Polyolefin Foam Market by Resin Type (Polyethylene, Polypropylene, Ethylene-Vinyl Acetate), End-use Industry (Protective Packaging, Automotive, Building & Construction, Footwear), and Region - Global Forecast to 2026

Polyolefin Foam Market

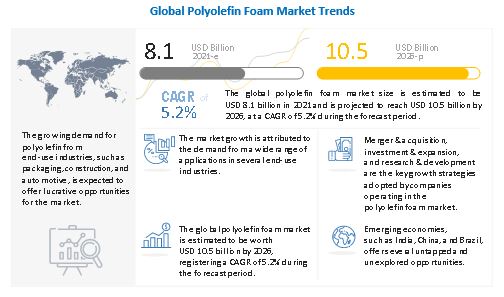

The global polyolefin foam market was valued at USD 8.1 billion in 2021 and is projected to reach USD 10.5 billion by 2026, growing at a cagr 5.2% from 2021 to 2026. Growing demand from automotive and packaging industry in APAC is likely to boost the market.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact on the Global Polyolefin Foam Market

The outbreak of COVID-19 has disrupted the production of raw materials used in polyolefin foam manufacturing. Asian countries such as India, China, Japan, Singapore, and Thailand are the hubs for polyolefin foam manufacturing and are major suppliers of these raw materials. The outbreak of the novel coronavirus in APAC has affected the supply of these raw materials. The break in the supplies of raw materials has reduced the production of polyolefin foam products.

In April 2020, all private buildings and construction sites, government constructions, and refinish automotive businesses were hit drastically.

Polyolefin Foam Market Dynamics

Driver: Growing demand from packaging and automotive industry

Polyolefin foam are used in the automotive, packaging and infrastructure industry for flooring, insulation.

Restraint: High prices of raw materials and energy

Polyolefin foam are costly, and their cost of manufacturing is also growing with the increase in the price of raw material. Raw materials for polyolefin foam vary a lot in terms of prices. In addition to the raw material prices, manufacturers are also burdened with the additional cost incurred due to the increased taxes on energy which results in higher operating costs and lower profit margins.

Opportunity: Increasing demand for lightweight products.

Several of them are exposed to environmental changes or involve the use of harsh materials. This results in the deterioration in the structure of the equipment or decline in the efficiency of the process, which causes shutdown of the plant or stoppage in the overall operations.

Challenge: Development of cost-effective products under stringent environmental regulations

Polyolefin Foam Market Ecosystem

Polyethylene resin segment accounted for the largest share of the polyolefin foam market in 2021.

Polyethylene resin segment accounts for the largest share in the polyolefin foam market. The properties of polyethylene foam can be enhanced by adding additives and modifiers to meet the required specifications. They are hard and offer resistance to humidity, abrasion, water, acid, alkali, and seawater. They possess low volatility and are water cleanable. These properties make these coatings ideal for use in metallic surfaces such as cast iron and aluminum.

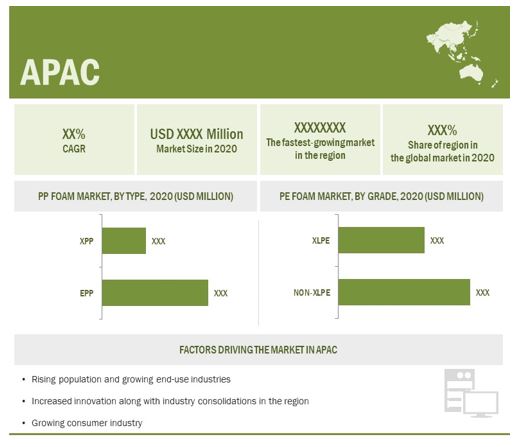

APAC is the largest polyolefin foam market in the forecast period

APAC has emerged as one of the leading producers as well as consumers of polyolefin foam. APAC is the hub of foreign investment and booming industrial sectors due to the low-cost labor and cheap availability of lands. Increase in the demand for polyolefin foam can be largely attributed to the growing packaging, construction, and automotive industries. APAC has a growing automotive industry that is likely to drive the market for polyolefin foam.

The spread of the coronavirus started in China in early January 2020. Within a small period, the spread in other Asian countries such as Japan, South Korea, and Thailand resulted in the pandemic situation, with numerous positive cases and deaths. This situation led national governments across APAC to announce lockdowns, leading to a decrease in traffic, construction & mining activities, manufacturing industries, and so on. Since China is a global manufacturing hub, the impact of COVID-19 is anticipated to be much higher in the country.

Polyolefin Foam Market Players

The key players operating in the market are BASF SE (Germany), Kaneka Corporation (Japan), JSP Corporation (Japan), Hanwha Total (South Korea).

Polyolefin Foam Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2019-2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin Type |

|

Regions covered |

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players BASF SE, Hanwha Total, JSP Corporation, Kaneka Corporation |

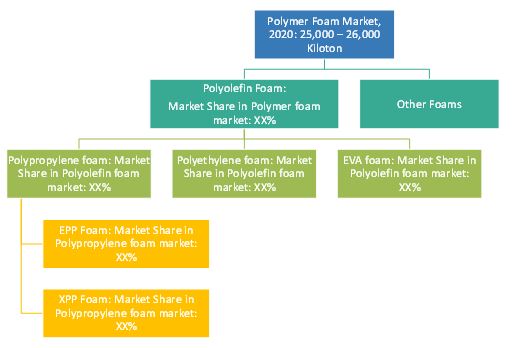

This research report categorizes the polyolefin foam market based on resin type, application, and region.

By Resin Type:

-

Polypropylene

- Expanded Polypropylene

- Extruded Polypropylene

-

Polyethylene

- XLPE

- NON-XLPE

- Ethylene-Vinyl Acetate

By Application:

- Automotive

- Packaging

- Construction

- Others

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In November 2019, Zotefoams PLC business, has set up a sales and service operation in one of India’s pharma hubs, Ahmedabad, in response to increase demand and opportunity for the technical insulation range.

- In June 2019, Pregis LLC has invested in a new protective packaging innovation center. It has invested in a new 50,000 square-foot innovation headquarters in Illinois designed to help solve protective packaging challenges

Frequently Asked Questions (FAQ):

What is the current size of the global polyolefin foam market?

The global polyolefin foam market is estimated to be USD 8.1 billion 2021 and projected to reach USD 10.5 billion by 2026, at a CAGR of 5.2%

Who are the major players of the polyolefin foam market?

Companies such as BASF SE(Germany), Kaneka Corporation(Japan), JSP Corporation(Japan), are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. New product launch and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for polyolefin foam?

Packaging was the largest industry of polyolefin foam, in terms of both volume and value, in 2020. Polyolefin foam are generally used in car to reduce weight, packaging of industrial product

Which is the fastest-growing region in the market?

APAC is the largest market for polyolefin foam globally. China is the largest market, and India is the fastest-growing market for polyolefin foam in the region. The easy availability of raw materials and high demand from end-use industries are driving the market in APAC. Emerging economies such as India, Taiwan, Thailand, and Indonesia also supporting market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET INCLUSIONS AND EXCLUSIONS

1.3.1 MARKET INCLUSIONS

1.3.2 MARKET EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 POLYOLEFIN FOAM MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 POLYOLEFIN FOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key primary data sources

2.1.2.2 Key data from primary sources

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 3 POLYOLEFIN FOAM MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 4 POLYOLEFIN FOAM MARKET SIZE ESTIMATION, BY VALUE

2.2.2 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 MARKET FORECAST APPROACH

2.3.1 DEMAND SIDE FORECAST PROJECTION

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 POLYOLEFIN FOAM MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 44)

TABLE 1 POLYOLEFIN FOAM MARKET, 2021 VS. 2026

FIGURE 8 POLYETHYLENE FOAM SEGMENT LED THE MARKET IN 2020

FIGURE 9 APAC WAS THE LARGEST MARKET FOR POLYOLEFIN FOAM IN 2020

FIGURE 10 AUTOMOTIVE AND PACKAGING WERE LEADING SEGMENTS IN OVERALL POLYOLEFIN FOAM MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN THE POLYOLEFIN FOAM MARKET

FIGURE 11 MARKET TO WITNESS MODERATE GROWTH DURING THE FORECAST PERIOD

4.2 POLYOLEFIN FOAM MARKET GROWTH, BY TYPE

FIGURE 12 POLYETHYLENE FOAM TO BE THE FASTEST-GROWING SEGMENT BETWEEN 2021 AND 2026

4.3 APAC: POLYETHYLENE FOAM MARKET, BY END-USE INDUSTRY AND COUNTRY, 2019

FIGURE 13 CHINA ACCOUNTED FOR LARGEST SHARE OF THE MARKET

4.4 EVA FOAMS MARKET, BY END-USE INDUSTRY

FIGURE 14 FOOTWEAR & LUGGAGE TO BE THE LARGEST END-USE INDUSTRY

4.5 EPP FOAM MARKET: BY MAJOR COUNTRIES

FIGURE 15 CHINA AND INDIA TO EMERGE AS LUCRATIVE MARKETS DURING THE FORECAST PERIOD

4.6 XPP FOAM MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 16 XPP FOAM MARKET TO WITNESS HIGHER GROWTH IN DEVELOPING COUNTRIES

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 VALUE CHAIN ANALYSIS

FIGURE 17 POLYOLEFIN FOAM MARKET: VALUE CHAIN ANALYSIS

5.2.1 POLYOLEFIN FOAM: SUPPLY CHAIN ECOSYSTEM

5.2.2 COVID-19 IMPACT ON VALUE CHAIN

5.2.2.1 Action plan against such vulnerability

5.3 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE POLYOLEFIN FOAM MARKET

5.3.1 DRIVERS

5.3.1.1 Growth of major end-use industries

5.3.1.2 Recyclable & reusable properties of polyolefin foam

5.3.1.3 Weight-to-performance ratio of polyolefin foam

5.3.2 RESTRAINTS

5.3.2.1 Volatile raw material prices

5.3.2.2 Higher price of polyolefin foam

5.3.3 OPPORTUNITIES

5.3.3.1 Growing demand for CO2-based polyols

5.3.3.2 Investments in emerging economies

5.3.4 CHALLENGES

5.3.4.1 Stringent government regulations

5.3.4.2 Growing demand for bio-based polyols

5.3.4.3 Less awareness about different kinds of polyolefin foams

5.4 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS: POLYOLEFIN FOAM MARKET

TABLE 2 POLYOLEFIN FOAM: PORTER’S FIVE FORCES ANALYSIS

5.4.1 INTENSITY OF COMPETITIVE RIVALRY

5.4.2 BARGAINING POWER OF BUYERS

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 THREAT OF SUBSTITUTES

5.4.5 THREAT OF NEW ENTRANTS

5.5 AVERAGE PRICING ANALYSIS

FIGURE 20 AVERAGE PRICE COMPETITIVENESS IN POLYOLEFIN FOAM MARKET

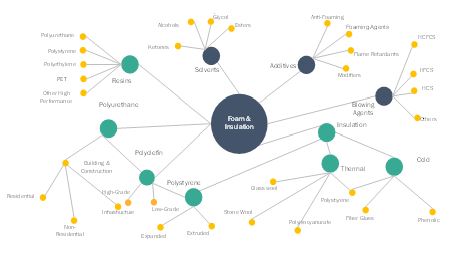

5.6 FOAMS ECOSYSTEM

FIGURE 21 FOAMS ECOSYSTEM

5.6.1 YC AND YCC SHIFT

5.7 MACROECONOMIC OVERVIEW

5.7.1 GLOBAL GDP TRENDS AND FORECASTS

TABLE 3 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2018–2025

5.8 INDUSTRY TRENDS

5.8.1 TRENDS AND FORECAST OF GLOBAL AUTOMOTIVE INDUSTRY

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION (2019-2020)

5.8.2 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

FIGURE 22 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

5.9 COVID-19 IMPACT ANALYSIS

5.9.1 COVID-19 ECONOMIC ASSESSMENT

5.9.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.9.3 EFFECTS ON GDP OF COUNTRIES

FIGURE 23 GDP FORECASTS OF G20 COUNTRIES IN 2020

5.9.4 SCENARIO ASSESSMENT

FIGURE 24 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

5.9.5 IMPACT ON CONSTRUCTION INDUSTRY

5.9.6 IMPACT ON AUTOMOTIVE INDUSTRY

5.10 POLYOLEFIN FOAM PATENT ANALYSIS

5.10.1 METHODOLOGY

5.10.2 PUBLICATION TRENDS

FIGURE 25 PUBLICATION TRENDS, 2017–2021

5.10.3 INSIGHT

5.10.4 JURISDICTION ANALYSIS

FIGURE 26 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2017–2021

5.10.5 TOP APPLICANTS

FIGURE 27 POLYOLEFIN FOAM: NUMBER OF PATENTS, BY COMPANY (2017–2021)

5.11 REGULATIONS

5.11.1 FOOD CONTACT-EU

5.11.2 US FOOD AND DRUG ADMINISTRATION (FDA)

5.12 TRADE ANALYSIS

5.12.1 TRADE SCENARIO OF POLYETHYLENE FOAMS

TABLE 5 US: IMPORT TRADE DATA, 2019

TABLE 6 MONTHLY IMPORT DATA FOR US, BY PARTNER, 2019

TABLE 7 MAJOR IMPORT PARTNERS OF US, 2019

TABLE 8 MONTHLY TRADE DATA FOR INDIA, 2019

TABLE 9 MONTHLY TRADE DATA FOR INDIA, BY PARTNER, 2019

TABLE 10 MAJOR TRADE PARTNERS OF INDIA, MONTHLY DATA, 2019

5.12.2 TRADE SCENARIO OF RAW MATERIAL FOR POLYPROPYLENE FOAMS

5.12.2.1 Polypropylene import-export trend impacting EPP and XPP foams production in the global market

TABLE 11 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

TABLE 12 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.13 CASE STUDY ANALYSIS

5.14 TECHNOLOGY ANALYSIS

5.14.1 POLYETHYLENE FOAM

5.14.2 EPP FOAM

5.14.3 XPP FOAM

6 POLYOLEFIN FOAM MARKET, BY TYPE (Page No. - 85)

6.1 INTRODUCTION

FIGURE 28 POLYETHYLENE FOAM SEGMENT ACCOUNTED FOR LARGEST SHARE OF POLYOLEFIN FOAM MARKET IN 2020

TABLE 13 POLYOLEFIN FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 14 POLYOLEFIN FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

6.2 POLYPROPYLENE (PP) FOAM

6.2.1 EXPANDED POLYPROPYLENE (EPP) FOAM

FIGURE 29 HIGH-DENSITY EPP FOAM IS THE MAJOR SEGMENT OF THE MARKET

TABLE 15 EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 16 EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

6.2.1.1 Low-density EPP Foam

6.2.1.1.1 Low-density EPP foams have high demand in the packaging industry

TABLE 17 LOW-DENSITY EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 18 LOW-DENSITY EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.2.1.2 High-density EPP Foam

6.2.1.2.1 These foams have good stability, high strength-to-weight ratio, and load-bearing structural support

TABLE 19 HIGH-DENSITY EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 20 HIGH-DENSITY EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.2.1.3 Porous PP Foam

6.2.1.3.1 These foams help in noise and vibration reduction

TABLE 21 POROUS PP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 POROUS PP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.2.2 EXTRUDED POLYPROPYLENE (XPP) FOAM

FIGURE 30 LOW-DENSITY SEGMENT DOMINATES THE XPP FOAM MARKET

TABLE 23 XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 24 XPP FOAM MARKET SIZE, BY DENSITY, 2016–2023 (KILOTON)

6.2.2.1 Low-Density XPP Foam

6.2.2.1.1 Increasing use of lightweight foams in automotive applications

TABLE 25 LOW-DENSITY XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 LOW-DENSITY XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.2.2.2 High-Density XPP Foam

6.2.2.2.1 Life cycle cost of high-density XPP foams is lower than low-density XPP foams

TABLE 27 HIGH-DENSITY XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 HIGH-DENSITY XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.3 POLYETHYLENE (PE) FOAM

FIGURE 31 NON-XLPE SEGMENT TO LEAD OVERALL POLYETHYLENE FOAM MARKET DURING THE FORECAST PERIOD

TABLE 29 POLYETHYLENE FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 30 POLYETHYLENE FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

6.3.1 NON-XLPE

6.3.1.1 Accounts for a larger share of the market

TABLE 31 NON-XLPE: POLYETHYLENE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 NON-XLPE: POLYETHYLENE FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

6.3.2 XLPE FOAM

6.3.2.1 To be the faster-growing segment of the market

TABLE 33 XLPE: POLYETHYLENE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 XLPE: POLYETHYLENE FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

7 POLYOLEFIN FOAM MARKET, BY END-USE INDUSTRY (Page No. - 98)

7.1 INTRODUCTION

7.2 PP FOAM

7.2.1 EPP FOAM

FIGURE 32 AUTOMOTIVE IS THE MAJOR END-USE INDUSTRY SEGMENT OF THE EPP FOAM MARKET

TABLE 35 EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 36 EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

7.2.1.1 Automotive

7.2.1.1.1 EPP foam is used widely in automotive industry for its low weight

TABLE 37 EPP FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 EPP FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (KILOTON)

7.2.1.2 Packaging

7.2.1.2.1 Affordability of EPP foam is driving the demand in packaging industry

TABLE 39 EPP FOAM MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 EPP FOAM MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (KILOTON)

7.2.1.3 Consumer Products

7.2.1.3.1 Energy absorption and acoustic insulation are boosting demand in consumer products

TABLE 41 EPP FOAM MARKET SIZE IN CONSUMER PRODUCTS, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 EPP FOAM MARKET SIZE IN CONSUMER PRODUCTS, BY REGION, 2019–2026 (KILOTON)

7.2.1.4 Others

TABLE 43 EPP FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 EPP FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

7.2.2 XPP FOAM

FIGURE 33 AUTOMOTIVE INDUSTRY DOMINATES XPP FOAM MARKET

TABLE 45 XPP FOAM MARKET, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 46 XPP FOAM MARKET, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

7.2.2.1 Automotive

7.2.2.1.1 XPP foam reduces overall weight of vehicles

TABLE 47 XPP FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 XPP FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (KILOTON)

7.2.2.2 Packaging

7.2.2.2.1 Excellent properties such as high stiffness, thermal insulation, and heat resistance

TABLE 49 XPP FOAM MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 XPP FOAM MARKET SIZE IN PACKAGING, BY REGION, 2019–2026 (KILOTON)

7.2.2.3 Building & Construction

7.2.2.3.1 PP based foam replacing PS foams in building & construction industry

TABLE 51 XPP FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

TABLE 52 XPP FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2016–2023 (KILOTON)

7.2.2.4 Others

TABLE 53 XPP FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 54 XPP FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

7.3 PE FOAM

FIGURE 34 PROTECTIVE PACKAGING SEGMENT TO LEAD THE POLYETHYLENE FOAMS MARKET

TABLE 55 POLYETHYLENE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 POLYETHYLENE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (KILOTON)

7.3.1 PROTECTIVE PACKAGING

7.3.1.1 Protective packaging is largest consumer of PE foams

TABLE 57 POLYETHYLENE FOAM MARKET SIZE IN PROTECTIVE PACKAGING, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 POLYETHYLENE FOAM MARKET SIZE IN PROTECTIVE PACKAGING, BY REGION, 2019–2026 (KILOTON)

7.3.2 AUTOMOTIVE

7.3.2.1 Automotive is second-largest end user of polyethylene foams

TABLE 59 POLYETHYLENE FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2021–2026 (USD MILLION)

TABLE 60 POLYETHYLENE FOAM MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2026 (KILOTON)

7.3.3 BUILDING & CONSTRUCTION

7.3.3.1 Growing infrastructural and new housing constructions to drive the market

TABLE 61 POLYETHYLENE FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 POLYETHYLENE FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (KILOTON)

7.3.4 FOOTWEAR, SPORTS & RECREATIONAL

7.3.4.1 Light-weight and durable properties of PE foams sui TABLE for sporting applications

TABLE 63 POLYETHYLENE FOAM MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 64 POLYETHYLENE FOAM MARKET SIZE IN FOOTWEAR, SPORTS & RECREATIONAL, BY REGION, 2021–2026 (KILOTON)

7.3.5 MEDICAL

7.3.5.1 Fastest-growing end-use industry of PE foams

TABLE 65 POLYETHYLENE FOAM MARKET SIZE IN MEDICAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 POLYETHYLENE FOAM MARKET SIZE IN MEDICAL, BY REGION, 2019–2026 (KILOTON)

7.3.6 OTHERS

TABLE 67 POLYETHYLENE FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 68 POLYETHYLENE FOAM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

7.4 EVA FOAM

TABLE 69 EVA FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 70 EVA FOAMS MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

7.4.1 FOOTWEAR & LUGGAGE

7.4.2 TOY, SPORTING GOODS, AND BUILDING MATERIALS

7.4.3 AUTOMOTIVE & ELECTRONIC COMPONENTS

8 POLYOLEFIN FOAM MARKET, BY REGION (Page No. - 119)

8.1 INTRODUCTION

FIGURE 35 APAC TO BE FASTEST-GROWING MARKET

TABLE 71 EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 72 EPP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 73 XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 74 XPP FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 75 PE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 76 PE FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 77 EVA FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 78 EVA FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.2 APAC

FIGURE 36 APAC: POLYOLEFIN FOAM MARKET SNAPSHOT

TABLE 79 APAC: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 80 APAC: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 81 APAC: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 82 APAC: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 83 APAC: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 84 APAC: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 85 APAC: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 86 APAC: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 87 APAC: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 88 APAC: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 89 APAC: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 90 APAC: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 91 APAC: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 92 APAC: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 93 APAC: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 94 APAC: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 95 APAC: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 96 APAC: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.2.1 CHINA

8.2.1.1 Growing industrial and manufacturing activities resulting in increasing demand for polyolefin foams

8.2.2 INDIA

8.2.2.1 Promising automobile manufacturing growth expected to drive the demand for polyolefin foam

8.2.3 JAPAN

8.2.3.1 Manufacturing industry projected to experience low growth due to saturated market conditions

8.2.4 SOUTH KOREA

8.2.4.1 Key automobile manufacturers are headquartered in the country

8.2.5 THAILAND

8.2.5.1 Thailand is largest automobile producer among Southeast Asian countries

8.2.6 REST OF APAC

8.3 NORTH AMERICA

FIGURE 37 NORTH AMERICA: POLYOLEFIN FOAM MARKET SNAPSHOT

TABLE 97 NORTH AMERICA: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 98 NORTH AMERICA: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 99 NORTH AMERICA: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 100 NORTH AMERICA: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 101 NORTH AMERICA: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 102 NORTH AMERICA: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 103 NORTH AMERICA: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 104 NORTH AMERICA: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 105 NORTH AMERICA: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 106 NORTH AMERICA: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 107 NORTH AMERICA: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 NORTH AMERICA: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 109 NORTH AMERICA: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 111 NORTH AMERICA: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 112 NORTH AMERICA: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD KILOTON)

TABLE 113 NORTH AMERICA: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD KILOTON)

8.3.1 US

8.3.1.1 Automotive industry is driving demand for polyolefin foam

8.3.2 CANADA

8.3.2.1 Market in Canada fueled by demand in packaging applications

8.3.3 MEXICO

8.3.3.1 Mexico is attracting investments from key market players

8.4 EUROPE

FIGURE 38 EUROPE: POLYOLEFIN FOAM MARKET SNAPSHOT

TABLE 115 EUROPE: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 116 EUROPE: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 117 EUROPE: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 118 EUROPE: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 119 EUROPE: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 120 EUROPE: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 121 EUROPE: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 122 EUROPE: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 123 EUROPE: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 124 EUROPE: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 125 EUROPE: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 EUROPE: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 127 EUROPE: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 128 EUROPE: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 129 EUROPE: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 130 EUROPE: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 131 EUROPE: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 132 EUROPE: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Increased demand from automotive parts manufacturing sector driving the market

8.4.2 FRANCE

8.4.2.1 France is a leading exporter of packaging materials globally

8.4.3 SPAIN

8.4.3.1 Spain has presence of established car manufacturers

8.4.4 UK

8.4.4.1 Significant investments made in automotive R&D to support market growth

8.4.5 NETHERLANDS

8.4.5.1 Growing automotive sector likely to boost the demand for polyolefin foam

8.4.6 REST OF EUROPE

8.5 SOUTH AMERICA

FIGURE 39 SOUTH AMERICA: POLYOLEFIN FOAM MARKET SNAPSHOT

TABLE 133 SOUTH AMERICA: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 134 SOUTH AMERICA: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 135 SOUTH AMERICA: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 136 SOUTH AMERICA: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 137 SOUTH AMERICA: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 138 SOUTH AMERICA: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 139 SOUTH AMERICA: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 140 SOUTH AMERICA: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 141 SOUTH AMERICA: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 142 SOUTH AMERICA: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 143 SOUTH AMERICA: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 144 SOUTH AMERICA: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 145 SOUTH AMERICA: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 146 SOUTH AMERICA: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 147 SOUTH AMERICA: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 148 SOUTH AMERICA: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 149 SOUTH AMERICA: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 150 SOUTH AMERICA: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.5.1 BRAZIL

8.5.1.1 Polyolefin foam market in Brazil led by demand from automotive industry

8.5.2 ARGENTINA

8.5.2.1 High demand for luxury cars and SUVs witnessed due to increasing consumer spending

8.5.3 REST OF SOUTH AMERICA

8.6 MIDDLE EAST & AFRICA

FIGURE 40 MIDDLE EAST & AFRICA: POLYOLEFIN FOAM MARKET SNAPSHOT

TABLE 151 MIDDLE EAST & AFRICA: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: EPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 153 MIDDLE EAST & AFRICA: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: XPP FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 155 MIDDLE EAST & AFRICA: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 156 MIDDLE EAST & AFRICA: PE FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 157 MIDDLE EAST & AFRICA: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: EPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 159 MIDDLE EAST & AFRICA: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: XPP FOAM MARKET SIZE, BY DENSITY, 2019–2026 (KILOTON)

TABLE 161 MIDDLE EAST & AFRICA: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: PE FOAM MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 163 MIDDLE EAST & AFRICA: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 164 MIDDLE EAST & AFRICA: EPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 165 MIDDLE EAST & AFRICA: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 166 MIDDLE EAST & AFRICA: XPP FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

TABLE 167 MIDDLE EAST & AFRICA: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 168 MIDDLE EAST & AFRICA: PE FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

8.6.1 SOUTH AFRICA

8.6.1.1 South Africa polyolefin foam market driven by presence of various car manufacturers in the country

8.6.2 MOROCCO

8.6.2.1 Presence of large number of automobile companies boosting the market

8.6.3 REST OF MIDDLE EAST & AFRICA

9 COMPETITIVE LANDSCAPE (Page No. - 157)

9.1 OVERVIEW

FIGURE 41 INVESTMENT & EXPANSION IS MOST FOLLOWED STRATEGY BY LEADING PLAYERS BETWEEN 2016 AND 2021

9.2 MARKET SHARE ANALYSIS

TABLE 169 POLYOLEFIN FOAM MARKET: DEGREE OF COMPETITION

FIGURE 42 MARKET SHARE ANALYSIS IN 2020

9.3 COMPANY REVENUE ANALYSIS

9.4 COMPANY EVALUATION QUADRANT MATRIX, 2020

9.4.1 STAR

9.4.2 EMERGING LEADERS

9.4.3 PERVASIVE

9.4.4 PARTICIPANTS

FIGURE 43 POLYOLEFIN FOAM MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

9.5 STRENGTH OF PRODUCT PORTFOLIO

9.6 BUSINESS STRATEGY EXCELLENCE

9.7 COMPETITIVE SCENARIO

9.7.1 MARKET EVALUATION FRAMEWORK

9.7.2 MARKET EVALUATION MATRIX

TABLE 170 COMPANY PRODUCT FOOTPRINT

TABLE 171 COMPANY REGION FOOTPRINT

TABLE 172 COMPANY INDUSTRY FOOTPRINT

9.8 STRATEGIC DEVELOPMENTS

9.8.1 MERGER & ACQUISITION

TABLE 173 MERGERS & ACQUISITIONS, 2017–2021

9.8.2 INVESTMENT & EXPANSION

TABLE 174 INVESTMENTS & EXPANSIONS, 2017–2021

10 COMPANY PROFILES (Page No. - 169)

10.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1.1 SEALED AIR

FIGURE 44 SEALED AIR: COMPANY SNAPSHOT

TABLE 175 SEALED AIR: BUSINESS OVERVIEW

TABLE 176 SEALED AIR: DEALS

TABLE 177 SEALED AIR: NEW PRODUCT LAUNCH

TABLE 178 SEALED AIR: OTHER DEVELOPMENTS

FIGURE 45 SEALED AIR: SWOT ANALYSIS

10.1.2 ZOTEFOAMS PLC

FIGURE 46 ZOTEFOAMS PLC: COMPANY SNAPSHOT

TABLE 179 ZOTEFOAMS PLC: BUSINESS OVERVIEW

TABLE 180 ZOTEFOAMS PLC: DEALS

TABLE 181 ZOTEFOAMS PLC: NEW PRODUCT LAUNCH

TABLE 182 ZOTEFOAMS PLC: OTHER DEVELOPMENTS

FIGURE 47 ZOTEFOAMS PLC: SWOT ANALYSIS

10.1.3 JSP CORPORATION

FIGURE 48 JSP CORPORATION: COMPANY SNAPSHOT

TABLE 183 JSP CORPORATION: BUSINESS OVERVIEW

TABLE 184 JSP CORPORATION: OTHER DEVELOPMENTS

FIGURE 49 JSP: SWOT ANALYSIS

10.1.4 KANEKA CORPORATION

FIGURE 50 KANEKA CORPORATION: COMPANY SNAPSHOT

TABLE 185 KANEKA CORPORATION: BUSINESS OVERVIEW

TABLE 186 KANEKA CORPORATION: OTHER DEVELOPMENTS

FIGURE 51 KANEKA CORPORATION: SWOT ANALYSIS

10.1.5 HANWHA TOTAL PETROCHEMICAL

FIGURE 52 HANWHA CHEMICAL CORPORATION: COMPANY SNAPSHOT

TABLE 187 HANWHA TOTAL PETROCHEMICAL: BUSINESS OVERVIEW

FIGURE 53 HANWHA: SWOT ANALYSIS

10.1.6 BASF SE

FIGURE 54 BASF: COMPANY SNAPSHOT

TABLE 188 BASF SE: BUSINESS OVERVIEW

FIGURE 55 BASF: SWOT ANALYSIS

10.1.7 FURUKAWA ELECTRIC CO., LTD.

FIGURE 56 FURUKAWA ELECTRIC: COMPANY SNAPSHOT

TABLE 189 FURUKAWA ELECTRIC: BUSINESS OVERVIEW

FIGURE 57 FURUKAWA ELECTRIC: SWOT ANALYSIS

10.1.8 DS SMITH PLC

FIGURE 58 DS SMITH: COMPANY SNAPSHOT

TABLE 190 DS SMITH: BUSINESS OVERVIEW

FIGURE 59 DS SMITH: SWOT ANALYSIS

10.1.9 SONOCO PRODUCTS COMPANY

FIGURE 60 SONOCO PRODUCTS COMPANY: COMPANY SNAPSHOT

TABLE 191 SONOCO PRODUCT COMPANY: BUSINESS OVERVIEW

FIGURE 61 SONOCO PRODUCTS COMPANY: SWOT ANALYSIS

10.1.10 RECTICEL NV

FIGURE 62 RECTICEL NV: COMPANY SNAPSHOT

TABLE 192 RECTICEL NV: BUSINESS OVERVIEW

TABLE 193 RECTICEL NV: OTHER DEVELOPMENTS

10.2 OTHER PLAYERS

10.2.1 WOODBRIDGE

TABLE 194 WOODBRIDGE: BUSINESS OVERVIEW

10.2.2 AUTOMA MULTI STYRENE

TABLE 195 AUTOMA MULTI STYRENE: BUSINESS OVERVIEW

10.2.3 CHEMISCHE FABRIK BUDENHEIM KG

TABLE 196 CHEMISCHE FABRIK BUDENHEIM KG: BUSINESS OVERVIEW

10.2.4 CLARK FOAM PRODUCTS

TABLE 197 CLARK FOAM PRODUCTS: BUSINESS OVERVIEW

10.2.5 K. K. NAG LTD.

TABLE 198 K. K. NAG LTD: BUSINESS OVERVIEW

10.2.6 KNAUF INDUSTRIES

TABLE 199 KNAUF INDUSTRIES: BUSINESS OVERVIEW

10.2.7 MITSUI CHEMICALS

FIGURE 63 MITSUI CHEMICALS: COMPANY SNAPSHOT

TABLE 200 MITSUI CHEMICALS: BUSINESS OVERVIEW

10.2.8 SEKISUI VOLTEK

TABLE 201 SEKISUI VOLTEK: BUSINESS OVERVIEW

10.2.9 PREGIS LLC

TABLE 202 PREGIS LLC: BUSINESS OVERVIEW

10.2.10 NMC SA

TABLE 203 NMC SA: BUSINESS OVERVIEW

TABLE 204 NMC SA: DEALS

10.2.11 TORAY INDUSTRIES

FIGURE 64 TORAY INDUSTRIES: COMPANY SNAPSHOT

TABLE 205 TORAY INDUSTRIES: BUSINESS OVERVIEW

10.2.12 ARMACELL LLC

FIGURE 65 ARMACELL LLC: COMPANY SNAPSHOT

TABLE 206 ARMACELL LLC: BUSINESS OVERVIEW

TABLE 207 ARMACELL LLC: DEALS

TABLE 208 ARMACELL LLC: OTHER DEVELOPMENTS

10.2.13 DAFA A/S

10.2.14 SUPREME INDUSTRIES LIMITED

TABLE 209 SUPREME INDUSTRIES LIMITED: BUSINESS OVERVIEW

10.2.15 FOAMPARTNER

TABLE 210 FOAMPARTNER: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 213)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATION

11.4 RELATED REPORT

11.5 AUTHOR DETAILS

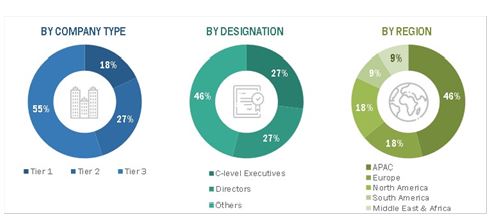

The study involves four major activities in estimating the current market size of polyolefin foam. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The polyolefin foam market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as automotive, packaging, construction, others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the polyolefin foam market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Polyolefin Foam Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the polyolefin foam market size, in terms of value and volume

- To provide detailed information regarding key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market growth

- To forecast the market size based on resin type and application

- To forecast the market size with respect to five regions namely North America, Europe, Asia Pacific (APAC), South America, and Middle East & Africa

- To strategically analyze micromarket with respect to individual growth trends, prospect, and their contribution to overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To analyze competitive developments such as new product launches, investment & expansions, mergers & acquisitions, and partnerships & agreements

- To strategically profile key players and comprehensively analyze their market shares and core competencies1

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the polyolefin foam market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyolefin Foam Market