Commercial Water Heaters Market by Type (Electric, Gas, Oil, Heat Pump, Solar, Hybrid & Others), Liter(Below 500, 500-1,000, 1,000-3,000, 3,000-4,000 & more), Rated Capacity (Up to 10kW, 10-50kW, 50-150kW & more),and Region - Global Forecast to 2026

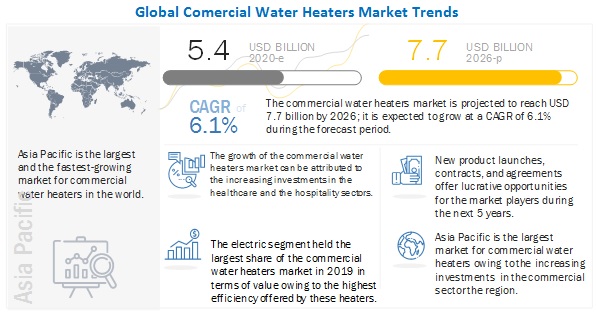

The global commercial water heaters market in terms of revenue was estimated to worth $5.4 billion in 2020 and is poised to reach $7.7 billion by 2026, growing at a CAGR of 4.1 % from 2020 to 2026.

Factors driving the growth of the commercial water heaters market include increasing investments for the development and expansion of commercial sector operations across different regions. In addition, supportive regulations and grants for using renewable sources of energy in different applications are also expected to play a key role in the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Commercial water heaters Market Dynamics

Driver: Flourishing global commercial sector

The commercial sector consists of service-providing facilities such as institutional living quarters, sewage treatment plants, medical facilities (hospitals and clinics), hotels, restaurants, motels, holiday homes, commercial complexes, shopping malls, and community and public places. It plays an important role in the GDP of developed and emerging economies of the world. For instance, according to the Department of Business, Energy, and Industrial Strategy, the commercial sector operations contributed a share of 71.0% to the total GDP of the UK in 2019, and this sector in the country is expected to grow at a rate of 1.4% annually. According to the US Bureau of Economic Analysis (BEA), the real estate sector was among the top 3 sectors to contribute a share of 6.4% to the GDP of the country in 2018. The GDP of the US grew at a rate of 3.2% in 2019. Moreover, according to the National Association of Realtors (NAR), the commercial real estate of the US ranged between USD 14 and USD 17 trillion as of the third quarter of 2019, and it is expected to grow at a rate of 4.7% in 2020. According to the Canadian Real Estate Wealth magazine, an investment of USD 36.9 billion is expected to take place in the Canadian commercial real estate sector in 2020, that is, USD 3.7 billion more than the investment made this sector in 2019.

On a similar note, the European Union has laid a roadmap for the development of new hospitals and primary healthcare facilities from 2021 to 2027 in the region. These facilities have a constant requirement of heated water for various processes, including cleaning, bathing, swimming, and drinking, as well as for commercial cleaning of vehicles and carpets. They also require it for laundries and sanitization purposes. In addition, during winters, cold regions such as parts of North America and Europe witness sub-zero degrees Celsius temperatures. This is expected to drive the demand for commercial water heating, thereby leading to the growth of the commercial water heaters market across the world.

Restraint: High capital expenditure (CapEx) for development of commercial water heaters

Commercial water heaters have a relatively long lifespan of nearly 10 to 15 years. The key manufacturers of these heaters take a number of precautionary measures to ensure their proper functioning over the years. They offer high-grade glass tanks and chemically-coated tanks, equipped with high-quality corrosion-resistant piping and tubing. Manufacturers of commercial water heaters use high-grade processes and materials, as well as require skilled labor and advanced tools for developing them, thereby leading to their increasing manufacturing costs. Companies such as RHEEM Manufacturing, Hitachi, and American Water Heaters offer stainless steel tanks, glass tanks, auto-cleaning tanks, and foam-insulated tanks. Some manufacturers also offer customized products for consumers with site-specific requirements, which increase the manufacturing costs of water heaters. Moreover, as commercial water heaters are operated 24x7, their repair and maintenance require special efforts such as the disconnection of gas/oil supply pipes, exhaust pipes, and heat exchangers. This additional effort makes maintenance and repair of water heaters complex and time-consuming. Thus, high CapEx requirements are key restraints for the growth of the commercial water heaters market from 2020 to 2026.

Opportunity: Integration of commercial water heaters with new-age technologies

Commercial water heaters have been present in the market for several years. However, their designs and operations have relatively remained unchanged. With the new generation commercial water heaters focusing on offering ease of operations and increased comfort, automation and remote operations have been one of the top priorities in their development. Presently, commercial water heaters are equipped with LCD, warning indicators, etc., to make them user-friendly. Companies such as A.O. Smith and a few others are focusing on integrating different technologies in their commercial water heaters to ensure their ease of operations and maintenance. Research activities are also being carried out globally for incorporating machine learning and artificial intelligence in water heaters. They are expected to reduce water and electricity wastage, along with ensuring the ease of operations. For instance, water heaters incorporated with machine learning and artificial intelligence are capable of understanding the usage pattern of consumers and analyzing their operational time and duration, thereby eliminating the requirement of users switching them on or off physically. All these factors are expected to act as opportunities for the growth of the commercial water heaters market.

Challenge : Operational losses in commercial water heaters

Commercial water heaters are often less maintained owing to their continuous and uninterrupted operations. Thus, the heating element that is used for heat transfer in them corrodes over time, thereby significantly decreasing their heat transfer capability. Tank-type commercial water heaters suffer from sedimentation and other common problems owing to their constant emersion in water. Oil- and gas-fired commercial water heaters require special pipelines for supplying fuel and carrying exhaust of the burnt fuel. These extra pipelines make the overall system highly complex to install, repair, and maintain.

Moreover, if commercial water heaters are not maintained regularly, their pipes are prone to clogging. In electric commercial water heaters, if contacts are not snug, it makes them prone to electric shocks and short-circuits. These technical factors act as key challenges for the growth of the commercial water heaters market.

By type, the electric segment is the largest contributor in the commercial water heaters market during the forecast period.

The electric segment is estimated to be the largest- segment of the commercial water heaters market, by type, from 2020 to 2026. Electric water heaters offer exceptionally high operational efficiency ranging from 95% to 98%. They are mainly used in Asia Pacific owing to the fact that countries such as China, India, South Korea, and Japan are focusing on limiting their carbon footprint resulting from the use of fossil fuels.

By liter, the below 500 liters segment is expected to grow at the fastest rate during the forecast period.

Commercial water heaters falling under this category are compact and hence, are easy to install. They provide ample hot water for almost all small commercial applications. Hence, water heaters with this capacity are suitable for low hot water requirement applications in small commercial establishments. Small individual commercial water heaters of below 500 liters capacity are used in the hospitality sector for holiday homes and motels as they ensure interruption-free availability of hot water for bathing, personal laundry, etc. applications.

By rated capacity, the 10–50kW segment is expected to be the largest contributor during the forecast period.

The 10–50kW segment is estimated to dominate the market from 2020 to 2026. In the commercial sector, the requirement of instant hot water has been rising at a significant rate. This led to the deployment of high-powered water heaters to cater to this instant hot water requirements. Commercial water heaters with 10–50kW rated capacity are easy to use, offer high operational efficiency, and reduce water wastage.

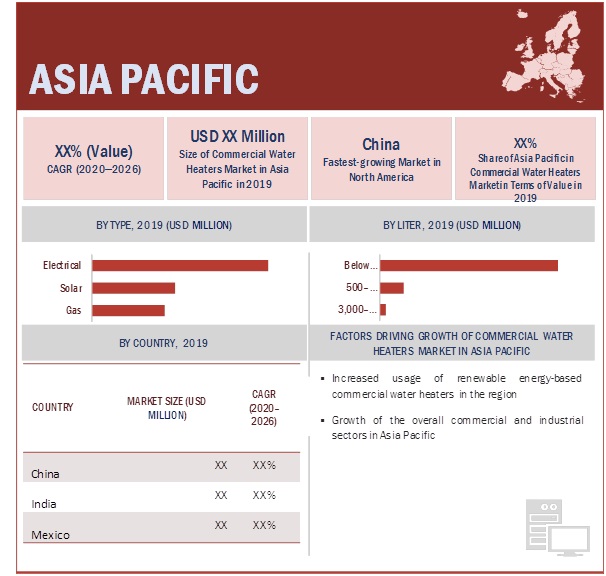

Asia Pacific is expected to account for the fastest growing market size during the forecast period.

Asia Pacific is expected to dominate the commercial water heaters market during the forecast period as owing to the increase in the use of renewable energy and energy efficient products. Several leading players in the commercial water heaters market such as A.O. Smith Corporation, Rinnai Corporation, RHEEM Manufacturing, and Ariston Thermo have their manufacturing facilities in countries such as China, India, and Malaysia. The region is home to a number of emerging economies such as China, India, Singapore, and Malaysia. These economies are witnessing increased investments in their commercial sectors. The figure below shows the projected market sizes of various regions with respective CAGRs for 2025.

Key Market Players

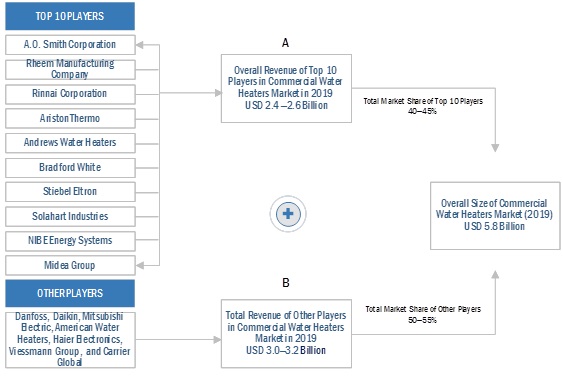

The key players in the commercial water heaters market include A.O. Smith Corporation (US), RHEEM Manufacturing Company (US), Rinnai Corporation (Japan), Solahart Industries (Australia), Carrier Global (US), Stiebel Eltron (Germany), etc. Other players in the market include the likes of Viessmann Group (Germany), NIBE Energy Systems (Sweden), Danfoss (Denmark), Valliant Group (Germany), American Water Heaters (US), Daikin (Japan), Mitsubishi Electric (Japan), Andrewes Water Heaters (Baxi Heating) (UK), and more.

Scope of the Report

|

Report Metric |

Details |

|

Market Size available for years |

2016–2026 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2026 |

|

Forecast units |

Value (USD), Volume (Units) |

|

Segments covered |

Type, Liter, Rated Capacity, and Region. |

|

Geographies covered |

Asia Pacific, South America, North America, Europe, Africa. |

|

Companies covered |

A.O. Smith Corporation (US), RHEEM Manufacturing Company (US), Rinnai Corporation (Japan), Solahart Industries (Australia), Carrier Global (US), Stiebel Eltron (Germany), etc. (25 total) |

This research report categorizes the commercial water heaters market based on Type, Liter, Rated Capacity, and Region.

Based on the Type :

- Electric

- Oil

- Gas

- Solar

- Hybrid

- Heat Pump

- Others (Bio-fuel & Solid Fuel-fired commercial water heaters)

Based on the Rated Capacity:

- Up to 10kW

- 10?50kW

- 50?150kW

- 150?300kW

- Above 300kW

Based on the Liter:

- Below 500 Liters

- 500?1,000 Liters

- 1,000?3,000 Liters

- 3,000?4,000 Liters

- Above 4,000 Liters

Based on the region:

- Asia Pacific

- Europe

- North America

- Africa

- South America

Recent Developments

- In April 2020, Danfoss opened a new online digital design and innovation center that provides users with all relevant design tools, building information modeling (BIM) tools, drawings, and product information and knowledge through a self-service based easy-to-access method.

- In November 2018: Rinnai Corporation launched an enhanced range of water heaters with integrated Google Homes support. The operations of these heaters can be controlled with voice commands from Google assistant for changing the temperature of the water, as well as turning heaters on and off.

- In September 2018, Rinnai Corporation opened a new headquarter in the Peachtree City in the State of Georgia (US) to serve its customers in North America.

Frequently Asked Questions (FAQ):

What is the current size of the commercial water heaters market?

The size of the global commercial water heaters market is USD 5.8 billion in 2019.

What are the major drivers for the commercial water heaters market?

Factors driving the growth of the commercial water heaters market include increasing investments for the development and expansion of commercial sector operations across different regions. In addition, supportive regulations and grants for using renewable sources of energy in different applications are also expected to play a key role in the growth of this market during the forecast period.

Which region dominates during the forecasted period in the commercial water heaters market?

Asia Pacific is the largest and the fastest growing region during the forecasted duration and countries such as China, South Korea and Australia are the fastest-growing markets in the Asia Pacific region, owing to the increased emphasis on renewable based technology.

Which is the fastest-growing type segment during the forecasted period in the commercial water heaters market?

The solar segment is the fastest-growing during the forecasted period due to the increased awareness about the usage fo renewable technology in water heating for commercial operations. Additionally, supportive grants, incentives, and regulations are also helping this market to grow at a healthy pace. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 COMMERCIAL WATER HEATERS MARKET, BY TYPE: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY LITER: INCLUSIONS & EXCLUSIONS

1.2.3 MARKET, BY RATED CAPACITY: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 44)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Break-up of primaries

2.2 DATA TRIANGULATION AND RESEARCH DESIGN

FIGURE 1 COMMERCIAL WATER HEATERS MARKET: DATA TRIANGULATION AND RESEARCH DESIGN

2.3 SCOPE

FIGURE 2 MAIN METRICS CONSIDERED WHILE ASSESSING GLOBAL DEMAND FOR COMMERCIAL WATER HEATERS

2.4 MARKET SIZE ESTIMATION

2.4.1 APPROACH 1-DEMAND-SIDE ANALYSIS BOTTOM-UP APPROACH

FIGURE 3 YEAR-ON-YEAR ADDITION OF DIFFERENT TYPES OF COMMERCIAL WATER HEATERS ACROSS COUNTRIES TO ACT AS KEY DETERMINING FACTOR FOR MARKET GROWTH

2.4.1.1 Key assumptions

2.4.1.2 Calculations

2.4.1.3 Forecast

2.4.2 APPROACH 2 - SUPPLY-SIDE ANALYSIS

FIGURE 4 REVENUES OF KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS ACROSS DIFFERENT REGIONS ACT AS DETERMINING FACTOR FOR MARKET GROWTH

2.4.2.1 Supply-side calculation

FIGURE 5 MARKET SIZE ESTIMATION FROM REVENUE ANALYSIS OF KEY PLAYERS IN MARKET

3 EXECUTIVE SUMMARY (Page No. - 56)

TABLE 1 COMMERCIAL WATER HEATERS MARKET SNAPSHOT

FIGURE 6 ASIA PACIFIC LED MARKET IN 2019

FIGURE 7 ELECTRIC SEGMENT TO HOLD LARGEST SIZE OF MARKET FROM 2020 TO 2026 IN TERMS OF VALUE

FIGURE 8 BELOW 500 LITERS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2026 IN TERMS OF VALUE

FIGURE 9 10–50KW SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FROM 2020 TO 2026 IN TERMS OF VALUE

4 PREMIUM INSIGHTS (Page No. - 60)

4.1 ATTRACTIVE OPPORTUNITIES IN COMMERCIAL WATER HEATERS MARKET

FIGURE 10 INCREASED DEMAND FOR HEATED WATER FROM COMMERCIAL SECTOR TO FUEL GROWTH OF MARKET FROM 2020 TO 2026

4.2 MARKET, BY REGION

FIGURE 11 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR IN TERMS OF VALUE FROM 2020 TO 2026

4.3 MARKET, BY TYPE

FIGURE 12 ELECTRIC SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET IN 2019

4.4 MARKET, BY LITER

FIGURE 13 BELOW 500 LITERS SEGMENT ACCOUNTED FOR LARGEST SIZE OF MARKET IN 2019 IN TERMS OF VALUE

4.5 MARKET, BY RATED CAPACITY

FIGURE 14 10–50KW SEGMENT HELD LARGEST SHARE OF COMMERCIAL WATER HEATER MARKET IN TERMS OF VALUE IN 2019

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Flourishing global commercial sector

5.2.1.2 Increasing demand for energy-efficient water heaters

FIGURE 16 ENERGY EFFICIENCY OF DIFFERENT TYPES OF WATER HEATERS

5.2.1.3 Ongoing initiatives by governments to promote use of renewable energy-based water heaters

5.2.2 RESTRAINTS

5.2.2.1 High capital expenditure (CapEx) for development of commercial water heaters

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of commercial water heaters with new-age technologies

5.2.3.2 Growth of global healthcare and hospitality sectors

5.2.4 CHALLENGES

5.2.4.1 Operational losses in commercial water heaters

5.2.5 IMPACT OF COVID-19 ON COMMERCIAL WATER HEATING INDUSTRY

6 COMMERCIAL WATER HEATERS MARKET, BY TYPE (Page No. - 68)

6.1 INTRODUCTION

FIGURE 17 ELECTRIC SEGMENT HELD LARGEST SHARE OF MARKET IN TERMS OF VALUE IN 2019

TABLE 2 MARKET, BY TYPE, 2016–2026 (UNITS)

TABLE 3 MARKET, BY TYPE, 2016–2026 (USD MILLION)

6.2 ELECTRIC

6.2.1 HIGH OPERATIONAL EFFICIENCY AND LOW INSTALLATION COSTS TO DRIVE GLOBAL DEMAND FOR ELECTRIC COMMERCIAL WATER HEATERS

TABLE 4 ELECTRIC MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 5 ELECTRIC MARKET, BY REGION, 2016–2026 (USD MILLION)

6.3 OIL

6.3.1 LOW COSTS AND EASY AVAILABILITY OF FUEL OILS TO LEAD TO INCREASED ADOPTION OF OIL-FIRED COMMERCIAL WATER HEATERS

TABLE 6 OIL-FIRED MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 7 OIL-FIRED MARKET, BY REGION, 2016–2026 (USD MILLION)

6.4 GAS

6.4.1 EASY AVAILABILITY OF NATURAL GAS AND PROPANE FUELING ADOPTION OF GAS-FIRED COMMERCIAL WATER HEATERS

TABLE 8 GAS-FIRED MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 9 GAS-FIRED MARKET, BY REGION, 2016–2026 (USD MILLION)

6.5 SOLAR

6.5.1 SUPPORTIVE GRANTS AND INCENTIVES TO DRIVE ADOPTION OF SOLAR COMMERCIAL WATER HEATERS WORLDWIDE

TABLE 10 SOLAR MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 11 SOLAR MARKET, BY REGION, 2016–2026 (USD MILLION)

6.6 HYBRID

6.6.1 HYBRID COMMERCIAL WATER HEATERS OFFER FUEL FLEXIBILITY AND HIGH OPERATIONAL EFFICIENCY

TABLE 12 HYBRID MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 13 HYBRID MARKET, BY REGION, 2016–2026 (USD MILLION)

6.7 HEAT PUMP

6.7.1 HEAT PUMP COMMERCIAL WATER HEATERS OFFER ENERGY EFFICIENCY AND USE RENEWABLE ENERGY FOR THEIR OPERATIONS

TABLE 14 HEAT PUMP MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 15 HEAT PUMP MARKET, BY REGION, 2016–2026 (USD MILLION)

6.8 OTHERS

TABLE 16 OTHER TYPES OF MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 17 OTHER TYPES OF MARKET, BY REGION, 2016–2026 (USD MILLION)

7 COMMERCIAL WATER HEATERS MARKET, BY LITER (Page No. - 78)

7.1 INTRODUCTION

FIGURE 18 BELOW 500 LITERS SEGMENT ACCOUNTED FOR LARGEST SHARE OF MARKET IN TERMS OF VALUE IN 2019

TABLE 18 MARKET, BY LITER 2016–2026 (UNITS)

TABLE 19 MARKET, BY LITER, 2016–2026 (USD MILLION)

7.2 BELOW 500 LITERS

7.2.1 EASE OF INSTALLATION OF 500 LITERS COMMERCIAL WATER HEATERS FUELING THEIR GLOBAL DEMAND

TABLE 20 BELOW 500 LITERS MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 21 BELOW 500 LITERS MARKET, BY REGION, 2016–2026 (USD MILLION)

7.3 500–1,000 LITERS

7.3.1 USE OF 500–1,000 LITERS WATER HEATERS IN APPLICATIONS WITH CONTINUOUS HOT WATER SUPPLY REQUIREMENTS

TABLE 22 500–1,000 LITERS MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 23 500–1,000 LITERS MARKET, BY REGION, 2016–2026 (USD MILLION)

7.4 1,000–3,000 LITERS

7.4.1 INCREASE IN ADOPTION OF CENTRALIZED WATER HEATING LAYOUT IN COMMERCIAL ESTABLISHMENTS

TABLE 24 1,000–3,000 LITERS MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 25 1,000–3,000 LITERS MARKET, BY REGION, 2016–2026 (USD MILLION)

7.5 3,000–4,000 LITERS

7.5.1 SURGE IN DEMAND 3,000–4,000 LITERS WATER HEATERS IN LARGE COMMERCIAL ESTABLISHMENTS

TABLE 26 3,000–4,000 LITERS MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 27 3,000–4,000 LITERS MARKET, BY REGION, 2016–2026 (USD MILLION)

7.6 ABOVE 4,000 LITERS

7.6.1 RISE IN ADOPTION OF ABOVE 4,000 LITERS WATER HEATERS BY LARGE COMMERCIAL AND INDUSTRIAL USERS

TABLE 28 ABOVE 4,000 LITERS MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 29 ABOVE 4,000 LITERS MARKET, BY REGION, 2016–2026 (USD MILLION)

8 COMMERCIAL WATER HEATERS MARKET, BY RATED CAPACITY (Page No. - 87)

8.1 INTRODUCTION

FIGURE 19 10–50KW SEGMENT HELD LARGEST SHARE OF MARKET IN TERMS OF VALUE IN 2019

TABLE 30 MARKET, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 31 MARKET, BY RATED CAPACITY, 2016–2026 (USD MILLION)

8.2 UP TO 10KW

8.2.1 INCREASED USE OF UP TO 10KW COMMERCIAL WATER HEATERS IN APPLICATIONS WITH LOW-VOLUME HOT WATER REQUIREMENTS

TABLE 32 UP TO 10KW MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 33 UP TO 10KW MARKET, BY REGION, 2016–2026 (USD MILLION)

8.3 10?50KW

8.3.1 SURGED DEMAND FOR INSTANTANEOUS HOT WATER AND EASE OF OPERATIONS TO CONTRIBUTE TO ADOPTION OF 10–50KW WATER HEATERS

TABLE 34 10?50KW COMMERCIAL WATER HEATER MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 35 10?50KW COMMERCIAL WATER HEATER MARKET, BY REGION, 2016–2026 (USD MILLION)

8.4 50?150KW

8.4.1 LARGE-SCALE CENTRALIZED WATER HEATING APPLICATIONS USE 50–150KW COMMERCIAL WATER HEATERS

TABLE 36 50?150KW COMERCIAL WATER HEATER MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 37 50?150KW COMERCIAL WATER HEATER MARKET, BY REGION, 2016–2026 (USD MILLION)

8.5 150?300KW

8.5.1 INCREASED ADOPTION OF 150–300KW COMMERCIAL WATER HEATERS IN LARGE COMMERCIAL FACILITIES

TABLE 38 150?300KW MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 39 150?300KW MARKET, BY REGION, 2016–2026 (USD MILLION)

8.6 ABOVE 300KW

8.6.1 SURGED DEMAND FOR ABOVE 300KW COMMERCIAL WATER HEATERS IN LARGE-SCALE COMMERCIAL COMPLEXES/STRUCTURES

TABLE 40 ABOVE 300KW MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 41 ABOVE 300KW MARKET, BY REGION, 2016–2026 (USD MILLION)

9 COMMERCIAL WATER HEATER MARKET, BY REGION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 20 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR IN TERMS OF VALUE FROM 2020 TO 2026

FIGURE 21 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MARKET IN TERMS OF VALUE IN 2019

TABLE 42 MARKET, BY REGION, 2016–2026 (UNITS)

TABLE 43 MARKET, BY REGION, 2016–2026 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 NORTH AMERICA REGIONAL SNAPSHOT

FIGURE 22 MARKET IN NORTH AMERICA, 2019

9.2.2 IMPORT/EXPORT DATA

TABLE 44 MARKET IN NORTH AMERICA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.2.3 DISTRIBUTION CHANNEL ANALYSIS

9.2.4 BY TYPE

TABLE 45 MARKET IN NORTH AMERICA, BY TYPE, 2016–2026 (UNITS)

TABLE 46 MARKET IN NORTH AMERICA, BY TYPE, 2016–2026 (USD MILLION)

9.2.5 BY LITER

TABLE 47 MARKET IN NORTH AMERICA, BY LITER, 2016–2026 (UNITS)

TABLE 48 MARKET IN NORTH AMERICA, BY LITER, 2016–2026 (USD MILLION)

9.2.6 BY RATED CAPACITY

TABLE 49 MARKET IN NORTH AMERICA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 50 MARKET IN NORTH AMERICA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.2.7 BY COUNTRY

TABLE 51 MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2026 (USD MILLION)

9.2.7.1 US

9.2.7.1.1 Growing investments in commercial sector and increasing demand for energy-efficient water heaters in US

9.2.7.1.2 General market trends

TABLE 52 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN US, 2019

9.2.7.1.3 Average selling price, 2019

FIGURE 23 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN US, 2019

9.2.7.1.4 Key manufacturers, 2019

TABLE 53 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN US, 2019

9.2.7.1.5 Key distributors, 2019

TABLE 54 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN US, 2019

9.2.7.1.6 Key consultants, 2019

TABLE 55 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN US, 2019

9.2.7.1.7 Import/export data

TABLE 56 MARKET IN US, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.2.7.1.8 By type

TABLE 57 MARKET IN US, BY TYPE, 2016–2026 (UNITS)

TABLE 58 MARKET IN US, BY TYPE, 2016–2026 (USD MILLION)

9.2.7.1.9 By liter

TABLE 59 MARKET IN US, BY LITER, 2016–2026 (UNITS)

TABLE 60 MARKET IN US, BY LITER, 2016–2026 (USD MILLION)

9.2.7.1.10 By rated capacity

TABLE 61 MARKET IN US, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 62 MARKET IN US, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.2.7.2 Canada

9.2.7.2.1 Increasing use of commercial water heaters in Canada owing to cold ambient temperature and flourishing commercial sector

9.2.7.2.2 General market trends

TABLE 63 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN CANADA, 2019

9.2.7.2.3 Average selling price, 2019

FIGURE 24 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN CANADA, 2019

9.2.7.2.4 Key manufacturers, 2019

TABLE 64 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN CANADA, 2019

9.2.7.2.5 Key distributors, 2019

TABLE 65 KEY DISTRIBUTORS OF MARKET IN CANADA, 2019

9.2.7.2.6 Key consultants, 2019

TABLE 66 KEY CONSULTANTS OF MARKET IN CANADA, 2019

9.2.7.2.7 Import/export data

TABLE 67 MARKET IN CANADA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.2.7.2.8 By type

TABLE 68 MARKET IN CANADA, BY TYPE, 2016–2026 (UNITS)

TABLE 69 MARKET IN CANADA, BY TYPE, 2016–2026 (USD MILLION)

9.2.7.2.9 By liter

TABLE 70 MARKET IN CANADA, BY LITER, 2016–2026 (UNITS)

TABLE 71 MARKET IN CANADA, BY LITER, 2016–2026 (USD MILLION)

9.2.7.2.10 By rated capacity

TABLE 72 MARKET IN CANADA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 73 MARKET IN CANADA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.2.7.3 Mexico

9.2.7.3.1 Growing use of economically-priced natural gas and oil in gas-fired commercial water heaters in Mexico

9.2.7.3.2 General market trends

TABLE 74 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN MEXICO, 2019

9.2.7.3.3 Average selling price, 2019

FIGURE 25 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN MEXICO, 2019

9.2.7.3.4 Key manufacturers, 2019

TABLE 75 KEY MANUFACTURERS OF MARKET IN MEXICO, 2019

9.2.7.3.5 Key distributors, 2019

TABLE 76 KEY DISTRIBUTORS OF MARKET IN MEXICO, 2019

9.2.7.3.6 Key consultants, 2019

TABLE 77 KEY CONSULTANTS OF MARKET IN MEXICO, 2019

9.2.7.3.7 Import/export data

TABLE 78 MARKET IN MEXICO, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.2.7.3.8 By type

TABLE 79 MARKET IN MEXICO, BY TYPE, 2016–2026 (UNITS)

TABLE 80 MARKET IN MEXICO, BY TYPE, 2016–2026 (USD MILLION)

9.2.7.3.9 By liter

TABLE 81 MARKET IN MEXICO, BY LITER, 2016–2026 (UNITS)

TABLE 82 MARKET IN MEXICO, BY LITER, 2016–2026 (USD MILLION)

9.2.7.3.10 By rated capacity

TABLE 83 MARKET IN MEXICO, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 84 MARKET IN MEXICO, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3 ASIA PACIFIC

9.3.1 REGIONAL SNAPSHOT

FIGURE 26 SNAPSHOT: MARKET IN ASIA PACIFIC

9.3.2 IMPORT/EXPORT DATA

TABLE 85 MARKET IN ASIA PACIFIC, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.3 DISTRIBUTION CHANNEL ANALYSIS

9.3.4 BY TYPE

TABLE 86 MARKET IN ASIA PACIFIC, BY TYPE, 2016–2026 (UNITS)

TABLE 87 MARKET IN ASIA PACIFIC, BY TYPE, 2016–2026 (USD MILLION)

9.3.5 BY LITER

TABLE 88 MARKET IN ASIA PACIFIC, BY LITER, 2016–2026 (UNITS)

TABLE 89 MARKET IN ASIA PACIFIC, BY LITER, 2016–2026 (USD MILLION)

9.3.6 BY RATED CAPACITY

TABLE 90 MARKET IN ASIA PACIFIC, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 91 MARKET IN ASIA PACIFIC, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7 BY COUNTRY

TABLE 92 MARKET IN ASIA PACIFIC, BY COUNTRY, 2016–2026 (USD MILLION)

9.3.7.1 China

9.3.7.1.1 Growing economy and flourishing commercial sector of China to fuel demand for commercial water heaters in country

9.3.7.1.2 General market trends

TABLE 93 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN CHINA, 2019

9.3.7.1.3 Average selling price, 2019

FIGURE 27 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN CHINA, 2019

9.3.7.1.4 Key manufacruters,2019

TABLE 94 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN CHINA, 2019

9.3.7.1.5 Key distributors, 2019

TABLE 95 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN CHINA, 2019

9.3.7.1.6 Key consultants, 2019

TABLE 96 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN CHINA, 2019

9.3.7.1.7 Import/export data

TABLE 97 MARKET IN CHINA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.1.8 By type

TABLE 98 MARKET IN CHINA, BY TYPE, 2016–2026 (UNITS)

TABLE 99 MARKET IN CHINA, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.1.9 By liter

TABLE 100 MARKET IN CHINA, BY LITER, 2016–2026 (UNITS)

TABLE 101 MARKET IN CHINA, BY LITER, 2016–2026 (USD MILLION)

9.3.7.1.10 By rated capacity

TABLE 102 MARKET IN CHINA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 103 MARKET IN CHINA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.2 India

9.3.7.2.1 Surging use of energy-efficient and renewable energy-based products to drive growth of market in India

9.3.7.2.2 General market trends

TABLE 104 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN INDIA, 2019

9.3.7.2.3 Average selling price, 2019

FIGURE 28 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN INDIA, 2019

9.3.7.2.4 Key manufacturers, 2019

TABLE 105 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN INDIA, 2019

9.3.7.2.5 Key distributors, 2019

TABLE 106 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN INDIA, 2019

9.3.7.2.6 Key consultants, 2019

TABLE 107 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN INDIA, 2019

9.3.7.2.7 Import/export data

TABLE 108 MARKET IN INDIA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.2.8 By type

TABLE 109 MARKET IN INDIA, BY TYPE, 2016–2026 (UNITS)

TABLE 110 MARKET IN INDIA, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.2.9 By liter

TABLE 111 MARKET IN INDIA, BY LITER, 2016–2026 (UNITS)

TABLE 112 MARKET IN INDIA, BY LITER, 2016–2026 (USD MILLION)

9.3.7.2.10 By rated capacity

TABLE 113 MARKET IN INDIA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 114 MARKET IN INDIA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.3 Australia

9.3.7.3.1 Increasing use of gas-fired market in Australia owing to easy availability of natural gas

9.3.7.3.2 General market trends

TABLE 115 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN AUSTRALIA, 2019

9.3.7.3.3 Average selling price, 2019

FIGURE 29 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN AUSTRALIA, 2019

9.3.7.3.4 Key manufacturers, 2019

TABLE 116 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN AUSTRALIA, 2019

9.3.7.3.5 Key distributors, 2019

TABLE 117 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN AUSTRALIA, 2019

9.3.7.3.6 Key consultants, 2019

TABLE 118 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN AUSTRALIA, 2019

9.3.7.3.7 Import/export data

TABLE 119 MARKET IN AUSTRALIA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.3.8 By type

TABLE 120 MARKET IN AUSTRALIA, BY TYPE, 2016–2026 (UNITS)

TABLE 121 MARKET IN AUSTRALIA, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.3.9 By liter

TABLE 122 MARKET IN AUSTRALIA, BY LITER, 2016–2026 (UNITS)

TABLE 123 MARKET IN AUSTRALIA, BY LITER, 2016–2026 (USD MILLION)

9.3.7.3.10 By rated capacity

TABLE 124 MARKET IN AUSTRALIA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 125 MARKET IN AUSTRALIA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.4 South Korea

9.3.7.4.1 Rising prices of commercial electricity in South Korea leading to rapid adoption of solar and gas-based commercial water heaters

9.3.7.4.2 General market trends

TABLE 126 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN SOUTH KOREA, 2019

9.3.7.4.3 Average selling price, 2019

FIGURE 30 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN SOUTH KOREA, 2019

9.3.7.4.4 Key manufacturers, 2019

TABLE 127 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN SOUTH KOREA, 2019

9.3.7.4.5 Key distributors and consultants, 2019

TABLE 128 KEY DISTRIBUTORS AND CONSULTANTS OF COMMERCIAL WATER HEATERS IN SOUTH KOREA, 2019

9.3.7.4.6 Import/export data

TABLE 129 MARKET IN SOUTH KOREA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.4.7 By type

TABLE 130 MARKET IN SOUTH KOREA, BY TYPE, 2016–2026 (UNITS)

TABLE 131 MARKET IN SOUTH KOREA, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.4.8 By liter

TABLE 132 MARKET IN SOUTH KOREA, BY LITER, 2016–2026 (UNITS)

TABLE 133 MARKET IN SOUTH KOREA, BY LITER, 2016–2026 (USD MILLION)

9.3.7.4.9 By rated capacity

TABLE 134 MARKET IN SOUTH KOREA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 135 MARKET IN SOUTH KOREA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.5 Singapore

9.3.7.5.1 Increasing availability of efficient gas-fired commercial water heaters in Singapore

9.3.7.5.2 General market trends

TABLE 136 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN SINGAPORE, 2019

9.3.7.5.3 Average selling price, 2019

FIGURE 31 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN SINGAPORE, 2019

9.3.7.5.4 Key manufacturers, 2019

TABLE 137 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN SINGAPORE, 2019

9.3.7.5.5 Key distributors, 2019

TABLE 138 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN SINGAPORE, 2019

9.3.7.5.6 Key consultants, 2019

TABLE 139 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN SINGAPORE, 2019

9.3.7.5.7 Import/export

TABLE 140 MARKET IN SINGAPORE, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.5.8 By type

TABLE 141 MARKET IN SINGAPORE, BY TYPE, 2016–2026 (UNITS)

TABLE 142 MARKET IN SINGAPORE, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.5.9 By liter

TABLE 143 MARKET IN SINGAPORE, BY LITER, 2016–2026 (UNITS)

TABLE 144 MARKET IN SINGAPORE, BY LITER, 2016–2026 (USD MILLION)

9.3.7.5.10 By rated capacity

TABLE 145 MARKET IN SINGAPORE, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 146 MARKET IN SINGAPORE, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.6 New Zealand

9.3.7.6.1 Increasing investments in commercial sector of New Zealand to fuel demand for commercial water heaters in country

9.3.7.6.2 General market trends

TABLE 147 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN NEW ZEALAND, 2019

9.3.7.6.3 Average selling price, 2019

FIGURE 32 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN NEW ZEALAND, 2019

9.3.7.6.4 Key manufacturers, 2019

TABLE 148 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN NEW ZEALAND, 2019

9.3.7.6.5 Key distributors, 2019

TABLE 149 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN NEW ZEALAND, 2019

9.3.7.6.6 Key consultants, 2019

TABLE 150 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN NEW ZEALAND, 2019

9.3.7.6.7 Import/export

TABLE 151 MARKET IN NEW ZEALAND, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.6.8 By type

TABLE 152 MARKET IN NEW ZEALAND, BY TYPE, 2016–2026 (UNITS)

TABLE 153 MARKET IN NEW ZEALAND, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.6.9 By liter

TABLE 154 MARKET IN NEW ZEALAND, BY LITER, 2016–2026 (UNITS)

TABLE 155 MARKET IN NEW ZEALAND, BY LITER, 2016–2026 (USD MILLION)

9.3.7.6.10 By rated capacity

TABLE 156 MARKET IN NEW ZEALAND, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 157 MARKET IN NEW ZEALAND, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.7 Malaysia

9.3.7.7.1 Surging use of gas-fired commercial water heaters in Malaysia owing to availability of low-cost natural gas

9.3.7.7.2 General market trends

TABLE 158 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN MALAYSIA, 2019

9.3.7.7.3 Average selling price, 2019

FIGURE 33 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN MALAYSIA, 2019

9.3.7.7.4 Key manufacturers, 2019

TABLE 159 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN MALAYSIA, 2019

9.3.7.7.5 Key distributors, 2019

TABLE 160 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN MALAYSIA, 2019

9.3.7.7.6 Key consultants, 2019

TABLE 161 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN MALAYSIA, 2019

9.3.7.7.7 Import/export

TABLE 162 MARKET IN MALAYSIA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.3.7.7.8 By type

TABLE 163 MARKET IN MALAYSIA, BY TYPE, 2016–2026 (UNITS)

TABLE 164 MARKET IN MALAYSIA, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.7.9 By liter

TABLE 165 MARKET IN MALAYSIA, BY LITER, 2016–2026 (UNITS)

TABLE 166 MARKET IN MALAYSIA, BY LITER, 2016–2026 (USD MILLION)

9.3.7.7.10 By rated capacity

TABLE 167 MARKET IN MALAYSIA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 168 MARKET IN MALAYSIA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.3.7.8 Taiwan

9.3.7.8.1 Increasing number of regulations to promote use of energy-efficient products driving adoption of electric commercial water heaters in Taiwan

9.3.7.8.2 General market trends

TABLE 169 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN TAIWAN, 2019

9.3.7.8.3 Average selling price,2019

FIGURE 34 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN TAIWAN, 2019

9.3.7.8.4 Key manufacturers,2019

TABLE 170 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN TAIWAN, 2019

9.3.7.8.5 Key distributors and consultants,2019

TABLE 171 KEY DISTRIBUTORS AND CONSULTANTS OF COMMERCIAL WATER HEATERS IN TAIWAN, 2019

9.3.7.8.6 By type

TABLE 172 MARKET IN TAIWAN, BY TYPE, 2016–2026 (UNITS)

TABLE 173 MARKET IN TAIWAN, BY TYPE, 2016–2026 (USD MILLION)

9.3.7.8.7 By liter

TABLE 174 MARKET IN TAIWAN, BY LITER, 2016–2026 (UNITS)

TABLE 175 MARKET IN TAIWAN, BY LITER, 2016–2026 (USD MILLION)

9.3.7.8.8 By rated capacity

TABLE 176 MARKET IN TAIWAN, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 177 MARKET IN TAIWAN, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.4 EUROPE

9.4.1 IMPORT/EXPORT DATA

TABLE 178 MARKET IN EUROPE, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.4.2 DISTRIBUTION CHANNEL ANALYSIS

9.4.3 BY TYPE

TABLE 179 MARKET IN EUROPE, BY TYPE, 2016–2026 (UNITS)

TABLE 180 MARKET IN EUROPE, BY TYPE, 2016–2026 (USD MILLION)

9.4.4 BY LITER

TABLE 181 MARKET IN EUROPE, BY LITER, 2016–2026 (UNITS)

TABLE 182 MARKET IN EUROPE, BY LITER, 2016–2026 (USD MILLION)

9.4.5 BY RATED CAPACITY

TABLE 183 MARKET IN EUROPE, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 184 MARKET IN EUROPE, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.4.6 BY COUNTRY

TABLE 185 MARKET IN EUROPE, BY COUNTRY, 2016–2026 (USD MILLION)

9.4.6.1 Italy

9.4.6.1.1 Increasing investments in healthcare sector of Italy to fuel demand for commercial water heaters in country

9.4.6.1.2 General market trends

TABLE 186 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN ITALY, 2019

9.4.6.1.3 Average selling price,2019

FIGURE 35 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN ITALY, 2019

9.4.6.1.4 Key manufacturers,2019

TABLE 187 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN ITALY, 2019

9.4.6.1.5 Key distributors,2019

TABLE 188 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN ITALY, 2019

9.4.6.1.6 Key consultants, 2019

TABLE 189 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN ITALY, 2019

9.4.6.1.7 Import/export data

TABLE 190 MARKET IN ITALY, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.4.6.1.8 By type

TABLE 191 MARKET IN ITALY, BY TYPE, 2016–2026 (UNITS)

TABLE 192 MARKET IN ITALY, BY TYPE, 2016–2026 (USD MILLION)

9.4.6.1.9 By liter

TABLE 193 MARKET IN ITALY, BY LITER, 2016–2026 (UNITS)

TABLE 194 MARKET IN ITALY, BY LITER, 2016–2026 (USD MILLION)

9.4.6.1.10 By rated capacity

TABLE 195 MARKET IN ITALY, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 196 MARKET IN ITALY, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.4.6.2 UK

9.4.6.2.1 Growing requirements of hot water in UK owing to its cold weather conditions

9.4.6.2.2 General market trends

TABLE 197 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN UK, 2019

9.4.6.2.3 Average selling price,2019

FIGURE 36 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN UK, 2019

9.4.6.2.4 Key manufacturers,2019

TABLE 198 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN UK, 2019

9.4.6.2.5 Key distributors, 2019

TABLE 199 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN UK, 2019

9.4.6.2.6 Key consultants, 2019

TABLE 200 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN UK, 2019

9.4.6.2.7 Import/export data

TABLE 201 COMMERCIAL WATER HEATERS MARKET IN UK, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.4.6.2.8 By type

TABLE 202 MARKET IN UK, BY TYPE, 2016–2026 (UNITS)

TABLE 203 MARKET IN UK, BY TYPE, 2016–2026 (USD MILLION)

9.4.6.2.9 By liter

TABLE 204 MARKET IN UK, BY LITER, 2016–2026 (UNITS)

TABLE 205 MARKET IN UK, BY LITER, 2016–2026 (USD MILLION)

9.4.6.2.10 By rated capacity

TABLE 206 MARKET IN UK, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 207 MARKET IN UK, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.5 SOUTH AMERICA

9.5.1 IMPORT/EXPORT DATA

TABLE 208 MARKET IN SOUTH AMERICA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.5.2 DISTRIBUTION CHANNEL ANALYSIS

9.5.3 BY TYPE

TABLE 209 MARKET IN SOUTH AMERICA, BY TYPE, 2016–2026 (UNITS)

TABLE 210 MARKET IN SOUTH AMERICA, BY TYPE, 2016–2026 (USD MILLION)

9.5.4 BY LITER

TABLE 211 MARKET IN SOUTH AMERICA, BY LITER, 2016–2026 (UNITS)

TABLE 212 MARKET IN SOUTH AMERICA, BY LITER, 2016–2026 (USD MILLION)

9.5.5 BY RATED CAPACITY

TABLE 213 MARKET IN SOUTH AMERICA, BY RATED CAPACITY, 2016–2026 (UNITS)

9.5.6 BY RATED CAPACITY

TABLE 214 MARKET IN SOUTH AMERICA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.5.7 BY COUNTRY

TABLE 215 MARKET IN SOUTH AMERICA, BY COUNTRY, 2016–2026 (USD MILLION)

9.5.7.1 Brazil

9.5.7.1.1 Surging adoption of energy-efficient commercial water heaters in Brazil owing to supportive government policies

9.5.7.1.2 General market trends

TABLE 216 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN BRAZIL, 2019

9.5.7.1.3 Average selling price, 2019

FIGURE 37 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN BRAZIL, 2019

9.5.7.1.4 Key manufacturers, 2019

TABLE 217 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN BRAZIL, 2019

9.5.7.1.5 Key distributors, 2019

TABLE 218 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN BRAZIL, 2019

9.5.7.1.6 Key consultants, 2019

TABLE 219 KEY CONSULTANTS OF COMMERCIAL WATER HEATERS IN BRAZIL, 2019

9.5.7.1.7 Import/export data

TABLE 220 COMMERCIAL WATER HEATERS MARKET IN BRAZIL, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.5.7.1.8 By type

TABLE 221 MARKET IN BRAZIL, BY TYPE, 2016–2026 (UNITS)

TABLE 222 MARKET IN BRAZIL, BY TYPE, 2016–2026 (USD MILLION)

9.5.7.1.9 By liter

TABLE 223 MARKET IN BRAZIL, BY LITER, 2016–2026 (UNITS)

TABLE 224 MARKET IN BRAZIL, BY LITER, 2016–2026 (USD MILLION)

9.5.7.1.10 By rated capacity

TABLE 225 MARKET IN BRAZIL, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 226 MARKET IN BRAZIL, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.5.7.2 Chile

9.5.7.2.1 Growing imports of natural gas in Chile fueling demand for gas-fired commercial water heaters in country

9.5.7.2.2 General market trends

TABLE 227 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN CHILE, 2019

9.5.7.2.3 Average selling price, 2019

FIGURE 38 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN CHILE, 2019

9.5.7.2.4 Key manufacturers, 2019

TABLE 228 KEY MANUFACTURERS OF COMMERCIAL WATER HEATER IN CHILE, 2019

9.5.7.2.5 Key distributors and consultants, 2019

TABLE 229 KEY DISTRIBUTORS AND CONSULTANTS OF COMMERCIAL WATER HEATER IN CHILE, 2019

9.5.7.2.6 Import/export data

TABLE 230 MARKET IN CHILE, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.5.7.2.7 By type

TABLE 231 MARKET IN CHILE, BY TYPE, 2016–2026 (UNITS)

TABLE 232 MARKET IN CHILE, BY TYPE, 2016–2026 (USD MILLION)

9.5.7.2.8 By liter

TABLE 233 MARKET IN CHILE, BY LITER, 2016–2026 (UNITS)

TABLE 234 MARKET IN CHILE, BY LITER, 2016–2026 (USD MILLION)

9.5.7.2.9 By rated capacity

TABLE 235 MARKET IN CHILE, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 236 MARKET IN CHILE, BY RATED CAPACITY, 2016–2026 (USD MILLION)

9.6 AFRICA

9.6.1 SOUTH AFRICA

9.6.1.1 Increasing number of support policies formulated by government for commercial sector to fuel growth of commercial water heaters market in South Africa

9.6.1.2 Import/export data

TABLE 237 COMMERCIAL WATER HEATERS MARKET IN SOUTH AFRICA, BY IMPORT AND EXPORT DATA, 2016–2019 (USD THOUSAND)

9.6.1.3 Distribution channel analysis

9.6.1.4 General market trends

TABLE 238 GENERAL MARKET TRENDS FOR COMMERCIAL WATER HEATERS IN SOUTH AFRICA, 2019

9.6.1.5 Average selling price, 2019

FIGURE 39 AVERAGE SELLING PRICE OF COMMERCIAL WATER HEATERS IN SOUTH AFRICA, 2019

9.6.1.6 Key manufacturers, 2019

TABLE 239 KEY MANUFACTURERS OF COMMERCIAL WATER HEATERS IN SOUTH AFRICA, 2019

9.6.1.7 Key distributors, 2019

TABLE 240 KEY DISTRIBUTORS OF COMMERCIAL WATER HEATERS IN SOUTH AFRICA, 2019

9.6.1.8 Key consultants, 2019

TABLE 241 CONSULTANTS OF COMMERCIAL WATER HEATERS IN SOUTH AFRICA, 2019

9.6.1.9 By type

TABLE 242 COMMERCIAL WATER HEATERS MARKET IN SOUTH AFRICA, BY TYPE, 2016–2026 (UNITS)

TABLE 243 MARKET IN SOUTH AFRICA, BY TYPE, 2016–2026 (USD MILLION)

9.6.1.10 By liter

TABLE 244 MARKET IN SOUTH AFRICA, BY LITER, 2016–2026 (UNITS)

TABLE 245 MARKET IN SOUTH AFRICA, BY LITER, 2016–2026 (USD MILLION)

9.6.1.11 By rated capacity, 2019

TABLE 246 MARKET IN SOUTH AFRICA, BY RATED CAPACITY, 2016–2026 (UNITS)

TABLE 247 MARKET IN SOUTH AFRICA, BY RATED CAPACITY, 2016–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 212)

10.1 OVERVIEW

FIGURE 40 KEY DEVELOPMENTS IN COMMERCIAL WATER HEATERS MARKET FROM JANUARY 2017 TO JULY 2020

10.2 COMPETITIVE LEADERSHIP MAPPING (OVERALL MARKET)

10.2.1 STAR

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 PRTICIPANT

FIGURE 41 COMMERCIAL WATER HEATERS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

10.3 MARKET SHARE, 2019

FIGURE 42 TOP PLAYERS MARKET SHARE, 2019

10.4 REVENUE ANALYSIS OF TOP 5 PLAYERS

FIGURE 43 A.O. SMITH CORPORATION LED MARKET IN 2019

10.5 COMPETITIVE SCENARIO

10.5.1 NEW PRODUCT LAUNCHES, JANUARY 2017–JULY 2020

10.5.2 INVESTMENTS AND EXPANSIONS, JANUARY 2017–JULY 2020

10.5.3 MERGERS AND ACQUISITIONS, JANUARY 2017–JULY 2020

10.5.4 PARTNERSHIPS AND COLLABORATIONS, JANUARY 2017–JULY 2020

11 COMPANY PROFILE (Page No. - 220)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

11.1 MIDEA GROUP

TABLE 248 MIDEA GROUP OFFICES AND MANUFACTURING LOCATIONS:

FIGURE 44 MIDEA GROUP: COMPANY SNAPSHOT

11.2 A.O. SMITH CORPORATION

TABLE 249 A.O. SMITH CORPORATION OFFICES AND MANUFACTURING LOCATIONS:

FIGURE 45 A.O. SMITH CORPORATION: COMPANY SNAPSHOT

11.3 DAIKIN

TABLE 250 DAIKIN OFFICES AND MANUFACTURING LOCATIONS:

FIGURE 46 DAIKIN: COMPANY SNAPSHOT

11.4 RINNAI CORPORATION

TABLE 251 RINNAI CORPORATION OFFICES AND MANUFACTURING LOCATIONS:

FIGURE 47 RINNAI CORPORATION: COMPANY SNAPSHOT

11.5 DANFOSS

FIGURE 48 DANFOSS: COMPANY SNAPSHOT

11.6 MITSUBISHI ELECTRIC

FIGURE 49 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

11.7 NIBE ENERGY SYSTEMS

11.8 JOHNSON CONTROLS–HITACHI AIR CONDITIONING

11.9 BOSCH INDUSTRIES

FIGURE 50 BOSCH INDUSTRIES: COMPANY SNAPSHOT

11.10 VIESSMANN

11.11 VAILLANT

11.12 RHEEM MANUFACTURING COMPANY

11.13 AMERICAN WATER HEATERS

11.14 BRADFORD WHITE

11.15 ARISTON THERMO GROUP

11.16 SOLAHART

11.17 JINYI SOLAR WATER HEATER

11.18 BOCK WATER HEATERS

11.19 STIEBEL ELTRON

11.20 GIANT

11.21 PVI INDUSTRIES

* Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 257)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

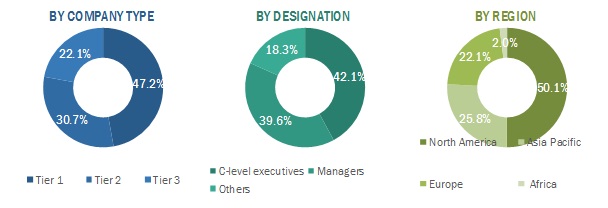

This study involved four major activities in estimating the current market size for commercial water heaters. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global commercial water heaters market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The commercial water heaters market comprises several stakeholders, such as service providers, contractors, and third-party vendors. The demand side of this market is characterized by the huge demand for digitalization from operators/service providers. Advancements in new technology in commercial water heaters characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global commercial water heaters market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Commercial water heaters Market Size: Top down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global commercial water heaters market by type, by liter, by rated capacity, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, the Americas, and Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and partnerships in the commercial water heaters market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Commercial Water Heaters Market