Palm Methyl Ester Derivatives Market by Product, Source (Crude Palm Oil, Palm Kernel Oil), End-Use (Soaps & Detergents, Personal Care & Cosmetic Products, Food & Beverages, Lubricants & Additives, Solvents), and Region - Global Forecast to 2027

Updated on : August 28, 2025

Palm Methyl Ester Derivatives Market

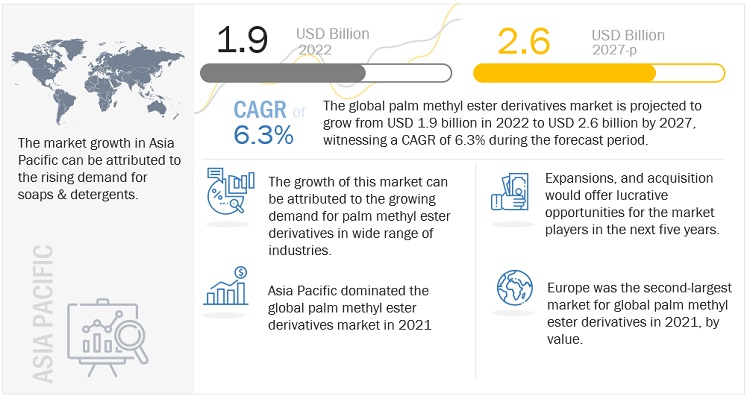

The global palm methyl ester derivatives market was valued at USD 1.9 billion in 2022 and is projected to reach USD 2.6 billion by 2027, growing at 6.3% cagr from 2022 to 2027. Increased usage of palm methyl ester derivatives in the soaps & detergents along with its higher consumption in food & beverages is expected to drive the market during the forecast period.

Palm Methyl Ester Derivatives Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Palm Methyl Ester Derivatives Market Dynamics

Driver: Steadily growing soaps & detergents industry worldwide

The most promising applications for palm methyl ester derivatives are the production of soaps & detergents, and personal care & cosmetics, among others. The continuous expansion of soaps & detergents industry across the world is driving the market for palm methyl ester derivatives. Palm methyl ester derivatives are extensively used as chemical intermediates in surfactants including soaps & detergents. Utilization of soaps and detergents has shoot up rapidly owing to the modern lifestyle along with booming urbanization in key countries. Thus, growing urban population and increasing hygiene maintenance among men and women will boost the demand for soaps and detergents, creating the market for palm methyl ester derivatives. Additionally, shifting consumer preferences for natural materials and process sustainability in personal care products are estimated to boost the demand for palm methyl ester derivatives.

Restraints: Concerns about deforestation and plant diversity loss

There are numerous concerns regarding the current condition of forests and plant diversities globally. Expanding palm plantations involves the clearing of large areas of rainforest, which causes long-term environmental damage. Palm oil has been and continues to be a major cause of deforestation in some of the world's most biodiverse forests, destroying habitats for endangered species, including pygmy elephants, orangutans, and Sumatran rhinos. Heightened concerns about at-scale deforestation due to extensive palm plantations in Malaysia and Indonesia, the two major palm plantation countries, have led to the rise of stringent norms controlling the plantations

Opportunity: High demand from personal care and cosmetic industry

In recent times, there has been incredible growth in demand for personal care and cosmetic products, and this is projected to increase at a substantial rate in the coming years. Increasing awareness about health, wellness, and personal grooming & appearance among men and women is contributing to the growth of the palm methyl ester derivatives market. Also, the rise in the GDP of emerging economies such as China, India, and Brazil are improving the standard of living in these countries. With the increased income level and changing lifestyles due to urbanization, the demand for cosmetic and personal care products is witnessing significant growth.

Challenge: Fluctuation in palm oil prices

The expansion of the palm methyl ester derivatives market is affected by a variety of market dynamics and supply-demand factors. The higher costs associated with the production and processing of palm oil are anticipated to hamper the global palm methyl ester derivatives market during the forecast period. Since palm oil accounts for the largest amount of vegetable oils traded globally, the downstream palm methyl ester derivatives market is expected to face considerable price volatility in the crude palm oil rates.

Based on product, palm methyl oleate segment is the largest market during the forecast period

The palm methyl oleate segment accounted for the largest segment in 2021 in terms of value and volume. Palm methyl oleate is used as an intermediate for detergents, wetting agents, emulsifiers, textile treatments. Methyl oleate finds application as a lubricant and lubricant additive. It is used as an emulsifier and emollient for cosmetics. Thus, the growing usage of palm methyl oleate in cosmetics & personal care along with a wide range of other application is expected to enhance the demand for the segment.

Based on source, palm kernel oil segment is expected to grow at the fastest rate during the forecast period

The palm kernel oil accounted for the fastest segment, by source during the forecast period, in terms of value and volume. Palm kernel oil (including its fractions) is generally used for non-edible purposes, such as the formulations of soaps, cosmetics, and detergents. Some of the palm methyl ester derivatives that are derived from palm kernel oil are methyl laurate and methyl palmitate. Growing urbanization in some of the key countries, such as India and China have boosted the demand for soaps and detergents resulting in the growth of palm methyl ester derivatives. Thus, growth in of palm methyl ester derivatives will fuel the demand for palm kernel oil.

Based on end-use, food & beverages segment is expected to grow at fastest rate during the forecast period

The food & beverages accounted for the fastest segment, by end-use during the forecast period, in terms of value and volume. Due to the growing population, there is a significant increase in the demand for food & beverages. Global sales of functional foods increased significantly from 2020 to 2021. There is also rising demand for ready to eat food in countries such as China and India due to changing lifestyle majorly in urban areas. Thus, growth in food industry will enhance the demand for food additives, creating the market for palm methyl ester derivatives.

Asia Pacific is the largest palm methyl ester derivatives market in terms of value

Asia Pacific accounted for the largest share followed by Europe, in terms of value, in 2021. The major economies of the Asia Pacific region contributing significantly to the growth of the palm methyl ester derivatives market are China, Japan, India, Malaysia, Indonesia, and South Korea. The region has emerged as an important consumer of specialty chemicals due to the increasing demand from the domestic front, aided by rise in the standard of living of the people and disposable income. This further increases the growth of palm methyl ester derivatives market in Asia Pacific.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Palm Methyl Ester Derivatives Market Players

Major companies in the palm methyl ester derivatives market include The Procter & Gamble Company (US), Wilmar International Ltd (Singapore), Musim Mas (Singapore), KLK OLEO (Malaysia), Emery Oleochemicals (US), and Hebei Jingu Plasticizer Co., Ltd. (China), among others. A total of 17 major players have been covered. These players have adopted joint ventures, new product launches and new product developments as the major strategies to consolidate their position in the market.

Palm Methyl Ester Derivatives Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 1.9 billion |

|

Revenue Forecast in 2027 |

USD 2.6 billion |

|

CAGR |

6.3% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) and Volume (Kiloton) |

|

Segments Covered |

Product, Source, End-use, and Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

|

Companies Covered |

The major market players include The Procter & Gamble Company (US), Wilmar International Ltd (Singapore), Musim Mas (Singapore), KLK OLEO (Malaysia), Emery Oleochemicals (US), Hebei Jingu Plasticizer Co., Ltd. (China), among others. |

This research report categorizes the Palm Methyl Ester Derivatives Market based on Product, Source, End-use, and Region.

Based on Product:

- Palm Methyl Caprylate

- Palm Methyl Laurate

- Palm Methyl Myristate

- Palm Methyl Palmitate

- Palm Methyl Stearate

- Palm Methyl Oleate

- Palm Methyl Linoleate

- Others

Based on Source:

- Crude Palm Oil

- Palm Kernel Oil

Based on End-use:

- Soaps & Detergents

- Personal Care & Cosmetic Products

- Food & Beverages

- Lubricants & Additives

- Solvents

- Others

Based on Region:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In March 2022, Vantage Specialty Chemicals acquired JEEN International Corporation to expand its leadership in personal care and food ingredients. This will help the company to enhance its market share for palm methyl ester derivatives market.

- In May 2022, Olean NV announced the construction of a new production facility in Baytown, Texas, Houston. The facility is expected to be in service by the end of 2023. This expansion aims to improve the production of esters.

- In October 2021, Vantage Specialty Chemicals increased production capacity for mild, sulfate-free surfactants at its Leona, Germany, production facility, with rising demand for natural personal care solutions.

Frequently Asked Questions (FAQ):

What is the current size of the global palm methyl ester derivatives market?

The global palm methyl ester derivatives market is projected to grow from USD 1.9 billion in 2022 to USD 2.6 billion by 2027, at a CAGR of 6.3% during the forecast period.

Who are the leading players in the global palm methyl ester derivatives market?

Some of the key players operating in the palm methyl ester derivatives market are The Procter & Gamble Company (US), Wilmar International Ltd (Singapore), Music Mas (Singapore), KLK OLEO (Malaysia), Emery Oleochemicals (US), and Hebei jingo Plasticizer Co., Ltd. (China), among others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

TABLE 1 PALM METHYL ESTER DERIVATIVES MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 PALM METHYL ESTER DERIVATIVES: MARKET SEGMENTATION

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 PALM METHYL ESTER DERIVATIVES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Participating companies in primary research

2.1.2.3 Breakdown of primary interviews

2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ESTIMATION

FIGURE 3 MAIN MATRIX CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING (1/2)

2.5 METHODOLOGY FOR SUPPLY SIDE SIZING (2/2)

2.5.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

2.5.2 FORECAST

2.5.3 GROWTH RATE ASSUMPTIONS/FORECAST

2.6 DATA TRIANGULATION

FIGURE 6 PALM METHYL ESTER DERIVATIVES MARKET: DATA TRIANGULATION

2.7 KEY ASSUMPTIONS WHILE CALCULATING DEMAND-SIDE MARKET SIZE

2.8 RESEARCH LIMITATIONS

2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 38)

TABLE 2 PALM METHYL ESTER DERIVATIVES MARKET

FIGURE 7 CRUDE PALM OIL SEGMENT TO DOMINATE MARKET BETWEEN 2022 AND 2027

FIGURE 8 PALM METHYL LAURATE SEGMENT TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 9 SOAPS & DETERGENTS SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

FIGURE 10 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 SIGNIFICANT OPPORTUNITIES FOR PLAYERS IN PALM METHYL ESTER DERIVATIVES MARKET

FIGURE 11 MARKET TO WITNESS MODERATE GROWTH BETWEEN 2022 AND 2027

4.2 PALM METHYL ESTER DERIVATIVES MARKET, BY REGION

FIGURE 12 ASIA PACIFIC MARKET TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

4.3 PALM METHYL ESTER DERIVATIVES MARKET, BY SOURCE

FIGURE 13 CRUDE PALM OIL SEGMENT TO LEAD MARKET BETWEEN 2022 AND 2027

4.4 PALM METHYL ESTER DERIVATIVES MARKET, BY PRODUCT

FIGURE 14 PALM METHYL LAURATE SEGMENT TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

4.5 PALM METHYL ESTER DERIVATIVES MARKET, BY END-USE

FIGURE 15 FOOD & BEVERAGES SEGMENT TO GROW AT HIGHEST RATE BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 45)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PALM METHYL ESTER DERIVATIVES MARKET

5.2.1 DRIVERS

5.2.1.1 Steadily growing soaps & detergents industry

5.2.1.2 Shift in consumer preference toward natural products

5.2.2 RESTRAINTS

5.2.2.1 Concerns about deforestation and plant diversity loss

5.2.3 OPPORTUNITIES

5.2.3.1 High demand from personal care & cosmetic industry

5.2.4 CHALLENGES

5.2.4.1 Fluctuations in palm oil prices

5.2.4.2 Decline in Malaysian palm oil output due to labor shortages in palm plantations

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 17 PALM METHYL ESTER DERIVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

TABLE 3 PALM METHYL ESTER DERIVATIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 ECOSYSTEM/MARKET MAP

FIGURE 18 PALM METHYL ESTER DERIVATIVES MARKET: ECOSYSTEM/MARKET MAP

TABLE 4 PALM METHYL ESTER DERIVATIVES MARKET: ECOSYSTEM

5.5 VALUE CHAIN

FIGURE 19 PALM METHYL ESTER DERIVATIVES MARKET: VALUE CHAIN

5.6 TRADE DATA

TABLE 5 IMPORT DATA FOR CRUDE PALM OIL IN 2020

TABLE 6 EXPORT DATA FOR CRUDE PALM OIL IN 2020

5.7 POLICIES AND REGULATIONS

5.7.1 FDA REGULATIONS

5.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.8 TECHNOLOGY ANALYSIS

5.9 PRICING ANALYSIS

FIGURE 20 MALAYSIAN PALM OIL PRICE TRENDS

5.10 FACTORS AFFECTING PALM OIL PRICES

6 PALM METHYL ESTER DERIVATIVES MARKET, BY SOURCE (Page No. - 56)

6.1 INTRODUCTION

FIGURE 21 CRUDE PALM OIL ACCOUNTED FOR LARGER SHARE DURING FORECAST PERIOD

TABLE 8 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY SOURCE, 2018–2020 (KILOTON)

TABLE 9 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY SOURCE, 2021–2027 (KILOTON)

TABLE 10 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY SOURCE, 2018–2020 (USD MILLION)

TABLE 11 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY SOURCE, 2021–2027 (USD MILLION)

6.2 CRUDE PALM OIL

6.2.1 GROWING AWARENESS ABOUT BENEFITS OF NATURAL INGREDIENTS IN PERSONAL CARE

6.3 PALM KERNEL OIL

6.3.1 GROWING USAGE OF SOAPS & DETERGENTS

7 PALM METHYL ESTER DERIVATIVES MARKET, BY PRODUCT (Page No. - 59)

7.1 INTRODUCTION

FIGURE 22 PALM METHYL OLEATE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

TABLE 12 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 13 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

TABLE 14 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 15 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (USD MILLION)

7.2 PALM METHYL CAPRYLATE

7.2.1 GROWING DEMAND FOR FMCG PRODUCTS IN EMERGING COUNTRIES

TABLE 16 PALM METHYL CAPRYLATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 17 PALM METHYL CAPRYLATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.3 PALM METHYL OLEATE

7.3.1 HIGH GROWTH IN COSMETIC & PERSONAL CARE SEGMENT

TABLE 18 PALM METHYL OLEATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 19 PALM METHYL OLEATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.4 PALM METHYL LAURATE

7.4.1 HIGH GROWTH RELATED TO TEXTILE INDUSTRY

TABLE 20 PALM METHYL LAURATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 21 PALM METHYL LAURATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.5 PALM METHYL PALMITATE

7.5.1 USAGE IN WIDE RANGE OF INDUSTRIES

TABLE 22 PALM METHYL PALMITATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 23 PALM METHYL PALMITATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.6 PALM METHYL STEARATE

7.6.1 HIGH GROWTH IN TEXTILE INDUSTRY

TABLE 24 PALM METHYL STEARATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 25 PALM METHYL STEARATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.7 PALM METHYL MYRISTATE

7.7.1 GROWING DEMAND FOR FOOD

TABLE 26 PALM METHYL MYRISTATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 27 PALM METHYL MYRISTATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.8 PALM METHYL LINOLEATE

7.8.1 INCREASE IN DEMAND FOR COSMETIC & PERSONAL CARE PRODUCTS

TABLE 28 PALM METHYL LINOLEATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 29 PALM METHYL LINOLEATE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

7.9 OTHERS

TABLE 30 OTHERS: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 31 OTHERS: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

8 PALM METHYL ESTER DERIVATIVES MARKET, BY END-USE (Page No. - 71)

8.1 INTRODUCTION

FIGURE 23 FOOD & BEVERAGES SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

TABLE 32 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 33 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 34 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (USD MILLION)

TABLE 35 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (USD MILLION)

8.2 PERSONAL CARE & COSMETIC PRODUCTS

8.2.1 PREFERENCE FOR NATURAL INGREDIENT COSMETICS & PERSONAL CARE PRODUCTS

8.3 LUBRICANTS & ADDITIVES

8.3.1 GROWING USAGE OF LUBRICANTS IN TEXTILE INDUSTRY

8.4 SOLVENTS

8.4.1 GROWTH IN PAINT INDUSTRY

8.5 SOAPS & DETERGENTS

8.5.1 INCREASE IN URBAN POPULATION

8.6 FOOD & BEVERAGES

8.6.1 GROWTH IN FOOD INDUSTRY

8.7 OTHERS

9 PALM METHYL ESTER DERIVATIVES MARKET, BY REGION (Page No. - 77)

9.1 INTRODUCTION

FIGURE 24 ASIA PACIFIC MARKET TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

TABLE 37 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY REGION, 2018–2020 (KILOTON)

TABLE 38 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

TABLE 39 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 40 PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 25 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SNAPSHOT

TABLE 41 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 42 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 43 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 44 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 45 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 46 NORTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.2.1 US

9.2.1.1 Growth in demand for beauty products

TABLE 47 US: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 48 US: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.2.2 CANADA

9.2.2.1 Growth of cosmetic industry

TABLE 49 CANADA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 50 CANADA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.2.3 MEXICO

9.2.3.1 Growth in demand for ready-to-eat food

TABLE 51 MEXICO: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 52 MEXICO: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3 ASIA PACIFIC

FIGURE 26 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SNAPSHOT

TABLE 53 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 54 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 55 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 56 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 57 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 58 ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.1 CHINA

9.3.1.1 Increase in demand for convenience food products and cosmetics

TABLE 59 CHINA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 60 CHINA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.2 SOUTH KOREA

9.3.2.1 Focus on organic cosmetics

TABLE 61 SOUTH KOREA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 62 SOUTH KOREA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.3 JAPAN

9.3.3.1 High demand for packaged food

TABLE 63 JAPAN: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 64 JAPAN: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.4 INDIA

9.3.4.1 Growth of paint industry

TABLE 65 INDIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 66 INDIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.5 MALAYSIA

9.3.5.1 Growth in usage of cosmetics and beauty products

TABLE 67 MALAYSIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 68 MALAYSIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.6 THAILAND

9.3.6.1 Growing expenditure on food & beverages

TABLE 69 THAILAND: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 70 THAILAND: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.7 AUSTRALIA

9.3.7.1 Growing food & beverages sector

TABLE 71 AUSTRALIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 72 AUSTRALIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.3.8 REST OF ASIA PACIFIC

TABLE 73 REST OF ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 74 REST OF ASIA PACIFIC: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4 EUROPE

FIGURE 27 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SNAPSHOT

TABLE 75 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 76 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 77 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 78 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 79 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 80 EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4.1 GERMANY

9.4.1.1 Growing market for processed food & beverages

TABLE 81 GERMANY: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 82 GERMANY: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4.2 UK

9.4.2.1 Significant growth in food & beverages manufacturing sector

TABLE 83 UK: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 84 UK: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4.3 FRANCE

9.4.3.1 Presence of leading cosmetic players

TABLE 85 FRANCE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 86 FRANCE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4.4 ITALY

9.4.4.1 Growing consumption of processed and ready-to-eat food

TABLE 87 ITALY: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 88 ITALY: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4.5 RUSSIA

9.4.5.1 Government initiatives to enhance food sector

TABLE 89 RUSSIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 90 RUSSIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.4.6 REST OF EUROPE

9.4.6.1 Agri-food to be key industry

TABLE 91 REST OF EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 92 REST OF EUROPE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.5 MIDDLE EAST & AFRICA

TABLE 93 MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 94 MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 95 MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 96 MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 97 MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 98 MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.5.1 SAUDI ARABIA

9.5.1.1 Increasing disposable income, growing young population, and expansion of domestic and foreign cosmetic brands

TABLE 99 SAUDI ARABIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 100 SAUDI ARABIA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.5.2 UAE

9.5.2.1 Major imports of consumer-ready food

TABLE 101 UAE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 102 UAE: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.5.3 REST OF MIDDLE EAST & AFRICA

TABLE 103 REST OF MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 104 REST OF MIDDLE EAST & AFRICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.6 SOUTH AMERICA

TABLE 105 SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2018–2020 (KILOTON)

TABLE 106 SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

TABLE 107 SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2018–2020 (KILOTON)

TABLE 108 SOUTH AMERICA PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY END-USE, 2021–2027 (KILOTON)

TABLE 109 SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 110 SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.6.1 ARGENTINA

9.6.1.1 Growing import of food & beverages

TABLE 111 ARGENTINA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 112 ARGENTINA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.6.2 BRAZIL

9.6.2.1 Rising disposable income among mid-and low-income consumers

TABLE 113 BRAZIL: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 114 BRAZIL: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

9.6.3 REST OF SOUTH AMERICA

TABLE 115 REST OF SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2018–2020 (KILOTON)

TABLE 116 REST OF SOUTH AMERICA: PALM METHYL ESTER DERIVATIVES MARKET SIZE, BY PRODUCT, 2021–2027 (KILOTON)

10 COMPETITIVE LANDSCAPE (Page No. - 120)

10.1 STRATEGIES ADPTED BY KEY PLAYERS

TABLE 117 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS

10.2 REVENUE ANALYSIS

FIGURE 28 REVENUE ANALYSIS FOR KEY COMPANIES DURING PAST FIVE YEARS

10.3 MARKET SHARE ANALYSIS, 2021

FIGURE 29 PALM METHYL ESTER DERIVATIVES MARKET SHARE ANALYSIS

TABLE 118 PALM METHYL ESTER DERIVATIVES MARKET: DEGREE OF COMPETITION

TABLE 119 PALM METHYL ESTER DERIVATIVES MARKET: PRODUCT TYPE FOOTPRINT

TABLE 120 PALM METHYL ESTER DERIVATIVES MARKET: END-USE FOOTPRINT

TABLE 121 PALM METHYL ESTER DERIVATIVES MARKET: REGION FOOTPRINT

10.4 COMPANY EVALUATION MATRIX

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 30 PALM METHYL ESTER DERIVATIVES: COMPANY EVALUATION MATRIX, 2021

10.5 COMPETITIVE SCENARIO

TABLE 122 PALM METHYL ESTER DERIVATIVES MARKET: PRODUCT LAUNCHES, 2018–2022

TABLE 123 PALM METHYL ESTER DERIVATIVES MARKET: DEALS, 2018–2022

TABLE 124 PALM METHYL ESTER DERIVATIVES MARKET: OTHER DEVELOPMENTS, 2018–2022

11 COMPANY PROFILES (Page No. - 132)

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1 THE PROCTER & GAMBLE COMPANY

TABLE 125 THE PROCTER & GAMBLE COMPANY: COMPANY OVERVIEW

FIGURE 31 THE PROCTER & GAMBLE COMPANY: COMPANY SNAPSHOT

TABLE 126 THE PROCTER & GAMBLE COMPANY: PRODUCTS OFFERED

TABLE 127 THE PROCTER & GAMBLE COMPANY: PRODUCT LAUNCH

11.2 WILMAR INTERNATIONAL LTD

TABLE 128 WILMAR INTERNATIONAL LTD: COMPANY OVERVIEW

FIGURE 32 WILMAR INTERNATIONAL LTD: COMPANY SNAPSHOT

TABLE 129 WILMAR INTERNATIONAL LTD: PRODUCTS OFFERED

TABLE 130 WILMAR INTERNATIONAL LTD: DEALS

11.3 MUSIM MAS

TABLE 131 MUSIM MAS: COMPANY OVERVIEW

TABLE 132 MUSIM MAS: PRODUCTS OFFERED

TABLE 133 MUSIM MAS: OTHERS

11.4 KLK OLEO

TABLE 134 KLK OLEO: COMPANY OVERVIEW

TABLE 135 KLK OLEO: PRODUCTS OFFERED

TABLE 136 KLK OLEO: DEALS

11.5 VANTAGE SPECIALTY CHEMICALS

TABLE 137 VANTAGE SPECIALTY CHEMICALS: COMPANY OVERVIEW

TABLE 138 VANTAGE SPECIALTY CHEMICALS: PRODUCTS OFFERED

TABLE 139 VANTAGE SPECIALTY CHEMICALS: DEALS

TABLE 140 VANTAGE SPECIALTY CHEMICALS: OTHERS

11.6 EMERY OLEOCHEMICALS

TABLE 141 EMERY OLEOCHEMICALS: COMPANY OVERVIEW

TABLE 142 EMERY OLEOCHEMICALS: PRODUCTS OFFERED

11.7 CAROTINO GROUP

TABLE 143 CAROTINO GROUP: COMPANY OVERVIEW

TABLE 144 CAROTINO GROUP: PRODUCTS OFFERED

11.8 HEBEI JINGU PLASTICIZER CO., LTD.

TABLE 145 HEBEI JINGU PLASTICIZER CO., LTD.: COMPANY OVERVIEW

TABLE 146 HEBEI JINGU PLASTICIZER CO., LTD.: PRODUCTS OFFERED

11.9 HAIYAN FINE CHEMICAL CO., LTD.

TABLE 147 HAIYAN FINE CHEMICAL CO., LTD.: COMPANY OVERVIEW

TABLE 148 HAIYAN FINE CHEMICAL CO., LTD.: PRODUCTS OFFERED

11.10 PMC BIOGENIX, INC.

TABLE 149 PMC BIOGENIX, INC.: COMPANY OVERVIEW

TABLE 150 PMC BIOGENIX, INC.: PRODUCTS OFFERED

TABLE 151 PMC BIOGENIX, INC.: DEALS

11.11 CREMER NORTH AMERICA, LP

TABLE 152 CREMER NORTH AMERICA, LP: COMPANY OVERVIEW

TABLE 153 CREMER NORTH AMERICA, LP: PRODUCTS OFFERED

11.12 SHANGHAI QIANWEI OIL SCIENCE & TECHNOLOGY CO., LTD.

TABLE 154 SHANGHAI QIANWEI OIL SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

TABLE 155 SHANGHAI QIANWEI OIL SCIENCE & TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

11.13 OLEON NV

TABLE 156 OLEON NV: COMPANY OVERVIEW

TABLE 157 OLEON NV: PRODUCTS OFFERED

TABLE 158 OLEON NV: DEALS

TABLE 159 OLEON NV: OTHERS

11.14 TCI CHEMICALS (INDIA) PVT. LTD.

TABLE 160 TCI CHEMICALS (INDIA) PVT. LTD.: COMPANY OVERVIEW

TABLE 161 TCI CHEMICALS (INDIA) PVT. LTD.: PRODUCTS OFFERED

11.15 ACME SYNTHETIC CHEMICALS

TABLE 162 ACME SYNTHETIC CHEMICALS: COMPANY OVERVIEW

TABLE 163 ACME SYNTHETIC CHEMICALS PRODUCTS OFFERED

11.16 ELEVANCE RENEWABLE SCIENCES, INC.

TABLE 164 ELEVANCE RENEWABLE SCIENCES, INC.: COMPANY OVERVIEW

TABLE 165 ELEVANCE RENEWABLE SCIENCES, INC.: PRODUCTS OFFERED

11.17 BERG + SCHMIDT

TABLE 166 BERG + SCHMIDT: COMPANY OVERVIEW

TABLE 167 BERG + SCHMIDT: PRODUCTS OFFERED

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 160)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 CUSTOMIZATION OPTIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

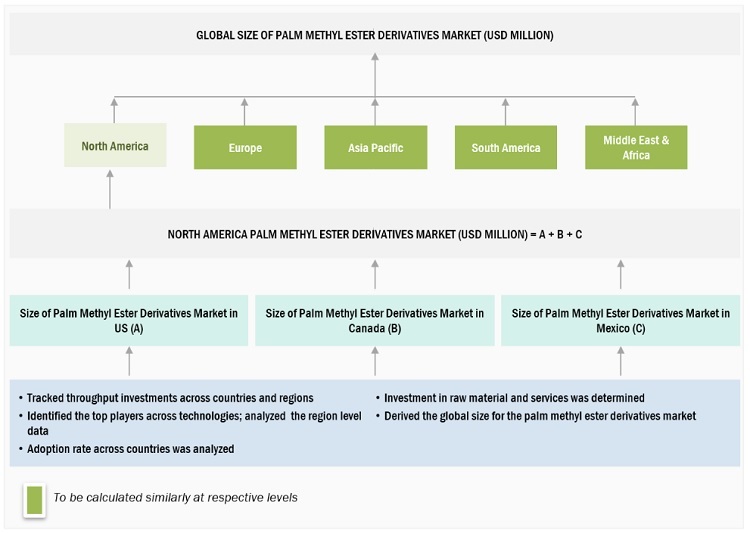

The study involved four major activities in estimating the current size of the palm methyl ester derivatives market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the palm methyl ester derivatives value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports; press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors, gold- and silver-standard websites, palm methyl ester derivatives manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The palm methyl ester derivatives market comprises several stakeholders, such as raw material suppliers, processors, end-use industries, and regulatory organizations in the supply chain. The demand side of the market is characterized by the presence of palm methyl ester derivatives manufacturers, importers/exporters, and manufacturers engaged in the production of various products. The supply side is characterized by key technology providers for palm methyl ester derivatives, end-users, researchers, and service providers.

In the primary research process, various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of manufacturing companies. The primary sources from the supply side included research institutions involved in R&D activities to introduce new technologies, key opinion leaders, distributors, and palm methyl ester derivatives manufacturing companies.

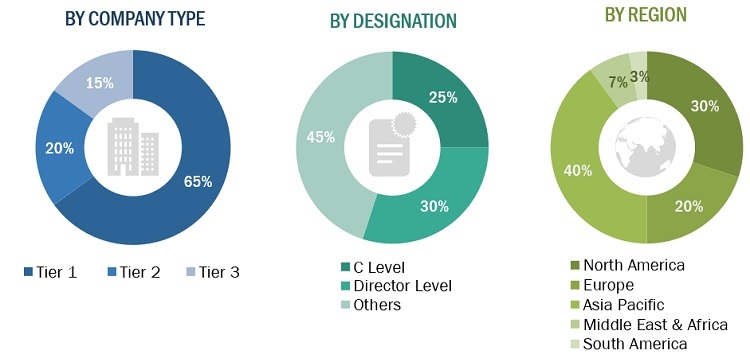

Breakdown of the Primary Interviews

Notes: Other designations include sales managers, engineers, and regional managers.

Tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 billion and USD 5 billion, and tier 3 company—revenue

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the palm methyl ester derivatives market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the palm methyl ester derivatives market, in terms of value and volume, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Palm Methyl Ester Derivatives Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Report Objectives

Market Intelligence

- To analyze and forecast the size of the palm methyl ester derivatives market in terms of value and volume

- To define, describe, and forecast the market size by product, source, end-use, and region

- To forecast the market size with respect to five main regions, namely, Asia Pacific, Europe, North America, the Middle East & Africa, and South America

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market segments with respect to individual growth trends, prospects, and their contribution to the market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To analyze competitive developments, such as product launches, joint ventures and expansions in the palm methyl ester derivatives market

Competitive Intelligence

- To identify and profile the key players in the palm methyl ester derivatives market

- To determine the top players offering various products in the palm methyl ester derivatives market

- To provide a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- To understand the competitive landscape of the market and identify the key growth strategies adopted by the leading players across key regions

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Palm Methyl Ester Derivatives Market

I want Palm Methyl Ester Derivatives Industry Coverage PDF for Europe