Pool & Spa Market by Type (Pools - Lap, Wading, Heated; Spas - Electric, Steam, Sauna, Hydromassage Bath), Accessories (Filters, Chlorinators, Blowers, Cleaners, Covers, Suction Fittings, Pumps), Material and Region - Global Forecast to 2027

[235 Pages Report] The pool & spa market is expected to grow from an estimated USD 19.1 billion in 2022 to USD 23.6 billion by 2027, at a CAGR of 4.3% during the forecast period. The luxury real estate market has made a very strong comeback since the onset of the pandemic. There is now a growing demand for larger homes that provide a healthy lifestyle and bring people closer to nature. Moreover, due to COVID-19, this segment of residential homes has evolved into a domain of family health and wellness. The increase in income and budget for home purchases and surging demand for attractive amenities greatly impact the construction of a spa, gym, and swimming pool in a residential complex.

To know about the assumptions considered for the study, Request for Free Sample Report

Pool & Spa Market Dynamics

Driver: High dependency on tourism and adventure activities

The pace of recovery remains slow and uneven across world regions due to varying degrees of mobility restrictions, vaccination rates, and traveler confidence post-COVID-19. Wellness and spa tourism have been growing rapidly on a global level, with Europe as a key player. This has driven the tourism industry and eventually increased the demand for swimming pools and spas for recreational purposes. Also, an increase in the number of tourists in a particular region will drive the demand for hotels and homestays. The construction of hotels and homestays will subsequently drive the demand for swimming pools and spas in that facility. Next to wellness tourism, the modern concept of a spa center includes a diverse range of services, which positively affect the psychophysical health of its consumers. This could be a significant driving factor for the pool & spa market.

Restraints: Surging adverse environmental impacts

Water conservation is a priority worldwide. The average domestic swimming pool holds between 20,000 and 60,000 liters of water. Water that is not filtered and balanced can become so contaminated it has to be drained away and replaced, which causes huge wastage to a greater extent. Poorly maintained pools may also require more frequent backwashing. Therefore, the best way to conserve water is to maintain the right chemical balance and ensure that the filtration is adequate. With such a high demand for energy resources, the volatility in energy prices centers on changes in supply and demand. Economic conditions, availability of energy resources, and increasing demand are prime factors contributing to price volatility. This could be a restraining factor since swimming pools and spas consume a lot of electricity to operate their components or accessories. Electricity is the main operating source for each component involved in a swimming pool or a spa.

Opportunities: Expansion of construction industry

Residential sector was the largest end-use sector and a key driver in increasing the demand for swimming pools and spas worldwide. While North America is expected to be the fastest-growing region for residential development, the Asia Pacific region will continue to be the most active. Construction activities fuel the demand for swimming pools to be installed in residential and commercial settings for various recreational activities. Therefore, a rise in construction activities will help the pool and spa industry grow in the coming years. It is creating an opportunity for the global swimming pool market. Attractive amenities in residential complexes draw more attention from property buyers. Hence, it influences builders to include gym facilities and a swimming pool in their projects.

Challenges: Instability in raw material prices

Raw materials, mostly crude oil and natural gas, but also coal are extracted as a complex combination of hundreds of components that must then be processed. The refining process converts crude oil into various petroleum compounds that are then transformed into usable chemicals. The changing crude oil prices in the last few years have affected the plastic value chain and caused a similar trend in the unit prices of the basic raw materials, primarily used in the production of components or accessories involved in the pool & spa market. This fluctuation can mount pressure on manufacturers to reduce the prices of filters, blowers, covers, etc., to have a competitive edge in the market.

The lap pools segment by type is expected to occupy the largest share from 2022 to 2027

Based on the type, pools is estimated to be the largest pool and spa industry from 2020 to 2027. In pools segment the lap pools are expected to carry the largest share in the market. Lap pools are meant for swimming laps. They are not the most family-friendly option, but they are excellent for swimmers using a pool for exercise. They are rectangular in shape and very long usually 30 to 70 feet. Annual maintenance costs are lower for lap pools than most other pools because there’s less water to deal with. As residential lots have become smaller, lap pools is expected to gain popularity and drive the market pool & spa.

Pool pumps by accessories is projected to emerge as the largest segment for pool & spa market

Based on the accessories, pool pumps is projected to hold the highest market share during the forecast period. Pool pumps are essential for a pool’s or spa’s circulation system. Pool or water bodies pumps are available in horizontal, single- stage, centrifugal, self-priming pumps. Swimming pool pumps draw water in through centrifugal force, pass the water through a filter, and push the water back into the pool. Variable-speed pumps are the latest innovations in pool equipment technology.

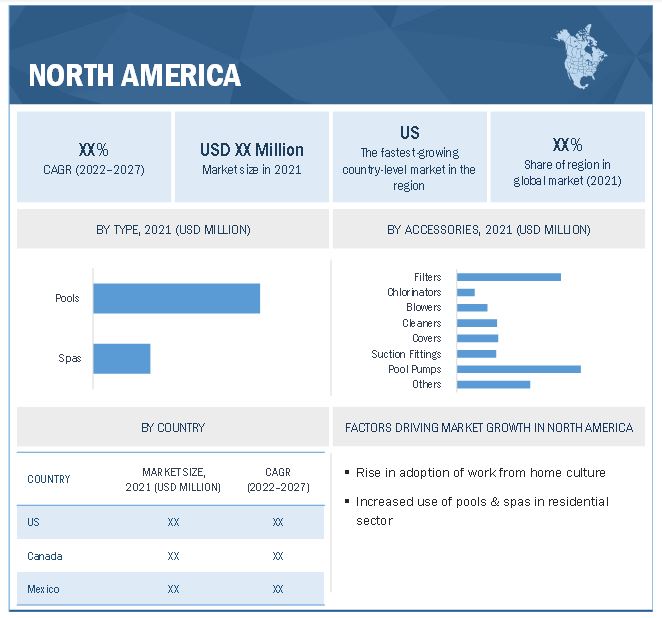

North America is expected to account for the largest market size during the forecast period.

North America region expected to dominate the pool & spa industry during the forecast period. In 2021, Canada’s total construction investment climbed by almost 11% year-over-year, with advancements in residential and non-residential sectors increasing by 14% and 8%, respectively. Also, Mexico has witnessed growth in its construction sector. The growing residential construction is expected to drive the demand for pools & spas in this region. Also, the rising consumer inclination toward wellness therapies, especially post-COVID-19, has increased health awareness in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Players

Harvia Group (Finland), Pentair (US), Fluidra (Spain), KLAFS GmbH & Co. KG (Germany), TyloHelo (Sweden), Kohler Co. (US), Arctic Spas (Canada), Roca (Spain), Jaquar (India), Bullfrog Spas (US)

Scope of the report

|

Report Metric |

Details |

|

Market Size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

Pool and Spa Market by Type, Accessories, and Material |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Harvia Group (Finland), Pentair (US), Fluidra (Spain), KLAFS GmbH & Co. KG (Germany), TyloHelo (Sweden), Roca (Spain), SAWO Inc. (Philippines), Kohler Co. (US), Jaquar (India), Bullfrog Spas (US), Coast Spas Manufacturing Inc. (Canada), BTL (US), Unbescheiden GmbH (Germany), Duravit AG (Germany), Narvi Oy (Finland), Stas Doyer (France), Physiotherm (Austria), Effe (Italy), Leisure Baths Ltd. (Canada) |

This research report categorizes the pool & spa market based on type, accessories, material, and region.

Based on type:

-

Spas

- Electric Spas

- Steam Baths

- Saunas

- Hydromassage Bathtubs

-

Pools

- Lap Pools

- Wading Pools

- Heated Pools

- Others (Spray Pools, Natural Pools, Zero-edge Pools)

Based on accessories:

- Filters

- Chlorinators

- Blowers

- Cleaners

- Covers

- Suction Fittings

- Pool Pumps

- Others (Biocides, pH adjusters, Odor controllers)

Based on material:

- Plastic

- Rubber

- Fiberglass

- Stainless Steel

- Others (Concrete, Ceramic)

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In January 2022, The new wellness area had a recreational stainless steel swimming pool and many water features: air beds, hydro-massage benches, cascades, neck massage jets, etc.

- In October 2021, Harvia Group signed up an exclusive distribution agreement with Bergman Ltd, a company, headquartered in Tokyo, and plans to open 50 Harvia Sauna & Spa showrooms in Japan within the next 3 years. Japan has a mature spa culture. It also has an evolving sauna market and Harvia has been supplying heaters to Japan for over 15 years.

- In October 2021, Pentair acquired Pleatco for approximately USD 255 million. Pleatco manufactures water filtration and clean air technologies for pool, spa, and industrial air customers.

Frequently Asked Questions (FAQs):

What is the current size of the pool & spa market?

The current market size of global pool & spa market is estimated to be USD 19.1 billion in 2022.

What is the major drivers for pool & spa market?

Due to the pandemic, consumers have spent relatively more time in their homes due to remote work and remote education. Thus, families are scouting for larger configurations to accommodate more time at home for everyone in the family. This has driven the demand for swimming pools and spas for recreational purposes in the residential sectors. The concept of wellness has been around for a long time surging. These days, consumers view wellness through a much broader and more sophisticated lens, encompassing not just fitness and nutrition but also overall physical and mental health and appearance. Also, wellness and spa should be in line with global trends and desires of current and potential clients to keep driving the pool & spa market.

Which is the largest-growing region during the forecasted period in pool & spa market?

North America is expected to account for the largest market size during the forecast period. The countries covered in the region are US, Canada, and Mexico. The major end-users for pools & spas in the region include commercial & residential sectors. The growing construction industries drive the market in the region. The construction industry is a major contributor to region’s economic growth. As the region’s economy recovered from the COVID-19 crisis, construction investments soared in 2021. This has driven the market for pools & spas in the region. The rising investment in construction industry is expected to drive the pool & spa market in the region.

Which is the fastest-growing segment, by type during the forecast period in pool & spa market?

The spas is expected to grow at the fastest CAGR during the forecast period. The saunas are expected to grow the fastest in the forecasted period. Saunas are mainly found in health clubs, community centers, or local gyms. The main part of any sauna is a heater which has a specific design to produce high temperature at constant rate.The traditional steam sauna needs some water every 2-6 minutes for steam production and to maintain humidity level. The benefits of saunas are the increased blood flow to the skin surface which is beneficial for blood circulation. Saunas are becoming popular in commercial as well as residential settings. The driving factors of the sauna market are growing health awareness among people which is leading to increase in usage of saunas in new residential construction, as well as growth in commercial use.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 POOL & SPA MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

1.3.2 MARKET, BY ACCESSORY: INCLUSIONS AND EXCLUSIONS

1.3.3 MARKET, BY MATERIAL: INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 POOL & SPA MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

FIGURE 3 KEY DATA FROM PRIMARY SOURCES

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR POOLS & SPAS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

2.3.3.1 Regional analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF POOLS & SPAS

FIGURE 9 MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 42)

TABLE 1 POOL & SPA MARKET SNAPSHOT

FIGURE 10 NORTH AMERICA DOMINATED MARKET IN 2021

FIGURE 11 POOLS TO ACCOUNT FOR LARGER MARKET SHARE BETWEEN 2022 AND 2027

FIGURE 12 SAUNAS TO LEAD MARKET FROM 2022 TO 2027

FIGURE 13 LAP POOLS TO DOMINATE MARKET FROM 2022 TO 2027

FIGURE 14 POOL PUMPS TO DOMINATE MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN POOL & SPA MARKET

FIGURE 15 RISING HEALTH AWARENESS AMONG PEOPLE EXPECTED TO DRIVE MARKET DURING FORECAST PERIOD

4.2 MARKET, BY REGION

FIGURE 16 NORTH AMERICAN MARKET TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4.3 NORTH AMERICA: POOL & SPA MARKET, BY TYPE AND COUNTRY, 2021

FIGURE 17 POOLS HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2021

4.4 MARKET, BY TYPE

FIGURE 18 POOLS TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

4.5 MARKET, BY SPAS

FIGURE 19 SAUNAS TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

4.6 MARKET, BY POOLS

FIGURE 20 LAP POOLS TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

4.7 MARKET, BY ACCESSORY

FIGURE 21 POOL PUMPS TO DOMINATE POOL AND SPA MARKET BY 2027

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 GLOBAL PROPAGATION OF COVID-19

FIGURE 23 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 24 REVISED GDP FOR SELECTED G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 25 POOL & SPA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 High dependency on tourism and adventure activities

TABLE 2 TRAVEL & TOURISM CONTRIBUTION TO GDP IN G20 COUNTRIES, 2021 (USD BILLION)

5.4.1.2 Rising consumer awareness about wellness therapies

5.4.1.3 Increase in spending capacity driving demand for luxury homes

5.4.2 RESTRAINTS

5.4.2.1 Surging adverse environmental impacts

FIGURE 26 TOTAL ELECTRICITY CONSUMPTION (EJ), 2010−2019

TABLE 3 ELECTRICITY PRICES IN SELECTED OECD COUNTRIES, 2021 (USD/UNIT)

5.4.2.2 High operating and maintenance costs

5.4.3 OPPORTUNITIES

5.4.3.1 Expansion of construction industry

FIGURE 27 CONSTRUCTION INDUSTRY GROWTH, BY REGION, 2021−2030

5.4.4 CHALLENGES

5.4.4.1 Instability in raw material prices

FIGURE 28 AVERAGE CRUDE OIL PRICE PER BARREL, MAY 2021−MAY 2022

5.5 COVID-19 IMPACT

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR POOL & SPA PROVIDERS

FIGURE 29 REVENUE SHIFT FOR POOL & SPA PROVIDERS

5.7 MARKET MAP

FIGURE 30 MARKET MAP: POOL & SPA MARKET

TABLE 4 MARKET: ROLE IN ECOSYSTEM

5.8 VALUE CHAIN ANALYSIS

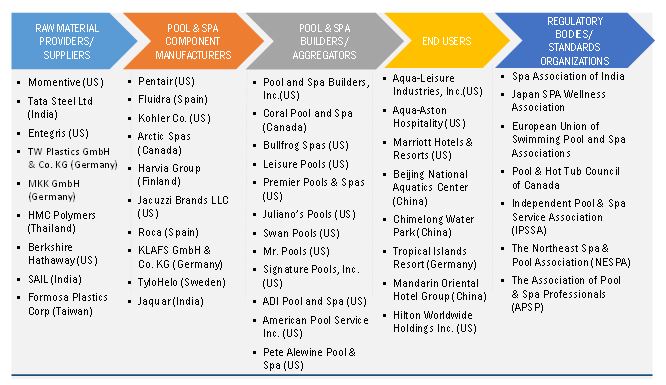

FIGURE 31 VALUE CHAIN ANALYSIS: POOL AND SPA MARKET

5.8.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.8.2 POOL & SPA COMPONENT MANUFACTURERS

5.8.3 POOL & SPA BUILDERS/AGGREGATORS

5.8.4 END USERS

5.8.5 POST-SALES SERVICES

5.9 TECHNOLOGY ANALYSIS

5.9.1 AUTOMATIC POOL CLEANING SYSTEMS

5.9.2 CONNECTED POOL: IOP (INTERNET OF POOLS)

5.10 KEY CONFERENCES & EVENTS TO BE HELD DURING 2022–2024

TABLE 5 POOL & SPA MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.11 TARIFFS, CODES, AND REGULATIONS

5.11.1 TARIFFS RELATED TO MARKET

TABLE 6 IMPORT TARIFFS FOR HS 842129 FILTERING/PURIFYING MACHINERY FOR LIQUIDS IN 2019

TABLE 7 IMPORT TARIFFS FOR HS 950699 EQUIPMENT FOR SPORTS, SWIMMING, AND PADDLING POOLS IN 2019

TABLE 8 IMPORT TARIFFS FOR HS 841370 CENTRIFUGAL PUMPS IN 2019

5.12 TRADE ANALYSIS

5.12.1 TRADE ANALYSIS FOR HS 842129 FILTERING/PURIFYING MACHINERY FOR LIQUIDS

5.12.1.1 Export scenario

TABLE 9 EXPORT SCENARIO FOR HS CODE: 842129, BY COUNTRY, 2019–2021 (USD)

5.12.1.2 Import scenario

TABLE 10 IMPORT SCENARIO FOR HS CODE: 842129, BY COUNTRY, 2019–2021 (USD)

5.12.2 TRADE ANALYSIS FOR HS 950699 EQUIPMENT FOR SPORTS, SWIMMING, AND PADDLING POOLS

5.12.2.1 Export scenario

TABLE 11 EXPORT SCENARIO FOR HS CODE: 950699, BY COUNTRY, 2019–2021 (USD)

5.12.2.2 Import scenario

TABLE 12 IMPORT SCENARIO FOR HS CODE: 950699, BY COUNTRY, 2019–2021 (USD)

5.12.3 TRADE ANALYSIS FOR HS 841370 CENTRIFUGAL PUMPS

5.12.3.1 Export scenario

TABLE 13 EXPORT SCENARIO FOR HS CODE: 841370, BY COUNTRY, 2019–2021 (USD)

5.12.3.2 Import scenario

TABLE 14 IMPORT SCENARIO FOR HS CODE: 841370, BY COUNTRY, 2019–2021 (USD)

5.12.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.5 CODES AND REGULATIONS RELATED TO MARKET

TABLE 19 MARKET: CODES AND REGULATIONS

5.13 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 20 POOL & SPA: INNOVATIONS AND PATENT REGISTRATIONS, OCTOBER 2019–APRIL 2022

5.14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS FOR POOL & SPA MARKET

TABLE 21 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF SUBSTITUTES

5.14.2 BARGAINING POWER OF SUPPLIERS

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 THREAT OF NEW ENTRANTS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 22 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

5.16 BUYING CRITERIA

FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 23 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.17 CASE STUDY ANALYSIS

5.17.1 PIONEER RECREATION AND SPORTS CENTRE TO RELY ON LIQTECH’S MODERN CERAMIC FILTER TECHNOLOGY

5.17.1.1 Problem statement: February 2022

5.17.1.2 Solution

5.17.2 PLATINUM SPAS LAUNCHED INNOVATIVE ENERGY-EFFICIENT SOLUTION

5.17.2.1 Problem Statement: February 2022

5.17.2.2 Solution

6 POOL & SPA MARKET, BY TYPE (Page No. - 91)

6.1 INTRODUCTION

FIGURE 35 MARKET, BY TYPE, 2021

TABLE 24 MARKET, BY TYPE, 2020–2027 (USD MILLION)

6.2 SPAS

6.2.1 GROWING AWARENESS OF WELLNESS THERAPIES EXPECTED TO BOOST MARKET

FIGURE 36 SPAS: MARKET, BY TYPE, 2021

TABLE 25 SPAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.1 Electric spas

TABLE 26 ELECTRIC SPAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.2 Steam baths

TABLE 27 STEAM BATHS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.3 Saunas

TABLE 28 SAUNAS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.2.1.4 Hydromassage bathtubs

TABLE 29 HYDROMASSAGE BATHTUBS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 POOLS

6.3.1 GROWTH IN TOURISM SECTOR EXPECTED TO DRIVE DEMAND FOR POOLS WORLDWIDE

FIGURE 37 POOLS: MARKET, BY TYPE, 2021

TABLE 30 POOLS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.1 Lap pools

TABLE 31 LAP POOLS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.2 Wading pools

TABLE 32 WADING POOLS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.3 Heated pools

TABLE 33 HEATED POOLS: MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3.1.4 Others

TABLE 34 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7 POOL & SPA MARKET, BY ACCESSORY (Page No. - 100)

7.1 INTRODUCTION

FIGURE 38 MARKET, BY ACCESSORY, 2021 (%)

TABLE 35 MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

7.2 FILTERS

7.2.1 PROVISION OF CLEAN WATER EXPECTED TO DRIVE MARKET FOR FILTERS

TABLE 36 FILTERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 CHLORINATORS

7.3.1 CONTROL OVER RATE OF CHLORINE IN POOL WATER TO DRIVE SEGMENT’S GROWTH

TABLE 37 CHLORINATORS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.4 BLOWERS

7.4.1 PROVISION OF ADDITIONAL EFFECTS TO BOOST DEMAND FOR BLOWERS

TABLE 38 BLOWERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.5 CLEANERS

7.5.1 EFFECTIVE AUTOMATIC CLEANING TO BOOST DEMAND FOR CLEANERS

TABLE 39 CLEANERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.6 COVERS

7.6.1 ADVANTAGE OF ENERGY SAVINGS TO BOOST DEMAND FOR COVERS

TABLE 40 COVERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.7 SUCTION FITTINGS

7.7.1 REDUCTION OF INJURIES TO INCREASE DEMAND FOR SUCTION FITTINGS

TABLE 41 SUCTION FITTINGS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.8 POOL PUMPS

7.8.1 ADVANTAGE OF REDUCTION IN ELECTRICITY BILLS TO BOOST DEMAND FOR POOL PUMPS

TABLE 42 POOL PUMPS: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.9 OTHER ACCESSORIES

TABLE 43 OTHER ACCESSORIES: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 POOL & SPA MARKET, BY MATERIAL (Page No. - 109)

8.1 INTRODUCTION

8.2 PLASTIC

8.2.1 HYGIENIC AND DISEASE PREVENTION LIKELY TO FUEL MARKET

8.3 RUBBER

8.3.1 WATER RETENTION PROPERTY TO DRIVE MARKET

8.4 FIBERGLASS

8.4.1 LOW MAINTENANCE COSTS TO BOOST MARKET GROWTH

8.5 STAINLESS STEEL

8.5.1 STRONG AND LIGHTWEIGHT QUALITIES OF STAINLESS STEEL TO DRIVE MARKET

8.6 OTHERS

8.6.1 EASY CLEAN AND MAINTENANCE OPTION TO BOOST MARKET FOR CERAMIC

9 POOL & SPA MARKET, BY REGION (Page No. - 112)

9.1 INTRODUCTION

FIGURE 39 MARKET SHARE, BY REGION, 2021 (%)

FIGURE 40 NORTH AMERICAN MARKET TO REGISTER HIGHEST CAGR FROM 2022 TO 2027

TABLE 44 MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 41 SNAPSHOT: NORTH AMERICA MARKET

9.2.1 BY TYPE

TABLE 45 NORTH AMERICA: POOL & SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.2.2 BY ACCESSORY

TABLE 46 NORTH AMERICA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

9.2.3 BY COUNTRY

TABLE 47 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.2.3.1 US

9.2.3.1.1 Work from home culture to drive market

TABLE 48 US: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 49 US: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 50 US: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.2.3.2 Canada

9.2.3.2.1 Growing construction industry to drive market

TABLE 51 CANADA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 52 CANADA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 53 CANADA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.2.3.3 Mexico

9.2.3.3.1 Increasing demand for residential spaces to drive market

TABLE 54 MEXICO: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 55 MEXICO: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 56 MEXICO: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3 EUROPE

FIGURE 42 SNAPSHOT: EUROPE MARKET

9.3.1 BY TYPE

TABLE 57 EUROPE: POOL & SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

9.3.2 BY COUNTRY

TABLE 59 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.2.1 Germany

9.3.2.1.1 Renovation of buildings to drive market

TABLE 60 GERMANY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 61 GERMANY: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 62 GERMANY: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3.2.2 Italy

9.3.2.2.1 Harsh winters to drive market

TABLE 63 ITALY: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 64 ITALY: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 ITALY: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3.2.3 UK

9.3.2.3.1 Booming construction industry to drive market

TABLE 66 UK: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 UK: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 68 UK: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3.2.4 France

9.3.2.4.1 Rising investments in commercial projects to drive market

TABLE 69 FRANCE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 70 FRANCE: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 71 FRANCE: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.3.2.5 Rest of Europe

TABLE 72 REST OF EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 REST OF EUROPE: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 74 REST OF EUROPE: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

9.4.1 BY TYPE

TABLE 75 ASIA PACIFIC: POOL & SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

9.4.2 BY COUNTRY

TABLE 77 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.4.2.1 China

9.4.2.1.1 Increasing investments in construction industry to drive market

TABLE 78 CHINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 CHINA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 80 CHINA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.4.2.2 India

9.4.2.2.1 Rising demand for luxury homes to drive market

TABLE 81 INDIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 82 INDIA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 83 INDIA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.4.2.3 Japan

9.4.2.3.1 Rise in wellness therapies to drive market

TABLE 84 JAPAN: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 JAPAN: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 JAPAN: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.4.2.4 Australia

9.4.2.4.1 Expanding home renovations to drive market

TABLE 87 AUSTRALIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 88 AUSTRALIA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 89 AUSTRALIA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.4.2.5 Rest of Asia Pacific

TABLE 90 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 REST OF ASIA PACIFIC: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 92 REST OF ASIA PACIFIC: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.5 MIDDLE EAST & AFRICA

9.5.1 BY TYPE

TABLE 93 MIDDLE EAST & AFRICA: POOL & SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 MIDDLE EAST & AFRICA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

9.5.2 BY COUNTRY

TABLE 95 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.5.2.1 UAE

9.5.2.1.1 Increasing construction of hotels to drive market

TABLE 96 UAE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 UAE: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 98 UAE: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.5.2.2 Saudi Arabia

9.5.2.2.1 Popularity as a tourist destination to drive market

TABLE 99 SAUDI ARABIA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 SAUDI ARABIA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 SAUDI ARABIA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.5.2.3 South Africa

9.5.2.3.1 Hot climatic conditions to drive market

TABLE 102 SOUTH AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 SOUTH AFRICA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 SOUTH AFRICA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.5.2.4 Rest of Middle East & Africa

TABLE 105 REST OF MIDDLE EAST & AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 REST OF MIDDLE EAST & AFRICA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 107 REST OF MIDDLE EAST & AFRICA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.6 SOUTH AMERICA

9.6.1 BY TYPE

TABLE 108 SOUTH AMERICA: POOL & SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 SOUTH AMERICA: MARKET, BY ACCESSORY, 2020–2027 (USD MILLION)

9.6.2 BY COUNTRY

TABLE 110 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.6.2.1 Brazil

9.6.2.1.1 Increasing adventure and water sports to drive market

TABLE 111 BRAZIL: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 112 BRAZIL: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 BRAZIL: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.6.2.2 Argentina

9.6.2.2.1 Variety of wellness programs to drive market

TABLE 114 ARGENTINA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 ARGENTINA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 116 ARGENTINA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.6.2.3 Rest of South America

TABLE 117 REST OF SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 REST OF SOUTH AMERICA: SPA MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 REST OF SOUTH AMERICA: POOL MARKET, BY TYPE, 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 148)

10.1 KEY PLAYER STRATEGIES

TABLE 120 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, AUGUST 2018–APRIL 2022

10.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 121 POOL & SPA MARKET: DEGREE OF COMPETITION

FIGURE 43 MARKET SHARE ANALYSIS, 2021

10.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 44 TOP PLAYERS IN MARKET FROM 2017 TO 2021

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 PERVASIVE PLAYERS

10.4.3 EMERGING LEADERS

10.4.4 PARTICIPANTS

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2021

10.5 START-UP/SME EVALUATION QUADRANT, 2021

10.5.1 PROGRESSIVE COMPANIES

10.5.2 RESPONSIVE COMPANIES

10.5.3 DYNAMIC COMPANIES

10.5.4 STARTING BLOCKS

FIGURE 46 MARKET: START-UP/SME EVALUATION QUADRANT, 2021

10.6 COMPETITIVE BENCHMARKING

TABLE 122 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 123 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

10.7 POOL & SPA MARKET: COMPANY FOOTPRINT

TABLE 124 BY TYPE: COMPANY FOOTPRINT

TABLE 125 BY ACCESSORY: COMPANY FOOTPRINT

TABLE 126 BY REGION: COMPANY FOOTPRINT

TABLE 127 COMPANY FOOTPRINT

10.8 COMPETITIVE SCENARIO

TABLE 128 MARKET: PRODUCT LAUNCHES, SEPTEMBER 2019–NOVEMBER 2020

TABLE 129 MARKET: DEALS, FEBRUARY 2019–JUNE 2022

TABLE 130 MARKET: OTHERS, JANUARY 2019–JANUARY 2022

11 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 HARVIA GROUP

TABLE 131 HARVIA GROUP: BUSINESS OVERVIEW

FIGURE 47 HARVIA GROUP: COMPANY SNAPSHOT (2021)

TABLE 132 HARVIA GROUP: PRODUCTS OFFERED

TABLE 133 HARVIA GROUP: DEALS

TABLE 134 HARVIA GROUP: OTHERS

11.1.2 PENTAIR

TABLE 135 PENTAIR: BUSINESS OVERVIEW

FIGURE 48 PENTAIR: COMPANY SNAPSHOT (2021)

TABLE 136 PENTAIR: PRODUCTS OFFERED

TABLE 137 PENTAIR: PRODUCT LAUNCHES

TABLE 138 PENTAIR: DEALS

TABLE 139 PENTAIR: OTHERS

11.1.3 FLUIDRA

TABLE 140 FLUIDRA: BUSINESS OVERVIEW

FIGURE 49 FLUIDRA: COMPANY SNAPSHOT (2021)

TABLE 141 FLUIDRA: PRODUCTS OFFERED

TABLE 142 FLUIDRA: DEALS

11.1.4 KLAFS GMBH & CO. KG

TABLE 143 KLAFS GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 144 KLAFS GMBH & CO. KG: PRODUCTS OFFERED

TABLE 145 KLAFS GMBH & CO. KG: DEALS

11.1.5 TYLOHELO

TABLE 146 TYLOHELO: BUSINESS OVERVIEW

TABLE 147 TYLOHELO: PRODUCTS OFFERED

11.1.6 ROCA

TABLE 148 ROCA: BUSINESS OVERVIEW

FIGURE 50 ROCA: COMPANY SNAPSHOT (2020)

TABLE 149 ROCA: PRODUCTS OFFERED

TABLE 150 ROCA: PRODUCT LAUNCHES

TABLE 151 ROCA: DEALS

11.1.7 SAWO INC.

TABLE 152 SAWO INC.: BUSINESS OVERVIEW

TABLE 153 SAWO INC.: PRODUCTS OFFERED

11.1.8 KOHLER CO.

11.1.9 ARCTIC SPAS

TABLE 159 ARCTIC SPAS: BUSINESS OVERVIEW

TABLE 161 ARCTIC SPAS: PRODUCT LAUNCHES

11.1.10 JAQUAR

TABLE 162 JAQUAR: COMPANY OVERVIEW

TABLE 163 JAQUAR: PRODUCTS OFFERED

TABLE 164 JAQUAR: PRODUCT LAUNCHES

TABLE 165 JAQUAR: OTHERS

11.1.11 BULLFROG SPAS

TABLE 166 BULLFROG SPAS: BUSINESS OVERVIEW

TABLE 167 BULLFROG SPAS: PRODUCTS OFFERED

TABLE 168 BULLFROG SPAS: PRODUCT LAUNCHES

TABLE 169 BULLFROG SPAS: OTHERS

11.1.12 COAST SPAS MANUFACTURING INC.

TABLE 170 COAST SPAS MANUFACTURING INC.: COMPANY OVERVIEW

TABLE 171 COAST SPAS MANUFACTURING INC.: PRODUCTS OFFERED

11.1.13 BTL

TABLE 172 BTL: COMPANY OVERVIEW

TABLE 173 BTL: PRODUCTS OFFERED

TABLE 174 BTL: OTHERS

11.1.14 DURAVIT AG

TABLE 175 DURAVIT AG: COMPANY OVERVIEW

TABLE 176 DURAVIT AG: PRODUCTS OFFERED

TABLE 177 DURAVIT AG: PRODUCT LAUNCHES

TABLE 178 DURAVIT AG: DEALS

11.1.15 NARVI OY

TABLE 179 NARVI OY: COMPANY OVERVIEW

TABLE 180 NARVI OY: PRODUCTS OFFERED

11.2 OTHER PLAYERS

11.2.1 UNBESCHEIDEN GMBH

11.2.2 STAS DOYER

11.2.3 PHYSIOTHERM

11.2.4 EFFE

11.2.5 LEISURE BATHS LTD.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

11.3 LIST OF MORE PLAYERS AS MARKET IS FRAGMENTED

12 APPENDIX (Page No. - 227)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATION

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

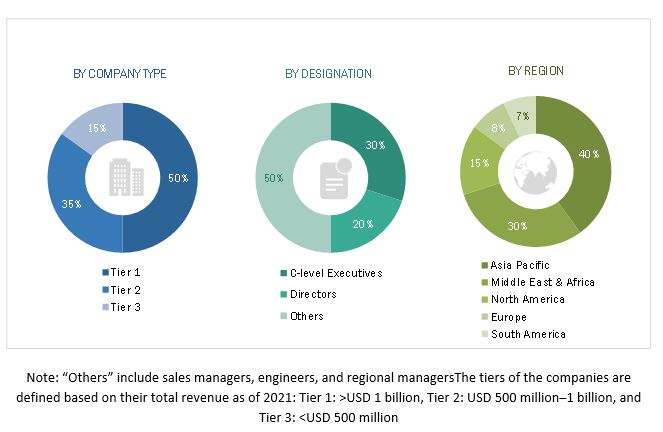

This study involved major activities in estimating the current size of the pool & spa market. Comprehensive secondary research was done to collect information on the market, peer market, and parent market. The next step involved was validation of these findings, assumptions, and market sizing with industry experts across the value chain through primary research. The total market size was estimated through country-wise analysis. Then, the market breakdown and data triangulation were performed to estimate the market size of the segments and sub-segments.

Secondary Research

The secondary research involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global market. The other secondary sources comprised press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturers, associations, trade directories, and databases.

Primary Research

The pool & spa market comprises several stakeholders, such as raw material providers/suppliers, component manufacturers, pool & spa builders/aggregators, service providers, end-users in the supply chain. The demand-side of this market is characterized by end-users. Moreover, the demand is also fueled by the growing demand of residential and commercial sectors. The supply side is characterized by rising demand for contracts from the residential and commercial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

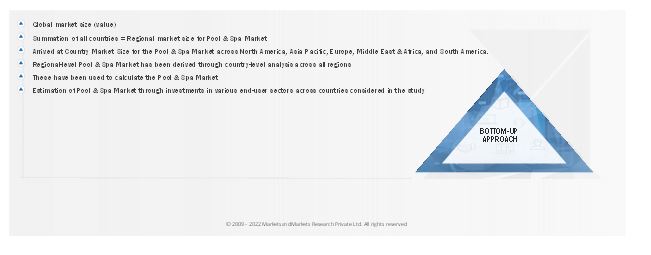

Market Size Estimation

The bottom-up approach has been used to estimate and validate the size of the pool & spa market.

In this approach, the pool & spa production statistics for each product type have been considered at a country and regional level.

Extensive secondary and primary research has been carried out to understand the global market scenario for various types of pool & spa.

Several primary interviews have been conducted with key opinion leaders related to pool & spa system development, including key OEMs and Tier I suppliers.

Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Pool & Spa Market Size: Bottom-Up Approach

Data Triangulation

The overall market size is estimated using the market size estimation processes as explained above, followed by splitting of the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market ecosystem.

Report Objectives

- To define, describe, segment, and forecast the pool & spa market by type, accessories, material, in terms of value

- To forecast the market size for five key regions: North America, Europe, Asia Pacific, Middle East & Africa, South America along with their key countries, in terms of value

- To provide comprehensive information about the drivers, restraints, opportunities, and industry-specific challenges that affect the market growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as agreements, sales contracts, partnerships, new product launches, acquisitions, joint ventures, contracts, expansions, and investments in the market

- This report covers the pool & spa market size in terms of value

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pool & Spa Market