Polyaryletherketone (PAEK) Market by Type (PEEK, PEK, PEKK), Fillers (Glass-filled, Carbon-filled, Unfilled), Form, Application (Oil & Gas, Electrical & Electronics, Automotive, Medical, Aerospace), and Region - Global Forecast to 2027

Polyaryletherketone (PAEK) Market

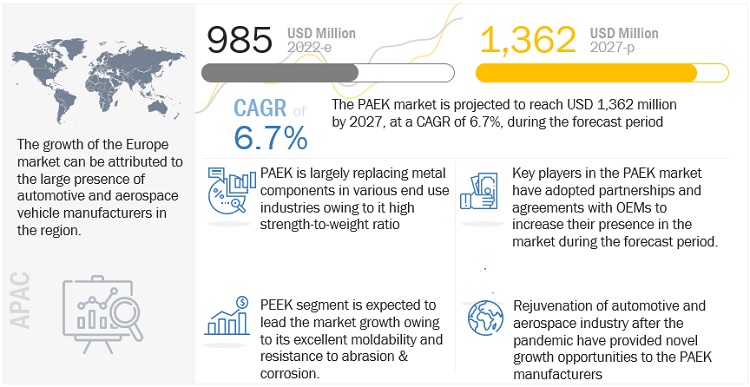

The global polyaryletherketone (PAEK) market size was valued at USD 985 million in 2022 and is projected to reach USD 1,362 million by 2027, growing at a cagr 6.7% from 2022 to 2027. The rising demand for clean and renewable energy is the key driving factor behind the growth of solar photovoltaic (PV) modules and in turn PAEK.

Attractive Opportunities in the PAEK Market

e-estimated, p-projected

To know about the assumptions considered for the study, Request for Free Sample Report

Polyaryletherketone (PAEK) Market Dynamics

Driver: Ability to perform in harsh environments driving the usage of PAEK in aerospace industry

PAEK are largely recognized as a polymer of enormous potential and currently more than 20 thousand aircraft rely on PAEK based solutions such as thermal acoustic blankets, brackets and pipes. Airbus, a leading aircraft manufacturer, for instance, used these thermoplastics for structural component in the doors of A350 XWB. The usage of these materials improve the quality of the component and reduce weight by about 40%. On the other hand, COMAC used pipes made using PAEK for protection of high-voltage cables. Such instances of PAEK replacing conventional materials in aerospace applications are increasing. Furthermore, by 2035, the industry estimates that around 41,000 new and replacement aircraft would be required to fulfil the growth in air transport. Thus it is evident that the demand for PAEK composites would expedite in the near future.

Restraint: Availability of low-price substitutes

Although PAEK provide excellent properties to the components, many other low-cost thermoplastic substitutes are available in the market. Polyetherimide (PEI), also known as ULTEM, is one such high-performance plastics. Although it offers lower performance characteristics, it considerably lower in cost and hence is utilized in high-end industries for extreme temperature condition operations. On the other hand, engineering plastics such as polyamide, PET, ABS, and fluoropolymers are also largely used as compared to PAEK owing to their lower cost. Hybrid technology-based polymers are being used to match the properties of PAEK at a cheaper cost. For instance, lower-grade polyamides such as PA6 and PA66 are developed as a composite to perform in high-temperature applications. Thus, such products prove a restraining factor for the growth of the market.

Opportunity: Growth in sales of electric vehicles

With the advancement in technology, especially in electric vehicles, the demand for materials that have high strength-to-weight ratio and good resistance to heat & electricity are gaining traction. PEKK is one such tested material which can withstand substantially greater temperature and has electrical insulation properties. Due to its low dielectric constant, PEKK has a wide range of uses and is becoming more important in EVs. The players operating in the market have partnered with EV manufacturers to expand the application of PAEK-based components in their vehicles. For instance, Victrex PLC has targeted to increase the weight of PAEK in EVs to about 100-120 gms per vehicle in the near future. Even OEMs have shown interest in developing components using PAEK owing to their better characteristics and thus the growth of EVs could prove to be an excellent opportunity for the growth of the PAEK market.

Challenges: Complexity involved in utilization of PEEK in additive manufacturing

Change in temperature of PEEK resin during additive manufacturing could result in crystallization problems, distortion or flawed printing. Improper crystallization could lead the color of component to change from beige to amber. On the other hand, due to flawed printing, shrinkage, warpage and delamination of component could occur. Such challenges uprising during the application of PAEK resins prove to be a critical challenge for the market players. However, they are doing significant R&D for development of new polymer composites that could suitably used in additive manufacturing applications.

Excellent temperature-resistance of PEEK leading to its dominance

Based on the type, the PEEK segment is estimated to hold the dominant share in the market. PEEK not only can survive at high temperatures such as 300-400 C, but also provides characteristics such as high strength, toughness, and resistance to wear and tear. Owing to these characteristics, PEEK-based components are largely being utilized in automotive, oil & gas and medical applications. PEEK is used to manufacture components such as gears, bearings, jet engine parts, battery assembly, automotive engine housing etc. With all these application areas experiencing a growth trend, the market for PEEK, and in turn of PAEK is expected to grow during the forecast period.

High strength provided by glass-filled PAEK composites providing a push for its demand

Based on the filler, the glass-filled segment is having the highest market share. PAEK composites filled with glass showcase exceptional strength, shock resistance, and toughness, making them useful for application in the aerospace, automotive, and electronics industries. Glass-reinforcement provides PAEK resins chemical with water resistance similar to polyphenylene sulfide and the ability to perform at significantly higher temperatures. The addition of glass also significantly reduces the expansion rate and improves the flexural modulus of PAEK, making them suitable for structural applications in vehicles and airplanes. Owing to these characteristics, the segment is also expected to grow at the fastest rate in the global PAEK market.

Development of PAEK tape for sub-sea piping application driving its demand

Based on the form, the tape segment held the largest share of PAEK market in terms of value. While the tape form is largely employed in areas such as semiconductor processing machinery, labeling, solder masking, and gasket manufacturing, it is now being employed in the production of pipes for the transportation of oil & gas. PAEK tape not only helps in the reduction of the weight of such pipes but also reinforces with additional strength and resistance to corrosion. Owing to these properties, the tape form held the largest value-based market share in 2021.

Oil & Gas held the largest market share in the PAEK market

Based on the application, the oil & gas segment is expected to account for the largest share of the market in 2022. A limited number of materials are able to handle the high pressures, extreme temperatures, aggressive chemicals, and rough handling from the oil & gas industry. PAEK polymers are one such family that proves to be an excellent material for such applications. They are mainly used in areas such as artificial lift ESP connectors, frac and activation balls, seals, logging tools, and connector bodies, amongst others. Owing to these applications, the market share of the oil & gas segment is expected to be the highest throughout the forecast period.

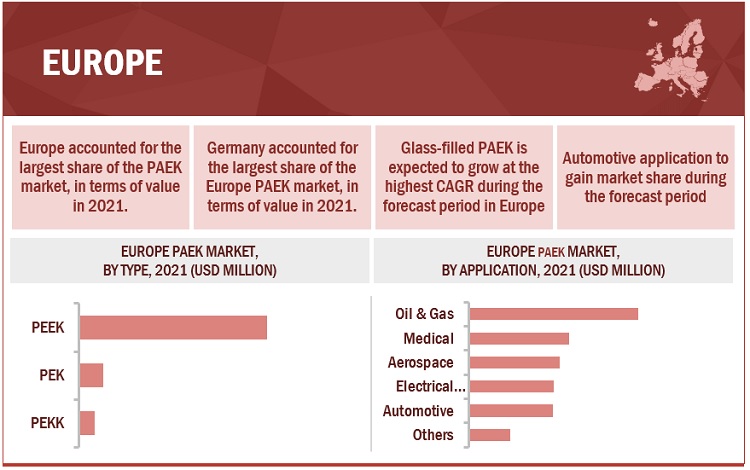

Concentration of EV manufacturing in Europe resulting in the region’s dominance in PAEK market

Europe is the largest PAEK market, in terms of volume, owing to large scale consumption of PAEK in automotive and aerospace companies located in Europe. According to AV-Volumes, a steep increase in sales of EVs has been observed in Europe in past couple of years. Furthermore, the European Union reached a political agreement in October 2022 to ban the sales of new nonelectric cars from 2035. This factor is expected to further drive the sales of EVs in the region. With automobile companies shifting from ICE-based offerings to EVs, the demand for PAEK in the region is also expected to grow at a significant rate through the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Polyaryletherketone Market Players

The major vendors in the PAEK market include Victrex PLC (UK), Solvay SA (Belgium), Evonik Industries AG (Germany), Arkema SA (France), Gharda Chemical Corporation (India), SABIC (Saudi Arabia), Ensinger (Germany), AKRO-PLASTIC GmbH (Germany), RTP Company (US), Mitsubishi Chemical Advanced Materials (Japan), Panin Zhohgrun High Performance Polymer Co., Ltd. (China).

The key companies are undertaking partnerships and collaboration strategies to improve their share in this market. Companies including Victrex PLC, Solvay SA, Evonik Industries AG, Arkema SA have partnered with end-users for development of novel grades and applications of PAEK between 2019 and 2022.

Polyaryletherketone Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 985 million |

|

Revenue Forecast in 2027 |

USD 1,362 million |

|

CAGR |

6.7% |

|

Market Size Available for Years |

2019-2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million), Volume (Ton) |

|

Segments Covered |

By type, by filler, by application, by form and Region. |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Victrex PLC (UK), Solvay (Belgium), Evonik Industries AG (Germany), Arkema SA (France), and SABIC (Saudi Arabia), Gharda Chemicals Limited (India), Ensinger Group (Germany), AKRO-PLASTIC (Germany), RTP Company (US), Mitsubishi Chemical Advanced Materials (Japan), Panjin Zhongrun High Performance Polymer Co. Ltd. (China), Lehmann&Voss&Co. (Germany), J.K. Overseas (India), Caledonian Industries Ltd. (Scotland), and Nanoshel LLC (US) |

This research report categorizes the polyaryletherketone (PAEK) market based on type, application, filler, form, and region.

Based on type, the PAEK market has been segmented as follows:

- PEEK

- PEK

- PEKK

Based on filler, the PAEK market has been segmented as follows:

- Glass-filled

- Carbon-filled

- Unfilled

- Other

Based on application, the PAEK market has been segmented as follows:

- Oil & Gas

- Automotive

- Aerospace

- Electrical & Electronics

- Medical

- Others

Based on form, the PAEK market has been segmented as follows:

- Tape

- Compound

- Sheet

- Fiber

- Film

Based on regions, the PAEK market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In August 2021, Evonik Industries announced an investment into GRC SinoGreen Fund V and Richland VC Fund III. The two funds focus on companies working on development of advanced materials, high-end manufacturing equipment, and green technologies. This investment is also expected to strengthen the company’s presence in the region.

- In November 2020, Victrex PLC partnered with In2Bones Global Inc., for the supply of its PEEK-Ultima Ultra Reinforced Carbon Fiber for the production of medical equipment.

- In March 2019, Evonik launched a new radiopaque PEEK material for implant products in healthcare applications.

Frequently Asked Questions (FAQ):

What is PAEK? What are its applications?

PAEK is a family of high-performance thermoplastic polymers that find application in the production of parts and components for oil & gas, aerospace, automotive, medical, and other high-end industries.

Who are the major players involved in this market?

Victrex PLC (UK), Solvay SA (Belgium), Evonik Industries AG (Germany), Arkema SA (France), Gharda Chemical Corporation (India), SABIC (Saudi Arabia), Ensinger (Germany), AKRO-PLASTIC GmbH (Germany), RTP Company (US), Mitsubishi Chemical Advanced Materials (Japan), Panin Zhohgrun High Performance Polymer Co., Ltd. (China) are the major manufacturers in the PAEK market.

What is the biggest challenge to the growth of the PAEK market?

Availability of low-cost substitutes is the biggest challenge to the growth of the PAEK market

Which region is likely to support PAEK market growth? Wh y?

Europe region will be supporting the growth of the PAEK market, owing to the increasing usage of PAEK in automotive manufacturing in the region. The growth will also be supported by an increase in the production of aerospace units and medical machinery in the region.

Which application leads the growth of the PAEK market?

The automotive segment would assist the growth of the PAEK market.

Which type accounts for the major share of the PAEK market?

The PEEK accounted for the largest share of the PAEK market, owing to high strength-to-weight ratio and resistance to high temperatures provided by the material. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

TABLE 1 Polyaryletherketone (PAEK) Market, BY APPLICATION: INCLUSIONS & EXCLUSIONS

TABLE 2 Polyaryletherketone (PAEK) Market, BY TYPE: INCLUSIONS & EXCLUSIONS

TABLE 3 Polyaryletherketone (PAEK) MARKET, BY FILLER: INCLUSIONS & EXCLUSIONS

TABLE 4 Polyaryletherketone (PAEK) MARKET, BY FORM: INCLUSIONS & EXCLUSIONS

TABLE 5 Polyaryletherketone (PAEK) MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 PAEK MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 42)

2.1 RESEARCH DATA

FIGURE 2 PAEK MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 KEY INDUSTRY INSIGHTS

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.2 BASE NUMBER CALCULATION

2.2.1 SUPPLY-SIDE APPROACH

2.2.2 DEMAND-SIDE APPROACH - 1

2.2.3 DEMAND-SIDE APPROACH - 2

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 6 PAEK MARKET: DATA TRIANGULATION

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 7 PEEK TO BE DOMINANT SEGMENT IN OVERALL MARKET

FIGURE 8 GLASS-FILLED SEGMENT TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

FIGURE 9 OIL & GAS TO BE LARGEST CONSUMER OF PAEK

FIGURE 10 EUROPE ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE OPPORTUNITIES IN Polyaryletherketone (PAEK) MARKET

FIGURE 11 ASIA PACIFIC TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

4.2 Polyaryletherketone (PAEK) MARKET GROWTH, BY TYPE

FIGURE 12 PEEK SEGMENT TO LEAD OVERALL MARKET

4.3 Polyaryletherketone (PAEK) MARKET, BY FILLER

FIGURE 13 GLASS-FILLED TO BE LARGEST SEGMENT IN OVERALL MARKET

4.4 Polyaryletherketone (PAEK) MARKET, BY APPLICATION

FIGURE 14 OIL & GAS TO BE LARGEST APPLICATION OF PAEK

4.5 EUROPE PAEK MARKET, BY TYPE AND COUNTRY

FIGURE 15 GERMANY TO LEAD MARKET IN EUROPE

4.6 Polyaryletherketone (PAEK) MARKET: MAJOR COUNTRIES

FIGURE 16 INDIA TO BE FASTEST-GROWING MARKET BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN Polyaryletherketone (PAEK) MARKET

5.2.1 DRIVERS

5.2.1.1 Additive manufacturing using PAEK

FIGURE 18 GLOBAL ADDITIVE MANUFACTURING GROWTH RATE

5.2.1.2 Medical industry's shift to PAEK solutions

FIGURE 19 GLOBAL DENTAL MARKET GROWTH

5.2.1.3 Growing demand for PAEK in aerospace industry

FIGURE 20 GLOBAL AIRCRAFT MANUFACTURING GROWTH

5.2.2 RESTRAINTS

5.2.2.1 Availability of low-price substitutes

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of electric vehicles to create opportunity for PEKK

FIGURE 21 CONSUMER AND GOVERNMENT SPENDING ON ELECTRIC CARS

5.2.4 CHALLENGES

5.2.4.1 Complexity involved in using PEEK in 3D printing

5.2.4.2 Numerous phases involved in manufacturing of PAEK parts compared to other thermoplastics

5.3 PORTER'S FIVE FORCES ANALYSIS

FIGURE 22 Polyaryletherketone (PAEK) MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 6 TRENDS AND FORECAST OF GDP, USD BILLION (2018–2022)

5.4.3 AUTOMOTIVE

TABLE 7 GLOBAL CAR SALES OUTLOOK

5.4.4 WORLD MANUFACTURING OUTPUT GROWTH (QUARTER II, 2022)

TABLE 8 GROWTH RATE OF WORLD MANUFACTURING OUTPUT (QUARTER II, 2022)

5.4.5 OIL & GAS

TABLE 9 GLOBAL OIL PRODUCTION (MILLION TONS)

6 INDUSTRY TRENDS (Page No. - 68)

6.1 PATENT ANALYSIS

6.1.1 METHODOLOGY

6.1.2 PATENT PUBLICATION TRENDS

FIGURE 23 NUMBER OF PATENTS YEAR-WISE (2012-2022)

6.1.3 INSIGHT

6.1.4 JURISDICTION ANALYSIS

FIGURE 24 REPUBLIC OF KOREA ACCOUNTED FOR HIGHEST NUMBER OF PATENTS

6.1.5 TOP COMPANIES/APPLICANTS

FIGURE 25 TOP TEN COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

6.1.5.1 List of major patents

6.2 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 10 Polyaryletherketone (PAEK) MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.3 TECHNOLOGY ANALYSIS

6.3.1 PAEK FILAMENT FOR ADDITIVE MANUFACTURING

6.3.2 MANUFACTURING TECHNOLOGY FOR LARGE PAEK THERMOPLASTIC PARTS

6.4 CASE STUDY ANALYSIS

6.4.1 STUDY ON EFFECT OF THERMOPLASTIC AIRCRAFT CURVED BEAM

6.4.1.1 Objective

6.4.1.2 Solution statement

6.4.2 STUDY ON EFFECT OF TEMPERATURE ON PAEK COMPOSITE

6.4.2.1 Objective

6.4.2.2 Solution statement

6.5 REGULATORY LANDSCAPE

6.5.1 STANDARDS RELATED TO PAEK

6.6 PAEK MARKET: ECOSYSTEM

FIGURE 26 ECOSYSTEM MAPPING: Polyaryletherketone (PAEK) MARKET

TABLE 11 PAEK MARKET: ECOSYSTEM

6.7 VALUE CHAIN ANALYSIS

FIGURE 27 PAEK MARKET: VALUE CHAIN ANALYSIS

6.8 TRENDS/DISRUPTION IMPACT

FIGURE 28 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR Polyaryletherketone (PAEK) MARKET

6.9 AVERAGE SELLING PRICE ANALYSIS

FIGURE 29 AVERAGE SELLING PRICE OF PAEK, BY REGION (USD/KG)

TABLE 12 AVERAGE PRICES OF PAEK, BY REGION (USD/KG)

TABLE 13 AVERAGE PRICES OF PAEK, BY TYPE (USD/KG)

TABLE 14 AVERAGE PRICES OF PAEK, BY FILLER (USD/KG)

TABLE 15 AVERAGE PRICES OF PAEK, BY APPLICATION (USD/KG)

7 PAEK MARKET, BY TYPE (Page No. - 80)

7.1 INTRODUCTION

FIGURE 30 PEEK TO BE FASTEST-GROWING SEGMENT IN OVERALL MARKET

TABLE 16 Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 17 Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 18 Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 19 Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

7.2 PEEK

7.2.1 PEEK TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

TABLE 20 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 21 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 22 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 23 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.3 PEK

7.3.1 PEK CATERS TO DEMANDING APPLICATIONS DUE TO ITS SUPERIOR TEMPERATURE AND CHEMICAL RESISTANCE

TABLE 24 PEK MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 25 PEK MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 26 PEK MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 27 PEK MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

7.4 PEKK

7.4.1 PEKK USED IN OFFSHORE OIL EXTRACTION APPLICATIONS DUE TO ITS ABILITY TO WITHSTAND HIGH MECHANICAL LOADS

TABLE 28 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 29 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 30 PEKK MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 31 PEKK MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8 PAEK MARKET, BY FILLER (Page No. - 88)

8.1 INTRODUCTION

FIGURE 31 GLASS-FILLED TO BE FASTEST-GROWING SEGMENT IN OVERALL PAEK MARKET

TABLE 32 Polyaryletherketone (PAEK) MARKET SIZE, BY FILLER, 2019–2021 (TON)

TABLE 33 PAEK MARKET SIZE, BY FILLER, 2022–2027 (TON)

TABLE 34 Polyaryletherketone (PAEK) MARKET SIZE, BY FILLER, 2019–2021 (USD MILLION)

TABLE 35 Polyaryletherketone (PAEK) MARKET SIZE, BY FILLER, 2022–2027 (USD MILLION)

8.2 GLASS-FILLED

8.2.1 INCREASED MECHANICAL STRENGTH AND HIGH RIGIDITY TO DRIVE MARKET FOR GLASS-FILLED PAEK

TABLE 36 GLASS-FILLED PAEK MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 37 GLASS-FILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 38 GLASS-FILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 39 GLASS-FILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.3 CARBON-FILLED

8.3.1 CARBON-FILLED PEEK ENABLES ADOPTION OF 3D PRINTING IN AUTOMOTIVE INDUSTRY

TABLE 40 CARBON-FILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 41 CARBON-FILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 42 CARBON-FILLED PAEK MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 43 CARBON-FILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.4 UNFILLED

8.4.1 ASIA PACIFIC TO WITNESS HIGHEST CAGR FOR UNFILLED PAEK

TABLE 44 UNFILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 45 UNFILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 46 UNFILLED PAEK MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 47 UNFILLED Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

8.5 OTHERS

TABLE 48 OTHER FILLERS PAEK MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 49 OTHER FILLERS Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 50 OTHER FILLERS PAEK MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 51 OTHER FILLERS Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

9 PAEK MARKET, BY FORM (Page No. - 98)

9.1 INTRODUCTION

FIGURE 32 COMPOUND TO BE FASTEST-GROWING SEGMENT IN OVERALL MARKET

TABLE 52 Polyaryletherketone (PAEK) MARKET SIZE, BY FORM, 2019–2021 (TON)

TABLE 53 Polyaryletherketone (PAEK) MARKET SIZE, BY FORM, 2022–2027 (TON)

TABLE 54 Polyaryletherketone (PAEK) MARKET SIZE, BY FORM, 2019–2021 (USD MILLION)

TABLE 55 Polyaryletherketone (PAEK) MARKET SIZE, BY FORM, 2022–2027 (USD MILLION)

9.2 COMPOUND

9.2.1 COMPOUNDS WIDELY USED IN HIGH-STRESS APPLICATIONS

9.3 FILM

9.3.1 PAEK FILM EXHIBITS EXCEPTIONAL WEAR RESISTANCE

9.4 SHEET

9.4.1 PEEK SHEETS USED FOR SEALING APPLICATIONS

9.5 TAPE

9.5.1 PEEK TAPE SUITABLE FOR USE IN HIGH-TEMPERATURE APPLICATIONS

9.6 FIBER

9.6.1 PEEK FIBER WIDELY USED IN CONVEYOR BELTS

10 PAEK MARKET, BY APPLICATION (Page No. - 103)

10.1 INTRODUCTION

FIGURE 33 OIL & GAS TO BE LARGEST APPLICATION OF PAEK

TABLE 56 PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 57 Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 58 PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 59 Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 ELECTRICAL & ELECTRONICS

10.2.1 SUPERIOR CHEMICAL AND ELECTRICAL PROPERTIES OF PAEK TO INCREASE DEMAND IN ELECTRICAL & ELECTRONICS

TABLE 60 Polyaryletherketone (PAEK) MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2019–2021 (TON)

TABLE 61 PAEK MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2022–2027 (TON)

TABLE 62 Polyaryletherketone (PAEK) MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2019–2021 (USD MILLION)

TABLE 63 Polyaryletherketone (PAEK) MARKET SIZE IN ELECTRICAL & ELECTRONICS, BY REGION, 2022–2027 (USD MILLION)

10.3 OIL & GAS

10.3.1 PAEK USED IN WIDE RANGE OF APPLICATIONS IN OIL & GAS INDUSTRY

TABLE 64 Polyaryletherketone (PAEK) MARKET SIZE IN OIL & GAS, BY REGION, 2019–2021 (TON)

TABLE 65 PAEK MARKET SIZE IN OIL & GAS, BY REGION, 2022–2027 (TON)

TABLE 66 Polyaryletherketone (PAEK) MARKET SIZE IN OIL & GAS, BY REGION, 2019–2021 (USD MILLION)

TABLE 67 Polyaryletherketone (PAEK) MARKET SIZE IN OIL & GAS, BY REGION, 2022–2027 (USD MILLION)

10.4 AEROSPACE

10.4.1 PAEK SUITABLE FOR AEROSPACE APPLICATIONS DUE TO ITS FLAME RETARDANCY AND RESISTANCE TO RAIN EROSION

TABLE 68 Polyaryletherketone (PAEK) MARKET SIZE IN AEROSPACE, BY REGION, 2019–2021 (TON)

TABLE 69 PAEK MARKET SIZE IN AEROSPACE, BY REGION, 2022–2027 (TON)

TABLE 70 Polyaryletherketone (PAEK) MARKET SIZE IN AEROSPACE, BY REGION, 2019–2021 (USD MILLION)

TABLE 71 PAEK MARKET SIZE IN AEROSPACE, BY REGION, 2022–2027 (USD MILLION)

10.5 MEDICAL

10.5.1 PAEK SUITABLE FOR USE IN MEDICAL APPLICATIONS DUE TO ITS EXCELLENT RESISTANCE TO HYDROLYSIS

TABLE 72 PAEK MARKET SIZE IN MEDICAL, BY REGION, 2019–2021 (TON)

TABLE 73 Polyaryletherketone (PAEK) MARKET SIZE IN MEDICAL, BY REGION, 2022–2027 (TON)

TABLE 74 PAEK MARKET SIZE IN MEDICAL, BY REGION, 2019–2021 (USD MILLION)

TABLE 75 Polyaryletherketone (PAEK) MARKET SIZE IN MEDICAL, BY REGION, 2022–2027 (USD MILLION)

10.6 AUTOMOTIVE

10.6.1 PEEK COMPONENTS WIDELY USED IN AUTOMOTIVE SECTOR

TABLE 76 PAEK MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2021 (TON)

TABLE 77 Polyaryletherketone (PAEK) MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022–2027 (TON)

TABLE 78 PAEK MARKET SIZE IN AUTOMOTIVE, BY REGION, 2019–2021 (USD MILLION)

TABLE 79 PAEK MARKET SIZE IN AUTOMOTIVE, BY REGION, 2022–2027 (USD MILLION)

10.7 OTHERS

TABLE 80 PAEK MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2021 (TON)

TABLE 81 Polyaryletherketone (PAEK) MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2022–2027 (TON)

TABLE 82 PAEK MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2021 (USD MILLION)

TABLE 83 Polyaryletherketone (PAEK) MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2022–2027 (USD MILLION)

11 PAEK MARKET, BY REGION (Page No. - 116)

11.1 INTRODUCTION

FIGURE 34 INDIA TO BE FASTEST-GROWING MARKET FOR PAEK

TABLE 84 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (TON)

TABLE 85 PAEK MARKET SIZE, BY REGION, 2022–2027 (TON)

TABLE 86 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2019–2021 (USD MILLION)

TABLE 87 Polyaryletherketone (PAEK) MARKET SIZE, BY REGION, 2022–2027 (USD MILLION)

11.2 EUROPE

FIGURE 35 EUROPE: Polyaryletherketone (PAEK) MARKET SNAPSHOT

TABLE 88 EUROPE: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (TON)

TABLE 89 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 90 EUROPE: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 91 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 92 EUROPE: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 93 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 94 EUROPE: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 95 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 96 EUROPE: PAEK MARKET SIZE, BY FILLER, 2019–2021 (TON)

TABLE 97 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY FILLER, 2022–2027 (TON)

TABLE 98 EUROPE: PAEK MARKET SIZE, BY FILLER, 2019–2021 (USD MILLION)

TABLE 99 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY FILLER, 2022–2027 (USD MILLION)

TABLE 100 EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 101 EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 102 EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 103 EUROPE: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.1 GERMANY

11.2.1.1 Automotive application driving growth of PAEK market

TABLE 104 GERMANY: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 105 GERMANY: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 106 GERMANY: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 107 GERMANY: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 108 GERMANY: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 109 GERMANY: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 110 GERMANY: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 111 GERMANY: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.2 FRANCE

11.2.2.1 Increasing use of PAEK in electrical & electronic devices to boost market growth

TABLE 112 FRANCE: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 113 FRANCE: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 114 FRANCE: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 115 FRANCE: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 116 FRANCE: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 117 FRANCE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 118 FRANCE: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 119 FRANCE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.3 UK

11.2.3.1 Oil & gas industry to create demand for PAEK

TABLE 120 UK: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 121 UK: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 122 UK: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 123 UK: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 124 UK: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 125 UK: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 126 UK: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 127 UK: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.4 ITALY

11.2.4.1 Automotive and healthcare industries to drive market in Italy

TABLE 128 ITALY: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 129 ITALY: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 130 ITALY: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 131 ITALY: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 132 ITALY: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 133 ITALY: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 134 ITALY: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 135 ITALY: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.5 SPAIN

11.2.5.1 Medical applications to boost market for PAEK in Spain

TABLE 136 SPAIN: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 137 SPAIN: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 138 SPAIN: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 139 SPAIN: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 140 SPAIN: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 141 SPAIN: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 142 SPAIN: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 143 SPAIN: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.2.6 REST OF EUROPE

TABLE 144 REST OF EUROPE: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 145 REST OF EUROPE: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 146 REST OF EUROPE: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 147 REST OF EUROPE: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 148 REST OF EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 149 REST OF EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 150 REST OF EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 151 REST OF EUROPE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3 NORTH AMERICA

FIGURE 36 NORTH AMERICA: PAEK MARKET SNAPSHOT

TABLE 152 NORTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (TON)

TABLE 153 NORTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 154 NORTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 155 NORTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 156 NORTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 157 NORTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 158 NORTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 159 NORTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 160 NORTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2019–2021 (TON)

TABLE 161 NORTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2022–2027 (TON)

TABLE 162 NORTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2019–2021 (USD MILLION)

TABLE 163 NORTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2022–2027 (USD MILLION)

TABLE 164 NORTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 165 NORTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 166 NORTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 167 NORTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.1 US

11.3.1.1 Expanding application base to create demand for PAEK

TABLE 168 US: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 169 US: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 170 US: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 171 US: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 172 US: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 173 US: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 174 US: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 175 US: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.2 CANADA

11.3.2.1 Increasing investments in oil & gas industry boosting PAEK market

TABLE 176 CANADA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 177 CANADA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 178 CANADA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 179 CANADA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 180 CANADA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 181 CANADA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 182 CANADA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 183 CANADA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.3.3 MEXICO

11.3.3.1 Growing electronic sector expected to fuel consumption of PAEK

TABLE 184 MEXICO: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 185 MEXICO: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 186 MEXICO: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 187 MEXICO: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 188 MEXICO: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 189 MEXICO: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 190 MEXICO: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 191 MEXICO: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 37 ASIA PACIFIC: PAEK MARKET SNAPSHOT

TABLE 192 ASIA PACIFIC: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (TON)

TABLE 193 ASIA PACIFIC: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 194 ASIA PACIFIC: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 195 ASIA PACIFIC: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 196 ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 197 ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 198 ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 199 ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 200 ASIA PACIFIC: PAEK MARKET SIZE, BY FILLER, 2019–2021 (TON)

TABLE 201 ASIA PACIFIC: PAEK MARKET SIZE, BY FILLER, 2022–2027 (TON)

TABLE 202 ASIA PACIFIC: PAEK MARKET SIZE, BY FILLER, 2019–2021 (USD MILLION)

TABLE 203 ASIA PACIFIC: PAEK MARKET SIZE, BY FILLER, 2022–2027 (USD MILLION)

TABLE 204 ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 205 ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 206 ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 207 ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.1 CHINA

11.4.1.1 High growth in electrical & electronics industry to boost demand for PAEK

TABLE 208 CHINA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 209 CHINA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 210 CHINA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 211 CHINA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 212 CHINA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 213 CHINA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 214 CHINA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 215 CHINA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.2 INDIA

11.4.2.1 Growing electrical & electronics industry and improving oil exploration activities to boost market

TABLE 216 INDIA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 217 INDIA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 218 INDIA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 219 INDIA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 220 INDIA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 221 INDIA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 222 INDIA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 223 INDIA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.3 JAPAN

11.4.3.1 Automotive industry to boost PAEK market

TABLE 224 JAPAN: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 225 JAPAN: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 226 JAPAN: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 227 JAPAN: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 228 JAPAN: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 229 JAPAN: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 230 JAPAN: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 231 JAPAN: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.4 SOUTH KOREA

11.4.4.1 Aerospace industry to boost demand for PAEK

TABLE 232 SOUTH KOREA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 233 SOUTH KOREA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 234 SOUTH KOREA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 235 SOUTH KOREA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 236 SOUTH KOREA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 237 SOUTH KOREA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 238 SOUTH KOREA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 239 SOUTH KOREA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.5 AUSTRALIA & NEW ZEALAND

11.4.5.1 Electrical & electronics to be fastest-growing application of PAEK in Australia

TABLE 240 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 241 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 242 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 243 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 244 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 245 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 246 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 247 AUSTRALIA & NEW ZEALAND: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 248 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 249 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 250 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 251 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 252 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 253 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 254 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 255 REST OF ASIA PACIFIC: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 256 SOUTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (TON)

TABLE 257 SOUTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 258 SOUTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 259 SOUTH AMERICA: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 260 SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 261 SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 262 SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 263 SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 264 SOUTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2019–2021 (TON)

TABLE 265 SOUTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2022–2027 (TON)

TABLE 266 SOUTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2019–2021 (USD MILLION)

TABLE 267 SOUTH AMERICA: PAEK MARKET SIZE, BY FILLER, 2022–2027 (USD MILLION)

TABLE 268 SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 269 SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 270 SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 271 SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increasing discovery and exploration of underground oilfields to propel market in Brazil

TABLE 272 BRAZIL: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 273 BRAZIL: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 274 BRAZIL: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 275 BRAZIL: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 276 BRAZIL: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 277 BRAZIL: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 278 BRAZIL: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 279 BRAZIL: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Development in oil & gas sector to drive market for PAEK

TABLE 280 ARGENTINA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 281 ARGENTINA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 282 ARGENTINA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 283 ARGENTINA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 284 ARGENTINA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 285 ARGENTINA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 286 ARGENTINA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 287 ARGENTINA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.5.3 REST OF SOUTH AMERICA

TABLE 288 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 289 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 290 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 291 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 292 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 293 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 294 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 295 REST OF SOUTH AMERICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6 MIDDLE EAST & AFRICA

TABLE 296 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (TON)

TABLE 297 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (TON)

TABLE 298 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY COUNTRY, 2019–2021 (USD MILLION)

TABLE 299 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 300 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 301 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 302 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 303 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 304 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY FILLER, 2019–2021 (TON)

TABLE 305 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY FILLER, 2022–2027 (TON)

TABLE 306 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY FILLER, 2019–2021 (USD MILLION)

TABLE 307 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY FILLER, 2022–2027 (USD MILLION)

TABLE 308 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 309 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 310 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 311 MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.1 SAUDI ARABIA

11.6.1.1 Presence of largest petroleum reserves boosting PAEK market

TABLE 312 SAUDI ARABIA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 313 SAUDI ARABIA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 314 SAUDI ARABIA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 315 SAUDI ARABIA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 316 SAUDI ARABIA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 317 SAUDI ARABIA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 318 SAUDI ARABIA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 319 SAUDI ARABIA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.2 UAE

11.6.2.1 Growing oil production driving market for PAEK in UAE

TABLE 320 UAE: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 321 UAE: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 322 UAE: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 323 UAE: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 324 UAE: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 325 UAE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 326 UAE: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 327 UAE: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.3 SOUTH AFRICA

11.6.3.1 Demand from automotive application to boost PAEK market

TABLE 328 SOUTH AFRICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 329 SOUTH AFRICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 330 SOUTH AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 331 SOUTH AFRICA: PAEK MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 332 SOUTH AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 333 SOUTH AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 334 SOUTH AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 335 SOUTH AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

11.6.4 REST OF MIDDLE EAST & AFRICA

TABLE 336 REST OF MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (TON)

TABLE 337 REST OF MIDDLE EAST & AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (TON)

TABLE 338 REST OF MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY TYPE, 2019–2021 (USD MILLION)

TABLE 339 REST OF MIDDLE EAST & AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY TYPE, 2022–2027 (USD MILLION)

TABLE 340 REST OF MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (TON)

TABLE 341 REST OF MIDDLE EAST & AFRICA: Polyaryletherketone (PAEK) MARKET SIZE, BY APPLICATION, 2022–2027 (TON)

TABLE 342 REST OF MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2019–2021 (USD MILLION)

TABLE 343 REST OF MIDDLE EAST & AFRICA: PAEK MARKET SIZE, BY APPLICATION, 2022–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 207)

12.1 OVERVIEW

12.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 344 OVERVIEW OF STRATEGIES ADOPTED BY PAEK MANUFACTURERS

12.3 MARKET SHARE ANALYSIS

FIGURE 38 RANKING OF KEY MARKET PLAYERS, 2021

12.3.1 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES FOR PAST FIVE YEARS

12.4 COMPETITIVE BENCHMARKING

12.4.1 COMPANY OVERALL FOOTPRINT

12.4.2 BUSINESS STRATEGY EXCELLENCE

12.4.3 COMPANY PRODUCT TYPE FOOTPRINT

12.4.4 COMPANY APPLICATION FOOTPRINT

12.4.5 COMPANY REGION FOOTPRINT

12.5 COMPANY EVALUATION QUADRANT (TIER 1)

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PARTICIPANTS

12.5.4 PERVASIVE PLAYERS

FIGURE 40 PAEK MARKET (GLOBAL): COMPANY EVALUATION MATRIX

12.6 START-UPS/SMES EVALUATION QUADRANT

TABLE 345 PAEK MARKET: DETAILED LIST OF KEY START-UPS/SMES

12.6.1 PROGRESSIVE COMPANIES

12.6.2 RESPONSIVE COMPANIES

12.6.3 STARTING BLOCKS

12.6.4 DYNAMIC COMPANIES

FIGURE 41 PAEK MARKET: START-UPS/SMES EVALUATION QUADRANT

12.7 COMPETITIVE SITUATION AND TRENDS

12.7.1 NEW PRODUCT LAUNCHES

TABLE 346 PAEK MARKET: NEW PRODUCT LAUNCHES (2018–2021)

12.7.2 DEALS

TABLE 347 PAEK MARKET: DEALS (2018–2021)

13 COMPANY PROFILES (Page No. - 223)

13.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

13.1.1 VICTREX PLC

TABLE 348 VICTREX PLC: COMPANY OVERVIEW

FIGURE 42 VICTREX PLC: COMPANY SNAPSHOT

TABLE 349 VICTREX PLC: DEALS

13.1.2 SOLVAY

TABLE 350 SOLVAY: COMPANY OVERVIEW

FIGURE 43 SOLVAY: COMPANY SNAPSHOT

TABLE 351 SOLVAY: DEALS

13.1.3 EVONIK INDUSTRIES AG

TABLE 352 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 44 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

TABLE 353 EVONIK INDUSTRIES AG: DEALS

TABLE 354 EVONIK INDUSTRIES AG: NEW PRODUCT LAUNCH

13.1.4 ARKEMA SA

TABLE 355 ARKEMA SA: COMPANY OVERVIEW

FIGURE 45 ARKEMA SA: COMPANY SNAPSHOT

TABLE 356 ARKEMA SA: DEALS

13.1.5 SABIC

TABLE 357 SABIC: COMPANY OVERVIEW

FIGURE 46 SABIC: COMPANY SNAPSHOT

TABLE 358 SABIC: DEALS

13.1.6 GHARDA CHEMICALS LIMITED

TABLE 359 GHARDA CHEMICALS LIMITED: COMPANY OVERVIEW

13.1.7 ENSINGER GROUP

TABLE 360 ENSINGER GROUP: COMPANY OVERVIEW

13.1.8 AKRO-PLASTIC

TABLE 361 AKRO-PLASTIC: COMPANY OVERVIEW

13.1.9 RTP COMPANY

TABLE 362 RTP COMPANY: COMPANY OVERVIEW

13.1.10 MITSUBISHI CHEMICAL ADVANCED MATERIALS

TABLE 363 MITSUBISHI CHEMICAL ADVANCED MATERIALS: COMPANY OVERVIEW

13.1.11 PANJIN ZHONGRUN HIGH PERFORMANCE POLYMERS CO. LTD.

TABLE 364 PANJIN ZHONGRUN HIGH PERFORMANCE POLYMERS CO. LTD.: COMPANY OVERVIEW

13.1.12 LEHMANN&VOSS&CO.

TABLE 365 LEHMANN&VOSS&CO.: COMPANY OVERVIEW

13.1.13 J.K. OVERSEAS

TABLE 366 J.K. OVERSEAS: COMPANY OVERVIEW

13.1.14 CALEDONIAN INDUSTRIES LTD.

TABLE 367 CALEDONIAN INDUSTRIES LTD.: COMPANY OVERVIEW

13.1.15 NANOSHEL LLC

TABLE 368 NANOSHEL LLC: COMPANY OVERVIEW

13.1.16 TORAY ADVANCED COMPOSITES

TABLE 369 TORAY ADVANCED COMPOSITES: COMPANY OVERVIEW

13.1.17 OXFORD PERFORMANCE MATERIALS

TABLE 370 OXFORD PERFORMANCE MATERIALS: COMPANY OVERVIEW

13.1.18 JILIN JOINATURE POLYMER COMPANY LIMITED

TABLE 371 JILIN JOINATURE POLYMER COMPANY LIMITED: COMPANY OVERVIEW

13.1.19 LATI S.P.A.

TABLE 372 LATI S.P.A.: COMPANY OVERVIEW

13.1.20 ZEUS COMPANY INC.

TABLE 373 ZEUS COMPANY INC.: COMPANY OVERVIEW

13.1.21 JRLON, INC.

TABLE 374 JRLON, INC.: COMPANY OVERVIEW

13.1.22 DARTER PLASTICS INC.

TABLE 375 DARTER PLASTICS INC.: COMPANY OVERVIEW

13.1.23 BIEGLO GMBH

TABLE 376 BIEGLO GMBH: COMPANY OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 261)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

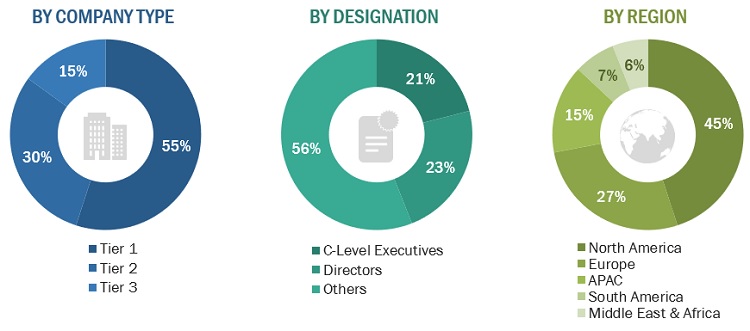

The study involved four major activities in estimating the current size of the Polyaryletherketone (PAEK) market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the PAEK value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analysed to arrive at the overall market size, which is further validated by primary research.

Primary Research

The Polyaryletherketone (PAEK) market comprises several stakeholders, such as PAEK manufacturer, traders, distributors, suppliers, end-use industry, other thermoplastic manufacturer, government & research organizations, R&D institutions, environmental support agencies in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the Polyaryletherketone (PAEK) market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the PAEK market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

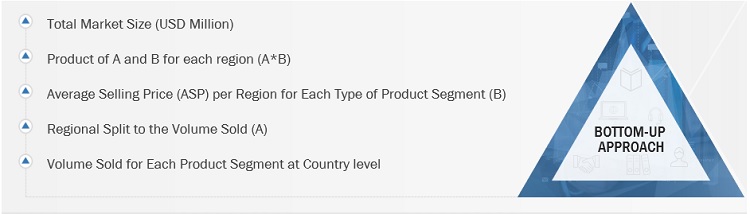

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the PAEK market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the PAEK market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the market size for polyaryletherketone (PAEK) in terms of value and volume

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the PAEK market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total PAEK market

- To analyze the opportunities in the PAEK market for the stakeholders and draw a competitive landscape of the market

- To define and segment the market size by type, application, filler, and form

- To forecast the market size with respect to five main regions, namely, Asia Pacific,

- North America, Europe, the Middle East & Africa, and South America, along with their respective key countries

- To analyze competitive developments, such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) activities in the PAEK market

- To strategically profile the key players in the PAEK market and comprehensively evaluate their current market shares

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the PAEK market

- A further breakdown of a region of the PAEK market with respect to a particular country

- Details and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polyaryletherketone (PAEK) Market