Industrial Hydrogen Peroxide Market by Function (Bleaching, Propulsion, Oxidizing), End Use Industry (Pulp & Paper, Chemical Synthesis, Healthcare & Personal Care, Food Processing, Textile), Region - Global Forecast to 2026

The global industrial hydrogen peroxide market was valued at USD 2.38 Billion in 2015, and is projected to reach USD 4.28 Billion by 2026, at a CAGR of 5.53%, from 2016 to 2026.

The base year considered for the study is 2015, while the forecast period is from 2016 to 2026. The objectives of the report are as follows:

- To analyze and forecast the industrial hydrogen peroxide market in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To define, describe, and forecast the industrial hydrogen peroxide market based on function, end-use industry, and region

- To forecast the size of the market with respect to five main regions, namely, North America, Europe, Asia-Pacific, South America, and the Middle East & Africa

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, agreements, joint ventures & collaborations, and new product launches in the industrial hydrogen peroxide market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Both, top-down and bottom-up approaches have been used to estimate and validate the size of the global industrial hydrogen peroxide market and to estimate the sizes of various other dependent submarkets in the overall industrial hydrogen peroxide market. The research study involved the extensive use of secondary sources, directories, and databases such as, Hoovers, Bloomberg, Chemical Weekly, Factiva, and other government and private websites to identify and collect information useful for the technical, market-oriented, and commercial study of the global industrial hydrogen peroxide market.

To know about the assumptions considered for the study, download the pdf brochure

The supply chain of the industrial hydrogen peroxide market starts with the sourcing of basic raw materials, manufacturing and supplying to intermediate product manufacturers, and ends with use in the various end-use applications. 2-ethyl anthraquinone is the main raw material for the production of hydrogen peroxide. Hydrogen peroxide is mostly produced by anthraquinone auto-oxidation process. Some of the main players in the market include, AkzoNobel N.V. (Netherlands), BASF SE (Germany), The Dow Chemical Company (U.S.), Solvay SA (Belgium), Evonik Industries AG (Germany), Ecolab Inc. (U.S.), Kemira Oyj (Finland), Arkema SA (France), Merck Group (Germany), and Mitsubishi Gas Chemical Company, Inc. (Japan).

Key Target Audience:

- Hydrogen peroxide manufacturing companies

- Traders, distributors, and retailers

- Raw material suppliers

- Commercial R&D institutes

- Research institutes, trade associations, and government agencies

Scope of the Report:

This research report categorizes the global industrial hydrogen peroxide market on the basis of function, end-use industry, and region.

On the basis of Function:

- Bleaching

- Oxidizing

- Sterilizing/Disinfecting

- Propulsion

- Others (Etching, Cleaning and Extraction)

On the basis of End-Use Industry:

- Pulp & Paper

- Chemical Synthesis

- Healthcare & Personal Care

- Food Processing

- Textile

- Water & Wastewater Treatment

- Electronics & Semiconductor

- Others (Mining and Metallurgy, Transportation, and Recycling)

On the basis of Region:

- Asia-Pacific

- North America

- South America

- Middle East & Africa

- Europe

The market is further analyzed for the key countries in each of these regions.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Country Information:

- Industrial hydrogen peroxide market analysis for additional countries

Company Information:

- Detailed analysis and profiles of additional market players (up to five)

Pricing Analysis:

- Detailed pricing analysis of each type of industrial hydrogen peroxide product

Patent Analysis:

- Detailed patent analysis in the industrial hydrogen peroxide market

The global industrial hydrogen peroxide market is projected to reach USD 4.28 Billion by 2026, at a CAGR of 5.53% from 2016 to 2026. Industrial hydrogen peroxide has functions such as, bleaching, oxidizing, sterilizing/disinfecting, propulsion, etching, cleaning and extraction. These functions drive the industrial hydrogen peroxide market globally.

Industrial hydrogen peroxide products find usage in several end-use industries such as, pulp & paper, chemical synthesis, healthcare & personal care, food processing, textile, water & wastewater treatment, electronics & semiconductor and others (mining and metallurgy, transportation and recycling).

The pulp & paper industry accounted for the largest share of the overall industrial hydrogen peroxide market and is expected to continue to do so throughout the forecast period. Industrial hydrogen peroxide is used for bleaching of pulp & paper, as it increases the brightness levels, improves brightness stability and reduces manufacturing cost. In addition to this, it is environment friendly.

Companies are investing in expansions of their production capacities to increase their market shares and cater to the increasing demand for industrial hydrogen peroxide. BASF SE, Solvay SA, and SK chemicals jointly invested in a production plant based in South Korea to build a hydrogen peroxide-to-propylene oxide facility.

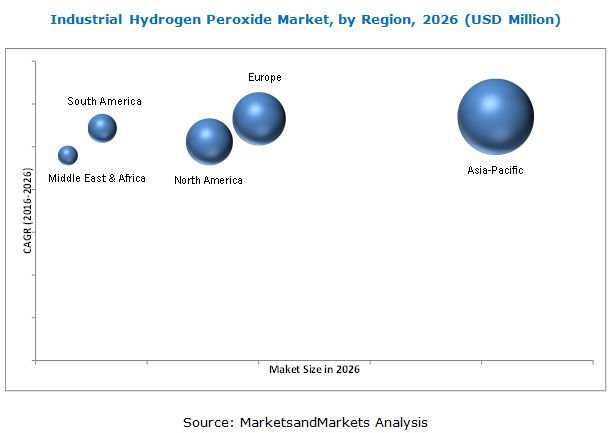

Growth in the pulp & paper and textile industries has increased the demand for industrial hydrogen peroxide. The Asia-Pacific region accounts for the largest share of the global industrial hydrogen peroxide market and is also the fastest-growing market. China is expected to account for the largest share in the Asia-Pacific region till 2026 and has registered the fastest growth rate for the forecast period. Germany is the largest market for industrial hydrogen peroxide in Europe. Major producers of industrial hydrogen peroxide such as, BASF SE (Germany), Evonik Industries AG (Germany), and Merck Group (Germany) are located in Germany.

Exposure of the eyes to concentrations of 5% or more industrial hydrogen peroxide can result in permanent loss of vision, while skin exposure causes painful blisters, burns and skin whitening. These are the restraints in the global industrial hydrogen peroxide market. However, industrial hydrogen peroxide is preferred over other chemicals, as it is environment friendly and reduces manufacturing cost, as it is the only one chemical that is required.

Companies such as, AkzoNobel N.V., BASF SE, Solvay SA, Evonik Industries AG, Kemira Oyj, The Dow Chemicals Company, and Merck Group have adopted the investments & expansions, agreements, joint ventures & collaborations and mergers & acquisitions strategies to expand their market shares and distribution networks in the global industrial hydrogen peroxide market for the forecast period, 2016 to 2026.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Key Data From Primary Sources

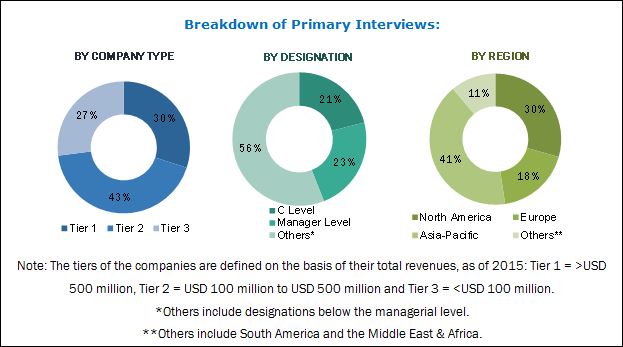

2.3.2 Breakdown of Primary Interviews

2.4 Market Size Estimation

2.5 Data Triangulation

2.6 Research Assumptions and Limitations

2.6.1 Assumptions

2.6.2 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Significant Opportunities in the Industrial Hydrogen Peroxide Market

4.2 Asia-Pacific Industrial Hydrogen Peroxide Market, By End-Use Industry and Country

4.3 Fastest-Growing Industrial Hydrogen Peroxide Market

4.4 Industrial Hydrogen Peroxide Market, By End-Use Industry

4.5 Industrial Hydrogen Peroxide Market in Pulp & Paper End-Use Industry

4.6 Industrial Hydrogen Peroxide Market, By Function

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Evolution

5.3 Market Segmentation

5.3.1 By Function

5.3.2 By End-Use Industry

5.3.3 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Demand for Environmental-Friendly Solutions

5.4.1.2 Paradigm Shift From Chlorine to Elemental Chlorine Free (ECF) Chemicals

5.4.1.3 Rising Demand From End-Use Industries

5.4.1.3.1 Growing Use as an Oxidizing Agent in the Chemical Industry

5.4.1.3.2 Increasing Demand From the Gradually Maturing Pulp & Paper Industry

5.4.2 Restraints

5.4.2.1 Exposure of the Eyes to Concentrations of 5% Or More Could Result in Permanent Loss of Vision

5.4.3 Opportunities

5.4.3.1 Emerging Applications in the Semiconductor, Mining & Metal Extraction, and Agriculture Industries

5.4.3.2 Increase in Use of Hydrogen Peroxide for Wastewater Treatment

5.4.4 Challenges

5.4.4.1 Increasing Raw Material Prices and Operating Costs

5.4.4.2 Digitalization to Reduce the Demand for Hydrogen Peroxide From Pulp & Paper Industry

5.5 Impact Analysis

6 Industry Trends (Page No. - 50)

6.1 Introduction

6.2 Supply Chain Analysis

6.3 Porters Five Forces

6.3.1 Threat of Substitutes

6.3.2 Threat of New Entrants

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Patent Analysis (Page No. - 56)

8 Macroeconomic Indicators (Page No. - 58)

8.1 GDP Growth Rate Forecast of Major Economies

8.2 Textile Industry Analysis

8.3 Pulp & Paper Industry Analysis

8.4 Chemical Industry Analysis

9 Global Industrial Hydrogen Peroxide Market, By Function (Page No. - 63)

9.1 Introduction

9.2 Bleaching

9.3 Oxidizing

9.4 Sterilizing/Disinfecting

9.5 Propulsion

9.6 Others

10 Global Industrial Hydrogen Peroxide Market, By End-Use Industry (Page No. - 75)

10.1 Introduction

10.2 Pulp & Paper

10.2.1 Chemical Pulp

10.2.2 Mechanical Pulp

10.2.3 Recycled Pulp

10.3 Chemical Synthesis

10.3.1 Inorganic Derivatives

10.3.1.1 Sodium Perborate

10.3.1.2 Sodium Percarbonate

10.3.2 Organic Derivatives

10.3.2.1 Methyl Ethyl Ketone Peroxides

10.3.2.2 Benzoyl Peroxide

10.4 Healthcare & Personal Care

10.4.1 Healthcare

10.4.2 Personal Care

10.5 Food Processing

10.5.1 Sterilization

10.5.2 Antimicrobial Agent

10.5.3 Oxidizing & Bleaching Agent

10.6 Textile

10.7 Water & Wastewater Treatment

10.8 Electronics & Semiconductor

10.9 Others

10.9.1 Mining & Metallurgy

10.9.2 Transportation

10.9.3 Recycling

11 Global Industrial Hydrogen Peroxide Market, By Region (Page No. - 95)

11.1 Introduction

11.2 Asia-Pacific

11.2.1 China

11.2.2 India

11.2.3 Japan

11.2.4 South Korea

11.2.5 Indonesia

11.2.6 Taiwan

11.2.7 Bangladesh

11.2.8 Rest of Asia-Pacific

11.3 North America

11.3.1 U.S.

11.3.2 Canada

11.3.3 Mexico

11.4 South America

11.4.1 Brazil

11.4.2 Argentina

11.4.3 Chile

11.4.4 Rest of South America

11.5 Middle-East & Africa

11.5.1 Saudi Arabia

11.5.2 UAE

11.5.3 Rest of the Middle-East & Africa

11.6 Europe

11.6.1 Germany

11.6.2 France

11.6.3 Spain

11.6.4 Italy

11.6.5 U.K.

11.6.6 Finland

11.6.7 Rest of the Europe

12 Competitive Landscape (Page No. - 146)

12.1 Overview

12.2 Market Share Analysis

12.3 Competitive Situation and Trends

12.4 Investments and Expansions the Most Popular Growth Strategy Between 2011 and 2016

12.4.1 Investments & Expansions

12.4.2 Agreements, Joint Ventures, & Collaborations

12.4.3 Mergers & Acquisitions

12.4.4 New Product Launches

13 Company Profiles (Page No. - 153)

(Overview, Financial*, Products & Services, Strategy, and Developments)

13.1 Solvay SA

13.2 Evonik Industries AG

13.3 Arkema SA

13.4 Akzonobel N.V.

13.5 BASF SE

13.6 The DOW Chemical Company

13.7 Ecolab Inc. (Nalco Company)

13.8 Kemira OYJ

13.9 Merck Group

13.10 Mitsubishi Gas Chemical Company

13.11 Other Key Market Players

13.11.1 Taekwang Industrial Co., Ltd.

13.11.2 FMC Corp

13.11.3 Thai Peroxide Co. Ltd.

13.11.4 OCI Chemical Corporation

13.11.5 Christeyns

13.11.6 National Peroxide Limited

13.11.7 Shandong Huatai Paper Co. Ltd.

13.11.8 Guangdong Zhongcheng Chemicals Inc.

13.11.9 Kingboard Chemical Holdings Ltd.

13.11.10 Khimprom

*Details Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 179)

14.1 Insights From Industry Experts

14.2 Discussion Guide

14.3 Knowledge Store: Marketsandmarkets Subscription Portal

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

14.7 Author Details

List of Tables (113 Tables)

Table 1 Industrial Hydrogen Peroxide Market, By function

Table 2 Industrial Hydrogen Peroxide Market, By End-Use Industry

Table 3 Oxidation Potential of Hydrogen Peroxide in Comparison to Various Oxidizers

Table 4 Legislations for Hydrogen Peroxide in European Union and U.S.

Table 5 Population Connected to Secondary Urban Wastewater Treatment (20102014)

Table 6 Trends and Forecast of GDP Growth Rate, 20162020

Table 7 Chemical Production, 20122020

Table 8 Global Industrial Hydrogen Peroxide Market Size, By Function, 20142026 (USD Million)

Table 9 Global Industrial Hydrogen Peroxide Market Size, By Function, 20142026 (Kilotons)

Table 10 Global Industrial Hydrogen Peroxide Market Size in Bleaching Function, By Region, 20142026 (USD Million)

Table 11 Global Industrial Hydrogen Peroxide Market Size in Bleaching Function, By Region, 20142026 (Kilotons)

Table 12 Global Industrial Hydrogen Peroxide Market Size in Oxidizing Function, By Region, 20142026 (USD Million)

Table 13 Global Industrial Hydrogen Peroxide Market Size in Oxidizing Function, By Region, 20142026 (Kilotons)

Table 14 Global Industrial Hydrogen Peroxide Market Size in Sterilizing/Disinfecting Function, By Region, 20142026 (USD Million)

Table 15 Global Industrial Hydrogen Peroxide Market Size in Sterilizing/Disinfecting Function, By Region, 20142026 (Kilotons)

Table 16 Global Industrial Hydrogen Peroxide Market Size in Propulsion Function, By Region, 20142026 (USD Million)

Table 17 Global Industrial Hydrogen Peroxide Market Size in Propulsion Function, By Region, 20142026 (Kilotons)

Table 18 Global Industrial Hydrogen Peroxide Market Size in Other Functions, By Region, 20142026 (USD Million)

Table 19 Global Industrial Hydrogen Peroxide Market Size in Other Functions, By Region, 20142026 (Kilotons)

Table 20 Global Industrial Hydrogen Peroxide Market Size, By End-Use Industry, 20142026 (USD Million)

Table 21 Global Industrial Hydrogen Peroxide Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 22 Global Industrial Hydrogen Peroxide Market Size in Pulp & Paper Industry, By Region, 20142026 (USD Million)

Table 23 Global Industrial Hydrogen Peroxide Market Size in Pulp & Paper Industry, By Region, 20142026 (Kilotons)

Table 24 Global Industrial Hydrogen Peroxide Market Size in Chemical Synthesis Industry, By Region, 20142026 (USD Million)

Table 25 Global Industrial Hydrogen Peroxide Market Size in Chemical Synthesis Industry, By Region, 20142026 (Kilotons)

Table 26 Global Industrial Hydrogen Peroxide Market Size in Healthcare & Personal Care Industry, By Region, 20142026 (USD Million)

Table 27 Global Industrial Hydrogen Peroxide Market Size in Healthcare & Personal Care Industry, By Region, 20142026 (Kilotons)

Table 28 Global Industrial Hydrogen Peroxide Market Size in Food Processing Industry, By Region, 20142026 (USD Million)

Table 29 Global Industrial Hydrogen Peroxide Market Size in Food Processing Industry, By Region, 20142026 (Kilotons)

Table 30 Global Industrial Hydrogen Peroxide Market Size in Textile Industry, By Region, 20142026 (USD Million)

Table 31 Global Industrial Hydrogen Peroxide Market Size in Textile Industry, By Region, 20142026 (Kilotons)

Table 32 Global Industrial Hydrogen Peroxide Market Size in Water & Wastewater Treatment Industry, By Region, 20142026 (USD Million)

Table 33 Global Industrial Hydrogen Peroxide Market Size in Water and Wastewater Treatment Industry, By Region, 20142026 (Kilotons)

Table 34 Global Industrial Hydrogen Peroxide Market Size in Electronics & Semiconductor Industry, By Region, 20142026 (USD Million)

Table 35 Glboal Industrial Hydrogen Peroxide Market Size in Electronics & Semiconductor Industry, By Region, 20142026 (Kilotons)

Table 36 Global Industrial Hydrogen Peroxide Market Size in Other End-Use Industries, By Region, 20142026 (USD Million)

Table 37 Global Industrial Hydrogen Peroxide Market Size in Other End-Use Industries, By Region, 20142026 (Kilotons)

Table 38 Global Industrial Hydrogen Peroxide Market Size, By Region, 20142026 (USD Million)

Table 39 Global Industrial Hydrogen Peroxide Market Size, By Region, 20142026 (Kilotons)

Table 40 Asia-Pacific: By Market Size, By Country, 20142026 (USD Million)

Table 41 Asia-Pacific: By Market Size, By Country, 20142026 (Kilotons)

Table 42 Asia-Pacific: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 43 Asia-Pacific: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 44 China: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 45 China: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 46 India: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 47 India: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 48 Japan: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 49 Japan: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 50 South Korea: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 51 South Korea: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 52 Indonesia: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 53 Indonesia: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 54 Taiwan: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 55 Taiwan: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 56 Bangladesh: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 57 Bangladesh: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 58 Rest of Asia-Pacific: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 59 Rest of Asia-Pacific: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 60 North America: By Market Size, By Country, 20142026 (USD Million)

Table 61 North America: By Market Size, By Country, 20142026 (Kilotons)

Table 62 North America: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 63 North America: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 64 U.S.: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 65 U.S.: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 66 Canada: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 67 Canada: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 68 Mexico: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 69 Mexico: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 70 South America: By Market Size, By Country, 20142026 (USD Million)

Table 71 South America: By Market Size, By Country, 20142026 (Kilotons)

Table 72 South America: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 73 South America: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 74 Brazil: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 75 Brazil: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 76 Argentina: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 77 Argentina: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 78 Chile: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 79 Chile: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 80 Rest of the South America: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 81 Rest of the South America: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 82 Middle-East & Africa: By Market Size, By Country, 20142026 (USD Million)

Table 83 Middle-East & Africa: By Market Size, By Country, 20142026 (Kilotons)

Table 84 Middle-East & Africa: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 85 Middle-East & Africa: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 86 Saudi Arabia: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 87 Saudi Arabia: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 88 UAE: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 89 UAE: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 90 Rest of the Middle-East & Africa: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 91 Rest of the Middle-East & Africa: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 92 Europe: By Market Size, By Country, 20142026 (USD Million)

Table 93 Europe: By Market Size, By Country, 20142026 (Kilotons)

Table 94 Europe: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 95 Europe: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 96 Germany: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 97 Germany: By oxide Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 98 France: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 99 France: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 100 Spain: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 101 Spain: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 102 Italy: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 103 Italy: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 104 U.K.: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 105 U.K.: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 106 Finland: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 107 Finland: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 108 Rest of the Europe: By Market Size, By End-Use Industry, 20142026 (USD Million)

Table 109 Rest of the Europe: By Market Size, By End-Use Industry, 20142026 (Kilotons)

Table 110 Investments & Expansions, 20112015

Table 111 Agreements, Joint Ventures, & Collaborations, 20112016

Table 112 Mergers and Acquisitions, 20112016

Table 113 New Product Launches, 20112016

List of Figures (67 Figures)

Figure 1 Industrial Hydrogen Peroxide: Market Segmentation

Figure 2 Hydrogen Peroxide Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Industrial Hydrogen Peroxide: Data Triangulation

Figure 6 Pulp & Paper Industry to Lead Global Industrial Hydrogen Peroxide Market, By Volume, 2016-2021 (Kilotons)

Figure 7 Bleaching Segment to Lead Global Industrial Hydrogen Peroxide Market, By Function, 2015-2021 (USD Million)

Figure 8 Asia-Pacific Led Global Industrial Hydrogen Peroxide Market in 2016

Figure 9 Global Industrial Hydrogen Peroxide Market Size, 2016 vs 2021

Figure 10 China to Lead Asia-Pacific Industrial Hydrogen Peroxide Market, By Country

Figure 11 China to Lead Global Industrial Hydrogen Peroxide Market, By Volume, 2016-2021 (Kilotons)

Figure 12 Pulp & Paper Industry to Lead Global Industrial Hydrogen Peroxide Market, By Volume, 20162021 (Kilotons)

Figure 13 Asia-Pacific to Lead Market in Pulp & Paper End-Use Industry, By Volume, 20162021 (Kilotons)

Figure 14 Bleaching Segment Accounted for Largest Share in 2015

Figure 15 1818 Marked Discovery of Industrial Hydrogen Peroxide in France

Figure 16 Industrial Hydrogen Peroxide Market, By Region

Figure 17 Increasing Demand From End-Use Industries is Major Market Driver

Figure 18 High Demand for Chemical Pulp in China, 2015

Figure 19 Pulp Production, 19912015

Figure 20 Impact Analysis of Drivers and Restraints

Figure 21 Supply Chain Analysis

Figure 22 Porters Five Forces Analysis

Figure 23 Japan Accounted for Maximum Patents Between 2013 and 2015

Figure 24 90 Patents Registered By U.S., Europe, and Japan in 2015

Figure 25 World Textile Trade, 20052014

Figure 26 World Textile Exports

Figure 27 Global Paper Production, 2013

Figure 28 Global Pulp Capacity, 20142019

Figure 29 Country-Wise Wood Pulp Capacity, 20142019

Figure 30 Bleaching Accounted for Major Share of Global Industrial Hydrogen Peroxide Market, By Function, 2015 (USD Million)

Figure 31 Asia-Pacific to Lead Bleaching Segment of Global Industrial Hydrogen Peroxide Market, 2016-2021 (USD Million)

Figure 32 Asia-Pacific to Lead Oxidizing Segment of Global Industrial Hydrogen Peroxide Market, 2016-2021 (USD Million)

Figure 33 Europe to Be Second-Largest Market in Sterilizing/Disinfecting Segment, 2016-2021 (USD Million)

Figure 34 Asia-Pacific to Lead Propulsion Segment of Global Industrial Hydrogen Market, 2016-2021 (USD Million)

Figure 35 North America to Be Second-Largest Market in Others Segment, 2016-2021 (USD Million)

Figure 36 Pulp & Paper Segment Held Major Share of Global Industrial Hydrogen Peroxide Market, By End-Use Industry, 2015 (USD Million)

Figure 37 Asia-Pacific to Lead Global Industrial Hydrogen Peroxide Market in Pulp & Paper End-Use Industry, 2016-2021 (USD Million)

Figure 38 Europe to Lead Global Industrial Hydrogen Peroxide Market in Chemical Synthesis End-Use Industry, 2016-2021 (USD Million)

Figure 39 APAC to Lead Global Industrial Hydrogen Peroxide Market in Healthcare & Personal Care End-Use Industry, 2016-2021 (USD Million)

Figure 40 Asia-Pacific to Lead Global Industrial Hydrogen Peroxide Market in Food Processing End-Use Industry, 2016-2021 (USD Million)

Figure 41 North America to Be Second-Largest Global Industrial Hydrogen Peroxide Market in Textile End-Use Industry, 2016-2021 (USD Million)

Figure 42 Asia-Pacific to Lead Global Industrial Hydrogen Peroxide Market in Water & Wastewater Treatment End-Use Industry, 2016-2021 (USD Million)

Figure 43 North America to Be Second-Largest Global Industrial Hydrogen Peroxide Market in Electronics & Semiconductor End-Use Industry, 2016-2021 (USD Million)

Figure 44 North America to Lead Global Industrial Hydrogen Peroxide Market in Other End-Use Industries, 2016-2021 (USD Million)

Figure 45 Regional Snapshot: Rapidly-Growing Markets Emerging as New Strategic Locations (CAGR: 2016-2021)

Figure 46 Asia-Pacific Snapshot: China to Be the Largest-Growing Market

Figure 47 Pulp & Paper Industry Held Largest Market Share in Asia-Pacific, 2015

Figure 48 U.S. Market Snapshot, 2016 vs 2021

Figure 49 Europe Market Snapshot: Italy to Be the Fastest-Growing Market

Figure 50 Companies Adopted Investments & Expansions as Key Growth Strategy Between 2011 and 2016

Figure 51 Top 4 Players Accounted for Majority of the Market Share in 2015

Figure 52 Market Evaluation Framework: Investments & Expansions Fueled Growth Between 2011 and 2016

Figure 53 Solvay SA: Company Snapshot

Figure 54 Solvay SA: SWOT Analysis

Figure 55 Evonik Industries AG: Company Snapshot

Figure 56 Evonik Industries AG: SWOT Analysis

Figure 57 Arkema SA: Company Snapshot

Figure 58 Akzonobel N.V.: Company Snapshot

Figure 59 Akzonobel N.V.: SWOT Analysis

Figure 60 BASF SE: Company Snapshot

Figure 61 BASF SE: SWOT Analysis

Figure 62 The DOW Chemical Company: Company Snapshot

Figure 63 The DOW Chemical Company: SWOT Analysis

Figure 64 Ecolab Inc.: Company Snapshot

Figure 65 Kemira OYJ: Company Snapshot

Figure 66 Merck Group: Company Snapshot

Figure 67 Mitsubishi Gas Chemical Company: Company Snapshot

Growth opportunities and latent adjacency in Industrial Hydrogen Peroxide Market