Partner Relationship Management Market by Component (Solutions (Engage, Collaborate, and Manage) and Services (managed and training, consulting, and integration)), Deployment Type, Organization Size, Vertical, and Region - Global Forecast to 2026

Updated on : June 9, 2023

Partner Relationship Management Market Analysis

The worldwide partner relationship management market was worth $920 million from 2020 to 2026. It is expected to grow at a rate of 13.8% and reach $1,977 million by 2026. Key factors that are expected to drive the growth of the market are the need to control the functional relationship between organizations and external partner channels, and focus on the enhancement of partner communication and reduction in channel management costs.

However, data security and privacy aspects are expected to limit the market growth. Apart from drivers and restraints, there are a few lucrative opportunities for PRM solution providers. Business intelligence (BI) for better channel performance and the incorporation of AI into PRM to optimize partner engagement are some of the opportunities for vendors in the partner relationship management market. These opportunities are expected to present new market growth prospects for PRM vendors.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. The pandemic has had a negative impact on the PRM market. Organizations use PRM solutions to enhance agility between their business functions and channel partners. The solutions primarily help companies in automating customer service functions and decreasing manual processing costs related to promotional funds management, order management, warranties, and returns processing. They can lower collateral distribution costs and promote self-service transactions through online inquiries (for example, order status, account status) and self-training programs. The deployment of PRM solutions, either in cloud or on-premises, helps organizations maintain consistency and authenticity across their partner management.

Partner Relationship Management Market Dynamics

Driver: Need to control the functional relationship between organizations and external partner channels

In the current competitive market scenario, and companies are finding it difficult to differentiate their offerings. The dizzying rate of transformation is making it even challenging. The rate of producing, selling, and pivoting has increased over the years. To stay ahead of the curve, companies are rapidly reaching out to sales partners to facilitate rapid growth. Sales partnerships enable businesses to expand into new territories.

To improve channel loyalty and reach, channel managers are announcing new market opportunities and providing branded solution offerings to their partners. As per a recent report by Accenture, a majority of tech companies are dependent on indirect sales channels to promote their business. For instance, Cisco would generate one-third of its sales through indirect channels and 80% of revenue through channel partners. Hence, the need to control the functional relationship between organizations and external partner channels is expected to drive the Partner Relationship Management market growth.

Restraint: Data security and privacy aspects

PRM solutions hold a variety of data, including business-critical data and customer data. Privacy issues can make PRM unviable. Mobile operators are afraid of compromising the security of customer data because it would result in the loss of customers. Regulations such as General Data Protection Regulation (GDPR) also hold the partner relationship management market accountable for data privacy. Enterprises are sensitive when it comes to data sharing and accessibility. Therefore, PRM solution and service providers need to maintain the highest level of privacy and security. Cybersecurity is one of the most important factors for smooth business operations. In recent times, there has been a huge rise in the number of data breaches and cyber attacks. Cyberattacks increased by 600% from 2016 to 2017.

The PRM solutions include sales, services and customer support, call centers, sales force automation systems, and order management. One of the problems with PRM is the trade-off between security and convenience. For user convenience, PCs, laptops, tablets, and mobile phones can be interface devices for accessing PRM systems. All these devices need to be connected to the internet, which can invite attacks such as Denial Of Service (DOS), malware, and identity thefts. Companies are finding it difficult to comply with GDPR. It is estimated that about 80% of companies are failing to comply with GDPR, which can result in fines and long-term problems. To provide seamless experiences and growth to customers, PRM providers need to provide a fully secure system to achieve business growth for customers while easily complying with regulations.

Opportunity: Business intelligence for better channel performance

Companies adopt channel partner techniques to market their products/services. However, these techniques can be a challenging task to effectively manage partners. The market is getting complex due to its evolving nature. Now-a-days, new partner types and partner programs are emerging to attract and retain partners. Utilizing the latest technologies such as AI and analytics for providing BI can further boost the adoption of PRM solutions. BI turns data into actionable insights that help organizations in strategic and tactical business decision-making. BI quickly provides channel visibility, tracks partner performance, and helps partners uncover opportunities to grow their business. It can help companies in making data-driven sales and marketing decisions. Therefore, the PRM solutions embedded with BI for better channel performance are an opportunity for players in the global Partner Relationship Management market.

Challenge: Complex data and system integration issues

Channel management is a complex process because it manages various business aspects. The channel management process varies from company to company; there would be different structures for SME, large enterprise, and government organizations. The configuration of PRM solutions is dependent on organizational structures as it defines the direct relationship between managers and subordinates. In the case of resellers or partner networks, structures are different and offer challenges to implement a PRM solution. Employees need special skills to use PRM solutions, and in the case of new staff, special training needs to be provided. Large enterprises have old systems in place, which might be a challenge for PRM providers while integrating them with PRM solutions. Hence, complex process and system integration issues offer challenges to the PRM providers.

Solutions segment to hold a larger market size during the forecast period

PRM solutions assist companies in automating customer service functions and decreasing manual processing costs related to promotional funds management, order management, warranties, and returns processing. Due to such benefits offered by PRM solutions, their demand across industry verticals is expected to increase during the forecast period. Major reasons behind the decline of PRM solutions during COVID-19 pandemic across the globe are reduced profit margins and less allocation of IT budgets. These reasons lead to low investments in new subscriptions. The demand for consulting, integration, and implementation services has also decreased with low technology spending on new subscriptions. These trends are expected to decrease the demand for PRM solutions and services.

On-premises deployment type to hold a larger market size in 2020

In the on-premises type of delivery model, software or solutions are installed and operated from customers’ in-house server and computing infrastructure. The cost of installing on-premises solutions is included in the Capital Expenditure (CAPEX) of companies. This approach is mostly adopted for applications that involve the processing of sensitive and confidential data. Nowadays, every organization generates vast amounts of data due to the use of ML, IT devices, sensors, clickstreams, and many other devices. The on-premises deployment type enables organizations to ingest data into their own databases, thereby maintaining data security. In the on-premises deployment type, companies must install the required hardware as well as software. In addition, they must maintain hardware, implement cybersecurity applications, train staff, update new versions, and arrange backup for data or damaged parts. Due to such huge initial upfront costs and the need for manual intervention, the on-premises deployment type can be afforded by large enterprises.

Large enterprises to hold a majority of the market share during the forecast period

Large enterprises have a large corporate network and many revenue streams. They are keen to invest in new and latest technologies to effectively run their business. The partner relationship management market has a stronghold in large enterprises, as the partner network of large enterprises is more complex than SMEs. The existing system integration with advanced PRM solutions is a challenge faced by large enterprises. This challenge can be easily resolved with robust integrations, and training and support services provided by PRM vendors. These enterprises prefer to implement solutions and their associated services on-premises. This deployment type can assist them in increasing their profits and maintaining data confidentiality. The market size of the large enterprises segment in the global Partner Relationship Management market is expected to hold a larger market size as compared to the SMEs segment during the forecast period.

IT and Telecommunications industry vertical to hold a majority of the market share during the forecast period

This industry vertical faces challenges to maintain IP copyrights, and it deals with cross-border data privacy and security challenges by regulators and anti-trust inquiries. The IT and telecommunication industry vertical requires to synchronize enterprise customers and their partners in terms of language, time, currency, and platform. Communication service providers and customers’ businesses operating globally need multi-currency support. The industry vertical is adopting PRM solutions for overcoming these challenges. Hence, the industry vertical is expected to hold the highest market share in the global Partner Relationship Management market.

To know about the assumptions considered for the study, download the pdf brochure

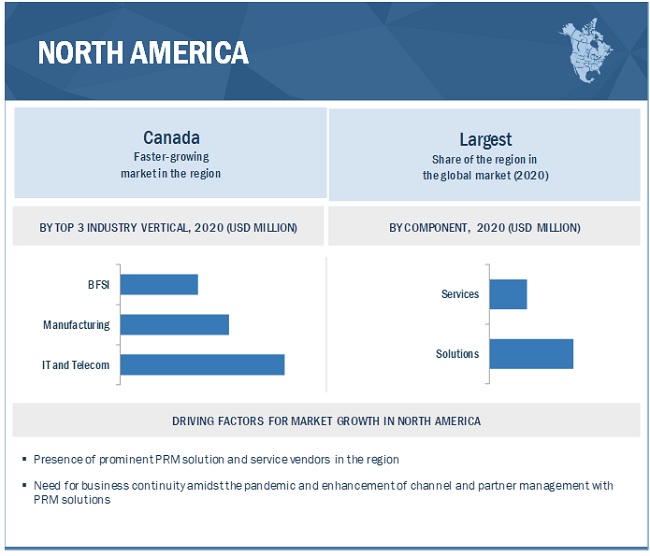

North America to account for the largest market size during the forecast period

The global partner relationship management market by region covers five major geographic regions, namely, North America, Asia Pacific (APAC), Europe, Middle East & Africa (MEA), and Latin America. North America is expected to account for the largest market size during the forecast period. The market in this region is projected to be the most promising for major verticals, such as IT and telecom, and BFSI. The size of the Partner Relationship Management market in North America is projected to grow steadily during the forecast period. In this report, North America is further segmented into the US and Canada. The US is projected to be one of the major revenue contributors for the growth of the Partner Relationship Management market in North America. Canada is also projected to present major growth opportunities for PRM solutions & service providers. North America is increasingly impacted by the COVID-19 pandemic. According to the Bureau of Economic Analysis, which is maintained by the US Department of Commerce, 11.6% of the US economic output comes from the manufacturing vertical. Due to the lockdown, various manufacturing firms have halted their operations and are, hence using few cloud services.

Top Companies in Partner Relationship Management

The partner relationship management vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions, to strengthen their offerings in the market. The major vendors offering PRM solutions and services globally are

- Allbound(US)

- Channeltivity(US)

- Oracle (US)

- Salesforce (US)

- Impartner (US)

- LogicBay (US)

- Magentrix (Canada)

- ZINFI Technologies (US)

- Zift Solutions (US)

- Mindmatrix (US)

- PartnerStack (Canada)

- ChannelXperts (Germany)

- Creatio (US)

- AppDirect (US)

- Webinfinity (US)

The study includes an in-depth competitive analysis of key players in the Partner Relationship Management market with their company profiles, recent developments, COVID-19 developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Market Revenue in 2020 |

USD 920 million |

|

Estimated value for 2026 |

USD 1,997 million |

|

Market Growth Rate |

13.8%CAGR |

|

Segments Covered |

Component (Solutions & Services), Deployment Type, Organization Size, Vertical, and Region |

|

Geographies covered |

North America, APAC, Europe, MEA, and Latin America |

|

Market Drivers |

|

|

Market Opportunities |

|

This research report categorizes the Partner Relationship Management market based on component, deployment type, organization size, vertical, and region.

Based on the component:

-

Solutions

- Engage

- Collaborate

- Manage

-

Services

- Managed Services

- Training, Consulting, and Implementation

Based on the deployment type:

- On-premises

- Cloud

Based on the organization size:

- Large Enterprises

- SMEs

Based on the vertical

- BFSI

- Retail and Franchising

- Healthcare and Life Sciences

- Manufacturing

- IT and Telecom

- Others

Based on the region:

-

North America

- US

- Canada

-

Europe

- UK

- Rest of Europe

-

APAC

- China

- Rest of APAC

-

MEA

- KSA

- Rest of MEA

-

Latin America

- Brazil

- Rest of Latin America

Recent Developments

- In March 2020, Allbound launched a new integration solution for HubSpot. The new integration solution can automatically integrate contacts and opportunities from partner referrals from Allbound and sync data inside of the HubSpot platform with an all-new Allbound workflow action.

- In September 2020, Alcatraz formed a partnership with Channelitivity. The aim of this partnership is to use Channeltivity’s PRM platform to develop a channel and training program to boost its biometric access control partners’ success.

- In June 2020, Impartner launched the Impartner Channel Ignite PRM Package. The company designed a new tailored solution in order to help companies stimulate the performance of their channel in a challenging business environment.

- In July 2019, Salesforce updated its PRM platform. The company added AI and self-reporting capabilities in its PRM platform to help channel managers to optimize partner engagement.

Frequently Asked Questions (FAQ):

How big is the partner relationship management market?

What is the estimated growth rate (CAGR) of the global partner relationship management market?

What are the major revenue pockets in the partner relationship management market currently?

Who are the major vendors in the partner relationship management market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 YEARS CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2017–2019

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 6 PARTNER RELATIONSHIP MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY RESPONDENTS: MARKET

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 PARTNER RELATIONSHIP MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING PARTNER RELATIONSHIP MANAGEMENT SOLUTIONS AND SERVICES (1/2)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING PARTNER RELATIONSHIP MANAGEMENT SOLUTIONS AND SERVICES (2/2)

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (BOTTOM-UP): REVENUE OF VENDORS FROM PARTNER RELATIONSHIP MANAGEMENT

2.4 MARKET REVENUE ESTIMATION

FIGURE 11 ILLUSTRATION OF PARTNER RELATIONSHIP MANAGEMENT REVENUE ESTIMATION

2.5 GROWTH FORECAST ASSUMPTIONS

2.6 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.7 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 12 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.8 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 13 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.9 RESEARCH ASSUMPTIONS

TABLE 4 ASSUMPTIONS FOR THE STUDY

2.10 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 14 ON-PREMISES, LARGE ENTERPRISES, AND MANAGED SERVICES SEGMENTS TO HOLD HIGHER SHARES IN PARTNER RELATIONSHIP MANAGEMENT MARKET IN 2020

FIGURE 15 NORTH AMERICA TO ACCOUNT FOR HIGHEST SHARE IN MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 ATTRACTIVE OPPORTUNITIES IN PARTNER RELATIONSHIP MANAGEMENT MARKET

FIGURE 16 GROWING NEED TO EFFICIENTLY MANAGE PARTNERS TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 MARKET, BY COMPONENT, 2020 VS. 2026

FIGURE 17 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE, 2020 VS. 2026

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

4.4 MARKET, BY INDUSTRY VERTICAL, 2020 VS. 2026

FIGURE 19 INFORMATION TECHNOLOGY AND TELECOMMUNICATIONINDUSTRY VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.5 MARKET INVESTMENT SCENARIO, 2020–2026

FIGURE 20 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT SIX YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 PARTNER RELATIONSHIP MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Need to control the functional relationship between organizations and external partner channels

FIGURE 22 REVENUE FROM CHANNEL PARTNERS

5.2.1.2 Focus on the enhancement of partner communication and reduction in channel management costs

FIGURE 23 MAJOR ACTIVITIES PERFORMED ON PARTNER RELATIONSHIP MANAGEMENT PLATFORM

5.2.2 RESTRAINTS

5.2.2.1 Data security and privacy aspects

FIGURE 24 MALWARE INFECTION, 2009-2018 (MILLION)

5.2.3 OPPORTUNITIES

5.2.3.1 Business intelligence for better channel performance

5.2.3.2 Incorporation of AI into PRM to enable quick decision-making and optimize partner engagement

5.2.4 CHALLENGES

5.2.4.1 Complex data and system integration issues

5.3 INDUSTRY TRENDS

5.3.1 CASE STUDY ANALYSIS

5.3.1.1 Implementation of partner program to increase demand generation

5.3.1.2 Fullstory implemented PRM solution to quickly onboard and evaluate new partner opportunities

5.3.1.3 Managing multiple partners through single PRM solution

5.3.2 PATENT ANALYSIS

TABLE 5 IMPORTANT INNOVATIONS AND PATENT REGISTRATIONS

5.3.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES ANALYSIS: PARTNER RELATIONSHIP MANAGEMENT MARKET

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.3.3.1 Threat of new entrants

5.3.3.2 Threat of substitutes

5.3.3.3 Bargaining power of suppliers

5.3.3.4 Bargaining power of buyers

5.3.3.5 Intensity of competitive rivalry

5.3.4 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

TABLE 7 MARKET: VALUE CHAIN

5.3.5 ECOSYSTEM: PARTNER RELATIONSHIP MANAGEMENT

5.3.6 PRICING ANALYSIS

FIGURE 27 PRICING ANALYSIS: PARTNER RELATIONSHIP MANAGEMENT MARKET

5.3.7 TECHNOLOGY ANALYSIS

5.3.7.1 Artificial intelligence

5.3.7.2 Cloud computing

5.3.7.3 Analytics

5.3.8 MARKET: COVID-19 IMPACT

FIGURE 28 PRE- AND POST-COVID-19 SCENARIOS DURING FORECAST PERIOD

5.3.8.1 COVID-19 impact on partner relationship management market: Assumptions

5.3.9 DRIVERS AND OPPORTUNITIES

5.3.10 RESTRAINTS AND CHALLENGES

5.3.11 REGULATORY LANDSCAPE

5.3.11.1 Introduction

5.3.11.2 Federal rules of civil procedure

5.3.11.3 General data protection regulation

5.3.11.4 Electronic communications privacy act

5.3.11.5 Health insurance portability and accountability act

5.3.11.6 DODD-frank wall street reform and consumer protection act

5.3.11.7 California consumer privacy act

5.3.11.8 Sarbanes-oxley act of 2002

5.3.11.9 The international organization for standardization 27001

5.3.11.10 Personal data protection act

6 PARTNER RELATIONSHIP MANAGEMENT (PRM) MARKET, BY COMPONENT (Page No. - 68)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 29 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 8 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 9 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 10 COMPONENTS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 COMPONENTS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2 SOLUTIONS

FIGURE 30 COLLABORATE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 SOLUTIONS: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 13 SOLUTIONS: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 14 SOLUTIONS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 SOLUTIONS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.1 ENGAGE

TABLE 16 ENGAGE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 ENGAGE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.2 COLLABORATE

TABLE 18 COLLABORATE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 COLLABORATE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.2.3 MANAGE

TABLE 20 MANAGE MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 MANAGE MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

FIGURE 31 TRAINING, CONSULTING, AND INTEGRATION SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 22 SERVICES: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 23 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 24 SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1 MANAGED SERVICES

TABLE 26 MANAGED SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 27 MANAGED SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.2 TRAINING, CONSULTING, AND INTEGRATION SERVICES

TABLE 28 TRAINING, CONSULTING, AND INTEGRATION SERVICES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 TRAINING, CONSULTING, AND INTEGRATION SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 PARTNER RELATIONSHIP MANAGEMENT (PRM) MARKET, BY DEPLOYMENT TYPE (Page No. - 81)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

FIGURE 32 CLOUD SEGMENT TO GROW AT HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 30 MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 31 MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

7.2 ON-PREMISES

TABLE 32 ON-PREMISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 CLOUD

TABLE 34 CLOUD: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 PARTNER RELATIONSHIP MANAGEMENT (PRM) MARKET, BY ORGANIZATION SIZE (Page No. - 86)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

8.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 33 LARGE ENTERPRISES TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 36 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 37 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

8.2 LARGE ENTERPRISES

TABLE 38 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 40 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 41 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 PARTNER RELATIONSHIP MANAGEMENT (PRM) MARKET, BY INDUSTRY VERTICAL (Page No. - 91)

9.1 INTRODUCTION

9.1.1 INDUSTRY VERTICALS: MARKET DRIVERS

9.1.2 INDUSTRY VERTICALS: COVID-19 IMPACT

FIGURE 34 BANKING, FINANCIAL SERVICES, AND INSURANCE INDUSTRY VERTICAL TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 43 MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

9.2 INFORMATION TECHNOLOGY AND TELECOM

TABLE 44 INFORMATION TECHNOLOGY AND TELECOM: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 INFORMATION TECHNOLOGY AND TELECOM: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 46 BANKING, FINANCIAL SERVICES, AND INSURANCE: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 RETAIL AND FRANCHISING

TABLE 48 RETAIL AND FRANCHISING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 RETAIL AND FRANCHISING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 MANUFACTURING

TABLE 50 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 MANUFACTURING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.6 HEALTHCARE AND LIFE SCIENCES

TABLE 52 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 53 HEALTHCARE AND LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.7 OTHERS

TABLE 54 OTHERS: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 PARTNER RELATIONSHIP MANAGEMENT MARKET, BY REGION (Page No. - 101)

10.1 INTRODUCTION

FIGURE 35 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 56 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: COVID-19 IMPACT

10.2.2 NORTH AMERICA: PARTNER RELATIONSHIP MANAGEMENT MARKET DRIVERS

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 36 NORTH AMERICA: MARKET SNAPSHOT

TABLE 58 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 64 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 65 NORTH AMERICA: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 72 UNITED STATES: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 73 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 74 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 75 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.2.5 CANADA

TABLE 76 CANADA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 77 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 78 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 79 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

10.3.2 EUROPE: PARTNER RELATIONSHIP MANAGEMENT MARKET DRIVERS

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 80 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 82 EUROPE: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 84 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 86 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 88 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 89 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 90 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 91 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 92 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 93 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 UNITED KINGDOM

TABLE 94 UNITED KINGDOM: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 95 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 96 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 97 UNITED KINGDOM: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 98 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

10.4.2 ASIA PACIFIC: PARTNER RELATIONSHIP MANAGEMENT MARKET DRIVERS

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 37 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 CHINA

TABLE 116 CHINA: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 117 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 118 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 119 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.4.5 REST OF ASIA PACIFIC

TABLE 120 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 121 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 122 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE,2016–2019 (USD MILLION)

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.2 MIDDLE EAST AND AFRICA: PARTNER RELATIONSHIP MANAGEMENT MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 124 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 125 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 126 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 127 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 128 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 129 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 130 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 131 MIDDLE EAST AND AFRICA: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 132 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 133 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 134 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 135 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 136 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 137 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

TABLE 138 KINGDOM OF SAUDI ARABIA: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 139 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 140 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 141 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.5.5 REST OF MIDDLE EAST AND AFRICA

TABLE 142 REST OF MIDDLE EAST AND AFRICA: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 143 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 144 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 145 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: COVID-19 IMPACT

10.6.2 LATIN AMERICA: PARTNER RELATIONSHIP MANAGEMENT MARKET DRIVERS

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 146 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 147 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 148 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2016–2019 (USD MILLION)

TABLE 149 LATIN AMERICA: MARKET SIZE, BY SOLUTION, 2020–2026 (USD MILLION)

TABLE 150 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2019 (USD MILLION)

TABLE 151 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2020–2026 (USD MILLION)

TABLE 152 LATIN AMERICA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 153 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 154 LATIN AMERICA: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 155 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 156 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2019 (USD MILLION)

TABLE 157 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2020–2026 (USD MILLION)

TABLE 158 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.4 BRAZIL

TABLE 160 BRAZIL: PARTNER RELATIONSHIP MANAGEMENT MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 161 BRAZIL: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 162 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 163 BRAZIL: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

10.6.5 REST OF LATIN AMERICA

TABLE 164 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 165 REST OF LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 166 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2019 (USD MILLION)

TABLE 167 REST OF LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 145)

11.1 MARKET EVALUATION FRAMEWORK

FIGURE 38 MARKET EVALUATION FRAMEWORK

11.2 MARKET RANKING

FIGURE 39 MARKET RANKING, 2019

11.3 MARKET SHARE ANALYSIS

TABLE 168 PARTNER RELATIONSHIP MANAGEMENT MARKET: DEGREE OF COMPETITION

FIGURE 40 MARKET SHARE ANALYSIS OF COMPANIES IN MARKET

11.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 41 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS IN MARKET, 2015-2019

11.5 KEY MARKET DEVELOPMENTS

FIGURE 42 KEY DEVELOPMENTS IN PARTNER RELATIONSHIP MANAGEMENT MARKET DURING 2018–2020

11.5.1 NEW PRODUCT LAUNCHES

TABLE 169 NEW PRODUCT LAUNCHES, 2018-2020

11.5.2 DEALS

TABLE 170 DEALS, 2019-2020

11.6 COMPANY EVALUATION MATRIX

TABLE 171 COMPANY PRODUCT FOOTPRINT

TABLE 172 COMPANY INDUSTRY FOOTPRINT

TABLE 173 COMPANY REGION FOOTPRINT

TABLE 174 COMPANY SOLUTION SCORE

11.6.1 STAR

11.6.2 EMERGING LEADERS

11.6.3 PERVASIVE

11.6.4 PARTICIPANTS

FIGURE 43 PARTNER RELATIONSHIP MANAGEMENT MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.7 STARTUP/SME EVALUATION MATRIX, 2020

11.7.1 RESPONSIVE COMPANIES

11.7.2 PROGRESSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 44 PARTNER RELATIONSHIP MANAGEMENT MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 159)

12.1 MAJOR PLAYERS

(Business Overview, Products, Key Insights, Recent Developments, MnM View)*

12.1.1 ALLBOUND

12.1.2 CHANNELTIVITY

12.1.3 ORACLE

FIGURE 45 ORACLE: COMPANY SNAPSHOT

12.1.4 IMPARTNER

12.1.5 SALESFORCE

FIGURE 46 SALESFORCE: COMPANY SNAPSHOT

12.1.6 LOGICBAY

12.1.7 MAGENTRIX

12.1.8 ZINFI TECHNOLOGIES

12.1.9 ZIFT SOLUTIONS

12.1.10 MINDMATRIX INC.

12.1.11 PARTNERSTACK

12.1.12 CHANNELXPERTS

12.1.13 CREATIO

12.1.14 APPDIRECT

12.1.15 WEBINFINITY

*Details on Business Overview, Products, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

12.2 STARTUP/SME PLAYERS

12.2.1 PARTNERPORTAL.IO

12.2.2 KIFLO

12.2.3 CROSSBEAM

12.2.4 EVERFLOW

12.2.5 AFFISE

12.2.6 WORKSPAN

12.2.7 LEADMETHOD

12.2.8 SHAREWORK

12.2.9 AGENTCIS

12.2.10 COSELL

13 ADJACENT AND RELATED MARKETS (Page No. - 187)

13.1 INTRODUCTION

13.1.1 RELATED MARKETS

13.1.2 LIMITATIONS

13.2 CUSTOMER RELATIONSHIP MANAGEMENT MARKET AND SOCIAL CUSTOMER RELATIONSHIP MANAGEMENT MARKET

13.2.1 MARKET OVERVIEW

13.2.2 MARKET SIZE AND FORECAST BY APPLICATION

TABLE 175 CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY APPLICATION, 2013 – 2018 (USD BILLION)

TABLE 176 CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY APPLICATION AND PROPORTION, 2013 – 2018 (Y-O-Y %)

TABLE 177 CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY APPLICATION, 2013 – 2018 (Y-O-Y %)

13.2.3 GEOGRAPHIC ANALYSIS

TABLE 178 SOCIAL CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY REGION AND PROPORTION, 2013 – 2018 (%)

TABLE 179 SOCIAL CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY REGION, 2013 – 2018 (Y-O-Y %)

TABLE 180 NORTH AMERICA: SOCIAL CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY SOLUTION, 2013 – 2018 (USD MILLION)

TABLE 181 NORTH AMERICA: SOCIAL CUSTOMER RELATIONSHIP MANAGEMENT MARKET SIZE, BY SOLUTION, 2013 – 2018 (Y-O-Y %)

14 APPENDIX (Page No. - 191)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the global Partner Relationship Management (PRM) market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total partner relationship management market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; and journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

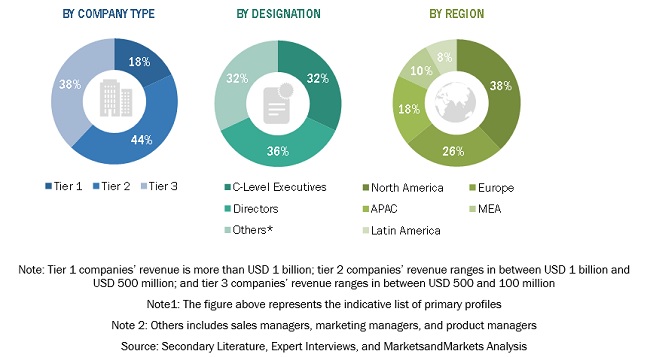

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the partner relationship management market along with the associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Partner Relationship Management Market Size Estimation

For making market estimates and forecasting the partner relationship management market, and other dependent submarkets, the top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global partner relationship management market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the partner relationship management market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the market based on component, solution, service, deployment type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the partner relationship management market

- To analyze the market with respect to individual growth trends in solutions and services, category prospects, and contribution to the overall market

- To analyze the impact of COVID-19 on the partner relationship management market

- To forecast the market size of the five major regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as mergers & acquisitions, new product developments, and partnerships and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional five market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Partner Relationship Management Market