Passenger Boarding Bridges Market by Elevation System (Hydraulic, Electro-Mechanical), Foundation (Fixed, Moveable), Point of Sale (OEM, Aftermarket), Product Type, Structure, Tunnel Type, Docking Type, Seaport-PBB and Region - Global Forecast to 2025

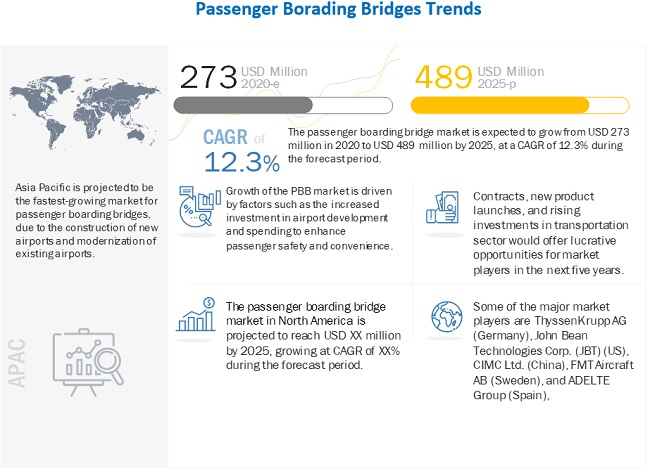

[332 Pages Report] The global Passenger Boarding Bridges Market size is projected to grow from USD 273 Million in 2020 to USD 489 Million by 2025, at a CAGR of 12.3% from 2020 to 2025.

Factors such as the high demand for large aircraft, increasing number of greenfield and brownfield airport projects, and increased spending on airside infrastructure by airport operators are driving factors assisting the growth of the Passenger Boarding Bridges Industry.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Passenger Boarding Bridges Market

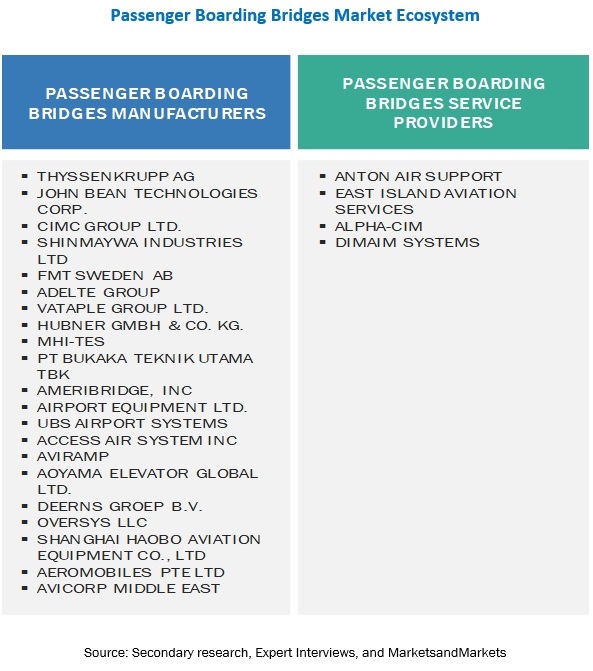

The passenger boarding bridges market includes major players ThyssenKrupp AG (Germany), John Bean Technologies Corp. (JBT) (US), CIMC Ltd. (China), FMT Aircraft AB (Sweden), and ADELTE Group (Spain), among others. JBT Corp and CIMC Ltd. hold the largest market share in the US and Asia Pacific.. These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and South America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 could affect passenger boarding bridges production and services by 7–10% globally in 2020.

The COVID-19 pandemic has impacted the end-use industries adversely, resulting in a sudden dip in 2020 passenger boarding bridges orders and installation. This is expected to negatively impact the passenger boarding bridges market in the short term, with slow recovery expected in Q1 of 2021. The end-use industries like aviation and seaport could take 2-3 years to recover from the financial effects of the COVID-19 crisis, leading to lower procurement of passenger boarding bridges compared to previous estimates.

Passenger Boarding Bridges Market Dynamics

Driver: High Demand for Large Aircraft

The increasing passenger traffic is driving the demand for large aircraft. According to IATA, despite rising fuel costs and economic slowdowns, air passenger travel has grown at an average rate of 5% in the last two decades and is projected to grow at the same pace in the future. According to ICAO’s annual global statistics, the total number of passengers carried on scheduled services rose to 4.3 billion in 2018, which was 6.4% higher than the previous year, while the number of departures reached 37.8 million in 2018, a 3.5% increase. Of this, Europe accounted for 26.3% of global air passenger traffic, posting a growth of 7.2%; North America accounted for 22.4%, posting a growth of 4.7%; Asia Pacific accounted for 34.8%, posting a growth of 9.5%; the Middle East accounted for 9.2%, posting a growth of 3.9%; Latin America and the Caribbean accounted for 5.1%, posting a growth of 7.7%; while Africa accounted for 2.1% of world traffic, posting a growth of 7.5%.

To address this growing passenger traffic, several airlines are now buying large aircraft to accommodate more passengers onboard single trips. Airlines are ordering large aircraft such as the Boeing 747-8 and the Airbus A380. Following this increase in the number of very large aircraft (VLA) deliveries, airport boarding areas gates now have to accommodate more passengers per gate per flight. Boarding all passengers using passenger stairs is time consuming and could results in loss of potential revenue as the turnaround time of an aircraft increases. Passenger boarding bridges cater to these problems efficiently and conveniently, which drives their market, especially for use on large aircraft.

Restraint: Long Life Cycle of Passenger Boarding Bridges

Passenger boarding bridges (PBBs) were introduced in 1959 at the San Francisco international Airport (US). A typical aerobridge serves for 15 to 20 years after which it is replaced. The installation of new PBBs largely depends on upcoming airport construction and modernization programs. The market for PBBs is restrained by the refurbishment market of aerobridges considering the low cost of the latter. Generally, an airport authority tends to opt for the refurbishment of aerobridges as it provides an expected lifespan of 8 to 10 years at half the cost of a new PBB.

Also, refurbishment provides airports with the option to upgrade and customize PBBs in terms of appearance and performance. The cost of buying new PBBs and their installation is high when compared to the refurbishment of the existing ones. Apart from this, the time required to order, procure, and install a PBB is also a restraining factor.

Opportunity: Public-Private Partnerships for Airside Operations

A public-private partnership (PPP) is a partnership among the public and private sectors to deliver airport infrastructure or services. Major functions of a PPP in aviation could include capital investments, developing air services, increasing airport commercial activities, and improving customer service for competitiveness. PPP airports are viable even with limited funds. Airports such as the John F. Kennedy International Airport (JFK) and the Indira Gandhi International Airport (IGIA) have benefited from the PPP model in terms of revenue increase and customer satisfaction. A public-private partnership (PPP) is a partnership among the public and private sectors to deliver airport infrastructure or services. Major functions of a PPP in aviation could include capital investments, developing air services, increasing airport commercial activities, and improving customer service for competitiveness. PPP airports are viable even with limited funds. Airports such as the John F. Kennedy International Airport (JFK) and the Indira Gandhi International Airport (IGIA) have benefited from the PPP model in terms of revenue increase and customer satisfaction.

As of now, Asia Pacific and Latin America lead the overall project count since the projects considered above include the development of airport infrastructure such as airside and terminal side projects, among others. The PPP model has been an innovative way of financing larger infrastructure projects with the involvement of major stakeholders, such as manufacturers/builders and end users (public) such as passengers traveling via airports. The initial investment by governments and builders is then recovered over a period of time through public expenditure.

Private airports mainly focus on bridging the gap between customer needs and services delivered. The PPP model has been successful in delivering a better experience to customers, which includes the use of equipment like PBBs. To improve commercial activities and passenger service, PPP airports are installing PBBs, with a majority of them projected to install glass-walled PBBs to meet both, passenger satisfaction and green airport requirements

Challenge: High Cost of Training and Lack of Skilled Personnel

A PBB needs to be brought close to the aircraft door for docking. Here, the operator must adjust the height of the PBB by operating the elevation system and align the PBB doors with those of the aircraft by extending the telescoped tunnel. This process, if not carried out properly, could lead to accidents. For instance, in October 2018, a passenger boarding bridge collapsed at the Islamabad International Airport; however, no serious damage was reported. Due to such technical and safety concerns surrounding aerobridges, PBB docking is to be carried out only by authorized personnel of airlines or ground handling staff who are certified to operate them. However, finding skilled labor in this field is a challenge since the time and cost incurred on training operators is high since it involves the use of techniques such as simulation, refresher courses, and examinations. Most airlines tend to focus on reducing operating costs such as parking charges, ground support equipment charges, and training aerobridge operators incurs an additional cost for them.

According to Boeing’s Commercial Market Outlook 2019–2038, airline passenger traffic will grow at 4.7% per year. This will lead to the need for more than 44,004 deliveries of new commercial aircraft in the next 20 years to meet the demand in the coming two decades. 39% of all new aircraft will be delivered to airlines in the Asia Pacific region alone, and another 41% will go to carriers in North America and Europe.

Airbus superjumbo commercial aircraft, the A380 and A350, and Boeing’s B-787 are wide-body aircraft. There would be a requirement for 8,340 such new wide-body fleets over the next 20 years. Considering the growing backlogs, Boeing and Airbus announced that they were targeting to produce 60 planes per month, which is large compared to the production rate of the 787 (14/month) and A350 (10/month). Aircraft manufacturing startup Boom Technology also revealed that they have plans to build commercial supersonic transport aircraft XB-1. Thus, these new airplane deliveries in the commercial aircraft segment would create high demand for passenger boarding bridges as these aircraft have multiple doors that will require large PBBs

To know about the assumptions considered for the study, download the pdf brochure

By Point of Sale, the OEM Segment is Expected to Be a Larger Contributor to the Passenger Boarding Bridges Market During the Forecast Period.

Passenger boarding bridges have been witnessing substantial growth over the last few years. One of the major factors driving this growth is the increased demand for larger aircarfts which will also increase passenger capacity. Airports are upgrading their infrastructure to cope up with increasing passenger footfall. This demand that has led to an increase in the number of passenger boarding bridges is expected to drive the OEM market during the forecast period.

By Product Type, the Over-the-wing Bridge Passenger Boarding Bridges Segment is Expected to Grow at the Highest Rate During the Forecast Period.

By product type, the over-the-wing bridge segment is expected to witness the highest CAGR because of the rise in larger aircrafts with wide-body and multiple doors. The number of larger aircrafts has experienced steady growth over the last few years, larger aircrafts has two deck thus needs multiple PBBs to caters increased passenger capacity. This growth in larger aircrafts is expected to drive the demand for over-the-wing bridge passenger boarding bridges maret.

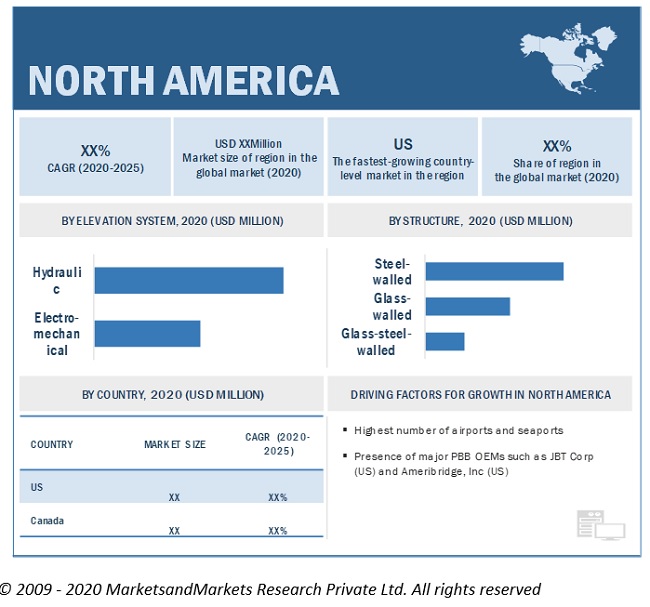

North America is Projected to Lead the Passenger Boarding Bridges Market During the Forecast Period.

North America is estimated to lead the passenger boarding bridges market during the forecast period. This is mainly due to the mature airport market in the US. According to the Federal Aviation Administration (FAA), passenger traffic is estimated to grow to more than a billion in the next 20 years. North America focuses mainly on R&D of its infrastructure, including PBBs, to remain economically competitive in the market.

Passenger Boarding Bridges Industry Companies: Top Key Market Players

The Passenger Boarding Bridges Companies are dominated by globally established players such as ThyssenKrupp AG (Germany), John Bean Technologies Corp. (JBT) (US), CIMC Ltd. (China), FMT Aircraft AB (Sweden) and ADELTE Group (Spain)

Scope Of The Report

|

Report Attributes |

Details |

|

Estimated Market Size |

USD 17.77 billion in 2022 |

|

Projected Market Size |

USD 27.8 Billion in 2026 |

|

Growth Rate |

11.2% |

|

Forecast Period |

2021–2026 |

|

On Demand Data Available |

2030 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

|

Key Market Driver |

High demand for large aircraft |

|

Key Market Opportunity |

Public-private partnerships for airside operations |

|

Largest Growing Region |

North America |

|

Largest Market Share Segment |

Over-the-Wing Bridge Passenger Boarding Bridges Segment |

|

Highest CAGR Segment |

OEM Segment |

The study categorizes the passenger boarding bridges market based on elevation system, product type, tunnel type, docking type, foundation, structure, point of sale, seaport and Region.

By Elevation System

- Hydraulic

- Electro-mechanical

By Product Type

- Apron Drive

- Commuter Bridges

- Nose-loader bridges

- T-bridges

- Over-the-wing Bridges

By Tunnel Type

- Air-conditioned

- Un-air-conditioned

By Docking Type

- Manual

- Intelligent

By Foundation

- Fixed

- Movable

By Structure

- Glass-walled

- Steel-walled

- Glass-steel-walled

By Point of Sale

- OEM

- Aftermarket

By Seaport

- Seaport

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Latin America

- Africa

Recent Developments

- In March 2020, Anton Air Support installed 3 passenger boarding bridges at the Landvetter Airport in Göteborg, Sweden. The contract also included the mechanical installation of PBBs.

- In January 2020, In December, Anton Air Support carried out the annual passenger boarding bridge maintenance on 2 passenger bridges at Leeds Bradford Airport. After inspection, the company decided to replace the hydraulic hoses, oil filters, and air filters.

- In September 2019, CIMC secured a contract to supply unmanned jet boarding bridges for operation in the Netherlands.

- In August 2019, Thyssenkrupp entered into a contract to install 42 modern passenger boarding bridges at the Adolfo Suárez Madrid-Barajas Airport in Spain. The contract also includes the maintenance of 122 passenger boarding bridges and the refurbishment of another 10. This will help both parties form a long-term business relationship.

- In March 2019, ADELTE received contracts from three cruise ports in the US to deliver a total of six seaport passenger boarding bridges for their cruise terminals.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the passenger boarding bridges market?

The passenger boarding bridges market is expected to grow substantially owing to the increasing demand for larger aircrafts and increasing annual passenger footfall.

What are the key sustainability strategies adopted by leading players operating in the passenger boarding bridges market?

Key players have adopted various organic and inorganic strategies to strengthen their position in the passenger boarding bridges market. The major players include ThyssenKrupp AG (Germany), John Bean Technologies Corp. (JBT) (US), these players have adopted various strategies, such as acquisitions, contracts and new product launches, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the passenger boarding bridges market?

Some of the major emerging technologies and use cases disrupting the market include automatic docking system which has been successfully tested and is projected to grow at a higher CAGR.

Who are the key players and innovators in the ecosystem of the passenger boarding bridges market?

The key players in the passenger boarding bridges market include ThyssenKrupp AG (Germany), John Bean Technologies Corp. (JBT) (US), CIMC Ltd. (China), FMT Aircraft AB (Sweden).

Which region is expected to hold the highest market share in the passenger boarding bridges market?

passenger boarding bridges market in North America is projected to hold the highest market share during the forecast period due to the North American countries having large number of airport and seaport. Also, the many airports are undergoiong major expansion which includes new terminal expansion. .

To speak to our analyst for a discussion on the above findings, clickSpeak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 56)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 PASSENGER BOARDING BRIDGES MARKET: INCLUSIONS & EXCLUSIONS

1.4 SEGMENTATION

1.4.1 PASSENGER BOARDING BRIDGES MARKET – FORECAST TO 2025

1.4.2 YEARS CONSIDERED

1.5 CURRENCY & PRICING

TABLE 2 USD EXCHANGE RATES

1.6 SUMMARY OF CHANGES

1.6.1 PASSENGER BOARDING BRIDGES MARKET TO GROW AT A HIGHER RATE COMPARED TO PREVIOUS REPORT ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 60)

2.1 RESEARCH DATA

2.1.1 RESEARCH FLOW

FIGURE 1 RESEARCH DESIGN

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary sources

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 1 (SUPPLY SIDE)

FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 2 (DEMAND SIDE)

2.2.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.3.1 BREAKDOWN OF PRIMARIES

FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

TABLE 3 PRIMARY DETAILS

2.4 COVID-19 IMPACT

2.5 GROWTH RATE ASSUMPTIONS

2.6 ASSUMPTIONS

2.7 DEMAND-SIDE ANALYSIS

2.7.1 INTRODUCTION

2.7.2 DEMAND-SIDE INDICATORS

2.7.2.1 Passenger traffic and airport capacity

FIGURE 7 AIRPORT CONSTRUCTION PROJECTS (VALUE), AS OF OCTOBER 2019

2.7.2.2 Emerging countries (by GDP)

2.7.2.3 New airport projects

FIGURE 8 NEW AIRPORT CONSTRUCTIONS (VALUE), BY REGION, 2019

2.8 SUPPLY-SIDE ANALYSIS

2.9 RISKS

3 EXECUTIVE SUMMARY (Page No. - 73)

FIGURE 9 HYDRAULIC SEGMENT PROJECTED TO DOMINATE DURING FORECAST PERIOD

FIGURE 10 APRON DRIVE SEGMENT TO LEAD DURING FORECAST PERIOD

FIGURE 11 STEEL-WALLED STRUCTURE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 NORTH AMERICA ESTIMATED TO BE THE LARGEST MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 76)

4.1 PASSENGER BOARDING BRIDGES MARKET, 2020–2025

FIGURE 13 ATTRACTIVE MARKET OPPORTUNITIES

4.2 PASSENGER BOARDING BRIDGES MARKET, BY ELEVATION SYSTEM

FIGURE 14 HYDRAULIC ELEVATION SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 PASSENGER BOARDING BRIDGES MARKET, BY FOUNDATION

FIGURE 15 MOVABLE BRIDGES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 PASSENGER BOARDING BRIDGES MARKET, BY DOCKING TYPE

FIGURE 16 MANUAL DOCKING SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 PASSENGER BOARDING BRIDGES MARKET, BY STRUCTURE

FIGURE 17 GLASS-WALLED SEGMENT PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.6 PASSENGER BOARDING BRIDGES MARKET, BY COUNTRY

FIGURE 18 MARKET IN CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 79)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 PASSENGER BOARDING BRIDGES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High demand for large aircraft

5.2.1.2 Increasing number of greenfield and brownfield airport projects

FIGURE 20 AIRPORT CONSTRUCTION PROJECTS

5.2.1.3 Increased spending on airside infrastructure by airport operators

5.2.2 RESTRAINTS

5.2.2.1 Long life cycle of passenger boarding bridges

5.2.2.2 High procurement and operational costs for low-cost airlines

5.2.3 OPPORTUNITIES

5.2.3.1 Public-private partnerships for airside operations

TABLE 4 PPP AIRPORT PROJECTS, BY REGION, 2018

5.2.4 CHALLENGES

5.2.4.1 High cost of training and lack of skilled personnel

5.3 OPERATIONAL DATA

TABLE 5 NUMBER OF NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-38

TABLE 6 NUMBER OF PBBS INSTALLED, BY REGION, 2016-2019

5.4 IMPACT OF COVID-19

FIGURE 21 FACTORS IMPACTING PASSENGER BOARDING BRIDGES MARKET DUE TO COVID-19

FIGURE 22 DECLINE IN PASSENGER CAPACITY DUE TO COVID-19

5.5 DISRUPTION IMPACTING CUSTOMER’S BUSINESS

5.5.1 REVENUE SHIFT AND & NEW REVENUE POCKETS FOR AVIATION PASSENGER BOARDING BRIDGE MANUFACTURERS

FIGURE 23 REVENUE SHIFT FOR PASSENGER BOARDING BRIDGES MARKET

5.6 AVERAGE SELLING PRICE

FIGURE 24 AVERAGE SELLING PRICE (2019)

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 25 SUPPLY CHAIN ANALYSIS: PASSENGER BOARDING BRIDGES MARKET

5.8 TECHNOLOGICAL ANALYSIS

6 INDUSTRY TRENDS (Page No. - 90)

6.1 INTRODUCTION

6.2 TECHNOLOGY TRENDS

6.2.1 ZIG BEE TECHNOLOGY

6.2.2 POINT TO GO SYSTEM TECHNOLOGY

6.2.3 AUTOMATED DOCKING TECHNOLOGY

6.2.4 TOUCHSCREEN TECHNOLOGY

6.2.5 WEBGATE TECHNOLOGY

6.2.6 ANTI-COLLISION TECHNOLOGY

6.2.7 R11 AND R12 TECHNOLOGY

6.3 PATENT REGISTRATION

TABLE 7 PATENT REGISTRATION, 2008-2016

7 PASSENGER BOARDING BRIDGES MARKET, BY ELEVATION SYSTEM (Page No. - 93)

7.1 INTRODUCTION

FIGURE 26 MARKET SIZE, BY ELEVATION SYSTEM, 2020 & 2025 (USD MILLION)

TABLE 8 MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

7.2 ELECTRO-MECHANICAL

7.2.1 LONG LIFE CYCLE DRIVES DEMAND FOR ELECTRO-MECHANICAL PBBS

TABLE 10 ELECTRO-MECHANICAL SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 ELECTRO-MECHANICAL SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 ELECTRO-MECHANICAL SEGMENT SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 13 ELECTRO-MECHANICAL SEGMENT SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

7.3 HYDRAULIC

7.3.1 SMOOTH VERTICAL ELEVATION OFFERED BY HYDRAULIC PBBS BOOST MARKET

TABLE 14 HYDRAULIC SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 HYDRAULIC SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 16 HYDRAULIC SEGMENT SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 17 HYDRAULIC SEGMENT SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

8 PASSENGER BOARDING BRIDGES MARKET, BY FOUNDATION (Page No. - 99)

8.1 INTRODUCTION

FIGURE 27 SIZE, BY FOUNDATION, 2020 & 2025 (USD MILLION)

TABLE 18 SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 19 SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

8.2 FIXED

8.2.1 REGIONAL AIRPORTS PREFER FIXED BRIDGES

TABLE 20 FIXED SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 FIXED SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

8.3 MOVABLE

8.3.1 ADJUSTABLE HEIGHT DRIVES DEMAND FOR MOVABLE BRIDGES

TABLE 22 MOVABLE SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 MOVABLE SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

9 PASSENGER BOARDING BRIDGES MARKET, BY POINT OF SALE (Page No. - 104)

9.1 INTRODUCTION

FIGURE 28 SIZE, BY POINT OF SALE, 2020 & 2025 (USD MILLION)

TABLE 24 SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 25 SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

9.2 OEM

9.2.1 PRODUCTION AND DELIVERY OF PBBS LIMITED DUE TO COVID-19 OUTBREAK

9.2.2 COVID-19 IMPACT ON OEMS

TABLE 26 OEM: SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 OEM: SIZE, BY REGION, 2020–2025 (USD MILLION)

9.3 AFTERMARKET

9.3.1 REPLACEMENT AND MRO OF PASSENGER BOARDING BRIDGE COMPONENTS DRIVE SEGMENT

9.3.2 IMPACT OF COVID-19 ON AFTERMARKET

TABLE 28 PASSENGER BOARDING BRIDGE AFTERMARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 PASSENGER BOARDING BRIDGE AFTERMARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

9.3.3 PARTS REPLACEMENT

9.3.4 MRO

10 PASSENGER BOARDING BRIDGES MARKET, BY PRODUCT TYPE (Page No. - 109)

10.1 INTRODUCTION

FIGURE 29 MARKET SIZE, BY PRODUCT TYPE, 2020 & 2025 (USD MILLION)

TABLE 30 MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 31 MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

10.2 APRON DRIVE

10.2.1 HIGH INVESTMENTS BOOST GROWTH OF APRON DRIVE SEGMENT

TABLE 32 APRON DRIVE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 APRON DRIVE MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.3 COMMUTER BRIDGES

10.3.1 ABILITY TO HANDLE DIFFERENT AIRCRAFT MODELS DRIVES COMMUTER BRIDGES SEGMENT

TABLE 34 COMMUTER BRIDGES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 COMMUTER BRIDGES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.4 NOSE-LOADER BRIDGES

10.4.1 NOSE-LOADER BRIDGES PREFERRED IN AIRPORTS WITH EXTREME WEATHER CONDITIONS

TABLE 36 NOSE-LOADER BRIDGES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 37 NOSE-LOADER BRIDGES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.5 T- BRIDGE

10.5.1 T-BRIDGES WIDELY USED FOR LARGE AIRCRAFT DOCKING

TABLE 38 T-BRIDGES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 T-BRIDGES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

10.6 OVER-THE-WING BRIDGE

10.6.1 OVER-THE-WING-BRIDGES DOCK TO L1 AND L2 DOORS AND REDUCE AIRCRAFT TURN TIME

TABLE 40 OVER-THE-WING BRIDGES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 OVER-THE-WING BRIDGES MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

11 PASSENGER BOARDING BRIDGES MARKET, BY STRUCTURE (Page No. - 117)

11.1 INTRODUCTION

FIGURE 30 MARKET SIZE, BY STRUCTURE, 2020 & 2025 (USD MILLION)

TABLE 42 MARKET SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 43 MARKET SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

11.2 STEEL-WALLED

11.2.1 STEEL-WALLED PBBS ARE SUITABLE FOR ALL TYPES OF AIRCRAFT

TABLE 44 STEEL-WALLED SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 STEEL-WALLED SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

11.2.2 MODERN ARCHITECTURAL TRENDS BOOST GLASS-WALLED PBB SEGMENT

TABLE 46 GLASS-WALLED SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 GLASS-WALLED SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

11.3 GLASS-STEEL-WALLED

11.3.1 SPENDING CAPACITY OF AIRPORT DETERMINES USE OF GLASS-STEEL-WALLED PBB

TABLE 48 GLASS-STEEL-WALLED SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 GLASS-STEEL-WALLED SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

12 PASSENGER BOARDING BRIDGES MARKET, BY TUNNEL TYPE (Page No. - 123)

12.1 INTRODUCTION

FIGURE 31 MARKET SIZE, BY TUNNEL TYPE, 2020 & 2025 (USD MILLION)

TABLE 50 MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 51 MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

12.2 AIR-CONDITIONED

12.2.1 COVID-19 OUTBREAK HAS LIMITED USE OF AIR-CONDITIONED PBBS

TABLE 52 AIR-CONDITIONED SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 AIR-CONDITIONED SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

12.3 UN-AIR-CONDITIONED

12.3.1 UN-AIR-CONDITIONED PBBS MOST COMMONLY USED AT AIRPORTS

TABLE 54 UN-AIR-CONDITIONED SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 UN-AIR-CONDITIONED SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

13 PASSENGER BOARDING BRIDGES MARKET, BY DOCKING TYPE (Page No. - 128)

13.1 INTRODUCTION

FIGURE 32 MARKET SIZE, BY DOCKING TYPE, 2020 & 2025 (USD MILLION)

TABLE 56 MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 57 MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

13.2 MANUAL

13.2.1 MANUALLY OPERATED PBBS PREFERRED BY AIRPORTS

TABLE 58 MANUAL SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 59 MANUAL SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

13.3 INTELLIGENT

13.3.1 ADVANCEMENTS IN TECHNOLOGY RESULTING IN INTELLIGENT PBBS BEING DEPLOYED AT SOME AIRPORTS

TABLE 60 INTELLIGENT SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 61 INTELLIGENT SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

14 SEAPORT PASSENGER BOARDING BRIDGES MARKET (Page No. - 133)

14.1 INTRODUCTION

14.2 SEAPORT

14.2.1 LOW PROCUREMENT COST DRIVES SEAPORT PBB MARKET

TABLE 62 SEAPORT SEGMENT SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 SEAPORT SEGMENT SIZE, BY REGION, 2020–2025 (USD MILLION)

14.3 SEAPORT MARKET, BY FOUNDATION

14.3.1 FIXED BRIDGES DOMINATE SEAPORT PBB MARKET

14.3.2 FIXED

14.3.3 MOVABLE

TABLE 64 SEAPORT SEGMENT SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 65 SEAPORT SEGMENT SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

14.4 SEAPORT MARKET, BY PRODUCT TYPE

14.4.1 INCREASING NUMBER OF CRUISE AND FERRY SHIPS DRIVES DEMAND FOR PBBS

14.4.2 COMMUTER BRIDGE

14.4.3 GANGWAY

TABLE 66 SEAPORT SEGMENT SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 67 SEAPORT SEGMENT SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

15 PASSENGER BOARDING BRIDGES MARKET, BY REGION (Page No. - 138)

15.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT (2020–2025)

TABLE 68 INDUSTRY SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 69 INDUSTRY SIZE, BY REGION, 2020–2025 (USD MILLION)

FIGURE 34 POST COVID-19 PBB MARKET SCENARIO

15.2 NORTH AMERICA

15.2.1 COVID-19 RESTRICTIONS IN NORTH AMERICA

15.2.2 NORTH AMERICA: PBB AVERAGE SELLING PRICE TREND

FIGURE 35 NORTH AMERICA: AVERAGE SELLING PRICE TREND

15.2.3 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 36 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 70 NORTH AMERICA: REGIONAL SIZE, BY COUNTRY, 2016–2019 (UNITS)

TABLE 71 NORTH AMERICA: REGIONAL SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: REGIONAL SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 73 NORTH AMERICA: REGIONAL SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: REGIONAL SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

TABLE 75 NORTH AMERICA: REGIONAL SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: REGIONAL SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 77 NORTH AMERICA: REGIONAL SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: REGIONAL SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 79 NORTH AMERICA: REGIONAL SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 80 NORTH AMERICA: REGIONAL SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 81 NORTH AMERICA: REGIONAL SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 82 NORTH AMERICA: REGIONAL SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 83 NORTH AMERICA: SEAPORT SEGMENT SIZE, 2016–2019 (USD MILLION)

TABLE 84 NORTH AMERICA: SEAPORT SEGMENT SIZE, 2020–2025 (USD MILLION)

TABLE 85 NORTH AMERICA: REGIONAL SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 86 NORTH AMERICA: REGIONAL SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

TABLE 87 NORTH AMERICA: REGIONAL SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 88 NORTH AMERICA: REGIONAL SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.2.3.1 US

TABLE 89 US: REGIONAL SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 90 US: REGIONAL SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 91 US: REGIONAL SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 92 US: REGIONAL SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 93 US: REGIONAL SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 94 US: REGIONAL SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 95 US: REGIONAL SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 96 US: REGIONAL SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 97 US: REGIONAL SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 98 US: REGIONAL SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 99 US: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 100 US: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.2.3.2 Canada

TABLE 101 CANADA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 102 CANADA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 103 CANADA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 104 CANADA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 105 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 106 CANADA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.3 EUROPE

15.3.1 COVID-19 RESTRICTIONS IN EUROPE

15.3.2 EUROPE: PBB AVERAGE SELLING PRICE TREND

FIGURE 37 EUROPE: AVERAGE SELLING PRICE TREND

15.3.3 PESTLE ANALYSIS: EUROPE

FIGURE 38 EUROPE: PASSENGER BOARDING BRIDGES MARKET SNAPSHOT

TABLE 113 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (UNITS)

TABLE 114 EUROPE: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 117 EUROPE: MARKET SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 119 EUROPE: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 126 EUROPE: SEAPORT SEGMENT SIZE, 2016–2019 (USD MILLION)

TABLE 127 EUROPE: SEAPORT SEGMENT MARKET SIZE, 2020–2025 (USD MILLION)

TABLE 128 EUROPE: SEGMENT MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 129 EUROPE: SEGMENT MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

TABLE 130 EUROPE: SEGMENT MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 131 EUROPE: SEGMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.3.3.1 UK

TABLE 132 UK: PASSENGER BOARDING BRIDGES MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 133 UK: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 134 UK: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 135 UK: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 136 UK: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 137 UK: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 138 UK: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 139 UK: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 140 UK: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 141 UK: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 142 UK: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 143 UK: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.3.3.2 Russia

TABLE 144 RUSSIA: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 145 RUSSIA: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 146 RUSSIA: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 147 RUSSIA: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 148 RUSSIA: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 149 RUSSIA: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 150 RUSSIA: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 151 RUSSIA: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 152 RUSSIA: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 153 RUSSIA: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 154 RUSSIA: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 155 RUSSIA: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.3.3.3 Germany

TABLE 156 GERMANY: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 157 GERMANY: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 158 GERMANY: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 159 GERMANY: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 160 GERMANY: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 161 GERMANY: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 162 GERMANY: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 163 GERMANY: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 164 GERMANY: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 165 GERMANY: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 166 GERMANY: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 167 GERMANY: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.3.3.4 France

TABLE 168 FRANCE: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 169 FRANCE: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 170 FRANCE: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 171 FRANCE: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 172 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 173 FRANCE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 174 FRANCE: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 175 FRANCE: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 176 FRANCE: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 177 FRANCE: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 178 FRANCE: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 179 FRANCE: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.3.3.5 Spain

TABLE 180 SPAIN: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 181 SPAIN: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 182 SPAIN: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 183 SPAIN: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 184 SPAIN: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 185 SPAIN: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 186 SPAIN: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 187 SPAIN: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 188 SPAIN: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 189 SPAIN: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 190 SPAIN: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 191 SPAIN: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.3.3.6 Rest of Europe

TABLE 192 REST OF EUROPE: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 193 REST OF EUROPE: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 194 REST OF EUROPE: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 195 REST OF EUROPE: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 196 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 197 REST OF EUROPE: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 198 REST OF EUROPE: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 199 REST OF EUROPE: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 200 REST OF EUROPE: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 201 REST OF EUROPE: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 202 REST OF EUROPE: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 203 REST OF EUROPE: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.4 ASIA PACIFIC

15.4.1 ASIA PACIFIC COVID-19 RESTRICTIONS

15.4.2 ASIA PACIFIC: PBB AVERAGE SELLING PRICE TREND

FIGURE 39 ASIA PACIFIC: AVERAGE SELLING PRICE TREND

15.4.3 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: PASSENGER BOARDING BRIDGES MARKET SNAPSHOT

TABLE 204 ASIA PACIFIC: SIZE, BY COUNTRY, 2016–2019 (UNITS)

TABLE 205 ASIA PACIFIC: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 206 ASIA PACIFIC: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 207 ASIA PACIFIC: SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 208 ASIA PACIFIC: SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

TABLE 209 ASIA PACIFIC: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 210 ASIA PACIFIC: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 211 ASIA PACIFIC: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 212 ASIA PACIFIC: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 213 ASIA PACIFIC: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 214 ASIA PACIFIC: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 215 ASIA PACIFIC: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 216 ASIA PACIFIC: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 217 ASIA PACIFIC: SEAPORT SEGMENT SIZE, 2016–2019 (USD MILLION)

TABLE 218 ASIA PACIFIC: SEAPORT SEGMENT MARKET SIZE, 2020–2025 (USD MILLION)

TABLE 219 ASIA PACIFIC: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 220 ASIA PACIFIC: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

TABLE 221 ASIA PACIFIC: SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 222 ASIA PACIFIC: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.4.3.1 China

TABLE 223 CHINA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 224 CHINA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 225 CHINA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 226 CHINA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 227 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 228 CHINA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 229 CHINA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 230 CHINA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 231 CHINA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 232 CHINA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 233 CHINA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 234 CHINA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.4.3.2 Japan

TABLE 235 JAPAN: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 236 JAPAN: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 237 JAPAN: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 238 JAPAN: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 239 JAPAN: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 240 JAPAN: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 241 JAPAN: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 242 JAPAN: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 243 JAPAN: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 244 JAPAN: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 245 JAPAN: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 246 JAPAN: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.4.3.3 India

TABLE 247 INDIA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 248 INDIA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 249 INDIA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 250 INDIA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 251 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 252 INDIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 253 INDIA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 254 INDIA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 255 INDIA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 256 INDIA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 257 INDIA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 258 INDIA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.4.3.4 Vietnam

TABLE 259 VIETNAM: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 260 VIETNAM: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 261 VIETNAM: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 262 VIETNAM: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 263 VIETNAM: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 264 VIETNAM: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 265 VIETNAM: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 266 VIETNAM: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 267 VIETNAM: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 268 VIETNAM: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 269 VIETNAM: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 270 VIETNAM: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.4.3.5 Australia

TABLE 271 AUSTRALIA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 272 AUSTRALIA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 273 AUSTRALIA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 274 AUSTRALIA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 275 AUSTRALIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 276 AUSTRALIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 277 AUSTRALIA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 278 AUSTRALIA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 279 AUSTRALIA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 280 AUSTRALIA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 281 AUSTRALIA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 282 AUSTRALIA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.4.3.6 Rest of Asia Pacific

TABLE 283 REST OF ASIA PACIFIC: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 284 REST OF ASIA PACIFIC: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 285 REST OF ASIA PACIFIC: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 286 REST OF ASIA PACIFIC: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 287 REST OF ASIA PACIFIC: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 288 REST OF ASIA PACIFIC: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 289 REST OF ASIA PACIFIC: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 290 REST OF ASIA PACIFIC: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 291 REST OF ASIA PACIFIC: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 292 REST OF ASIA PACIFIC: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 293 REST OF ASIA PACIFIC: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 294 REST OF ASIA PACIFIC: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.5 MIDDLE EAST

15.5.1 COVID-19 RESTRICTIONS IN MIDDLE EAST

15.5.2 PESTLE ANALYSIS: MIDDLE EAST

FIGURE 41 MIDDLE EAST: PASSENGER BOARDING BRIDGES MARKET SNAPSHOT

TABLE 295 MIDDLE EAST: MARKET SIZE, BY COUNTRY, 2016–2019 (UNITS)

TABLE 296 MIDDLE EAST: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 297 MIDDLE EAST: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 298 MIDDLE EAST: MARKET SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 299 MIDDLE EAST: MARKET SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

TABLE 300 MIDDLE EAST: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 301 MIDDLE EAST: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 302 MIDDLE EAST: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 303 MIDDLE EAST: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 304 MIDDLE EAST: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 305 MIDDLE EAST: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 306 MIDDLE EAST: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 307 MIDDLE EAST: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 308 MIDDLE EAST: SEAPORT SEGMENT SIZE, 2016–2019 (USD MILLION)

TABLE 309 MIDDLE EAST: SEAPORT SEGMENT SIZE, 2020–2025 (USD MILLION)

TABLE 310 MIDDLE EAST: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 311 MIDDLE EAST: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

TABLE 312 MIDDLE EAST: SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 313 MIDDLE EAST: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.5.2.1 UAE

TABLE 314 UAE: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 315 UAE: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 316 UAE: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 317 UAE: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 318 UAE: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 319 UAE: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 320 UAE: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 321 UAE: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 322 UAE: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 323 UAE: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 324 UAE: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 325 UAE: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.5.2.2 Saudi Arabia

TABLE 326 SAUDI ARABIA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 327 SAUDI ARABIA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 328 SAUDI ARABIA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 329 SAUDI ARABIA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 330 SAUDI ARABIA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 331 SAUDI ARABIA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 332 SAUDI ARABIA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 333 SAUDI ARABIA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 334 SAUDI ARABIA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 335 SAUDI ARABIA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 336 SAUDI ARABIA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 337 SAUDI ARABIA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.5.2.3 Turkey

TABLE 338 TURKEY: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 339 TURKEY: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 340 TURKEY: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 341 TURKEY: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 342 TURKEY: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 343 TURKEY: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 344 TURKEY: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 345 TURKEY: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 346 TURKEY: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 347 TURKEY: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 348 TURKEY: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 349 TURKEY: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.5.2.4 Rest of Middle East

TABLE 350 REST OF MIDDLE EAST: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 351 REST OF MIDDLE EAST: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 352 REST OF MIDDLE EAST: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 353 REST OF MIDDLE EAST: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 354 REST OF MIDDLE EAST: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 355 REST OF MIDDLE EAST: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 356 REST OF MIDDLE EAST: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 357 REST OF MIDDLE EAST: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 358 REST OF MIDDLE EAST: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 359 REST OF MIDDLE EAST: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 360 REST OF MIDDLE EAST: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 361 REST OF MIDDLE EAST: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.6 LATIN AMERICA

15.6.1 COVID-19 RESTRICTIONS IN LATIN AMERICA

15.6.2 PESTLE ANALYSIS: LATIN AMERICA

FIGURE 42 LATIN AMERICA: PASSENGER BOARDING BRIDGES MARKET SNAPSHOT

TABLE 362 LATIN AMERICA: SIZE, BY COUNTRY, 2016–2019 (UNITS)

TABLE 363 LATIN AMERICA: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 364 LATIN AMERICA: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 365 LATIN AMERICA: SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 366 LATIN AMERICA: SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

TABLE 367 LATIN AMERICA: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 368 LATIN AMERICA: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 369 LATIN AMERICA: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 370 LATIN AMERICA: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 371 LATIN AMERICA: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 372 LATIN AMERICA: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 373 LATIN AMERICA: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 374 LATIN AMERICA: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 375 LATIN AMERICA: SEAPORT SEGMENT SIZE, 2016–2019 (USD MILLION)

TABLE 376 LATIN AMERICA: SEAPORT SEGMENT SIZE, 2020–2025 (USD MILLION)

TABLE 377 LATIN AMERICA: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 378 LATIN AMERICA: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

TABLE 379 LATIN AMERICA: SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 380 LATIN AMERICA: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.6.2.1 Brazil

TABLE 381 BRAZIL: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 382 BRAZIL: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 383 BRAZIL: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 384 BRAZIL: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 385 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 386 BRAZIL: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 387 BRAZIL: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 388 BRAZIL: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 389 BRAZIL: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 390 BRAZIL: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 391 BRAZIL: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 392 BRAZIL: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.6.2.2 Mexico

TABLE 393 MEXICO: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 394 MEXICO: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 395 MEXICO: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 396 MEXICO: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 397 MEXICO: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 398 MEXICO: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 399 MEXICO: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 400 MEXICO: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 401 MEXICO: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 402 MEXICO: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 403 MEXICO: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 404 MEXICO: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.6.2.3 Rest of Latin America

TABLE 405 REST OF LATIN AMERICA: PASSENGER BOARDING BRIDGES MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 406 REST OF LATIN AMERICA: PASSENGER BOARDING BRIDGES MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 407 REST OF LATIN AMERICA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 408 REST OF LATIN AMERICA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 409 REST OF LATIN AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 410 REST OF LATIN AMERICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 411 REST OF LATIN AMERICA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 412 REST OF LATIN AMERICA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 413 REST OF LATIN AMERICA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 414 REST OF LATIN AMERICA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 415 REST OF LATIN AMERICA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 416 REST OF LATIN AMERICA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.7 AFRICA

15.7.1 COVID-19 RESTRICTIONS IN AFRICA

FIGURE 43 AFRICA: PASSENGER BOARDING BRIDGES MARKET SNAPSHOT

TABLE 417 AFRICA: SIZE, BY COUNTRY, 2016–2019 (UNITS)

TABLE 418 AFRICA: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 419 AFRICA: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 420 AFRICA: SIZE, BY STRUCTURE, 2016–2019 (USD MILLION)

TABLE 421 AFRICA: SIZE, BY STRUCTURE, 2020–2025 (USD MILLION)

TABLE 422 AFRICA: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 423 AFRICA: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 424 AFRICA: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 425 AFRICA: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 426 AFRICA: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 427 AFRICA: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 428 AFRICA: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 429 AFRICA: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 430 AFRICA: SEAPORT SEGMENT SIZE, 2016–2019 (USD MILLION)

TABLE 431 AFRICA: SEAPORT SEGMENT SIZE, 2020–2025 (USD MILLION)

TABLE 432 AFRICA: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 433 AFRICA: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

TABLE 434 AFRICA: SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 435 AFRICA: SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.7.1.1 South Africa

TABLE 436 SOUTH AFRICA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 437 SOUTH AFRICA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 438 SOUTH AFRICA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 439 SOUTH AFRICA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 440 SOUTH AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 441 SOUTH AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 442 SOUTH AFRICA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 443 SOUTH AFRICA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 444 SOUTH AFRICA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 445 SOUTH AFRICA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 446 SOUTH AFRICA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 447 SOUTH AFRICA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.7.1.2 Egypt

TABLE 448 EGYPT: SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 449 EGYPT: SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 450 EGYPT: SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 451 EGYPT: SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 452 EGYPT: SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 453 EGYPT: SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 454 EGYPT: SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 455 EGYPT: SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 456 EGYPT: SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 457 EGYPT: SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 458 EGYPT: SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 459 EGYPT: SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

15.7.1.3 Rest of Africa

TABLE 460 REST OF AFRICA: MARKET SIZE, BY ELEVATION SYSTEM, 2016–2019 (USD MILLION)

TABLE 461 REST OF AFRICA: MARKET SIZE, BY ELEVATION SYSTEM, 2020–2025 (USD MILLION)

TABLE 462 REST OF AFRICA: MARKET SIZE, BY FOUNDATION, 2016–2019 (USD MILLION)

TABLE 463 REST OF AFRICA: MARKET SIZE, BY FOUNDATION, 2020–2025 (USD MILLION)

TABLE 464 REST OF AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2016–2019 (USD MILLION)

TABLE 465 REST OF AFRICA: MARKET SIZE, BY PRODUCT TYPE, 2020–2025 (USD MILLION)

TABLE 466 REST OF AFRICA: MARKET SIZE, BY TUNNEL TYPE, 2016–2019 (USD MILLION)

TABLE 467 REST OF AFRICA: MARKET SIZE, BY TUNNEL TYPE, 2020–2025 (USD MILLION)

TABLE 468 REST OF AFRICA: MARKET SIZE, BY DOCKING TYPE, 2016–2019 (USD MILLION)

TABLE 469 REST OF AFRICA: MARKET SIZE, BY DOCKING TYPE, 2020–2025 (USD MILLION)

TABLE 470 REST OF AFRICA: MARKET SIZE, BY POINT OF SALE, 2016–2019 (USD MILLION)

TABLE 471 REST OF AFRICA: MARKET SIZE, BY POINT OF SALE, 2020–2025 (USD MILLION)

16 COMPETITIVE LANDSCAPE (Page No. - 278)

16.1 INTRODUCTION

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 472 OVERVIEW OF STRATEGIES DEPLOYED BY KEY COMPANIES

16.3 REVENUE ANALYSIS OF TOP THREE MARKET PLAYERS

FIGURE 44 TOP 3 PLAYERS HAVE DOMINATED MARKET IN LAST 5 YEARS

16.4 MARKET SHARE OF TOP THREE PLAYERS

FIGURE 45 MARKET SHARE OF TOP 3 COMPANIES (2019)

16.5 MARKET RANKING

16.6 WHO TO WHOM ANALYSIS

16.7 COMPANY EVALUATION QUADRANT

16.7.1 STAR

16.7.2 EMERGING LEADERS

16.7.3 PARTICIPANT

16.7.4 PERVASIVE

FIGURE 46 COMPETITIVE LEADERSHIP MAPPING

FIGURE 47 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN PBB MARKET

16.8 COMPETITIVE SCENARIO

16.8.1 CONTRACTS AND AGREEMENTS

TABLE 473 CONTRACTS AND AGREEMENTS, 2018–MARCH 2020

16.8.2 NEW PRODUCT LAUNCHES

TABLE 474 NEW PRODUCT LAUNCHES, 2018–MARCH 2020

16.8.3 ACQUISITIONS

TABLE 475 ACQUISITIONS, 2018–MARCH 2020

17 COMPANY PROFILES (Page No. - 286)

17.1 KEY COMPANIES

(Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats)*

17.1.1 THYSSENKRUPP AG

FIGURE 48 THYSSENKRUPP AG: COMPANY SNAPSHOT

17.1.2 JOHN BEAN TECHNOLOGIES CORP.

FIGURE 49 JOHN BEAN TECHNOLOGIES CORP: COMPANY SNAPSHOT

17.1.3 CHINA INTERNATIONAL MARINE CONTAINERS (GROUP) LTD. (CIMC)

FIGURE 50 CIMC GROUP LTD: COMPANY SNAPSHOT

17.1.4 SHINMAYWA INDUSTRIES LTD

FIGURE 51 SHINMAYWA INDUSTRIES LTD: COMPANY SNAPSHOT

17.1.5 FMT SWEDEN AB

17.1.6 ADELTE GROUP

17.1.7 VATAPLE GROUP LTD

17.1.8 HUBNER GMBH & CO. KG

17.1.9 MITSUBISHI HEAVY INDUSTRIES, LTD

FIGURE 52 MITSUBISHI HEAVY INDUSTRIES, LTD: COMPANY SNAPSHOT

17.1.10 PT BUKAKA TEKNIK UTAMA TBK

FIGURE 53 PT BUKAKA TEKNIK UTAMA TBK: COMPANY SNAPSHOT

17.1.11 AMERIBRIDGE, INC

17.1.12 AIRPORT EQUIPMENT LTD

17.1.13 UBS AIRPORT SYSTEMS

17.1.14 ACCESSAIR SYSTEMS INC

17.1.15 AVIRAMP LTD

17.1.16 AOYAMA ELEVATOR CO., LTD

17.1.17 DEERNS GROEP BV

17.1.18 OVERSYS LLC

17.1.19 SHANGHAI HAOBO AVIATION EQUIPMENT CO., LTD

17.1.20 AEROMOBILES PTE LTD

17.1.21 AVICORP MIDDLE EAST

17.2 PBB SERVICE PROVIDERS

17.2.1 ANTON AIR SUPPORT

17.2.2 EAST ISLAND AVIATION SERVICES

17.2.3 DIMAIM SYSTEMS

17.2.4 ALPHA-CIM

*Business overview, Products offered, Recent developments, MnM view, Key strengths, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

18 PASSENGER BOARDING BRIDGE ADJACENT MARKET (Page No. - 316)

18.1 GROUND SUPPORT EQUIPMENT MARKET, BY APPLICATION

18.1.1 INTRODUCTION

FIGURE 54 GROUND SUPPORT EQUIPMENT MARKET, BY APPLICATION, 2019 & 2025 (USD MILLION)

TABLE 476 GROUND SUPPORT EQUIPMENT MARKET SIZE, BY APPLICATION, 2017–2025 (USD MILLION)

18.1.2 COMMERCIAL

TABLE 477 GROUND SUPPORT EQUIPMENT MARKET SIZE, BY COMMERCIAL APPLICATION, 2017–2025 (USD MILLION)

18.1.2.1 PASSENGER SERVICEs

TABLE 478 GROUND SUPPORT EQUIPMENT MARKET IN COMMERCIAL APPLICATIONS, BY PASSENGER SERVICE, 2017–2025 (USD MILLION)

18.1.2.1.1 Cabin service vehicles

18.1.2.1.2 Boarding stairs

18.1.2.1.3 Lavatory vehicles

18.1.2.1.4 Passenger boarding bridges

18.1.2.1.5 Passenger buses

18.1.2.2 CARGO SERVICEs

TABLE 479 GROUND SUPPORT EQUIPMENT MARKET IN COMMERCIAL APPLICATIONS, BY CARGO SERVICE, 2017–2025 (USD MILLION)

18.1.2.2.1 Cargo/container loaders

18.1.2.2.2 Pushback tractors

18.1.2.2.3 Forklifts

18.1.2.2.4 Container pallet transporters

18.1.2.2.5 Baggage tractors

18.1.2.2.6 Bulk loaders/conveyors

18.1.2.3 Aircraft services

TABLE 480 GROUND SUPPORT EQUIPMENT MARKET IN COMMERCIAL APPLICATIONS, BY AIRCRAFT SERVICE, 2017–2025 (USD MILLION)

18.1.2.3.1 Deicers

18.1.2.3.2 Ground power units

18.1.2.3.3 Pre-conditioned air units

18.1.2.4 Chargers

TABLE 481 GROUND SUPPORT EQUIPMENT MARKET IN CHARGERS EQUIPMENT, BY CHARGING PORT, 2017–2025 (USD MILLION)

18.1.2.4.1 Single port chargers

18.1.2.4.2 Double port chargers

18.1.2.4.3 Multiple port chargers

18.1.2.5 Hydrant fuel systems

18.1.2.6 Others

18.1.3 MILITARY

TABLE 482 GROUND SUPPORT EQUIPMENT MARKET SIZE, BY MILITARY APPLICATION, 2017–2025 (USD MILLION)

18.1.3.1 Deicers

18.1.3.2 Ground power units

18.1.3.3 Tow tractors

19 APPENDIX (Page No. - 327)

19.1 DISCUSSION GUIDE

19.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

19.3 AVAILABLE CUSTOMIZATIONS

19.4 RELATED REPORTS

19.5 AUTHOR DETAILS

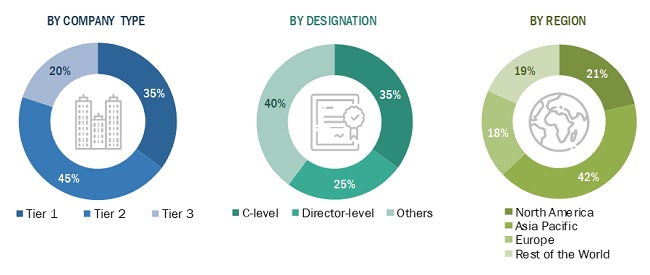

The study involved four major activities in estimating the current size of the Passenger Boarding Bridges Market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Statista, Global Firepower, SIPRI report, UN Comtrade World Bank, Factiva, Bloomberg, BusinessWeek, SEC filings, annual reports, press releases & investor presentations of companies, certified publications, and articles by recognized authors were referred to for identifying and collecting information on the Passenger Boarding Bridges Market.

Primary Research

The passenger boarding bridges market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, service providers and system integrators in its supply chain. The demand side of this market is characterized by various end-users such as commercial, private organizations of different countries. The supply side is characterized by suppliers, manufacturers, solution providers, technology developers, and service provider. The following is the breakdown of the primary respondents that were interviewed to obtain qualitative and quantitative information about the Passenger Boarding Brridges Market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the passenger boarding bridges market. These methods were also used extensively to estimate the size of various segments and subsegment of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the Passenger Boarding Bridges Market using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the passenger boarding bridges market.

Report Objectives

- To describe, segment, and forecast the size of the passenger boarding bridges market, by elevation system, product type, tunnel type, docking type, structure, foundation, point of sale, and seaport, in terms of value

- To describe and forecast the size of various segments of the market with respect to 6 major regions—North America, Europe, Asia Pacific, Latin America, Middle East, and Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the passenger boarding bridges market

- To identify prevailing industry trends, market trends, and technology trends related to the passenger boarding bridges market

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the degree of competition in the market by identifying key market players

- To analyze competitive developments such as contracts, and new product launches and acquisitions in the passenger boarding bridges market

- To identify the detailed financial position, key products/services, and major developments of leading companies in the market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the passenger boarding bridges market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Passenger Boarding Bridges Market

Growth opportunities and latent adjacency in Passenger Boarding Bridges Market

I am trying to learn more about the current market share in the aftermarket space for passenger boarding bridges and ancillary equipment.