Plastic Adhesives Market by Resin Type (Epoxy, PU, Acrylic, Silicone, MMA, Cyanoacrylate), By Substrate (PE, PP, PVC), By Application (Packaging, Building & Construction, Automotive & Transportation, Assembly, Medical), and Region - Global Forecast to 2025

Updated on : April 17, 2024

Plastic Adhesives Market

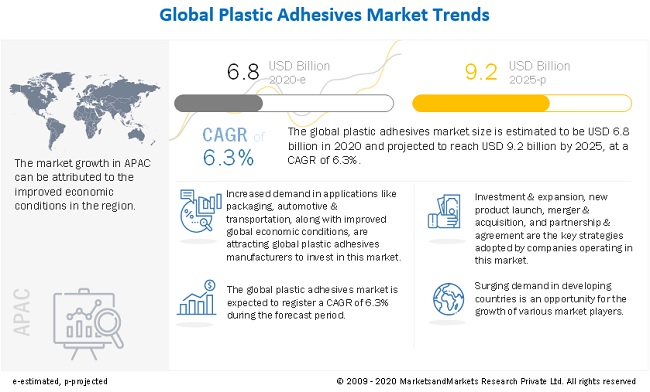

The global plastic adhesives market was valued at USD 6.8 billion in 2020 and is projected to reach USD 9.2 billion by 2025, growing at a cagr 6.3% from 2020 to 2025. APAC is the largest consumer of plastic adhesives. Increasing demand in the medical industry, growth in the appliance industry, and growing demand from packaging and e-commerce industries are the factors driving the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Plastic Adhesives Market

COVID-19 has posed many challenges for the automotive sector. The US, Germany, the UK, Italy, South Korea, Spain, and Japan are among the adversely affected major industrialized economies. More than 90% of automotive and related companies report that COVID-19 will have a direct impact on their 2020 sales revenues. The outbreak of COVID-19 and resulting economic uncertainty may reduce consumer demand in the short term. This would possibly hamper new vehicle sales and delay spending on non-essential maintenance. In the long run, these factors could influence consumer preferences.

COVID-19 has posed many challenges in the construction sector. Major economies across the world, such as the US, Germany, the UK, Italy, South Korea, Spain, and Japan, are among the severely affected countries by the pandemic. Social distancing measures, supply chain disruptions, and workforce dislocation have led to the suspension of construction activities in most countries due to the disruptions in supply chains and shortage of raw materials and labor. Construction companies with high debts and lower cash reserves faced a liquidity crisis. However, the construction of temporary hospitals and quarantine centers increased with this outbreak of coronavirus.

Plastic Adhesives Market Dynamics

Driver: Increased demand in the medical industry

The demand for plastic adhesives has increased in the medical industry in the last few years. Recently, with the outbreak of COVID-19, the governments, the private sector, and people throughout the world have been affected hugely due to the pandemic. Hence, the healthcare and medical devices sector has become the centerpiece for the recovery of the patients. Medical devices like ventilators, pulse oximeter, oxygen concentrator/generator, syringe pumps, and many other devices are being used in large numbers due to increased number of positive cases. This has increased the use of plastic adhesives.

Restraint: Decline in the automotive industry

Because of the ongoing COVID-19 pandemic, there has been a huge impact on the automotive industry worldwide. The automotive supply chains are disrupted, bringing under scrutiny the extended global supply strategies. The sudden closure of production centers in China caused widespread chaos between global auto manufacturers, especially in Europe, the US, India, and South America. Having offshored their manufacturing activities to low-cost countries, many automotive manufacturers and suppliers are now scrambling to establish shorter or localized regional supply chains. Car manufacturers across the world saw initial signs of improvement in the second quarter, but the automotive industry remains concerned as COVID-19 cases have continued to flare up. Many countries could implement another lockdown, which would again delay economic recovery and reduce consumer confidence. Buying cars will be the last thing on the minds of consumers affected by the downturn caused by the pandemic

Opportunity: Increasing opportunities in APAC and Middle East

The construction industry in the APAC region has taken hits as a result of the COVID-19 pandemic. However, there is potential for growth, depending on the commitment to improve infrastructure, tourism, and general economic health. China, which was the epicenter of the COVID-19 pandemic, has shown signs of recovery in recent months, supported by investment in infrastructure. According to the National Development and Reform Commission (NDRC), China has resumed construction on just under 90% of key projects. The countries in the Middle East region have been promoting the development of the non-oil sector, which is projected to increase construction activities in the region. The increase in construction activities in the region will create opportunities for the plastic adhesives market. In recent years, the GCC government have been making remarkable investments in the tourism and hospitality sectors, as well as leisure attractions. Saudi Arabia, which has been active in pursuing both social and economic reform, has launched a variety of megaprojects, including the Red Sea Project, Qiddiya Entertainment City, Project Neom, and Diriyah Gate, which have a combined value of USD 532 billion. These projects will increase the demand for plastic adhesives.

Challenge: Environmental challenges and stringent government regulations

The chemical industry is also regulated by regulatory authorities such as the Control of Substances Hazardous to Health (COSHH), the European Union (EU), Registration, Evaluation, Authorization and Restriction of Chemicals (REACH), Globally Harmonized System (GHS), and the Environmental Protection Agency (EPA) in Europe and North America. Manufacturers in Europe and North America need to comply with regulations regarding the production and usage of plastic adhesives in various applications to reduce VOC emissions. Manufacturers have to bear additional burden in terms of labeling, paperwork, and extra cost for external testing, to demonstrate compliance. Plastic adhesives manufacturers have to abide by the rules and changing standards for commercializing their products. This poses a challenge for manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

Packaging segment accounted for the largest share of the plastic adhesives market in 2020.

The use of plastic adhesives in flexible packaging offer advantages in terms of reduction in energy and material use and packaging costs. A range of plastic such as PP and PET are used in food & beverage packaging. These plastics provide sustainable and innovative solutions, along with longer shelf life and barrier to aroma, vapor, and moisture. PP is used for microwavable packaging, while PET is used in meat and cheese packaging. The demand for plastic adhesives is high due to the rising demand for packaged food products. The demand for longer shelf life of food products such as meat, milk, and cheese is driving the consumption of plastic adhesives in the food & beverage application. There is rising awareness among consumers about the nutritional value of food, which has led to the increased use of plastic adhesives in the packaging of food & beverage.

PE segment is projected to witness the fastest growth during the forecast period.

PE (Polyethylene) substrate is the largest segment in the overall plastic adhesives market. PE is one of the widely used plastics in the world. It is a lightweight, durable thermoplastic with variable crystalline structure. It is used in applications, such as films, plastic parts, tubes, laminates, and so on, in packaging, automotive, electrical, and other industries. PE is made by the addition or radical polymerization of ethylene monomers. Ziegler-Natta and Metallocene catalysts are used to carry out the polymerization of polyethylene.

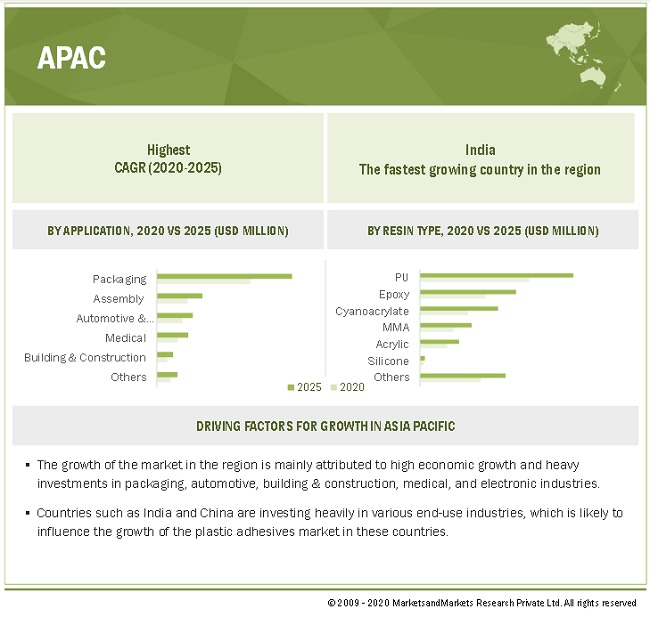

APAC is the largest plastic adhesives market in the forecast period

APAC is currently the fastest-growing and the largest market for plastic adhesives. With economic contraction and saturation in European and North American markets, the demand is shifting to the APAC region. The growth of the market in the region is mainly attributed to high economic growth and heavy investments in packaging, automotive, building & construction, medical, and electronic industries. APAC is increasingly becoming an important global trade and commerce center. Various companies such as Henkel AG (Germany) and other international players are setting up new plants or expanding their existing plastic adhesives production units in this region because of the low cost of production and the ability to serve the local emerging market. Countries such as India and China are investing heavily in various end-use industries, which is likely to influence the growth of the plastic adhesives market in these countries.

The spread of the coronavirus started in China in early January 2020. Within a small period, the spread in other Asian countries such as Japan, South Korea, and Thailand resulted in the pandemic situation, with rapid positive cases and death. This situation led national governments across APAC to announce lockdowns, leading to a decrease in traffic, construction & mining activities, manufacturing industries, and so on. Since China is a global manufacturing hub, the impact of COVID-19 is anticipated to be much higher in the country. Considering the above factors, the plastic adhesives market is expected to decline in APAC in 2020.

Plastic Adhesives Market Players

The key players operating in the market are Henkel AG (Germany), H.B. Fuller (US), Arkema (Bostik SA) (France), 3M Company (US), Sika AG (Switzerland).

Plastic Adhesives Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2016-2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

Resin Type, Substrate, Application, and Region |

|

Regions covered |

APAC, Europe, North America, South America, Middle East & Africa |

|

Companies profiled |

The major market players include Henkel AG (Germany), H.B. Fuller (US), Arkema (Bostik SA) (France), 3M Company (US), Sika AG (Switzerland). (Total of 25 companies) |

This research report categorizes the plastic adhesives market based on resin type, substrate, application, and region.

By Resin Type:

- Epoxy

- Polyurethane

- Acrylic

- Silicone

- MMA

- Cyanoacrylate

- Others

By Substrate:

- PE

- PP

- PVC

- Others

By Application:

- Packaging

- Building & Costruction

- Automotive & Transportation

- Assembly

- Medical

- Others

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In July 2019, Henkel Corporation announced that it would expand its operations in Salisbury. The company will invest up to USD 45 million in new equipment and a series of improvements at its Salisbury facility, including a new state-of-the-art production area for UV acrylic adhesives used in tapes and labels in the packaging and consumer goods industry.

- In July 2018, 3M added Scotch-Weld multi-material composite urethane adhesives DP6310NS and DP6330NS to its portfolio of structural adhesives. These products are designed for lightweight assemblies in trucks, buses, RVs, specialty vehicles, passenger rail, sporting goods, and panels.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 18)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

2.5 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 29)

4 PREMIUM INSIGHTS (Page No. - 34)

4.1 ATTRACTIVE OPPORTUNITIES IN THE PLASTIC ADHESIVES MARKET

4.2 PLASTIC ADHESIVES MARKET GROWTH, BY RESIN TYPE

4.3 PLASTIC ADHESIVES MARKET IN APAC, BY APPLICATION AND COUNTRY

4.4 PLASTIC ADHESIVES MARKET, DEVELOPED VS. DEVELOPING COUNTRIES

4.5 PLASTIC ADHESIVES MARKET: MAJOR COUNTRIES

5 MARKET OVERVIEW (Page No. - 37)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased demand in the medical industry

5.2.1.2 Growth in the appliance industry

5.2.1.3 Growing demand from packaging and e-commerce industries

5.2.2 RESTRAINTS

5.2.2.1 Decline in the automotive industry

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing opportunities in APAC and Middle East

5.2.4 CHALLENGES

5.2.4.1 Environmental challenges and stringent government regulations

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC OVERVIEW AND KEY TRENDS

5.4.1 TRENDS AND FORECAST OF GDP

5.4.2 TRENDS IN AUTOMOTIVE INDUSTRY

5.4.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

5.5 PATENT ANALYSIS

5.6 COVID-19 IMPACT ANALYSIS

5.6.1 COVID-19 ECONOMIC ASSESSMENT

5.6.2 MAJOR ECONOMIC EFFECTS OF COVID-19

5.6.3 EFFECTS ON GDP OF COUNTRIES

5.6.4 SCENARIO ASSESSMENT

5.6.4.1 Scenarios based analysis of impact of COVID-19

5.6.5 IMPACT ON CONSTRUCTION INDUSTRY

5.6.6 IMPACT ON AUTOMOTIVE INDUSTRY

5.6.7 VALUE CHAIN ANALYSIS

5.6.8 COVID-19 IMPACT ON VALUE CHAIN

5.6.8.1 Action plan against current vulnerability

5.6.9 PRICING ANALYSIS

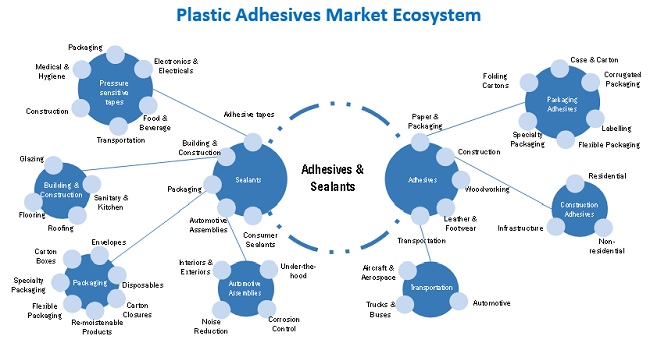

5.7 ADHESIVES & SEALANTS ECOSYSTEM

5.7.1 EFFECTS OF FUTURE TRENDS AND TECHNOLOGY DISRUPTION ON ADHESIVES MANUFACTURERS

5.7.2 AUTOMOTIVE & TRANSPORTATION

5.7.2.1 Electric vehicles

5.7.2.2 Shared mobility

5.7.2.3 Innovation in batteries to power electric vehicles

5.7.2.4 Revolutionary transformation in autonomous driving

5.7.3 AEROSPACE

5.7.3.1 Ultralight and light aircraft

5.7.3.2 Continued technological advancement

5.7.3.3 Unmanned aircraft systems (UAS) or drones

5.7.4 HEALTHCARE

5.7.4.1 Wearable medical devices

5.7.4.2 Microfluidics-based POC and LOC diagnostic devices for laboratory testing

5.7.5 ELECTRONICS

5.7.5.1 Digitalization

5.7.5.2 Artificial intelligence

5.7.5.3 Augmented reality

5.8 TECHNOLOGY ANALYSIS

6 PLASTIC ADHESIVES MARKET, BY RESIN TYPE (Page No. - 60)

6.1 INTRODUCTION

6.2 EPOXY

6.2.1 EPOXY ADHESIVES OFFER EXCELLENT RESISTANCE TO OIL, MOISTURE, AND SOLVENTS

6.3 POLYURETHANE

6.3.1 POLYURETHANE PLASTIC ADHESIVES ACCOUNT FOR LARGEST SHARE OF OVERALL MARKET

6.4 ACRYLIC

6.4.1 ACRYLICS PROVIDE SUPERIOR GAP FILLING, GOOD ENVIRONMENTAL RESISTANCE, AND CLEAR BOND LINES

6.5 SILICONE

6.5.1 SILICONE ADHESIVES ARE MAINLY USED IN AUTOMOTIVE AND MEDICAL INDUSTRIES

6.6 CYANOACRYLATE

6.6.1 CYANOACRYLATE SEGMENT TO WITNESS HIGHEST GROWTH DURING THE FORECAST PERIOD

6.7 METHYL METHACRYLATE (MMA)

6.7.1 MMA OFFERS HIGH STRENGTH PERFORMANCE AND RAPID CURE SPEED

6.8 OTHERS

7 PLASTIC ADHESIVES MARKET, BY SUBSTRATE (Page No. - 70)

7.1 INTRODUCTION

7.2 PE

7.2.1 PE ACCOUNTS FOR LARGEST SHARE OF OVERALL PLASTIC ADHESIVES MARKET

7.3 PP

7.3.1 PP PROVIDES GOOD CHEMICAL RESISTANCE AND WELDABILITY

7.4 PVC

7.4.1 PVC REPLACING VARIOUS TRADITIONAL MATERIALS IN BUILDING APPLICATIONS

7.5 OTHERS

8 PLASTIC ADHESIVES MARKET, BY APPLICATION (Page No. - 78)

8.1 INTRODUCTION

8.2 PACKAGING

8.2.1 PACKAGING IS LARGEST CONSUMER OF PLASTIC ADHESIVES

8.3 BUILDING & CONSTRUCTION

8.3.1 GROWING INFRASTRUCTURE AND NEW HOUSING CONSTRUCTION WILL DRIVE THE MARKET FOR PLASTIC ADHESIVES

8.4 ASSEMBLY

8.4.1 GROWTH IN CONSUMER APPLIANCES TO BOOST THE PLASTIC ADHESIVES MARKET

8.5 AUTOMOTIVE & TRANSPORTATION

8.5.1 AUTOMOTIVE & TRANSPORTATION IS A MAJOR CONSUMER OF PLASTIC ADHESIVES

8.6 MEDICAL

8.6.1 MEDICAL IS FASTEST-GROWING MARKET FOR PLASTIC ADHESIVES

8.7 OTHERS

9 PLASTIC ADHESIVES MARKET, BY REGION (Page No. - 89)

9.1 INTRODUCTION

9.2 EUROPE

9.2.1 COVID-19 IMPACT ON EUROPE

9.2.2 GERMANY

9.2.2.1 Growing trend of small personal care and food packaging will drive the market

9.2.3 FRANCE

9.2.3.1 Investment plans in automotive industry will increase demand for plastic adhesives

9.2.4 ITALY

9.2.4.1 Improvement and reestablishment of construction industry to boost plastic adhesives market

9.2.5 UK

9.2.5.1 Innovative and energy-efficient technology in household appliances to increase demand

9.2.6 RUSSIA

9.2.6.1 Packaging is largest application in the country

9.2.7 REST OF EUROPE

9.3 APAC

9.3.1 IMPACT OF COVID-19 ON APAC

9.3.2 CHINA

9.3.2.1 China is largest plastic adhesives market in APAC

9.3.3 JAPAN

9.3.3.1 Increasing demand from construction industry for plastic adhesives

9.3.4 INDIA

9.3.4.1 India to register highest CAGR in plastic adhesives market

9.3.5 SOUTH KOREA

9.3.5.1 Growth in automotive industry to fuel demand for plastic adhesives in South Korea

9.3.6 REST OF APAC

9.4 NORTH AMERICA

9.4.1 US

9.4.1.1 US dominates North American plastic adhesives market

9.4.2 CANADA

9.4.2.1 Packaging is major consumer of plastic adhesives in Canada

9.4.3 MEXICO

9.4.3.1 Rising population and changing lifestyles driving Mexican packaging industry

9.5 MIDDLE EAST & AFRICA

9.5.1 COVID-19 IMPACT ON MIDDLE EAST

9.5.2 SAUDI ARABIA

9.5.2.1 Growing healthcare and food sectors expected to propel demand for plastic adhesives

9.5.3 AFRICA

9.5.3.1 Growing industrialization and urbanization is primary driver of plastic adhesives market

9.5.4 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 IMPACT OF COVID-19 ON SOUTH AMERICA

9.6.2 BRAZIL

9.6.2.1 Brazil accounts for largest share of South American plastic adhesives market

9.6.3 ARGENTINA

9.6.3.1 Strategic Industrial Plan 2020 supporting the market for plastic adhesives

9.6.4 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 143)

10.1 OVERVIEW

10.2 COMPETITIVE LEADERSHIP MAPPING, 2019

10.2.1 STARS

10.2.2 EMERGING LEADERS

10.2.3 PERVASIVE

10.2.4 EMERGING COMPANIES

10.3 STRENGTH OF PRODUCT PORTFOLIO

10.4 BUSINESS STRATEGY EXCELLENCE

10.5 MARKET RANKING ANALYSIS

10.6 MARKET SHARE ANALYSIS

10.7 INVESTMENT & EXPANSION

10.8 NEW PRODUCT LAUNCH

10.9 MERGER & ACQUISITION

10.10 PARTNERSHIP & AGREEMENT

11 COMPANY PROFILES (Page No. - 160)

11.1 HENKEL AG

11.1.1 BUSINESS OVERVIEW

11.1.2 PRODUCTS OFFERED

11.1.3 RECENT DEVELOPMENTS

11.1.4 SWOT ANALYSIS

11.1.5 HENKEL AG’S RIGHT TO WIN

11.2 H.B. FULLER

11.2.1 BUSINESS OVERVIEW

11.2.2 PRODUCTS OFFERED

11.2.3 RECENT DEVELOPMENTS

11.2.4 SWOT ANALYSIS

11.2.5 H.B. FULLER’S RIGHT TO WIN

11.3 ARKEMA (BOSTIK SA)

11.3.1 BUSINESS OVERVIEW

11.3.2 PRODUCTS OFFERED

11.3.3 RECENT DEVELOPMENTS

11.3.4 SWOT ANALYSIS

11.3.5 ARKEMA’S RIGHT TO WIN

11.4 SIKA AG

11.4.1 BUSINESS OVERVIEW

11.4.2 PRODUCTS OFFERED

11.4.3 RECENT DEVELOPMENTS

11.4.4 SWOT ANALYSIS

11.4.5 SIKA AG’S RIGHT TO WIN

11.5 3M COMPANY

11.5.1 BUSINESS OVERVIEW

11.5.2 PRODUCTS OFFERED

11.5.3 RECENT DEVELOPMENTS

11.5.4 SWOT ANALYSIS

11.5.5 3M COMPANY’S RIGHT TO WIN

11.6 DOW INC.

11.6.1 BUSINESS OVERVIEW

11.6.2 PRODUCTS OFFERED

11.6.3 RECENT DEVELOPMENTS

11.7 ILLINOIS TOOL WORKS INC.

11.7.1 BUSINESS OVERVIEW

11.7.2 PRODUCTS OFFERED

11.8 PARKER HANNIFIN CORP (PARKER LORD)

11.8.1 BUSINESS OVERVIEW

11.8.2 PRODUCTS OFFERED

11.8.3 RECENT DEVELOPMENTS

11.9 MASTER BOND INC.

11.9.1 BUSINESS OVERVIEW

11.9.2 PRODUCT OFFERED

11.10 HUNTSMAN INTERNATIONAL LLC.

11.10.1 BUSINESS OVERVIEW

11.10.2 PRODUCTS OFFERED

11.10.3 RECENT DEVELOPMENTS

11.11 OTHER KEY COMPANIES

11.11.1 ASHLAND INC.

11.11.2 MAPEI S.P.A.

11.11.3 PANACOL-ELOSOL GMBH

11.11.4 IPS CORPORATION (SCIGRIP ADHESIVES)

11.11.5 PERMABOND LLC.

11.11.6 DYMAX CORPORATION

11.11.7 HUBEI HUITIAN NEW MATERIALS STOCK CO., LTD.

11.11.8 ASTRAL ADHESIVES

11.11.9 PIDILITE INDUSTRIES LTD.

11.11.10 THREEBOND HOLDINGS CO., LTD.

11.11.11 WEICON GMBH & CO. KG

11.11.12 HERNON MANUFACTURING INC.

11.11.13 BEIJING COMENS NEW MATERIALS CO., LTD.

11.11.14 DELO INDUSTRIE KLEBSTOFFE GMBH & CO. KGAA

11.11.15 JOWAT SE

12 APPENDIX (Page No. - 224)

12.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

LIST OF TABLES (145 TABLES)

TABLE 1 PLASTIC ADHESIVES MARKET SNAPSHOT, 2020 VS. 2025

TABLE 2 TRENDS AND FORECAST OF GDP, PERCENTAGE CHANGE

TABLE 3 AUTOMOTIVE PRODUCTION, BY REGION, 2016–2017

TABLE 4 PLASTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2018-2025 (USD MILLION)

TABLE 5 PLASTIC ADHESIVES MARKET SIZE, BY RESIN TYPE, 2018-2025 (KILOTON)

TABLE 6 EPOXY PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 7 EPOXY PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 8 POLYURETHANE PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 9 POLYURETHANE PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 10 ACRYLIC PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 11 ACRYLIC PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 12 SILICONE PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 13 SILICONE PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 14 CYANOACRYLATE PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 15 CYANOACRYLATE PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 16 MMA PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 17 MMA PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 18 OTHER PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 19 OTHER PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 20 APPLICATION OF PLASTICS

TABLE 21 PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 22 PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 23 PE: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 24 PE: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 25 PP: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 26 PP PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 27 PVC: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 28 PVC: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 29 OTHERS: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 30 OTHERS: PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 31 USAGE OF PLASTICS

TABLE 32 PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 33 PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 34 PLASTIC ADHESIVES MARKET SIZE IN PACKAGING, BY REGION, 2018-2025 (USD MILLION)

TABLE 35 PLASTIC ADHESIVES MARKET SIZE IN PACKAGING, BY REGION, 2018-2025 (KILOTON)

TABLE 36 PLASTIC ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018-2025 (USD MILLION)

TABLE 37 PLASTIC ADHESIVES MARKET SIZE IN BUILDING & CONSTRUCTION, BY REGION, 2018-2025 (KILOTON)

TABLE 38 PLASTIC ADHESIVES MARKET SIZE IN ASSEMBLY, BY REGION, 2018-2025 (USD MILLION)

TABLE 39 PLASTIC ADHESIVES MARKET SIZE IN ASSEMBLY, BY REGION, 2018-2025 (KILOTON)

TABLE 40 USE OF PLASTICS IN AUTOMOTIVE

TABLE 41 PLASTIC ADHESIVES MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018-2025 (USD MILLION)

TABLE 42 PLASTIC ADHESIVES MARKET SIZE IN AUTOMOTIVE & TRANSPORTATION, BY REGION, 2018-2025 (KILOTON)

TABLE 43 PLASTIC ADHESIVES MARKET SIZE IN MEDICAL, BY REGION, 2018-2025 (USD MILLION)

TABLE 44 PLASTIC ADHESIVES MARKET SIZE IN MEDICAL, BY REGION, 2018-2025 (KILOTON)

TABLE 45 PLASTIC ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (USD MILLION)

TABLE 46 PLASTIC ADHESIVES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018-2025 (KILOTON)

TABLE 47 PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (USD MILLION)

TABLE 48 PLASTIC ADHESIVES MARKET SIZE, BY REGION, 2018-2025 (KILOTON)

TABLE 49 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 50 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 51 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (USD MILLION)

TABLE 52 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (KILOTON)

TABLE 53 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 54 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 55 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 56 EUROPE: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 57 GERMANY: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 58 GERMANY: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 59 GERMANY: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 60 GERMANY: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 61 FRANCE: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 62 FRANCE: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 63 FRANCE: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 64 FRANCE: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 65 ITALY: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 66 ITALY: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 67 ITALY: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 68 ITALY: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 69 UK: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 70 UK: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 71 UK: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 72 UK: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 73 RUSSIA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 74 RUSSIA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 75 RUSSIA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 76 RUSSIA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 77 APAC: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 78 APAC: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 79 APAC: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (USD MILLION)

TABLE 80 APAC: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (KILOTON)

TABLE 81 APAC: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 82 APAC: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 83 APAC: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 84 APAC: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 85 CHINA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 86 CHINA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 87 CHINA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 88 CHINA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 89 JAPAN: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 90 JAPAN: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 91 JAPAN: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 92 JAPAN: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 93 INDIA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 94 INDIA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 95 INDIA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 96 INDIA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 97 SOUTH KOREA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 98 SOUTH KOREA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 99 SOUTH KOREA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 100 SOUTH KOREA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 101 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 102 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 103 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (USD MILLION)

TABLE 104 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (KILOTON)

TABLE 105 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 106 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 107 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 108 NORTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 109 US: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 110 US: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 111 US: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 112 US: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 113 CANADA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 114 CANADA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 115 CANADA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 116 CANADA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 117 MEXICO: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 118 MEXICO: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 119 MEXICO: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 120 MEXICO: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 121 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 122 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 123 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (USD MILLION)

TABLE 124 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (KILOTON)

TABLE 125 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 126 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 127 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 128 MIDDLE EAST & AFRICA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 129 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (USD MILLION)

TABLE 130 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY COUNTRY, 2018-2025 (KILOTON)

TABLE 131 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (USD MILLION)

TABLE 132 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY RESIN, 2018-2025 (KILOTON)

TABLE 133 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 134 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 135 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 136 SOUTH AMERICA: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 137 BRAZIL: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (USD MILLION)

TABLE 138 BRAZIL: PLASTIC ADHESIVES MARKET SIZE, BY APPLICATION, 2018-2025 (KILOTON)

TABLE 139 BRAZIL: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (USD MILLION)

TABLE 140 BRAZIL: PLASTIC ADHESIVES MARKET SIZE, BY SUBSTRATE, 2018-2025 (KILOTON)

TABLE 141 MARKET RANKING OF KEY PLAYERS, 2019

TABLE 142 INVESTMENT & EXPANSION, 2016–2020

TABLE 143 NEW PRODUCT LAUNCH, 2016–2020

TABLE 144 MERGER & ACQUISITION, 2016–2020

TABLE 145 PARTNERSHIP & AGREEMENT, 2016–2020

LIST OF FIGURES (55 FIGURES)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 REGIONS COVERED

FIGURE 3 PLASTIC ADHESIVES MARKET: RESEARCH DESIGN

FIGURE 4 PLASTIC ADHESIVES MARKET ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

FIGURE 7 PLASTIC ADHESIVES MARKET: DATA TRIANGULATION

FIGURE 8 APAC TO LEAD THE GLOBAL PLASTIC ADHESIVES MARKET

FIGURE 9 PACKAGING INDUSTRY TO DOMINATE OVERALL PLASTIC ADHESIVES MARKET

FIGURE 10 PE (POLYETHYLENE) SUBSTRATE TO REGISTER HIGHEST CAGR IN THE OVERALL MARKET

FIGURE 11 POLYURETHANE PLASTIC ADHESIVES ACCOUNT FOR LARGEST SHARE OF THE MARKET

FIGURE 12 APAC WAS LARGEST MARKET FOR PLASTIC ADHESIVES IN 2019

FIGURE 13 PLASTIC ADHESIVES MARKET TO WITNESS HIGH GROWTH BETWEEN 2020 AND 2025

FIGURE 14 POLYURETHANE TO BE DOMINATING SEGMENT IN OVERALL PLASTIC ADHESIVES MARKET

FIGURE 15 PACKAGING WAS LARGEST APPLICATION OF PLASTIC ADHESIVES

FIGURE 16 MARKET IN DEVELOPING COUNTRIES TO GROW FASTER THAN IN DEVELOPED COUNTRIES

FIGURE 17 INDIA EMERGING AS A LUCRATIVE MARKET FOR PLASTIC ADHESIVES

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE PLASTIC ADHESIVES MARKET

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS: PLASTIC ADHESIVES MARKET

FIGURE 20 GLOBAL SPENDING IN CONSTRUCTION INDUSTRY, 2017–2025

FIGURE 21 PATENTS PUBLISHED IN LAST 5 YEARS

FIGURE 22 PATENTS: JURISDICTION ANALYSIS

FIGURE 23 PATENTS: TOP APPLICANTS

FIGURE 24 GDP FORECASTS OF G20 COUNTRIES IN 2020

FIGURE 25 FACTORS IMPACTING ECONOMY OF SELECT G20 COUNTRIES IN 2020

FIGURE 26 SCENARIOS: IMPACT OF COVID-19

FIGURE 27 VALUE CHAIN ANALYSIS

FIGURE 28 AVERAGE PRICE COMPETITIVENESS IN PLASTIC ADHESIVES MARKET

FIGURE 29 ADHESIVES & SEALANTS ECOSYSTEM

FIGURE 30 ADHESIVE INDUSTRY: YC AND YCC SHIFT

FIGURE 31 POLYURETHANE TO LEAD PLASTIC ADHESIVES MARKET DURING FORECAST PERIOD

FIGURE 32 TYPES OF PLASTICS BONDED

FIGURE 33 POLYETHYLENE TO LEAD OVERALL PLASTIC ADHESIVES MARKET DURING FORECAST PERIOD

FIGURE 34 PACKAGING APPLICATION TO LEAD OVERALL PLASTIC ADHESIVES MARKET

FIGURE 35 INDIA PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 36 EUROPE: PLASTIC ADHESIVES MARKET SNAPSHOT

FIGURE 37 APAC: PLASTIC ADHESIVES MARKET SNAPSHOT

FIGURE 38 NORTH AMERICA: PLASTIC ADHESIVES MARKET SNAPSHOT

FIGURE 39 COMPANIES ADOPTED INVESTMENT & EXPANSION AS KEY GROWTH STRATEGY OVER THE LAST FIVE YEARS

FIGURE 40 PLASTIC ADHESIVES MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 41 MARKET SHARE OF BY KEY PLAYERS (2019)

FIGURE 42 HENKEL AG: COMPANY SNAPSHOT

FIGURE 43 HENKEL AG: SWOT ANALYSIS

FIGURE 44 H.B. FULLER: COMPANY SNAPSHOT

FIGURE 45 H.B. FULLER: SWOT ANALYSIS

FIGURE 46 ARKEMA (BOSTIK SA): COMPANY SNAPSHOT

FIGURE 47 ARKEMA (BOSTIK SA): SWOT ANALYSIS

FIGURE 48 SIKA AG: COMPANY SNAPSHOT

FIGURE 49 SIKA AG: SWOT ANALYSIS

FIGURE 50 3M COMPANY: COMPANY SNAPSHOT

FIGURE 51 3M COMPANY: SWOT ANALYSIS

FIGURE 52 DOW: COMPANY SNAPSHOT

FIGURE 53 ILLINOIS TOOL WORKS INC.: COMPANY SNAPSHOT

FIGURE 54 PARKER HANNIFIN CORPORATION (PARKER LORD): COMPANY SNAPSHOT

FIGURE 55 HUNTSMAN INTERNATIONAL LLC.: COMPANY SNAPSHOT

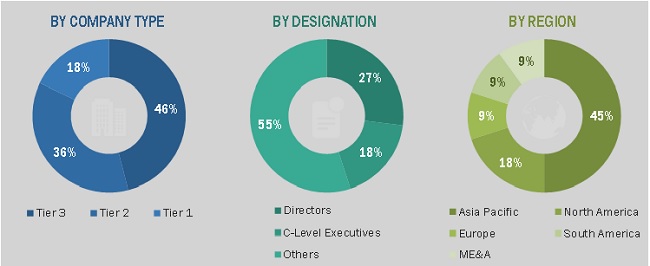

The study involves four major activities in estimating the current market size of plastic adhesives. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methods were used to estimate the size of the segments and sub-segments of the overall market.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, have been referred to for identifying and collecting information for this study. These secondary sources also included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The Plastic adhesives market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as packaging, building & construction, automotive & transportation, assembly, medical, and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the plastic adhesives market. These methods were also used extensively to estimate the sizes of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the plastic adhesives market in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on resin type, substrate, application, and region

- To forecast the market size with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), the Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze recent developments such as new product development, investment & expansion, merger & acquisition, and partnership & agreement in the plastic adhesives market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies1

Note: Core competencies1 of the companies are determined in terms of their key developments and key strategies to sustain in the market.

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the plastic adhesives market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Plastic Adhesives Market