Agrigenomics Market by Application (Crops and Livestock), Sequencer Type (Sanger Sequencing, Illumina HiSeq Family, PacBio Sequencer, Solid Sequencer), Objectives, and Region (North America, Europe, APAC, South America,Row) - Forecast year 2026

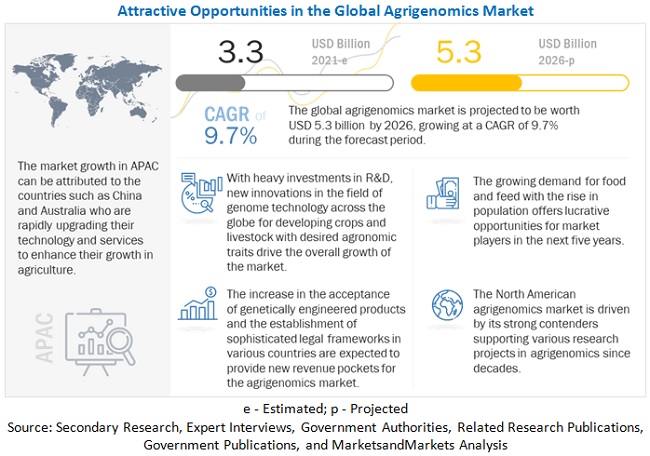

The agrigenomics market is an emerging field that has already achieved a substantial value of USD 3.3 billion in 2021, and its projected growth rate of 9.7% CAGR is expected to result in a market size of USD 5.3 billion by 2026, highlighting its importance in the global agriculture industry. This growth trajectory is a testament to the increasing importance of genomics in agriculture, as farmers and researchers alike seek to optimize crop yields, improve livestock health, and enhance overall sustainability in the industry. As technology continues to advance and data analysis capabilities improve, agrigenomics is poised to revolutionize the agriculture industry, paving the way for more efficient and effective crop management and livestock breeding programs. The utilization of genomics solutions for crops can lead to the development of specific crop varieties exhibiting resistance to different diseases, drought tolerance, nutritional enrichment, and high quality. Gene editing can provide a sustainable way in the mass production of desired crops by eliminating the traits hampering widespread production. Genomics in livestock production can lead to a better understanding of the genetic risk in animals, thereby adapting to measures for future profitability. Animal genomics empowers livestock producers with strategic animal selection and breeding decisions to optimize profitability and yield enhancement of livestock herds.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Agrigenomics Market

The outbreak of COVID-19 has brought serious medical, social, and economic challenges. Where the medical community is focused on developing successful diagnostic and medical treatment, the agricultural & food processing industries are channelizing their efforts to restore efficient food production, logistics and supply chain efficiency, and creating buffer systems to absorb future supply-demand shocks. Apart from commodities producers & suppliers, seed manufacturers, trait developers, and genomics researchers alike are focusing to bring solutions for capacity-building in the wake of the COVID-19 pandemic. Agricultural genomics is advancing in the direction of harnessing gene-editing techniques to develop a plethora of anti-bacterial, anti-fungal, and anti-viral solutions

Global Agrigenomcis Market Dynamics

Drivers: ADVANCED TOOLS AND TECHNIQUES OF GENOME ANALYSIS ARE AT THE FOREFRONT OF THE AGRIGENOMICS GROWTH MOMENTUM

The global market is majorly fueled by rapid advances in the functional genomics sector with the adaptation of massively parallel sequencing technologies and the development of protocols to efficiently analyze cellular behavior at the molecular level. For applied genomics in agriculture, molecular marker-assisted crop breeding has proved effective over conventional breeding programs, with regard to the increasing scope, speed, and efficiency of crop selection. Advanced genome characterization techniques have shown increased quality and yield of crops at the same time requiring less fertilizers, pesticides, and water. For livestock, the novel technologies are known to greatly improvise the desirable traits, such as milk yield, meat quality, and reproductive life.

Restraints: SUB-OPTIMIZED MULTIDISCIPLINARY RESEARCH APPROACHES AND LACKLUSTER INFRASTRUCTURE SUPPORT

Due to budgetary constraints, the adoption of automated systems in agrigenomics research has been comparatively low, unlike other areas such as human genetics. Thus, in developing countries, researchers still prefer manual methods over automated ones, despite being aware of the benefits of using automated systems. Similarly, academic research laboratories in emerging economies find it difficult to invest in such systems. Hence, the penetration of these high-cost automated systems is restricted to developed countries, thus limiting the scope of further market growth in automation in agrigenomics research.

Opportunities: AGRIGENOMICS FOR FOOD & NUTRITIONAL SECURITY AND FOOD SAFETY & AUTHENTICITY

The growth of the market hinges on broadening the application spectrum beyond food and nutritional security. Tools and techniques of genome analysis can also assist in detecting food safety issues such as spoilage & contamination, adulteration and economic fraud, as well as assisting traceability over the entire supply chain from farm to fork.

New Breeding Techniques (NBT) based on applied genetics have revolutionized breeding strategies for crops and livestock by providing unprecedented access to genomic information. Genomics has also successfully furnished information about the biological status of important resources such as fisheries, crops, and livestock health.

Challenges: TECHNOLOGICAL CONSTRAINTS OF APPLIED GENETICS IN AGRICULTURE

The technological impediments faced by the agrigenomics sector are challenging its current full-fledged growth and jeopardizing its future growth trajectories. Some of the challenges are to overcome species and genotype-dependent transformation, especially in the crops, thereby broadening the spectrum of targeted crop improvements via genome editing, achieving high-efficiency base replacement by shifting the focus away from targeted mutagenesis. Superior and desirable traits of plants are often governed by genetic variations in SNPs (single nucleotide polymorphisms). The main bottleneck is the identification and integration of all such traits in elite varieties at an expedited pace.

Market Ecosystem

The crops application segment of the agrigenomcis market is projected to account for the largest share

The crops segment holds the largest share in the agrigenomcis market. Researchers have significantly increased the use of genotyping and next-generation sequencing (NGS) technologies to study a variety of agricultural species and gain a better understanding of the genetic variation influencing phenotypes. Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) tools are accelerating the development because they are economical and provide advanced capabilities such as multiplexing. In fact, gene editing is democratizing the development of engineered plants. Not only is the technology adopted by large, established players such as Syngenta, Bayer, BASF, and Corteva, it is driving the emergence of small companies such as Calyxt and Pairwise Plants.

The market for Marker-assisted selection in the agrigenomcis market is projected to account for the largest share during the forecast period

Marker-assisted selection is estimated to hold the largest share in 2021 because it greatly increases the efficiency and effectiveness for breeding compared to conventional breeding. Marker-assisted selection has been gaining demand in North America due to the strong research support and presence of key technology providers in the US. However, DNA/RNA sequencing and genotyping were the normal requirements for agrigenomics testing services in 2020. This is because high genotyping call accuracy allows researchers to customize fine-mapping cost-effectively. Animal and plant genotyping has become a mainstay of modern agricultural research. Genotyping is the technology that detects small genetic differences that can lead to major changes in phenotype, including both physical differences that make us unique and pathological changes underlying a disease. It has a vast range of uses across basic scientific research, medicine, and agriculture. Genotyping determines differences in genetic complement by comparing a DNA sequence to that of another sample or a reference sequence. It identifies small variations in genetic sequence within populations, such as single-nucleotide polymorphisms (SNPs).

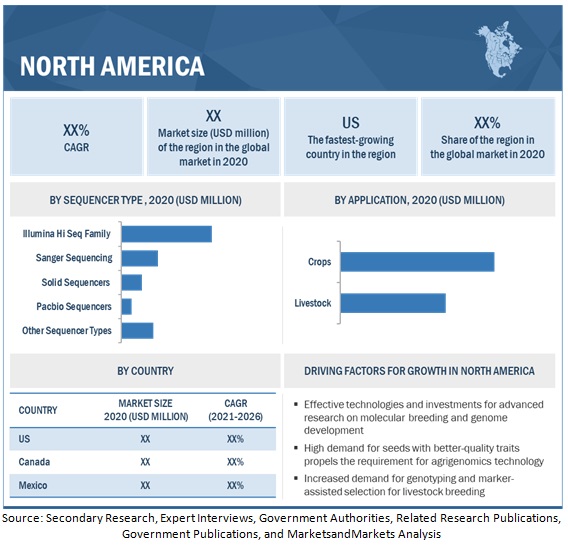

The Illumina Hi seq family is the highest share holder, by the sequencing type in the market, across the globe

The Sequencing tests based on Illumina HiSeq accounted for the largest share in the agrigenomics market in 2020. It is a very powerful sequencing system with the flexibility to perform multiple applications. Despite the presence of other next-generation sequencers, Sanger sequencing was the second-most preferred among research institutions and service providers in 2020 due to limited machine costs. The Sanger method relies on a primer that binds to a denatured DNA molecule and initiates the synthesis of a single-stranded polynucleotide in the presence of a DNA polymerase enzyme, using the denatured DNA as a template. Sanger DNA sequencing is widely used for research purposes such as: Targeting smaller genomic regions in a larger number of samples, sequencing of variable regions and validating results from next-generation sequencing (NGS) studies.

North America holds the largest market during the forecast period in the agrigenomcis market

North America dominated the market due to the strong R&D, technology innovation, and increased mergers and acquisitions in agrigenomics in the region. The US accounted for the largest country-level share in 2020 due to the advancements in sequencing and molecular breeding that are used in applications such as food & agriculture, animal health, and public health. Countries in the North American region produce a large quantum of GM crops such as canola, corn, soybean, and beet every year. However, cross-contamination between GMOs and non-GMO crops leading to new proteins could potentially cause allergic reactions in human beings. Therefore, regulations require safety tests to be conducted on novel traits that have been introduced by conducting GMO/trait purity tests on samples. Such developments along with greater thrust on R&D activities in agricultural biotechnology have intensified the market for agrigenomics in the region.

Key Market Players

The key players in this market include Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), Illumina, Inc. (US), Eurofins Scientific SE (Luxembourg), and LGC Limited (UK). Some of these players–Thermo Fisher Scientific, Inc. (US) and Illumina, Inc. (US)–are both, technology and service providers who have streamlined their supply chain in providing agrigenomics services.

Scope of the Agrigenomics Market (Revenue, USD Billion, 2020- 2026)

|

Report Metric |

Details |

|

Market valuation in 2020 |

USD 3.3 billion |

|

Financial outlook in 2026 |

USD 5.3 billion |

|

Progress rate |

CAGR of 9.7% from 2020-2026 |

|

Historical data |

2020-2026 |

|

Base year for estimation |

2019 |

|

Forecast period |

2020-2026 |

|

Quantitative units |

Value (USD Million) and Volume (Thousand Units) |

|

Report coverage |

Revenue forecast, company ranking, driving factors, competitive landscape, and analysis |

|

Segments covered |

Application, Sequencer Type, Region |

|

Regional scope |

Europe, North America, South America, Asia Pacific |

|

Primary companies highlighted |

Thermo Fisher Scientific, Inc. (US), Agilent Technologies, Inc. (US), Illumina, Inc. (US), Eurofins Scientific SE (Luxembourg), and LGC Limited (UK) |

|

Primary catalysts |

|

The study categorizes the agrigenomics market based on type, applications, at the regional and global levels.

By Sequencer Type

- SANGER SEQUENCING

- ILLUMINA HI SEQ FAMILY

- PACBIO SEQUENCERS

- SOLID SEQUENCERS

- OTHER SEQUENCER TYPES

By application

- Crops

- Livestock

By Objective

- DNA EXTRACTION & PURIFICATION

- DNA/RNA SEQUENCING

- GENOTYPING

- GENE EXPRESSION PROFILING

- MARKER-ASSISTED SELECTION

- GMO/TRAIT PURITY TESTING

- OTHER OBJECTIVES

By Region

- North America

- Europe

- Asia Pacific

- South America

- Row

Recent Developments

- In November 2020, LGC announced the extension of its regulated bioanalytical LC-MS service through the implementation of a high-resolution mass spectrometer, the SCIEX TripleTOF 6600 LC-MS/MS System.

- In November 2019, The newly launched platform by Thermo Fisher is the first fully integrated, next-generation sequencing platform featuring an automated sample-to-report workflow that delivers results economically in a single day.

- In January 2017, Illumina, Inc. announced the launch of the NovaSeq S4 flow cell reagent kit and NovaSeq Xp workflow for its NovaSeq 6000 System. Flow cell innovation facilitates the power and flexibility of the NovaSeq platform. The release of this new flow cell and workflow extends the capabilities of the platform.

- In February 2021, Thermo Fisher Scientific Inc. acquired cell sorting technology from Propel Labs, which is a fully owned subsidiary of SIDIS Corp. With this, Thermo Fisher aims toward bringing flow cytometry expertise, R&D capabilities, and engineering strength for elevating its cell analysis and cell therapy research businesses.

Frequently Asked Questions (FAQ):

What is the expected market size for the global agrigenomics market in the coming years?

With a projected market size of USD 5.3 billion by 2026 and an impressive CAGR of 9.7%, the agrigenomics market is cultivating a promising future. Its current value of USD 3.3 billion in 2021 indicates a strong foundation for continued success.

What is the estimated growth rate (CAGR) of the global agrigenomics market for the next five years?

The global agrigenomics market is set for significant growth, with a projected surge at a CAGR of 9.7%

What are the major revenue pockets in the agrigenomics market currently?

North America dominates the agrigenomics market owing to its strong R&D focus, technological innovation, and increased mergers and acquisitions in the region. In 2020, the US emerged as the largest contributor due to its advancements in sequencing and molecular breeding, which are widely used in food & agriculture, animal health, and public health applications. Additionally, the region produces a significant amount of GM crops such as canola, corn, soybean, and beet annually.

What are some of the major regulatory challenges and restraints that the industry faces?

The agrigenomics market growth is also hampered by prevailing misconceptions among consumers about gene-editing technologies owing to the nuances of the differences between genetically modified organism (GMO) and gene-edited crops/livestock. While the former (GMOs) is less accurate with the genome being synthetic and exotic, the latter (gene-edited technologies) is highly accurate with induced changes and the DNA remaining native. The prevailing mass confusion on the know-how of gene-editing has led to controversy and stigma surrounding genetically altering crops and food sources. Understanding, proactively identifying, and mitigating perception issues are critical in ensuring full-fledged growth of agrigenomics and empowering farmers with access to beneficial technologies.

Which region is projected to emerge as a global leader by 2026?

The market for agrigenomics in Asia Pacific is projected to witness the highest growth rate during the review period. India is projected to be the fastest-growing country in the Asia Pacific region during the forecast period due to the increasing genomic approaches to enhance plant resistance to diseases, plant breeding, and increase livestock yield. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 38)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION: AGRIGENOMICS MARKET

1.3.2 INCLUSIONS AND EXCLUSIONS

1.3.3 GEOGRAPHIC SCOPE

1.4 PERIODIZATION CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES CONSIDERED FOR THE STUDY, 2017–2020

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE ANALYSIS

2.2.2.1 Finite land resources under agricultural cultivation

FIGURE 4 GLOBAL AREA UNDER AGRICULTURAL PRACTICE, 2015–2018 (MILLION HECTARES)

2.2.2.2 Strong need to reduce the dependence on agrochemicals

2.2.3 SUPPLY-SIDE ANALYSIS

2.2.3.1 Declining price rates for agrigenomics testing services

FIGURE 5 DECADAL DECLINE IN THE GENOMIC TESTING COSTS, 2004–2014 (USD THOUSAND)

2.2.3.2 Growing regulatory & environmental concerns

2.3 MARKET SIZE ESTIMATION

2.3.1 SUPPLY-SIDE AND DEMAND-SIDE ASPECTS OF MARKET SIZING

FIGURE 6 MARKET ESTIMATION APPROACHES BASED ON SUPPLY AND DEMAND ANALYSIS

2.3.2 BOTTOM-UP APPROACH

2.3.3 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.5 RESEARCH ASSUMPTIONS & LIMITATIONS

2.5.1 ASSUMPTIONS

FIGURE 8 ASSUMPTIONS OF THE STUDY

2.6 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.7 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.7.1 SCENARIO-BASED MODELLING

3 EXECUTIVE SUMMARY (Page No. - 57)

FIGURE 9 MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021 VS. 2026 (USD MILLION)

FIGURE 10 AGRIGENOMICS MARKET SHARE, BY APPLICATION, 2021 VS. 2026

FIGURE 11 MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 AGRIGENOMICS MARKET SHARE, BY REGION, 2020

4 PREMIUM INSIGHTS (Page No. - 63)

4.1 BRIEF OVERVIEW OF THE AGRIGENOMICS MARKET

FIGURE 13 INCREASE IN APPLICATION OF GENOMICS IN AGRICULTURE TO IMPROVE THE PRODUCTIVITY AND SUSTAINABILITY IN CROP AND LIVESTOCK PRODUCTION TO DRIVE THE GROWTH OF THE AGRIGENOMICS MARKET

4.2 AGRIGENOMICS, BY SEQUENCER TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 ILLUMINA HI SEQ FAMILY TO ACCOUNT FOR THE LARGEST SHARE

4.3 MARKET FOR AGRIGENOMICS, BY APPLICATION AND REGION

FIGURE 15 NORTH AMERICA DOMINATED THE MARKET ACROSS ALL APPLICATIONS IN 2020

4.4 MARKET FOR AGRIGENOMICS, BY OBJECTIVE

FIGURE 16 MARKER-ASSISTED SELECTION SEGMENT TO DOMINATE THE MARKET

4.5 NORTH AMERICA: MARKET FOR AGRIGENOMICS, BY APPLICATION AND COUNTRY, 2020

FIGURE 17 CROPS SEGMENT ACCOUNTED FOR A LARGER SHARE, BY APPLICATION, IN 2020

4.6 COVID-19 IMPACT ON THE AGRIGENOMICS MARKET

FIGURE 18 GROWTH IN 2020 DECLINED IN THE POST-COVID-19 SCENARIO COMPARED TO THE PRE-COVID-19 SCENARIO

5 MARKET OVERVIEW (Page No. - 67)

5.1 INTRODUCTION

FIGURE 19 DISTRIBUTION OF MARKET-ORIENTED GENOMIC APPLICATIONS IN AGRICULTURE, 1996-2019

5.2 MARKET DYNAMICS

FIGURE 20 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Advanced tools and techniques of genome analysis are at the forefront of the agrigenomics growth momentum

TABLE 2 KEY TECHNOLOGIES FOR FUNCTIONAL GENOME ANALYSIS

5.2.1.2 Robust growth in grants & funding initiatives propelling agrigenomics growth

5.2.2 RESTRAINTS

5.2.2.1 Sub-optimized multidisciplinary research approaches and lackluster infrastructure support

5.2.2.2 Public perceptions and regulatory barriers for genome editing in agriculture

TABLE 3 REGULATORY STATUS FOR GENOME-EDITED CROPS IN KEY GEOGRAPHIES

5.2.3 OPPORTUNITIES

5.2.3.1 Agrigenomics for food & nutritional security and food safety & authenticity

5.2.3.2 Rising opportunities for DNA sequencing in crops and livestock

5.2.4 CHALLENGES

5.2.4.1 Technological constraints of applied genetics in agriculture

5.3 IMPACT OF COVID-19 ON MARKET DYNAMICS

5.3.1 COVID-19 NEGATIVELY IMPACTED THE SUPPLY CHAIN AND REVENUE STREAMS OF THE AGRIGENOMICS MARKET

6 INDUSTRY TRENDS (Page No. - 74)

6.1 INTRODUCTION

6.2 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.3.1 POLYMERASE CHAIN REACTION (PCR)

6.3.2 QUANTITATIVE PCR

6.3.3 SEQSNP

6.3.4 AGRENSEQ

6.3.5 MICROARRAY TECHNOLOGY

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 22 SUPPLY CHAIN ANALYSIS

6.5 ECOSYSTEM & MARKET MAP

FIGURE 23 MARKET ECOSYSTEM

FIGURE 24 MARKET MAP

6.5.1 UPSTREAM

6.5.2 DOWNSTREAM

6.5.2.1 Regulatory bodies

6.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 AGRIGENOMICS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.6.1 THREAT OF NEW ENTRANTS

6.6.2 THREAT OF SUBSTITUTES

6.6.3 BARGAINING POWER OF SUPPLIERS

6.6.4 BARGAINING POWER OF BUYERS

6.6.5 DEGREE OF COMPETITION

6.7 YC-YCC SHIFT

FIGURE 25 YC & YCC SHIFT FOR THE AGRIGENOMICS MARKET

6.8 PATENT ANALYSIS

FIGURE 26 NUMBER OF PATENTS GRANTED FOR AGRIGENOMICS, 2017–2021

FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED IN THE MARKET, 2017–2021

TABLE 5 LIST OF A FEW PATENTS IN THE AGRIGENOMICS MARKET

6.9 CASE STUDIES

6.9.1 CASE STUDY 1

TABLE 6 DISCOVERY AND DEVELOPMENT OF EXOME-BASED, CO-DOMINANT SINGLE NUCLEOTIDE POLYMORPHISM MARKERS IN HEXAPLOID WHEAT

6.9.2 CASE STUDY 2

TABLE 7 HY-LINE INTERNATIONAL USES GENETIC RESEARCH AND TESTING TO COMBAT COMMERCIAL EGG-LAYING CHALLENGES

7 REGULATORY FRAMEWORK (Page No. - 85)

7.1 INTRODUCTION

7.1.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)

7.1.2 WORLD ORGANIZATION FOR ANIMAL HEALTH (OIE)

7.2 NORTH AMERICA

7.2.1 US

7.2.1.1 US regulations on genetically modified crops

7.2.2 CANADA

7.2.3 MEXICO

7.3 EUROPE

7.3.1 GERMANY

7.3.2 UK

7.3.3 SPAIN

7.4 ASIA PACIFIC

7.4.1 CHINA

7.4.2 INDIA

7.4.2.1 Department of animal husbandry, dairying & fisheries (DADF)

7.4.2.2 Department of biotechnology

7.4.3 JAPAN

7.4.4 ISRAEL

7.4.5 AUSTRALIA

7.4.6 NEW ZEALAND

7.5 LATIN AMERICA

8 AGRIGENOMICS MARKET, BY APPLICATION (Page No. - 92)

8.1 INTRODUCTION

FIGURE 28 AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

TABLE 8 MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 9 MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

8.2 COVID-19 IMPACT ON THE AGRIGENOMICS MARKET, BY APPLICATION (2018-2021)

8.2.1 OPTIMISTIC SCENARIO

TABLE 10 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.2.2 PESSIMISTIC SCENARIO

TABLE 11 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.2.3 REALISTIC SCENARIO

TABLE 12 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

8.3 CROPS

8.3.1 AVAILABILITY OF GENOMIC TOOLS AND RESOURCES LEADING TO A NEW REVOLUTION OF CROP BREEDING, AS THEY FACILITATE THE COMBINATION OF COMPLEX TRAITS

TABLE 13 AGRIGENOMICS: CROPS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 14 AGRIGENOMICS: CROPS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 LIVESTOCK

8.4.1 GENOMIC SELECTION IS THE FUTURE OF LIVESTOCK BREEDING COMPANIES AS IT IMPROVES THE GENETIC GAIN BY DECREASING GENETIC INTERVAL AND IMPROVING RELIABILITY

TABLE 15 AGRIGENOMICS: LIVESTOCK MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 16 AGRIGENOMICS: LIVESTOCK MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 AGRIGENOMICS MARKET, BY OBJECTIVE (Page No. - 98)

9.1 INTRODUCTION

FIGURE 29 MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021 VS. 2026 (USD MILLION)

TABLE 17 MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 18 MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

9.2 COVID-19 IMPACT ON THE AGRIGENOMICS MARKET, BY OBJECTIVE (2018-2021)

9.2.1 OPTIMISTIC SCENARIO

TABLE 19 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE AGRIGENOMICS MARKET SIZE, BY OBJECTIVE, 2018–2021 (USD MILLION)

9.2.2 PESSIMISTIC SCENARIO

TABLE 20 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY OBJECTIVE, 2018–2021 (USD MILLION)

9.2.3 REALISTIC SCENARIO

TABLE 21 REALISTIC SCENARIO: COVID-19 IMPACT ON THE AGRIGENOMICS MARKET SIZE, BY OBJECTIVE, 2018–2021 (USD MILLION)

9.3 DNA EXTRACTION & PURIFICATION

9.3.1 DNA EXTRACTION IS INTEGRAL TO THE PROCESS OF GENETIC MODIFICATION OF PLANTS

TABLE 22 AGRIGENOMICS: DNA EXTRACTION & PURIFICATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 AGRIGENOMICS: DNA EXTRACTION & PURIFICATION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.4 RNA & DNA SEQUENCING

9.4.1 RNA & DNA SEQUENCING HAS BEEN INCREASINGLY CONSIDERED A VERY POPULAR TECHNIQUE THAT UNRAVELS MANY IMPORTANT ASPECTS RELATED TO THEIR BIOLOGICAL ROLES

TABLE 24 AGRIGENOMICS: RNA & DNA SEQUENCING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 AGRIGENOMICS: DNA & RNA SEQUENCING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.5 GENOTYPING

9.5.1 BECAUSE OF THE HIGH PRICE TAG, WHICH COMPRISES THE BREEDING BUDGETS, THERE IS A PRESSING NEED TO OPTIMIZE GENOTYPING PROCEDURES IN AGRICULTURE

TABLE 26 AGRIGENOMICS: GENOTYPING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 AGRIGENOMICS: GENOTYPING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.6 GENE EXPRESSION PROFILING

9.6.1 STUDYING THE GENE EXPRESSION OF VARIOUS CROPS UNDER STRESS HAS LED TO THE DEVELOPMENT OF HARDIER AND DROUGHT-TOLERANT STRAINS THAT PRODUCE HIGHER YIELDS

TABLE 28 AGRIGENOMICS: GENE EXPRESSION PROFILING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 AGRIGENOMICS: GENE EXPRESSION PROFILING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.7 MARKER-ASSISTED SELECTION

9.7.1 THIS TECHNIQUE IS USED IN PLANT AND ANIMAL BREEDING TO SELECT QUALITIES THAT ARE DESIRABLE FOR FARMERS AND CONSUMERS

TABLE 30 AGRIGENOMICS: MARKER-ASSISTED SELECTION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 AGRIGENOMICS: MARKER-ASSISTED SELECTION MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.8 GMO/TRAIT PURITY TESTING

9.8.1 TO ENSURE REGULATORY COMPLIANCES, GENOMICS COMPANIES MAY FIND IT NECESSARY TO TEST GMOS PRIOR TO IMPORT/EXPORT

TABLE 32 AGRIGENOMICS: GMO/TRAIT PURITY TESTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 AGRIGENOMICS: GMO/TRAIT PURITY TESTING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.9 OTHER OBJECTIVES

TABLE 34 AGRIGENOMICS: OTHER OBJECTIVES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 AGRIGENOMICS: OTHER OBJECTIVES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10 AGRIGENOMICS MARKET, BY SEQUENCER TYPE (Page No. - 111)

10.1 INTRODUCTION

FIGURE 30 AGRIGENOMICS MARKET SIZE, BY SEQUENCER TYPE, 2021 VS. 2026 (USD MILLION)

TABLE 36 MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2016–2020 (USD MILLION)

TABLE 37 MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021–2026 (USD MILLION)

10.2 COVID-19 IMPACT ON THE AGRIGENOMICS MARKET, BY SEQUENCER TYPE (2018-2021)

10.2.1 OPTIMISTIC SCENARIO

TABLE 38 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE AGRIGENOMICS MARKET SIZE, BY SEQUENCER TYPE, 2018–2021 (USD MILLION)

10.2.2 PESSIMISTIC SCENARIO

TABLE 39 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY SEQUENCER TYPE, 2018–2021 (USD MILLION)

10.2.3 REALISTIC SCENARIO

TABLE 40 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY SEQUENCER TYPE, 2018–2021 (USD MILLION)

10.3 SANGER SEQUENCING

10.3.1 SANGER SEQUENCING IS NOW EXTENSIVELY USED FOR THE INITIAL SEQUENCING OF A DNA MOLECULE TO OBTAIN THE PRIMARY SEQUENCE DATA FOR AN ORGANISM OR GENE

TABLE 41 SANGER SEQUENCING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 42 SANGER SEQUENCING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 ILLUMINA HISEQ FAMILY

10.4.1 HISEQ SYSTEMS LEVERAGE INNOVATIVE PATTERNED FLOW CELL TECHNOLOGY TO PROVIDE RAPID, HIGH-PERFORMANCE SEQUENCING

TABLE 43 ILLUMINA HISEQ FAMILY MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 ILLUMINA HI SEQ FAMILY MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 PACBIO SEQUENCERS

10.5.1 PACBIO’S SMRT (SINGLE MOLECULE REAL-TIME) SEQUENCING IS ONE OF THE MOST COMMONLY USED THIRD-GENERATION SEQUENCING TECHNOLOGIES

TABLE 45 PACBIO SEQUENCERS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 46 PACBIO SEQUENCERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 SOLID SEQUENCERS

10.6.1 PRINCIPLE OF SOLID SEQUENCING RELIES ON THE ABILITY OF DNA LIGASE TO DETECT AND INCORPORATE BASES IN A VERY SPECIFIC MANNER

TABLE 47 SOLID SEQUENCERS MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 48 SOLID SEQUENCERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 OTHER SEQUENCER TYPES

TABLE 49 OTHER SEQUENCER TYPES MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 50 OTHER SEQUENCER TYPES MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 AGRIGENOMICS MARKET, BY REGION (Page No. - 121)

11.1 INTRODUCTION

FIGURE 31 AGRIGENOMICS MARKET, 2021-2026

TABLE 51 MARKET SIZE FOR AGRIGENOMICS, BY REGION, 2016–2020 (USD MILLION)

TABLE 52 MARKET SIZE FOR AGRIGENOMICS, BY REGION, 2021–2026 (USD MILLION)

11.2 COVID-19 IMPACT ON THE AGRIGENOMICS MARKET, BY REGION (2018-2021)

11.2.1 OPTIMISTIC SCENARIO

TABLE 53 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE AGRIGENOMICS MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2.2 PESSIMISTIC SCENARIO

TABLE 54 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.2.3 REALISTIC SCENARIO

TABLE 55 REALISTIC SCENARIO: COVID-19 IMPACT ON THE MARKET SIZE, BY REGION, 2018–2021 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 32 US DOMINATED THE NORTH AMERICAN AGRIGENOMICS MARKET

TABLE 56 NORTH AMERICA: AGRIGENOMICS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2016–2020 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.1 US

11.3.1.1 Presence of key agrigenomics companies focusing on innovation has led to the increase in usage of genomics services in the country

TABLE 64 US: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 65 US: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 66 US: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 67 US: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Rising adoption of genomics for disease-resistant crops and livestock has provided a momentum to agrigenomics in Canada

TABLE 68 CANADA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 69 CANADA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 70 CANADA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 71 CANADA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Developments in the field of GM technology to drive the agrigenomics market in Mexico

TABLE 72 MEXICO: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 73 MEXICO: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 74 MEXICO: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 75 MEXICO: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4 EUROPE

FIGURE 33 EUROPEAN AGRIGENOMICS MARKET

TABLE 76 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 77 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2016–2020 (USD MILLION)

TABLE 79 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.1 UK

11.4.1.1 Presence of numerous research institutes and innovative companies dedicated to agricultural sciences expected to drive the agrigenomics market in the UK

TABLE 84 UK: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 85 UK: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 86 UK: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 87 UK: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.2 GERMANY

11.4.2.1 The huge number of breeding activities carried out by private plant breeding companies in the country expected to increase the adoption of agrigenomics

TABLE 88 GERMANY: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 89 GERMANY: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 90 GERMANY: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 91 GERMANY: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.3 FRANCE

11.4.3.1 With the increase in demand for food, the use of genomics in agriculture in France might increase

TABLE 92 FRANCE: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 93 FRANCE: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 94 FRANCE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 95 FRANCE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.4 ITALY

11.4.4.1 Increase in the price of feed materials has shifted focus on biotech commodities, thereby driving the market for agrigenomics

TABLE 96 ITALY: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 97 ITALY: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 98 ITALY: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 99 ITALY: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.5 SPAIN

11.4.5.1 Farmers in Spain are gradually inclining toward various GE technologies to maintain a competitive edge

TABLE 100 SPAIN: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 101 SPAIN: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 102 SPAIN: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 103 SPAIN: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.6 NETHERLANDS

11.4.6.1 Increased utilization of genetically engineered agricultural products for the livestock sector is driving the agrigenomics market

TABLE 104 NETHERLANDS: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 105 NETHERLANDS: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 106 NETHERLANDS: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 107 NETHERLANDS: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.4.7 REST OF EUROPE

TABLE 108 REST OF EUROPE: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 109 REST OF EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 34 ASIA PACIFIC AGRIGENOMICS MARKET

TABLE 112 ASIA PACIFIC: AGRIGENOMICS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2016–2020 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021–2026 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.1 CHINA

11.5.1.1 Growing need for feeding the ever-growing population in China is expected to drive the agrigenomics market

TABLE 120 CHINA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 121 CHINA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 122 CHINA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 123 CHINA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.2 INDIA

11.5.2.1 With the increase in demand for food, conventional technologies are not sufficient to meet the food and nutrition requirements

TABLE 124 INDIA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 125 INDIA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 126 INDIA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 127 INDIA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.3 JAPAN

11.5.3.1 Minimal ecological impact of GM crops grown in Japan over the past decades has strengthened the agrigenomics market

TABLE 128 JAPAN: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 129 JAPAN: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 130 JAPAN: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 131 JAPAN: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.4 SOUTH KOREA

11.5.4.1 Development of GM crops with useful traits that enhance food security to fuel the agrigenomics market in the country

TABLE 132 SOUTH KOREA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 133 SOUTH KOREA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 134 SOUTH KOREA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 135 SOUTH KOREA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.5 AUSTRALIA & NEW ZEALAND

11.5.5.1 Long-term funding to research and development and approved biotech products facilitate the agrigenomics market growth

TABLE 136 AUSTRALIA & NEW ZEALAND: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 137 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 138 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 139 AUSTRALIA & NEW ZEALAND: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.5.6 REST OF ASIA PACIFIC

TABLE 140 REST OF ASIA PACIFIC: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 141 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.6 SOUTH AMERICA

TABLE 144 SOUTH AMERICA: AGRIGENOMICS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 145 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 146 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2016–2020 (USD MILLION)

TABLE 147 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021–2026 (USD MILLION)

TABLE 148 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 149 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 150 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 151 SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.6.1 BRAZIL

11.6.1.1 The presence of large biotechnology companies and a sophisticated legal framework to drive Brazil’s agrigenomics market

TABLE 152 BRAZIL: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 153 BRAZIL: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 154 BRAZIL: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 155 BRAZIL: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.6.2 ARGENTINA

11.6.2.1 The public sector facilitation in developing biotechnological ventures expected to propel the agrigenomics market

TABLE 156 ARGENTINA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 157 ARGENTINA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 158 ARGENTINA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 159 ARGENTINA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.6.3 REST OF SOUTH AMERICA

TABLE 160 REST OF SOUTH AMERICA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 161 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 162 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 163 REST OF SOUTH AMERICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.7 REST OF THE WORLD (ROW)

TABLE 164 REST OF THE WORLD: AGRIGENOMICS MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 165 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 166 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2016–2020 (USD MILLION)

TABLE 167 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY SEQUENCER TYPE, 2021–2026 (USD MILLION)

TABLE 168 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 169 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 170 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 171 REST OF THE WORLD: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.7.1 SOUTH AFRICA

11.7.1.1 Enabling regulatory and policy-level framework for genetically engineered products has made the agrigenomics market flourish in the country

TABLE 172 SOUTH AFRICA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 173 SOUTH AFRICA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 174 SOUTH AFRICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 175 SOUTH AFRICA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.7.2 SAUDI ARABIA

11.7.2.1 The increase in research and development in the field of genome technology to drive the market for agrigenomics

TABLE 176 SAUDI ARABIA: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 177 SAUDI ARABIA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 178 SAUDI ARABIA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 179 SAUDI ARABIA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.7.3 ISRAEL

11.7.3.1 To meet the increasing food demand, the country is expected to develop plants that can survive its harsh climate

TABLE 180 ISRAEL: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 181 ISRAEL: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 182 ISRAEL: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 183 ISRAEL: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

11.7.4 UAE

11.7.4.1 Government initiatives along with increasing awareness programs and workshops on agrigenomics driving the market growth

TABLE 184 UAE: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 185 UAE: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.5 BAHRAIN

11.7.5.1 Increasing investment in genomics driving the market growth

TABLE 186 BAHRAIN: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 187 BAHRAIN: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.6 SAUDI ARABIA

11.7.6.1 Rich variety of diverse plant genetic resources drives the growth of the plant genomics market in the country

TABLE 188 SAUDI ARABIA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 189 SAUDI ARABIA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.7 EGYPT

11.7.7.1 Rising risk for desertification is expected to increase the demand for agrigenomics to achieve better flora and fauna in future

TABLE 190 EGYPT: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 191 EGYPT: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.8 KUWAIT

11.7.8.1 Increasing investment in plant genomics driving the market growth

TABLE 192 KUWAIT: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 193 KUWAIT: AGRIGENOMICS MARKET SIZE, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.9 OMAN

11.7.9.1 Increasing acceptance of genomics in agriculture to increase the production without compromising quality

TABLE 194 OMAN: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 195 OMAN: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.10 QATAR

11.7.10.1 Increasing focus on the countries’ fauna getting extinct

TABLE 196 QATAR: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 197 QATAR: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.11 REST OF MENA

11.7.11.1 Untapped opportunities in biotechnological plant genomic breeding technologies accelerating the market growth

TABLE 198 REST OF MENA: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 199 REST OF MENA: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2019–2026 (USD MILLION)

11.7.12 OTHER COUNTRIES IN ROW

TABLE 200 OTHER COUNTRIES IN ROW: AGRIGENOMICS MARKET SIZE, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 201 OTHER COUNTRIES IN ROW: MARKET SIZE FOR AGRIGENOMICS, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 202 OTHER COUNTRIES IN ROW: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2016–2020 (USD MILLION)

TABLE 203 OTHER COUNTRIES IN ROW: MARKET SIZE FOR AGRIGENOMICS, BY OBJECTIVE, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 196)

12.1 OVERVIEW

12.2 MARKET SHARE ANALYSIS, 2020

TABLE 204 AGRIGENOMICS MARKET: DEGREE OF COMPETITION

12.3 REVENUE ANALYSIS OF KEY PLAYERS, 2017-2020

FIGURE 35 REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017–2020 (USD BILLION)

12.4 KEY PLAYER STRATEGIES: MARKET FOR AGRIGENOMICS

12.5 COVID-19-SPECIFIC COMPANY RESPONSE

12.5.1 EUROFINS (LUXEMBOURG)

12.5.2 THERMO FISHER SCIENTIFIC, INC.

12.5.3 AGILENT TECHNOLOGIES, INC.

12.6 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

12.6.1 STARS

12.6.2 PERVASIVE PLAYERS

12.6.3 EMERGING LEADERS

12.6.4 PARTICIPANTS

FIGURE 36 MARKET FOR AGRIGENOMICS, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.7 PRODUCT FOOTPRINT

TABLE 205 COMPANY, BY OBJECTIVE FOOTPRINT

TABLE 206 COMPANY, BY APPLICATION FOOTPRINT

TABLE 207 COMPANY, BY SEQUENCER TYPE FOOTPRINT

TABLE 208 COMPANY, BY REGIONAL FOOTPRINT

TABLE 209 OVERALL COMPANY FOOTPRINT

12.8 MARKET FOR AGRIGENOMICS, START-UP/SME EVALUATION QUADRANT, 2020

12.8.1 PROGRESSIVE COMPANIES

12.8.2 STARTING BLOCKS

12.8.3 RESPONSIVE COMPANIES

12.8.4 DYNAMIC COMPANIES

FIGURE 37 AGRIGENOMICS MARKET: COMPANY EVALUATION QUADRANT, 2020 (START-UP/SME)

12.9 SERVICE DEVELOPMENTS, DEALS, AND OTHER DEVELOPMENTS

12.9.1 SERVICE DEVELOPMENTS, DEALS, AND OTHER DEVELOPMENTS

TABLE 210 MARKET FOR AGRIGENOMICS: NEW SERVICE/PRODUCT DEVELOPMENTS, JANUARY 2016-NOVEMBER 2020

12.9.2 DEALS

TABLE 211 MARKET FOR AGRIGENOMICS: DEALS, JANUARY 2016-MARCH 2021

12.9.3 OTHER DEVELOPMENTS

TABLE 212 AGRIGENOMICS MARKET: DEALS, MARCH 2016-APRIL 2020

13 COMPANY PROFILES (Page No. - 217)

13.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1.1 EUROFINS SCIENTIFIC

TABLE 213 EUROFINS SCIENTIFIC: BUSINESS OVERVIEW

FIGURE 38 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

TABLE 214 EUROFINS SCIENTIFIC: SERVICES OFFERED

TABLE 215 EUROFINS SCIENTIFIC: DEALS

TABLE 216 EUROFINS SCIENTIFIC: OTHER DEVELOPMENTS

13.1.2 AGILENT TECHNOLOGIES, INC.

TABLE 217 AGILENT TECHNOLOGIES, INC.: BUSINESS OVERVIEW

FIGURE 39 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT

TABLE 218 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

TABLE 219 AGILENT TECHNOLOGIES, INC.: NEW SERVICE/PRODUCT DEVELOPMENT

TABLE 220 AGILENT TECHNOLOGIES, INC.: DEALS

13.1.3 THERMO FISHER SCIENTIFIC, INC.

TABLE 221 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 40 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT

TABLE 222 THERMO FISHER SCIENTIFIC, INC.: SERVICES OFFERED

TABLE 223 THERMO FISHER SCIENTIFIC, INC.: PRODUCTS OFFERED

TABLE 224 THERMO FISHER SCIENTIFIC, INC.: NEW SERVICE/PRODUCT DEVELOPMENT

TABLE 225 THERMO FISHER SCIENTIFIC, INC.: DEALS

TABLE 226 THERMO FISHER SCIENTIFIC, INC.: OTHER DEVELOPMENTS

13.1.4 LGC LIMITED

TABLE 227 LGC LIMITED: BUSINESS OVERVIEW

FIGURE 41 LGC LIMITED: COMPANY SNAPSHOT

TABLE 228 LGC LIMITED: SERVICES OFFERED

TABLE 229 LGC LIMITED: PRODUCT OFFERED

TABLE 230 LGC LIMITED: NEW SERVICE/PRODUCT DEVELOPMENT

TABLE 231 LGS LIMITED: DEALS

TABLE 232 LGC LIMITED: OTHER DEVELOPMENTS

13.1.5 ILLUMINA, INC.

TABLE 233 ILLUMINA, INC.: BUSINESS OVERVIEW

FIGURE 42 ILLUMINA, INC.: COMPANY SNAPSHOT

TABLE 234 ILLUMINA, INC.: SERVICES OFFERED

TABLE 235 ILLUMINA, INC.: PRODUCTS OFFERED

TABLE 236 ILLUMINA, INC.: NEW SERVICE/PRODUCT DEVELOPMENT

TABLE 237 ILLUMINA, INC.: DEALS

13.1.6 ZOETIS

TABLE 238 ZOETIS: BUSINESS OVERVIEW

FIGURE 43 ZOETIS: COMPANY SNAPSHOT

TABLE 239 ZOETIS: PRODUCTS OFFERED

TABLE 240 ZOETIS: NEW SERVICE DEVELOPMENT

TABLE 241 ZOETIS: DEALS

TABLE 242 ZOETIS: OTHER DEVELOPMENTS

13.1.7 NEOGEN CORPORATION

TABLE 243 NEOGEN CORPORATION: BUSINESS OVERVIEW

FIGURE 44 NEOGEN CORPORATION: COMPANY SNAPSHOT

TABLE 244 NEOGEN CORPORATION: SERVICES OFFERED

TABLE 245 NEOGEN CORPORATION: PRODUCTS OFFERED

TABLE 246 NEOGEN CORPORATION: NEW SERVICE DEVELOPMENT

TABLE 247 NEOGEN CORPORATION: DEALS

13.1.8 GALSEQ SRL

TABLE 248 GALSEQ SRL: BUSINESS OVERVIEW

TABLE 249 GALSEQ SRL: SERVICES OFFERED

13.1.9 BIOGENETIC SERVICES, INC.

TABLE 250 BIOGENETIC SERVICES, INC.: BUSINESS OVERVIEW

TABLE 251 BIOGENETIC SERVICES, INC.: SERVICES OFFERED

13.1.10 DAICEL ARBOR BIOSCIENCES

TABLE 252 DAICEL ARBOR BIOSCIENCES: BUSINESS OVERVIEW

TABLE 253 DAICEL ARBOR BIOSCIENCES: SERVICES OFFERED

TABLE 254 DAICEL ARBOR BIOSCIENCES: PRODUCTS OFFERED

TABLE 255 DAICEL ARBOR BIOSCIENCES: NEW SERVICE DEVELOPMENTS

TABLE 256 DAICEL ARBOR BIOSCIENCES: DEALS

13.2 START-UPS/SMES

13.2.1 TECAN GENOMICS, INC

TABLE 257 TECAN GENOMICS, INC.: BUSINESS OVERVIEW

TABLE 258 TECAN GENOMICS, INC.: PRODUCTS OFFERED

TABLE 259 TECAN GENOMICS, INC.: DEALS

13.2.2 GENOTYPIC TECHNOLOGY PVT LTD

TABLE 260 GENOTYPIC TECHNOLOGY PVT LTD: BUSINESS OVERVIEW

TABLE 261 GENOTYPIC TECHNOLOGY PVT LTD: SERVICES OFFERED

TABLE 262 GENOTYPIC TECHNOLOGY PVT LTD: PRODUCTS OFFERED

13.2.3 BGI GENOMICS

TABLE 263 BGI GENOMICS: BUSINESS OVERVIEW

TABLE 264 BGI GENOMICS: SERVICES OFFERED

13.2.4 GENEWIZ

TABLE 265 GENEWIZ: BUSINESS OVERVIEW

TABLE 266 GENEWIZ: SERVICES OFFERED

TABLE 267 GENEWIZ: DEALS

13.2.5 TIANGEN BIOTECH (BEIJING) CO., LTD.

TABLE 268 TIANGEN BIOTECH (BEIJING) CO., LTD.: BUSINESS OVERVIEW

13.2.6 NUCLEOME INFORMATICS PVT LTD

13.2.7 IGA TECHNOLOGY SERVICES

13.2.8 ARRAYGEN TECHNOLOGIES PVT. LTD.

13.2.9 LC SCIENCES, LLC

13.2.10 CD GENOMICS

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS (Page No. - 270)

14.1 INTRODUCTION

14.2 LIMITATIONS

14.3 NEXT-GENERATION SEQUENCING (NGS) MARKET

14.3.1 MARKET DEFINITION

14.3.2 MARKET OVERVIEW

FIGURE 45 NEXT-GENERATION SEQUENCING IS EXPECTED TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

14.3.3 NEXT-GENERATION SEQUENCING MARKET, BY APPLICATION

TABLE 270 NEXT-GENERATION SEQUENCING MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

14.4 PLANT GENOMICS MARKET

14.4.1 MARKET DEFINITION

14.4.2 MARKET OVERVIEW

FIGURE 46 PLANT GENOMICS MARKET IS EXPECTED TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

14.4.3 PLANT GENOMICS MARKET, BY APPLICATION

FIGURE 47 PLANT GENOMICS MARKET SIZE, BY APPLICATION, 2019 VS. 2025 (USD MILLION)

TABLE 271 PLANT GENOMICS MARKET SIZE, BY APPLICATION, 2017–2025 (USD THOUSAND)

15 APPENDIX (Page No. - 275)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

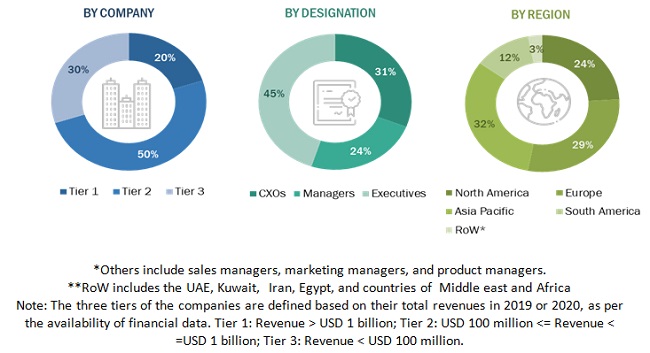

The study involves four major activities to estimate the current market size of the global agrigenomics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as the Food and Agriculture organization (FAO), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Primary Research

The market comprises several stakeholders such as in the Supply-side: agrigenomics service and products producers, suppliers, distributors, importers, and exporters, and in the Demand-side: farmers, livestock breeders and research organizations. Regulatory-side: Related government authorities, commercial research & development (R&D) institutions, FDA, EFSA, USDA, FSANZ, EUFIC government agencies & NGOs, and other regulatory bodies, Food product consumers, Regulatory bodies, including government agencies and NGOs, Commercial research & development (R&D) institutions and financial institutions, Government and research organizations

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage shares splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Baking Ingredients Market Size: Bottom-Up Approach

- With the bottom-up approach, agrigenomcis for each application, objective and sequencer type were added to arrive at the global and regional market size and CAGR.

- The pricing analysis was conducted based on types in regions. From this, we derived the market sizes, in terms of volume, for each region and type of baking ingredients.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- The bottom-up procedure has been employed to arrive at the overall size of the baking ingredients market from the revenues of key players (companies) and their product share in the market.

- The market share was then estimated for each company to verify the revenue share used earlier in the bottom-up procedure. With the data triangulation procedure and validation of data through primaries, the exact values of the overall parent and each market have been determined and confirmed in this study. The data triangulation procedure implemented for this study is explained in the next section.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the agrigenomics market.

Report Objectives

- To define, segment, and estimate the size of the market with respect to application, objective and sequencer type and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete value chain and influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the baking ingredients market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe agrigenomics market include Poland, Sweden, Switzerland, Russia, and other Eu and non-Eu countries

- Further breakdown of the Rest of Asia-Pacific agrigenomics market include Malaysia, Singapore, Indonesia, and other countries of Southeast Asia

- Further breakdown of the Rest of South America into Chile, Peru, Bolivia, and other countries of Latin America.

- Further breakdown of other countries in row primarily include UAE, Kuwait, Iran, Egypt, and countries of Middle east and Africa

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agrigenomics Market

This looks good. However, we are interested to know the assumptions and research methodology before purchasing the full report.