Industrial Foam Market by Foam Type (Flexible, Rigid), Resin Type (Polyurethane, Polystyrene, Polyolefins, Phenolic, Pet), End-Use Industry and Region (North America, APAC, Europe, MEA, South America) - Global Forecast to 2026

Updated on : August 25, 2025

Industrial Foam Market

The global industrial foam market was valued at USD 55.6 billion in 2021 and is projected to reach USD 72.2 billion by 2026, growing at 5.4% cagr from 2021 to 2026. The market is propelled by the growth of various end-use industries. Increasing investments in infrastructure, new housing projects, and renovation of non-residential buildings in China, India, and Brazil have also boosted the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Industrial Foam Market

The pandemic is estimated to have huge impact on various factors of the value chain of industrial foams, which is expected to reflect during the forecast period, especially in the year 2021. The various impact of COVID-19 are as follows:

- Impact on raw materials: The imposition of COVID-19 lockdowns across the world, lead to a decrease in demand for MDI, significantly from March to June 2020. The key buyers in Asia Pacific either cancelled their advance orders or delayed their purchases. The outbreak and the spread of the COVID-19 situation have led to a shortage of TDI in key regions across the world. Most industrial companies have shut their operations, and many countries have sealed their ports, thereby resulting in no product movement. This has led to the cancellation of several orders for TDI.

- Impact on industrial foam manufacturers: The impact of COVID-19 outbreak resulted in the majority of production plants of industrial foams in Europe have either been closed or are operating with limited capacity.

- Impact on end-use industries: The impact of the COVID-19 on the construction industry is estimated to vary in different regions across the world. In Europe, the building & construction industry has been contracted by 60–70% in 2020. However, in Asia Pacific, the economy of China is improving as the construction sector in most parts of the country have resumed normal activities.

Industrial Foam Market Dynamics

Driver: Increasing demand for industrial foam from various industries.

Major industries requiring industrial foam include building & construction, HVAC, marine, aerospace, and pipe insulation. Industrial foam is used in the building & construction industry for forging, pipe-in-pipe, doors, roof board, and slabs. Industrial foam is widely used for interior insulation of walls or roofs in residential and commercial properties. Extruded polystyrene (XPS) material is also used in crafts and architectural model building. Expanded polystyrene (EPS) is an excellent material for building and construction, as it is light yet rigid with good thermal insulation and high impact resistance.

Restraint: Volatility in raw material prices

The price and availability of raw materials determine the cost structure of foam products. The key raw materials used to make foam are benzene, toluene, polyol, and phosgene. These are petroleum-based derivatives and are vulnerable to price fluctuations. Oil prices have been highly volatile from 2018 to 2021 due to the rising global demand, conflict and foreign military intervention in the Middle East, and the recent COVID-19 pandemic.

Opportunities: Growing demand for bio-based polyols

In view of the growing concerns over the dependence on fossil fuels and the impact of plastics on the environment, foam manufacturers are continuously striving for sustainability in business practices. The volatility in oil prices in recent years had a significant impact on the profitability of the foam industry. This led to the development of bio-based polyols that can be used to manufacture foam. Bio-derived materials such as soy-based polyols are far superior to conventional polyols in terms of sustainability and cost. They are also more thermally stable and less sensitive to hydrolysis. The key producers of soy-based polyols include Urethane Soy Systems, Bio-Based Technologies, The Dow Chemical Company, Cargill, Inc., and MCPU Polymer Engineering.

However, a major concern for companies interested in developing and commercializing soy-based polyols, natural oil-based polyols, and similar materials is the rapidly growing biodiesel market. The increase in the prices of conventional polyols resulted in the growing use of bio-based polyols, but the rising demand for biodiesel has led to a decrease in natural oil prices and, subsequently, of bio-based polyols. In such a scenario, producers who are backward integrated with the natural oil industry will have the edge over manufacturers of other polyols.

Challenges: Stringent regulations pertaining to use of chemicals

Overexposure to MDI (Methylene diphenyl diisocyanate) is hazardous to health and can cause skin, eye, nose, throat, and lung irritation. Polystyrene is carcinogenic and contains toxic substances such as benzene, ethylene, and styrene. The use of chlorofluorocarbons (CFCs) as blowing agents during the manufacturing process of industrial foam is a major reason for the depletion of the ozone layer. Hence, regulators such as Control of Substances Hazardous to Health (COSHH), European Union (EU), Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and the Environmental Protection Agency (EPA) in Europe and North America regulate the use of foam in various applications. It is thus a challenge for market players to develop cost-effective, eco-friendly foam products while complying with stringent environmental regulations.

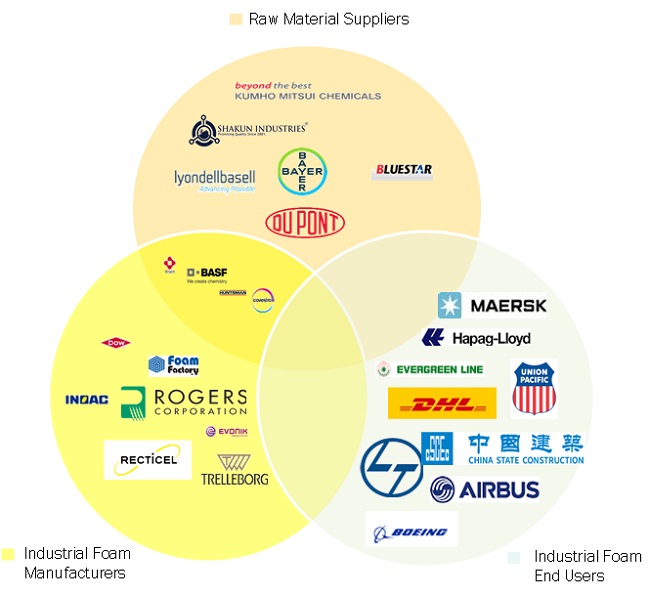

Industrial Foam Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on end-use industry, building and construction accounted for the largest market share in 2020

Industrial foam is used in numerous applications in the building & construction end-use industry. This foam is used as thermal insulators, in floorings & waterproofing, and for air sealing applications. The spray and rigid industrial foams are also used as structural and insulation foams in buildings. Although, the COVID-19 is estimated to have a huge impact on the building & construction sector, still this end-use industry stands as one of the major consumers of industrial foams as the volume of these foams used in this industry is more than other end-use industries.

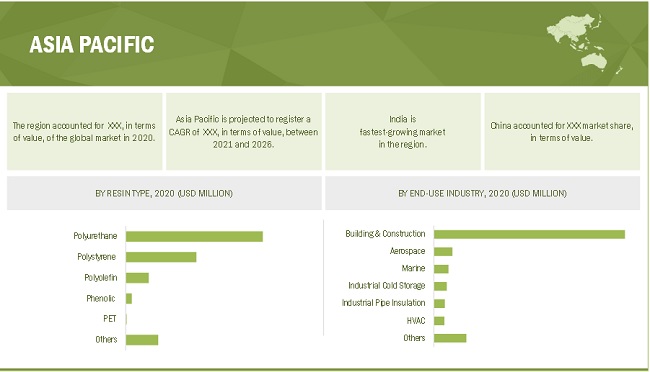

Asia Pacific accounted for the largest share of the industrial foam market in 2020

Asia-Pacific was the largest market for industrial foam in 2020. Asia Pacific is a rapidly developing region that offers many opportunities for the industry players. Most of the leading players of North America and Europe are planning to move their production base to this region because of the availability of inexpensive raw materials, low production costs, and the need to better serve the local market. The demand for premium and better-quality products is increasing in the region with the growth in the middle-class population. “Housing for All by 2025,” “Make in India,” and other infrastructure development activities initiated by the government of India help in the growth of the building & construction and marine industries of the country. These factors will play an important role in driving the industrial foam market.

Industrial Foam Market Players

Covestro AG (Germany), BASF SE (Germany), Dow Inc. (US), Huntsman Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Saint-Gobain (France), Chemtura Corporation (Lanxess) (US), Recticel NV/SA (Belgium), Rogers Corporation (US), Trelleborg AB (Sweden), FoamPartner Group (Switzerland), Eurofoam Group (Austria), Woodbridge Foam Corporation (Canada), Tosoh Corporation (Japan), Foamcraft, Inc. (US), Loyal Group(China), JSP Corporation(Japan), and Sealed Air Corporation (US) are among the key players leading the market.

Industrial Foam Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 55.6 Billion |

|

Revenue Forecast in 2026 |

USD 72.2 Billion |

|

CAGR |

5.4% |

|

Market Size Available for Years |

2016–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Units |

Value (USD Million) ,Volume (Kiloton) |

|

Segments Covered |

Foam type, Resin type and End-use industry |

|

Geographies Covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies Covered |

Covestro AG (Germany), BASF SE (Germany), Dow Inc. (US), Huntsman Corporation (US), Sekisui Chemical Co., Ltd. (Japan), Saint-Gobain (France), Chemtura Corporation (Lanxess) (US), Recticel NV/SA (Belgium), Rogers Corporation (US), Trelleborg AB (Sweden), Eurofoam Group (Austria), Woodbridge Foam Corporation (Canada), Tosoh Corporation (Japan), Foamcraft, Inc. (US), Loyal Group(China), JSP Corporation(Japan), and Sealed Air Corporation (US) |

This research report categorizes the industrial foam market based on foam type, end-use industry, resin type, and region and forecasts revenues as well as analyzes trends in each of these submarkets.

Based on Foam Type, the industrial foam market has been segmented into:

- Flexible

- Rigid

Based on End-use Industry, the industrial foam market has been segmented into:

- Building & Construction

- HVAC

- Industrial pipe insulation

- Marine

- Aerospace

- Industrial cold storage

- Others

Based on Resin Type, the industrial foam market has been segmented into:

- Polyurethane

- Polystyrene

- Polyolefin

- Phenolic

- PET

- Others

Based on Region, the industrial foam market has been segmented into:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In June 2020, BASF SE Ltd. established partnered with China-based Shanghai Zhengming Modern Logistics Co., Ltd. or Zhengming to develop insulating industrial (PU) sandwich panels. These panels are used in refrigerated storage of the cold chain industry in China. Under this partnership, BASF SE aims at supplying industrials for all joint cold storage units of Zhengming. This partnership is expected to strengthen the position of BASF SE in the industrial foam market of China.

- In June 2020, Huntsman Corporation acquired Icynene-Lapolla (US), a manufacturer and distributor of spray industrial foam (SPF) insulation systems for residential and commercial applications for USD 350 million. This acquisition aims at helping Huntsman Corporation in enhancing its downstream industrials business, as well as in strengthening its industrial product portfolio.

- In May 2020, Dow Inc. entered into an agreement with Univar Solutions Inc., a global chemical and ingredient distributor and provider of value-added services. Under the agreement, Univar Solutions Inc. will exclusively distribute VORASURF silicone industrial additives of Dow Inc. across North America. These silicone additives and surfactants enable improved foam properties by bringing flexibility and rigidness to industrial foams.

Frequently Asked Questions (FAQ):

What is Industrial Foam?

Industrial foam is made from polymers, resins, and additives and is produced through various processing methods, such as slab-stock by pouring, extrusion, and different forms of molding. It is classified on the basis of structure as closed and open cell. Closed cell foam is rigid, while open cell foam is flexible. Industrial foam is used in a wide variety of industries such as building & construction, HVAC, marine, aerospace, railways, and industrial cold storage.

What is the current size of the global industrial foam market?

The global industrial foam market is estimated to be USD 55.6 billion in 2021 and projected to reach to USD 72.2 billion by 2026, at a CAGR of 5.4%.

Who are the winners in the global industrial foam market?

Companies such as Covestro AG, BASF SE, Dow Inc., Sealed Air Corporation and Huntsman Corporation, fall under the winners category. These are leading players in the industrial foams market, globally, and are some of the leading players operating in the industrial foams market. These players have adopted the strategies of expansions, agreements, mergers & acquisitions, partnerships, new product launches, joint ventures, investments & contracts, and new technology & new process developments to increase their presence in the global market.

What is the COVID-19 impact on the industrial foam value chain?

COVID-19 outbreak is expected to have a major impact on the global demand for industrial foam in the building & construction industry. The outbreak and the spread of the COVID-19 led to major supply chain disruptions across the world, thereby resulting in non-delivery of raw materials used for manufacturing industrials in the Middle East. Also, this demand for MDI decreased significantly from March to June 2020. The key buyers in Asia Pacific either cancelled their advance orders or delayed their purchases.

What are the key regions in the global Industrial Foam market?

In terms of region, the highest consumption was observed to be in Asia Pacific. This is primarily due to growing demand from the building and construction industry. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INDUSTRIAL FOAM MARKET, BY FOAM TYPE: INCLUSIONS & EXCLUSIONS

TABLE 2 INDUSTRIAL FOAM MARKET, BY RESIN TYPE: INCLUSIONS & EXCLUSIONS

TABLE 3 INDUSTRIAL FOAM MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

TABLE 4 INDUSTRIAL FOAM MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 SCOPE OF THE MARKET

1.4.1 MARKETS COVERED

FIGURE 1 INDUSTRIAL FOAM MARKET SEGMENTATION

FIGURE 2 INDUSTRIAL FOAM MARKET: REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 INDUSTRIAL FOAM MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 List of participating companies for primary research

2.1.2.3 Key industry insights

2.1.2.4 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 5 FOAM MARKET SIZE ESTIMATION, BY VALUE

2.2.2 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

FIGURE 7 INDUSTRIAL FOAM MARKET: DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 5 INDUSTRIAL FOAM MARKET SNAPSHOT, 2021 & 2026

FIGURE 8 POLYURETHANE FOAM ACCOUNTED FOR LARGEST SHARE OF OVERALL MARKET IN 2020

FIGURE 9 BUILDING & CONSTRUCTION ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL FOAM MARKET IN 2020

FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF INDUSTRIAL FOAM MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ATTRACTIVE OPPORTUNITIES IN INDUSTRIAL FOAM MARKET

FIGURE 11 GROWING APPLICATIONS IN AEROSPACE AND HVAC INDUSTRIES EXPECTED TO DRIVE THE MARKET

4.2 INDUSTRIAL FOAM MARKET, BY REGION

FIGURE 12 INDUSTRIAL FOAM MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

4.3 ASIA PACIFIC INDUSTRIAL FOAM MARKET, BY END-USE INDUSTRY & COUNTRY

FIGURE 13 BUILDING & CONSTRUCTION SEGMENT ACCOUNTS FOR LARGEST SHARE OF ASIA PACIFIC INDUSTRIAL FOAM MARKET

4.4 INDUSTRIAL FOAM MARKET, BY MAJOR COUNTRIES

FIGURE 14 INDUSTRIAL FOAM MARKET IN CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 45)

5.1 MARKET DYNAMICS

FIGURE 15 INDUSTRIAL FOAM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES & CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Increasing demand for foam from various industries

FIGURE 16 GROWTH IN INFRASTRUCTURE CONSTRUCTION (2020-2030)

5.1.1.2 Energy conservation and sustainability

5.1.2 RESTRAINTS

5.1.2.1 Volatility in raw material prices

TABLE 6 GLOBAL OIL & GAS PRICES, USD/BBL (2016–2020)

FIGURE 17 GLOBAL OIL DEMAND GROWTH (2016-2021)

5.1.3 OPPORTUNITIES

5.1.3.1 Growing demand for bio-based polyols

5.1.3.2 Increasing use of CO2-based polyols

5.1.4 CHALLENGES

5.1.4.1 Stringent regulations pertaining to use of chemicals

5.1.4.2 Supply chain, trade, and economic disruptions due to COVID-19 pandemic

TABLE 7 COVID-19 IMPACT ON INDUSTRIAL FOAM SUPPLY CHAIN

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 INDUSTRIAL FOAM MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 INDUSTRIAL FOAM MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 INTENSITY OF COMPETITIVE RIVALRY

5.2.2 BARGAINING POWER OF BUYERS

5.2.3 BARGAINING POWER OF SUPPLIERS

5.2.4 THREAT OF SUBSTITUTES

5.2.5 THREAT OF NEW ENTRANTS

5.3 SUPPLY CHAIN ANALYSIS

FIGURE 19 SUPPLY CHAIN OF INDUSTRIAL FOAM MARKET

TABLE 9 COMPANIES INVOLVED IN SUPPLY CHAIN OF INDUSTRIAL FOAM MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 20 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING PRODUCTION PROCESS

5.4.1 COVID-19 IMPACT ON VALUE CHAIN

5.4.2 PROMINENT COMPANIES

5.4.3 SMALL & MEDIUM ENTERPRISES

5.5 ECOSYSTEM MARKET MAP

FIGURE 21 ECOSYSTEM MAP FOR INDUSTRIAL FOAM MARKET

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

FIGURE 22 YC AND YCC SHIFT

5.7 TECHNOLOGY ANALYSIS

5.7.1 POLYURETHANE FOAM

5.7.2 POLYSTYRENE FOAM

5.7.3 POLYETHYLENE FOAM

5.7.4 EXPANDED POLYPROPYLENE FOAM

5.7.5 EXTRUDED POLYPROPYLENE FOAM

5.8 TRADE ANALYSIS

5.8.1 TRADE SCENARIO FOR POLYPROPYLENE FOAM

5.8.1.1 Polypropylene import-export trend impacting EPP and XPP foam production

TABLE 10 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

TABLE 11 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD)

5.8.2 POLYSTYRENE AND EPS IMPORT-EXPORT TREND IMPACTING EPS AND XPS FOAM PRODUCTION

TABLE 12 IMPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD MILLION)

TABLE 13 EXPORT TRADE DATA FOR TOP COUNTRIES, 2016–2020 (USD MILLION)

5.9 REGULATORY LANDSCAPE

TABLE 14 DETAILS ON DIFFERENT REGULATIONS FOR ENERGY EFFICIENCY

5.10 AVERAGE PRICING ANALYSIS

FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN INDUSTRIAL FOAM MARKET

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 PUBLICATION TRENDS

FIGURE 24 PUBLICATION TRENDS, 2017–2021

5.11.3 INSIGHT

5.11.4 JURISDICTION ANALYSIS

FIGURE 25 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2017–2021

5.11.5 TOP APPLICANTS

TABLE 15 POLYOLEFIN FOAM: NUMBER OF PATENTS, BY COMPANY (2017–2021)

TABLE 16 POLYSTYRENE FOAM: NUMBER OF PATENTS, BY COMPANY (2017–2021)

TABLE 17 POLYURETHANE FOAM: NUMBER OF PATENTS, BY COMPANY (2017–2021)

TABLE 18 PET FOAM: NUMBER OF PATENTS, BY COMPANY (2017–2021)

5.12 COVID-19 IMPACT ANALYSIS

5.12.1 COVID-19 HEALTH ASSESSMENT

FIGURE 26 COUNTRY-WISE SPREAD OF COVID-19

FIGURE 27 IMPACT OF COVID-19 ON DIFFERENT COUNTRIES IN 2020

FIGURE 28 THREE SCENARIO-BASED ANALYSES OF COVID-19 IMPACT ON GLOBAL ECONOMY

5.12.2 IMPACT ON BUILDING & CONSTRUCTION INDUSTRY

5.12.3 IMPACT ON HVAC INDUSTRY

6 INDUSTRIAL FOAM MARKET, BY END-USE INDUSTRY (Page No. - 75)

6.1 INTRODUCTION

FIGURE 29 BUILDING & CONSTRUCTION TO LEAD FOAM MARKET BETWEEN 2021 AND 2026

TABLE 19 INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 20 INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

6.2 BUILDING & CONSTRUCTION

6.2.1 BUILDING & CONSTRUCTION SECTOR TO LEAD OVERALL INDUSTRIAL FOAM MARKET

6.2.2 RESIDENTIAL

6.2.3 COMMERCIAL

6.2.4 INDUSTRIAL

TABLE 21 INDUSTRIAL FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 INDUSTRIAL FOAM MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2019–2026 (KILOTON)

6.3 HVAC

6.3.1 ASIA PACIFIC TO LEAD INDUSTRIAL FOAM MARKET IN HVAC

6.3.2 PIPING

6.3.3 DUCTING

TABLE 23 INDUSTRIAL FOAM MARKET SIZE IN HVAC, BY REGION, 2019–2026 (USD MILLION)

TABLE 24 INDUSTRIAL FOAM MARKET SIZE IN HVAC, BY REGION, 2019–2026 (KILOTON)

6.4 INDUSTRIAL PIPE INSULATION

6.4.1 ASIA PACIFIC TO LEAD INDUSTRIAL FOAM MARKET IN INDUSTRIAL PIPE INSULATION

6.4.2 HOT PIPE INSULATION

6.4.3 COLD PIPE INSULATION

TABLE 25 INDUSTRIAL FOAM MARKET SIZE IN INDUSTRIAL PIPE INSULATION, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 INDUSTRIAL FOAM MARKET SIZE IN INDUSTRIAL PIPE INSULATION, BY REGION, 2019–2026 (KILOTON)

6.5 MARINE

6.5.1 ASIA PACIFIC TO LEAD INDUSTRIAL FOAM MARKET IN MARINE INDUSTRY

6.5.2 SEATS AND CUSHION

6.5.3 FLOORING

6.5.4 TABLE/DOORS

6.5.5 WINDOW SEALS

TABLE 27 INDUSTRIAL FOAM MARKET SIZE IN MARINE, BY REGION, 2019–2026 (USD MILLION)

TABLE 28 INDUSTRIAL FOAM MARKET SIZE IN MARINE, BY REGION, 2019–2026 (KILOTON)

6.6 AEROSPACE

6.6.1 AEROSPACE INDUSTRY WITNESSING INCREASING USE OF INDUSTRIAL FOAM

6.6.2 SEATS AND CUSHION

6.6.3 FLOORING

6.6.4 TABLE/DOORS

6.6.5 WINDOW SEALS

TABLE 29 INDUSTRIAL FOAM MARKET SIZE IN AEROSPACE, BY REGION, 2019–2026 (USD MILLION)

TABLE 30 INDUSTRIAL FOAM MARKET SIZE IN AEROSPACE, BY REGION, 2019–2026 (KILOTON)

6.7 INDUSTRIAL COLD STORAGE

6.7.1 ASIA PACIFIC TO LEAD INDUSTRIAL FOAM MARKET IN INDUSTRIAL COLD STORAGE

TABLE 31 INDUSTRIAL FOAM MARKET SIZE IN INDUSTRIAL COLD STORAGE, BY REGION, 2019–2026 (USD MILLION)

TABLE 32 INDUSTRIAL FOAM MARKET SIZE IN INDUSTRIAL COLD STORAGE, BY REGION, 2019–2026 (KILOTON)

6.8 OTHERS

TABLE 33 INDUSTRIAL FOAMS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 34 INDUSTRIAL FOAMS MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (KILOTON)

7 FOAM MARKET, BY TYPE (Page No. - 88)

7.1 INTRODUCTION

7.2 FLEXIBLE FOAM

7.3 RIGID FOAM

8 INDUSTRIAL FOAM MARKET, BY RESIN TYPE (Page No. - 90)

8.1 INTRODUCTION

FIGURE 30 POLYURETHANE FOAM SEGMENT TO DOMINATE INDUSTRIAL FOAM MARKET DURING FORECAST PERIOD

TABLE 35 INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 36 INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

8.2 POLYURETHANE

8.2.1 POLYURETHANE SEGMENT TO LEAD INDUSTRIAL FOAM MARKET

TABLE 37 PU FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 38 PU FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.3 POLYSTYRENE

8.3.1 HIGH DEMAND FOR PS FOAM FROM BUILDING & CONSTRUCTION INDUSTRY

8.3.2 EXPANDED POLYSTYRENE FOAM (EPS)

8.3.3 EXTRUDED POLYSTYRENE FOAM (XPS)

TABLE 39 POLYSTYRENE FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 40 POLYSTYRENE FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.4 POLYOLEFIN

8.4.1 POLYETHYLENE FOAM (PE)

8.4.2 POLYPROPYLENE FOAM (PP)

8.4.3 EVA FOAM

TABLE 41 POLYOLEFIN FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 42 POLYOLEFIN FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.5 PHENOLIC

8.5.1 PHENOLIC FOAM WIDELY USED IN HIGH-END APPLICATIONS

TABLE 43 PHENOLIC FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 44 PHENOLIC FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.6 PET FOAM

TABLE 45 PET FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 46 PET FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

8.7 OTHERS

8.7.1 PVC FOAM

8.7.2 MELAMINE FOAM

8.7.3 SILICONE FOAM

8.7.4 PVDF FOAM

8.7.5 RUBBER

TABLE 47 OTHER FOAMS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 OTHER FOAMS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9 INDUSTRIAL FOAM MARKET, BY REGION (Page No. - 102)

9.1 INTRODUCTION

FIGURE 31 REGIONAL SNAPSHOT: INDIA AND CHINA TO EMERGE AS STRATEGIC LOCATIONS

TABLE 49 INDUSTRIAL FOAM MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 50 INDUSTRIAL FOAM MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

9.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA SNAPSHOT: US TO DOMINATE INDUSTRIAL FOAM MARKET

TABLE 51 NORTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 53 NORTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 54 NORTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 55 NORTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.1 US

9.2.1.1 Building & construction industry driving the demand for industrial foams

TABLE 57 US: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 58 US: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.2 CANADA

9.2.2.1 State-of-the-art manufacturing facilities and excellent infrastructure to provide growth opportunities

TABLE 59 CANADA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 60 CANADA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.2.3 MEXICO

9.2.3.1 Economic development to drive the market growth

TABLE 61 MEXICO: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 62 MEXICO: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC SNAPSHOT: CHINA TO LEAD INDUSTRIAL FOAM MARKET IN ASIA PACIFIC

TABLE 63 ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 USD MILLION)

TABLE 64 ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 65 ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 66 ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 67 ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 68 ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.1 CHINA

9.3.1.1 Improved public infrastructure and construction sectors to boost the demand

TABLE 69 CHINA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 70 CHINA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.2 JAPAN

9.3.2.1 Industrial foam market in Japan is mature and estimated to grow at a moderate rate

TABLE 71 JAPAN: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 72 JAPAN: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.3 INDIA

9.3.3.1 Availability of resources, rapid economic growth, increasing disposable income, and urbanization to influence the market

TABLE 73 INDIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 74 INDIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.4 SOUTH KOREA

9.3.4.1 Growth in manufacturing sector to drive demand for industrial foam

TABLE 75 SOUTH KOREA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 SOUTH KOREA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.5 MALAYSIA

9.3.5.1 Increase in demand for industry foam in renovation activities of construction sector to drive the market

TABLE 77 MALAYSIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 78 MALAYSIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.6 INDONESIA

9.3.6.1 High growth in building & construction industries to drive the industrial foam market

TABLE 79 INDONESIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 80 INDONESIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.7 THAILAND

9.3.7.1 Strong local supply chain and efficient infrastructure to drive the demand for industrial foam

TABLE 81 THAILAND: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 82 THAILAND: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.3.8 REST OF ASIA PACIFIC

TABLE 83 REST OF ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4 EUROPE

FIGURE 34 EUROPE SNAPSHOT: GERMANY TO LEAD FOAM MARKET IN EUROPE

TABLE 85 EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 87 EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 88 EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 89 EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 90 EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.1 GERMANY

9.4.1.1 Ongoing advancement in industrial foam technologies to lead the market growth

TABLE 91 GERMANY: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 92 GERMANY: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.2 FRANCE

9.4.2.1 Building & construction industry to drive the market growth

TABLE 93 FRANCE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 94 FRANCE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.3 ITALY

9.4.3.1 Increasing foreign investments to drive market

TABLE 95 ITALY: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 96 ITALY: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.4 UK

9.4.4.1 Presence of major industrial foam companies contributing to market growth

TABLE 97 UK: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 98 UK: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.5 SPAIN

9.4.5.1 Growth of construction industry to propel demand for industrial foam

TABLE 99 SPAIN: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 100 SPIAN: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.6 RUSSIA

9.4.6.1 Government investments to modernize infrastructure to boost demand

TABLE 101 RUSSIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 102 RUSSIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.7 TURKEY

9.4.7.1 Building & construction industry to contribute significantly to industrial foam market

TABLE 103 TURKEY: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 104 TURKEY: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.4.8 REST OF EUROPE

TABLE 105 REST OF EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 106 REST OF EUROPE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5 MIDDLE EAST & AFRICA

TABLE 107 MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 108 MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 109 MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 110 MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 111 MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 112 MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.1 SAUDI ARABIA

9.5.1.1 HVAC industry is fastest-growing consumer of industrial foam in Saudi Arabia

TABLE 113 SAUDI ARABIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 114 SAUDI ARABIA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.2 SOUTH AFRICA

9.5.2.1 Growth of various manufacturing industries to positively influence growth of industrial foam market

TABLE 115 SOUTH AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 116 SOUTH AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.3 UAE

9.5.3.1 Building of new resorts, shopping malls, and other ongoing projects to boost demand for industrial foam

TABLE 117 UAE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 118 UAE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 119 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 120 REST OF MIDDLE EAST & AFRICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6 SOUTH AMERICA

TABLE 121 SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 122 SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 123 SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

TABLE 124 SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 125 SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 126 SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.1 BRAZIL

9.6.1.1 Expansion of production capacity, established distribution channels, and proximity to South American countries to propel the market

TABLE 127 BRAZIL: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 128 BRAZIL: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.2 ARGENTINA

9.6.2.1 Increasing demand for industrial foam in Argentina to drive the market

TABLE 129 ARGENTINA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 130 ARGENTINA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.3 CHILE

9.6.3.1 Government investment in end-use industries to drive the demand for industrial foam market

TABLE 131 CHILE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 132 CHILE: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

9.6.4 REST OF SOUTH AMERICA

TABLE 133 REST OF SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 134 REST OF SOUTH AMERICA: INDUSTRIAL FOAM MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 149)

10.1 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN

TABLE 135 OVERVIEW OF STRATEGIES ADOPTED BY INDUSTRIAL FOAM VENDORS

10.2 REVENUE ANALYSIS

FIGURE 35 REVENUE ANALYSIS FOR TOP 5 COMPANIES IN PAST 5 YEARS, 2016-2020

10.3 MARKET SHARE ANALYSIS

FIGURE 36 POLYSTYRENE FOAM: CAPACITY SHARE ANALYSIS IN 2020

TABLE 136 POLYSTYRENE FOAM MARKET: DEGREE OF COMPETITION

FIGURE 37 POLYOLEFIN FOAM: MARKET SHARE ANALYSIS IN 2020

TABLE 137 POLYOLEFIN FOAM MARKET: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION MATRIX

10.4.1 STAR

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE

10.4.4 PARTICIPANTS

FIGURE 38 INDUSTRIAL FOAM MARKET: COMPANY EVALUATION MATRIX, 2020

10.5 COMPETITIVE BENCHMARKING

FIGURE 39 COMPANY PRODUCT FOOTPRINT

TABLE 138 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 139 COMPANY END-USE INDUSTRY FOOTPRINT

TABLE 140 COMPANY REGION FOOTPRINT

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) MATRIX, 2020

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 DYNAMIC COMPANIES

10.6.4 RESPONSIVE COMPANIES

FIGURE 40 INDUSTRIAL FOAM MARKET: SME MATRIX, 2020

10.7 COMPETITIVE BENCHMARKING

FIGURE 41 COMPANY PRODUCT FOOTPRINT (SME)

TABLE 141 COMPANY PRODUCT TYPE FOOTPRINT (SME)

TABLE 142 COMPANY END-USE INDUSTRY FOOTPRINT (SME)

TABLE 143 COMPANY REGION FOOTPRINT (SME)

10.8 COMPETITIVE SCENARIO AND TRENDS

10.8.1 PRODUCT LAUNCHES

TABLE 144 INDUSTRIAL FOAM MARKET: PRODUCT LAUNCHES, JANUARY 2016-JULY 2021

10.8.2 DEALS

TABLE 145 INDUSTRIAL FOAM MARKET: DEALS, JANUARY 2016-JULY 2021

11 COMPANY PROFILES (Page No. - 170)

11.1 KEY PLAYERS

(Business Overview, Products Recent Developments, MnM View)*

11.1.1 ARMACELL

TABLE 146 ARMACELL: COMPANY OVERVIEW

FIGURE 42 ARMACELL: COMPANY SNAPSHOT

TABLE 147 ARMACELL: DEALS

11.1.2 BASF SE

TABLE 148 BASF SE: BUSINESS OVERVIEW

FIGURE 43 BASF SE: COMPANY SNAPSHOT

TABLE 149 BASF SE: PRODUCT/PROCESS LAUNCHES

TABLE 150 BASF SE: DEALS

11.1.3 COVESTRO AG

TABLE 151 COVESTRO AG: BUSINESS OVERVIEW

FIGURE 44 COVESTRO AG: COMPANY SNAPSHOT

TABLE 152 COVESTRO AG: DEALS

11.1.4 DOW CHEMICAL

TABLE 153 DOW CHEMICAL: BUSINESS OVERVIEW

FIGURE 45 DOW CHEMICAL: COMPANY SNAPSHOT

TABLE 154 DOW CHEMICAL: PRODUCT LAUNCHES

TABLE 155 DOW CHEMICAL: DEALS

TABLE 156 DOW CHEMICAL: OTHERS

11.1.5 HUNTSMAN CORPORATION

TABLE 157 HUNTSMAN CORPORATION: COMPANY OVERVIEW

FIGURE 46 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

TABLE 158 HUNTSMAN CORPORATION: DEALS

TABLE 159 HUNTSMAN CORPORATION: OTHERS

11.1.6 JSP CORPORATION

TABLE 160 JSP CORPORATION: BUSINESS OVERVIEW

FIGURE 47 JSP CORPORATION: COMPANY SNAPSHOT

TABLE 161 JSP CORPORATION: OTHER DEVELOPMENTS

11.1.7 RECTICEL NV/SA

TABLE 162 RECTICEL NV/SA: BUSINESS OVERVIEW

FIGURE 48 RECTICEL NV/SA: COMPANY SNAPSHOT

TABLE 163 RECTICEL NV/SA: DEALS

11.1.8 ROGERS CORPORATION

TABLE 164 ROGERS CORPORATION: BUSINESS OVERVIEW

FIGURE 49 ROGERS CORPORATION: COMPANY SNAPSHOT

TABLE 165 ROGERS CORPORATION: PRODUCT LAUNCHES

TABLE 166 ROGERS CORPORATION: DEALS

11.1.9 SAINT-GOBAIN

TABLE 167 SAINT-GOBAIN: COMPANY OVERVIEW

FIGURE 50 SAINT-GOBAIN: COMPANY SNAPSHOT

TABLE 168 SAINT-GOBAIN: DEALS

11.1.10 SEALED AIR CORPORATION

TABLE 169 SEALED AIR CORPORATION: BUSINESS OVERVIEW

FIGURE 51 SEALED AIR CORPORATION: COMPANY SNAPSHOT

TABLE 170 SEALED AIR: DEALS

11.1.11 ZOTEFOAMS PLC

TABLE 171 ZOTEFOAMS PLC: BUSINESS OVERVIEW

FIGURE 52 ZOTEFOAMS PLC: COMPANY SNAPSHOT

TABLE 172 ZOTEFOAMS PLC: DEALS

TABLE 173 ZOTEFOAMS PLC: NEW PRODUCT LAUNCH

TABLE 174 ZOTEFOAMS PLC: OTHER DEVELOPMENTS

11.1.12 TRELLEBORG AB

TABLE 175 TRELLEBORG AB: COMPANY OVERVIEW

FIGURE 53 TRELLEBORG AB: COMPANY SNAPSHOT

TABLE 176 TRELLEBORG AB: PRODUCT LAUNCHES

TABLE 177 TRELLEBORG AB: DEALS

11.1.13 TOSOH CORPORATION

TABLE 178 TOSOH CORPORATION: COMPANY OVERVIEW

FIGURE 54 TOSOH CORPORATION: COMPANY SNAPSHOT

TABLE 179 TOSOH CORPORATION: DEALS

11.1.14 SEKISUI CHEMICAL CO., LTD.

TABLE 180 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

FIGURE 55 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

TABLE 181 SEKISUI CHEMICAL CO., LTD.: DEALS

11.1.15 ACH FOAM TECHNOLOGIES, INC.

TABLE 182 ACH FOAM TECHNOLOGIES: BUSINESS OVERVIEW

11.1.16 EUROFOAM GROUP

TABLE 183 EUROFOAM GROUP: COMPANY OVERVIEW

TABLE 184 EUROFOAM GROUP: DEALS

11.1.17 BOREALIS AG

TABLE 185 BOREALIS AG: COMPANY OVERVIEW

TABLE 186 BOREALIS AG: DEALS

11.1.18 HANWHA CHEMICAL CORPORATION

TABLE 187 HANWHA CHEMICAL CORPORATION: BUSINESS OVERVIEW

11.1.19 ARKEMA S.A.

TABLE 188 ARKEMA S.A.: BUSINESS OVERVIEW

11.1.20 KANEKA CORPORATION

TABLE 189 KANEKA CORPORATION: BUSINESS OVERVIEW

TABLE 190 KANEKA CORPORATION: OTHER DEVELOPMENTS

11.1.21 CHEMTURA CORPORATION (LANXESS)

TABLE 191 CHEMTURA CORPORATION (LANXESS): COMPANY OVERVIEW

TABLE 192 CHEMTURA CORPORATION (LANXESS): OTHERS

11.1.22 MITSUI CHEMICALS CORP.

TABLE 193 MITSUI CHEMICALS CORP.: BUSINESS OVERVIEW

11.1.23 TORAY INDUSTRIES, INC.

TABLE 194 TORAY INDUSTRIES: BUSINESS OVERVIEW

11.1.24 WOODBRIDGE FOAM CORPORATION

TABLE 195 WOODBRIDGE FOAM CORPORATION: COMPANY OVERVIEW

TABLE 196 WOODBRIDGE FOAM CORPORATION: DEALS

11.1.25 LOYAL GROUP

TABLE 197 LOYAL GROUP: COMPANY OVERVIEW

11.1.26 SIMONA AMERICA INC.

TABLE 198 SIMONA AMERICA INC.: COMPANY OVERVIEW

11.1.27 SABIC

TABLE 199 SABIC: COMPANY OVERVIEW

TABLE 200 SABIC: PRODUCT LAUNCHES

TABLE 201 SABIC: DEALS

*Details on Business Overview, Products, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 237)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

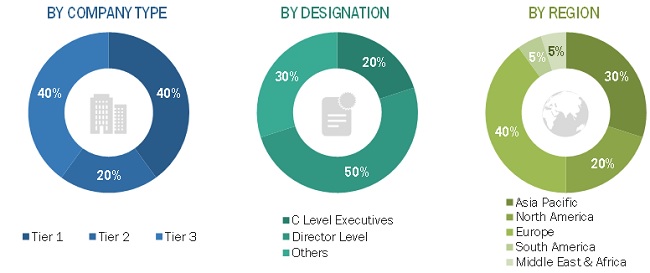

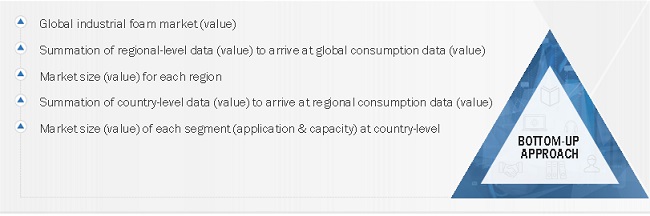

This study involved four major activities in estimating the current size of the industrial foam market. Exhaustive secondary research was undertaken to collect information on the industrial foam market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both, the top-down and bottom-up approaches were employed to estimate the overall size of the market. Thereafter, the market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the industrial foam market.

Secondary Research

As a part of the secondary research process, various secondary sources such as Hoovers, Bloomberg, BusinessWeek, Reuters, and Factiva were referred for identifying and collecting information for this study on the industrial foam market. Secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, authenticated directories, and databases.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the monetary chain of the market, the total pool of players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments undertaken from both, market- and technology oriented perspectives.

Primary Research

In the primary research process, experts from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents (VPs), marketing directors, and related key executives from major companies and organizations operating in the industrial foam market. Primary sources from the demand side included purchase managers of companies, end users, suppliers, and distributors of industrial foam.

Following is the breakdown of primary respondents interviewed:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the industrial foam market. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research

- The supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data

- The research includes the study of reports, reviews, and newsletters of the key market players along with extensive interviews for opinions from leaders, such as directors and marketing executives

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were used, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments of the market. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Report

- To define, describe, and forecast the size of the global industrial foam market, in terms of value and volume; based on resin type, end-use industries and region.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the global industrial foam market

- To provide the market share analysis of the major players in the industrial foam market

- To analyze and forecast the size of various segments such as foam type, resin type, end-use industries and type of the industrial foam market based on five major regions—Norths America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze region-specific trends in North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To estimate and forecast the market, in terms of value (USD million) and in terms of volume (Kiloton) at global and country levels

- To analyze recent developments and competitive strategies, such as acquisitions, agreements, divestment, expansions, investment, joint ventures, mergers, and new product launches

- To strategically profile the key players in the market and comprehensively analyze their core competencies

The following customization options are available for the report:

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Industrial Foam Market