Pacemakers Market by Implantability (External), Technology (Single Chamber, Dual Chamber, CRT-P/Biventricular Pacemaker), Type (Conventional, MRI Compatible), End User (Hospitals and Cardiac Centers, Ambulatory Surgical Center) - Global Forecasts to 2023

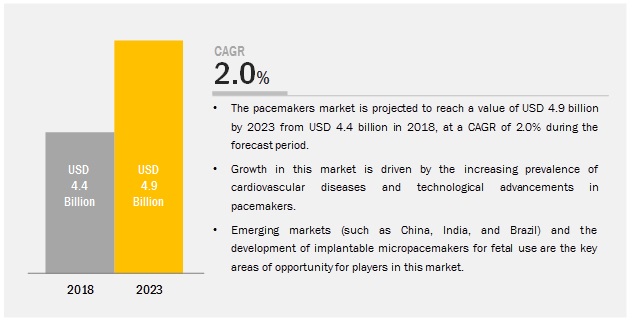

The pacemakers market is projected to reach USD 4.9 billion by 2023, at a CAGR of 2.0%.

The study involved 4 major activities in estimating the current market size for pacemaker. Exhaustive secondary research was done to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet have been referred to, so as to identify and collect information useful for a technical, market-oriented, and commercial study of the pacemakers market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, World Bank (US), Organisation for Economic Co-operation and Development (OECD), US Food and Drug Administration (FDA), World Health Organization (WHO), National Institute of Cardiovascular Outcomes Research (NICOR), and Healthcare Quality Improvement Partnership (HQIP). The secondary data was collected and analyzed to arrive at the overall market splits, which were further validated by primary research. The secondary research was used for the following processes, trade directories, and databases. Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation, according to the industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

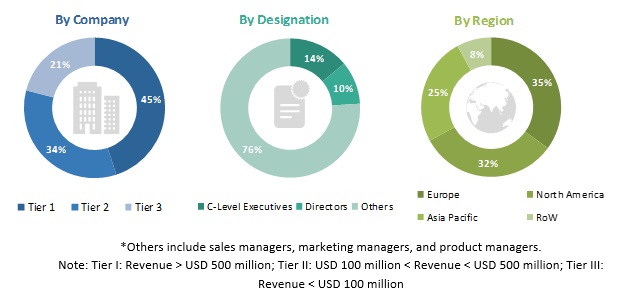

Extensive primary research was conducted after acquiring extensive knowledge about the global pacemakers industry scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as diagnostic centers, doctors, professors, and hospitals) and supply-side respondents (such as pacemaker device manufacturers and distributors) across all four major geographies. Approximately 30% and 70% of primary interviews were conducted with both the demand and supply sides, respectively. This primary data was collected through questionnaires, e-mails, online surveys, and telephonic interviews. Given below is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the pacemakers market. These approaches were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players have been identified through extensive secondary research

- Pacemaker product portfolios were studied for each player

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After deriving the overall pacemakers market value data from the market size estimation process explained above, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative & quantitative variables as well as by analyzing regional trends for both the demand and supply side macro-indicators.

Report Objectives

- To define, describe, segment, and forecast the pacemaker market by implantability, type, technology, end user, and region

- To provide detailed information about factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile the key players and comprehensively analyze their core competencies2 in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as acquisitions, product developments, partnerships, agreements, collaborations, and expansions in the market

Pacemakers Market Scope

|

Report Metric |

Details |

|

Market size available for years |

2016-2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018-2023 |

|

Forecast units |

Values (USD Million), and Volume (Thousand) |

|

Segments covered |

Type, Technology, Implantability, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Medtronic (Ireland), Abbott (US), and Boston Scientific (US) |

This research report categorizes the market based on type, implantability, technology, end user, and region.

On the basis of type, the pacemaker market is segmented as follows:

- MRI Compatible Pacemaker

- Conventional Pacemaker

On the basis of technology, the pacemakers market is segmented as follows:

- Single-chamber Pacemaker

- Dual-chamber Pacemaker

- Biventricular/CRT Pacemaker

On the basis of implantability, the pacemaker market is segmented as follows:

- Implantable Pacemaker

- External Pacemaker

On the basis of end user, the pacemaker market is segmented as follows:

- Hospitals & Cardiac Centers

- Ambulatory Surgical Centers

On the basis of region, the pacemaker market is segmented as follows:

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- RoW

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific pacemaker market, by key country

- Further breakdown of the Rest of Europe pacemakers market, by key country

Growth in this market is driven by increasing prevalence of cardiovascular diseases and technological advancements in devices.

By type, the MRI compatible pacemaker segment is expected to be the faster-growing in the pacemaker market during the forecast period.

The MRI compatible pacemakers segment is projected to grow at the higher CAGR between 2018 and 2023. This can be attributed to the growing number of patients with implanted pacemaker and the increasing need for MRI scans in the geriatric population, as patients in this age group are more likely to have cardiac devices such as pacemakers.

By implantability, the implantable pacemakers segment is expected to account for the largest market share during the forecast period.

The implantable pacemakers segment is expected to account for the largest market share in 2018, and this trend is expected to continue during the forecast period. The large share of the implantable pacemakers segment is primarily attributed to the increasing prevalence of CVDs and the rising preference for these pacemaker due to their benefits over their external counterparts.

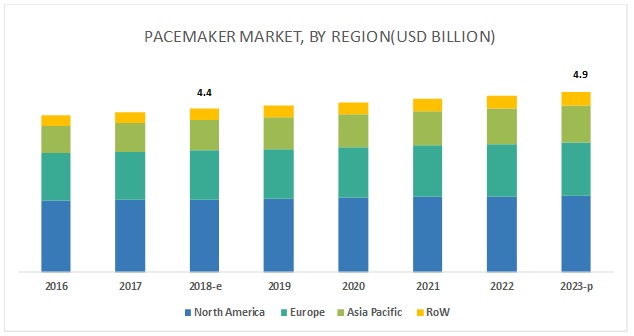

North America is expected to account for the largest market share during the forecast period.

North America is the major revenue-generating region in the global pacemaker market. Factors such as the rising prevalence of CVDs, growing geriatric population, increasing healthcare expenditure, and the availability of technologically advanced devices are driving the growth of the market in North America

The major vendors in the global pacemaker market are Medtronic (Ireland), Abbott (US), and Boston Scientific (US), BIOTRONIK (Germany), LivaNova (UK), OSCOR (US), Pacetronix (India), MEDICO (Italy), Osypka Medical (Germany), and Lepu Medical (China).

Recent Developments:

- In November 2017, Medtronic received FDA approval and launched the Azure pacemaker with BlueSync technology in the US market

- In February 2017, Medtronic received CE Mark certification for its Next Generation Cardiac Resynchronization Therapy-Pacemakers

- In February 2017, Abbott Laboratories received FDA approval for the Assurity MRI Pacemakers

- In March 2016, St. Jude Medical received the CE Mark certification for MRI compatibility for its Nanostim leadless pacemakers

Key questions addressed by the report:

- Who are the major market players in pacemakers?

- What are the regional growth trends and the largest revenue-generating region for pacemakers?

- Why are pacemaker necessary for cardiac patients?

- What are the major types of pacemakers?

- Who are the major end users of the pacemaker market?

Frequently Asked Questions (FAQs):

What is the size of Pacemakers Market?

The pacemakers market is projected to reach USD 4.9 billion by 2023, at a CAGR of 2.0%.

What are the major growth factors of Pacemakers Market?

Growth in this market is driven by increasing prevalence of cardiovascular diseases and technological advancements in devices.

Who all are the prominent players of Pacemakers Market?

Major vendors in the pacemakers market include Medtronic (Ireland), Abbott (US), and Boston Scientific (US), BIOTRONIK (Germany), LivaNova (UK), OSCOR (US), Pacetronix (India), MEDICO (Italy), Osypka Medical (Germany), and Lepu Medical (China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Covered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Primary Data

2.1.1.1 Key Data From Primary Sources

2.1.2 Secondary Data

2.1.2.1 Key Data From Secondary Sources

2.2 Market Estimation Methodology

2.2.1 Primary Research Validation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

2.5 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Market Overview

4.2 Geographical Snapshot

4.3 Pacemaker Market: By Technology (2018–2023)

4.4 Asia Pacific: By Technology (2017)

5 Market Overview (Page No. - 32)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Burden of CVD

5.2.1.2 Technological Advancements

5.2.2 Restraints

5.2.2.1 High Cost of Pacemakers, Unfavorable Reimbursement Scenario

5.2.3 Opportunities

5.2.3.1 Emerging Markets

5.2.3.2 Implantable Micropacemakers Designed for Fetal Use

5.2.4 Challenges

5.2.4.1 Shortage of Cardiac Surgeons

5.2.4.2 Frequent Product Recalls

6 Pacemaker Market, By Implantability (Page No. - 37)

6.1 Introduction

6.1.1 Implantable Pacemakers

6.1.1.1 Introduction of Leadless, Miniaturized Implantable Pacemakers to Boost Segment Popularity

6.1.2 External Pacemaker

6.1.2.1 North America to Lead the External Pacemakers Market During the Forecast Period

7 Pacemaker Market, By Technology (Page No. - 43)

7.1 Introduction

7.1.1 Dual-Chamber Pacemakers

7.1.1.1 Dual-Chamber Pacemakers are the Most Popular of All Pacemaker Technologies in the Market

7.1.2 Single-Chamber Pacemakers

7.1.2.1 The Advent of Leadless Pacemakers Will Stimulate Demand in This Product Segment

7.1.3 Biventricular/CRT Pacemakers

7.1.3.1 North America is the Largest Market for Biventricular/CRT Pacemakers

8 Pacemaker Market, By Type (Page No. - 51)

8.1 Introduction

8.1.1 Mri Compatible Pacemakers

8.1.1.1 Technological Advancement is Driving the Growth of Mri Compatible Pacemakers

8.1.2 Conventional Pacemakers

8.1.2.1 Increasing Aging Population is A Major Factor Driving the Growth of the Conventional Pacemaker Market

9 Pacemaker Market, By End User (Page No. - 57)

9.1 Introduction

9.2 Hospitals & Cardiac Centers

9.2.1 Rising Prevalence of Cardiovascular Diseases

9.3 Ambulatory Surgical Centers

9.3.1 Increasing Number of Ascs in the Us

10 Pacemaker Market, By Region (Page No. - 63)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.1.1 Rising Prevalence of CVDs and Technological Advancements in Pacemakers are the Major Factors Driving Market Growth

10.2.2 Canada

10.2.2.1 Rising Prevalence of CVDs and Growing Geriatric Population are Driving the Growth of the Canadian Pacemakers Market

10.3 Europe

10.3.1 Germany

10.3.1.1 Germany is Expected to Account for the Largest Share of European Pacemakers Market in 2018

10.3.2 France

10.3.2.1 Favorable Insurance System is Driving the Growth of the French Pacemakers Market

10.3.3 UK

10.3.3.1 Technological Advancements in Pacemaker Devices to Drive the Demand for Pacemakers in the Country

10.3.4 Rest of Europe

10.4 Asia Pacific

10.4.1 Japan

10.4.1.1 Mri Compatible Pacemakers Have Huge Growth Potential in Japan

10.4.2 China

10.4.2.1 Increasing Prevalence of CVDs is Driving the Growth of the Pacemakers Market in China

10.4.3 India

10.4.3.1 Increasing Pacemaker Implantation Procedures in India to Propel Market Growth

10.4.4 Rest of Asia Pacific (RoAPAC)

10.5 Rest of the World

11 Competitive Landscape (Page No. - 95)

11.1 Introduction

11.2 Pacemakers Market Share Analysis

11.3 Competitive Situation and Trends

11.3.1 Product Launches

11.3.2 Collaborations

11.3.3 Expansions

11.3.4 Mergers & Acquisitions

12 Company Profiles (Page No. - 98)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

12.1 Medtronic

12.2 Abbott Laboratories

12.3 Boston Scientific

12.4 Biotronik

12.5 Livanova

12.6 Lepu Medical

12.7 Shree Pacetronix

12.8 Osypka Medical

12.9 Medico Spa

12.10 Oscor

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 116)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (114 Tables)

Table 1 Conventional vs Mri Compatible Pacemakers: Price List

Table 2 List of Product Recalls

Table 3 Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 4 Implantable Pacemaker Market, By Region, 2016–2023 (USD Million)

Table 5 North America: Implantable Pacemaker Market, By Country, 2016–2023 (USD Million)

Table 6 Europe: Implantable Pacemaker Market, By Country, 2016–2023 (USD Million)

Table 7 Asia Pacific: Implantable Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 8 External Pacemakers Market, By Region, 2016–2023 (USD Million)

Table 9 North America: External Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 10 Europe: External Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 11 Asia Pacific: External Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 12 Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 13 Dual-Chamber Pacemakers: Key Manufacturers and Products

Table 14 Dual-Chamber Pacemakers Market, By Region, 2016–2023 (USD Million)

Table 15 North America: Dual-Chamber Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 16 Europe: Dual-Chamber Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 17 Asia Pacific: Dual-Chamber Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 18 Single-Chamber Pacemakers: Key Manufacturers and Products

Table 19 Single-Chamber Pacemakers Market, By Region, 2016–2023 (USD Million)

Table 20 North America: Single-Chamber Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 21 Europe: Single-Chamber Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 22 Asia Pacific: Single-Chamber Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 23 Biventricular/CRT Pacemakers: Key Manufacturers and Products

Table 24 Biventricular/Cardiac Resynchronization Therapy Pacemaker Market, By Region, 2016–2023 (USD Million)

Table 25 North America: Biventricular/Cardiac Resynchronization Therapy Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 26 Europe: Biventricular/Cardiac Resynchronization Therapy Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 27 Asia Pacific: Biventricular/Cardiac Resynchronization Therapy Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 28 Pacemaker Market, By Type, 2016–2023 (USD Million)

Table 29 Mri Compatible Pacemakers Market, By Region, 2016–2023 (USD Million)

Table 30 North America: Mri Compatible Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 31 Europe: Mri Compatible Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 32 Asia Pacific: Mri Compatible Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 33 Conventional Pacemakers Market, By Region, 2016–2023 (USD Million)

Table 34 North America: Conventional Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 35 Europe: Conventional Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 36 Asia Pacific: Conventional Pacemakers Market, By Country, 2016–2023 (USD Million)

Table 37 Pacemaker Market, By End User, 2016–2023 (USD Million)

Table 38 Pacemaker Market for Hospitals & Cardiac Centers, By Region, 2016–2023 (USD Million)

Table 39 North America: PacemakersMarket for Hospitals & Cardiac Centers, By Country, 2016–2023 (USD Million)

Table 40 Europe: Pacemakers Market for Hospitals & Cardiac Centers, By Country, 2016–2023 (USD Million)

Table 41 Asia Pacific: Pacemaker Market for Hospitals & Cardiac Centers, By Country, 2016–2023 (USD Million)

Table 42 Pacemaker Market for Ambulatory Surgical Centers, By Region, 2016–2023 (USD Million)

Table 43 North America: Pacemaker Market for Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 44 Europe: Pacemaker Market for Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 45 Asia Pacific: Pacemaker Market for Ambulatory Surgical Centers, By Country, 2016–2023 (USD Million)

Table 46 Pacemaker Market, By Region, 2016–2023 (USD Million)

Table 47 Pacemaker Market, By Region, 2016–2023 (Thousand Units)

Table 48 North America: Pacemaker Market, By Country, 2016–2023 (USD Million)

Table 49 North America: Pacemakers Market, By Country, 2016–2023 (Thousand Units)

Table 50 North America: Pacemakers Market, By Implantability, 2016–2023 (USD Million)

Table 51 North America: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 52 North America: Pacemaker Market, By Type, 2016–2023 (USD Million)

Table 53 North America: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 54 Clinical Trails Related to Pacemakers in the US

Table 55 US: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 56 US: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 57 US: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 58 US: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 59 Canada: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 60 Canada: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 61 Canada: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 62 Canada: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 63 Europe: Pacemaker Market, By Country, 2016–2023 (USD Million)

Table 64 Europe: Pacemakers Market, By Country, 2016–2023 (Thousand Units)

Table 65 Europe: Pacemakers Market, By Implantability, 2016–2023 (USD Million)

Table 66 Europe: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 67 Europe: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 68 Europe: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 69 Germany: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 70 Germany: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 71 Germany: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 72 Germany: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 73 France: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 74 France: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 75 France: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 76 France: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 77 UK: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 78 UK: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 79 UK: Pacemaker Market, By Type, 2016–2023 (USD Million)

Table 80 UK: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 81 RoE: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 82 RoE: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 83 RoE: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 84 RoE: Pacemakers Market, By End User, 2016–2023 (USD Million)

Table 85 APAC: Pacemaker Market, By Country, 2016–2023 (USD Million)

Table 86 APAC: Pacemakers Market, By Country, 2016–2023 (Thousand Units)

Table 87 APAC: Pacemakers Market, By Implantability, 2016–2023 (USD Million)

Table 88 APAC: Pacemakers Market, By Technology, 2016–2023 (USD Million)

Table 89 APAC: Pacemakers Market, By Type, 2016–2023 (USD Million)

Table 90 Asia Pacific: Pacemaker Market, By End User, 2016–2023 (USD Million)

Table 91 Japan: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 92 Japan: Market, By Technology, 2016–2023 (USD Million)

Table 93 Japan: Market, By Type, 2016–2023 (USD Million)

Table 94 Japan: Market, By End User, 2016–2023 (USD Million)

Table 95 China: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 96 China: Market, By Technology, 2016–2023 (USD Million)

Table 97 China: Market, By Type, 2016–2023 (USD Million)

Table 98 China: Market, By End User, 2016–2023 (USD Million)

Table 99 India: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 100 India: Market, By Technology, 2016–2023 (USD Million)

Table 101 India: Market, By Type, 2016–2023 (USD Million)

Table 102 India: Market, By End User, 2016–2023 (USD Million)

Table 103 RoAPAC: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 104 RoAPAC: Market, By Technology, 2016–2023 (USD Million)

Table 105 RoAPAC: Market, By Type, 2016–2023 (USD Million)

Table 106 RoAPAC: Market, By End User, 2016–2023 (USD Million)

Table 107 RoW: Pacemaker Market, By Implantability, 2016–2023 (USD Million)

Table 108 RoW: Market, By Technology, 2016–2023 (USD Million)

Table 109 RoW: Market, By Type, 2016–2023 (USD Million)

Table 110 RoW: Market, By End User, 2016–2023 (USD Million)

Table 111 Product Launches, 2015 to 2018

Table 112 Collaborations and Agreements 2015-2018

Table 113 Expansions, 2015 to 2018

Table 114 Mergers & Acquisitions, 2015-2018

List of Figures (24 Figures)

Figure 1 Research Methodology Steps

Figure 2 Research Design

Figure 3 Breakdown of Primaries

Figure 4 Market Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Pacemaker Market, By Implantability, 2018 vs 2023 (USD Million)

Figure 8 Pacemaker Market, By Type, 2018 vs 2023 (USD Million)

Figure 9 Pacemaker Market, By End User, 2018 vs 2023 (USD Million)

Figure 10 Geographical Snapshot of the Market

Figure 11 Increasing Prevalence of Cardiovascular Diseases—Major Factor Driving Market Growth

Figure 12 US Accounted for the Largest Share of the Pacemakers Market in 2017

Figure 13 Dual-Chamber Pacemakers to Register the Highest Growth During the Forecast Period (2018–2023)

Figure 14 Dual-Chamber Pacemakers Accounted for the Largest Share of the APAC Pacemakers Market in 2017

Figure 15 Drivers, Restraints, Opportunities, and Challenges: Pacemaker Market

Figure 16 North America: Pacemaker Market Snapshot

Figure 17 Incidence of CVD, IHD, and Stroke in Germany, 2015

Figure 18 Asia Pacific: Pacemaker Market Snapshot

Figure 19 Medtronic: Company Snapshot (2018)

Figure 20 Abbott Laboratories : Company Snapshot (2017)

Figure 21 Boston Scientific: Company Snapshot (2017)

Figure 22 Livanova : Company Snapshot (2017)

Figure 23 Lepu Medical: Company Snapshot (2016)

Figure 24 Shree Pacetronix: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pacemakers Market