Polyaspartic Coatings Market by Type (100% Solids Polyaspartic, Hybrid Polyaspartic), Systems (Quartz, Metallic), End-use Industry (Building & Construction, Transportation, Industrial, Power Generation, Landscape), Region - Global Forecast to 2025

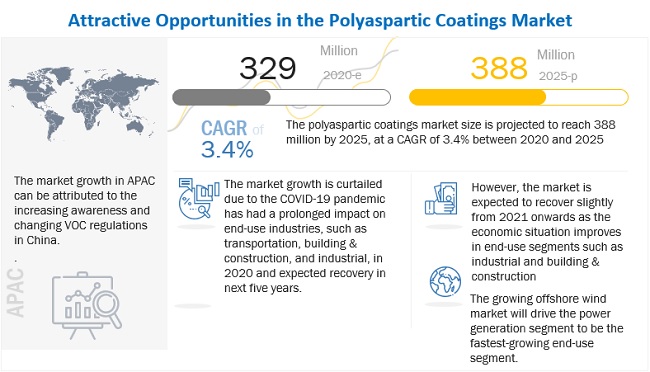

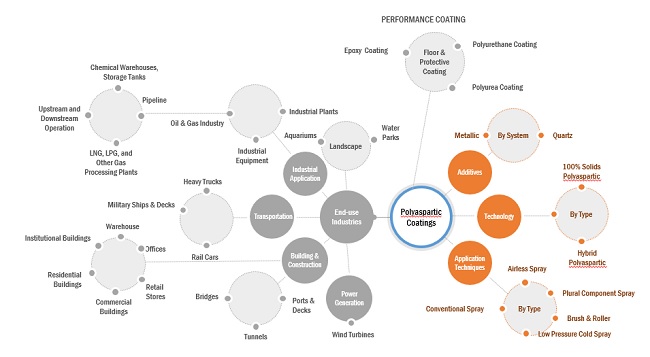

[170 Pages Report] The market for polyaspartic coatings is projected to grow from USD 329 million in 2020 to USD 388 million by 2025, at a CAGR of 3.4% during the forecast period. Aspartics react with aliphatic polyisocyanates to form polyaspartics. Polyaspartic technology differentiates itself from traditional polyurethanes as these polyaspartic esters can be used in various end-use applications by simple manipulation. While coating systems such as epoxy and polyurethane take longer to cure polyaspartic coatings cure more quickly. These coatings can also be easily formulated for application at temperatures below freezing. Polyaspartic coatings are used for bridges, flooring, OEM coatings, automotive repair, wind turbines, and pipelines in the oil & gas industry, among others. The COVID-19 pandemic is expected to impact the polyaspartic coatings market with 10.3% decline in 2020, in terms of value.

To know about the assumptions considered for the study, Request for Free Sample Report

Building & construction is projected to register a slow growth during the forecast period.

Polyaspartic coatings are widely used in the building & construction industry. The application areas include bridge construction, commercial architecture, floor & roof coating, caulks, joint fill, parking decks, concrete repair, and structural bonds. Polyaspartic coatings in construction are used as topcoats, stone carpets, sealants, and waterproofing. The increasing construction activities and growing product awareness in China are expected to drive the polyaspartic coatings market.

100% solids polyaspartic is projected to be the fastest segment of the polyaspartic market during the forecast period.

100% solids polyaspartic coatings are manufactured without the use of any solvent. The solid content plays a vital role in determining the properties of the final coated surface. They contain low/zero VOCs and are widely used due to their relatively short curing time, long pot life, and excellent chemical & moisture resistance. These systems serve a wide variety of coating or lining applications on substrates such as concrete or metals to protect from corrosion. The main advantages of 100% solids polyaspartic over hybrid polyaspartic are its rapid reactivity, better chemical & mechanical resistance, high resistance to tearing, better abrasion & impact resistance, resistance to water, and the absence of solvents. However, curing time is relatively longer in comparison to hybrid.

Polyaspartic coatings market dynamics

Driver: Higher efficiency compared to conventional coating technology

Traditional epoxy coating technology is widely used in various industries due to their low price, ease of application, and favorable results. However, epoxies take long to cure and, when returned to service, fade in direct sunlight, yellow with age, bulge at vulnerable points, and can crack at floor joints. Polyurethanes, on the other hand, are fast curing but are extremely sensitive to moisture.

Polyaspartic coatings are not only fast curing but also overcome most deficiencies of epoxy- and polyurethane-based coating technology. Polyaspartic coatings have more abrasion resistance, are more flexible & UV-stable than epoxies, and are not sensitive to moisture like polyurethanes. Polyaspartic coatings are increasingly replacing two-layer systems of epoxy-based coat and urethane topcoats with one coat systems that provide fast curing and superior performance. This subsequently improves process productivity and increases the demand for polyaspartic coatings

Restraints: Higher cost compared to conventional coatings

Polyaspartic coatings are more expensive than their substitutes such as epoxy and polyurethane coatings, which can act as a restraint. This increased cost can be attributed to the high prices of raw materials, the cost involved in formulating polyaspartic coating systems, and high investments in R&D. Also, the need for skilled workforce during formulation and operation further increases the cost of application. Thus, the high cost acts as a major restraint to the demand for polyaspartic coatings.

Opportunities: Emerging application areas of polyaspartic coatings

The ability of polyaspartic coatings to replace epoxy and polyurethane coatings is a valued trait and leads to the high demand in industrial and commercial applications. Owing to its benefits and features, the applications of polyaspartic coatings are growing rapidly, which generates significant opportunities for the market players.

Challenges: Limited awareness about polyaspartic coatings

Most end users seeking options for floor coating are not aware of the advantages of polyaspartic coatings. They use conventional coatings such as aromatic polyurea, epoxy, and polyurethane coatings, which leads to high curing time and also increases the frequency of coatings. Polyaspartic coatings are fast curing and overcome almost all deficiencies of epoxy- and polyurethane-based coating technology. However, alternative products are priced lower compared to polyaspartic coatings. Therefore, end users prefer to use alternative products to reduce their short-term expenses. Considering all the above factors, creating awareness about polyaspartic coatings is a significant challenge for the market players.

Polyaspartic coatings ecosystem

To know about the assumptions considered for the study, download the pdf brochure

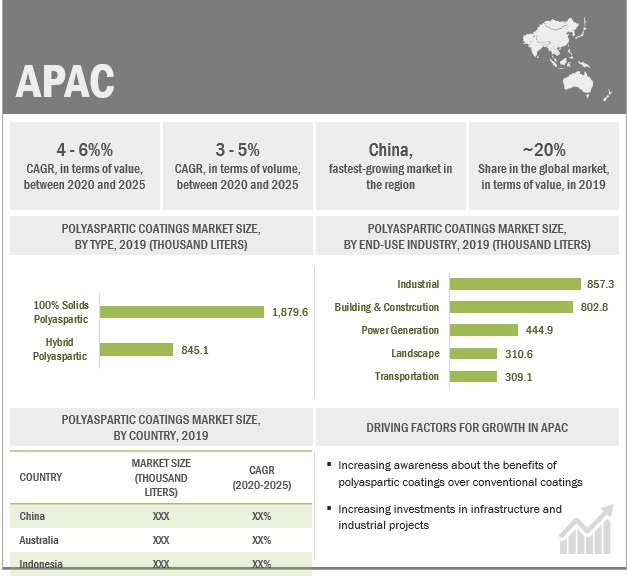

APAC is projected to be the fastest market during the forecast period.

APAC is the largest polyaspartic coatings market, and this dominance is expected to continue until 2025. China was the key market in the region, followed by Australia, Indonesia, and Malaysia in the year 2019. China is also expected to witness the highest growth rate, in terms of consumption, between 2020 and 2025. There is an increase in the consumption of polyaspartic coatings in the building & construction, transportation, industrial, and power generation sectors in APAC due to industrialization and growth of the building & construction sector of the region. Growing innovation and the rising demand for improved products are driving the use of polyaspartic coatings.

Key Market Players

The leading players in the polyaspartic coatings market are The Sherwin-Williams Company (US), PPG Industries (US), BASF SE (Germany), AkzoNobel (Netherlands), Hempel (Denmark), Carboline (US), Rust-Oleum (US), Laticrete International (US), SIKA AG (Switzerland), Feiyang Protech (China), Indmar Coatings (US), Satyen Polymers (India), and VIP Coatings (Germany). These players adopted expansions, acquisitions, new product development, and agreements as their key growth strategies from 2017 to 2020, which helped them increase their capacities and cater to the widening customer base.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD Million) and Volume (Thousand Liters) |

|

Segments |

Type, System, End-use industry, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies profiled |

The Sherwin-Williams Company (US), PPG Industries (US), BASF SE (Germany), AkzoNobel (Netherlands), Hempel (Denmark), Carboline (US), Rust-Oleum (US), Laticrete International (US), SIKA AG (Switzerland), Feiyang Protech (China), Indmar Coatings (US), Satyen Polymers (India), and VIP Coatings (Germany) among the total 21 major players covered |

This research report categorizes the global polyaspartic coatings market on the basis of type, system, end-use industry, and region.

On the basis of type:

- 100% Solids Polyaspartic

- Hybrid Polyaspartic

On the basis of systems:

- Quartz

- Metallic

On the basis of end-use industry:

- Building & Construction

- Transportation

- Industrial

- Power Generation

- Landscape

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In May 2020, Hempel began construction of a new factory in Yantai Chemical Industrial Park, China. The new factory will help meet the increasing demand for more sustainable and innovative coating solutions in the region. The company will invest USD 100 million for the construction of the new factory.

- In August 2020, The Sherwin-Williams Company has launched Environlastic 2500 for structural and steel protection. It is used in bridges, highways, large manufacturing plants, ports, and machinery. It offers a life of 25 years.

- In December 2019, The Sherwin-Williams Company has announced the opening of a new 4,200-square-feet store in Alexandria Bay, New York, US.

- In August 2019, The Sherwin-Williams Company has acquired the business and assets of Dresdner Lackfabrik Novatic (Germany) in Germany, Poland, and the Czech Republic. It is a company that manufactures paints and coatings solutions. This company also has polyaspartic coatings in its product portfolio.

Frequently Asked Questions (FAQ):

What are the features of polyaspartic coatings?

Polyaspartic coatings are based on aliphatic polyisocyanates along with a co-reactant that contains an amine functional group (polyaspartic esters). These are similar to polyurethane systems in terms of characteristics such as abrasion, chemical and UV resistance and, hence, used interchangeably in certain application areas. These coatings are offers for fast curing speeds which results in significant increases in productivity.

What are the major end-use industries using polyaspartic coatings?

Building & Construction, transportation, industrial, and power generation are the end-use industries, together, accounted for the dominant share of the polyaspartic coatings market.

What are the factors influencing the growth of polyaspartic coatings?

Polyaspartic coatings are not only fast curing but also overcome most deficiencies of epoxy- and polyurethane-based coating technology. Polyaspartic coatings have more abrasion resistance, are more flexible & UV-stable than epoxies, and are not sensitive to moisture like polyurethanes (pure polyurea exhibit this property). Also, polyaspartic coatings have low to zero VOC, and there is minimal threat of degradation of indoor air quality (IAQ). This enables quick as well as safe applications. Polyaspartic coatings are also used for customized decorative finishes to suit specific flooring needs.

What are the competing products / alternatives for polyaspartic coatings in the market?

Polyurethane and epoxy-based coating systems are suitable substitutes available in the market in place of polyaspartic coatings. However, polyaspartic coatings have advantages over these traditionally used coatings.

What types of polyaspartic coatings available in the market?

There are two types of polyaspartic coatings available in the market, namely: 100% solids polyaspartic and hybrid polyaspartic. 100% solids polyaspartic coating is derived from the chemical reaction of isocyanates and amine-terminated resins, whereas Hybrid polyaspartic contains solvent in 10-15%.

Who are the major players in the polyaspartic coatings market?

The leading players of the polyaspartic coatings market are Covestro AG (Germany), The Sherwin-Williams Company (US), PPG Industries (US), BASF SE (Germany), and AkzoNobel (Netherlands)

What are the opportunities for the polyaspartic coatings in the coming years?

New application areas such as geotextiles are projected to provide growth opportunities for polyaspartic coatings. Also, growing demand and lack of presence are expected to make polyaspartic coatings manufacturers establish manufacturing bases in these regions.

What are the factors restraining the polyaspartic coatings market?

Despite having more benefits and customizable options, polyaspartic coatings are more expensive than their substitutes, such as epoxy and polyurethane coatings, which can serve as a restraint. This increased cost can be attributed to the high prices of raw materials, the cost involved in formulating polyaspartic coating systems, and high investments in R&D. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1 Market Scope

1.1.1 Market Definition

1.1.2 Market Covered

1.1.2.1 Polyaspartic Coatings Market, By Type

1.1.2.2 Polyaspartic Coating Market, By Technology

1.1.2.3 Polyaspartic Coatings Market, By System

1.1.2.4 Polyaspartic Coating Market, By End-Use Industry

1.1.2.5 Polyaspartic Coatings Market, By Region

1.1.3 Years Considered for The Study

1.1.4 Currency

1.1.5 Package size

1.1.6 Limitations

1.1.7 Stakeholders

1.1.8 Summary of Changes

2 Research Methodology

2.1 Market Size Estimation

2.1.1 Bottom-Up Approach

2.1.2 Top-Down Approach

2.2 Market Share Estimation

2.2.1 Key Data from Secondary Sources

2.2.2 Key Data from Primary Sources

2.2.2.1 Key Industry Insights

2.2.2.2 Breakdown of Primary Interviews

2.3 Data Triangulation

2.3.1 Assumptions

3 Executive Summary

4 Premium Insights

4.1 Attractive Market Opportunities for Polyaspartic Coatings Market

4.2 Top Region Polyaspartic Coating Market, By End-Use Industry

4.3 Polyaspartic Coatings Market, By Type

4.4 Polyaspartic Coating Market, By Technology

4.5 Polyaspartic Coatings Market, By System

4.6 Polyaspartic Coating Market, By End-Use Industry

4.7 Polyaspartic Coatings Market, By Region

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.2 Restraints

5.2.3 Opportunities

5.2.4 Challenges

5.3 Porter's Five Forces

5.4 Coating Ecosystem/Market Map

5.5 Coatings Trade Analysis

5.6 Average Selling Price Analysis

5.7 Technology Analysis

5.8 Regulatory Landscape

5.9 Innovation (Patent Analysis

5.1 Value Chain Analysis

5.11 Forecast Factors Impacting Growth

5.12 YC, YCC Shift

5.13 COVID19 Impact Analysis

5.14 Macro-economic Indicators

6 Polyaspartic Coatings Market, By Type - Forecast till 2025 ( in Kilotons and USD Million

6.1 Introduction

6.2 Pure-Polyurea

6.3 Hybrid Polyurea

7 Polyaspartic Coatings Market, By Technology - Forecast till 2025 (in Kilotons and USD Million

7.1 Introduction

7.2 Water

7.3 Solvent

7.4 Powder

8 Polyaspartic Coatings Market, By System - Forecast till 2025 (in Kilotons and USD Million

8.1 Introduction

8.2 Quartz

8.3 Metallic

9 Polyaspartic Coating Market, By End-Use Industry - Forecast till 2025 ( in Kilotons and USD Million

9.1 Introduction

9.2 Building & Construction

9.2.1 Impact of megatrends in the building & construction

9.3 Transportation

9.3.1 Impact of megatrends in transportation

9.4 Industrial

9.4.1 Impact of megatrends in industrial

9.5 Power Generation

9.5.1 Impact of megatrends in power generations

9.6 Landscape

9.6.1 Impact of megatrends in Landscape

9.7 Others (If applicable

10 Polyaspartic Coatings Market, By Region - Forecast till 2025 ( in Kilotons and USD Million

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Russia

10.3.5 Spain

10.3.6 Russia

10.3.7 Rest of the Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Australia

10.4.3 Malaysia

10.4.4 Indonesia

10.4.5 Rest of APAC

10.5 Middle East & Africa

10.5.1 UAE

10.5.2 Saudi Arabia

10.5.3 South Africa

10.5.4 Rest of Middle East & Africa

10.6 South America

10.6.1 Brazil

10.6.2 Argentina

10.6.3 Rest of South America

11 Competitive Landscape

11.1 Introduction

11.2 Company Evaluation Matrix Definition And Technology

11.2.1 Market Share & Industry Tier Structure Analysis

11.2.2 Product Footprint

11.2.3 Star

11.2.4 Emerging Leader

11.2.5 Pervasive

11.3 Company Evaluation Matrix 2019

11.4 Competitive Scenario

11.4.1 Expansions

11.4.2 Acquisitions

11.4.3 New Product launches

11.4.4 Market Strategy Analysis

11.4.5 Revenue Analysis of Top Players

12 Company Profiles

(Business Overview, Financials, Impact of Covid-19 on Business Segment, Products & Services, Winning imperatives, Right to Win, Key Strategy, Operational Growth, and Recent Developments *

12.1.1 The Sherwin-Williams Company

12.1.2 PPG Industries

12.1.3 AkzoNobel

12.1.4 BASF SE

12.1.5 Hempel

12.1.6 SIKA AG

12.1.7 Nippon Paint

12.1.8 Carboline

12.1.9 Rust-Oleum

12.1.10 Laticrete International

12.2 Startup/SME Evaluation Matrix, 2019

12.3 Startup/SME Profiles

12.3.1 Indmar Coatings

12.3.2 Satyen Polymers

12.3.3 VIP Coatings Solutions

12.3.4 The Floor Company

12.3.5 Duraamen Engineered Products Inc.

12.3.6 Chromaflo Technologies Corporation

12.3.7 Iron Man Coatings

12.3.8 Flexmar Polyaspartics

12.3.9 Prokem Speciality Chemicals

12.3.10 Lifetime Flooring Systems

12.3.11 Advantage Chemical Coatings

12.3.12 Rhino Lining Corporation

12.3.13 Shorecrete Coatings Llc

12.3.14 US Coatings

12.3.15 Polyset

13 APPENDIX

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Related Reports

13.4 Author Details

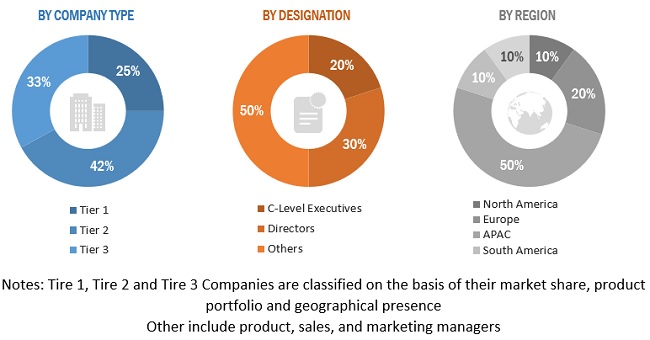

This study involved four major activities to estimate the current market size of polyaspartic coatings. Exhaustive secondary research was carried out to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; publications by recognized websites; and databases were referred to for identifying and collecting information. Secondary research was used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both, the market- and technology-oriented perspectives.

Primary Research

The polyaspartic coatings market comprises several stakeholders such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the building & construction, industrial, transportation, power generation, and other industries. The supply side is characterized by advancements in technology and diverse end-use industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents—

To know about the assumptions considered for the study, download the pdf brochure

Notes: Tier 1, Tier 2, and Tier 3 companies are classified on the basis of their market share, product portfolio, and geographical presence.

Others include product, sales, and marketing managers.

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global polyaspartic coatings market and to estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials such as directors and marketing executives.

Data Triangulation

After arriving at the total market size through the estimation process, the overall market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both, the demand and supply sides. In addition, the market size was validated by using the top-down and bottom-up approaches. Then, it was verified through primary interviews. Thus, for every data segment, there were three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed to be correct when the values arrived at from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the polyaspartic coatings market, in terms of value and volume

- To provide detailed information regarding the significant factors (drivers, restraints, and opportunities) influencing the growth of the market

- To analyze and forecast the market size on the basis of type, system, and end-use industry

- To forecast the market size of different segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze the competitive developments such as expansion, new product launches, and acquisition

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Geographical Analysis:

- Country-level analysis of the global polyaspartic coatings market

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Growth opportunities and latent adjacency in Polyaspartic Coatings Market