Polymer Nanomembrane Market by Type (PAN, PE, PVC, Polyamide, PP, PC, PTFE), End-Use Industry (Water & Wastewater Treatment, Chemical, Electronics, Oil & Gas, Food & Beverages, Pharmaceutical & Biomedical) & Region - Trends and Forecasts Up to 2026

Updated on : May 23, 2024

Polymer Nanomembrane Market

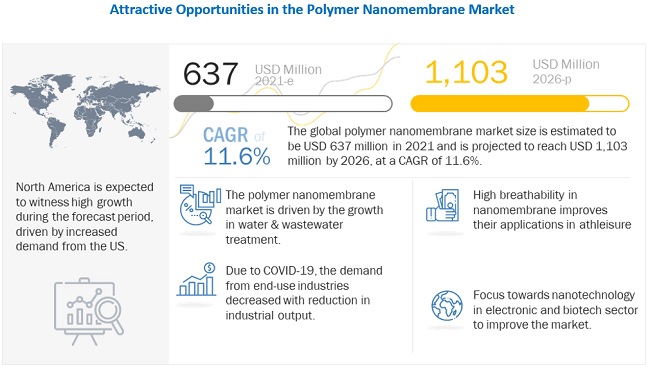

Polymer Nanomembrane Market is estimated to be USD 637 million in 2021 and is projected to reach USD 1,103 million by 2026, at a CAGR of 11.6% between 2021 and 2026. The polymer nanomembrane market is driven by water & wastewater treatment industry during the forecast period. North America is dominating the region in water treatment with an increase in demand from the US.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the global polymer nanomembrane market

In 2020, the polymer nanomembrane market saw a dip in growth rate due to COVID-19 and the consequent lockdown across the world. The lockdown has shut down almost all the major biopharmaceutical, food & beverage processing, water & wastewater treatment projects, and petrochemical processing activities across the world. The demand for milk and dairy products decreased amid the pandemic. Many dairy processing facilities were shut down or were operating at reducing capacity due to low demand in the market. Water and wastewater treatment requirements in municipal public drinking water increased to minimize the uncertainty of transmission of the virus via sewage water. However, the industrial wastewater was minimized with a reduction in industrial output. Reduction in water and wastewater treatment resulted in fewer replacements of membranes. Moreover, nanofiber membranes were increasingly being utilized in the production of facemask and other protective clothing.

Polymer Nanomembrane Market Dynamics

Driver: The growing problem of water scarcity is a key factor for the growth of water & wastewater industry

According to the United Nations (UN), 2.2 billion people have no access to safe drinking water, and water scarcity is increasing by 1% every year. Moreover, it is estimated that over 80% of wastewater is discharged into the environment without any treatment. According to the UN World Water Development Report 2020, the manufacturing industry uses 19% of fresh water and is projected to increase to 24% by 2050.

Water and wastewater treatment plants are being established to decontaminate water and make it fit for consumption. Government organizations such as the US EPA (Environment Protection Agency), European Union WFD (Water Frame Directive), and others have set standards and regulations to control water pollution. Due to stringent government regulations and rising water demand, the water/wastewater industry is growing steadily.

In water treatment, the focus is on minimizing energy expenses and chemical utilization. Nanomembranes are used in the filtration and purification of water. These are semipermeable membranes that allow certain molecules to pass through while blocking others. Nanomembranes are an economical option in the filtration of water by eliminating total dissolved solids (TDS) and other pollutants.

The water demand is growing significantly with urbanization and industrialization. The use of nanotechnology for water/wastewater treatment is projected to increase with water consumption. The growth in the water/wastewater treatment industry will drive the market for nanomembranes during the forecast period.

Restraints: Geopolitical tensions between US and China impacting the electronics industry

The US-China trade war is one of the significant geopolitical tensions and is expected to impact the nanomembrane market. The US and China are major players in the semiconductor value chain. The ban on Huawei for 5G participation in the US has slowed the implementation of 5G technology, which is necessary for the growth of AI and IoT technologies. The US imposed export restrictions on Semiconductor Manufacturing International Corporation (SMIC) and restricted the supply of chips without a license. These developments have an adverse effect on the global semiconductor market. Semiconductors are building blocks for various electronic devices. The impact on the semiconductor market acts as a restrain for the polymer nanomembranes market.

Opportunity: Growing demand for athleisure

Athleisure include apparel that is suitable for the athletic, casual, workplace, and social occasions. These are made of stretchable and lightweight material allowing air permeability, breathability, and are waterproof. The growing trend towards physical fitness and sports activities is driving the market for athleisure clothing. The use of a layer of polymer nanomembrane provides the properties required for athleisure clothing. These clothes are resistant to wind, rain, snow. Polymer nanomembrane allows better permeability of air and water vapors but acts as an impermeable membrane for water. The growing trend for athleisure clothing is expected to increase the market for nanomembranes in textile applications.

Challenges: Limited awareness in developing countries

Polymer nanomembranes are ultrathin membranes with thickness less than 100 nm. They are utilized in various industries such as water & wastewater treatment, chemicals, food & beverage, electronics, and others. Weak infrastructure, poor sanitation policies, lack of finances are some of the major problems faced by developing countries for establishing water & wastewater treatment plants. The treatment plants are still utilizing conventional methods for the filtration of water. Nanomembranes are a newer technology, and their utilization in water & wastewater treatment (desalination, filtration, and others) is limited in developing countries due to lack of awareness.

Polyacrylonitrile (PAN) is the largest segment by type in the polymer nanomembrane market.

Polyacrylonitrile (PAN) is the largest segment by type for the polymer nanomembrane market. Polyacrylonitrile membranes are prepared with the support of a hydroxylamine-induced phase inversion process. The obtained polyacrylonitrile membrane displays high flux along with the required separation efficiency for various oil-in-water emulsions. Polyacrylonitrile membrane shows superior antifouling property and recyclability due to its ultralow oil adhesion property. Hence, it is highly utilized for emulsified oil/water separation.

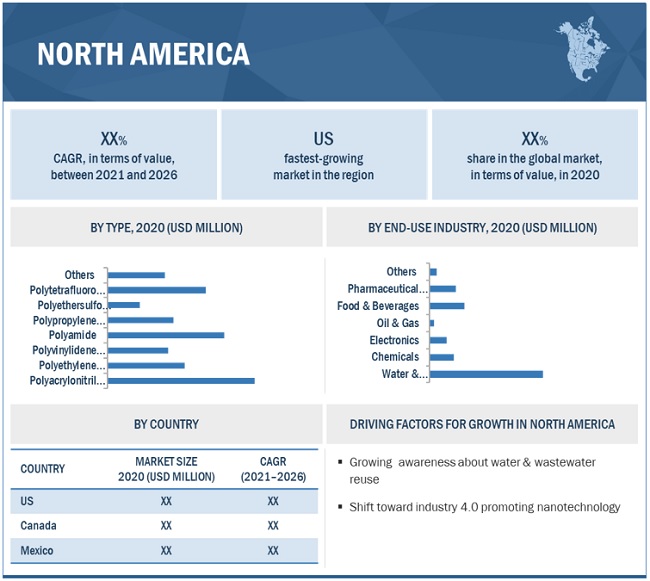

North America is estimated to be the largest market for Polymer Nanomembrane.

North America accounted for the largest share of the polymer nanomembrane market in 2020, followed by Europe and APAC. The stringent environmental regulations in this region, which directly affect the water treatment industry, are the Clean Water Act (CWA), the United States Environmental Protection Agency (EPA), and the Safe Drinking Water Act (SDWA). The US is the largest polymer nanomembrane market in the world. The large-scale end-use industries of polymer nanomembrane with a higher adoption rate of newer technologies as compared to other countries are key drivers for the market. With the increasing demand for potable water, the country is developing a vast system for the collection, pumping, and treatment of wastewater across the country. The demand for polymer nanomembrane in the US is expected to be driven by the modernization of existing water supply and wastewater treatment plants, along with investments for new facilities. Leading polymer nanomembrane companies are Dupont De Nemours, Inc., (US), Nitto Denko Corporation- Hydranautics (US), Koch Separation Solutions (US), Pall Corporation (US), Synder Filtration, Inc. (US) are based in North America. These companies are investing in R&D activities to develop innovative products for the packaging industry.

To know about the assumptions considered for the study, download the pdf brochure

Polymer Nanomembrane Market Players

The leading players in the polymer nanomembrane market are Dupont De Nemours, Inc., (US), Nitto Denko Corporation- Hydranautics (US), Koch Separation Solutions (US), MICRODYN-NADIR GMBH (Germany), Pall Corporation (US), Synder Filtration, Inc. (US), Alfa Laval AB (Sweden), Pentair - X-Flow (The Netherlands), Toray Industries, Inc. (Japan) and Sumitomo Electric Fine Polymer, Inc (Japan).

Polymer Nanomembrane Market Report Scope

|

Report Metric |

Details |

|

Years Considered |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Unit considered |

Value (USD Million) |

|

Segments |

Type, End-Use Industry and Region |

|

Regions |

APAC, North America, Europe, Middle East & Africa and South America |

|

Companies |

The major players are, Dupont De Nemours, Inc., (US), Nitto Denko Corporation- Hydranautics (US), Koch Separation Solutions (US), MICRODYN-NADIR GMBH (Germany), Pall Corporation (US), Synder Filtration, Inc. (US), Alfa Laval AB (Sweden), Pentair - X-Flow (The Netherlands), Toray Industries, Inc. (Japan) and Sumitomo Electric Fine Polymer, Inc (Japan). are covered in the polymer nanomembrane market. |

This research report categorizes the global polymer nanomembrane market on the basis of Type, End-Use Industry and Region.

On the basis of Type

- Polyacrylonitrile (PAN)

- Polyethylene (PE)

- Polyvinylchloride (PVC)

- Polyamide

- Polypropylene

- Polycarbonate

- Polytetrafluoroethylene (PTFE)

- Others

On the basis of End-use Industry

- Water & Wastewater Treatment

- Chemical

- Electronics

- Oil & Gas

- Food & Beverages

- Pharmaceutical & Biomedical

- Others

On the basis of region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East & Africa (MEA)

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In December 2020, MICRODYN-NADIR came into a distributor partnership with Chembond Clean Water Technologies Limited (India) for the distribution of water and wastewater products in India.

- In November 2020, Koch Separation Solutions acquired RELCO, a processing technology provider for the dairy industry.

- In December 2019, DuPont acquired Desalitech Ltd., closed-circuit reverse osmosis (CCRO) company.

- In October 2019, DuPont acquired the ultrafiltration and membrane biofiltration (MBR) technologies division of Evoqua Water Technologies Corp.

- In September 2019, Dupont acquired the ultrafiltration Membrane business division and inge GmbH from BASF

Frequently Asked Questions (FAQ):

What is the major driver influencing the growth of the POLYMER NANOMEMBRANE market?

The major driver influencing the growth of polymer nanomembrane is the growth of water & wastewater treatment industry.

How is the polymer nanomembrane market segmented by type?

The polymer nanomembrane market is segmented into Polyacrylonitrile (PAN), Polyethylene (PE), Polyvinylidene Fluoride (PVDF), Polyamide, Polypropylene, Polyethersulfone (PES), and Polytetrafluoroethylene (PTFE).

What is the major challenge in the polymer nanomembrane market?

Limited awareness in developing countries is a major challenge in the polymer nanomembrane market.

What is the range of pore sizes in the production of polymer nanomembrane?

Polymer nanomembrane have pore size in the range of 1nm to 300nm.

What are the major opportunities in the polymer nanomembrane market?

Growing demand for athleisure clothing is opportunity for the polymer nanomembrane market.

For which application polymer nanomembrane is utilized in water & wastewater treatment?

In the water & wastewater treatment industry, polymer nanomembranes are utilized as filtration membranes for reducing heavy metals, salt, nitrate, sulfate, and NOM content in water. It is also utilized for softening hard water and disinfecting and purification of potable water.

Which region has the largest demand

North America has the largest demand for polymer nanomembrane owing to the presence of large-scale end-use industries of polymer nanomembrane with a higher adoption rate of newer technologies as compared to other countries are key drivers for the market.

On the basis of end-use industry, how POLYMER NANOMEMBRANE market is segmented?

Based on end-use industry the polymer nanomembrane market is segmented into water & wastewater treatment, chemical, electronics, oil & gas, food & beverages, pharmaceutical & biomedical, and others.

For which application polymer nanomembrane is utilized in food & beverage industry?

In food & beverage, these membranes are used to concentrate whey, sugar processing, degumming of solutions in edible oil processing, production of cheese & sweeteners, and others.

Who are the major manufacturers of POLYMER NANOMEMBRANE?

The major manufacturers of POLYMER NANOMEMBRANE are Dupont De Nemours, Inc., (US), Nitto Denko Corporation- Hydranautics (US), Koch Separation Solutions (US), MICRODYN-NADIR GMBH (Germany), Pall Corporation (US), Synder Filtration, Inc. (US), Alfa Laval AB (Sweden), Pentair - X-Flow (The Netherlands), Toray Industries, Inc. (Japan) and Sumitomo Electric Fine Polymer, Inc (Japan). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

TABLE 1 MARKET SEGMENT DEFINITION, BY TYPE

TABLE 2 MARKET SEGMENT DEFINITION, BY END-USE INDUSTRY

1.3 MARKET SCOPE

FIGURE 1 POLYMER NANOMEMBRANE MARKET SEGMENTATION

1.3.1 INCLUSION & EXCLUSION

TABLE 3 INCLUSIONS & EXCLUSIONS IN THE REPORT

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 POLYMER NANOMEMBRANE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 APPROACH 1: BASED ON MEMBRANE MARKET, 2020

FIGURE 3 APPROACH 1: BASED ON MEMBRANE MARKET, 2020

2.2.2 APPROACH 2: BASED ON COMPANY REVENUE

FIGURE 4 APPROACH 2: BASED ON COMPANY REVENUE, 2020

2.3 DATA TRIANGULATION

FIGURE 5 POLYMER NANOMEMBRANE MARKET: DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

2.4.3 GROWTH RATE ASSUMPTIONS

2.5 FACTOR ANALYSIS

FIGURE 6 FACTORS IMPACTING GROWTH OF POLYMER NANOMEMBRANE MARKET

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 POLYACRYLONITRILE (PAN) HELD THE LARGEST SHARE IN 2020

FIGURE 8 WATER & WASTEWATER TREATMENT HELD THE LARGEST SHARE IN 2020

FIGURE 9 APAC TO WITNESS HIGHEST CAGR DURING 2021-2026

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 SIGNIFICANT OPPORTUNITIES IN POLYMER NANOMEMBRANE MARKET

FIGURE 10 GROWTH IN WATER & WASTEWATER TREATMENT TO OFFER GROWTH OPPORTUNITIES

4.2 NORTH AMERICA POLYMER NANOMEMBRANE MARKET, BY TYPE, END-USE INDUSTRY, AND COUNTRY, 2020

4.3 POLYMER NANOMEMBRANE MARKET, BY TYPE

FIGURE 11 POLYACRYLONITRILE (PAN) TO DOMINATE THE OVERALL POLYMER NANOMEMBRANE MARKET, 2021–2026

4.4 POLYMER NANOMEMBRANE MARKET, BY END-USE INDUSTRY

FIGURE 12 WATER & WASTEWATER TREATMENT TO DOMINATE OVERALL POLYMER NANOMEMBRANE MARKET, 2021–2026

4.5 POLYMER NANOMEMBRANE MARKET, BY COUNTRY

FIGURE 13 CHINA TO BE FASTEST-GROWING MARKET FOR POLYMER NANOMEMBRANE

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

FIGURE 14 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

5.1.1 DRIVERS

5.1.1.1 Growing water & wastewater industry due to increasing water scarcity

TABLE 4 INDUSTRIAL DEMAND FOR WATER, BY CONTINENT

5.1.1.2 Technological advancements in electronic and biotech devices

5.1.1.3 Implementation of industry 4.0 fueling demand for polymer nanomembrane in electronics

5.1.1.4 Requirement of selective permeability to meet water quality standard

TABLE 5 SEPARATION OF ELEMENTS BY MEMBRANES

5.1.2 RESTRAINTS

5.1.2.1 Geopolitical tensions between US and China impacting the electronics industry

5.1.3 OPPORTUNITIES

5.1.3.1 Growing demand for athleisure

5.1.4 CHALLENGES

5.1.4.1 Limited awareness in developing countries

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 15 POLYMER NANOMEMBRANE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF SUPPLIERS

5.2.2 BARGAINING POWER OF BUYERS

5.2.3 INTENSITY OF COMPETITIVE RIVALRY

5.2.4 THREAT OF NEW ENTRANTS

5.2.5 THREAT OF SUBSTITUTES

TABLE 6 POLYMER NANOMEMBRANE MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3 ECOSYSTEM

5.4 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN OF POLYMER NANOMEMBRANE

5.5 AVERAGE SELLING PRICE

FIGURE 17 PRICE TREND IN WATER & WASTEWATER TREATMENT INDUSTRY ACROSS REGIONS

FIGURE 18 PRICE TREND IN CHEMICAL INDUSTRY ACROSS REGIONS

FIGURE 19 PRICE TREND IN ELECTRONICS INDUSTRY ACROSS REGION

FIGURE 20 PRICE TREND IN OIL & GAS INDUSTRY ACROSS REGIONS

FIGURE 21 PRICE TREND IN FOOD & BEVERAGES INDUSTRY ACROSS REGIONS

FIGURE 22 PRICE TREND IN PHARMACEUTICAL & BIOMEDICAL INDUSTRY ACROSS REGIONS

5.6 TECHNOLOGY ANALYSIS

5.6.1 METHODS FOR CONTROLLING PORE SHAPE, POROSITY, AND SIZE OF NANOPOROUS POLYMER MATERIALS

5.6.1.1 Electro-spinning

5.6.1.2 Gas sorption

5.6.1.3 Optical methods

5.6.1.4 Permeation test

5.7 REGION-WISE REGULATORY MANDATES

TABLE 7 REGULATORY LANDSCAPE, REGION/COUNTRY-WISE

5.8 PATENT ANALYSIS

5.8.1 INTRODUCTION

5.8.2 METHODOLOGY

5.8.3 DOCUMENT TYPE

FIGURE 23 NUMBER OF PATENTS IN THE LAST 11 YEARS

5.8.4 PUBLICATION TRENDS

FIGURE 24 NUMBER OF PATENTS PUBLISHED YEAR-WISE

5.8.5 INSIGHT

5.8.6 JURISDICTION ANALYSIS

FIGURE 25 PATENT ANALYSIS, BY TOP JURISDICTION

5.8.7 TOP COMPANIES/APPLICANTS

FIGURE 26 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

TABLE 8 LIST OF PATENTS BY DUPONT

TABLE 9 LIST OF PATENTS BY DSM IP ASSETS B.V.

TABLE 10 LIST OF PATENTS BY KYUNGPOOK NAT UNIV IND ACAD.

TABLE 11 LIST OF PATENTS BY CORN PRODUCTS DEVELOPMENT, INC.

TABLE 12 LIST OF PATENTS BY INMEDBIO LLC.

TABLE 13 TOP 10 PATENT OWNERS (US) IN LAST 11 YEARS

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 27 GROWING DEMAND FROM OIL & GAS SECTOR OWING TO POLLUTION CONTROL POLICIES, SUSTAINABILITY, ENERGY EFFICIENCY, AND DIGITALIZATION TO BRING IN CHANGE IN FUTURE REVENUE MIX!

TABLE 14 SHIFTS IMPACTING YCC AND YC

5.10 MACROECONOMIC OVERVIEW

TABLE 15 WORLD GDP GROWTH PROJECTION

TABLE 16 STATUS OF GLOBAL WATER INDICATORS (REGION-WISE)

5.11 RANGE SCENARIO

FIGURE 28 RANGE SCENARIO OF POLYMER NANOMEMBRANE DEMAND

5.12 COVID-19 IMPACT

FIGURE 29 PRE & POST-COVID ANALYSIS OF POLYMER NANOMEMBRANE DEMAND

5.13 ADJACENT AND RELATED MARKETS

5.13.1 INTRODUCTION

5.13.2 LIMITATIONS

5.13.3 PVDF MEMBRANE MARKET

5.13.3.1 Market definition

5.13.3.2 PVDF membrane market, by type

TABLE 17 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 18 PVDF MEMBRANE MARKET SIZE, BY TYPE, 2020–2025 (USD MILLION)

5.13.3.3 PVDF membrane market, by technology

TABLE 19 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 20 PVDF MEMBRANE MARKET SIZE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

5.13.3.4 PVDF membrane market, by application

TABLE 21 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 22 PVDF MEMBRANE MARKET SIZE, BY APPLICATION, 2020–2025 (USD MILLION)

5.13.3.5 PVDF membrane market, by end-use industry

TABLE 23 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 24 PVDF MEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2020–2025 (USD MILLION)

5.13.3.6 PVDF membrane market, by region

TABLE 25 PVDF MEMBRANE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 26 PVDF MEMBRANE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

5.13.4 PTFE MEMBRANE MARKET

5.13.4.1 Market definition

5.13.4.2 PTFE membrane market, by type

TABLE 27 PTFE MEMBRANE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

5.13.4.3 PTFE membrane market, by application

TABLE 28 PTFE MEMBRANE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

5.13.4.4 PTFE membrane market, by region

TABLE 29 PTFE MEMBRANE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

5.13.5 MEMBRANES MARKET

5.13.5.1 Market definition

5.13.5.2 Membranes market, by material

TABLE 30 MEMBRANES MARKET SIZE, BY MATERIAL, 2017–2024 (USD MILLION)

5.13.5.3 Membranes market, by technology

TABLE 31 MEMBRANES MARKET SIZE, BY TECHNOLOGY, 2017–2024 (USD MILLION)

5.13.5.4 Membranes market, by application

TABLE 32 MEMBRANES MARKET SIZE, BY APPLICATION, 2017–2024 (USD MILLION)

5.13.5.5 Membranes market, by region

TABLE 33 MEMBRANES MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

6 POLYMER NANOMEMBRANE MARKET, BY TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 30 POLYACRYLONITRILE (PAN) ACCOUNTED FOR LARGEST SHARE IN 2020 (BY VALUE)

TABLE 34 POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 35 POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

6.2 POLYACRYLONITRILE (PAN)

TABLE 36 POLYACRYLONITRILE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 37 POLYACRYLONITRILE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.3 POLYETHYLENE (PE)

TABLE 38 POLYETHYLENE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 POLYETHYLENE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.4 POLYVINYLIDENE FLUORIDE (PVDF)

TABLE 40 POLYVINYLIDENE FLUORIDE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 41 POLYVINYLIDENE FLUORIDE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.5 POLYAMIDE

TABLE 42 POLYAMIDE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 POLYAMIDE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.6 POLYPROPYLENE

TABLE 44 POLYPROPYLENE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 45 POLYPROPYLENE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.7 POLYETHERSULFONE (PES)

TABLE 46 POLYETHERSULFONE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 47 POLYETHERSULFONE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.8 POLYTETRAFLUOROETHYLENE (PTFE)

TABLE 48 POLYTETRAFLUOROETHYLENE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 49 POLYTETRAFLUOROETHYLENE NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

6.9 OTHERS

TABLE 50 OTHER POLYMER NANOMEMBRANES MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 51 OTHER POLYMER NANOMEMBRANES MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7 POLYMER NANOMEMBRANE MARKET, BY END-USE INDUSTRY (Page No. - 92)

7.1 INTRODUCTION

TABLE 52 SUPPLIER AND END USER OF POLYMER NANOMEMBRANE IN ELECTRONICS INDUSTRY

FIGURE 31 WATER & WASTEWATER TREATMENT ACCOUNTED FOR LARGEST SHARE IN 2020 (BY VALUE)

TABLE 53 POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 54 POLYMER NANOMEMBRANE MARKET SIZE, END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

7.2 WATER & WASTEWATER TREATMENT

7.2.1 IMPACT OF MEGATRENDS ON WATER & WASTEWATER TREATMENT SEGMENT

TABLE 55 POLYMER NANOMEMBRANE MARKET SIZE IN WATER & WASTEWATER TREATMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 POLYMER NANOMEMBRANE MARKET SIZE IN WATER & WASTEWATER TREATMENT, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7.3 CHEMICAL

7.3.1 IMPACT OF MEGATRENDS ON CHEMICAL SEGMENT

TABLE 57 POLYMER NANOMEMBRANE MARKET SIZE IN CHEMICAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 58 POLYMER NANOMEMBRANE MARKET SIZE IN CHEMICAL, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7.4 ELECTRONICS

7.4.1 IMPACT OF MEGATRENDS ON ELECTRONICS SEGMENT

TABLE 59 POLYMER NANOMEMBRANE MARKET SIZE IN ELECTRONICS, BY REGION, 2019–2026 (USD MILLION)

TABLE 60 POLYMER NANOMEMBRANE MARKET SIZE IN ELECTRONICS, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7.5 OIL & GAS

7.5.1 IMPACT OF MEGATRENDS ON OIL & GAS SEGMENT

TABLE 61 POLYMER NANOMEMBRANE MARKET SIZE IN OIL & GAS, BY REGION, 2019–2026 (USD MILLION)

TABLE 62 POLYMER NANOMEMBRANE MARKET SIZE IN OIL & GAS, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7.6 FOOD & BEVERAGES

7.6.1 IMPACT OF MEGATRENDS ON FOOD & BEVERAGES SEGMENT

TABLE 63 POLYMER NANOMEMBRANE MARKET SIZE IN FOOD & BEVERAGES, BY REGION, 2019–2026 (USD MILLION)

TABLE 64 POLYMER NANOMEMBRANE MARKET SIZE IN FOOD & BEVERAGES, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7.7 PHARMACEUTICAL & BIOMEDICAL

7.7.1 IMPACT OF MEGATRENDS ON PHARMACEUTICAL & BIOMEDICAL SEGMENT

TABLE 65 POLYMER NANOMEMBRANE MARKET SIZE IN PHARMACEUTICAL & BIOMEDICAL, BY REGION, 2019–2026 (USD MILLION)

TABLE 66 POLYMER NANOMEMBRANE MARKET SIZE IN PHARMACEUTICAL & BIOMEDICAL, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

7.8 OTHERS

TABLE 67 POLYMER NANOMEMBRANE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 68 POLYMER NANOMEMBRANE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

8 POLYMER NANOMEMBRANE MARKET, BY REGION (Page No. - 105)

8.1 INTRODUCTION

FIGURE 32 CHINA TO BE FASTEST-GROWING POLYMER NANOMEMBRANE MARKET DURING FORECAST PERIOD

TABLE 69 POLYMER NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

TABLE 70 POLYMER NANOMEMBRANE MARKET SIZE, BY REGION, 2019–2026 (THOUSAND SQUARE METER)

8.2 NORTH AMERICA

FIGURE 33 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SNAPSHOT

TABLE 71 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 72 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND SQUARE METER)

TABLE 73 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 75 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 76 NORTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.2.1 US

8.2.1.1 Presence of large industries to drive the market

TABLE 77 US: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 78 US: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 79 US: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 80 US: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.2.2 CANADA

8.2.2.1 Growing government investments in water & wastewater industry to boost the market

TABLE 81 CANADA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 82 CANADA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 83 CANADA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 84 CANADA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.2.3 MEXICO

8.2.3.1 Increasing investments in pharmaceutical & biomedical and growing food & beverage industries to be the main drivers

TABLE 85 MEXICO: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 86 MEXICO: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 87 MEXICO: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 88 MEXICO: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3 EUROPE

TABLE 89 EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 90 EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND SQUARE METER)

TABLE 91 EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 92 EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 93 EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 94 EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3.1 GERMANY

8.3.1.1 Shift toward membrane technology for water & wastewater treatment to drive the demand

TABLE 95 GERMANY: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 96 GERMANY: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 97 GERMANY: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 98 GERMANY: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3.2 UK

8.3.2.1 Growth in food processing and investment in water and wastewater treatment to drive the market

TABLE 99 UK: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 100 UK: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 101 UK: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 102 UK: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3.3 FRANCE

8.3.3.1 Development in chemical and pharmaceutical sectors to drive the market

TABLE 103 FRANCE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 104 FRANCE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 105 FRANCE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 106 FRANCE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3.4 ITALY

8.3.4.1 Investment in water and wastewater treatment plant to drive the market

TABLE 107 ITALY: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 ITALY: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 109 ITALY: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 110 ITALY: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3.5 CZECH REPUBLIC

8.3.5.1 Development in nanotech to drive nanomembrane market

TABLE 111 CZECH REPUBLIC: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 CZECH REPUBLIC: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 113 CZECH REPUBLIC: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 114 CZECH REPUBLIC: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.3.6 REST OF EUROPE

TABLE 115 REST OF EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 REST OF EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 117 REST OF EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 118 REST OF EUROPE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.4 APAC

FIGURE 34 APAC: POLYMER NANOMEMBRANE MARKET SNAPSHOT

TABLE 119 APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 120 APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND SQUARE METER)

TABLE 121 APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 122 APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 123 APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 124 APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.4.1 CHINA

8.4.1.1 Growing end-use industries to create high demand for polymer nanomembrane

TABLE 125 CHINA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 126 CHINA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 127 CHINA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 128 CHINA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.4.2 INDIA

8.4.2.1 Growing FDI investments in manufacturing industry to support market growth

TABLE 129 INDIA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 130 INDIA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 131 INDIA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 132 INDIA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.4.3 JAPAN

8.4.3.1 Growing investment in pharmaceutical industry supporting market growth

TABLE 133 JAPAN: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 134 JAPAN: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 135 JAPAN: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 136 JAPAN: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.4.4 SOUTH KOREA

8.4.4.1 Investments in electronics and water & wastewater treatment industries to play a key role in market growth

TABLE 137 SOUTH KOREA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 138 SOUTH KOREA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 139 SOUTH KOREA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 140 SOUTH KOREA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.4.5 REST OF APAC

TABLE 141 REST OF APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 142 REST OF APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 143 REST OF APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 144 REST OF APAC: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.5 MIDDLE EAST & AFRICA

TABLE 145 MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 146 MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND SQUARE METER)

TABLE 147 MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 149 MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.5.1 SAUDI ARABIA

8.5.1.1 Growth in desalination plant to drive the market in the region

TABLE 151 SAUDI ARABIA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 152 SAUDI ARABIA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 153 SAUDI ARABIA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 154 SAUDI ARABIA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.5.2 UAE

8.5.2.1 Growing production of food and beverage will improve demand for nanomembrane

TABLE 155 UAE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 156 UAE: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 157 UAE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 158 UAE: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.5.3 SOUTH AFRICA

8.5.3.1 Water scarcity fueling the water and wastewater treatment industry

TABLE 159 SOUTH AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 160 SOUTH AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 161 SOUTH AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 162 SOUTH AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 163 REST OF MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 164 REST OF MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 165 REST OF MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 166 REST OF MIDDLE EAST & AFRICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.6 SOUTH AMERICA

TABLE 167 SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 168 SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY COUNTRY, 2019–2026 (THOUSAND SQUARE METER)

TABLE 169 SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 170 SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 171 SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 172 SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.6.1 BRAZIL

8.6.1.1 Growth in industrial processes to improve the applications for nanomembrane

TABLE 173 BRAZIL: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 174 BRAZIL: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 175 BRAZIL: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 176 BRAZIL: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.6.2 ARGENTINA

8.6.2.1 Development of water & wastewater treatment infrastructure to fuel demand for polymer nanomembrane

TABLE 177 ARGENTINA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 178 ARGENTINA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 179 ARGENTINA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 180 ARGENTINA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

8.6.3 REST OF SOUTH AMERICA

TABLE 181 REST OF SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

TABLE 182 REST OF SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY TYPE, 2019–2026 (THOUSAND SQUARE METER)

TABLE 183 REST OF SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (USD MILLION)

TABLE 184 REST OF SOUTH AMERICA: POLYMER NANOMEMBRANE MARKET SIZE, BY END-USE INDUSTRY, 2019–2026 (THOUSAND SQUARE METER)

9 COMPETITIVE LANDSCAPE (Page No. - 171)

9.1 INTRODUCTION

FIGURE 35 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS BETWEEN 2018 AND 2021

9.2 MARKET RANKING ANALYSIS

9.3 REVENUE ANALYSIS

FIGURE 36 REVENUE ANALYSIS FOR PUBLIC COMPANIES IN PAST 5 YEARS

9.4 MARKET SHARE ANALYSIS

FIGURE 37 MARKET SHARE OF KEY PLAYERS, 2020 (BY VALUE)

9.5 COMPANY EVALUATION MATRIX

9.5.1 STAR

9.5.2 EMERGING LEADER

9.5.3 PERVASIVE

9.5.4 PARTICIPANT

FIGURE 38 COMPANY EVALUATION MATRIX FOR POLYMER NANOMEMBRANE MARKET, 2020

9.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.6.1 PROGRESSIVE COMPANIES

9.6.2 RESPONSIVE COMPANIES

9.6.3 DYNAMIC COMPANIES

9.6.4 STARTING BLOCKS

FIGURE 39 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2020

9.7 COMPETITIVE BENCHMARKING

9.7.1 COMPANY PRODUCT FOOTPRINT

9.7.2 COMPANY END-USE INDUSTRY FOOTPRINT

9.7.3 COMPANY REGION FOOTPRINT

9.8 COMPETITIVE SCENARIO AND TRENDS

9.8.1 EXPANSION

TABLE 185 EXPANSION, 2018–2021

9.8.2 NEW PRODUCT DEVELOPMENT

TABLE 186 NEW PRODUCT DEVELOPMENT, 2018–2021

9.8.3 PARTNERSHIP

TABLE 187 PARTNERSHIP, 2018–2021

9.8.4 ACQUISITION

TABLE 188 ACQUISITION, 2018–2021

10 COMPANY PROFILES (Page No. - 181)

10.1 MAJOR PLAYERS

(Business Overview, Products Offered, Deals, SWOT Analysis, Right to win, Strategic overview)*

10.1.1 DUPONT

FIGURE 40 DUPONT.: COMPANY SNAPSHOT

10.1.2 NITTO DENKO CORPORATION

10.1.3 KOCH SEPARATION SOLUTIONS

10.1.4 MICRODYN-NADIR GMBH

10.1.5 PALL CORPORATION

10.1.6 SYNDER FILTRATION, INC.

10.1.7 ALFA LAVAL AB

FIGURE 41 ALFA LAVAL AB: COMPANY SNAPSHOT

10.1.8 PENTAIR - X-FLOW

10.1.9 TORAY INDUSTRIES, INC.

FIGURE 42 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

10.1.10 SUMITOMO ELECTRIC FINE POLYMER, INC.

10.1.11 APPLIED MEMBRANES, INC.

10.1.12 SPUR A.S.

10.1.13 AXEON WATER TECHNOLOGIES

10.1.14 TEIJIN LIMITED

FIGURE 43 TEIJIN LIMITED: COMPANY SNAPSHOT

10.2 START-UP / SME PLAYERS

10.2.1 HUNAN KEENSSEN TECHNOLOGY CO., LTD.

10.2.2 OSMOTECH MEMBRANES PVT. LTD.

10.2.3 NX FILTRATION BV

10.2.4 AMS TECHNOLOGIES

10.2.5 RISINGSUN MEMBRANE TECHNOLOGY (BEIJING) CO., LTD.

10.2.6 NAFIGATE CORPORATION, A.S.

10.2.7 NANOMEMBRANE S.R.O.

10.2.8 MEMBRANIUM (RM NANOTECH)

10.2.9 NXTNANO, LLC

10.2.10 HANGZHOU DEEFINE FILTRATION TECHNOLOGY CO., LTD.

10.2.11 M-TECHX INC.

*Details on Business Overview, Products Offered, Deals, SWOT Analysis, Right to win, Strategic overview might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 216)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

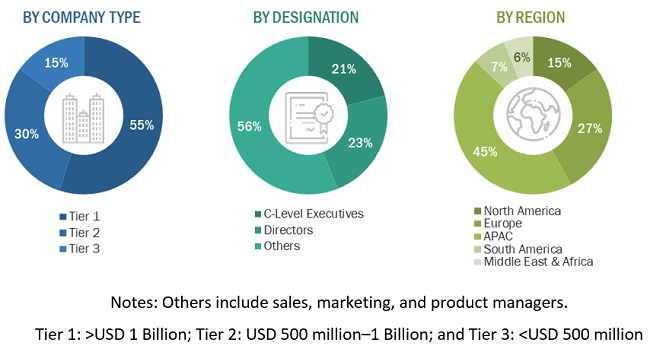

The research study involves the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the polymer nanomembrane market. Primary sources include industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

The polymer nanomembrane market comprises several stakeholders in the supply chain, which include distributors, membrane-producing companies, carriers, and end users. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the end-use segments. Primary sources from the supply side include associations and institutions involved in the membrane industry, key opinion leaders, and processing players in the polymer nanomembrane market.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global polymer nanomembrane market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global polymer nanomembrane market in terms of value & volume

- To provide insights regarding significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on the type and end-use industry

- To analyze the impact of COVID-19 on the market

- To forecast the market size, in terms of volume and value, with respect to five main regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launch, capacity expansion, and merger & acquisition

- To strategically profile the leading players and comprehensively analyze their key developments, such as expansions and mergers & acquisitions, in the polymer nanomembrane market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of APAC Catalyst Handling Services market

- Further breakdown of Rest of Europe Catalyst Handling Services market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polymer Nanomembrane Market