Lubricant Additives Market by Function Type (Dispersants, VII, Detergents, Antiwear, Antioxidants, Corrosion inhibitors, Emulsifiers & Others) and Application (Automotive & Industrial Lubricants) - Global Trends & Forecast to 2019

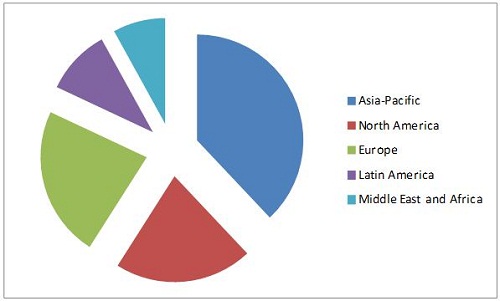

[220 pages Report] The lubricant additives market is expected to grow at a CAGR of 2.7%, by value, over the next five years, to reach $16.2 billion by 2019. Asia-Pacific, with its flourishing economy and rapidly expanding industrial and automotive sectors, is the leading consumer of lubricant additives and will experience the highest growth in demand from 2014 to 2019, followed by North America.

The major driving factors of this market are the emerging economies in the Asia-Pacific region, as it accounts for nearly 30% of the lubricant additive demand. The growing construction, manufacturing, and automobile industries, with no strict environmental regulations, fuels the demand for moderate quality lubricant additives, due to price sensitivity in the region. This has made Asia-Pacific a global manufacturing and commercial hub where several major companies are setting up their new plants to target high growth markets. Cheap labor and easy availability of feedstocks are major factors that attract manufacturers in the region. Europe and North America, on the other hand, have several environmental regulations that drive the market of alternative fuels, which includes compressed natural gas (CNG), liquefied petroleum gas (LPG), and bio lubricants. This is expected to decrease the demand for lubricants, because their life increase with these fuels, resulting in delayed oil change intervals.

The lubricant additives market has been analyzed in terms of both volume (KT) and value ($Million) for the function types and in volume (KT) for the applications for the five regions, namely, North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa (MEA).

For this report, various secondary sources, such as, directories, technical handbooks, company annual reports, industry association publications, chemical magazine articles, world economic outlook, trade websites, and databases have been referred to identify and collect information useful for this extensive commercial study of the lubricant additives market. The primary sources-experts from related industries and suppliers–have been interviewed to obtain and verify critical information, as well as to assess future prospects and market estimations.

This lubricant additives report analyzes various marketing trends and establishes the most effective growth strategy in the market. It identifies market dynamics such as drivers, restraints, opportunities, burning issues, and winning imperatives. Major companies such as Lubrizol (U.S.), BASF (Germany), Chevron Oronite (U.S.), Afton (U.S.), Chemtura (U.S.), Infineum (U.K.), Croda (U.K.), Tianhe Chemicals Group (China), Evonik (Germany), and Shamrock Shipping And Trading Limited (Cyprus) have also been profiled in this report.

Scope of the report

- On the basis of region:

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa (MEA)

- On the basis of lubricant additives type:

- Dispersants

- VI Improvers

- Detergents

- Anti-wear

- Antioxidants

- Corrosion Inhibitors

- Friction Modifiers

- Emulsifiers

- Extreme Pressure (EP)

- Pour Point Depressants (PPD)

- Others

- On the basis of application:

- Automotive lubricants

- Heavy duty motor oil (HDMO)

- Passenger car motor oil (PCMO)

- Other automotive

- Industrial Lubricant

- Metal Working Fluids

- Industrial Engine Oils

- General Industrial Oils

- Others

- Automotive lubricants

The lubricant additives market is expected to grow at a CAGR of 2.69% by volume over the next five years to 4,865 KT by 2019. Lubricant additive are primarily used to enhance fuel efficiency, improve performance, and engine protection. The lubricant additives are expected to play a vital role in the coming years, towards fuel economy, especially contributing to emerging technologies like Dual Clutch Technology (DCT). The report covers the market and its trends that concern five regions, namely, North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa (MEA).

Lubricant additives are divided into ten major types based on their functions; they are dispersants, viscosity index improvers, detergents, antiwear, antioxidants, corrosion inhibitors, emulsifiers, friction modifiers, EP, PPDs, and others. These are made of raw materials/ chemicals such as poly amines, phenols, olefin, maleic anhydride, and others. Automotive lubricants and industrial lubricants are the end-use applications of the lubricant additives. Automotive industry is the major consumer of the lubricant additives with two-third consumption with respect to industrial lubricants additives market.

Asia-Pacific, being the global manufacturing hub of the world, is the largest market for lubricant additives. Emerging economies such as China and India, and growing activities in the construction, industrial and automotive sector provide a further push to the market. Lower cost of production has provided a great opportunity for the global players to place them in the Asia-Pacific region, especially, in the developing nations such as China and India.

Lubricant Additives Market Share, by Geography , 2014

Source: MarketsandMarkets Analysis

Asia-Pacific will continue to lead the market till 2019, followed by North America and Europe. Latin America will be the second most growing market, leaving behind developed economies, such as North America and Europe. Europe will experience the slowest growth among all the regions due to economic slowdown and use of high quality lubricants. In the lubricant additives market, the industry comprises several global and regional players such as BASF (Germany), Lubrizol (U.S.), Afton Chemical (U.S.), and Tianhe Chemicals Group (China), among various others.

Table Of Contents

1 Introduction (Page No. - 18)

1.1 Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stake Holders

1.5 Research Methodology – Data Triangulation

1.5.1 Market Size

1.5.2 Key Data Taken From Secondary Sources

1.5.3 Major Secondary Sources Used

1.5.4 Key Data Taken From Primary Sources

1.5.5 Assumptions Made for This Report

2 Executive Summary (Page No. - 25)

3 Premium Insights (Page No. - 28)

3.1 Market Segmentation

3.2 Dispersants, the Largest Consumed Lubricant Additives

3.3 Heavy Duty Motor Oil, the Largest End-User Application for Lubricant Additives

3.4 Asia-Pacific, the Dominating Market

3.5 HDMO & PCMO to Dominate the Market By 2019

3.6 A Majority of the Companies Relied on Capacity Expansion for Growth

4 Market Overview (Page No. - 34)

4.1 Introduction

4.2 Value Chain Analysis

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Fuel Economy: Next Big Target

4.3.1.2 High Growth in Developing Nations

4.3.1.2.1 Growth of Automotive Industry

4.3.1.2.2 Lower Cost of Production

4.3.2 Restraints

4.3.2.1 Drive towards Alternative Fuels

4.3.2.2 High Quality of Fuels and Lubes in Developed Nations

4.3.2.3 Economic Restraints

4.3.3 Opportunities

4.3.3.1 Extensive R&D to Develop Better and Environment Friendly Products

4.3.3.2 Dual Clutch Technology (Dct): the Game Changer

4.4 Burning Issues

4.4.1 No Aftermarket in Lubricant Price Sensitive Markets

4.5 Winning Imperatives

4.5.1 Expansion Into New & Emerging Markets

4.6 Porter’s Five forces Analysis

4.6.1 Buyer’s Power

4.6.2 Bargaining Power of Suppliers

4.6.3 Threat of New Entrants

4.6.4 Threat of Substitutes

4.6.5 Degree of Competition

4.7 Price Analysis

4.8 Market Share Analysis

5 Lubricant Additives Market, By Type (Page No. - 54)

5.1 Introduction

5.1.1 Dispersants Largest Function Type in Terms of Market Volume

5.1.2 Viscosity Index Improvers, the Largest Function Type in Terms of Value

5.2 Dispersants

5.2.1 Introduction

5.2.2 APAC, Leading the Market for Dispersants

5.2.3 Automotive Lubricants Largest Application for Dispersants

5.3 Viscosity Index Improvers

5.3.1 Introduction

5.3.2 North America, Second Largest Market for VII

5.3.3 Industrial Lubricants Application to Experience the Highest Growth in VII

5.4 Detergents

5.4.1 Introduction

5.4.2 Latin America to Experience the Second Highest Growth in Detergents

5.4.3 Automotive Lubricants Is the Largest Application for Detergents

5.5 Anti-Wear Additives

5.5.1 Introduction

5.5.2 Slow Growth for Antiwear Additives in Europe

5.5.3 Antiwear Finds Large Application in Automotive Lubricant Additives

5.6 Antioxidants

5.6.1 Introduction

5.6.2 Antioxidants Largely Used in Asia-Pacific

5.6.3 Antioxidants to Experience Good Growth in Automotive Lubricants

5.7 Corrosion Inhibitors

5.7.1 Introduction

5.7.2 APAC, the Market Leader for Corrosion Inhibitors

5.7.3 Industrial Lubricants, the Largest Market for Corrosion Inhibitors

5.8 Friction Modifiers

5.8.1 Introduction

5.8.2 Developed Economies to Experience High Growth in Friction Modifiers

5.8.3 Automotive Lubricants, the Largest Application for Friction Modifiers

5.9 Extreme Pressure (EP) Additives

5.9.1 Introduction

5.9.2 Industrial Lubricants, the Largest Market for Extreme Pressure Additives

5.10 Pour Point Depressant (Ppd)

5.11 Emulsifiers

5.12 Others

6 Lubricant Additives Market, By Application (Page No. - 104)

6.1 Introduction

6.2 Automotive Lubricants

6.2.1 Introduction

6.2.2 Heavy Duty Motor Oil, the Largest Application in Automotive Lubricant Additives

6.2.3 Heavy Duty Motor Oil (HDMO)

6.2.3.1 Introduction

6.2.3.2 Dispersants Extensively Used in HDMO Lubricating Oils

6.2.3.3 APAC to Experience the Largest Growth in HDMO Lubricant Additives

6.2.4 Passenger Car Motor Oil (PCMO)

6.2.4.1 Introduction

6.2.4.2 VII, Largest Additive for PCMO

6.2.5 Other Automotive

6.2.5.1 Introduction

6.3 Industrial Lubricant Additives

6.3.1 Introduction

6.3.2 Metal Working Fluids, the Largest Consumer of Additives in Industrial Segment

6.3.3 Friction Modifiers to Experience Large Growth in the Industrial Additives Segment

6.3.4 Asia-Pacific, Largest Consumer of Additives in the Industrial Segment

6.3.5 Metal Working Fluid

6.3.5.1 Introduction

6.3.6 Corrosion Inhibitors Used Extensively in Metal Working Lubricants

6.3.7 Industrial Engine Oil

6.3.7.1 Introduction

6.3.7.2 Friction Modifiers to Experience the Highest Growth in Industrial Engine Lubricant Oil Additives

6.3.8 General Industrial Oil

6.3.8.1 Introduction

6.3.9 Others

7 Lubricant Additives Market, By Geography (Page No. - 131)

7.1 Introduction

7.1.1 Ever Increasing Fuel Consumption in Developing Regions Driving the Market

7.2 North America

7.2.1 Friction Modifiers & Viscosity Index Improvers Witness Higher Growth

7.2.2 Automotive Lubricants Consume Maximum Share

7.3 Asia-Pacific

7.3.1 Antioxidants Experience the Highest Growth

7.3.2 Lined Up Industrial and Automotive Developments Will Drive the Market

7.4 Europe

7.4.1 Mature Markets in Europe Experience Sluggish Growth

7.4.2 Additvies Consumpion in End-Use Industries

7.5 Middle East & Africa (MEA)

7.5.1 Market Awareness to Drive the Growth

7.5.2 Industrial Segment to Experience Relatively Higher Growth

7.6 Latin America

7.6.1 Vi Improver Has the Maximum Market Share

7.6.2 Automotive VS Industrial Lubricants

8 Competitive Landscape (Page No. - 156)

8.1 Introduction

8.1.1 Company Analysis, By Application Type

8.2 Strategic Developments

8.2.1 Expansion: Most Preferred Strategic Approach

8.2.2 Maximum Developments in 2011

8.2.3 Asia-Pacific: the Most Active Region

8.2.4 the Lubrizol Corporation & Afton Chemical Corporation: the Most Active Participants

8.3 Capacity Expansion

8.4 New Product Developments

8.5 Acquisitions

8.6 Partnerships

8.7 Research & Development

8.8 Others

9 Company Profiles (Overview, Financial*, Products & Services, Strategy, and Developments) (Page No. - 175)

9.1 Afton Chemical Corporation

9.2 BASF SE

9.3 Chemtura Corporation

9.4 Chevron Oronite Company Llc

9.5 Croda International Plc

9.6 Evonik Industries Ag

9.7 Infineum International Ltd.

9.8 the Lubrizol Corporation

9.9 Shamrock Shipping & Trading Limited

9.10 Tianhe Chemicals Group

*Details Might Not Be Captured in Case of Unlisted Companies.

List of Tables (106 Figures)

Table 1 Lubricant Additives Market Size, 2012-2019

Table 2 Current Co2 Emissions of Various Vehicles

Table 3 Light Duty Vehicle Production in Western and Central Europe

Table 4 Winning Imperatives: Expansion

Table 5 Average Lubricant Additives Price, By Geography ($/Metric Ton)

Table 6 Market Share, By Company, 2013

Table 7 Market Size, By Type, 2012-2019 (Kilo Tons)

Table 8 Market Size, By Type, 2012-2019 ($Million)

Table 9 Types of Lubricant Additives & their Chemical Composition

Table 10 Lubricant Additives & their Major Applications

Table 11 Dispersants Market Size, By Geography, 2014-2019 ($ Million)

Table 12 Dispersants Market Size, By Geography, 2012-2019 (KT)

Table 13 Dispersants Market Size, By End-Use Industry, 2012-2019 (KT)

Table 14 VII Chemicals and their Description:

Table 15 VII Lubricant Additives Market Size, By Geography, 2012-2019 ($Million)

Table 16 VII Market Size, By Geography, 2012-2019 (KT)

Table 17 VII Market Size, By End-Use Industry, 2012-2019 (KT)

Table 18 Detergents Market Size, By Geography, 2012-2019 ($Million)

Table 19 Detergents Market Size, By Geography, 2012-2019 (KT)

Table 20 Detergents Market Size, By End-Use Industry, 2012 to 2019 (KT)

Table 21 Antiwear Market Size, By Geography, 2012-2019 ($ Million)

Table 22 Antiwear Market Size, By Geography, 2012-2019 (KT)

Table 23 Antiwear Market Size, By End-Use Industry, 2012-2019 (KT)

Table 24 Types of Antioxidants

Table 25 Antioxidants Additives Market Size, By Geography, 2012-2019 ($Million)

Table 26 Antioxidants Lubricant Additives Market Size, By End-Use Industry, 2012-2019 (KT)

Table 27 Antioxidants Market Size, By End-Use Industry, 2012-2019 (KT)

Table 28 Types of Corrosion Inhibitors, Application, & Composition

Table 29 Corrosion Inhibitors Lubricant Additives Market Size, By Geography, 2012-2019 ($Million)

Table 30 Corrosion Inhibitors Market Size, By Geography, 2012-2019 (KT)

Table 31 Corrosion Inhibitors Market Size, By End-Use Industry, 2012-2019 (KT)

Table 32 Type of Friction Modifiers

Table 33 Friction Modifiers Lubricant Additives Market Size, By Geography, 2012-2019 ($Million)

Table 34 Friction Modifiers Market Size, By Geography, 2012-2019 (KT)

Table 35 Friction Modifiers Market Size, By End-Use Industry, 2012-2019 (KT)

Table 36 EP Lubricant Additives Market Size, By Geography, 2012-2019 ($Million)

Table 37 EP Market Size, By Geography, 2012-2019 (KT)

Table 38 EP Market Size, By Geography, By End-Use Industry, 2012-2019 (KT)

Table 39 Types of PPDS & their Descriptions

Table 40 PPDS Lubricant Additives Market Size, By Geography, 2012-2019 ($Million)

Table 41 PPDS Market Size, By Geography, 2012-2019 (KT)

Table 42 PPDS Market Size, By End-Use Industry, 2012-2019 (KT)

Table 43 Emulsifiers Lubricant Additives Market Size, By Geography, 2012-2019 ($Million)

Table 44 Emulsifiers Market Size, By Geography, 2012-2019 (KT)

Table 45 Emulsifiers Market Size, By End-Use Industry, 2012-2019 (KT)

Table 46 Others Lubricant Additives Market Size, By Geography, 2012-2019 ($ Million)

Table 47 Others Market Size, By Geography, 2012-2019 (KT)

Table 48 Others Market Size, By End-Use Industry, 2012-2019 (KT)

Table 49 Lubricant Additives Market Size, By End-Use Industry, 2012-2019 (KT)

Table 50 Automotive Lubricant Additives Market Size, By Application, 2012–2019 (KT)

Table 51 Automotive Lubricant Additives Market Size, By Type, 2012-2019 (KT)

Table 52 Automotive Market Size, By Geography, 2014-2019 (KT)

Table 53 HDMO Lubricant Additives Market Size, By Type, 2012-2019 (KT)

Table 54 HDMO Market Size, By Geography, 2012-2019 (KT)

Table 55 PCMO Lubricant Additives Market Size, By Type, 2012-2019 (KT)

Table 56 PCMO Market Size, By Geography, 2014-2019 (KT)

Table 57 Other Automotive Lubricant Additives Market Size, By Geography, 2012-2019 (KT)

Table 58 Other Automotive Market, By Geography, 2012-2019 (KT)

Table 59 Industrial Lubricant Additives Market Size, By Application, 2012-2019 (KT)

Table 60 Industrial Market Size, By Type, 2012-2019 (KT)

Table 61 Industrial Market Size, By Geography, 2012-2019 (KT)

Table 62 Metal Working Fluid Lubricant Additives Market Size, By Geography, 2012-2019 (KT)

Table 63 Metal Working Fluid Market Size, By Geography, 2012-2019 (KT)

Table 64 Industrial Engine Oil Lubricant Additives Market Size, By Geography, 2012-2019 (KT)

Table 65 Industrial Engine Oil Market Size, By Geography, 2014-2019 (KT)

Table 66 General Industrial Oil Market Size, By Geography, 2014-2019 (KT)

Table 67 General Industrial Oil Market Size, By Geography, 2014-2019 (KT)

Table 68 Other Industrial Lubricant Additives Market Size, By Geography, 2014-2019 (KT)

Table 69 Other Industrial Market, By Geography, 2014-2019 (KT)

Table 70 Market Size, By Geography, 2012-2019 ($Million)

Table 71 Market Size, By Geography, 2012-2019 (KT)

Table 72 North America: Lubricant Additives Market Size, By Type, 2012-2019 ($Million)

Table 73 North America: Market Size, By Type, 2012-2019 (KT)

Table 74 North America: Market Size, By End-Use Industry, 2012-2019 (KT)

Table 75 Asia-Pacific: Lubricant Additives Market Size, By Type, 2012-2019 ($Million)

Table 76 Asia-Pacific: Market Size, By Type, 2012-2019 (KT)

Table 77 Asia-Pacific: Market Size, By End-Use Industry, 2012-2019 (KT)

Table 78 Europe: Market Size, By Type, 2012-2019 ($Million)

Table 79 Europe: Market Size, By Type, 2012-2019 (KT)

Table 80 Europe: Market Size, By End-Use Industry, 2012-2019 (KT)

Table 81 Middle East & Africa: Market Size, By Type, 2012-2019 ($Million)

Table 82 Middle East and Africa: Market Size, By Type, 2012-2019 (KT)

Table 83 Middle East and Africa: Lubricant Additives Market Size, By End-Use Industry, 2012-2019 (KT)

Table 84 Latin America: Market Size, By Type, 2012-2019 ($Million)

Table 85 Latin America: Market Size, By Type, 2012-2019 (KT)

Table 86 Latin America: Lubricant Additives Market Size, By End-Use Industry, 2012-2019 (KT)

Table 87 Company Analysis, By Application Type

Table 88 Expansion, 2010–2014

Table 89 New Product Development, 2010-2014

Table 90 Acquisitions, 2010-2014

Table 91 Partnership, 2010-2014

Table 92 Research & Development, 2010-2014

Table 93 Others, 2010-2014

Table 94 Afton Chemical: Products & Services

Table 95 BASF SE: Product Specification, By Application

Table 96 BASF SE: Product Specification, By Function

Table 97 Product Specification

Table 98 Product Specification

Table 99 Chevron: Partnerships & Certification

Table 100 Product Specification

Table 101 Evonik: Product Specification

Table 102 Infinium: Product Specification

Table 103 Lubrizol: Product Specification

Table 104 Product Specification

Table 105 Product Specification By Function

Table 106 Product Specification By Application

List of Figures (27 Figures)

Figure 1 Lubricant Additives Market Share (Volume), By Type, Geography and Application, 2013 (KT)

Figure 2 Lubricant Additive Market Segmentation

Figure 3 Lubricant Additives Growth Matrix, By Type, 2014

Figure 4 Lubricant Additives Growth Matrix, By End-User Application, 2014

Figure 5 Lubricant Additives Growth Matrix, By Geography,2014

Figure 6 Lubricant Additives Market Size, By End-User Application & Geography (KT), 2014

Figure 7 Growth Strategies of Major Companies, 2010 – 2013

Figure 8 Value Chain for Lubricant Additives Market

Figure 9 Impact Analysis–Drivers (2012–2019)

Figure 10 Impact Analysis–Restraints (2012–2019)

Figure 11 Impact Analysis–Opportunities (2012–2019)

Figure 12 Porter’s Five forces Analysis

Figure 13 Lubricant Additive Market Share (Volume), By Type, 2013

Figure 14 Lubricant Additive Market Share (Volume), By Type, 2019

Figure 15 Change in Viscosity of Lubricants With Temperature

Figure 16 Molecular Weight of the VII VS Thickening Efficiency & Shear Stability

Figure 17 Lubricant Additives Market Share (Value), By Geography, 2014 VS 2019 (%)

Figure 18 Competitive Developments, By Growth Strategy, 2010-2013

Figure 19 Competitive Developments, By Year, 2010-2013

Figure 20 Competitive Developments, By Geography, 2010-2013

Figure 21 Competitive Developments, By Company, 2010-2013

Figure 22 Expansion, 2010–2014

Figure 23 New Product Development, 2010-2014

Figure 24 Acquisitions, 2010-2014

Figure 25 Partnership, 2010-2014

Figure 26 Research & Development, 2010-2014

Figure 27 Others, 2010-2014

Growth opportunities and latent adjacency in Lubricant Additives Market