PDMS Market by Type (LMW, HMW, UHMW), Form (Elastomers, Fluids, Resins), End-Use Industries (Industrial Process, Building & Construction, Household & Personal Care, Electrical & Electronics, Transportation, Healthcare) and Region - Global Forecast to 2024

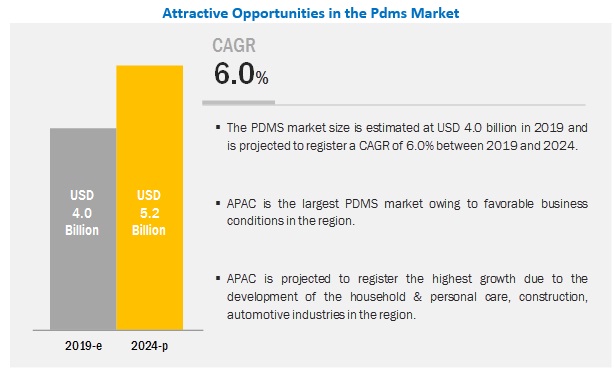

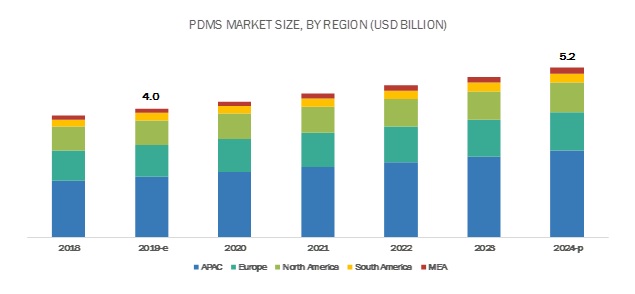

[135 Pages Report] The polydimethylsiloxane (PDMS) market size is estimated at USD 4.0 billion in 2019 and is projected to reach USD 5.2 billion by 2024, at a CAGR of 6.0%. The PDMS market is driven majorly by the growing industrial processes, building & construction, personal care & consumer products, transportation, and electronics industries in India, China, Japan, South Korea, Australia, and Southeast Asian countries.

Low-molecular weight PDMS is estimated to lead the overall PDMS market during the forecast period.

The low-molecular weight PDMS is the dominant segment in the overall of PDMS market. It is used widely as laboratory bath fluids, heat transfer fluids, dielectric fluids, low viscosity damping fluids, low viscosity hydraulic fluids, and others. The increasing demand for these products due to the high growth rate of the building & construction, and automotive industries in the developing countries of APAC, South America, and the Middle East & Africa is expected to drive the market for PDMS.

Elastomer is estimated to be the largest form of PDMS.

Elastomer is estimated to be the primarily used form of PDMS in 2019. PDMS elastomers are used widely in industrial applications such as personal care products, medical devices, microfluidic devices, and others. Its properties, such as elasticity, transparency, durability, and long shelf, make it the highly preferred form of PDMS. The growth of healthcare, personal care, cosmetics, and other industries is expected to drive the demand for PDMS elastomers. Hence, the increasing demand for elastomers is expected to drive the PDMS market during the forecast period.

APAC is projected to be the fastest-growing PDMS market.

APAC is estimated to be the fastest growing PDMS market during the forecast period. The APAC region is segmented further into China, Japan, India, South Korea, Australia, and the Rest of APAC. The growing construction, automotive, personal care & consumer products, and electronic & electrical industries in the region owing to growing consumer spending and increasing income levels are expected to boost the demand for PDMS. PDMS is used commonly as adhesives, sealants, and coatings in the construction industry. PDMS is an essential raw material in household & personal products.

Key Market Players

DowDuPont Inc. (US), Shin-Etsu Chemical Co., Ltd. (Japan), Wacker Chemie AG (Germany), Avantor, Inc. (US), Elkem ASA (Norway), KCC Corporation (South Korea), Dongyue Group Limited (China), Alfa Aesar (UK), CHT Group (Germany), and Zhonghao Chenguang Research Institute of Chemical Industry (China) are the key players operating in the PDMS market.

These companies have adopted organic and inorganic growth strategies to strengthen their position in the market. New product development, merger & acquisition, and expansion are the key growth strategies adopted by these leading players to enhance their product offering and regional presence and meet the growing demand for PDMS from emerging economies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year |

2018 |

|

Forecast period |

20192024 |

|

Units considered |

Value (USD), Volume (Kiloton) |

|

Segments |

Type, Form, End-Use Industry, and Region |

|

Regions |

APAC, Europe, North America, the Middle East & Africa, and South America |

|

Companies |

DowDuPont Inc. (US), Shin-Etsu Chemical Co., Ltd. (Japan), Wacker Chemie AG (Germany), Avantor, Inc. (US), Elkem ASA (Norway), KCC Corporation (South Korea), Dongyue Group Limited (China), Alfa Aesar (UK), CHT Group (Germany), and Zhonghao Chenguang Research Institute of Chemical Industry (China) |

This research report categorizes the PDMS market based on type, form, end-use industry, and region.

The PDMS Market By Type:

- Low-Molecular Weight

- High-Molecular Weight

- Ultra-High Molecular Weight

The PDMS Market By Form:

- Elastomer

- Fluid

- Resin

- Others

The PDMS Market By End-Use Industry:

- Industrial Process

- Building & Construction

- Household & Personal Care

- Electrical & Electronics

- Transportation

- Healthcare

- Others

The PDMS Market, By Region

- APAC

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In April 2019, CHT Group expanded its production base with the inauguration of its new pilot plant in Dusslingen, Germany. The expansion is the part of the companys strategy to optimize the process for the smooth transition of products from laboratory to production units. Further, the plant will be used for sample product development for customer trials and new process technology testing.

- In October 2018, KCC Corporation, along with Wonik Group and SJL Partners, signed an agreement to acquire Momentive Performance Materials Inc. (US) for USD 3.2 billion. The acquisition will help KCC to strengthen its silicone product portfolio.

- In March 2018, Wacker Chemie AG launched a new polydimethylsiloxane-based silicone fluid range namely BELSIL which comprises of six silicone fluids. The product will be used in cosmetic applications such as formulation of moisturizing creams, lotions, sunscreens, shampoos, and others due to its viscosity range between 5 to 60,000 centistokes.

- In March 2018, Wacker Chemie AG expanded its production facility with the opening of its new hydrosilylation plant for manufacturing functional silicone fluids at Amtala near Kolkata. The expansion will help the company to cater to increasing regional demand for specialty silicone form industries such as textile, personal-care, rigid and flexible polyurethane foam, and agrochemical sectors.

- In September 2017, The Dow Chemical Company and E.I.du Pont de Nemours & Company successfully merged their businesses to create DowDuPont. The holding company will operate with three business divisions, namely Agriculture, Materials Science, and Specialty Products.

Critical questions the report answers:

- What are the upcoming hot bets for the PDMS market?

- What are the market dynamics for the different types of PDMS?

- What are the market dynamics for the different forms of PDMS?

- What are the market dynamics for the different end-use industry of PDMS?

- Who are the major manufacturers of PDMS?

- What are the major factors which will impact market growth during the forecast period?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 PDMS Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.3.1 Assumptions for the Study

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the PDMS Market

4.2 PDMS Market, By Region

4.3 PDMS Market in APAC, By Country and Form, 2018

4.4 PDMS Market Attractiveness

5 Market Overview (Page No. - 30)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Increasing Demand in Different End-Use Industries

5.1.1.2 Replacement of Hydrocarbon-Based Products With PDMS Fluid-Based Products

5.1.2 Restraints

5.1.2.1 Regulatory Policies on PDMS in Few End-Use Industries

5.1.2.2 High Cost of Production

5.1.3 Opportunities

5.1.3.1 Growing Demand for PDMS in Healthcare Applications

5.1.4 Challenges

5.1.4.1 Price Sensitive Market

5.2 Porters Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Threat of New Entrants

5.2.3 Threat of Substitutes

5.2.4 Bargaining Power of Buyers

5.2.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Indicators

5.3.1 Contribution of Healthcare Industry to GDP

5.3.2 Global GDP Trends

5.3.3 Contribution of Construction Industry to GDP

6 PDMS Market, By Type (Page No. - 38)

6.1 Introduction

6.2 Low-Molecular Weight PDMS

6.2.1 Low-Molecular Weight PDMS Expected to Have High Demand in Industrial Processes in APAC

6.3 High-Molecular Weight PDMS

6.3.1 Demand From Personal Care Industry in APAC to Drive Demand for High-Molecular Weight PDMS

6.4 Ultra-High Molecular Weight PDMS

6.4.1 Increased Demand for PDMS Resins Will Lead to Growth of Ultra-High Molecular Weight PDMS

7 PDMS Market, By Form (Page No. - 43)

7.1 Introduction

7.2 PDMS Elastomers

7.2.1 Growing Demand in Personal Care Industry Expected to Boost Demand for PDMS Elastomers

7.3 PDMS Fluids

7.3.1 PDMS Fluids Witnessing Increasing Consumption in Various Applications

7.4 PDMS Resins

7.4.1 Growing Construction Industry Expected to Drive the PDMS Resins Market

7.5 Others

7.5.1 Increasing Demand in APAC to Drive the Demand for Other Forms of PDMS

8 PDMS Market, By End-Use Industry (Page No. - 51)

8.1 Introduction

8.2 Industrial Process

8.2.1 Wide Scale Industrial Activities in APAC to Drive Demand for PDMS in Industrial Processes

8.3 Building & Construction

8.3.1 Demand for Adhesives, Sealants, and Coatings in Building & Construction Drive Market for PDMS

8.4 Household & Personal Care

8.4.1 PDMS Market in Household & Personal Care Industry to Witness Highest Growth in APAC

8.5 Transportation

8.5.1 Increase in Vehicle Production Leading to Growing Consumption of PDMS as Clutch Fluids, Brake Fluids

8.6 Electrical & Electronics

8.6.1 PDMS Increasingly Used in Electrical & Electronic Products Due to Its Di-Electrical Properties

8.7 Healthcare

8.7.1 PDMS Increasingly Used Inhealthcare Sector Due to Its Versatile Properties

8.8 Others

9 PDMS Market, By Region (Page No. - 60)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.1.1 Major Use of PDMS in Cosmetic & Personal Care Industry Driving the Market

9.2.2 Japan

9.2.2.1 Increasing Demand for Beauty and Personal Care Products and Growing Automotive Industry Driving Demand for PDMS

9.2.3 India

9.2.3.1 Personal Care and Growing Automotive Industries are Major Consumers of PDMS

9.2.4 South Korea

9.2.4.1 Rising Demand for Personal Care Driving the Market for PDMS

9.2.5 Australia

9.2.5.1 Growth of Construction and Personal Care Industries Expected to Drive the PDMS Market

9.2.6 Rest of APAC

9.3 Europe

9.3.1 Germany

9.3.1.1 Growth of Personal Care Industry Along With Other Industries Such as Automotive to Drive the PDMS Market

9.3.2 France

9.3.2.1 Increasing Demand From Household &Personal Care Industry is Expected to Drive the PDMS Market

9.3.3 UK

9.3.3.1 Demand From Construction Industry to Drive the PDMS Market in UK

9.3.4 Italy

9.3.4.1 Increasing Demand for Lubricants in Automotive Industry and Demand for Personal Care Products Expected to Drive the PDMS Market

9.3.5 Russia

9.3.5.1 Growth in Industrial Processes and Building & Construction is Expected to Drive the PDMS Market in Russia

9.3.6 Turkey

9.3.6.1 Increasing Demand From Construction Industry Driving the PDMS Market in Turkey

9.3.7 Rest of Europe

9.4 North America

9.4.1 US

9.4.1.1 Investments in Construction Industry and Growing Household & Personal Care Market to Fuel Demand for PDMS

9.4.2 Canada

9.4.2.1 Household & Personal Care and Healthcare Industries to Drive Consumption of PDMS in Canada

9.4.3 Mexico

9.4.3.1 Strong Household & Personal Careindustry to Fuel Growth of PDMS Market

9.5 South America

9.5.1 Brazil

9.5.1.1 Increase in Consumer Spending on Personal Care Products to Lead to Higher Demand for PDMS

9.5.2 Argentina

9.5.2.1 Increased Foreign Investments on End-Use Industries to Increase Demand for PDMS

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Saudi Arabia

9.6.1.1 Growth in the Construction Industry to Drive Demand for PDMS in Saudi Arabia

9.6.2 UAE

9.6.2.1 Growth in Construction and Personal Care Industries Will Fuel Demand for PDMS

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 101)

10.1 Introduction

10.2 Market Ranking of PDMS Manufacturers

10.3 Competitive Situation and Trends

10.3.1 Expansion

10.3.2 New Product Development

10.3.3 Merger & Acquisition

11 Company Profiles (Page No. - 104)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 Dowdupont Inc.

11.2 Shin-Etsu Chemical Co., Ltd.

11.3 Wacker Chemie AG

11.4 Avantor, Inc.

11.5 Elkem Asa

11.6 KCC Corporation

11.7 Dongyue Group Limited

11.8 Alfa Aesar

11.9 CHT Group

11.10 Zhonghao Chenguang Research Institute of Chemical Industry

11.11 Additional Company Profiles

11.11.1 Brb International

11.11.2 Spectrum Chemical Manufacturing Corp.

11.11.3 Hubei Xin Si Hai Chemical Industry Co., Ltd.

11.11.4 Anhui Youcheng Siliconeoil Co., Ltd.

11.11.5 Gelest, Inc.

11.11.6 Santa Cruz Biotechnology, Inc.

11.11.7 Specialty Silicone Products Inc.

11.11.8 Elkay Chemicals Pvt. Ltd.

11.11.9 KB Roller Tech Kopierwalzen GmbH

11.11.10 Clearco Products Co., Inc.

11.11.11 Iota Silicone Oil (Anhui) Co., Ltd.

11.11.12 Terra Silikon Teknolojileri Ve Kimya

11.11.13 Wynca Group

11.11.14 Yichang Collin Silicone Material Co., Ltd.

11.11.15 Siltech Corporation

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 129)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (82 Tables)

Table 1 Contribution of Healthcare Spending to GDP, 2015 and 2016 (Percentage)

Table 2 Trends of Growth in World GDP Per Capita, 20162022, (USD)

Table 3 Trends and Forecast of Construction Industry, By Country, 20142021 (USD Billion)

Table 4 PDMS Market Size, By Type, 20172024 (USD Million)

Table 5 Low-Molecular Weight PDMS Market Size, By Region, 20172024 (USD Million)

Table 6 High-Molecular Weight PDMS Market Size, By Region, 20172024 (USD Million)

Table 7 Ultra-High Molecular Weight PDMS Market Size, By Region, 20172024 (USD Million)

Table 8 PDMS Market Size, By Form, 20172024 (USD Million)

Table 9 Polydimethylsiloxane Market Size, By Form, 20172024 (Kiloton)

Table 10 PDMS Elastomers Market Size, By Region, 20172024 (USD Million)

Table 11 PDMS Elastomers Market Size, By Region, 20172024(Kiloton)

Table 12 PDMS Fluids Market Size, By Region, 20172024 (USD Million)

Table 13 PDMS Fluids Market Size, By Region, 20172024 (Kiloton)

Table 14 PDMS Resins Market, By Region, 20172024 (USD Million)

Table 15 PDMS Resins Market, By Region, 20172024 (Kiloton)

Table 16 PDMS Market Size for Other Forms, By Region, 20172024 (USD Million)

Table 17 Polydimethylsiloxane Market Size for Other Forms, By Region, 20172024 (Kiloton)

Table 18 PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 19 Polydimethylsiloxane Market Size in Industrial Process, By Region, 20192024 (USD Million)

Table 20 PDMS Market Size in Building & Construction, By Region, 20172024 (USD Million)

Table 21 Polydimethylsiloxane Market Size in Household & Personal Care, By Region, 20172024 (USD Million)

Table 22 PDMS Market Size in Transportation, By Region, 20172024 (USD Million)

Table 23 Polydimethylsiloxane Market Size in Electrical & Electronics, By Region, 20172024 (USD Million)

Table 24 PDMS Market Size in Healthcare, By Region, 20172024 (USD Million)

Table 25 Polydimethylsiloxane Market Size in Other End-Use Industries, By Region, 20172024 (USD Million)

Table 26 PDMS Market Size, By Region, 20172024 (USD Million)

Table 27 Polydimethylsiloxane Market Size, By Region, 20172024 (Kiloton)

Table 28 APAC: PDMS Market Size, By Country, 20172024 (USD Million)

Table 29 APAC: Polydimethylsiloxane Market Size, By Country, 20172024 (Kiloton)

Table 30 APAC: PDMS Market Size, By Type, 20172024 (USD Million)

Table 31 APAC: PDMS Market Size, By Form, 20172024 (USD Million)

Table 32 APAC: Polydimethylsiloxane Market Size, By Form, 20172024 (Kiloton)

Table 33 APAC: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 34 China: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 35 Japan: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 36 India: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 37 South Korea:Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 38 Australia: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 39 Rest of APAC: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 40 Europe: PDMS Market Size, By Country, 20172024 (USD Million)

Table 41 Europe: PDMS Market Size, By Country, 20172024 (Kiloton)

Table 42 Europe: Polydimethylsiloxane Market Size, By Type, 20172024 (USD Million)

Table 43 Europe: PDMS Market Size, By Form, 20172024 (USD Million)

Table 44 Europe: Polydimethylsiloxane Market Size, By Form, 20172024 (Kiloton)

Table 45 Europe: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 46 Germany: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 47 France: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 48 UK: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 49 Italy: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 50 Russia: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 51 Turkey: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 52 Rest of Europe: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 53 North America: PDMS Market Size, By Country, 20172024 (USD Million)

Table 54 North America: Polydimethylsiloxane Market Size, By Country, 20172024 (Kiloton)

Table 55 North America: PDMS Market Size, By Type, 20172024 (USD Million)

Table 56 North America: PDMS Market Size, By Form, 20172024 (USD Million)

Table 57 North America: Polydimethylsiloxane Market Size, By Form, 20172024 (Kiloton)

Table 58 North America : PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 59 US: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 60 Canada: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 61 Mexico: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 62 South America: Polydimethylsiloxane Market Size, By Country, 20172024 (USD Million)

Table 63 South America: PDMS Market Size, By Country, 20172024 (Kiloton)

Table 64 South America: Polydimethylsiloxane Market Size, By Type, 20172024 (USD Million)

Table 65 South America: PDMS Market Size, By Form, 20172024 (USD Million)

Table 66 South America: PDMS Market Size, By Form, 20172024 (Kiloton)

Table 67 South America: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 68 Brazil: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 69 Argentina: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 70 Rest of South America: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 71 Middle East & Africa: PDMS Market Size, By Country, 20172024 (USD Million)

Table 72 Middle East & Africa: Polydimethylsiloxane Market Size, By Country, 20172024 (Kiloton)

Table 73 Middle East & Africa: PDMS Market Size, By Type, 20172024 (USD Million)

Table 74 Middle East & Africa: Polydimethylsiloxane Market Size, By Form, 20172024 (USD Million)

Table 75 Middle East & Africa: PDMS Market Size, By Form, 20172024 (Kiloton)

Table 76 Middle East & Africa: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 77 Saudi Arabia: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 78 UAE: PDMS Market Size, By End-Use Industry, 20172024 (USD Million)

Table 79 Rest Ofmiddle East & Africa: Polydimethylsiloxane Market Size, By End-Use Industry, 20172024 (USD Million)

Table 80 Expansion, 20142019

Table 81 New Product Development, 20142019

Table 82 Merger & Acquisition, 20142019

List of Figures (50 Figures)

Figure 1 PDMS Market: Research Design

Figure 2 Market Size Estimation: Top-Down Approach

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 PDMS Market: Data Triangulation

Figure 5 Low-Molecular Weight PDMS is the Largest Type of PDMS in 2018

Figure 6 PDMS Elastomers Accounted for Largest Share of Overall PDMS Market in 2018

Figure 7 Industrial Processes is the Largest End-Use Industry of PDMS in 2018

Figure 8 APAC Was the Largest Market for PDMS in 2018

Figure 9 Growing Household & Personal Care Industry to Drive the Market (20192024)

Figure 10 APAC to Be the Largest Market Between 2019 and 2024

Figure 11 PDMS Elastomers Segment Accounted for Largest Share of the Market

Figure 12 PDMS Market to Register Highest Growth in India and China

Figure 13 Drivers, Restraints, Opportunities, and Challenges Governing the PDMS Market

Figure 14 PDMS Market: Porters Five Forces Analysis

Figure 15 Low-Molecular Weight PDMS to Be the Largest Type Segment of the PDMS Market

Figure 16 APAC to Be the Largest Market for Low-Molecular Weight PDMS

Figure 17 APAC to Be the Largest Market for High-Molecular Weight PDMS

Figure 18 APAC to Be the Largest Market for Ultra-High Molecular Weight PDMS

Figure 19 PDMS Elastomers Segment to Dominate Overall PDMS Market

Figure 20 APAC to Be the Largest PDMS Elastomers Market

Figure 21 APAC to Be the Largest PDMS Fluids Market

Figure 22 APAC to Be the Largest PDMS Resins Market

Figure 23 APAC to Be the Largest PDMS Others Market

Figure 24 Industrial Processes to Dominate the PDMS Market

Figure 25 APAC to Be the Largest Market for PDMS in Industrial Processes

Figure 26 APAC to Be Largest Market for PDMS in Building & Construction

Figure 27 APAC to Be Largest Market for PDMS in Household & Personal Care Industry

Figure 28 APAC to Be the Largest Market for PDMS in Transportation Industry

Figure 29 APAC to Be Largest Market for PDMS in Electrical & Electronics Industry

Figure 30 North America to Be Largest Market for PDMS in Healthcare Industry

Figure 31 APAC to Be Largest Market for PDMS in Other End-Use Industries

Figure 32 APAC is Projected to Register the Highest Cagr in the PDMS Market

Figure 33 APAC: PDMS Market Snapshot

Figure 34 Europe: PDMS Market Snapshot

Figure 35 North America: PDMS Market Snapshot

Figure 36 South American PDMS Market Snapshot

Figure 37 Middle East & Africa: PDMS Market Snapshot

Figure 38 Dowdupont Inc.: Company Snapshot

Figure 39 Dowdupont Inc.: SWOT Analysis

Figure 40 Shin-Etsu Chemical Co., Ltd.: Company Snapshot

Figure 41 Shin-Etsu Chemical Co., Ltd.: SWOT Analysis

Figure 42 Wacker Chemie AG: Company Snapshot

Figure 43 Wacker Chemie AG: SWOT Analysis

Figure 44 Avantor, Inc.: Company Snapshot

Figure 45 Avantor, Inc.: SWOT Analysis

Figure 46 Elkem Asa: Company Snapshot

Figure 47 Elkem Asa: SWOT Analysis

Figure 48 KCC Corporation: Company Snapshot

Figure 49 KCC Corporation: SWOT Analysis

Figure 50 Dongyue Group Limited: Company Snapshot

The study involved four major activities in estimating the current market size for PDMS. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

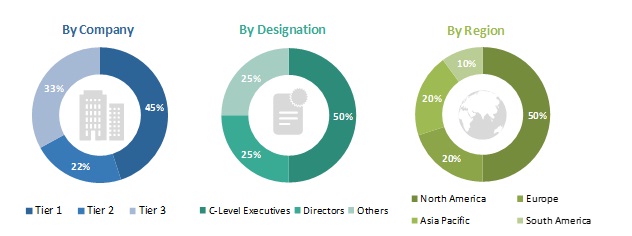

The PDMS market comprises several stakeholders, such as raw material suppliers, end product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the developments in household & personal care, construction, automotive, electrical & electronics, and other industries. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of the PDMS market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study:

- To define, describe, and forecast the global PDMS market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the PDMS market based on type, form, and end-use industries.

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific (APAC), Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, mergers & acquisitions, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the PDMS market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in PDMS Market