Plant Phenotyping Market by Product (Equipment (Site, Platform/Carrier, Application, Analysis Systems, Automation Level), Sensors (Image Sensors, NDVI Sensors, Temperature Sensors), and Software), Service, and Region - Global Forecast to 2027

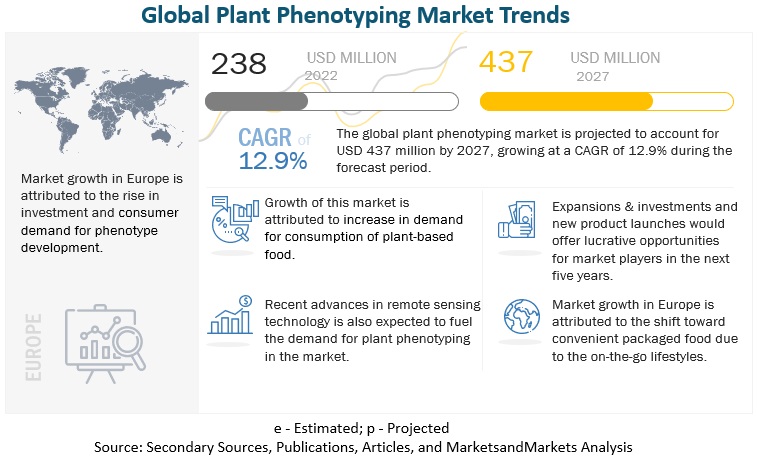

The global plant phenotyping market in terms of revenue was estimated to be worth $238 million in 2022 and is poised to reach $437 million by 2027, growing at a CAGR of 12.9% from 2022 to 2027.

The plant phenotyping market is a rapidly growing industry that is driven by the increasing demand for food security and crop improvement. Plant phenotyping technologies such as high-throughput phenotyping, imaging, and sensor-based systems are being used to improve crop yields and quality, as well as to develop new crop varieties that are more resistant to pests and diseases. This market is also driven by advances in technologies such as artificial intelligence, machine learning, and big data analytics, which are enabling the development of more sophisticated and efficient plant phenotyping systems. Plant phenotyping is the process of measuring and describing various physical and physiological characteristics of plants, such as their shape, size, color, and structural compounds. These characteristics make up the plant's phenome, which is the sum of all its phenotypic properties. The goal of plant phenotyping is to quantify these properties in a precise and objective manner.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19

The COVID-19 pandemic has had a historical impact on businesses across various industries in a short time, including the food and beverage supply chain. The biggest misconception about COVID-19 is that empty grocery shelves are an indicator that there is a shortage of food due to the recent runs on grocery stores, which have created these short-term disruptions as the supply chain works to catch up and replenish.

The pandemic will have both positive and negative impacts on the overall plant phenotyping market. The sales of plant-based foods have increased as consumers rush to stock their pantries. It is expected that the COVID-19 pandemic will increase the consumption of processed foods and other shelf-stable foods that have a longer shelf-life. Furthermore, with the shutdown of various foodservice outlets and restaurants across the globe due to nationwide lockdown, consumers are compelled to cook at home. Hence, consumers stockpile food products that can be easily cooked and opt for ready-to-eat foods with longer shelf life.

Plant Phenotyping Market Dynamics

Drivers: Growing importance of sustainable crop production using improved crop varieties

Plant-based products are facing challenges due to the increasing requirement for food, feed, and raw material. Therefore, it is necessary to integrate approaches across all scales—from the molecular level to field applications—to develop sustainable plant production with higher crop yield and using limited resources. Plant breeders use a wide range of plant defense and resistance mechanisms developed by plants over millions of years of co-evolution with harmful organisms.

The use of new high-yielding plant varieties that are able to adapt to changing climatic conditions and require less use of pesticides can help in mitigating the gap in the food supply. Improved crop varieties can be achieved through phenotype- and genome-based breeding. Plant phenotyping links genomics with plant physiology and agronomy.

Restraints: Low adoption in emerging economies due to limited funding and less presence of key players

Plant phenotyping networks such as APPN and China Plant Phenotyping Network are established in these countries to increase the visibility and impact of plant phenotyping and enable cooperation Though the EPPN is aiming to establish plant phenotyping networks in different countries outside Europe to increase research for the advancement of plant phenotyping systems, there is less adoption in emerging economies such as Japan, India, South Korea, and countries in Sub-Saharan Africa and the Middle East.

Additionally, the presence of key players offering plant phenotyping equipment and services is low in these countries. Hence, the awareness regarding the benefits of plant phenotyping is less among plant breeders. However, in 2021, conferences focusing on plant phenotyping were organized in countries such as China and Australia.

Opportunities: Attractive opportunities for field-based phenotyping using remote sensing tools

Field-based phenotyping is considered an important component of crop improvement. With the development of automatic and multifunctional platforms for high-throughput field-based phenotyping, such as unmanned ground vehicles (UGVs), cable-suspended vehicles (CSVs), and unmanned aerial vehicles (UAVs), the bottleneck of plant phenotyping would be relaxed to provide plant scientists with a new insight into all aspects of living plants.

Advancements in remote sensing techniques of field-based phenotypes would help in finding relevant solutions for major problems that limit crop production. In regions such as North America, Europe, and Asia Pacific (especially Australia), there would be high demand for remote-sensing tools for field-based phenotyping due to less availability of manpower

Challenges: High cost associated with plant phenotyping

The cost of plant phenotyping equipment depends on factors such as the degree of automation, throughput, size, and the number of sensors. Also, it depends on the plant phenotyping market for phenotyping instruments and the number of suppliers present in the market. A major concern for users regarding plant phenotyping systems has been the cost, which is relatively higher than genotyping.

Although many market players have entered this industry in the last few decades to offer various plant phenotyping equipment and services, constant R&D is required to sustain in the market and to ascertain plant phenotyping as an established method in plant breeding research.

Key Region Trends

To know about the assumptions considered for the study, download the pdf brochure

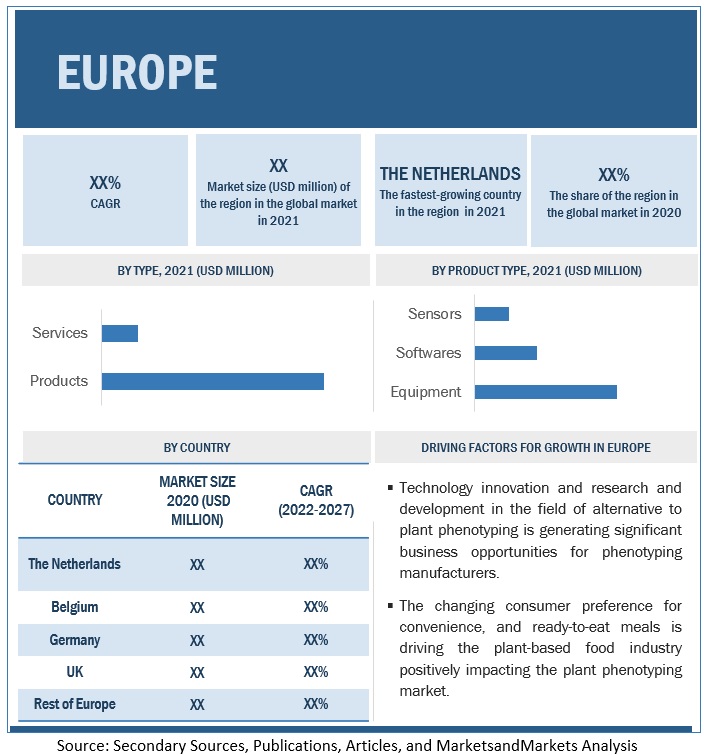

Europe dominated the plant phenotyping market, with a value of USD 81 million in 2021; it is projected to reach USD 162 million by 2027, at a CAGR of 12.6% during the forecast period.

Today Europe is the world’s leading producer of plant phenotyping, with European plant phenotyping being exported to all corners of the globe. Europe accounted for a plant phenotyping market share of 38.8.2% in the global market, in 2021. The Europe plant phenotyping industry has a range of products, ranging from native to modified services. The versatility of phenotyping products enables their application as functional ingredients in the food, non-food, and feed industries.

In terms of the end-use application industry, there is no stand-out trend. However, the food industry is projected to witness the fastest growth with the newer variations of plant phenotyping, new products, and a range of applications.

Key Market Players

The key players in plant phenotyping market include LemnaTec (Germany), Delta-T Devices (UK), Heinz Walz (Germany), Phenospex (Netherlands), KeyGene (Netherlands), Phenomix (France), Qubit Phenomics (Canada), Photon Systems Instruments (Czech Republic), and Rothamsted Research Limited (UK).

Scope of the Report

|

Report Metrics |

Details |

| Market size value in 2022 | USD 238 milloin |

| Market size value in 2027 | USD 437 milloin |

| Market growth rate | CAGR 12.9% |

| Market size estimation | 2022–2027 |

| Base year considered | 2021 |

| Forecast period considered | 2022–2027 |

| Units considered | Value (USD) |

| Segments covered | By Type and Region |

| Regions covered | North America, Asia Pacific, Europe, and Rest of the World |

| Companies studied |

|

This research report categorizes the plant phenotyping market, based on type and region

Target Audience:

- Plant phenotyping raw material suppliers

- Plant phenotyping manufacturers

- Intermediate suppliers, such as traders and distributors of plant phenotyping

- Government and research organizations

-

Associations, regulatory bodies, and other industry-related bodies:

- Starch Europe

- World Health Organization (WHO)

- Food Industry Association of Austria (FIAA)

- International Federation of Starch Associations (IFSA)

- NISAD Starch Industrialists Association

- United States Department of Agriculture (USDA)

- Association of Enterprises of Deep Processing of Grains

Report Scope:

Plant Phenotyping Market:

By Type

-

Product

- Equipment

- Software

- Sensor

- Services

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In March 2022, Royal Van Zanten and KeyGene started a partnership to accelerate the breeding of ornamental crops

- In March 2019, Chlorophyll fluorescence developer Heinz Walz GmbH (Germany), and phenotyping specialist, LemnaTec GmbH (Germany) facilitated physiological measurements in plant phenotyping. By integrating a Walz IMAGING PAM camera into the LemnaTec Phenocenter, chlorophyll fluorescence measurements would be enabled as part of an automated plant phenotyping procedure.

- In August 2019, Nynomic acquired the business operation of LemnaTec GmbH. The strategic acquisition would strengthen the technological competence of Nyomic in the field of plant phenotyping.

Frequently Asked Questions (FAQ):

Which region is projected to account for the largest share in the plant phenotyping market?

Europe dominated the plant phenotyping market, with a value of USD 81 million in 2021; it is projected to reach USD 162 million by 2027, at a CAGR of 12.6% during the forecast period. Major players present in the Europe plant phenotyping market are LemnaTec (Germany), Delta-T Devices (UK), Heinz Walz (Germany), Phenospex (Netherlands), KeyGene (Netherlands), Phenomix (France), Photon Systems Instruments (Czech Republic), and Rothamsted Research Limited (UK).

What is the current size of the global plant phenotyping market?

The global plant phenotyping market is estimated to be valued at USD 238 million in 2022. It is projected to reach USD 437 million by 2027, recording a CAGR of 12.9% during the forecast period.

Which are the key players in the market, and how intense is the competition?

Key players in this market include Qubit Phenomics (Canada), LemnaTec (Germany), Delta-T Devices (UK), Heinz Walz (Germany), Phenospex (Netherlands), KeyGene (Netherlands). Since plant phenotyping is a fast-growing market, the existing players are fixated upon improving their market shares, while startups are being established rapidly. The plant phenotyping market can be classified as a fragmented market as it has a large number of organized players, accounting for a major part of the market share, present at the global level, and unorganized players present at the local level in several countries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

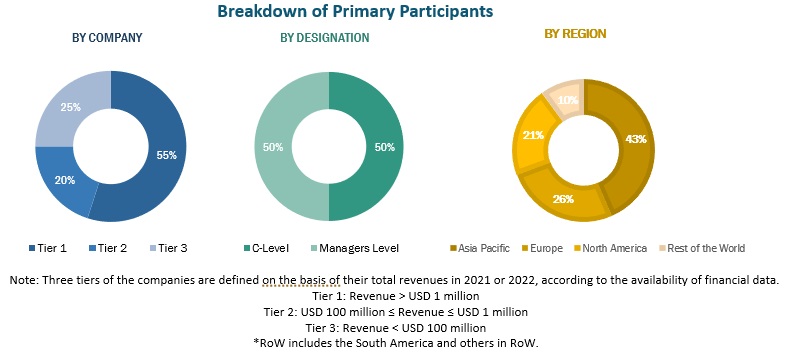

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the plant phenotyping market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information as well as to assess prospects. The following figure depicts the research design applied in drafting this report on the plant phenotyping market.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases, were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the plant phenotyping market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the plant phenotyping market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues of major plant phenotyping manufacturers were determined through primary and secondary research, such as paid databases, which were used as the basis for market estimation.

- All macroeconomic and microeconomic factors affecting the growth of the plant phenotyping market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using the top-down and bottom-up approaches.

Report Objectives

- To define, segment, and project the global market for plant phenotyping on the basis of type and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & developments in the plant phenotyping market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of Europe market for plant phenotyping into the Greece

- Further breakdown of the Rest of South America market for plant phenotyping into Chile, Peru, and Ecuador

- Further breakdown of RoW market for plant phenotyping into UAE, Saudi Arabia, and South Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant Phenotyping Market