Agricultural Pheromones Market by Crop Type (Fruits & Nuts, Field Crops, & Vegetable Crops), Function (Mating Disruption, Mass Trapping, Detection & Monitoring), Mode of Application (Dispensers, Traps, & Sprays), Type and Region - Global Forecast to 2029

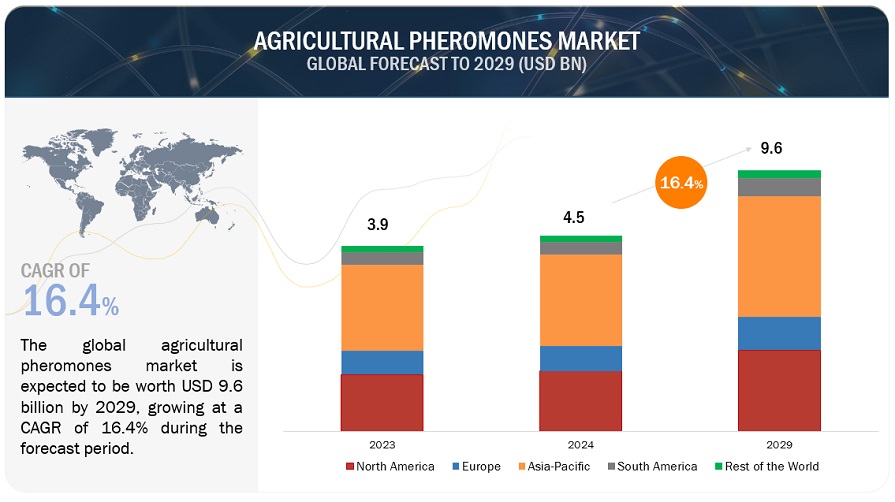

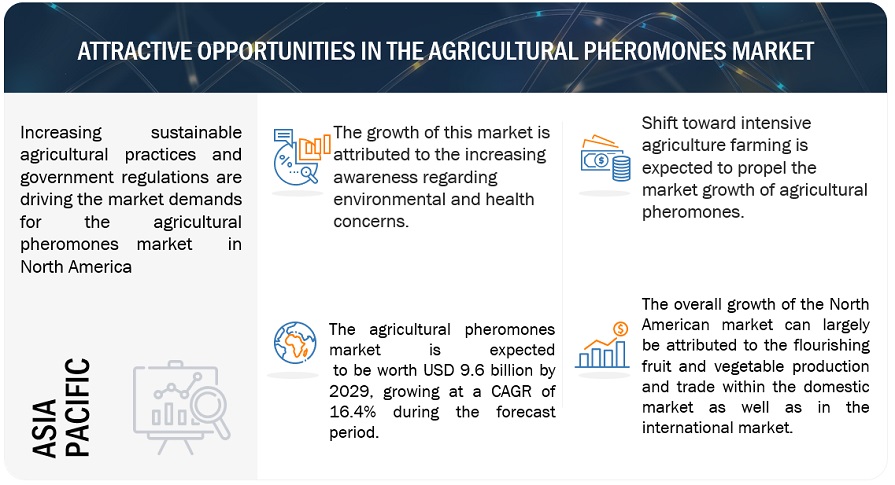

The global Agricultural Pheromones Market is on a trajectory of significant expansion, with an estimated value projected to reach USD 9.6 billion by 2029 from the 2024 valuation of USD 4.5 billion, indicating a substantial Compound Annual Growth Rate (CAGR) of 16.4%. The rise in concerns of consumers and governments about food safety has encouraged growers to explore new environment-friendly methods to replace or at least supplement the current chemical-based practices. The use of pheromones has emerged as a promising alternative to chemical pesticides. Pheromones are offered at a low cost in the market as compared to chemical pesticide sprays. In addition, government organizations are encouraging the adoption of pheromones for crop protection across regions. Moreover, government initiatives for the improvement and development of the agricultural sector across the world are also positively influencing the market growth of agricultural pheromones.

The agricultural pheromones market is driven by innovations, such as the use of new technical ingredients, innovative pheromone traps, and lure designs. The agricultural pheromones market growth is mainly supported by factors such as a rise in awareness regarding chemical pesticides' ill effects and pheromones' properties (including target specificity).

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Growing demand for sustainable crop solutions

The global agriculture sector actively uses insecticides and pesticides to eliminate pests and attain high crop yields. According to the FAO, at the global level, total pesticide use in agriculture remained stable in 2020, at 2.7 million tonnes (2.9 million tons) of active ingredients. However, growing consumer awareness of the negative effects of insecticides and chemical pesticides on human health is propelling farmers to enhance their agricultural practices. This is further resulting in the application of biopesticides and the implementation of sustainable crop management systems across the globe. Many horticulture and agriculture farmers are employing sex pheromones and attractants to decrease the number of crop-damaging insects and pests effectively.

In addition, companies nowadays are increasing their research & development investments to diversify the application area for these pesticides and thus, propelling the growth of the overall market over the next few years. For instance, Provivi invested over USD 85 million in October 2019 to support the development of its pheromone product portfolio. Rising R&D initiatives to improve the overall efficiency of the product are projected to drive the agricultural pheromones market in the coming years

Restraint: Increased production and maintenance costs of agricultural pheromones

The high costs of agricultural pheromones as compared to the conventional insecticides and other pesticides is hindering the growth of the market. The cost of pheromones can range from USD 1000 to USD 3500 to produce 1 kg of artificial pheromones. Utilization of these pheromones can cost between USD 40 – USD 400 per hectare depending on the type of pest. This has limited the use of pheromones to crops which require small area of land and produce decent returns on investments such as fruits and nuts. Farmers who are mainly into cultivation of crops such as traditional crops such corn or soyabeans among others are often not able to afford the deployment of agricultural pheromones in the large fields. The high cost of agricultural pheromones is making them unaffordable in large-scale agriculture for pest control. Furthermore, a highly skilled workforce is required to deploy and maintain the insect pheromones. The lack of skilled workers coupled with the growing labor wages is restraining the growth of the agricultural pheromones market.

Opportunity: Rise in demand for high-value crops

Agricultural insect pheromones are primarily used in permanent croplands, where fruits, tree nuts, ornamentals, and plantation crops are grown. The demand for insect pheromones is mostly concentrated in high-value crops, such as pome fruits, grapes, cotton, and other vegetable and ornamental crops, as they improve crop quality and yield. The growing demand for high-value crops is proliferating the demand for agricultural pheromones. consumer preferences have shifted toward consuming healthy and organic food products to maintain health and improve immunity. Other emerging industry trends, including the consumption of safe, natural, clean-label, and pesticide-free products, have also changed the scenario of agriculture across the globe. Therefore, increasing demand for high-value crops, such as organic fruits & vegetables and organic commodities among consumers, is projected to spur the pheromones market over the forecast period.

Challenges: Inadequate awareness and low application of pheromones in developing economies

The awareness among farmers of biologicals like pheromones is comparatively low. Farmers lack technical knowledge on how to use pheromones for pest control. Furthermore, farmers in developing countries are highly accustomed to the use of chemical pesticides as they are simple. Hence, they are finding the methods of pheromone applications highly complex and difficult. As the market is highly fragmented at the regional level, awareness regarding various brands is low. Despite considerable efforts by agronomists, agricultural universities, companies, and governments across the globe in recent years, the majority of farmers are unaware of pheromone products and their benefits in increasing cost-yield sustainability. The resistance and reluctance of farmers to unfamiliar technologies like agricultural pheromones are posing a challenge to the growth of the agricultural pheromones market.

AGRICULTURAL PHEROMONES MARKET ECOSYSTEM

In the type segment, the market for sex pheromones is projected to grow at the highest CAGR during the forecast period.

The high usage of sex pheromones is attributed to their utilization in mating disruption and detection & monitoring techniques. Sex pheromones do not assist in capturing both the sexes of the insect species; however, they are effective in reducing the reproduction activity of both sexes to less than 5%. Different pheromone products based on functions, such as host-marking (repellants), trail, and alarm (dispersal pheromones), are being identified and researched to be introduced for commercial purposes. There are several benefits in using sex pheromone-based mating disruption strategies for the control of pests. Sex pheromones are favorable to the environment since it lessen the need for chemical pesticides, minimizing the harm they cause to ecosystems and organisms that are not their intended targets. The ability to target specific pest species with mating disruption techniques also makes them a precise and efficient way to manage insect populations. The benefits of sex pheromones in controlling insect populations efficiently in a sustainable manner is augmenting the growth of the market.

In the crop type segment, field crops are anticipated to record the highest CAGR during the forecast period.

A research paper, “Insect pest management with sex pheromone precursors from engineered oilseed plants,” in 2022, stated that many commercially significant crops, particularly row crops grown in broad fields such as soybean, corn, and cotton, still lack pheromone-based pest management. This is mostly because growers of lower-value crops are unable to afford mating disruption solutions due to the high expense of the traditional chemical manufacture of pheromones. However, considering this, in lower-value but higher-volume row crops such as corn, cotton, and soybean, where pheromone-based solutions are highly underutilized, the players in the market are involved in research and development and partnerships to launch pheromones specifically to the field crops. For instance, in 2022, Provivi and Syngenta Crop Protection launched a pheromone-based technology Nelvium to control detrimental rice pests. Nelvium is a mating disruption solution that effectively and more safely contains detrimental pests in rice. The growing research and development and new product launches for field crops are boosting the growth of the market during the forecast period.

The agricultural pheromones market in the North American region is expected to grow at the highest CAGR during the forecast period

The US Environment Protection Agency (EPA) has been actively involved in integrated pest management practices. It adopts less risky pest control options, such as pheromones and biological control, with a view to disrupting mating among insect pests. The EPA regulates certain uses of pheromones, considers them a pesticide, and regulates their use through registration. The EPA has registered pheromone products to control oriental fruit moth, peach tree borer, codling moth, and pests on some nonfood crops. Government support, an increase in demand for organic food, expansion of areas under organic farming, new enhanced regulations to modernize the export industry, and reduced dependence on conventional insecticides are some factors that have contributed to the growth of the agricultural pheromones market in this region.

Key Market Players

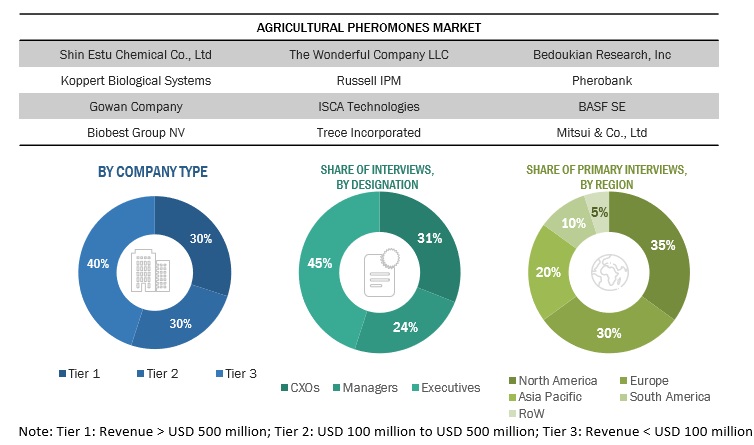

Shin-Etsu Chemical Co., Ltd (Japan), BASF SE (Germany), Mitsui & Co., Ltd. (Japan), Biobest Group NV (Belgium), and The Wonderful Company LLC (US) are among the key players in the global agricultural pheromones market. To strengthen their market position in the global agricultural pheromones market, key players are now focusing on strategies such as collaborations, partnerships, acquisitions, mergers, and expansions.

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD Million) |

|

Segments Covered |

By Type, By Function, By Mode of Application, By Crop Type, and By Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies covered |

|

Target Audience

- Agricultural pheromones manufacturers, formulators, and blenders

- Agricultural biological manufacturers

- Technological and raw material providers to agricultural pheromone manufacturers

- Commercial research & development (R&D) organizations and financial institutions

- Government agricultural departments and regulatory bodies such as the US Environmental Protection Agency (EPA), US Department of Agriculture (USDA) - Animal and Plant Health Inspection Service (APHIS), and Canadian Food Inspection Agency (CFIA)

Agricultural Pheromones Market:

By Type

- Sex Pheromones

- Aggregation Pheromones

- Other Types

By Function

- Detection & Monitoring

- Mass Trapping

- Mating Disruption

By Mode of Application

- Dispensers

- Traps

- Sprays

By Crop Type

- Field Crops

- Fruits & Nuts

- Vegetable Crops

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In December 2023, Biobest Group N.V. acquired Biotrop Participações s.a (“Biotrop”). Biotrop, a leading player in Brazil’s biologicals market. This acquisition is part of the company’s objective to enter the top 10 agricotech companies by 2034. Through this acquisition aims to shift from a horticulture biocontrol and pollination specialist to a prominent biological player in agriculture, encompassing beneficial biopesticides, stimulants and -inoculants, and pollination in covered and in open-field crops.

- In February 2023, Pherobank launched a new pheromone lure that would be used as an attractant for Syngrapha parilis and Sympistis lapponica. This company launch would help it expand its product portfolio and serve a larger consumer base.

- In January 2023, Koppert Biological Systems completed the acquisition of Linderso AB, a prominent distributor in Sweden. The acquisition would enable the company to improve its geographical presence and commercial strength in the Scandinavian market.

- In February 2022, Suterra LLC, a subsidiary of Wonderful Company LLC, launched a new monitoring lure for pear, apple, and walnut pests. This lure would be beneficial for controlling codling moths affecting fruit crops. It could also be used to monitor in conjunction with pheromone mating disruption solutions that confuse male species of codling moths. With this, Suterra LLC expanded the portfolio of monitoring products used for mating disruption, especially in orchards.

Frequently Asked Questions (FAQ):

Which are the major companies in the agricultural pheromones market? What is the intensity of competition in the agricultural pheromones market?

The global market for agricultural pheromones is dominated by major players such as Shin-Etsu Chemical Co., Ltd (Japan), BASF SE (Germany), Mitsui & Co., Ltd. (Japan), Biobest Group NV (Belgium), and The Wonderful Company LLC (US). The agricultural pheromones market is fairly competitive with the companies focusing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market shares. New product launches because of extensive research & development (R&D) initiatives, increased geographical presence, and strategic acquisitions to strengthen the supply chain are some of the key strategies companies are adopting in the agricultural pheromones market.

What are the drivers for the agricultural pheromones market?

The agricultural pheromones market is experiencing technological innovations as players are offering faster and more accurate technologies such as IoT-connected pheromone devices. IoT-connected pheromone devices offer the ability to gather data automatically from devices placed at strategic points around a business. Sensors in the devices can automatically collect data, such as the presence of an insect/pest, using an infrared sensor to detect body heat, or triggering a trap that shows an insect/pest has been captured. These connected devices can also automatically report other data that reduces the need for technician visits, such as battery level and the device’s operational status. This sensor data, when sent to the central server, can generate alerts for a technician to visit the site to deal with the insect pest and reset the trap and also inform the farmer of insect pest activity on their field.

Which region is accounts for the majority of the market share during the study period?

The market in North America will dominate the market share in 2024, indicating strong demand for agricultural products in the region. The region accounts for 39.4% of the overall agricultural pheromones market share. North America is also anticipated to be the fastest-growing market during the forecast period (2024-2029). The increased awareness of sustainable practices and government regulations is propelling the growth of the market.

What kind of information is provided in the company profile section?

The company profile provides information such as a detailed business overview, including details on the company's various business segments, financial performance, geographical reach, revenue composition, and the breakdown of their business revenue. Furthermore, these profiles offer insights into the company's product offerings, significant milestones, and expert analyst perspectives to further explain the company's potential.

What is the expected total CAGR for the agricultural pheromones market from 2024 to 2029??

The CAGR is expected to be 16.4% from 2024 to 2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSSTEADY INCREASE OF ORGANIC FARMLANDSRISE IN GLOBAL POPULATION AND DIVERSE FOOD CONSUMPTION

-

5.3 MARKET DYNAMICSDRIVERS- Pest proliferation as result of rapid climate change- Increase in demand for sustainable crop protection solutions- Rise in awareness among farmers and focus on reducing chemical pesticide usageRESTRAINTS- High maintenance and production costs of agricultural pheromonesOPPORTUNITIES- Rise in global consumption of high-value crops- Regulations supportive of semiochemicals- International environmental regulations in favor of sustainable pest control solutionsCHALLENGES- Need for development of multi-target insect pheromone dispensers- Lack of awareness and low utilization of biologicals in emerging economies

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

-

6.3 ECOSYSTEM ANALYSIS

- 6.4 VALUE CHAIN ANALYSIS

-

6.5 TECHNOLOGY ANALYSISAGRICULTURAL PHEROMONES AND INTERNET OF THINGS (IOT)AGRICULTURAL PHEROMONES AND CRISPR

- 6.6 PRICING ANALYSIS: AGRICULTURAL PHEROMONES MARKET, BY TYPE AND REGION

-

6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

-

6.8 PATENT ANALYSIS

-

6.9 TRADE ANALYSISIMPORT SCENARIO OF INSECTICIDESEXPORT SCENARIO OF INSECTICIDES

-

6.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.11 CASE STUDY ANALYSISANTICIMEX’S IOT SOLUTION HELPED CREATE DIGITAL CONNECTED TRAPSRENTOKIL USED IOT SOLUTIONS TO EXPAND ITS CUSTOMER BASE AND IMPROVE CUSTOMER RETENTION

-

6.12 REGULATORY FRAMEWORKREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCOUNTRY-WISE REGULATORY AUTHORITIES- US- Canada- India- Australia- South Africa

- 7.1 INTRODUCTION

-

7.2 SEX PHEROMONESMATING DISRUPTION TO HELP MANAGE INSECT POPULATION

-

7.3 AGGREGATION PHEROMONESAGGREGATION PHEROMONES FIND USE IN MASS-TRAPPING PRACTICES

- 7.4 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 MATING DISRUPTIONHIGH EFFICIENCY TO CONTROL INVASIVE PESTS SUCH AS CODLING MOTHS

-

8.3 DETECTION & MONITORINGRISE IN DETECTION & MONITORING ACTIVITIES IN NORTH AMERICA FOR PEST MANAGEMENT

-

8.4 MASS TRAPPINGHIGH SUPPRESSION OF INSECT POPULATION THROUGH MASS TRAPPING

- 9.1 INTRODUCTION

-

9.2 DISPENSERSCOMPANIES FOCUS ON RESEARCHING ENVIRONMENT-FRIENDLY AND SUSTAINABLE OPTIONS IN DISPENSERS

-

9.3 TRAPSPHEROMONE TRAPS TO BE CONVENIENT AND READY-TO-USE

-

9.4 SPRAYSMICROENCAPSULATED PHEROMONES TO SUPPORT TARGETED AND CONTROLLED RELEASE

- 10.1 INTRODUCTION

-

10.2 FRUITS & NUTSEXTENSIVE RESEARCH ON USE OF PHEROMONE NANOGELS IN PEST MANAGEMENT FOR FRUITS

-

10.3 FIELD CROPSNEW LAUNCHES IN PHEROMONES MARKET TO OFFER MATING DISRUPTION SOLUTIONS FOR FIELD CROPS

-

10.4 VEGETABLE CROPSINSECT ATTACKS PREVALENT IN VEGETABLE CROPS

- 10.5 OTHER CROP TYPES

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Presence of major pheromone companiesCANADA- Semiochemical-based tactics used for pest management coupled with strong foothold in export of agricultural commoditiesMEXICO- Utilization of mating disruption along with government initiatives for development of agricultural sector

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISSPAIN- Major producer and exporter of fruits and vegetablesITALYGERMANY- Among largest markets in EU for fresh fruitsFRANCE- Key initiatives taken by government to reduce pesticide useNETHERLANDS- Established agricultural sector with favorable trading scenarioREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Combined focus on food production and sustainable farming practicesJAPAN- Economically viable option of pheromones to combat large-scale destruction by Japanese beetleINDIA- Pheromone traps to be mostly preferred in India among large landholders of high-value cropsBANGLADESH- Government support policies and initiativesAUSTRALIA- Biosecurity measures taken by governmentREST OF ASIA PACIFIC

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSISARGENTINA- Argentina to witness high demand for pheromone traps to combat corn earwormsBRAZIL- Flourishing agricultural sectorCHILE- Investment in R&D activities to develop pheromone-equipped biopolymers to combat grapevine mothsREST OF SOUTH AMERICA

-

11.6 REST OF THE WORLD (ROW)ROW: RECESSION IMPACT ANALYSISSOUTH AFRICA- Flourishing agricultural sectorOTHERS IN ROW

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS

- 12.3 KEY PLAYER STRATEGIES

- 12.4 ANNUAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT OF KEY PLAYERS

-

12.6 COMPANY EVALUATION QUADRANT (STARTUPS/SMES)PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSSHIN-ETSU CHEMICAL CO., LTD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKOPPERT BIOLOGICAL SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOWAN COMPANY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBIOBEST GROUP NV- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHE WONDERFUL COMPANY LLC- Business overview- Products offered- Recent developments- MnM viewRUSSELL IPM- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewISCA TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTRÉCÉ INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBEDOUKIAN RESEARCH, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPHEROBANK- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF SE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUI & CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINVIVO- Business overview- Products offered- Recent developments- MnM viewBIO CONTROLE- Business overview- Products offered- Recent developments- MnM viewATGC BIOTECH PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERS/STARTUPS/SMESINDORE BIO AGRI INDPUTS & RESEARCH PVT LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSEDQ HEALTHY CROPS SL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLABORATORIOS AGROCHEM, S.L.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNOVAGRICA- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewINTERNATIONAL PHEROMONE SYSTEMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGRI PHERO SOLUTIONZBARRIX AGRO SCIENCES PVT. LTD.PHEROMONE CHEMICALSGAIAGEN TECHNOLOGIES PRIVATE LIMITEDSCYLL'AGRO

- 14.1 INTRODUCTION

-

14.2 AGRICULTURAL BIOLOGICALS MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWAGRICULTURAL BIOLOGICALS MARKET, BY FUNCTIONAGRICULTURAL BIOLOGICALS MARKET, BY REGION

-

14.3 BIOPESTICIDES MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWBIOPESTICIDES MARKET, BY CROP TYPEBIOPESTICIDES MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 AGRICULTURAL PHEROMONES MARKET SNAPSHOT (VALUE), 2023 VS. 2028

- TABLE 3 AGRICULTURAL PHEROMONES MARKET ECOSYSTEM

- TABLE 4 LIST OF MAJOR PATENTS FOR AGRICULTURAL PHEROMONES MARKET, 2018–2022

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 12 AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 13 AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 14 AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 15 SEX PHEROMONES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 16 SEX PHEROMONES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 SEX PHEROMONES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 18 SEX PHEROMONES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 19 AGGREGATION PHEROMONES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 AGGREGATION PHEROMONES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 AGGREGATION PHEROMONES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 22 AGGREGATION PHEROMONES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 23 OTHER AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 OTHER AGRICULTURAL PHEROMONES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 OTHER AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 26 OTHER AGRICULTURAL PHEROMONES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 27 AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 28 AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 29 MATING DISRUPTION FUNCTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 MATING DISRUPTION FUNCTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 DETECTION & MONITORING FUNCTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 DETECTION & MONITORING FUNCTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 MASS TRAPPING FUNCTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 MASS TRAPPING FUNCTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 36 AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 37 AGRICULTURAL PHEROMONE DISPENSERS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 AGRICULTURAL PHEROMONE DISPENSERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 AGRICULTURAL PHEROMONE TRAPS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 AGRICULTURAL PHEROMONE TRAPS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 AGRICULTURAL PHEROMONE SPRAYS MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 AGRICULTURAL PHEROMONE SPRAYS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 44 AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 45 PESTS THAT INFECT FRUIT CROPS

- TABLE 46 AGRICULTURAL PHEROMONES MARKET IN FRUIT & NUT CROPS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 AGRICULTURAL PHEROMONES MARKET IN FRUIT & NUT CROPS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 AGRICULTURAL PHEROMONES MARKET IN FIELD CROPS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 AGRICULTURAL PHEROMONES MARKET IN FIELD CROPS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 AGRICULTURAL PHEROMONES MARKET IN VEGETABLE CROPS, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 AGRICULTURAL PHEROMONES MARKET IN VEGETABLE CROPS, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 AGRICULTURAL PHEROMONES MARKET IN OTHER CROP TYPES, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 AGRICULTURAL PHEROMONES MARKET IN OTHER CROP TYPES, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 AGRICULTURAL PHEROMONES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 AGRICULTURAL PHEROMONES MARKET, BY REGION, 2018–2022 (KT)

- TABLE 57 AGRICULTURAL PHEROMONES MARKET, BY REGION, 2023–2028 (KT)

- TABLE 58 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 65 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 66 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 US: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 71 US: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 72 US: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 73 US: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 US: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 75 US: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 76 US: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 77 US: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 79 CANADA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 81 CANADA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 CANADA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 83 CANADA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 84 CANADA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 85 CANADA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 86 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 87 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 88 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 89 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 91 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 92 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 93 MEXICO: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 101 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 102 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 103 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 104 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 105 EUROPE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 107 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 108 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 109 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 111 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 112 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 113 SPAIN: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 114 ITALY: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 115 ITALY: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 116 ITALY: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 117 ITALY: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 ITALY: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 119 ITALY: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 120 ITALY: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 121 ITALY: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 123 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 124 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 127 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 128 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 129 GERMANY: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 131 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 132 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 133 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 135 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 136 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 137 FRANCE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 139 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 140 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 141 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 143 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 144 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 145 NETHERLANDS: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 147 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 151 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 152 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 153 REST OF EUROPE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 157 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 161 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 162 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 166 CHINA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 167 CHINA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 168 CHINA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 169 CHINA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 CHINA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 171 CHINA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 172 CHINA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 173 CHINA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 174 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 175 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 176 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 177 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 178 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 179 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 180 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 181 JAPAN: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 182 INDIA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 183 INDIA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 184 INDIA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 185 INDIA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 186 INDIA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 187 INDIA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 188 INDIA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 189 INDIA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 190 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 191 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 192 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 193 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 194 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 195 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 196 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 197 BANGLADESH: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 198 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 199 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 200 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 201 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 202 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 203 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 204 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 205 AUSTRALIA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 214 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 215 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 216 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 217 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 218 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 219 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 220 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 221 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 222 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 223 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 224 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 225 SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 226 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 227 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 228 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 229 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 230 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 231 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 232 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 233 ARGENTINA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 234 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 235 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 236 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 237 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 238 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 239 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 240 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 241 BRAZIL: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 242 CHILE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 243 CHILE: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 244 CHILE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 245 CHILE: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 246 CHILE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 247 CHILE: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 248 CHILE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 249 CHILE: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 250 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 251 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 252 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 253 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 254 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 255 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 256 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 257 REST OF SOUTH AMERICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 258 ROW: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 259 ROW: AGRICULTURAL PHEROMONES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 260 ROW: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 261 ROW: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 262 ROW: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 263 ROW: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 264 ROW: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (KT)

- TABLE 265 ROW: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (KT)

- TABLE 266 ROW: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 267 ROW: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2 023–2028 (USD MILLION)

- TABLE 268 ROW: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 269 ROW: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 270 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2018–2022 (USD MILLION)

- TABLE 271 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 272 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 273 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 274 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 275 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 276 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 277 SOUTH AFRICA: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 278 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2 018–2022 (USD MILLION)

- TABLE 279 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 280 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 281 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 282 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2018–2022 (USD MILLION)

- TABLE 283 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023–2028 (USD MILLION)

- TABLE 284 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 285 OTHERS IN ROW: AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 286 AGRICULTURAL PHEROMONES MARKET: DEGREE OF COMPETITION

- TABLE 287 COMPANY FOOTPRINT, BY FUNCTION

- TABLE 288 COMPANY FOOTPRINT, BY CROP TYPE

- TABLE 289 COMPANY FOOTPRINT, BY REGION

- TABLE 290 OVERALL COMPANY FOOTPRINT

- TABLE 291 DETAILED LIST OF KEY STARTUP/SMES

- TABLE 292 COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

- TABLE 293 AGRICULTURAL PHEROMONES MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 294 AGRICULTURAL PHEROMONES MARKET: DEALS, 2018–2023

- TABLE 295 SHIN-ETSU CHEMICAL CO., LTD: BUSINESS OVERVIEW

- TABLE 296 SHIN-ETSU CHEMICAL CO., LTD: PRODUCTS OFFERED

- TABLE 297 KOPPERT BIOLOGICAL SYSTEMS: BUSINESS OVERVIEW

- TABLE 298 KOPPERT BIOLOGICAL SYSTEMS: PRODUCTS OFFERED

- TABLE 299 KOPPERT BIOLOGICAL SYSTEMS: DEALS

- TABLE 300 GOWAN COMPANY: BUSINESS OVERVIEW

- TABLE 301 GOWAN COMPANY: PRODUCTS OFFERED

- TABLE 302 GOWAN COMPANY: DEALS

- TABLE 303 BIOBEST GROUP NV: BUSINESS OVERVIEW

- TABLE 304 BIOBEST GROUP NV: PRODUCTS OFFERED

- TABLE 305 BIOBEST GROUP NV: DEALS

- TABLE 306 THE WONDERFUL COMPANY LLC: BUSINESS OVERVIEW

- TABLE 307 THE WONDERFUL COMPANY LLC: PRODUCTS OFFERED

- TABLE 308 THE WONDERFUL COMPANY LLC: PRODUCT LAUNCHES

- TABLE 309 THE WONDERFUL COMPANY LLC: DEALS

- TABLE 310 RUSSELL IPM: BUSINESS OVERVIEW

- TABLE 311 RUSSELL IPM: PRODUCTS OFFERED

- TABLE 312 ISCA TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 313 ISCA TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 314 ISCA TECHNOLOGIES: DEALS

- TABLE 315 TRÉCÉ INCORPORATED: BUSINESS OVERVIEW

- TABLE 316 TRÉCÉ INCORPORATED: PRODUCT OFFERINGS

- TABLE 317 TRÉCÉ INCORPORATED: PRODUCT LAUNCHES

- TABLE 318 BEDOUKIAN RESEARCH, INC.: BUSINESS OVERVIEW

- TABLE 319 BEDOUKIAN RESEARCH, INC.: PRODUCTS OFFERED

- TABLE 320 BEDOUKIAN RESEARCH, INC.: DEALS

- TABLE 321 PHEROBANK: BUSINESS OVERVIEW

- TABLE 322 PHEROBANK: PRODUCTS OFFERED

- TABLE 323 PHEROBANK: PRODUCT LAUNCHES

- TABLE 324 BASF SE: BUSINESS OVERVIEW

- TABLE 325 BASF SE: PRODUCTS OFFERED

- TABLE 326 BASF SE: PRODUCT LAUNCHES

- TABLE 327 MITSUI & CO., LTD.: BUSINESS OVERVIEW

- TABLE 328 MITSUI & CO., LTD.: PRODUCTS OFFERED

- TABLE 329 MITSUI & CO., LTD.: DEALS

- TABLE 330 INVIVO: BUSINESS OVERVIEW

- TABLE 331 INVIVO: PRODUCT OFFERINGS

- TABLE 332 INVIVO: DEALS

- TABLE 333 BIO CONTROLE: BUSINESS OVERVIEW

- TABLE 334 BIO CONTROLE: PRODUCT OFFERINGS

- TABLE 335 ATGC BIOTECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 336 ATGC BIOTECH PVT. LTD.: PRODUCTS OFFERED

- TABLE 337 INDORE BIO AGRI INDPUTS & RESEARCH PVT LTD.: BUSINESS OVERVIEW

- TABLE 338 INDORE BIO AGRI INDPUTS & RESEARCH PVT LTD.: PRODUCTS OFFERED

- TABLE 339 SEDQ HEALTHY CROPS SL: BUSINESS OVERVIEW

- TABLE 340 SEDQ HEALTHY CROPS SL.: PRODUCTS OFFERED

- TABLE 341 LABORATORIOS AGROCHEM, S.L.: BUSINESS OVERVIEW

- TABLE 342 LABORATORIOS AGROCHEM, S.L.: PRODUCTS OFFERED

- TABLE 343 NOVAGRICA: BUSINESS OVERVIEW

- TABLE 344 NOVAGRICA: PRODUCTS OFFERED

- TABLE 345 INTERNATIONAL PHEROMONE SYSTEMS: BUSINESS OVERVIEW

- TABLE 346 INTERNATIONAL PHEROMONE SYSTEMS: PRODUCTS OFFERED

- TABLE 347 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2017–2020 (USD MILLION)

- TABLE 348 AGRICULTURAL BIOLOGICALS MARKET, BY FUNCTION, 2021–2027 (USD MILLION)

- TABLE 349 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2017–2020 (USD MILLION)

- TABLE 350 AGRICULTURAL BIOLOGICALS MARKET, BY REGION, 2021–2027 (USD MILLION)

- TABLE 351 BIOPESTICIDES MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 352 BIOPESTICIDES MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 353 BIOPESTICIDES MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 354 BIOPESTICIDES MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 AGRICULTURAL PHEROMONES MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION: SUPPLY SIDE

- FIGURE 5 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION: DEMAND SIDE

- FIGURE 6 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 7 AGRICULTURAL PHEROMONES MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATES, 2011–2021

- FIGURE 11 GLOBAL GDP, 2011–2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON AGRICULTURAL PHEROMONES MARKET

- FIGURE 13 AGRICULTURAL PHEROMONES MARKET: PREVIOUS FORECAST VS RECESSION IMPACT FORECAST

- FIGURE 14 AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 AGRICULTURAL PHEROMONES MARKET, BY FUNCTION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 AGRICULTURAL PHEROMONES MARKET SHARE (VALUE), BY REGION, 2022

- FIGURE 19 INCREASE IN ADOPTION OF INTEGRATED PEST MANAGEMENT PRACTICES AND SUSTAINABLE AGRICULTURE TO PROPEL MARKET

- FIGURE 20 US ACCOUNTED FOR LARGEST SHARE IN NORTH AMERICAN MARKET IN 2022

- FIGURE 21 SEX PHEROMONES DOMINATED MARKET DURING FORECAST PERIOD IN 2022

- FIGURE 22 MATING DISRUPTION LED AGRICULTURAL PHEROMONES MARKET IN 2022

- FIGURE 23 US DOMINATED AGRICULTURAL PHEROMONES MARKET GROWTH IN 2022

- FIGURE 24 TOP FIVE COUNTRIES WITH LARGEST AREA UNDER ORGANIC AGRICULTURE LAND, 2021

- FIGURE 25 POPULATION GROWTH TREND, 1950–2050 (MILLION)

- FIGURE 26 AGRICULTURAL PHEROMONES MARKET DYNAMICS

- FIGURE 27 SEMIOCHEMICALS MARKET, 2016–2026 (USD MILLION)

- FIGURE 28 SUPPLY CHAIN ANALYSIS

- FIGURE 29 AGRICULTURAL PHEROMONES MARKET MAP

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 PRICING TREND OF AGRICULTURAL PHEROMONES, BY REGION, 2018–2022 (USD/KG)

- FIGURE 32 PRICING TREND OF AGRICULTURAL PHEROMONES, BY TYPE, 2018–2022 (USD/KG)

- FIGURE 33 TRENDS/DISRUPTIONS IMPACTING REVENUE SHIFT

- FIGURE 34 LIST OF TOP PATENTS, 2012–2022

- FIGURE 35 INSECTICIDE IMPORT VALUE, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 36 INSECTICIDE EXPORT VALUE, BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 37 AGRICULTURAL PHEROMONES MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 38 AGRICULTURAL PHEROMONES MARKET, BY FORM, 2023 VS. 2028 (USD MILLION)

- FIGURE 39 AGRICULTURAL PHEROMONES MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 40 AGRICULTURAL PHEROMONES MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 41 AGRICULTURAL PHEROMONES MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 42 NETHERLANDS TO BE FASTEST GROWING REGION FOR AGRICULTURAL PHEROMONES MARKET DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: AGRICULTURAL PHEROMONES MARKET SNAPSHOT

- FIGURE 44 NORTH AMERICA: INFLATION RATES, BY COUNTRY, 2018–2021

- FIGURE 45 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 46 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 48 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 49 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 50 SOUTH AMERICA: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 51 SOUTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 52 ROW: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 53 ROW: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 54 ANNUAL REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 55 AGRICULTURAL PHEROMONES MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 56 AGRICULTURAL PHEROMONES MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUPS/SMES)

- FIGURE 57 SHIN-ETSU CHEMICAL CO., LTD: COMPANY SNAPSHOT

- FIGURE 58 BASF SE: COMPANY SNAPSHOT

- FIGURE 59 MITSUI & CO., LTD: COMPANY SNAPSHOT

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural pheromones market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the EU Commission, European Food Safety Authority (EFSA), German Federal Institute for Risk Assessment, Food Standards Australia New Zealand (FSANZ), Food Safety and Standards Authority of India (FSSAI), Ministry of Agriculture and Rural Affairs (MARA), Ministry of Agriculture, Forestry, and Fisheries (MAFF) in Japan and Department of Agriculture, Land Reform, and Rural Development (DALRRD) were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade

Primary Research

The agricultural pheromones market comprises several stakeholders, including the finance/procurement department playing a crucial role in managing the financial aspects of purchasing agricultural pheromones. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, agricultural pheromones manufacturers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of crop protection products manufacturers through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

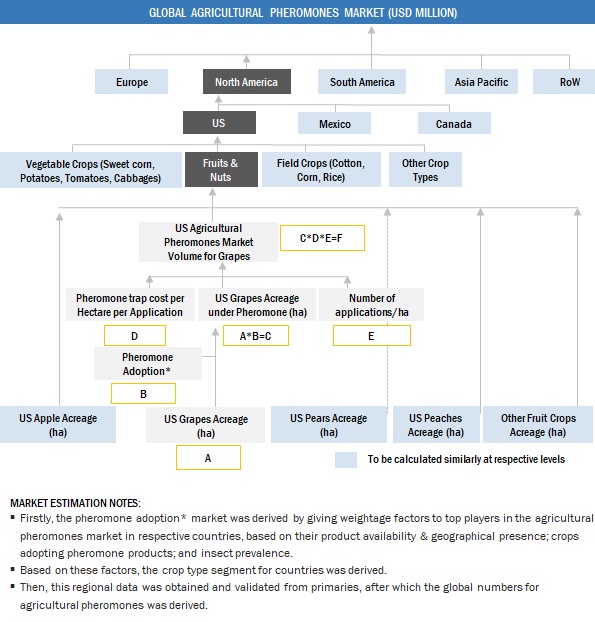

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the agricultural pheromones market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The agricultural pheromones value chain and market size in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural pheromones market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for this study.

Market size estimation: Bottom-up approach

- In the bottom-up approach, form, mode of application, crop type, function and region were added up to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the agricultural pheromones market from the revenues of key players (companies) and their product share in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: top-down approach

For the calculation of each type of specific market segment, the most appropriate, immediate parent and peer market sizes were used for implementing the top-down procedure.

Secondary reports from various sources like company revenues, associations, and regulatory bodies were considered. Further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of labs, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall agricultural pheromones market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Agricultural pheromones are chemical substances that plants or insects produce to interact with one another in agricultural settings for a variety of functions. These pheromones can communicate reproductive behaviour, establish territory, or attract or repel pests. Industries can create efficient plans to eliminate pests, improve crop pollination, and raise overall agricultural output in a targeted and ecologically responsible way by harnessing and using these pheromones.

Key Stakeholders

- Insect pheromone manufacturers

- Insect pheromone product traders, distributors, suppliers, and service providers

- Crop protection product manufacturers

- Raw material suppliers and technology providers to manufacturers

- Government and research organizations

- Agricultural institutes and universities

- Associations and industry bodies

- Government, legislative, and regulatory bodies

Report Objectives

Market Intelligence

- Determining and projecting the size of the global agricultural pheromones market, with respect to based on type, function, mode of application, crop type and regional markets, over a five-year period, ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the agricultural pheromones market.

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the global agricultural pheromones market

-

Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global agricultural pheromones market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to the company-specific scientific needs.

- Further breakdown of the Rest of European agricultural pheromones market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Pheromones Market