Microcellular Polyurethane Foam Market by Type (Low Density Foam, High Density Foam), Application (Automotive, Building & Construction, Electronics, Medical, Aerospace, Others), Region (North America, Europe, APAC, MEA, RoW) - Global Forecast to 2021

Microcellular Polyurethane Foam Market was valued at USD 5.06 Billion in 2015, and is projected to reach USD 6.95 Billion by 2021, at a cagr 5.5% between 2016 and 2021. The objectives of this study are:

- To analyze and forecast the size of the global market, in terms of value and volume

- To define, describe, and forecast the global market by application, type, and region

- To forecast the size, in terms of value and volume, of the global microcellular polyurethane foam market and its different submarkets in five regions, namely, Asia-Pacific, Europe, North America, the Middle East & Africa, and Rest of the World

- To identify significant trends and factors that may drive or restrain the growth of the market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze competitive developments, such as expansions, contracts & agreements, joint ventures, and new product launches in the microcellular polyurethane foam market.

- To strategically profile the key players and comprehensively analyze their growth strategies

The years considered for the study are:

- Historical Year – 2014

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

For company profiles in the report, 2015 has been considered as the base year. Where information was unavailable for the base year, the years prior to the base year have been considered.

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases (Hoovers, Bloomberg, Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial aspects of microcellular polyurethane foam. The below explain the research methodology.

- Analysis of the types of microcellular polyurethane foam and their consumption across different applications

- Analysis of country-wise consumption of microcellular polyurethane foam across regions

- Analysis of market trends in various regions/countries

- Data triangulation and market estimation procedures were employed to determine the market size

- After arriving at the overall market size, the market was split into several segments and sub-segments.

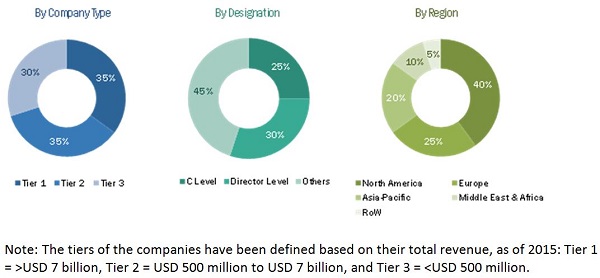

The figure below shows the break-down of the primaries on the basis of company, designation, and region, conducted during the research study

To know about the assumptions considered for the study, download the pdf brochure

The value chain of microcellular polyurethane foam manufacturing includes raw material manufacturers, such as BASF SE (Germany), Huntsman Corporation (U.S.), The Dow Chemical Company (U.S.), and Bayer MaterialScience (Germany), among others. Companies, such as BASF SE (Germany), Huntsman Corporation (U.S.), The Dow Chemical Company (U.S.), Rogers Corporation (U.S.), and Era Polymers (Australia), among others manufacture either high-density or low-density microcellular polyurethane foams. The products manufactured by these companies are used by companies operational in the automotive, building & construction, and footwear, among other industries, such as Ford Motor Company (U.S.), Kiewit Corporation (U.S.), Adidas AG (Germany), and Sleepwell (India).

Target Audience

- Microcellular Polyurethane Foam Producers

- Microcellular Polyurethane Foam Traders, Distributors, and Suppliers

- Manufacturers in End-use Industries

- Associations and Industry Bodies

Scope of the Report: This research report categorizes the global microcellular polyurethane foam market on the basis of application and region and forecasts the market size in terms of volumes and values. The report has also analyzed the market based on the following subsegments:

-

On the basis of Type:

- High-density foams

- Low-density foams

-

On the basis of Application:

- Automotive

- Building & Construction

- Electronics

- Medical

- Aerospace

- Others

-

On the basis of Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- RoW

The following customization options are available for the report:

- Further breakdown of Rest of Asia-Pacific, Rest of Europe, and Rest of Middle East & Africa

- Detailed analysis and profiling of the additional market players (Up to 5)

- Product matrix, which gives a detailed comparison of product portfolio of each company

The global microcellular polyurethane foam market was valued at USD 5.06 Billion in 2015, and is projected to reach USD 6.95 Billion by 2021, at a CAGR of 5.5% between 2016 and 2021. The market is projected witness significant growth in the coming years, owing to the rising demand for lightweight materials from various industries, such as automotive, aerospace, and construction.

The automotive, building & construction, and electronics segments contributed a major share to the global microcellular polyurethane foam market. The automotive segment is expected to be the fastest-growing application segment of the market, as microcellular polyurethane foams are widely used in this industry to increase comfort, safety, quality, and visual appeal of vehicles.

The high-density foam segment of the global microcellular polyurethane foam market is expected to witness significant growth during the forecast period. The higher the density of the foam, the higher is their cost. High-density foams are widely consumed by the automotive and building & construction industries, while low-density foams are predominantly used by the electronics, medical, and aerospace industries.

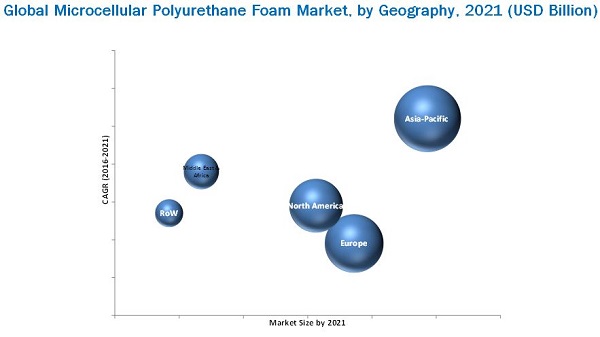

Asia-Pacific is expected to be the fastest-growing market for microcellular polyurethane foam, as there is an increasing demand for polyurethane foams from both developed and emerging countries in the region. Key manufacturers in the U.S. and Western Europe are now focusing on establishing their manufacturing base in Asia-Pacific to meet the region’s growing demand. The U.S., China, and Germany are major consumers of microcellular polyurethane foams.

Volatile raw material prices and environmental impact related to raw materials are the key factors that may restrain the growth of the global microcellular polyurethane foam market.

BASF SE (Germany), The Dow Chemical Company (United States), and Huntsman Corporation (United States) are the key players in the global microcellular polyurethane foam market. These companies have been focusing on R&D activities to launch microcellular polyurethane foam products to cater to the requirements of end-use manufacturing industries. This has helped the companies to cater to a broader customer base and helped them achieve growth in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Regional Scope

1.3.2 Markets Covered

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.3.1 Key Industry Insights

2.3.2 Assumptions

2.3.3 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Significant Opportunities for Global Microcellular Polyurethane Foam Market (2016 & 2021)

4.2 Microcellular Polyurethane Foam Market Growth, By Region (2016-2021)

4.3 Global Market Attractiveness

4.4 Global Market–Major Types

4.5 Global Market, End-Use Industries

4.6 Global Market: Developed Markets and Developing Markets

4.7 Life Cycle Analysis, By Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Global Microcellular Polyurethane Foam Market, By Type

5.2.2 Global Microcellular Polyurethane Foam Market, By Application

5.2.3 Global Microcellular Polyurethane Foam Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Feasible Properties Offered By Microcellular Polyurethane Foams

5.3.1.2 Growth of Various End-Use Industries

5.3.2 Restraints

5.3.2.1 Volatility in Raw Material Prices

5.3.2.2 Exposure Risks and Environmental Impacts Related to Raw Materials Used in Microcellular Polyurethane Foams

5.3.3 Opportunities

5.3.3.1 Development of Carbon Dioxide-Based Polyols

5.3.3.2 Expansion Opportunities in the Asia-Pacific Region

5.3.4 Challenges

5.3.4.1 High Pricing Pressure

6 Industry Trends (Page No. - 43)

6.1 Introduction

6.2 Value Chain Analysis

6.2.1 Raw Materials

6.2.2 Manufacturers

6.2.3 End Users

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

6.4 Price Analysis of Microcellular Polyurethane Foams and Raw Materials

6.5 Economic Indicators

6.5.1 Industry Outlook

6.5.1.1 Automotive

6.5.1.2 Construction

6.5.1.3 Electronics

6.5.1.4 Healthcare & Medical

6.5.1.5 Aerospace

6.5.2 Country Outlook

6.5.2.1 Brazil

6.5.2.2 China

6.5.2.3 France

6.5.2.4 Germany

6.5.2.5 India

6.5.2.6 Italy

6.5.2.7 Japan

6.5.2.8 Mexico

6.5.2.9 Saudi Arabia

6.5.2.10 South Korea

6.5.2.11 U.K.

6.5.2.12 U.S.

7 Microcellular Polyurethane Foam Market, By Type (Page No. - 58)

7.1 Introduction

7.2 High Density Foam

7.3 Low Density Foam

8 Global Microcellular Polyurethane Foam Market, By Application (Page No. - 65)

8.1 Introduction

8.2 Automotive

8.3 Building & Construction

8.4 Electronics

8.5 Medical

8.6 Aerospace

8.7 Others

9 Microcellular Polyurethane Foams Market, By Region (Page No. - 77)

9.1 Introduction

9.2 Asia-Pacific

9.2.1 China

9.2.2 Japan

9.2.3 India

9.2.4 South Korea

9.2.5 Rest of Asia-Pacific

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 Italy

9.3.4 U.K.

9.3.5 Russia

9.3.6 Rest of Europe

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 Middle East & Africa

9.5.1 UAE

9.5.2 Saudi Arabia

9.5.3 South Africa

9.5.4 Rest of Middle East & Africa

9.6 Rest of the World

9.6.1 Brazil

9.6.2 Others

10 Competitive Landscape (Page No. - 137)

10.1 Overview

10.2 Market Share Analysis

10.3 Acquisitions

10.4 Expansions

10.5 Investments

11 Company Profiles (Page No. - 141)

11.1 Introduction

11.2 BASF SE

11.2.1 Business Overview

11.2.2 Product Offerings

11.2.3 Recent Developments

11.2.4 SWOT Analysis

11.2.5 MnM View

11.3 The DOW Chemical Company

11.3.1 Business Overview

11.3.2 Product Offerings

11.3.3 Recent Developments

11.3.4 SWOT Analysis

11.3.5 MnM View

11.4 Saint-Gobain Performance Plastics

11.4.1 Business Overview

11.4.2 Product Offerings

11.4.3 SWOT Analysis

11.4.4 MnM View

11.5 Huntsman Corporation

11.5.1 Business Overview

11.5.2 Product Offerings

11.5.3 SWOT Analysis

11.5.4 MnM View

11.6 Evonik Industries

11.6.1 Business Overview

11.6.2 Product Offerings

11.6.3 SWOT Analysis

11.6.4 MnM View

11.7 Inoac Corporation

11.7.1 Business Overview

11.7.2 Product Offerings

11.7.3 SWOT Analysis

11.7.4 MnM View

11.8 Rogers Corporation

11.8.1 Business Overview

11.8.2 Product Offerings

11.8.3 Recent Developments

11.8.4 SWOT Analysis

11.8.5 MnM View

11.9 Rubberlite Inc.

11.9.1 Business Overview

11.9.2 Product Offerings

11.9.3 MnM View

11.10 Mearthane Products Corporation

11.10.1 Business Overview

11.10.2 Product Offerings

11.10.3 MnM View

11.11 Griswold International, Llc

11.11.1 Business Overview

11.11.2 Product Offerings

11.11.3 MnM View

11.12 ERA Polymers

11.12.1 Business Overview

11.12.2 Product Offerings

11.12.3 MnM View

12 Appendix (Page No. - 164)

12.1 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.2 Introducing RT: Real Time Market Intelligence

12.3 Available Customizations

12.4 Discussion Guide

12.5 Related Reports

List of Tables (150 Tables)

Table 1 Global Microcellular Polyurethane Foam Market Snapshot

Table 2 International Car Sales Outlook

Table 3 Brazil: Economic Outlook

Table 4 China: Economic Outlook

Table 5 France: Economic Outlook

Table 6 Germany: Economic Outlook

Table 7 India: Economic Outlook

Table 8 Italy: Economic Outlook

Table 9 Japan: Economic Outlook

Table 10 Mexico: Economic Outlook

Table 11 Saudi Arabia: Economic Outlook

Table 12 South Korea: Economic Outlook

Table 13 U.K.: Economic Outlook

Table 14 U.S.: Economic Outlook

Table 15 Global Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 16 Global Market, By Type, 2014–2021 (USD Million)

Table 17 Global High Density Microcellular Polyurethane Foam Market, By Region, 2014–2021 (Kilotons)

Table 18 Global High Density Microcellular Polyurethane Foam Market, By Region, 2014–2021 (USD Million)

Table 19 Global Low Density Microcellular Polyurethane Foam Market, By Region, 2014–2021 (Kilotons)

Table 20 Global Low Density Microcellular Polyurethane Foam Market, By Region, 2014–2021 (USD Million)

Table 21 Global Market, By Application, 2014-2021 (Kilotons)

Table 22 Global Market, By Application, 2014-2021 (USD Million)

Table 23 Global Market in Automotive, By Region, 2014–2021 (Kilotons)

Table 24 Global Market in Automotive, By Region, 2014–2021 (USD Million)

Table 25 Global Market in Building & Construction Application, By Region, 2014–2021 (Kilotons)

Table 26 Global Market in Building & Construction Application, By Region, 2014–2021 (USD Million)

Table 27 Global Market in Electronics, By Region, 2014–2021 (Kilotons)

Table 28 Global Market in Electronics, By Region, 2014–2021 (USD Million)

Table 29 Global Market in Medical, By Region, 2014–2021 (Kilotons)

Table 30 Global Market in Medical, By Region, 2014–2021 (USD Million)

Table 31 Global Market in Aerospace, By Region, 2014–2021 (Kilotons)

Table 32 Global Market in Aerospace, By Region, 2014–2021 (USD Million)

Table 33 Global Market for Others, By Geography, 2014–2021 (Kilotons)

Table 34 Global Market in Others, By Region, 2014–2021 (USD Million)

Table 35 Global Market, By Region, 2014–2021 (Kilotons)

Table 36 Global Market, By Region, 2014–2021 (USD Million)

Table 37 Asia-Pacific Microcellular Polyurethane Foam Market, By Country, 2014–2021 (Kilotons)

Table 38 Market, By Country, 2014–2021 (USD Million)

Table 39 Market, By Type, 2014–2021 (Kilotons)

Table 40 Market, By Type, 2014–2021 (USD Million)

Table 41 Market, By Application, 2014–2021 (Kilotons)

Table 42 Market, By Application, 2014–2021 (USD Million)

Table 43 China Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 44 Market, By Type, 2014–2021 (USD Million)

Table 45 Market, By Application, 2014–2021 (Kilotons)

Table 46 Market, By Application, 2014–2021 (USD Million)

Table 47 Japan Market, By Type, 2014–2021 (Kilotons)

Table 48 Market, By Type, 2014–2021 (USD Million)

Table 49 Market, By Application, 2014–2021 (Kilotons)

Table 50 Market, By Application, 2014–2021 (USD Million)

Table 51 India Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 52 Market, By Type, 2014–2021 (USD Million)

Table 53 Market, By Application, 2014–2021 (Kilotons)

Table 54 Market, By Application, 2014–2021 (USD Million)

Table 55 South Korea Car Makers: Domestic/Overseas Sales By Brand, March 2016

Table 56 South Korea Microcellular Polyurethane Foams Market, By Type, 2014–2021 (Kilotons)

Table 57 Market, By Type, 2014–2021 (USD Million)

Table 58 Market, By Application, 2014–2021 (Kilotons)

Table 59 Market, By Application, 2014–2021 (USD Million)

Table 60 Rest of Asia-Pacific Market, By Type, 2014–2021 (Kilotons)

Table 61 Market, By Type, 2014–2021 (USD Million)

Table 62 Rest of Asia-Pacific Microcellular Polyurethane Foam Market, By Application, 2014–2021 (Kilotons)

Table 63 Market, By Application, 2014–2021 (USD Million)

Table 64 Europe Microcellular Polyurethane Foams Market, By Country, 2014–2021 (Kilotons)

Table 65 Market, By Country, 2014–2021 (USD Million)

Table 66 Market, By Type, 2014–2021 (Kilotons)

Table 67 Market, By Type, 2014–2021 (USD Million)

Table 68 Market, By Application, 2014–2021 (Kilotons)

Table 69 Market, By Application, 2014–2021 (USD Million)

Table 70 Germany Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 71 Market, By Type, 2014–2021 (USD Million)

Table 72 Market, By Application, 2014–2021 (Kilotons)

Table 73 Market, By Application, 2014–2021 (USD Million)

Table 74 France Market, By Type, 2014–2021 (Kilotons)

Table 75 Market, By Type, 2014–2021 (USD Million)

Table 76 Market, By Application, 2014–2021 (Kilotons)

Table 77 Market, By Application, 2014–2021 (USD Million)

Table 78 Italy Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 79 Market, By Type, 2014–2021 (USD Million)

Table 80 Market, By Application, 2014–2021 (Kilotons)

Table 81 Market, By Application, 2014–2021 (USD Million)

Table 82 U.K. Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 83 Market, By Type, 2014–2021 (USD Million)

Table 84 Market, By Application, 2014–2021 (Kilotons)

Table 85 Market, By Application, 2014–2021 (USD Million)

Table 86 Russia Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 87 Market, By Type, 2014–2021 (USD Million)

Table 88 Market, By Application, 2014–2021 (Kilotons)

Table 89 Market, By Application, 2014–2021 (USD Million)

Table 90 Rest of Europe Market, By Type, 2014–2021 (Kilotons)

Table 91 Market, By Type, 2014–2021 (USD Million)

Table 92 Rest of Europe Market, By Application, 2014–2021 (Kilotons)

Table 93 Market, By Application, 2014–2021 (USD Million)

Table 94 North America Market, By Country, 2014–2021 (USD Million)

Table 95 Market, By Region, 2014–2021 (Kilotons)

Table 96 Market, By Type, 2014–2021 (Kilotons)

Table 97 Market, By Type, 2014–2021 (USD Million)

Table 98 Market, By Application, 2014–2021 (Kilotons)

Table 99 North America Microcellular Polyurethane Foam Market, By Application, 2014–2021 (USD Million)

Table 100 U.S. Market, By Type, 2014–2021 (Kilotons)

Table 101 Market, By Type, 2014–2021 (USD Million)

Table 102 Market, By Application, 2014–2021 (Kilotons)

Table 103 Market, By Application, 2014–2021 (USD Million)

Table 104 Canada Market, By Type, 2014–2021 (Kilotons)

Table 105 Market, By Type, 2014–2021 (USD Million)

Table 106 Market, By Application, 2014–2021 (Kilotons)

Table 107 Market, By Application, 2014–2021 (USD Million)

Table 108 Mexico Market, By Type, 2014–2021 (Kilotons)

Table 109 Market, By Type, 2014–2021 (USD Million)

Table 110 Market, By Application, 2014–2021 (Kilotons)

Table 111 Market, By Application, 2014–2021 (USD Million)

Table 112 Middle East & Africa Microcellular Polyurethane Foam Market, By Country, 2014–2021 (Kilotons)

Table 113 Market, By Region, 2014–2021 (USD Million)

Table 114 Market, By Type, 2014–2021 (Kilotons)

Table 115 Market, By Type, 2014–2021 (USD Million)

Table 116 Market, By Application, 2014–2021 (Kilotons)

Table 117 Market, By Application, 2014–2021 (USD Million)

Table 118 UAE Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 119 Market, By Type, 2014–2021 (USD Million)

Table 120 Market, By Application, 2014–2021 (Kilotons)

Table 121 Market, By Application, 2014–2021 (USD Million)

Table 122 Saudi Arabia Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 123 Market, By Type, 2014–2021 (USD Million)

Table 124 Market, By Application, 2014–2021 (Kilotons)

Table 125 Market, By Application, 2014–2021 (USD Million)

Table 126 Market, By Type, 2014–2021 (Kilotons)

Table 127 Market, By Type, 2014–2021 (USD Million)

Table 128 Market, By Application, 2014–2021 (Kilotons)

Table 129 Market, By Application, 2014–2021 (USD Million)

Table 130 Rest of Middle East & Africa Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 131 Market, By Type, 2014–2021 (USD Million)

Table 132 Rest of Middle East & Africa Market, By Application, 2014–2021 (Kilotons)

Table 133 Market, By Application, 2014–2021 (USD Million)

Table 134 Rest of the World Microcellular Polyurethane Foam Market, By Country, 2014–2021 (Kilotons)

Table 135 Market, By Region, 2014–2021 (USD Million)

Table 136 Market, By Type, 2014–2021 (Kilotons)

Table 137 Market, By Type, 2014–2021 (USD Million)

Table 138 Market, By Application, 2014–2021 (Kilotons)

Table 139 Market, By Application, 2014–2021 (USD Million)

Table 140 Brazil Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 141 Market, By Type, 2014–2021 (USD Million)

Table 142 Market, By Application, 2014–2021 (Kilotons)

Table 143 Market, By Application, 2014–2021 (USD Million)

Table 144 Others Microcellular Polyurethane Foam Market, By Type, 2014–2021 (Kilotons)

Table 145 Market, By Type, 2014–2021 (USD Million)

Table 146 Market, By Application, 2014–2021 (Kilotons)

Table 147 Market, By Application, 2014–2021 (USD Million)

Table 148 Acquisitions, 2010–2015

Table 149 Expansions, 2010–2016

Table 150 Investments, 2010–2016

List of Figures (61 Figures)

Figure 1 Microcellular Polyurethane Foam: Market Segmentation

Figure 2 Microcellular Polyurethane Foam Market, Research Design

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Global Microcellular Polyurethane Foam Market: Data Triangulation

Figure 6 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 7 Market for High Density Microcellular Polyurethane Foam to Register the Highest Growth Between 2016 and 2021

Figure 8 Market for Automotive Application to Register the Highest Growth Between 2016 and 2021

Figure 9 Asia-Pacific to Be the Dominating Market Between 2016 and 2021

Figure 10 Global Microcellular Polyurethane Foam Market to Witness Moderate Growth Between 2016 and 2021

Figure 11 Asia-Pacific to Grow at the Highest Rate Between 2016 and 2021

Figure 12 Asia-Pacific to Be the Fastest-Growing Market for Microcellular Polyurethane Foam Between 2016 and 2021

Figure 13 High Density Microcellular Polyurethane Foam to Register the Fastest Growth Rate

Figure 14 Automotive Accounted for the Largest Market Share, in 2016

Figure 15 China to Emerge as A Lucrative Market

Figure 16 Low Density Foam has Started to Gain Higher Growth

Figure 17 Types of Microcellular Polyurethane Foams Used By Various End-Use Industries

Figure 18 Global Market, By Type

Figure 19 Global Market, By Application

Figure 20 Global Market, By Geography

Figure 21 Drivers, Restraints, Opportunities, and Challenges in the Global Microcellular Polyurethane Foam Market

Figure 22 Crude Oil Price Trends (2011–2015)

Figure 23 Global Microcellular Polyurethane Foam Industry: Value Chain Analysis

Figure 24 Porter’s Five Forces Analysis

Figure 25 Price Trend of Microcellular Polyurethane Foams and Raw Materials, 2014–2021

Figure 26 Density Ranges for Different Microcellular Polyurethane Foam Applications

Figure 27 High Density Foam Dominates Microcellular Polyurethane Foam Market Globally

Figure 28 Global High Density Microcellular Polyurethane Foam Market Snapshot, By Region, 2016 & 2021

Figure 29 Global Low Density Microcellular Polyurethane Foam Market, By Region, 2016 & 2021

Figure 30 Automotive Segment to Witness Highest Demand During the Forecast Period

Figure 31 Automotive Industry is the Largest and the Fastest-Growing Segment in Asia-Pacific

Figure 32 Building & Construction Application Segment is the Second-Largest Industry in Middle East & Africa

Figure 33 Europe is the Second-Largest Market in the in the Global Microcellular Polyurethane Foam Market in Electronics

Figure 34 The Medical Segment Shows A Moderate Growth in the Global Microcellular Polyurethane Foam Market

Figure 35 Aerospace Segment is the Third Largest Industry in North America in the Microcellular Polyurethane Foam Market

Figure 36 Other Application Segment Shows A Moderate Growth in the Global Microcellular Polyurethane Foam Market

Figure 37 Global Microcellular Polyurethane Foams Market Regional Snapshot, 2016

Figure 38 Asia-Pacific Dominant for Both High Density and Low Density Microcellular Polyurethane Foams

Figure 39 Automotive Industry is the Leading Application in the Global Microcellular Polyurethane Foams Market

Figure 40 Asia-Pacific Market Snapshot: China to Register the Highest Growth

Figure 41 Europe Market Snapshot: Germany to Continue to Dominate the Market

Figure 42 North American Market Snapshot: the Region is A Mature Market for Microcellular Polyurethane Foams

Figure 43 Middle East & Africa Market Snapshot: the Region is A Mature Market for Polyurethane Foams

Figure 44 Rest of the World Market Snapshot: the Region Shows A Moderate Growth Potential for Microcellular Polyurethane Foams

Figure 45 Companies Adopted Expansion as the Key Growth Strategy Between 2010-2016

Figure 46 BASF SE Dominated the Microcellular Polyurethane Foam Market in 2015

Figure 47 Battle for Market Share: Acquisitions Have Been the Key Strategy Adopted By the Companies

Figure 48 Geographic Revenue Mix of Top Five Market Players

Figure 49 BASF SE: Company Snapshot

Figure 50 BASF SE: SWOT Analysis

Figure 51 The DOW Chemical Company: Company Snapshot

Figure 52 The DOW Chemical Company: SWOT Analysis

Figure 53 Saint-Gobain: Company Snapshot

Figure 54 Saint-Gobain Performance Plastics: SWOT Analysis

Figure 55 Huntsman Corporation: Company Snapshot

Figure 56 Huntsman Corporation: SWOT Analysis

Figure 57 Evonik Industries: Company Snapshot

Figure 58 Evonik Industries: SWOT Analysis

Figure 59 Inoac Corporation: SWOT Analysis

Figure 60 Rogers Corporation: Company Snapshot

Figure 61 Roger Corporation: SWOT Analysis

Growth opportunities and latent adjacency in Microcellular Polyurethane Foam Market