Polyamide-imide Resin Market by Type (Unfilled, Glass-Filled, Carbon-Filled), End-Use Industry (Automotive, Aerospace, Electrical & Electronics, Oil & Gas), and Region (North America, Europe, APAC) - Global Forecast to 2022

[100 Pages Report] Polyamide-imide Resin Market was valued at USD 473.7 million in 2016 and is projected to reach USD 687.1 million by 2022, at a CAGR of 6.5% during the forecast period. The base year considered for this study is 2016, and the forecast period is between 2017 and 2022.

Objectives of the report

- To define, describe, and forecast the polyamide-imide resin market in terms of value and volume

- To provide detailed information regarding key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the polyamide-imide resin market

- To analyze and forecast the market size of polyamide-imide resin based on type, end-use industry, and region

- To forecast the market size with respect to 5 main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America, in addition to key countries in each of these regions

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

Both, top-down and bottom-up approaches were used to estimate and validate the size of the polyamide-imide resin market, and to determine the sizes of various other dependent submarkets. The research study involved the extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites, to identify and collect information useful for the technical, market-oriented, and commercial study of the polyamide-imide resin market.

To know about the assumptions considered for the study, download the pdf brochure

Key players operating in the polyamide-imide resin market include Solvay (Belgium), Quadrant (US), Toyobo (Japan), Ensinger (Germany), Innotek Technology (China), and Kermel (France).

Key Target Audience:

- Suppliers of Raw Materials

- Manufacturers of Polyamide-imide Resin

- Traders, Distributors, and Suppliers of Polyamide-imide Resin

- Government & Regional Agencies

- Research Organizations

- Investment Research Firms of High-performance Polymers

Scope of the Report:

This research report categorizes the polyamide-imide resin market on the basis of type, end-use industry, and region.

Polyamide-imide Resin Market, By Type:

- Unfilled

- Glass-filled

- Carbon-filled

- Others

Polyamide-imide Resin Market, By End-use Industry:

- Automotive

- Aerospace

- Electrical & Electronics

- Oil & Gas

- Others

Polyamide-imide Resin Market, By Region:

- North America

- Europe

- APAC

- South America

- Middle East & Africa

The market has been further analyzed for key countries in each of these regions.

Drivers

Superior properties of polyamide-imide

Polyamide-imides are thermoplastic amorphous polymers that have exceptional mechanical strength, and thermal and chemical resistance. Some of the other properties include high strength and stiffness, excellent wear resistance, exceptional chemical resistance, and excellent thermal stability. It also exhibits greater compressive strength and higher impact resistance than most advanced engineering plastics. Polyamide-imides are also unaffected by aliphatic and aromatic hydrocarbons, chlorinated and fluorinated hydrocarbons, and most acids at moderate temperatures. Owing to these superior properties, polyamide-imides are widely used in different industries such as aerospace, automotive, electrical & electronics, and oil & gas.

Replacement of conventional materials by polyamide-imide

Polyamide-imides are replacing conventional materials, including thermoset polymers, metal, and other types of plastics, in applications that require high thermal resilience. Their demand is increasing in various end-use industries, such as oil & gas, automotive, aerospace, and electrical & electronics. This high demand is attributed to the superior properties of polyamide-imides such as high strength and stiffness, excellent wear resistance, exceptional chemical resistance, and excellent thermal stability.

Restraints

Competition from hybrid polymers and composites

The hybrid technology is being used to manufacture conventional and engineering plastics to match the properties of polyamide-imides. Conventional and engineering plastics are comparatively cheaper than polyamide-imides because of the easy availability of raw materials and lower processing cost. The hybrid technology unites the properties of two materials, with the combined effect being greater than the sum of the individual parts. For example, lower grade polyamides such as PA6 and PA66 are developed along with composites to perform in high temperature applications.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of companies. The following customization options are available for the report:

Regional Analysis:

- Further breakdown of the regional polyamide-imide resin market into key countries

Company Information:

- Detailed analysis and profiles of additional market players

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of each company

The polyamide-imide resin market is estimated to be USD 501.7 million in 2017 and is projected to reach USD 687.1 million by 2022, at a CAGR of 6.5% between 2017 and 2022. The high demand for polyamide-imide resins from various end-use industries and superior properties of polyamide-imide resins are key factors driving the growth of the polyamide-imide resin market. The expansion of end-use industries, such as automotive, aerospace, electrical & electronics, and oil & gas, is another significant factor projected to influence the growth of the polyamide-imide resin market.

Based on type, the glass-filled segment of the polyamide-imide resin market is projected to grow at the highest CAGR during the forecast period. The addition of glass fiber to polyamide-imide resins helps in expanding the flexural modulus of polyamide-imide resins while reducing their rate of expansion. This, in turn, is expected to drive the growth of the market for glass-filled polyamide-imide resins.

The electrical & electronics segment is projected to be the fastest-growing end-use industry segment of the polyamide-imide resin market. Increase in the production of electronic products is expected to drive the demand for polyamide-imide resins from the electrical & electronics industry.

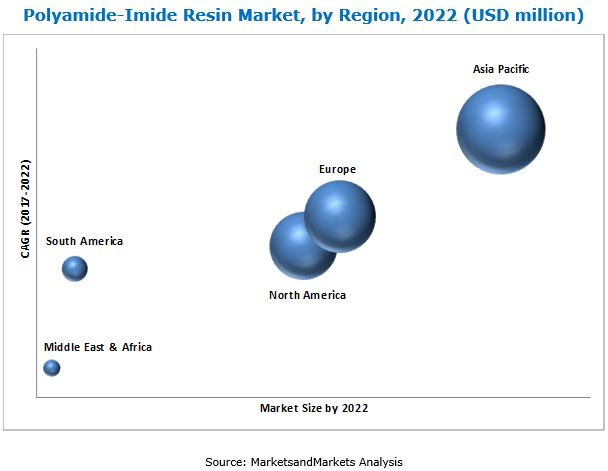

APAC accounted for the largest share of the polyamide-imide resin market in 2017, followed by Europe. The growth of the polyamide-imide resin market in APAC can be attributed to the increasing demand for vehicles, rising innovations in the aerospace industry, and increasing demand for consumer electronics. In addition, increased investments in the electrical & electronics industry are also projected to influence the growth of the polyamide-imide resin market in APAC.

Competition from hybrid polymers and composites is expected to restrain the growth of the polyamide-imide market. Moreover, high cost of polyamide-imide resins is acting as a major challenge to the growth of the polyamide-imide resin market.

Major companies profiled in this market research report include Solvay (Belgium), Quadrant (US), Toyobo (Japan), Ensinger (Germany), Innotek Technology (China), and Kermel (France). These companies are engaged in R&D activities to innovate and develop products to enhance their presence in the polyamide-imide resin market. For instance, in March 2017, Solvay innovated its new line of EnduroSharp scrapper blades for aerospace applications. These blades have high strength and stiffness, sharp edges, and high resistance to heat, wear, and chemicals. This new product launch strategy helped the company expand its existing line of products and widen its customer base in the aerospace industry.

Opportunities

Growing demand in end-use industries

Applications of polyamide-imides are increasing in different end-use industries such as aerospace, automotive, oil & gas, wire enamel coatings, electrical & electronics owing to their superior properties. Polyamide-imides are increasingly used as a substitute for many metal components in the aerospace industry, and they are used in different applications such as high temperature bushings and brackets, inert rings, fuel pipes, and pump bushings. Use of polyamide-imides in the aerospace industry improves fuel efficiency, provides chemical resistance to all common aircraft fluids, and high wear resistance.

The automotive industry is aiming to reduce the overall weight of vehicles and to execute the idea; the industry is increasing the usage of fiber reinforced polyamide-imide in some components such as thrust washers, thrust bearings, and seal rings.

Challenges

High cost of polyamide-imides

The manufacturing of polyamide-imides requires high initial investments, as the manufacturing process is much more complex than that of any other group of plastics. To manufacture a quality product, a high level of technical competency is required. As the production of polyamide-imides is costly, the plastics themselves are also very costly. The high price of polyamide-imides limits their application areas and, thus, acts as a challenge to the market players. The high cost of production also prohibits the entry of mid- and small-level market players in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 By Region

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Units Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

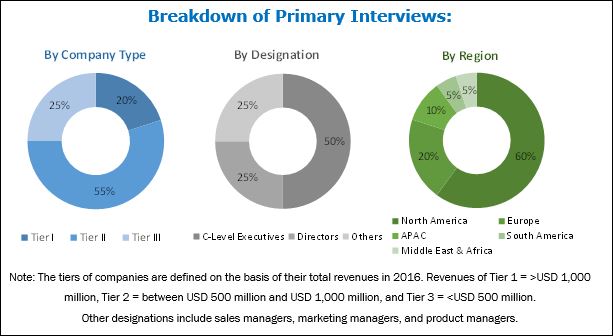

2.1.2.2 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 26)

4.1 Significant Opportunities in the Polyamide-imide Resin Market

4.2 APAC Polyamide-imide Resin Market, By End-Use Industry and Country

4.3 Polyamide-imide Resin Market, By Region

4.4 Polyamide-imide Resin Market, By Type

4.5 Polyamide-imide Resin Market, By End-Use Industry

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Superior Properties of Polyamide-imide

5.2.1.2 Replacement of Conventional Materials By Polyamide-imide

5.2.2 Restraints

5.2.2.1 Competition From Hybrid Polymers and Composites

5.2.3 Opportunities

5.2.3.1 Growing Demand in End-Use Industries

5.2.4 Challenges

5.2.4.1 High Cost of Polyamide-imides

5.3 Porters Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Polyamide-imide Resin Market, By Type (Page No. - 36)

6.1 Introduction

6.2 Unfilled

6.3 Glass Filled

6.4 Carbon Filled

6.5 Others

7 Polyamide-imide Resin Market, By End-Use Industry (Page No. - 40)

7.1 Introduction

7.2 Automotive

7.3 Aerospace

7.4 Electrical & Electronics

7.5 Oil & Gas

7.6 Others

8 Polyamide-imide Resin Market, By Region (Page No. - 47)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.2.3 Mexico

8.3 APAC

8.3.1 China

8.3.2 India

8.3.3 Japan

8.3.4 Malaysia

8.3.5 Indonesia

8.3.6 South Korea

8.3.7 Rest of APAC

8.4 Europe

8.4.1 Germany

8.4.2 France

8.4.3 UK

8.4.4 Italy

8.4.5 Rest of Europe

8.5 Middle East & Africa

8.5.1 South Africa

8.5.2 UAE

8.5.3 Rest of the Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.2 Argentina

8.6.3 Rest of South America

9 Company Profile (Page No. - 84)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

9.1 Solvay

9.2 Quadrant

9.3 Toyobo

9.4 Ensinger

9.5 Innotek Technology

9.6 Kermel

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

10 Appendix (Page No. - 94)

10.1 Insights From Industry Experts

10.2 Discussion Guide

10.3 Knowledge Store: Marketsandmarkets Subscription Portal

10.4 Available Customizations

10.5 Related Reports

10.6 Author Details

List of Tables (86 Tables)

Table 1 Unfilled Polyamide-imide Resin Market Size, By Region, 20152022 (Ton)

Table 2 Glass Filled Polyamide-imide Resin Market Size, By Region, 20152022 (Ton)

Table 3 Carbon Filled Polyamide-imide Resin Market Size, By Region, 20152022 (Ton)

Table 4 Others Polyamide-imide Resin Market Size, By Region, 20152022 (Ton)

Table 5 Polyamide-imide Resin Market Size in Automotive, By Region, 20152022 (Ton)

Table 6 Polyamide-imide Resin Market Size in Automotive, By Region, 20152022 (USD Million)

Table 7 Polyamide-imide Resin Market Size in Aerospace, By Region, 20152022 (Ton)

Table 8 Polyamide-imide Resin Market Size in Aerospace, By Region, 20152022 (USD Million)

Table 9 Polyamide-imide Resin Market Size in Electrical & Electronics, By Region, 20152022 (Ton)

Table 10 Polyamide-imide Resin Market Size in Electrical & Electronics, By Region, 20152022 (USD Million)

Table 11 Polyamide-imide Resin Market Size in Oil & Gas, By Region, 20152022 (Ton)

Table 12 Polyamide-imide Resin Market Size in Oil & Gas, By Region, 20152022 (USD Million)

Table 13 Polyamide-imide Resin Market Size in Others, By Region, 20152022 (Ton)

Table 14 Polyamide-imide Resin Market Size in Others, By Region, 20152022 (USD Million)

Table 15 Polyamide-imide Resin Market Size, By Region, 20152022 (Ton)

Table 16 Polyamide-imide Resin Market Size, By Region, 20152022 (USD Million)

Table 17 Polyamide-imide Resin Market Size, By Type, 20152022 (Ton)

Table 18 Polyamide-imide Resin Market Size, By End-Use Industry, 20152022 (Ton)

Table 19 Polyamide-imide Resin Market Size, By End-Use Industry, 20152022 (USD Million)

Table 20 North America: By Market Size, By Country, 20152022 (Ton)

Table 21 North America: By Market Size, By Country, 20152022 (USD Million)

Table 22 North America: By Market Size, By Type, 20152022 (Ton)

Table 23 North America: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 24 North America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 25 US: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 26 US: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 27 Canada: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 28 Canada: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 29 Mexico: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 30 Mexico: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 31 APAC: By Market Size, By Country, 20152022 (Ton)

Table 32 APAC: By Market Size, By Country, 20152022 (USD Million)

Table 33 APAC: By Market Size, By Type, 20152022 (Ton)

Table 34 APAC: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 35 APAC: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 36 China: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 37 China: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 38 India: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 39 India: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 40 Japan: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 41 Japan: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 42 Malaysia: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 43 Malaysia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 44 Indonesia: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 45 Indonesia: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 46 South Korea: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 47 South Korea: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 48 Rest of APAC: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 49 Rest of APAC By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 50 Europe: By Market Size, By Country, 20152022 (Ton)

Table 51 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 52 Europe: By Market Size, By Type, 20152022 (Ton)

Table 53 Europe: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 54 Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 55 Germany: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 56 Germany: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 57 France: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 58 France: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 59 UK: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 60 UK: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 61 Italy: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 62 Italy: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 63 Rest of Europe: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 64 Rest of Europe: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 65 Middle East & Africa: By Market Size, By Country, 20152022 (Tons)

Table 66 Middle East & Africa: By Market Size, By Country, 20152022 (USD Million)

Table 67 Middle East & Africa: By Market Size, By Type, 20152022 (Ton)

Table 68 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 69 Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 70 South Africa: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 71 South Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 72 UAE: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 73 UAE: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 74 Rest of the Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 75 Rest of the Middle East & Africa: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 76 South America: By Market Size, By Country, 20152022 (Ton)

Table 77 South America: By Market Size, By Country, 20152022 (USD Million)

Table 78 South America: By Market Size, By Type, 20152022 (Ton)

Table 79 South America: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 80 South America: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 81 Brazil: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 82 Brazil: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 83 Argentina: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 84 Argentina: By Market Size, By End-Use Industry, 20152022 (USD Million)

Table 85 Rest of South America: By Market Size, By End-Use Industry, 20152022 (Ton)

Table 86 Rest of South America: By Market Size, By End-Use Industry, 20152022 (USD Million)

List of Figures (22 Figures)

Figure 1 Polyamide-imide Resin Market Segmentation

Figure 2 Polyamide-imide Resin Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Polyamide-imide Resin Market: Data Triangulation

Figure 6 Glass Filled Type to Account for the Largest Share of the Polyamide-imide Resin Market

Figure 7 Electrical & Electronics to Be the Second-Largest End-Use Industry

Figure 8 APAC Accounted for the Largest Share of the Polyamide-imide Resin Market

Figure 9 Emerging Economies to Offer Lucrative Growth Opportunities to Market Players Between 2017 and 2022

Figure 10 Electrical & Electronics Was the Second Largest End-Use Industry of Polyamide-imide Resin

Figure 11 APAC Accounted for Largest Share of the Polyamide-imide Resin Market in 2016

Figure 12 Glass Filled to Be the Largest Type

Figure 13 Electrical & Electronics to Account for the Second-Largest Market Share

Figure 14 Overview of Factors Governing the Polyamide-imide Resin Market

Figure 15 Polyamide-imides Resin Market: Porters Five Forces Analysis

Figure 16 Glass Filled to Be the Largest Type of Polyamide-imide Resin

Figure 17 Electrical & Electronics to Be the Second-Largest End-Use Industry of Polyamide-imide Resin

Figure 18 China to Be the Fastest-Growing Market

Figure 19 North America: Polyamide-imide Resin Market Snapshot

Figure 20 APAC: Polyamide-imide Resin Market Snapshot

Figure 21 Solvay: Company Snapshot

Figure 22 Toyobo: Company Snapshot

Growth opportunities and latent adjacency in Polyamide-imide Resin Market