Persulfates Market by Type (Ammonium, Sodium, & Potassium),End-Use Industry (Polymer, Electronics and Cosmetic & Personal Care), Application (Polymer Initiator, Oxidation, bleaching and Sizing Agent) and Region - Global Forecast to 2025

Updated on : April 04, 2024

Persulfates Market

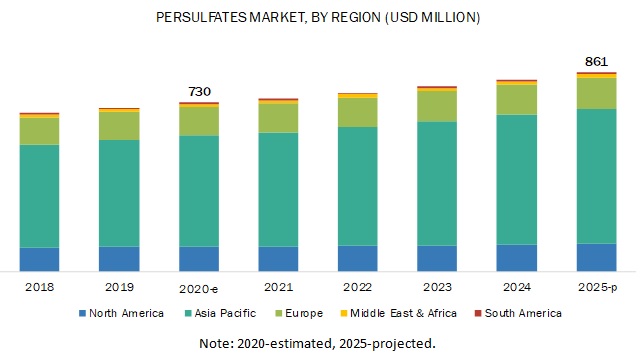

Persulfates market was valued at USD 730 million in 2020 and is projected to reach USD 861 million by 2025, growing at 3.4% cagr from 2020 to 2025. Persulfates are used for different functions across various end-use industries. They are used as oxidizers, free radical generators, and chain initiators in polymer manufacturing. In the electronics industry, they are used as a cleaning agent and as an etchant. Persulfates are also used in the formulations of skincare and hair care products in the cosmetics & personal care industry. Other uses include as a cleaning agent in soil remediation and as a viscosity breaker for hydraulic fracturing in the oil & gas industry.

Growth in the application areas mentioned above is expected to drive the consumption of persulfates in these end-use industries. However, with the ongoing COVID-19 outbreak, the end-use industries will be slowing down, except from some applications such as the gloves where latex polymer is used for manufacturing, polymer in food packaging and tissue papers. These slowing down of end-use industries will have an impact on the persulfate demand until 2021. China being the epicentre of COVUD-19 has also impacted the persulfates market as more the 70% of the persulfates production capacity is in China.

Persulfates Market Dynamics

Sodium persulfate is the fastest-growing type in the persulfate market during the forecast period.

The sodium persulfate segment is projected to lead the global persulfates market during the forecast period. Sodium persulfate is a strong oxidizing agent and is used extensively in polymers. Moreover, it is used as an etchant and cleaning agent in PCB manufacturing. It is the second most expensive chemical after ammonium persulfate. The demand for sodium persulfate in cosmetics & personal care end-use industry is projected to grow at the highest rate during the forecast period, in terms of value.

Water treatment industry is the fastest-growing end-use industry in the persulfate market during the forecast period.

By end-use industry, the water treatment segment is likely to grow at the highest CAGR between 2020 and 2025. Persulfates are used as oxidizing agents for the treatment of water. With the increasing concerns about the environment, the consumption of persulfates in the water treatment industry is projected to grow fastest during the forecast period.

APAC is projected to be the fastest-growing persulfates market during the forecast period

The persulfates market in the Asia Pacific is expected to grow at the highest CAGR between 2020 and 2025. Increasing demand from end-use industries such as electronics, polymer manufacturing, and cosmetics & personal care is expected to drive the demand for persulfates in APAC. Newer applications of persulfates such as water treatment and soil remediation are projected to grow at high rates during the forecast period. Increasing concerns regarding soil pollution are expected to boost the consumption of persulfates in soil remediation in APAC.

Persulfates Market Players

The key companies profiled in the global persulfates market research report are PeroxyChem (US), United Initiators (Germany), Mitsubishi Gas Chemical Company (Japan), Ak-Kim Kimya (Turkey), Adeka Corporation (Japan), and Fujian Zhanhua Chemical Company (China).

Persulfates Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 730 million |

|

Revenue Forecast in 2025 |

USD 861 million |

|

CAGR |

3.4% |

|

Years Considered |

2018–2025 |

|

Base year |

2019 |

|

Forecast period |

2020–2025 |

|

Units Considered |

Value (USD Million) and Volume (Ton) |

|

Segments |

By Type, End-Use Industry and Application |

|

Regions |

APAC, Europe, North America, South America, and the Middle East & Africa |

|

Companies |

PeroxyChem (US), United Initiators (Germany), Mitsubishi Gas Chemical Company (Japan), Ak-Kim Kimya (Turkey), Adeka Corporation (Japan), Fujian Zhanhua Chemicals (China)and 13 other players |

This research report categorizes the global persulfates market based on type, end-use industry and application, and region.

Persulfates Market based on Type

- Ammonium Persulfate

- Sodium Persulfate

- Potassium Persulfate

Persulfates Market based on End-use industry

- Polymers

- Electronics

- Cosmetics & Personal Care

- Pulp, Paper & Textile

- Water Treatment

- Oil & Gas

- Soil Remediation

- Others

Persulfates Market based on Application

- Polymer Initiator

- Oxidation, Bleaching & Sizing Agent

- Down-hole

- Others

Persulfates Market based on Region

- APAC

- North America

- Europe

- South America

- Middle East & Africa

The market is further analyzed for the key countries in each of these regions.

Recent Developments

- In 2020, Evonik has acquired PeroxyChem, which is a manufacturer of hydrogen peroxide, peracetic acid and persulfates for USD 625 million.

- In 2019, United Initiators opened a new plant with 10 KT annual production capacity of sodium persulfates in Huaibei, China.

- In 2018, United Initiators entered into a joint venture with VR Persulfates from India for the manufacturing of persulfates.

- In 2017, PeroxyChem launched the Klozur series of sodium persulfate, as it is expected to be advantageous for use in-situ chemical oxidation (ISCO).

Key questions addressed by the report

- This report segments the global persulfates market comprehensively and provides the closest approximations of sizes for the overall market and sub-segments across various verticals and regions.

- This report will help the stakeholders understand the persulfates market, in terms of volume and value, across regions, and at the global level.

- The report will help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

- This report will help stakeholders understand the major competitors and gain insights to enhance their positions in the market

- This report will help stakeholders to understand the persulfates market in 2020 and 2021 with the impact of COVID-19 taking into consideration.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of persulfates?

What will be the impact of COVID-19 in the persulfates market?

What are the different types of persulfates?

What are the major end-use industries of the persulfates market?

What are the different types of applications?

Which countries are the major exporters of persulfates?

How consolidated is the persulfates industry?

Who are the major manufactures of persulfates?

What are the biggest restraints for the persulfates market?

What are the new opportunities in the persulfates market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 22)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

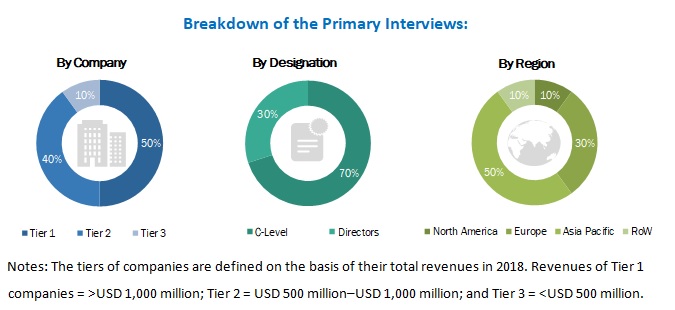

2.1.2.2 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 DEMAND ESTIMATION BASED ON CAPACITY, UTILIZATION RATES, AND IMPORT DATA BY KEY COUNTRIES

2.2.2 BASED ON COMPANY REVENUE

2.2.3 BASED ON COUNTRY-WISE DEMAND, BOTTOM-UP APPROACH

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 28)

4 PREMIUM INSIGHTS (Page No. - 31)

4.1 SIGNIFICANT OPPORTUNITIES IN THE PERSULFATES MARKET

4.2 PERSULFATES MARKET, BY TYPE

4.3 PERSULFATES MARKET, BY END-USE INDUSTRY

4.4 PERSULFATES MARKET, BY APPLICATION

4.5 PERSULFATES MARKET IN APAC, BY END-USE INDUSTRY AND COUNTRY, 2019

4.6 PERSULFATES MARKET, BY MAJOR COUNTRIES

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Growing demand from end-use industries

5.2.2 RESTRAINTS

5.2.2.1 Issues in storage & transportation of persulfates

5.2.3 OPPORTUNITIES

5.2.3.1 Usage in food applications

5.2.3.2 Usage in environmental application

5.2.4 CHALLENGES

5.2.4.1 Surplus capacity of persulfates in China

5.2.4.2 Impact of COVID-19 outbreak

5.3 PORTER’S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 YC, YCC DRIVERS

5.5 PERSULFATES PATENT ANALYSIS

5.5.1 METHODOLOGY

5.5.2 DOCUMENT TYPE

5.5.3 INSIGHT

5.5.4 JURISDICTION ANALYSIS

5.5.5 TOP APPLICANTS

6 PERSULFATES MARKET, BY TYPE (Page No. - 45)

6.1 INTRODUCTION

6.2 AMMONIUM PERSULFATE

6.2.1 IT IS LARGELY USED IN POLYMER APPLICATIONS

6.3 SODIUM PERSULFATE

6.3.1 STEADY DEMAND IS EXPECTED DURING THE FORECAST PERIOD

6.4 POTASSIUM PERSULFATE

6.4.1 THIS PERSULFATE TYPE IS WIDELY USED IN THE COSMETICS & PERSONAL CARE INDUSTRY

7 PERSULFATES MARKET, BY APPLICATION (Page No. - 51)

7.1 INTRODUCTION

7.2 POLYMER INITIATOR

7.2.1 POLYMER INITIATOR IS THE LARGEST APPLICATION OF PERSULFATES

7.3 OXIDATION, BLEACHING AND SIZING AGENT

7.3.1 THE GROWING PCB MANUFACTURING INDUSTRY IS FUELING THE MARKET IN THIS SEGMENT

7.4 DOWN-HOLE

7.4.1 FLUCTUATING CRUDE OIL PRICES WOULD AFFECT THE MARKET IN THIS SEGMENT

7.5 OTHERS

8 PERSULFATES MARKET, BY END-USE INDUSTRY (Page No. - 57)

8.1 INTRODUCTION

8.2 POLYMER

8.2.1 PERSULFATES ARE USED AS INITIATORS IN THE POLYMERIZATION OF LATEX AND SYNTHETIC RUBBER

8.3 ELECTRONICS

8.3.1 INCREASING PCB MANUFACTURING IS FAVORABLE FOR THE MARKET IN THIS SEGMENT

8.4 COSMETICS & PERSONAL CARE

8.4.1 AMMONIUM, SODIUM, AND POTASSIUM PERSULFATES ARE EXTENSIVELY USED AS BOOSTERS FOR HAIR BLEACHES AND OXIDIZATION OF HAIR DYES

8.5 PULP, PAPER, & TEXTILE

8.5.1 PERSULFATES ARE USED IN THE BLEACHING OF TEXTILES

8.6 WATER TREATMENT

8.6.1 THE USE OF PERSULFATES FOR WATER TREATMENT IS EMERGING

8.7 SOIL REMEDIATION

8.7.1 PERSULFATES ARE USED TO DECONTAMINATE THE SOIL

8.8 OIL & GAS

8.8.1 THE DEMAND FOR PERSULFATES IS EXPECTED TO GROW DUE TO THE EXPLORATION OF POTENTIAL RESERVES

8.9 OTHERS

9 PERSULFATES MARKET, BY REGION (Page No. - 68)

9.1 INTRODUCTION

9.2 APAC

9.2.1 CHINA

9.2.1.1 Large-scale polymer industry is expected to drive the market

9.2.2 JAPAN

9.2.2.1 The cosmetics & personal care industry is the fastest-growing end-use industry in the country

9.2.3 INDIA

9.2.3.1 The increasing demand for polymers is likely to drive the market

9.2.4 SOUTH KOREA

9.2.4.1 There is a growing popularity of South Korean cosmetic products in the international market

9.2.5 TAIWAN

9.2.5.1 There are growing exports of cosmetic products from the country

9.2.6 THAILAND

9.2.6.1 Thailand is the fastest-growing persulfates market in the region

9.2.7 REST OF APAC

9.3 NORTH AMERICA

9.3.1 US

9.3.1.1 The electronics industry is the market driver

9.3.2 CANADA

9.3.2.1 The growing cosmetics & personal care industry is the governing factor for the market

9.3.3 MEXICO

9.3.3.1 The increasing demand for cosmetic products is expected to propel the demand for persulfates

9.4 EUROPE

9.4.1 GERMANY

9.4.1.1 The growing demand for polymers in the country is influencing the market positively

9.4.2 FRANCE

9.4.2.1 The cosmetics & personal care industry of the country is boosting the persulfates market

9.4.3 ITALY

9.4.3.1 The cosmetics & personal care industry of Italy is growing steadily

9.4.4 TURKEY

9.4.4.1 The increasing exports of cosmetic products from Turkey would increase the demand for persulfates

9.4.5 REST OF EUROPE

9.5 MIDDLE EAST & AFRICA

9.5.1 IRAN

9.5.1.1 The polymer industry is the major market driver

9.5.2 SOUTH AFRICA

9.5.2.1 The increasing demand for polymers is driving the persulfates market

9.5.3 REST OF MIDDLE EAST & AFRICA

9.6 SOUTH AMERICA

9.6.1 BRAZIL

9.6.1.1 Cosmetics & personal care is the prime end-use industry of persulfates

9.6.2 ARGENTINA

9.6.2.1 The economic recession in the country is estimated to slow down the growth of the persulfates market

9.6.3 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE (Page No. - 135)

10.1 MARKET SHARE ANALYSIS

10.2 IMPACT OF COVID-19 ON PERSULFATES MARKET

11 COMPANY PROFILES (Page No. - 139)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

11.1 PEROXYCHEM (ACQUIRED BY EVONIK)

11.2 UNITED INITIATORS

11.3 MITSUBISHI GAS CHEMICAL COMPANY

11.4 AK-KIM KIMYA

11.5 ADEKA CORPORATION

11.6 MERCK

11.7 HEBEI YATAI ELECTROCHEMISTRY COMPANY

11.8 HEBEI JIHENG GROUP

11.9 FUJIAN ZHANHUA CHEMICAL

11.10 DUPONT

11.11 STARS CHEMICAL (YONGAN)

11.12 LANXESS

11.13 ABC CHEMICALS (SHANGHAI)

11.14 SHAANXI BAOHUA TECHNOLOGIES

11.15 XIAMEN SINCHEM IMP&EXP

11.16 HENGSHUI JIAMU

11.17 TONGLING HUAXING CHEMICAL

11.18 SHANGHAI ANSIN CHEMICAL

11.19 POWDER PACK CHEM

11.20 FUJIAN JIANOU YONGSHENG INDUSTRY

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 158)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (212 Tables)

TABLE 1 LIST OF PATENTS BY SICHUAN NORMAL UNIVERSITY

TABLE 2 LIST OF PATENTS BY DOW GLOBAL TECHNOLOGIES LLC

TABLE 3 LIST OF PATENTS BY HENKEL AG & COMPANY

TABLE 4 PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 5 PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 6 AMMONIUM PERSULFATE MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 7 AMMONIUM PERSULFATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 8 SODIUM PERSULFATE MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 9 SODIUM PERSULFATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 POTASSIUM PERSULFATE MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 11 POTASSIUM PERSULFATE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 12 PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 13 PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 14 PERSULFATES MARKET SIZE IN POLYMER INITIATOR APPLICATION, BY REGION, 2018–2025 (TON)

TABLE 15 PERSULFATES MARKET SIZE IN POLYMER INITIATOR APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 16 PERSULFATES MARKET SIZE IN OXIDATION, BLEACHING AND SIZING AGENT APPLICATION, BY REGION, 2018–2025 (TON)

TABLE 17 PERSULFATES MARKET SIZE IN OXIDATION, BLEACHING AND SIZING AGENT APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 PERSULFATES MARKET SIZE IN DOWN-HOLE APPLICATION, BY REGION, 2018–2025 (TON)

TABLE 19 PERSULFATES MARKET SIZE IN DOWN-HOLE APPLICATION, BY REGION, 2018–2025 (USD MILLION)

TABLE 20 PERSULFATES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

TABLE 21 PERSULFATES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 23 PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 24 PERSULFATES MARKET SIZE IN POLYMER END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 25 PERSULFATES MARKET SIZE IN POLYMER END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 PERSULFATES MARKET SIZE IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 27 PERSULFATES MARKET SIZE IN ELECTRONICS END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 28 PERSULFATES MARKET SIZE IN COSMETICS & PERSONAL CARE END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 29 PERSULFATES MARKET SIZE IN COSMETICS & PERSONAL CARE END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 PERSULFATES MARKET SIZE IN PULP, PAPER, & TEXTILE END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 31 PERSULFATES MARKET SIZE IN PULP, PAPER, & TEXTILE END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 PERSULFATES MARKET SIZE IN WATER TREATMENT END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 33 PERSULFATES MARKET SIZE IN WATER TREATMENT END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 PERSULFATES MARKET SIZE IN SOIL REMEDIATION END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 35 PERSULFATES MARKET SIZE IN SOIL REMEDIATION END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 36 PERSULFATES MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 2018–2025 (TON)

TABLE 37 PERSULFATES MARKET SIZE IN OIL & GAS END-USE INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 PERSULFATES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (TON)

TABLE 39 PERSULFATES MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2018–2025 (USD MILLION)

TABLE 40 PERSULFATES MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 41 PERSULFATES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 42 APAC: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 43 APAC: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 APAC: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 45 APAC: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 46 APAC: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 47 APAC: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 48 APAC: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 49 APAC: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 50 CHINA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 51 CHINA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 52 CHINA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 53 CHINA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 54 CHINA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 55 CHINA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 56 JAPAN: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 57 JAPAN: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 58 JAPAN: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 59 JAPAN: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 60 JAPAN: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 61 JAPAN: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 62 INDIA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 63 INDIA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 INDIA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 65 INDIA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 66 INDIA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 67 INDIA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 68 SOUTH KOREA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 69 SOUTH KOREA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 SOUTH KOREA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 71 SOUTH KOREA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 72 SOUTH KOREA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 73 SOUTH KOREA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 TAIWAN: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 75 TAIWAN: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 76 TAIWAN: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 77 TAIWAN: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 78 TAIWAN: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 79 TAIWAN: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 THAILAND: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 81 THAILAND: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 THAILAND: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 83 THAILAND: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 84 THAILAND: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 85 THAILAND: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 REST OF APAC: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 87 REST OF APAC: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 88 REST OF APAC: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 89 REST OF APAC: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 90 REST OF APAC: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 91 REST OF APAC: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 93 NORTH AMERICA: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 95 NORTH AMERICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 97 NORTH AMERICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 98 NORTH AMERICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 99 NORTH AMERICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 100 US: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 101 US: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 US: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 103 US: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 104 US: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 105 US: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 106 CANADA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 107 CANADA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 108 CANADA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 109 CANADA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 110 CANADA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 111 CANADA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 112 MEXICO: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 113 MEXICO: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 MEXICO: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 115 MEXICO: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 116 MEXICO: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 117 MEXICO: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 118 EUROPE: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 119 EUROPE: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 120 EUROPE: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 121 EUROPE: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 EUROPE: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 123 EUROPE: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 124 EUROPE: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 125 EUROPE: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 126 GERMANY: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 127 GERMANY: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 128 GERMANY: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 129 GERMANY: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 130 GERMANY: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 131 GERMANY: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 132 FRANCE: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 133 FRANCE: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 134 FRANCE: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 135 FRANCE: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 136 FRANCE: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 137 FRANCE: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 138 ITALY: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 139 ITALY: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 140 ITALY: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 141 ITALY: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 142 ITALY: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 143 ITALY: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 144 TURKEY: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 145 TURKEY: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 146 TURKEY: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 147 TURKEY: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 148 TURKEY: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 149 TURKEY: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 150 REST OF EUROPE: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 151 REST OF EUROPE: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 152 REST OF EUROPE: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 153 REST OF EUROPE: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 154 REST OF EUROPE: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 155 REST OF EUROPE: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 156 PERSULFATES MARKET SIZE IN MIDDLE EAST & AFRICA, BY COUNTRY, 2018–2025 (TON)

TABLE 157 PERSULFATES MARKET SIZE IN MIDDLE EAST & AFRICA, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 158 MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 159 MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 160 MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 161 MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 162 MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 163 MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 164 IRAN: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 165 IRAN: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 166 IRAN: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 167 IRAN: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 168 IRAN: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 169 IRAN: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 170 SOUTH AFRICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 171 SOUTH AFRICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 172 SOUTH AFRICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 173 SOUTH AFRICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 174 SOUTH AFRICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 175 SOUTH AFRICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 177 REST OF MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 179 REST OF MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 180 REST OF MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 181 REST OF MIDDLE EAST & AFRICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 182 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 183 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 184 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 185 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 186 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY,2018–2025 (TON)

TABLE 187 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 188 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 189 SOUTH AMERICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 190 BRAZIL: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 191 BRAZIL: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 192 BRAZIL: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 193 BRAZIL: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 194 BRAZIL: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 195 BRAZIL: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 196 ARGENTINA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 197 ARGENTINA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 198 ARGENTINA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 199 ARGENTINA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 200 ARGENTINA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 201 ARGENTINA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 202 REST OF SOUTH AMERICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (TON)

TABLE 203 REST OF SOUTH AMERICA: PERSULFATES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 204 REST OF SOUTH AMERICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (TON)

TABLE 205 REST OF SOUTH AMERICA: PERSULFATES MARKET SIZE, BY END-USE INDUSTRY, 2018–2025 (USD MILLION)

TABLE 206 REST OF SOUTH AMERICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 207 REST OF SOUTH AMERICA: PERSULFATES MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 208 MARKET SHARE OF KEY PERSULFATE PLAYERS

TABLE 209 PRODUCTION CAPACITIES OF PERSULFATES MANUFACTURERS

TABLE 210 PRODUCTION CAPACITIES, BY REGION

TABLE 211 EXPORT OF PERSULFATES FROM CHINA, 2017–2018 (KILOTON)

TABLE 212 IMPACT OF COVID-19 ON END-USE INDUSTRIES

LIST OF FIGURES (38 Figures)

FIGURE 1 PERSULFATES MARKET SEGMENTATION

FIGURE 2 PERSULFATES MARKET: RESEARCH DESIGN

FIGURE 3 MARKET SIZE ESTIMATION:BASED ON CAPACITY, UTILIZATION RATES, AND IMPORT DATA BY KEY COUNTRIES

FIGURE 4 MARKET SIZE ESTIMATION: COMPANY REVENUE

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND IN INDIA

FIGURE 6 PERSULFATES MARKET: DATA TRIANGULATION

FIGURE 7 SODIUM PERSULFATE ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2019

FIGURE 8 POLYMER TO BE THE LARGEST END-USE INDUSTRY OF PERSULFATES BETWEEN 2020 AND 2025

FIGURE 9 APAC DOMINATED THE PERSULFATES MARKET IN 2019

FIGURE 10 APAC TO OFFER HIGH GROWTH OPPORTUNITIES FOR PERSULFATES MARKET PLAYERS BETWEEN 2020 AND 2025

FIGURE 11 SODIUM PERSULFATE TO BE THE LARGEST SEGMENT

FIGURE 12 POLYMER TO BE THE LARGEST END-USE INDUSTRY OF PERSULFATES

FIGURE 13 POLYMER INITIATOR TO ACCOUNT FOR THE LARGEST MARKET SHARE

FIGURE 14 POLYMER SEGMENT AND CHINA ACCOUNTED FOR THE LARGEST SHARES

FIGURE 15 THAILAND TO GROW AT THE FASTEST RATE

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PERSULFATES MARKET

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS OF PERSULFATES MARKET

FIGURE 18 PATENT COUNT OVER THE LAST 5 YEARS

FIGURE 19 PUBLICATION TRENDS - LAST 5 YEARS

FIGURE 20 PATENTS BY JURISDICTION

FIGURE 21 PATENTS BY APPLICANTS

FIGURE 22 SODIUM PERSULFATE IS THE LARGEST TYPE

FIGURE 23 PERSULFATES MARKET SHARE, BY TYPE, 2019, IN TERMS OF VALUE

FIGURE 24 PERSULFATES MARKET SHARE, BY APPLICATION (IN TERMS OF VALUE , 2019)

FIGURE 25 POLYMER INITIATOR IS THE LARGEST APPLICATION OF PERSULFATES

FIGURE 26 PERSULFATES MARKET SHARE, BY END-USE INDUSTRY (IN TERMS OF VALUE IN 2019)

FIGURE 27 POLYMER TO BE THE LARGEST END-USE INDUSTRY OF PERSULFATES

FIGURE 28 GLOBAL EXPORTS OF PERSULFATES

FIGURE 29 APAC: PERSULFATES MARKET SNAPSHOT

FIGURE 30 PERSULFATES EXPORTS FROM CHINA TO OTHER COUNTRIES, 2017–2018

FIGURE 31 PRODUCTION OF POLYSTYRENE, SYNTHETIC RUBBER, AND PVC IN JAPAN, 2019

FIGURE 32 PRODUCTION OF PVC, STYRENE, AND POLYSTYRENE IN INDIA, 2018

FIGURE 33 EUROPE: PERSULFATES MARKET SNAPSHOT

FIGURE 34 GLOBAL PERSULFATES MARKET: COVID- 19 IMPACT

FIGURE 35 PEROXYCHEM: COMPANY SNAPSHOT

FIGURE 36 MITSUBISHI GAS CHEMICAL COMPANY: COMPANY SNAPSHOT

FIGURE 37 ADEKA CORPORATION: COMPANY SNAPSHOT

FIGURE 38 MERCK: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the global persulfates market. Exhaustive secondary research was done to collect information related to the persulfates industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The persulfates market comprises several stakeholders, such as raw material suppliers, technology developers, derivative manufacturers, and regulatory organizations in the supply chain. The development of applications characterizes the demand side of this market. The supply side is characterized by advancements in technology and diverse application segments. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the persulfates market and estimate the sizes of various other dependent submarkets. The research methodology used to estimate the market size included the following steps:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value and volume, were determined through primary and secondary research.

- All percentage split and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of the key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Data Triangulation

After arriving at the overall market size from the process explained above, the total persulfates market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable. To complete the overall market estimation process and arrive at the exact statistics for all segments and sub-segments, the data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size of the persulfates market, in terms of value and volume

- To provide information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the persulfates market size based on type, end-use industry, and application.

- To forecast the market size of different segments with respect to five regions, namely, APAC, North America, Europe, South America, and the Middle East and Africa.

- To forecast the persulfates market size for different segments with respect to key countries of each region

- To analyze the opportunities in the market for stakeholders by identifying its high-growth segments

- To strategically profile the key players and comprehensively analyze their growth strategies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the persulfates market report:

Regional Analysis:

- Country-level analysis of the persulfates market

Company Information:

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Persulfates Market

Inquiring about single and multi-user license

Interested in persulfates for speciality polymers, specifically in the US.