Piperidine Market by Type (99% Purity and 98% Purity), End Use Industry (Pharmaceutical, Agrochemicals, Rubber, and Others), Region (Asia Pacific, Europe, North America, Middle East & Africa and South America) - Global Forecast to 2027

Updated on : March 20, 2024

Piperidine Market

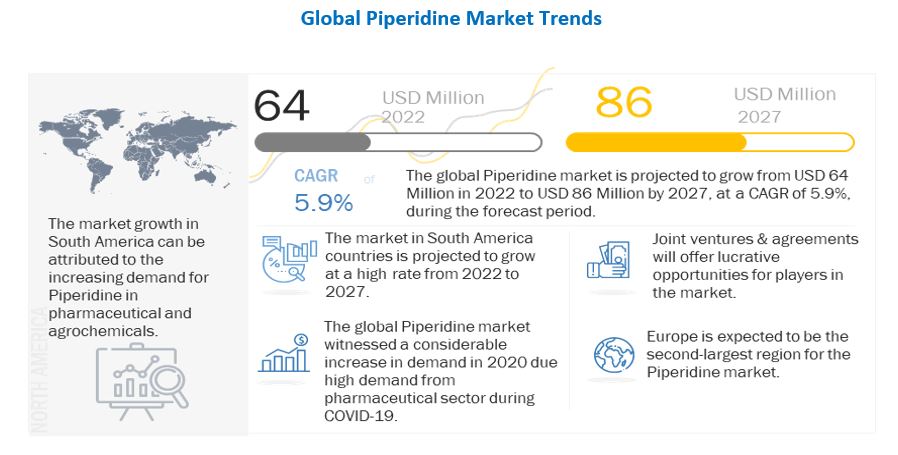

The global piperidine market was valued at USD 64 million in 2022 and is projected to reach USD 86 million by 2027, growing at 5.9% cagr from 2022 to 2027. Piperidine is widely used in crop protection, as active pharmaceutical ingredient (API) in drug manufacturing, as a solvent in organic synthesis. Increasing demand for piperidine in pharmaceutical and agrochemicals end-use industries is likely to support the growth of the market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 Impact on Global Piperidine Market

In 2020, the piperidine market was positively impacted by the COVID-19 pandemic due to the high demand in pharmaceutical drug manufacturing. However, demand of piperidine from end-use industries such as agrochemicals, rubber and others was impacted due to unavailability of labor, transportation barriers and lack of inventory. The market started recovering from year 2021.

Piperidine Market Dynamics

Driver: Increasing demand from pharmaceutical industry

Piperidine derivatives represent a key and extensive category of nitrogen bearing heterocyclic compounds. Compounds with piperidine moiety show a wide variety of biologic activities. Piperidine is a vital compound used in the production of various drugs. They are widely used in anticancer, antimicrobial, analgesic, anti-inflammatory, and antipsychotic drugs. Piperidine and pyridine complexes are two of the most common heterocyclic fragments present in FDA approved drugs. Piperidine and its derivatives are ubiquitous building blocks in the synthesis of active pharmaceutical ingredient (APIs), intermediates, and fine chemicals. It is a common organic compound or a representative structure element within many pharmaceutical intermediates.

Over the last few decades, the incidence of chronic diseases such as diabetes, coronary artery disease, chronic obstructive pulmonary disease (COPD), asthma, hepatitis, arthritis, and cancer has increased significantly in major regions across the globe. This can be attributed to the rising geriatric population across the globe (by 2050, more than 20% of the global population is expected to be aged over 65 years), changing lifestyles, and dietary changes as a result of rapid urbanization. The high incidence and prevalence of chronic diseases have resulted in a greater need for APIs for their effective treatment. Leading players in the market are focusing on aligning their API product portfolios toward therapies for chronic diseases that are on the rise, as well as trying to expand their production facilities for increasing their production capacities for APIs specific to the treatment of chronic diseases. Thus, the growing need for piperidine in the production of API’s will drive the market.

Restraint: Rising raw material prices

The Piperidine is derived from hydrogenation of pyridine. This process is usually done over a molybdenum disulfide catalyst. The price and availability of raw materials are two crucial parameters in the value chain of the piperidine market. Prices of piperidine vary in each region based on their production, imports, and exports. Hence, a similar volume-to-revenue ratio varies from region to region, making the piperidine market uncertain.

The prices of pyridine and its derivatives fluctuate significantly. Due to the COVID-19 pandemic, the demand for pyridine and piperidine surged, as they are used as an intermediate for various APIs in the pharmaceutical industry. The domestic consumption of pyridine increased in the Asia pacific region during the fourth quarter of 2020. The demand across the region witnessed an enormous surge due to strong demand for medicines for boosting immunity as a preventive measure for the new Coronavirus. Export for pyridine and its derivatives improved in India in the Q4 of 2020. Also, significant domestic demand for pyridine resulted in price hike, where pyridine prices settled at USD 3310.14 per ton in Q4 2020. Pyridine prices also showed an upward trend in the US during Q1 2022 owing to limited availability in the region. Thus, the fluctuating prices of pyridine acts as a restraint for the market.

Opportunity: Emergence of piperidine and its derivatives as antimetastatic and antiproliferation drug

Piperidine is a vital compound in the production of drugs. It show several characteristics and are being utilized in different ways as anticancer, antipsychotic, analgesic, and antimicrobial agents. There are more than one hundred medically approved chemotherapeutic medications for cancer. However, the toxicological data of most anticancer drugs have restrained their medicinal application as antiproliferative agents.. Several piperidine alkaloids isolated from natural herbs were found to exhibit antimetastatic and antiproliferation effects on various types of cancers both in vitro and in vivo such as Piperine, Evodiamine, Matrine, Berberine, and Tetrandine. Moreover, piperidine derivatives can be used as anticancer agents. For example, vinblastine and raloxifene are chemotherapeutic agents which have piperidine group within their structure and are used as antimetastatic and antiproliferation drug. Vinblastine is a plant alkaloid which is extracted from Vinca Rosea and is used as antineoplastic agent. Raloxifene is a second-generation selective estrogen receptor modulator (SERM). It is used for reducing the risk of invasive breast carcinoma in postmenopausal women by acting as estrogen blocker.

Challenge: Health risks associated with piperidine

Piperidine is a highly flammable and toxic compound. If piperidine is inhaled, it causes irritation in the nose and throat and can lead to coughing and wheezing. Piperidine emits explosive concentrations of vapor at normal room temperatures. When heated, it emits highly toxic fumes of nitrogen oxides. Elevated levels of nitrogen dioxide can cause damage to the human respiratory tract and increase a person's vulnerability to respiratory infections and asthma. Long-term exposure to high levels of nitrogen dioxide can cause chronic lung disease. Piperidine is a basic irritant of skin and mucous membranes. It can cause permanent injury after short exposure to small amounts. In an accidental case of skin exposure of piperidine, third-degree burns were developed after only three minutes of skin contact. Prolonged exposure to piperidine can cause damage to respiratory tract, liver, gastrointestinal tract, and kidney. Personnel using piperidine are advised to wear protective body suit, gloves, and eye googles to avoid direct contact with piperidine.

Piperidine Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

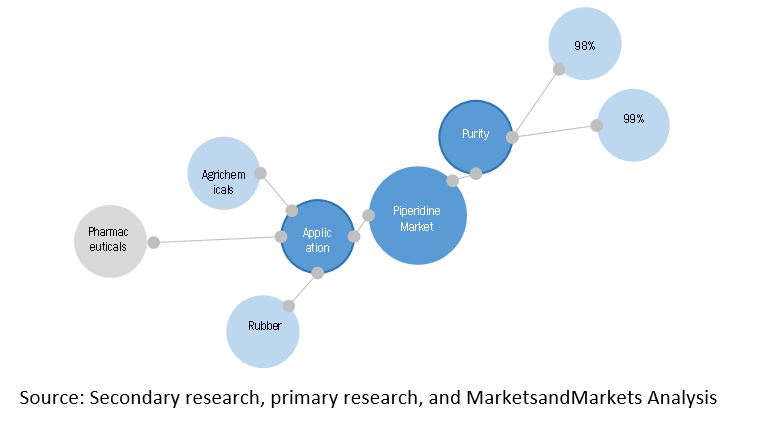

98% purity to be fastest growing type in piperidine market

Piperidine with 98% purity is mainly used in organic synthesis, rubber manufacturing, agrochemicals, and other applications. In agrochemicals, piperidine is a part of the finished active ingredient, or it is used as a solvent, base, catalyst, or other processing aid during the manufacturing process. It is a key component in the manufacturing of the active ingredient mepiquat, a plant growth regulator exclusively used on cotton.

The major application of piperidine is in elastomer processing. Unlike inorganic vulcanizing accelerators, organic accelerators based on piperidine can be easily dispersed into the rubber compound. Piperidine is used in the manufacturing of important catalysts such as p-Phenylenediamine (PPD) and dipentamethylene thiuram tetrasulfate (DPTS), which are both ultra-accelerator and vulcanizing agents.

In the global piperidine market pharmaceutical med-use industry had the largest share in 2021

The pharmaceutical sector is the largest industry segment of piperidine. Piperidine is used as a key component to manufacture different pharmaceutical products. The characteristics of nitrogen-bearing heterocyclic ring system present in piperidine and its derivatives are essentially used in the production of different drugs such as anti-cancer, antimicrobial, analgesic, anti-inflammatory, and antipsychotic agents. The market growth is attributed to the growing demand of pharmaceutical drug in treatment of chronic disease and drug for ageing-related.

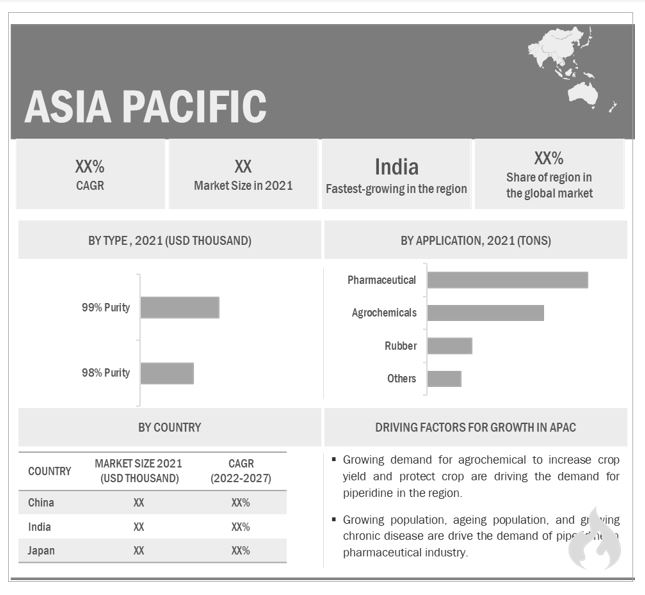

APAC region to lead the global piperidine market by 2027

Asia Pacific was the largest market for piperidine, in terms of value, in 2021. Emerging economies in the region are expected to experience significant demand for piperidine because of the expansion of pharmaceutical and agriculture sectors due to rapid economic development and government initiatives toward economic development. In addition to this, the growing population in these countries represents a strong customer base. Asia Pacific is the fastest-growing market for piperidine globally, in terms of value and volume, during the forecast period.

Piperidine Market Players

The piperidine market is dominated by a few globally established players, such as Jubilant Ingrevia Limited (India), Vertellus (US), KOEI Chemical Co. Ltd. (Japan), and BASF (Germany).

Piperidine Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 64 million |

|

Revenue Forecast in 2027 |

USD 86 million |

|

CAGR |

5.9% |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) and Volume (Ton) |

|

Segments covered |

Type, End Use Industry and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

BASF SE (Germany), Koei Chemical Co. Ltd. (Japan), Vertellus (US), Jubilant Ingrevia Limited (India), Vasudha Pharma (India), Taj Pharmaceuticals Ltd. (India), Avantor Inc. (US), Allchem Lifescience Pvt. Ltd. (India), Toronto Research Chemicals (Canada), Merck KGaA (Germany), among others. |

This research report categorizes the piperidine market based on type, end use industry, and region.

Based on Type:

- 99% Purity

- 98% Purity

Based on End Use Industry:

- Pharmaceutical

- Agrochemicals

- Rubber

- Others

Based on region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In August 2020, Vertellus acquired IM chemicals.IM Chemicals, the intermediates and specialties division of ESIM Chemicals. It’s a leading provider of specialty chemical products serving the pharmaceutical, coatings, and fuel & lubricant markets. With the addition of IM Chemicals, Vertellus expanded its specialty ingredients portfolio into new markets and bolsters its manufacturing capabilities in Europe.

- In May 2022 Avantor Inc. announced that it will create a new manufacturing and distribution Hub in Singapore by integrating its existing distribution facility with new manufacturing operations. The Singapore Manufacturing and Distribution Hub will enable Avantor to better serve the fast-growing Asia Pacific biopharma market by facilitating shorter lead times, enhancing supply chain security, and increasing capacity in the region.

Frequently Asked Questions (FAQs):

What is the current size of global piperidine market?

The global piperidine market is estimated to be USD 61 million in 2021 and is projected to reach USD 86 million by 2027, at a CAGR of 5.9% from 2022 to 2027.

How is the piperidine market aligned?

The piperidine market is competitive, and have number of manufacturer operating at the regional, and domestic level.

Who are the key players in the global piperidine market?

The key players operating in the piperidine market, were Jubilant Ingrevia Limited (India), Vertellus (US), KOEI Chemical Co. Ltd. (Japan), and BASF (Germany) in 2021.

What are the latest ongoing trends in the piperidine market?

The latest ongoing trends in the piperidine market are increasing demand for piperidine in pharmaceutical active ingredient manufacturing.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 PIPERIDINE MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 PIPERIDINE MARKET: RESEARCH DESIGN

2.2 KEY INDUSTRY INSIGHTS

FIGURE 3 DATA VALIDATION THROUGH PRIMARY EXPERTS

TABLE 2 LIST OF STAKEHOLDERS INVOLVED

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

2.3 BASE NUMBER CALCULATION

2.3.1 SUPPLY-SIDE APPROACH – 1

FIGURE 5 PIPERIDINE MARKET: SUPPLY-SIDE APPROACH – 1

2.3.2 SUPPLY-SIDE APPROACH – 2

FIGURE 6 PIPERIDINE MARKET: SUPPLY-SIDE APPROACH – 2

2.3.3 DEMAND-SIDE APPROACH – 1

FIGURE 7 PIPERIDINE MARKET: DEMAND-SIDE APPROACH - 1

2.4 MARKET SIZE ESTIMATION

2.4.1 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 TRIANGULATION

2.5.1 SECONDARY DATA

2.5.2 PRIMARY DATA

FIGURE 8 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS & LIMITATIONS

2.6.1 ASSUMPTIONS

2.6.2 RISK ASSESSMENT

TABLE 3 LIMITATIONS & ASSOCIATED RISKS

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 9 MARKET GROWTH PROJECTIONS FROM GROWTH DRIVERS AND OPPORTUNITIES

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 10 99% PURITY SEGMENT TO DOMINATE OVERALL PIPERIDINE MARKET, 2022–2027

FIGURE 11 PHARMACEUTICAL SEGMENT TO DOMINATE PIPERIDINE MARKET, 2022–2027

FIGURE 12 ASIA PACIFIC DOMINATED PIPERIDINE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 ASIA PACIFIC TO WITNESS RELATIVELY HIGHER DEMAND FOR PIPERIDINE

FIGURE 13 ASIA PACIFIC OFFERS ATTRACTIVE OPPORTUNITIES IN PIPERIDINE MARKET

4.2 ASIA PACIFIC: PIPERIDINE MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 14 CHINA WAS LARGEST MARKET FOR PIPERIDINE IN 2021

4.3 PIPERIDINE MARKET, BY END-USE INDUSTRY

FIGURE 15 PHARMACEUTICAL SEGMENT TO LEAD OVERALL PIPERIDINE MARKET DURING FORECAST PERIOD

4.4 PIPERIDINE MARKET, BY TYPE

FIGURE 16 99% PURITY TO LEAD PIPERIDINE MARKET DURING FORECAST PERIOD

4.5 PIPERIDINE MARKET, BY COUNTRY

FIGURE 17 INDIA PROJECTED TO WITNESS HIGHEST CAGR FROM 2022 TO 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PIPERIDINE MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand from pharmaceutical industry

5.2.1.2 Increasing agrochemicals consumption in emerging and highly populated countries

5.2.2 RESTRAINTS

5.2.2.1 Rising raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of piperidine and its derivatives as antimetastatic and antiproliferation drug

5.2.4 CHALLENGES

5.2.4.1 Health risks associated with piperidine

6 INDUSTRY TRENDS (Page No. - 48)

6.1 PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 PIPERIDINE MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 PIPERIDINE MARKET: PORTER'S FIVE FORCE ANALYSIS

6.1.1 BARGAINING POWER OF SUPPLIERS

6.1.2 BARGAINING POWER OF BUYERS

6.1.3 THREAT OF NEW ENTRANTS

6.1.4 THREAT OF SUBSTITUTES

6.1.5 INTENSITY OF COMPETITIVE RIVALRY

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 20 PIPERIDINE SUPPLY CHAIN

6.3 ECOSYSTEM MAPPING

FIGURE 21 PIPERIDINE MARKET: ECOSYSTEM MAP

6.4 TECHNOLOGY ANALYSIS

6.5 CASE STUDY ANALYSIS

6.6 PRICE ANALYSIS

TABLE 5 PIPERIDINE MARKET: PRICE ANALYSIS

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESS

FIGURE 22 PIPERIDINE MARKET: TRENDS IMPACTING CUSTOMER'S BUSINESS

6.8 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 6 PIPERIDINE MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.9 REGULATORY ANALYSIS

6.9.1 REACH

6.9.2 DRUG ENFORCEMENT ADMINISTRATION

6.9.3 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION

6.9.4 FEDERAL FINAL RULE OF HAZARD COMMUNICATION REVISED IN 2012 (HAZCOM 2012)

TABLE 7 SKIN CORROSION/IRRITATION: CATEGORY 1C

6.9.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6.10 TRADE ANALYSIS

6.10.1 IMPORT-EXPORT SCENARIO OF PIPERIDINE MARKET

6.10.2 EXPORT SCENARIO OF PIPERIDINE

FIGURE 23 PIPERIDINE MARKET: EXPORTING COUNTRIES

6.10.3 IMPORT SCENARIO OF PIPERIDINE

FIGURE 24 PIPERIDINE MARKET: IMPORTING COUNTRIES

6.11 PATENT ANALYSIS

6.11.1 INTRODUCTION

6.11.2 METHODOLOGY

6.11.3 DOCUMENT TYPE

TABLE 9 PIPERIDINE MARKET: REGISTERED PATENTS

FIGURE 25 PIPERIDINE MARKET: REGISTERED PATENTS

6.11.4 PATENT PUBLICATION TRENDS

FIGURE 26 PIPERIDINE MARKET: PATENT PUBLICATION TRENDS, 2016-2021

6.11.5 INSIGHT

6.11.6 LEGAL STATUS OF PATENTS

FIGURE 27 PIPERIDINE MARKET: LEGAL STATUS

6.11.7 JURISDICTION ANALYSIS

FIGURE 28 PIPERIDINE MARKET: JURISDICTION ANALYSIS

6.11.8 TOP PATENT APPLICANTS

FIGURE 29 PIPERIDINE MARKET: TOP PATENT APPLICANTS

TABLE 10 PIPERIDINE MARKET: LIST OF PATENTS BY CELGENE CORPORATION

TABLE 11 PIPERIDINE MARKET: LIST OF PATENTS BY TAKEDA

TABLE 12 PIPERIDINE MARKET: LIST OF PATENTS BY MERCK SHARP & DOHME

6.11.9 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

TABLE 13 PIPERIDINE MARKET: LIST TOP 10 PATENT OWNERS IN US

6.12 PIPERIDINE WORLD MERCHANDISE EXPORTS AND IMPORTS

6.12.1 IMPORT-EXPORT SCENARIO OF PIPERIDINE MARKET

6.12.2 TOP EXPORTERS OF PIPERIDINE & ITS SALTS

FIGURE 30 TOP EXPORTERS OF PIPERIDINE IN 2019-2020: SHARE OF WORLD EXPORTS

6.12.3 TOP IMPORTERS OF PIPERIDINE & ITS SALTS

FIGURE 31 TOP IMPORTERS OF PIPERIDINE IN 2019-2020: SHARE OF WORLD IMPORTS

6.12.4 EXPORT FLOW

6.12.5 IMPORT FLOW

7 PIPERIDINE MARKET, BY TYPE (Page No. - 69)

7.1 INTRODUCTION

FIGURE 32 99% PURITY SEGMENT DOMINATED PIPERIDINE MARKET IN 2021

TABLE 14 PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 15 PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (TON)

7.2 98% PURITY

7.2.1 WIDELY USED FOR ELASTOMER PROCESSING

TABLE 16 98% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 17 98% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020–2027 (TON)

7.3 99% PURITY

7.3.1 HIGH DEMAND FROM PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

TABLE 18 99% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 19 99% PURITY: PIPERIDINE MARKET SIZE, BY REGION, 2020–2027 (TON)

8 PIPERIDINE MARKET, BY END-USE INDUSTRY (Page No. - 73)

8.1 INTRODUCTION

FIGURE 33 PHARMACEUTICAL END-USE INDUSTRY TO LEAD PIPERIDINE MARKET

TABLE 20 PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 21 PIPERIDINE MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

8.2 AGROCHEMICALS

8.2.1 INCREASING GLOBAL POPULATION DRIVING DEMAND FOR AGROCHEMICALS AND, IN TURN, FOR PIPERIDINE

TABLE 22 PIPERIDINE MARKET SIZE IN AGROCHEMICALS, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 23 PIPERIDINE MARKET SIZE IN AGROCHEMICALS, BY REGION, 2020–2027 (TON)

8.3 PHARMACEUTICAL

8.3.1 LARGEST END-USE INDUSTRY OF PIPERIDINE

TABLE 24 PIPERIDINE MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 25 PIPERIDINE MARKET SIZE IN PHARMACEUTICAL, BY REGION, 2020–2027 (TON)

8.4 RUBBER

8.4.1 HIGH DEMAND FOR PIPERIDINE AS VULCANIZATION CATALYST

TABLE 26 PIPERIDINE MARKET SIZE IN RUBBER, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 27 PIPERIDINE MARKET SIZE IN RUBBER, BY REGION, 2020–2027 (TON)

8.5 OTHERS

TABLE 28 PIPERIDINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 29 PIPERIDINE MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2020–2027 (TON)

9 PIPERIDINE MARKET, BY REGION (Page No. - 80)

9.1 INTRODUCTION

FIGURE 34 ARGENTINA TO GROW AT HIGHEST RATE GLOBALLY

TABLE 30 PIPERIDINE MARKET SIZE, BY REGION, 2020–2027 (USD THOUSAND)

TABLE 31 PIPERIDINE MARKET SIZE, BY REGION, 2020–2027 (TON)

9.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: PIPERIDINE MARKET SNAPSHOT

TABLE 32 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 33 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 34 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 35 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 36 ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 37 ASIA PACIFIC: MARKET SIZE, END-USE INDUSTRY, 2020–2027 (TON)

9.2.1 CHINA

9.2.1.1 Largest piperidine market in Asia Pacific

TABLE 38 CHINA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 39 CHINA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 40 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 41 CHINA: MARKET SIZE, END-USE INDUSTRY, 2020–2027 (TON)

9.2.2 INDIA

9.2.2.1 Fastest-growing market in region

TABLE 42 INDIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 43 INDIA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 44 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 45 INDIA: MARKET SIZE, END-USE INDUSTRY, 2020–2027 (TON)

9.2.3 JAPAN

9.2.3.1 Second-fastest-growing mature pharmaceutical market in world

TABLE 46 JAPAN: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 47 JAPAN: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 48 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 49 JAPAN: MARKET SIZE, END-USE INDUSTRY, 2020–2027 (TON)

9.2.4 SOUTH KOREA

9.2.4.1 Growth in pharmaceutical industry to drive the market

TABLE 50 SOUTH KOREA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 51 SOUTH KOREA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 52 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 53 SOUTH KOREA: MARKET SIZE, END-USE INDUSTRY, 2020–2027 (TON)

9.2.5 ASEAN COUNTRIES

9.2.5.1 Rapid urbanization to be major market driver

TABLE 54 ASEAN COUNTRIES: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 55 ASEAN COUNTRIES: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 56 ASEAN COUNTRIES: MARKET SIZE, BY END-USE INDUSTRY 2020–2027 (USD THOUSAND)

TABLE 57 ASEAN COUNTRIES: MARKET SIZE, END-USE INDUSTRY 2020–2027 (TON)

9.2.6 REST OF ASIA PACIFIC

TABLE 58 REST OF ASIA PACIFIC: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 59 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 60 REST OF ASIA PACIFIC: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 61 REST OF ASIA PACIFIC: MARKET SIZE, END-USE INDUSTRY, 2020–2027 (TON)

9.3 EUROPE

TABLE 62 EUROPE: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 63 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 64 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 65 EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 66 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 67 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.1 GERMANY

9.3.1.1 Germany to lead market for piperidine in Europe

TABLE 68 GERMANY: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 69 GERMANY: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 70 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 71 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.2 ITALY

9.3.2.1 Pharmaceutical and agrochemicals industries to propel growth of piperidine market

TABLE 72 ITALY: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 73 ITALY: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 74 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 75 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.3 FRANCE

9.3.3.1 Growing pharmaceutical industry to drive market

TABLE 76 FRANCE: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 77 FRANCE: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 78 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 79 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.4 SPAIN

9.3.4.1 Increase in production and exports of agriculture products to propel growth of piperidine

TABLE 80 SPAIN: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 81 SPAIN: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 82 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 83 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.5 UK

9.3.5.1 Increasing government investment in pharmaceutical industry to offer opportunities for piperidine market

TABLE 84 UK: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 85 UK: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 86 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 87 UK: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.6 RUSSIA

9.3.6.1 Growing food export to support market growth

TABLE 88 RUSSIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 89 RUSSIA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 90 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 91 RUSSIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.3.7 REST OF EUROPE

TABLE 92 REST OF EUROPE: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 93 REST OF EUROPE: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 94 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 95 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.4 NORTH AMERICA

TABLE 96 NORTH AMERICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 97 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 98 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 99 NORTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 100 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 101 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.4.1 US

9.4.1.1 Growing pharmaceutical market and development of new agrochemical products driving market

TABLE 102 US: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 103 US: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 104 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 105 US: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.4.2 CANADA

9.4.2.1 Presence of major pharmaceutical companies to boost market

TABLE 106 CANADA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 107 CANADA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 108 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 109 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.4.3 MEXICO

9.4.3.1 Growing pharmaceutical production to be key market driver

TABLE 110 MEXICO: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 111 MEXICO: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 112 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 113 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.5 MIDDLE EAST & AFRICA

TABLE 114 MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 115 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 116 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 117 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 118 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 119 MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.5.1 SAUDI ARABIA

9.5.1.1 Growing domestic pharmaceutical industry boosting demand for piperidine

TABLE 120 SAUDI ARABIA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 121 SAUDI ARABIA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 122 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 123 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.5.2 UAE

9.5.2.1 Increasing need for development of healthcare & pharmaceutical sector to drive demand for piperidine

TABLE 124 UAE: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 125 UAE: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 126 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 127 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.5.3 SOUTH AFRICA

9.5.3.1 Huge potential for piperidine market in agrochemicals industry

TABLE 128 SOUTH AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 129 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 130 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 131 SOUTH AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 132 REST OF MIDDLE EAST & AFRICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 133 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 134 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 135 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.6 SOUTH AMERICA

TABLE 136 SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY COUNTRY, 2020–2027 (USD THOUSAND)

TABLE 137 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2027 (TON)

TABLE 138 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 139 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 140 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 141 SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.6.1 BRAZIL

9.6.1.1 Rising usage of agrochemicals to boost market

TABLE 142 BRAZIL: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 143 BRAZIL: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 144 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 145 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.6.2 ARGENTINA

9.6.2.1 Growing agriculture sector to drive market

TABLE 146 ARGENTINA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 147 ARGENTINA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 148 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 149 ARGENTINA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

9.6.3 REST OF SOUTH AMERICA

TABLE 150 REST OF SOUTH AMERICA: PIPERIDINE MARKET SIZE, BY TYPE, 2020–2027 (USD THOUSAND)

TABLE 151 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2020–2027 (TON)

TABLE 152 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (USD THOUSAND)

TABLE 153 REST OF SOUTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2020–2027 (TON)

10 COMPETITIVE LANDSCAPE (Page No. - 128)

10.1 INTRODUCTION

FIGURE 36 ACQUISITION WAS KEY STRATEGY ADOPTED BY PLAYERS BETWEEN 2018 AND 2022

10.2 MARKET SHARE ANALYSIS

FIGURE 37 MARKET SHARE OF KEY PLAYERS, 2021

TABLE 154 PIPERIDINE MARKET: DEGREE OF COMPETITION

TABLE 155 STRATEGIC POSITIONING OF KEY PLAYERS

10.3 COMPANY EVALUATION MATRIX

10.3.1 STAR

10.3.2 PERVASIVE

10.3.3 EMERGING LEADER

10.3.4 PARTICIPANT

FIGURE 38 PIPERIDINE MARKET: COMPANY EVALUATION MATRIX, 2021

10.4 STARTUPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

10.4.1 PROGRESSIVE COMPANIES

10.4.2 RESPONSIVE COMPANIES

10.4.3 DYNAMIC COMPANIES

10.4.4 STARTING BLOCKS

FIGURE 39 PIPERIDINE MARKET: STARTUP AND SMES MATRIX, 2021

10.5 REVENUE ANALYSIS OF TOP PLAYERS

10.6 STRENGTH OF PRODUCT PORTFOLIO

10.7 BUSINESS STRATEGY EXCELLENCE

10.8 KEY MARKET DEVELOPMENTS

10.8.1 DEALS

10.8.2 OTHERS

11 COMPANY PROFILES (Page No. - 138)

(Business Overview, Products and solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY COMPANIES

11.1.1 BASF SE

TABLE 156 BASF SE: COMPANY OVERVIEW

FIGURE 40 BASF SE: COMPANY SNAPSHOT

TABLE 157 BASF SE: PRODUCT OFFERED

11.1.2 KOEI CHEMICAL CO. LTD.

TABLE 158 KOEI CHEMICAL CO. LTD.: COMPANY OVERVIEW

FIGURE 41 KOEI CHEMICAL CO. LTD.: COMPANY SNAPSHOT

TABLE 159 KOEI CHEMICAL CO. LTD.: PRODUCT OFFERED

11.1.3 VERTELLUS

TABLE 160 VERTELLUS: COMPANY OVERVIEW

TABLE 161 VERTELLUS: PRODUCT OFFERED

TABLE 162 VERTELLUS: DEALS

11.1.4 JUBILANT INGREVIA LIMITED

TABLE 163 JUBILANT INGREVIA LIMITED: COMPANY OVERVIEW

FIGURE 42 JUBILANT INGREVIA LIMITED: COMPANY SNAPSHOT

TABLE 164 JUBILANT INGREVIA LIMITED: PRODUCT OFFERED

11.1.5 VASUDHA PHARMA

TABLE 165 VASUDHA PHARMA: COMPANY OVERVIEW

TABLE 166 VASUDHA PHARMA: PRODUCT OFFERED

11.1.6 TAJ PHARMACEUTICALS LTD.

TABLE 167 TAJ PHARMACEUTICALS LTD.: COMPANY OVERVIEW

TABLE 168 TAJ PHARMACEUTICALS LTD.: PRODUCT OFFERED

11.1.7 AVANTOR INC.

TABLE 169 AVANTOR INC.: COMPANY OVERVIEW

FIGURE 43 AVANTOR INC.: COMPANY SNAPSHOT

TABLE 170 AVANTOR INC.: PRODUCT OFFERED

TABLE 171 AVANTOR INC.: DEALS

11.1.8 ALLCHEM LIFESCIENCE PVT. LTD.

TABLE 172 ALLCHEM LIFESCIENCE PVT. LTD.: COMPANY OVERVIEW

TABLE 173 ALLCHEM LIFESCIENCE PVT. LTD.: PRODUCT OFFERED

11.1.9 TORONTO RESEARCH CHEMICALS

TABLE 174 TORONTO RESEARCH CHEMICALS: COMPANY OVERVIEW

TABLE 175 TORONTO RESEARCH CHEMICALS: PRODUCT OFFERED

11.1.10 MERCK KGAA

TABLE 176 MERCK KGAA: COMPANY OVERVIEW

FIGURE 44 MERCK KGAA: COMPANY SNAPSHOT

11.2 OTHER COMPANIES

11.2.1 LANXESS

TABLE 177 LANXESS: BUSINESS OVERVIEW

11.2.2 OTTO CHEMIE PVT. LTD.

TABLE 178 OTTO CHEMIE PVT. LTD.: COMPANY OVERVIEW

11.2.3 SIMSON PHARMA

TABLE 179 SIMSON PHARMA: COMPANY OVERVIEW

11.2.4 ROBINSON BROTHERS LIMITED

TABLE 180 ROBINSON BROTHERS LIMITED: COMPANY OVERVIEW

11.2.5 ALFA AESAR

TABLE 181 ALFA AESAR: COMPANY OVERVIEW

11.2.6 A.R. LIFE SCIENCE PVT. LTD.

TABLE 182 AR LIFE SCIENCE: COMPANY OVERVIEW

11.2.7 AMI ORGANIC LIMITED

TABLE 183 AMI ORGANIC LIMITED: COMPANY OVERVIEW

11.2.8 COREY ORGANICS

TABLE 184 COREY ORGANICS: COMPANY OVERVIEW

11.2.9 J&K SCIENTIFIC

TABLE 185 J&K SCIENTIFIC: COMPANY OVERVIEW

11.2.10 PENTA S.R.O

TABLE 186 PENTA S.R.O: COMPANY OVERVIEW

11.2.11 MUBY CHEMICALS

TABLE 187 MUBY CHEMICALS: COMPANY OVERVIEW

11.2.12 VORTEX PRODUCTS LIMITED

TABLE 188 VORTEX: COMPANY OVERVIEW

11.2.13 SICHUAN HENGKANG SCIENCE AND TECHNOLOGY DEVELOPMENT CO., LTD.

TABLE 189 SICHUAN HENGKANG SCIENCE AND TECHNOLOGY DEVELOPMENT CO., LTD.: COMPANY OVERVIEW

11.2.14 VITAL SYNTHESIS

TABLE 190 VITAL SYNTHESIS: COMPANY OVERVIEW

11.2.15 VANAMALI ORGANICS

TABLE 191 VANAMALI ORGANICS: COMPANY OVERVIEW

*Details on Business Overview, Products and solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 166)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAIL

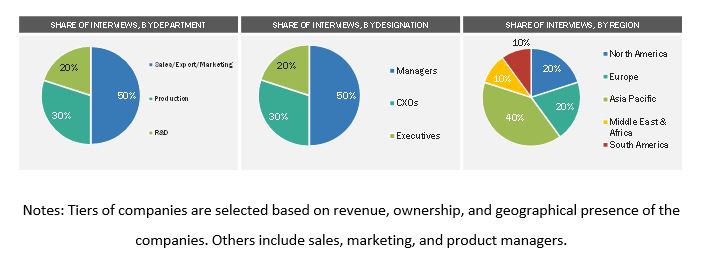

The study involved four major activities in estimating the current market size for the piperidine. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers and Bloomberg BusinessWeek, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, and databases.

Primary Research

The piperidine market comprises of several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The supply side is characterized by market consolidation activities undertaken by raw material suppliers. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the total size of piperidine market. These methods were also used extensively to estimate the size of the various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Piperidine Market Size: Bottom-UP Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, and forecast the global piperidine market size, in terms of value and volume

- To provide detailed information regarding the key drivers, restraints, challenges, and opportunities influencing the market growth

- To analyze and forecast the piperidine based on type and end use industry

- To analyze and forecast the market size, based on five key regions, namely, Asia Pacific, Europe, North America, the Middle East & Africa, and South America along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as expansions, merger & acquisition, collaboration, and new product developments in the market

- To strategically identify and profile the key market players and analyze their core competencies in the market

Available Customizations:

- MarketsandMarkets offers customizations according to the specific requirements of companies with the given market data.

- The following customization options are available for the report

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Piperidine Market