Plumbing Fixtures Market by Material (Vitreous China, Metal, Plastics), Product (Bathtub & Shower Fixtures and Fittings, Sink Fixtures & Fittings, Toilet Fixtures & Fittings), Application (Renovated, New Buildings), End-Use - Forecast to 2021

[214 Pages report] The plumbing fixtures & fittings market size is estimated to grow from USD 74.72 Billion in 2015 to USD 102.07 Billion by 2021, at a CAGR of 5.45%. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021. The fixtures & fittings report aims to study the fixtures & fittings market on the basis of material, product, end-use, and application. The other objectives include providing detailed information regarding the main factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). It also aims to study the individual growth trends, future prospects, and contribution of various segments to the total market. The study also analyzes opportunities in the market for stakeholders and details of the competitive landscape for the market leaders. The study strategically profiles key players and comprehensively analyzes their core competencies. Finally, the study tracks and analyzes competitive developments such as new product developments, acquisitions, agreements, partnerships, and expansions, and research & development activities in the plumbing fixtures & fittings market.

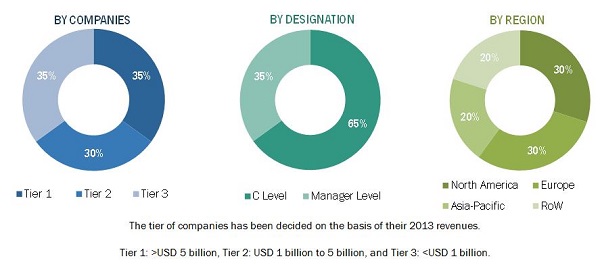

The research methodology used to estimate and forecast the plumbing fixtures & fittings market includes the top-down and bottom-up approach. The total market size of fixtures & fittings was calculated based on the percentage split of plumbing fixtures & fittings products as well as on the percentage spilt of different materials, application, and end-use industries. The allotment and calculation were done on the basis of extensive primary interviews and secondary research. Secondary research included information from Indian Plumbing Association (IPA), International Association of Plumbing & Mechanical Officials (IAPMO), Plumbing Manufacturers International, American Society of Plumbing Engineers, North American Plumbing & Heating LLC, and Regulatory Bodies. Primary research involved in this report includes extensive interviews with key people such as CEOs, VPs, directors, and executives. After arriving at the overall market size, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and sub segments. The breakdown of profiles of primary is depicted in the following figure:

To know about the assumptions considered for the study, download the pdf brochure

The market ecosystem includes various stakeholders involved in the supply chain of the plumbing fixtures & fittings industry starting from raw materials suppliers, research & development, and manufacturing. Post this, the marketing and sales of the products take place which is only possible if an efficient distribution channel is developed. Finally, the end products are made available to the consumers. The global market for plumbing fixtures & fittings is dominated by players such as Geberit AG (Switzerland), Kohler Co. (U.S.), Jacuzzi Inc. (U.S.), Masco Corporation (U.S.), LIXIL Group Corporation (Japan), Fortune Brands Home & Security, Inc. (U.S.), TOTO Ltd. (Japan), and Roca Sanitario, S.A. (Spain). The other players in the market are Elkay Manufacturing Company (U.S.) and MAAX Bath Inc. (Canada).

Target Audience

- Plumbing Product manufacturers

- Raw material suppliers

- End users

- Consulting firms

Scope of the Report

The research report segments the plumbing fixtures & fittings market into the following submarkets:

By Material:

- Vitreous china

- Metal

- Plastic

By Product:

- Bathtub & shower fixtures

- Sink fixtures

- Toilet fixtures

- Bathtub & shower fittings

- Sink fittings

- Toilet fittings

- Other fixtures & fittings

By End-Use:

- Residential buildings

- Non-residential buildings

By Application:

- New buildings

- Renovated buildings

By Region:

- North America

- Europe

- Asia-Pacific

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further analysis of the plumbing fixtures & fittings market for additional countries

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets projects that the plumbing fixtures & fittings market size will grow from USD 74.72 Billion in 2015 to USD 102.07 Billion by 2021, at an estimated CAGR of 5.45%. The plumbing fixtures & fittings market is expected to witness high growth as a result of the rising urbanization, building renovations due to disasters and upgradation, large-scale investment in infrastructure & industrial sectors, and rising construction activities in emerging economies. The renovated buildings segment is projected to have the largest market share and dominate the plumbing fixtures & fittings market from 2016 to 2021. New buildings plays a key role in changing the plumbing fixtures & fittings landscape and is projected to grow at the highest rate during the forecast period.

The segmentation for this report is based on material, product, end-use, application, and region. Bathtub & shower fixtures are projected to form the fastest-growing product in the plumbing fixtures & fittings market. Residential buildings use bathtubs to gain a luxuriant experience. Many non-residential buildings such as hotels, gyms, and spa resorts use bathtub & shower fixtures as a way to promote their status and improve customer satisfaction. Growth in construction expenditures in the nonresidential market, including health care rehabilitation centers where whirlpool baths serve a more therapeutic purpose, will continue to support the demand for bathtubs.

In 2015, the market share of vitreous china was the largest on the basis of raw material and plastics is projected to be the fastest-growing segment during the forecast period. This is closely followed by metal, which has the second-highest growth rate.

Plastic plumbing fixtures & fittings are made from a wide range of polymers such as fiberglass, cast polymer, and acrylic. Safety is another important factor when designing plumbing fixtures and fittings; prefabricated slip-resistant surface coatings have been developed by key players to gain a competitive edge in the market. Hence, plastic which can be molded in any shape is gaining popularity in the plumbing fixtures & fittings market.

Plumbing fixtures & fittings are used in residential and non-residential buildings. The global market, in terms of end use, was dominated by residential buildings in 2015. Rising disposable incomes of urban population is stimulating the construction of new houses in urban regions, giving rise to an increased demand for plumbing fittings and fixtures.

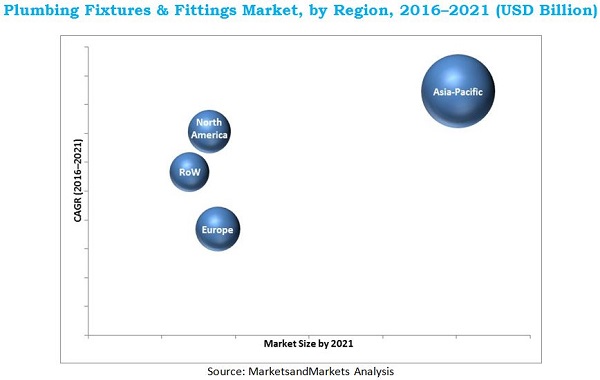

Asia-Pacific is projected to have the largest market share and dominate the plumbing fixtures & fittings market from 2016 to 2021. Asia-Pacific offers potential growth opportunities; developing countries such as China and India are projected to be emerging markets, making the Asia-Pacific region the fastest-growing market for plumbing fixtures & fittings. The growth of the plumbing fixtures & fittings market in this region is driven by factors such as the growth in the construction of the residential and non-residential buildings. Also, the growing population and economic development are other factors driving the growth of this market.

Factors such as fluctuations in raw material prices act as a restraint for the growth of the market. The global market for plumbing fixtures & fittings is dominated by players such as Geberit AG (Switzerland), Kohler Co. (U.S.), Jacuzzi Inc. (U.S.), Masco Corporation (U.S.), LIXIL Group Corporation (Japan), Fortune Brands Home & Security, Inc. (U.S.), TOTO Ltd. (Japan), and Roca Sanitario, S.A. (Spain). Other players in the market are Elkay Manufacturing Company (U.S.) and MAAX Bath Inc. (Canada). These players adopted various strategies such as new product developments, acquisitions, agreements, partnerships, and expansions to cater to the needs of the plumbing fixtures & fittings market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 24)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Unit Considered for the Plumbing Fixtures & Fittings Market

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 27)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries, By Company Type, Designation, and Region

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Market Share Estimation

2.5 Research Assumptions and Limitations

2.5.1 Assumptions

2.5.1.1 Assumptions Made for This Study

2.5.2 Limitations

3 Executive Summary (Page No. - 37)

3.1 Plumbing Fixtures & Fittings Market, By Product

3.2 Plumbing Fixtures Market, By End Use

3.3 Plumbing Fixtures & Fittings Market, By Material

3.4 Asia-Pacific Set to Grow at the Highest Rate Between 2016 & 2021

4 Premium Insights (Page No. - 41)

4.1 Attractive Opportunities in the Plumbing Fixtures & Fittings Market

4.2 China Captured the Largest Share in the Asia-Pacific Plumbing Fixtures Market in 2015

4.3 Leading Countries in the Plumbing Fixtures & Fittings Market, 2015

4.4 Plumbing Fixtures Market, By Material

5 Market Overview (Page No. - 45)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Building Renovations Due to Disasters and Upgradation

5.4.1.2 Rapid Urbanization and Consequent Rise in Construction Activities

5.4.1.3 Large-Scale Investments in Industrial and Infrastructure Sectors

5.4.2 Restraints

5.4.2.1 Fluctuations in Raw Material Prices

5.4.3 Opportunities

5.4.3.1 Improving U.S. Construction Market

5.4.3.2 Product Innovations

5.4.4 Challenges

5.4.4.1 Stringent Environmental Regulations

5.4.4.2 Rising Labor Costs in the U.S.

6 Plumbing Fixtures & Fittings Market, By Material (Page No. - 55)

6.1 Introduction

6.2 Vitreous China

6.3 Metal

6.3.1 Cast Iron

6.3.2 Others

6.4 Plastic

6.4.1 Fiber Glass

6.4.2 Cast Polymer

6.4.3 Acrylics

6.4.4 Other Plastics

7 Plumbing Fixtures & Fittings Market, By Product (Page No. - 61)

7.1 Introduction

7.2 Bathtub & Shower Fixtures

7.3 Sink Fixtures

7.4 Toilet Fixtures

7.5 Fittings

7.6 Others

8 Plumbing Fixtures & Fittings Market, By Application (Page No. - 66)

8.1 Introduction

8.2 Renovated Buildings

8.3 New Buildings

9 Plumbing Fixtures & Fittings Market, By End Use (Page No. - 69)

9.1 Introduction

9.2 Residential Buildings

9.3 Non-Residential Buildings

9.4 Non-Residential Buildings Market, By Type

10 Plumbing Fixtures & Fittings Market, By Region (Page No. - 74)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 Asia-Pacific: Plumbing Fixtures & Fittings Market, By Country

10.2.1.1 China is Projected to Be the Fastest-Growing Plumbing Fixtures Market in the Asia-Pacific Region

10.2.2 Asia-Pacific: Plumbing Fixtures & Fittings Market, By Material

10.2.2.1 Vitreous China Was the Most-Widely Used Material in the Plumbing Fixtures Market in 2015

10.2.3 Asia-Pacific: Plumbing Fixtures & Fittings Market, By Product

10.2.3.1 Bathtub & Shower Fixtures Dominated the Asia-Pacific Region in 2015

10.2.4 Asia-Pacific: Plumbing Fixtures & Fittings Market, By End Use

10.2.4.1 Residential Buildings Segment is Projected to Be the Fastest-Growing From 2016 to 2021

10.2.5 Asia-Pacific: Plumbing Fixtures Market , By Application

10.2.5.1 Renovated Buildings Segment is Projected to Be the Second-Fastest-Growing From 2016 to 2021

10.2.6 China

10.2.6.1 China: Plumbing Fixtures & Fittings Market, By Material

10.2.6.1.1 Metal Segment is Projected to Grow at the Second-Highest CAGR During the Forecast Period

10.2.6.2 China: Plumbing Fixtures Market, By Product

10.2.6.2.1 Bathtub & Shower Fixtures Segment is Projected to Grow at the Highest Rate During the Forecast Period

10.2.6.3 China: Plumbing Fixtures & Fittings Market, By End Use

10.2.6.3.1 Residential Segment Dominated the Plumbing Fixtures Market in China in 2015

10.2.6.4 China: Plumbing Fixtures & Fittings Market, By Application

10.2.6.4.1 Renovated Buildings Segment Dominated the Plumbing Fixtures Market in China in 2015

10.2.7 India

10.2.7.1 India: Plumbing Fixtures & Fittings Market, By Material

10.2.7.1.1 Plastics Segment is Projected to Grow at the Highest CAGR During the Forecast Period in India

10.2.7.2 India: Plumbing Fixtures Market, By Product

10.2.7.2.1 Bathtub & Shower Fixtures Segment is Projected to Grow at the Highest Rate During the Forecast Period

10.2.7.3 India: Plumbing Fixtures & Fittings Market, By End Use

10.2.7.3.1 Residential Buildings Segment Dominated the Plumbing Fixtures Market in India in 2015

10.2.7.4 India: Plumbing Fixtures & Fittings Market, By Application

10.2.7.4.1 Renovated Buildings Segment Dominated the Plumbing Fixtures Market in India in 2015

10.2.8 Japan

10.2.8.1 Japan: Plumbing Fixtures & Fittings Market, By Material

10.2.8.1.1 Plastics Segment is Projected to Grow at the Highest CAGR During the Forecast Period in Japan

10.2.8.2 Japan: Plumbing Fixtures Market, By Product

10.2.8.2.1 Bathtub & Shower Fixtures Segment is Projected to Grow at the Highest Rate During the Forecast Period

10.2.8.3 Japan: Plumbing Fixtures & Fittings Market, By End Use

10.2.8.3.1 Residential Buildings Segment Dominated the Plumbing Fixtures Market in Japan in 2015

10.2.8.4 Japan: Plumbing Fixtures & Fittings Market, By Application

10.2.8.4.1 Renovated Buildings Segment Dominated the Plumbing Fixtures Market in Japan in 2015

10.2.9 Australia

10.2.9.1 Australia: Plumbing Fixtures & Fittings Market, By Raw Material

10.2.9.1.1 Vitreous China Accounted for the Largest Share in the Australian Plumbing Fixtures Market in 2015

10.2.9.2 Australia: Plumbing Fixtures & Fittings Market, By Product

10.2.9.2.1 Bathtub & Shower Fixtures Segment is Projected to Grow at the Highest Rate During the Forecast Period

10.2.9.3 Australia: Plumbing Fixtures Market, By End Use

10.2.9.3.1 Residential Buildings Segment Dominated the Plumbing Fixtures & Fittings Market in Australia in 2015

10.2.9.4 Australia: Plumbing Fixtures Market , By Application

10.2.9.4.1 Renovated Buildings Segment Dominated the Plumbing Fixtures & Fittings Market in Australia in 2015

10.2.10 Rest of Asia-Pacific

10.2.10.1 Rest of Asia-Pacific: Plumbing Fixtures & Fittings Market, By Material

10.2.10.1.1 Vitreous China Accounted for the Largest Share in the Rest of Asia-Pacific Plumbing Fixtures Market in 2015

10.2.10.2 Rest of Asia-Pacific: Plumbing Fixtures & Fittings Market, By Product

10.2.10.2.1 Bathtub & Shower Fixtures Segment is Projected to Grow at the Highest Rate During the Forecast Period

10.2.10.3 Rest of Asia-Pacific: Plumbing Fixtures Market, By End Use

10.2.10.3.1 Residential Buildings Segment Dominated the Plumbing Fixtures & Fittings Market in the Rest of Asia-Pacific in 2015

10.2.10.4 Rest of Asia-Pacific: Plumbing Fixtures Market, By Application

10.2.10.4.1 Renovated Buildings Segment Dominated the Plumbing Fixtures & Fittings Market in the Rest of Asia-Pacific in 2015

10.3 North America

10.3.1 North America: Plumbing Fixtures Market , By Country

10.3.1.1 U.S. Dominated the Plumbing Fixtures & Fittings Market in the North American Region in 2015

10.3.2 North America: Plumbing Fixtures Market, By Material

10.3.2.1 Plastic Projected to Be the Fastest-Growing Segment

10.3.3 North America: Plumbing Fixtures & Fittings Market, By Product

10.3.3.1 Bathtub & Shower Fixtures Segment Dominated the North American Market in 2015

10.3.4 North America: Plumbing Fixtures Market, By End Use

10.3.4.1 Residential Buildings Projected to Be the Fastest-Growing Segment in North America

10.3.5 North America: Plumbing Fixtures & Fittings Market, By Application

10.3.5.1 New Buildings Projected to Be the Fastest-Growing Application in North America

10.3.6 U.S.

10.3.6.1 U.S.: Plumbing Fixtures & Fittings Market, By Material

10.3.6.1.1 Plastic Projected to Be the Fastest-Growing Segment

10.3.6.2 U.S.: Plumbing Fixtures Market, By Product

10.3.6.2.1 Bathtub & Shower Fixtures Segment Dominated the U.S. Market in 2015

10.3.6.3 U.S.: Plumbing Fixtures & Fittings Market, By End Use

10.3.6.3.1 Residential Buildings Projected to Be the Fastest-Growing Segment in the U.S.

10.3.6.4 U.S.: Plumbing Fixtures Market, By Application

10.3.6.4.1 Renovated Buildings Projected to Be the Fastest-Growing Segment in the U.S.

10.3.7 Canada

10.3.7.1 Canada: Plumbing Fixtures & Fittings Market, By Material

10.3.7.1.1 Plastic Projected to Be the Fastest-Growing Segment

10.3.7.2 Canada: Plumbing Fixtures Market, By Product

10.3.7.2.1 Bathtub & Shower Fixtures Segment Dominated the Canadian Market in 2015

10.3.7.3 Canada: Plumbing Fixtures & Fittings Market, By End Use

10.3.7.3.1 Residential Buildings Projected to Be the Fastest-Growing Segment in Canada

10.3.7.4 Canada: Plumbing Fixtures Market, By Application

10.3.7.4.1 New Buildings Projected to Be the Fastest-Growing Segment in Canada

10.3.8 Mexico

10.3.8.1 Mexico: Plumbing Fixtures & Fittings Market, By Material

10.3.8.1.1 Plastic Projected to Be the Fastest-Growing Segment

10.3.8.2 Mexico: Plumbing Fixtures Market, By Product

10.3.8.2.1 Bathtub & Shower Fixtures Segment Dominated the Mexican Market in 2015

10.3.8.3 Mexico: Plumbing Fixtures & Fittings Market, By End Use

10.3.8.3.1 Residential Buildings Projected to Be the Fastest-Growing Segment in Mexico

10.3.8.4 Mexico: Plumbing Fixtures Market, By Application

10.3.8.4.1 New Buildings Projected to Be the Fastest-Growing Segment in Mexico

10.4 Europe

10.4.1 Europe: Plumbing Fixtures & Fittings Market, By Country

10.4.1.1 Germany Dominated the Plumbing Fixtures Market in the European Region in 2015

10.4.2 Europe: Plumbing Fixtures & Fittings Market, By Material

10.4.2.1 Plastic Projected to Be the Fastest-Growing Material Segment

10.4.3 Europe: Plumbing Fixtures Market, By Product

10.4.3.1 The Bathtub & Shower Fixtures Segment Dominated the European Market in 2015

10.4.4 Europe: Plumbing Fixtures & Fittings Market, By End Use

10.4.4.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in Europe

10.4.5 Europe: Plumbing Fixtures Market, By Application

10.4.5.1 New Buildings Projected to Be the Fastest-Growing Application Segment in Europe

10.4.6 Germany

10.4.6.1 Germany: Plumbing Fixtures & Fittings Market, By Material

10.4.6.1.1 Plastic Projected to Be the Fastest-Growing Material Segment

10.4.6.2 Germany: Plumbing Fixtures Market, By Product

10.4.6.2.1 The Bathtub & Shower Fixtures Segment Dominated the Germany Market, By Product, in 2015

10.4.6.3 Germany: Plumbing Fixtures & Fittings Market, By End Use

10.4.6.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in Germany

10.4.6.4 Germany: Plumbing Fixtures Market, By Application

10.4.6.4.1 New Buildings to Be the Fastest-Growing Application Segment in Germany

10.4.7 France

10.4.7.1 France: Plumbing Fixtures & Fittings Market, By Material

10.4.7.1.1 Plastic Projected to Be the Fastest-Growing Material Segment

10.4.7.2 France: Plumbing Fixtures Market, By Product

10.4.7.2.1 The Bathtub & Shower Fixtures Segment Dominated the France Market in 2015

10.4.7.3 France: Plumbing Fixtures & Fittings Market, By End Use

10.4.7.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in France

10.4.7.4 France: Plumbing Fixtures Market, By Application

10.4.7.4.1 New Buildings to Be the Fastest-Growing Application Segment in France

10.4.8 U.K.

10.4.8.1 U.K.: Plumbing Fixtures & Fittings Market, By Material

10.4.8.1.1 Plastic Projected to Be the Fastest-Growing Material Segment

10.4.8.2 U.K.: Plumbing Fixtures Market, By Product

10.4.8.2.1 The Bathtub & Shower Fixtures Segment Dominated the U.K. Market in 2015

10.4.8.3 U.K.: Plumbing Fixtures & Fittings Market, By End Use

10.4.8.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in the U.K.

10.4.8.4 U.K.: Plumbing Fixtures Market, By Application

10.4.8.4.1 New Buildings Projected to Be the Fastest-Growing Application Segment in the U.K.

10.4.9 Russia

10.4.9.1 Russia: Plumbing Fixtures & Fittings Market, By Material

10.4.9.1.1 Plastic to Be the Fastest-Growing Material Segment in Russia

10.4.9.2 Russia: Plumbing Fixtures Market, By Product

10.4.9.2.1 The Bathtub & Shower Fixtures Segment Dominated the Russian Market in 2015

10.4.9.3 Russia: Plumbing Fixtures & Fittings Market, By End Use

10.4.9.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in the Russian Market

10.4.9.4 Russia: Plumbing Fixtures Market, By Application

10.4.9.4.1 New Buildings Projected to Be the Fastest-Growing Application Segment in Russia

10.4.10 Rest of Europe

10.4.10.1 Rest of Europe: Plumbing Fixtures & Fittings Market, By Material

10.4.10.1.1 Plastic Projected to Be the Fastest-Growing Material Segment

10.4.10.2 Rest of Europe: Plumbing Fixtures Market, By Product

10.4.10.2.1 The Bathtub & Shower Fixtures Segment Dominated the Rest of Europe Market in 2015

10.4.10.3 Rest of Europe: Plumbing Fixtures & Fittings Market, By End Use

10.4.10.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in Rest of Europe

10.4.10.4 Rest of Europe: Plumbing Fixtures Market, By Application

10.4.10.4.1 New Buildings to Be the Fastest-Growing Application Segment in Rest of Europe

10.5 RoW

10.5.1 RoW: Plumbing Fixtures & Fittings Market, By Country

10.5.1.1 Brazil Dominated the Plumbing Fixtures Market in the RoW Region in 2015

10.5.2 RoW: Plumbing Fixtures & Fittings Market, By Material

10.5.2.1 Plastic Projected to Be the Fastest-Growing Material Segment

10.5.3 RoW: Plumbing Fixtures Market, By Product

10.5.3.1 Bathtub & Shower Fixtures Segment Dominated the RoW Market, in 2015

10.5.4 RoW: Plumbing Fixtures & Fittings Market, By End Use

10.5.4.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in RoW

10.5.5 RoW: Plumbing Fixtures Market Size, By Application

10.5.5.1 New Buildings Projected to Be the Fastest-Growing Application Segment in RoW

10.5.6 Brazil

10.5.6.1 Brazil: Plumbing Fixtures & Fittings Market, By Material

10.5.6.1.1 Plastics Projected to Be the Fastest-Growing Material Segment

10.5.6.2 Brazil: Plumbing Fixtures Market, By Product

10.5.6.2.1 Bathtub & Shower Fixtures Segment Dominated the Brazilian Market, By Product, in 2015

10.5.6.3 Brazil: Plumbing Fixtures & Fittings Market Size, By End Use

10.5.6.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in Brazilian Market

10.5.6.4 Brazil: Plumbing Fixtures Market, By Application

10.5.6.4.1 Renovated Buildings Projected to Be the Fastest-Growing Application Segment in Brazilian Market

10.5.7 South Africa

10.5.7.1 South Africa: Plumbing Fixtures & Fittings Market, By Material

10.5.7.1.1 Vitreous China Dominated the South African Market, By Material, in 2015

10.5.7.2 South Africa: Plumbing Fixtures Market, By Product

10.5.7.2.1 Bathtub & Shower Fixtures Segment Dominated the South African Market, By Product, in 2015

10.5.7.3 South Africa: Plumbing Fixtures & Fittings Market, By End Use

10.5.7.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in South Africa

10.5.7.4 South Africa: Plumbing Fixtures Market, By Application

10.5.7.4.1 New Buildings Projected to Be the Fastest-Growing Application Segment in South Africa

10.5.8 Argentina

10.5.8.1 Argentina: Plumbing Fixtures & Fittings Market, By Material

10.5.8.1.1 Plastics Projected to Be the Fastest-Growing Material Segment

10.5.8.2 Argentina: Plumbing Fixtures Market, By Product

10.5.8.2.1 Bathtub & Shower Fixtures Segment Dominated the Argentine Market, in 2015

10.5.8.3 Argentina: Plumbing Fixtures & Fittings Market, By End Use

10.5.8.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in Argentina

10.5.8.4 Argentina: Plumbing Fixtures Market, By Application

10.5.8.4.1 New Buildings Projected to Be the Fastest-Growing Application Segment in Argentina

10.5.9 Others in RoW

10.5.9.1 Others in RoW: Plumbing Fixtures & Fittings Market, By Material

10.5.9.1.1 Plastics Projected to Be the Fastest-Growing Material Segment

10.5.9.2 Others in RoW: Plumbing Fixtures Market, By Product

10.5.9.2.1 Bathtub & Shower Fixtures Segment Dominated the Others in RoW Market, in 2015

10.5.9.3 Others in RoW: Plumbing Fixtures & Fittings Market, By End Use

10.5.9.3.1 Residential Buildings Projected to Be the Fastest-Growing End-Use Segment in Others in RoW

10.5.9.4 Others in RoW: Plumbing Fixtures Market, By Application

10.5.9.4.1 New Buildings Projected to Be the Fastest-Growing Application Segment in Others in RoW

11 Competitive Landscape (Page No. - 173)

11.1 Introduction

11.2 Competitive Situations and Trends

11.2.1 New Product Development

11.2.2 Acquisitions

11.2.3 Expansion

11.2.4 Partnership

12 Company Profiles (Page No. - 179)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Introduction

12.2 Fortune Brands Home & Security, Inc.

12.3 Geberit AG

12.4 Masco Corporation

12.5 Lixil Group Corporation

12.6 Toto Ltd.

12.7 Roca Sanitario, S.A.

12.8 Elkay Manufacturing Company

12.9 Maax Bath Inc.

12.10 Kohler Co.

12.11 Jacuzzi Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 206)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (194 Tables)

Table 1 List of Natural Disasters in the U.S., 20162011

Table 2 Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 3 Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 4 Market Size, By Product, 20142021 (USD Million)

Table 5 Market Size, By Product, 20142021 (Million Units)

Table 6 Market Size, By Application, 20142021 (USD Million)

Table 7 Market Size, By Application, 20142021 (Million Units)

Table 8 Market Size, By End Use, 20142021 (USD Million)

Table 9 Market Size, By End Use, 20142021 (Million Units)

Table 10 Non-Residential Buildings Market Size, By Type, 20142021 (USD Million)

Table 11 Non-Residential Buildings Market Size, By Type, 20142021 (Million Units)

Table 12 Market Size, By Region, 2014-2021 (USD Million)

Table 13 Market Size, By Region, 2014-2021 (Million Units)

Table 14 Asia-Pacific: Plumbing Fixtures & Fittings Market Size, By Country, 20142021 (USD Million)

Table 15 Asia-Pacific: Plumbing Fixtures Market Size, By Country, 20142021 (Million Units)

Table 16 Asia-Pacific: Market Size, By Material, 20142021 (USD Million)

Table 17 Asia-Pacific: Market Size, By Material, 20142021 (Million Units)

Table 18 Asia-Pacific: Market Size, By Product, 20142021 (USD Million)

Table 19 Asia-Pacific: Market Size, By Product, 20142021 (Million Units)

Table 20 Asia-Pacific: Market Size, By End Use, 20142021 (USD Million)

Table 21 Asia-Pacific: Market Size, By End Use, 20142021 (Million Units)

Table 22 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 23 Asia-Pacific: Market Size, By Application, 20142021 (Million Units)

Table 24 China: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 25 China: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 26 China: Market Size, By Product, 20142021 (USD Million)

Table 27 China: Market Size, By Product, 20142021 (Million Units)

Table 28 China: Market Size, By End Use, 20142021 (USD Million)

Table 29 China: Market Size, By End Use, 20142021 (Million Units)

Table 30 China: Market Size, By Application, 20142021 (USD Million)

Table 31 China: Market Size, By Application, 20142021 (Million Units)

Table 32 India: Plumbing Fixtures & Fittings Market Market Size, By Material, 20142021 (USD Million)

Table 33 India: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (Million Units)

Table 34 India: Market Size, By Product, 20142021 (USD Million)

Table 35 India: Market Size, By Product, 20142021 (Million Units)

Table 36 India: Market Size, By End Use, 20142021 (USD Million)

Table 37 India: Market Size, By End Use, 20142021 (Million Units)

Table 38 India: Market Size, By Application, 20142021 (USD Million)

Table 39 India: Market Size, By Application, 20142021 (Million Units)

Table 40 Japan: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 41 Japan: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 42 Japan: Market Size, By Product, 20142021 (USD Million)

Table 43 Japan: Market Size, By Product, 20142021 (Million Units)

Table 44 Japan: Market Size, By End Use, 20142021 (USD Million)

Table 45 Japan: Market Size, By End Use, 20142021 (Million Units)

Table 46 Japan: Market Size, By Application, 20142021 (USD Million)

Table 47 Japan: Market Size, By Application, 20142021 (Million Units)

Table 48 Australia: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 49 Australia: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 50 Australia: Market Size, By Product, 20142021 (USD Million)

Table 51 Australia: Market Size, By Product, 20142021 (Million Units)

Table 52 Australia: Market Size, By End Use, 20142021 (USD Million)

Table 53 Australia: Market Size, By End Use, 20142021 (Million Units)

Table 54 Australia: Market Size, By Application, 20142021 (USD Million)

Table 55 Australia: Market Size, By Application, 20142021 (Million Units)

Table 56 Rest of Asia-Pacific: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 57 Rest of Asia-Pacific: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 58 Rest of Asia-Pacific: Market Size, By Product, 20142021 (USD Million)

Table 59 Rest of Asia-Pacific: Market Size, By Product, 20142021 (Million Units)

Table 60 Rest of Asia-Pacific: Market Size, By End Use, 20142021 (USD Million)

Table 61 Rest of Asia-Pacific: Market Size, By End Use, 20142021 (Million Units)

Table 62 Rest of Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 63 Rest of Asia-Pacific: Market Size, By Application, 20142021 (Million Units)

Table 64 North America: Plumbing Fixtures & Fittings Market Size, By Country, 2014-2021 (USD Million)

Table 65 North America: Plumbing Fixtures Market Size, By Country, 2014-2021 (Million Units)

Table 66 North America: Market Size, By Material, 2014-2021 (USD Million)

Table 67 North America: Market Size, By Material, 2014-2021 (Million Units)

Table 68 North America: Market Size, By Product, 2014-2021 (USD Million)

Table 69 North America: Market Size, By Product, 2014-2021 (Million Units)

Table 70 North America: Market Size, By End Use, 2014-2021 (USD Million)

Table 71 North America: Market Size, By End Use, 2014-2021 (Million Units)

Table 72 North America: Market Size, By Application, 2014-2021 (USD Million)

Table 73 North America: Market Size, By Application, 2014-2021 (Million Units)

Table 74 U.S.: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 75 U.S.: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 76 U.S.: Market Size, By Product, 2014-2021 (USD Million)

Table 77 U.S.: Market Size, By Product, 2014-2021 (Million Units)

Table 78 U.S.: Market Size, By End Use, 2014-2021 (USD Million)

Table 79 U.S.: Market Size, By End Use, 2014-2021 (Million Units)

Table 80 U.S.: Market Size, By Application, 2014-2021 (USD Million)

Table 81 U.S.: Market Size, By Application, 2014-2021 (Million Units)

Table 82 Canada: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 83 Canada: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 84 Canada: Market Size, By Product, 2014-2021 (USD Million)

Table 85 Canada: Market Size, By Product, 2014-2021 (Million Units)

Table 86 Canada: Market Size, By End Use, 2014-2021 (USD Million)

Table 87 Canada: Market Size, By End Use, 2014-2021 (Million Units)

Table 88 Canada: Market Size, By Application, 2014-2021 (USD Million)

Table 89 Canada: Market Size, By Application, 2014-2021 (Million Units)

Table 90 Mexico: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 91 Mexico: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 92 Mexico: Market Size, By Product, 2014-2021 (USD Million)

Table 93 Mexico: Market Size, By Product, 2014-2021 (Million Units)

Table 94 Mexico: Market Size, By End Use, 2014-2021 (USD Million)

Table 95 Mexico: Market Size, By End Use, 2014-2021 (Million Units)

Table 96 Mexico: Market Size, By Application, 2014-2021 (USD Million)

Table 97 Mexico: Market Size, By Application, 2014-2021 (Million Units)

Table 98 Europe: Plumbing Fixtures & Fittings Market Market Size, By Country, 20142021 (USD Million)

Table 99 Europe: Plumbing Fixtures Market Size, By Country, 20142021 (Million Units)

Table 100 Europe: Market Size, By Material, 20142021 (USD Million)

Table 101 Europe: Market Size, By Material, 20142021 (Million Units)

Table 102 Europe: Market Size, By Product, 20142021 (USD Million)

Table 103 Europe: Market Size, By Product, 20142021 (Million Units)

Table 104 Europe: Market Size, By End Use, 20142021 (USD Million)

Table 105 Europe: Market Size, By End Use, 20142021 (Million Units)

Table 106 Europe: Market Size, By Application, 20142021 (USD Million)

Table 107 Europe: Market Size, By Application, 20142021 (Million Units)

Table 108 Germany: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 109 Germany: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 110 Germany: Market Size, By Product, 20142021 (USD Million)

Table 111 Germany: Market Size, By Product, 20142021 (Million Units)

Table 112 Germany: Market Size, By End Use, 20142021 (USD Million)

Table 113 Germany: Market Size, By End Use, 20142021 (Million Units)

Table 114 Germany: Market Size, By Application, 20142021 (USD Million)

Table 115 Germany: Market Size, By Application, 20142021 (Million Units)

Table 116 France: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 117 France: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 118 France: Market Size, By Product, 20142021 (USD Million)

Table 119 France: Market Size, By Product, 20142021 (Million Units)

Table 120 France: Market Size, By End Use, 20142021 (USD Million)

Table 121 France: Market Size, By End Use, 20142021 (Million Units)

Table 122 France: Market Size, By Application, 20142021 (USD Million)

Table 123 France: Market Size, By Application, 20142021 (Million Units)

Table 124 U.K.: Plumbing Fixtures & Fittings Market Construction Industry in Quarter 2 of 2015

Table 125 U.K.: Plumbing Fixtures Market Size, By Material, 20142021 (USD Million)

Table 126 U.K.: Market Size, By Material, 20142021 (Million Units)

Table 127 U.K.: Market Size, By Product, 20142021 (USD Million)

Table 128 U.K.: Market Size, By Product, 20142021 (Million Units)

Table 129 U.K.: Market Size, By End Use, 20142021 (USD Million)

Table 130 U.K.: Market Size, By End Use, 20142021 (Million Units)

Table 131 U.K.: Market Size, By Application, 20142021 (USD Million)

Table 132 U.K.: Market Size, By Application, 20142021 (Million Units)

Table 133 Russia: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 134 Russia: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 135 Russia: Market Size, By Product, 20142021 (USD Million)

Table 136 Russia: Market Size, By Product, 20142021 (Million Units)

Table 137 Russia: Market Size, By End Use, 20142021 (USD Million)

Table 138 Russia: Market Size, By End Use, 20142021 (Million Units)

Table 139 Russia: Market Size, By Application, 20142021 (USD Million)

Table 140 Russia: Market Size, By Application, 20142021 (Million Units)

Table 141 Rest of Europe: Plumbing Fixtures & Fittings Market Size, By Material, 20142021 (USD Million)

Table 142 Rest of Europe: Plumbing Fixtures Market Size, By Material, 20142021 (Million Units)

Table 143 Rest of Europe: Market Size, By Product, 20142021 (USD Million)

Table 144 Rest of Europe: Market Size, By Product, 20142021 (Million Units)

Table 145 Rest of Europe: Market Size, By End Use, 20142021 (USD Million)

Table 146 Rest of Europe: Market Size, By End Use, 20142021 (Million Units)

Table 147 Rest of Europe: Market Size, By Application, 20142021 (USD Million)

Table 148 Rest of Europe: Market Size, By Application, 20142021 (Million Units)

Table 149 RoW: Plumbing Fixtures & Fittings Market Size, By Country, 2014-2021 (USD Million)

Table 150 RoW: Plumbing Fixtures Market Size, By Country, 2014-2021 (Million Units)

Table 151 RoW: Market Size, By Material, 2014-2021 (USD Million)

Table 152 RoW: Market Size, By Material, 2014-2021 (Million Units)

Table 153 RoW: Market Size, By Product, 2014-2021 (USD Million)

Table 154 RoW: Market Size, By Product, 2014-2021 (Million Units)

Table 155 RoW: Market Size, By End Use, 2014-2021 (USD Million)

Table 156 RoW: Market Size, By End Use, 2014-2021 (Million Units)

Table 157 RoW: Market Size, By Application, 2014-2021 (USD Million)

Table 158 RoW: Market Size, By Application, 2014-2021 (Million Units)

Table 159 Brazil: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 160 Brazil: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 161 Brazil: Market Size, By Product, 2014-2021 (USD Million)

Table 162 Brazil: Market Size, By Product, 2014-2021 (Million Units)

Table 163 Brazil: Market Size, By End Use, 2014-2021 (USD Million)

Table 164 Brazil: Market Size, By End Use, 2014-2021 (Million Units)

Table 165 Brazil: Market Size, By Application, 2014-2021 (USD Million)

Table 166 Brazil: Market Size, By Application, 2014-2021 (Million Units)

Table 167 South Africa: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 168 South Africa: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 169 South Africa: By tings Market Size, By Product, 2014-2021 (USD Million)

Table 170 South Africa: Market Size, By Product, 2014-2021 (Million Units)

Table 171 South Africa: Market Size, By End Use, 2014-2021 (USD Million)

Table 172 South Africa: Market Size, By End Use, 2014-2021 (Million Units)

Table 173 South Africa: Market Size, By Application, 2014-2021 (USD Million)

Table 174 South Africa: Market Size, By Application, 2014-2021 (Million Units)

Table 175 Argentina: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 176 Argentina: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 177 Argentina: Market Size, By Product, 2014-2021 (USD Million)

Table 178 Argentina: Market Size, By Product, 2014-2021 (Million Units)

Table 179 Argentina: Market Size, By End Use, 2014-2021 (USD Million)

Table 180 Argentina: Market Size, By End Use, 2014-2021 (Million Units)

Table 181 Argentina: Market Size, By Application, 2014-2021 (USD Million)

Table 182 Argentina: Market Size, By Application, 2014-2021 (Million Units)

Table 183 Others in RoW: Plumbing Fixtures & Fittings Market Size, By Material, 2014-2021 (USD Million)

Table 184 Others in RoW: Plumbing Fixtures Market Size, By Material, 2014-2021 (Million Units)

Table 185 Others in RoW: Market Size, By Product, 2014-2021 (USD Million)

Table 186 Others in RoW: Market Size, By Product, 2014-2021 (Million Units)

Table 187 Others in RoW: Market Size, By End Use, 2014-2021 (USD Million)

Table 188 Others in RoW: Market Size, By End Use, 2014-2021 (Million Units)

Table 189 Others in RoW: Market Size, By Application, 2014-2021 (USD Million)

Table 190 Others in RoW: Market Size, By Application, 2014-2021 (Million Units)

Table 191 New Product Development, 20092016

Table 192 Acquisitions, 20092016

Table 193 Expansion, 20092016

Table 194 Partnership, 20092016

List of Figures (49 Figures)

Figure 1 Plumbing Fixtures & Fittings Market: Research Design

Figure 2 Breakdown of Primaries

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Bathtub & Shower Fixtures Market is Projected to Grow at the Highest CAGR

Figure 7 Residential : the Largest End Use for the Plumbing Fixtures Market

Figure 8 Vitreous China Segment Accounted for the Largest Market Share as A Raw Material for the Plumbing Fixtures & Fittings Market in 2015

Figure 9 Asia-Pacific Was the Key Contributor to the Global Plumbing Fixtures Market in 2015

Figure 10 Emerging Economies Offer Attractive Opportunities in the Plumbing Fixtures & Fittings Market

Figure 11 Residential Buildings Accounted for the Largest Market Share, By End Use, in 2015

Figure 12 China is Projected to Be the Fastest-Growing Country-Level Market for Plumbing Fixtures & Fittings

Figure 13 Vitreous China, By Material, Accounted for the Largest Share in the Plumbing Fixtures & Fittings Packaging Market in 2015

Figure 14 Evolution of the Plumbing Fixtures & Fittings Market

Figure 15 Plumbing Fixtures Market Segmentation

Figure 16 Product Innovations: Major Opportunity for the Growth of the Plumbing Fixtures & Fittings Market

Figure 17 India Dominated the Construction Output in 2015 (USD Billion)

Figure 18 Copper Prices, 20132016

Figure 19 Stainless Steel Prices, 20152016

Figure 20 Vitreous China Segment is Projected to Dominate the Material Market for Plumbing Fixtures & Fittings in 2021

Figure 21 Bathtub & Shower Fixtures Segment is Projected to Dominate the Market Through 2021

Figure 22 Renovated Buildings Segment Projected to Dominate the Market Through 2021

Figure 23 Residential Buildings Segment Projected to Dominate the Market Through 2021

Figure 24 Geographical Snapshot: Plumbing Fixtures Market Growth Rate, 2016-2021

Figure 25 Asia-Pacific Region Accounted for the Largest Market in 2015

Figure 26 Increasing Urbanization has Led to A Growing Market for Bathroom Fixtures & Fittings

Figure 27 Real Estate Sector is A Key Target Segment for the Bathroom Fixtures & Fittings Industry

Figure 28 Residential and Non-Residential Construction in Australia, 2004-2009

Figure 29 U.S. Projected to Be the Fastest-Growing Plumbing Fixtures & Fittings Market in North America

Figure 30 Germany Projected to Be the Fastest-Growing Plumbing Fixtures Market in Europe

Figure 31 Completion of Buildings, 20052011

Figure 32 Completion of Residential & Non-Residential Buildings, 20052011

Figure 33 Brazil Projected to Be the Fastest-Growing Plumbing Fixtures & Fittings Market in RoW

Figure 34 New Product Development is the Major Strategy Adopted By Companies During 20092016

Figure 35 2016 Observed to Be the Most Active Year in Terms of Developments for the Plumbing Fixtures Market

Figure 36 New Product Development: the Key Strategy, 20092016

Figure 37 Geographic Revenue Mix of the Top Five Market Players

Figure 38 Fortune Brands Home & Security, Inc.: Company Snapshot

Figure 39 Fortune Brands Home & Security, Inc.: SWOT Analysis

Figure 40 Fortune Brands Home & Security, Inc.: Capital Deployed

Figure 41 Geberit AG: Company Snapshot

Figure 42 Geberit AG: SWOT Analysis

Figure 43 Net Sales in 2015 By Country/ Region

Figure 44 Masco Corporation: Company Snapshot

Figure 45 Masco Corporation: SWOT Analysis

Figure 46 Lixil Group Corporation: Company Snapshot

Figure 47 Lixil Group Corporation: SWOT Analysis

Figure 48 Toto Ltd.: Company Snapshot

Figure 49 Roca Sanitario, S.A.: Company Snapshot

Growth opportunities and latent adjacency in Plumbing Fixtures Market