (Slovenia), Janitza Electronics (Germany), Arbiter Systems (US), Valhalla Scientific (US) |

This research report categorizes the power device analyzer market based by type, current, and end user.

Based on type, the power device analyzer market has been segmented as follows:

- Both AC and DC

- AC

- DC

Based on Current, the power device analyzer market has been segmented as follows:

- Below 1000 A

- Above 1000 A

Based on End user, the power device analyzer market has been segmented as follows:

- Automotive

- Energy

- Telecommunication

- Consumer Electronics and Appliances

- Medical

- Others – Aerospace, Defence and Government services

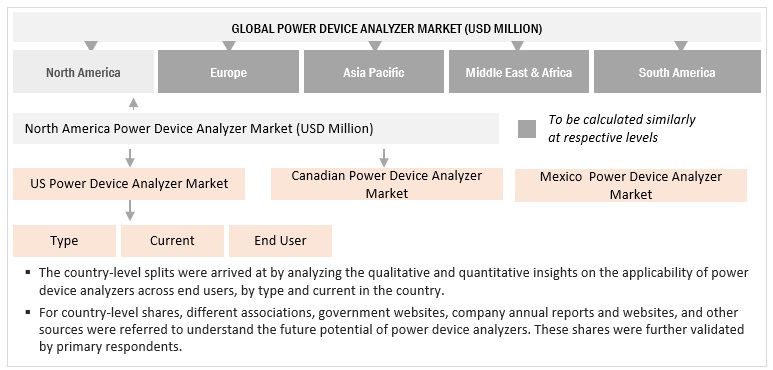

Based on the region, the power device analyzer market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- Middle East & Africa

Recent Developments

- In May 2021, Iwatsu launched Curve Tracer CS-8000 series. The series can test up to 5kV, 2000A.

- In December 2020, Keysight introduced N6705C DC power analyzer. For greater convenience, all sourcing and measuring functions are available from the front panel. Keysight now offers a recessed binding post (RBP) option with the N6705C for added safety when using banana plugs.

- In October 2020, Yokogawa Electric Corporation was awarded a contract by Oman government to supply an analyzer package solution for Liwa Plastics Industries Complex that is being built for Oman Oil Refineries and Petroleum Industries Company.

- In March 2019, ROHDE & SCHWARZ was awarded a contract by University of Aalborg to supply test equipment for the Electronic Engineering IoT living laboratory which includes oscilloscope, power analyzer, and radio scanner.

Frequently Asked Questions (FAQ):

What is the current size of the power device analyzer market?

The current market size of global power device analyzer market is estimated to be USD 457 million in 2021.

What are the major drivers for power device analyzer market?

Rising focus on energy savings, growth of electric vehicle market and increasing adoption of power efficient devices across various industries are the major drivers for power analyzer market..

Which is the fastest-growing region during the forecasted period in power device analyzer market?

Asia Pacific is the fastest-growing region during the forecasted period.

Which is the fastest-growing segment, by end user during the forecasted period in power device analyzer market?

Automotive is to be the fastest-growing segment by component during forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising focus on energy savings- Increasing adoption of power-efficient devices across various industries- Growth of electric vehicles marketRESTRAINTS- Expanding gray marketOPPORTUNITIES- Growing focus on energy audits and regulations- Increasing adoption of power device analyzers by renewable energy sectors- Growing market for IoT devicesCHALLENGES- High initial cost of installation- Requirement of skilled personnel

-

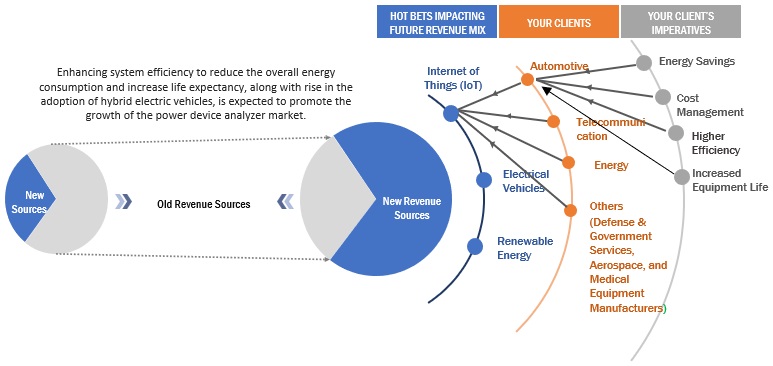

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR POWER DEVICE ANALYZER PROVIDERS

- 5.4 PRICING ANALYSIS

- 5.5 MARKET MAP

-

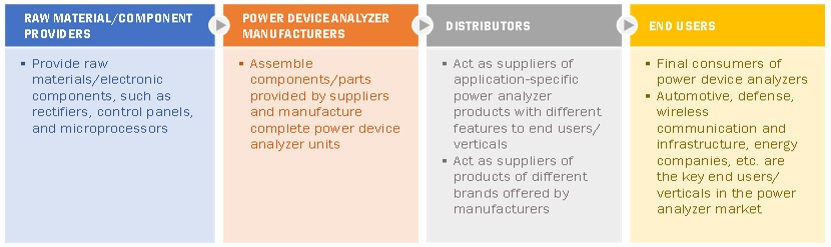

5.6 VALUE/SUPPLY CHAIN ANALYSISRAW MATERIAL/COMPONENT PROVIDERSPOWER DEVICE ANALYZER MANUFACTURERSDISTRIBUTORS AND AFTER-SALES SERVICESEND USERS

-

5.7 TECHNOLOGY ANALYSISPOWER DEVICE ANALYZER MARKET BASED ON DIFFERENT TECHNOLOGIES

- 5.8 POWER DEVICE ANALYZER: CODES AND REGULATIONS

- 5.9 INNOVATIONS AND PATENT REGISTRATIONS

-

5.10 CASE STUDY ANALYSISMAJOR METROPOLITAN TRANSIT SYSTEM USES VITREK POWER DEVICE ANALYZER TO MONITOR HIGH-POWER DC FEEDERS- Problem statement- SolutionPERFORMING POWER QUALITY STUDIES AND TROUBLESHOOTING LOADS- Problem statement- SolutionHIGH-PRECISION POWER DEVICE ANALYZER FOR ENGINE TEST BENCHES- Problem statement- Solution

-

5.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 INTRODUCTION

-

6.2 BOTH AC AND DCUSE OF AC AND DC POWER DEVICE ANALYZERS IN VARIOUS END-USER INDUSTRIES

-

6.3 ACMANDATORY REGULATIONS FOR ENERGY AUDITS IN EUROPEAN COUNTRIES

-

6.4 DCINCREASING DEPLOYMENT OF EVS AND GROWING RENEWABLE ENERGY SECTOR

- 7.1 INTRODUCTION

-

7.2 BELOW 1000ARISE IN DEMAND FOR ELECTRIC VEHICLES TO FUEL DEMAND

-

7.3 ABOVE 1000AGROWTH IN CONSUMER ELECTRONICS INDUSTRY TO DRIVE MARKET

- 8.1 INTRODUCTION

-

8.2 CONSUMER ELECTRONICS AND APPLIANCESGROWING DEMAND FOR CONSUMER ELECTRONIC PRODUCTS IN ASIA PACIFIC

-

8.3 AUTOMOTIVERISING ADOPTION OF ELECTRIC VEHICLES AND INCREASING INVESTMENTS IN AUTONOMOUS VEHICLES

-

8.4 TELECOMMUNICATIONINCREASE IN NUMBER OF DATA CENTERS AND GROWTH OF TELECOM SECTOR

-

8.5 ENERGYRISE IN GLOBAL POWER CONSUMPTION

-

8.6 MEDICALINCREASING INVESTMENTS FOR ELECTRICAL EQUIPMENT IN HEALTHCARE SECTOR

-

8.7 OTHERSSTRONG DEMAND FROM AEROSPACE AND DEFENSE SECTOR

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTBY TYPEBY CURRENTBY END USERBY COUNTRY- China- Japan- Australia- South Korea- India- Rest of Asia Pacific

-

9.3 NORTH AMERICANORTH AMERICA: RECESSION IMPACTBY TYPEBY CURRENTBY END USERBY COUNTRY- US- Canada- Mexico

-

9.4 EUROPEEUROPE: RECESSION IMPACTBY TYPEBY CURRENTBY END USERBY COUNTRY- UK- Germany- France- Russia- Spain- Italy- Rest of Europe

-

9.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBY TYPEBY CURRENTBY END USERBY COUNTRY- Brazil- Argentina- Chile- Rest of South America

-

9.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTBY TYPEBY CURRENTBY END USERBY COUNTRY- Saudi Arabia- UAE- South Africa- Rest of Middle East & Africa

- 10.1 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET EVALUATION FRAMEWORK

- 10.4 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- 10.5 COMPETITIVE SCENARIO

-

10.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING

-

11.1 KEY PLAYERSKEYSIGHT TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYOKOGAWA ELECTRIC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFLUKE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIWATSU ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHIOKI E.E. CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROHDE & SCHWARZ- Business overview- Products/Solutions/Services offered- Recent developmentsCARLO GAVAZZI- Business overview- Products/Solutions/Services offered- Recent developmentsNEWTONS4TH- Business overview- Products/Solutions/Services offeredVITREK- Business overview- Products/Solutions/Services offered- Recent developmentsCIRCUTOR- Business overview- Products/Solutions/Services offered- Recent developmentsZES ZIMMER ELECTRONIC SYSTEMS GMBH- Business overview- Products/Solutions/Services offered- Recent developmentsTEXAS INSTRUMENTS- Business overview- Products/Solutions/Services offered- Recent developmentsPCE INSTRUMENTS- Business overview- Products/Solutions/Services offeredEXTECH INSTRUMENTS- Business overview- Products/Solutions/Services offeredDEWETRON- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER KEY PLAYERSMAGTROLDEWESOFT D.O.OJANITZA ELECTRONICS GMBHARBITER SYSTEMSVALHALLA SCIENTIFIC

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS

- TABLE 1 MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

- TABLE 2 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

- TABLE 3 MARKET, BY CURRENT: INCLUSIONS & EXCLUSIONS

- TABLE 4 SNAPSHOT OF MARKET

- TABLE 5 PRICING ANALYSIS OF POWER DEVICE ANALYZERS

- TABLE 6 MARKET: ECOSYSTEM

- TABLE 7 MARKET: CODES AND REGULATIONS

- TABLE 8 MARKET: INNOVATIONS AND PATENT REGISTRATIONS, APRIL 2016–SEPTEMBER 2021

- TABLE 9 MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 10 MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 11 BOTH AC AND DC: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 12 AC: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 13 DC: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 14 MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 15 BELOW 1000A: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 16 ABOVE 1000A: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 17 MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 18 CONSUMER ELECTRONICS AND APPLIANCES: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 19 AUTOMOTIVE: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 20 TELECOMMUNICATION: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 21 ENERGY: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 22 MEDICAL: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 23 OTHERS: MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 24 MARKET, BY REGION, 2019–2027 (USD MILLION)

- TABLE 25 MARKET, BY VOLUME, 2019–2027 (MILLION UNITS)

- TABLE 26 ASIA PACIFIC: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 27 ASIA PACIFIC: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 28 ASIA PACIFIC: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 29 ASIA PACIFIC: MARKET, BY COUNTRY 2019–2027 (USD MILLION)

- TABLE 30 CHINA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 31 CHINA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 32 CHINA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 33 JAPAN: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 34 JAPAN: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 35 JAPAN: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 36 AUSTRALIA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 37 AUSTRALIA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 38 AUSTRALIA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 39 SOUTH KOREA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 40 SOUTH KOREA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 41 SOUTH KOREA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 42 INDIA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 43 INDIA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 44 INDIA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 45 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 46 REST OF ASIA PACIFIC: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 47 REST OF ASIA PACIFIC: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 48 NORTH AMERICA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 49 NORTH AMERICA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 50 NORTH AMERICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

- TABLE 52 US: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 53 US: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 54 US: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 55 CANADA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 56 CANADA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 57 CANADA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 58 MEXICO: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 59 MEXICO: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 60 MEXICO: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 61 EUROPE: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 62 EUROPE: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 63 EUROPE: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 64 EUROPE: MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

- TABLE 65 UK: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 66 UK: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 67 UK: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 68 GERMANY: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 69 GERMANY: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 70 GERMANY: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 71 FRANCE: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 72 FRANCE: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 73 FRANCE: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 74 RUSSIA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 75 RUSSIA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 76 RUSSIA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 77 SPAIN: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 78 SPAIN: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 79 SPAIN: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 80 ITALY: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 81 ITALY: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 82 ITALY: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 83 REST OF EUROPE: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 84 REST OF EUROPE: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 85 REST OF EUROPE: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 86 SOUTH AMERICA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 87 SOUTH AMERICA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 88 SOUTH AMERICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 89 SOUTH AMERICA: MARKET, BY COUNTRY 2019–2027 (USD MILLION)

- TABLE 90 BRAZIL: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 91 BRAZIL: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 92 BRAZIL: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 93 ARGENTINA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 94 ARGENTINA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 95 ARGENTINA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 96 CHILE: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 97 CHILE: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 98 CHILE: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 99 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 100 REST OF SOUTH AMERICA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 101 REST OF SOUTH AMERICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 102 MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 104 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2019–2027 (USD MILLION)

- TABLE 106 SAUDI ARABIA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 107 SAUDI ARABIA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 108 SAUDI ARABIA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 109 UAE: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 110 UAE: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 111 UAE: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 112 SOUTH AFRICA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 113 SOUTH AFRICA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 114 SOUTH AFRICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2019–2027 (USD MILLION)

- TABLE 116 REST OF MIDDLE EAST & AFRICA: MARKET, BY CURRENT, 2019–2027 (USD MILLION)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2019–2027 (USD MILLION)

- TABLE 118 OVERVIEW OF STRATEGIES ADOPTED BY TOP PLAYERS, JANUARY 2017–APRIL 2021

- TABLE 119 MARKET: DEGREE OF COMPETITION

- TABLE 120 MARKET EVALUATION FRAMEWORK

- TABLE 121 MARKET: PRODUCT LAUNCHES, JANUARY 2017– DECEMBER 2022

- TABLE 122 MARKET: DEALS, JUNE 2017–DECEMBER 2022

- TABLE 123 MARKET: OTHERS, JULY 2017–DECEMBER 2022

- TABLE 124 COMPANY PRODUCT FOOTPRINT

- TABLE 125 COMPANY END USER FOOTPRINT

- TABLE 126 COMPANY CURRENT FOOTPRINT

- TABLE 127 COMPANY REGION FOOTPRINT

- TABLE 128 KEYSIGHT TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 129 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 130 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 131 YOKOGAWA ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 132 YOKOGAWA ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES

- TABLE 134 YOKOGAWA ELECTRIC CORPORATION: OTHERS

- TABLE 135 FLUKE CORPORATION: COMPANY OVERVIEW

- TABLE 136 FLUKE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 FLUKE CORPORATION: PRODUCT LAUNCHES

- TABLE 138 FLUKE CORPORATION: DEALS

- TABLE 139 IWATSU ELECTRIC: COMPANY OVERVIEW

- TABLE 140 IWATSU ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 IWATSU ELECTRIC: DEALS

- TABLE 142 IWATSU INSTRUMENTS: OTHERS

- TABLE 143 HIOKI E.E. CORPORATION: COMPANY OVERVIEW

- TABLE 144 HIOKI E.E. CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 HIOKI E.E. CORPORATION: PRODUCT LAUNCHES

- TABLE 146 ROHDE & SCHWARZ: COMPANY OVERVIEW

- TABLE 147 ROHDE & SCHWARZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 ROHDE & SCHWARZ: OTHERS

- TABLE 149 CARLO GAVAZZI: COMPANY OVERVIEW

- TABLE 150 CARLO GAVAZZI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 CARLO GAVAZZI: PRODUCT LAUNCHES

- TABLE 152 NEWTONS4TH: COMPANY OVERVIEW

- TABLE 153 NEWTONS4TH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 VITREK: COMPANY OVERVIEW

- TABLE 155 VITREK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 VITREK: PRODUCT LAUNCHES

- TABLE 157 VITREK: DEALS

- TABLE 158 CIRCUTOR: COMPANY OVERVIEW

- TABLE 159 CIRCUTOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 CIRCUTOR: PRODUCT LAUNCHES

- TABLE 161 ZES ZIMMER ELECTRONIC SYSTEMS GMBH: COMPANY OVERVIEW

- TABLE 162 ZES ZIMMER ELECTRONIC SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 ZES ZIMMER ELECTRONIC SYSTEMS: PRODUCT LAUNCHES

- TABLE 164 TEXAS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 165 TEXAS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 166 TEXAS INSTRUMENTS: DEALS

- TABLE 167 PCE INSTRUMENTS: COMPANY OVERVIEW

- TABLE 168 PCE INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 EXTECH INSTRUMENTS: COMPANY OVERVIEW

- TABLE 170 EXTECH INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 DEWETRON: COMPANY OVERVIEW

- TABLE 172 DEWETRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 DEWETRON: DEALS

- FIGURE 1 MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

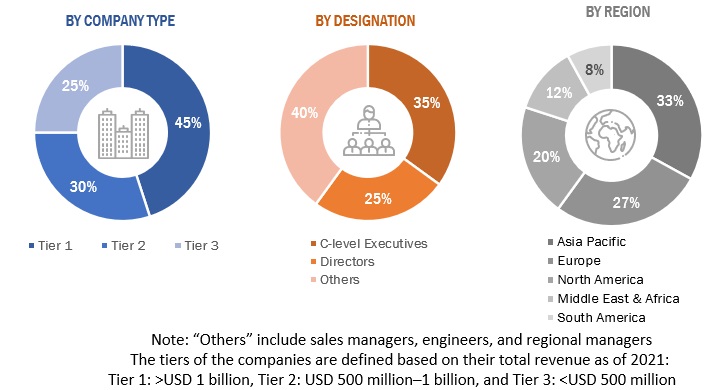

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR POWER DEVICE ANALYZERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 7 MAIN METRICS CONSIDERED IN ASSESSING SUPPLY FOR MARKET

- FIGURE 8 MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 INDUSTRY CONCENTRATION, 2021

- FIGURE 10 BOTH AC AND DC SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 BELOW 1000A SEGMENT EXPECTED TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 AUTOMOTIVE SEGMENT EXPECTED TO ACQUIRE LARGER MARKET SHARE OF MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC DOMINATED MARKET IN 2021

- FIGURE 14 RISING NEED FOR ENERGY EFFICIENCY TO DRIVE MARKET

- FIGURE 15 AUTOMOTIVE SEGMENT AND CHINA DOMINATED MARKET IN ASIA PACIFIC IN 2021

- FIGURE 16 BOTH AC AND DC SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 17 BELOW 1000A SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 AUTOMOTIVE END USER SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC, SOUTH AMERICA, AND NORTH AMERICA TO BE FASTEST-GROWING MARKETS FOR POWER DEVICE ANALYZERS DURING FORECAST PERIOD

- FIGURE 20 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 INVESTMENTS IN ENERGY EFFICIENCY BY REGION, 2014–2018

- FIGURE 22 GLOBAL EV (CARS) SALES, 2016–2020 (UNITS)

- FIGURE 23 TRADE FLOW BY ICT GOODS CATEGORY (USD MILLION)

- FIGURE 24 REVENUE SHIFT FOR MARKET

- FIGURE 25 MARKET MAP/ECOSYSTEM

- FIGURE 26 MARKET VALUE CHAIN ANALYSIS

- FIGURE 27 PORTER’S FIVE FORCES ANALYSIS FOR MARKET

- FIGURE 28 MARKET, BY TYPE, 2021 (%)

- FIGURE 29 MARKET, BY CURRENT, 2021 (%)

- FIGURE 30 MARKET, BY END USER, 2021 (%)

- FIGURE 31 REGIONAL SNAPSHOT: MARKET IN ASIA PACIFIC, SOUTH AMERICA, AND NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 MARKET, IN TERMS OF VALUE, BY REGION, 2021

- FIGURE 33 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 34 NORTH AMERICA: REGIONAL SNAPSHOT

- FIGURE 35 EUROPE: REGIONAL SNAPSHOT

- FIGURE 36 LEADING PLAYERS IN POWER DEVICE ANALYZER MARKET

- FIGURE 37 TOP FIVE PLAYERS IN POWER DEVICE ANALYZER MARKET FROM 2017 TO 2021

- FIGURE 38 COMPANY EVALUATION QUADRANT: POWER DEVICE ANALYZER MARKET, 2021

- FIGURE 39 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 40 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 IWATSU ELECTRIC: COMPANY SNAPSHOT

- FIGURE 42 CARLO GAVAZZI: COMPANY SNAPSHOT

- FIGURE 43 TEXAS INSTRUMENTS: COMPANY SNAPSHOT

This study involved major activities in estimating the current size of the power device analyzer market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Country-wise analysis were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global power analyzer market. The other secondary sources included press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The power device analyzer market comprises several stakeholders, such as product manufacturers, service providers, distributors, and end-users in the supply chain. The demand-side of this market is characterized by its various end-user industries. Moreover, the demand is also driven by the rising demand of increasing energy saving and improving efficiency across every industry. The supply side is characterized by rising demand for contracts from the end user industries, and new product launches. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the power device analyzer market ecosystem.

Report Objectives

- To define, describe, and forecast the size of the power device analyzer market by type, current, and end user.

- To estimate and forecast the global power device analyzer market for various segments with respect to 5 main regions, namely, North America, Europe, South America, Middle East & Africa, and Asia Pacific in terms of value and volume

- To provide detailed information regarding the drivers, restraints, opportunities, and industry-specific challenges that influence the market growth

- To provide a detailed overview of the power device analyzer value chain, along with industry trends, use cases, security standards, and Porter’s five forces

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments and detail the competitive landscape for market players

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as joint ventures, mergers and acquisitions, contracts, and agreements, and new product launches, in the power device analyzer market

- To benchmark players within the market using the proprietary competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy excellence and strength of product portfolio

- This report covers the power device analyzer market size in terms of value and volume.

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Power Device Analyzer Market