Operational Technology Market Size, Share, Trends & Industry Growth Analysis Report by Components (Field Devices, Control Systems, & Services), Networking Technology, Industry (Process and Discrete), and Geography (North America, Europe, Asia Pacific, RoW)

Operational Technology Market

Operational Technology Market and Top Companies

Schneider Electric

Schneider Electric is a European multinational corporation specializing in energy management and automation solutions. The company serves the residential and commercial buildings and industrial infrastructure segments. It operates through the Energy Management (medium voltage, low voltage, and secure power) and Industrial Automation segments in 4 key markets: nonresidential and residential buildings, utilities and infrastructure, industry and machine manufacturers, and data centers and networks. Schneider provides an OASyS dynamic network of applications (DNA) based on real-time SCADA solutions. OASyS DNA offers real-time data related to field activities through enterprise networks. The company serves automotive, oil & gas, food & beverages, mining & minerals, and network & data centers industries with many subsidiaries across the world; the major ones are Schneider (US), Schneider (Europe) GmbH (Switzerland), Schneider Belgium NV (Belgium), and Schneider Electric (India).

Siemens

Siemens is a leading conglomerate pioneer in electrical engineering. The company is well-known for establishing major electrical infrastructure, trains & railways electrification, industrial automation, motors & drives, and healthcare diagnostics machines. Siemens operates through 4 reportable segments: Digital Industries, Smart Infrastructure, Mobility, and Siemens Healthineers. Siemens provides a complete range of automation products & components—from field devices such as industrial control equipment, sensors, and process analysis equipment, to plant-level software such as plant operations management and plant performance analytics software solutions. The company has a wide geographic presence, mainly across regions such as the Americas, Europe, Asia, Australia, Africa, and the Middle East. It is listed on the Frankfurt Stock Exchange as FWB: SIE.

Emerson Electric Co.

Emerson Electric Co. is a manufacturer of electric motors and fans. The company was founded as The Emerson Electric Manufacturing Company in St. Louis, Missouri, US. Emerson is primarily engaged in the manufacturing and development of process control systems, valves, and analytical instruments. It delivers products and services to industrial, commercial, and consumer markets. The company operates through 2 business segments, namely, Automation Solutions and Commercial & Residential Solutions. The company offers Plantweb digital ecosystem which enables measurable performance improvement in the areas of production, reliability, safety, and energy management by empowering personnel with new insights and actionable information. The company is listed on the New York Stock Exchange as NYSE: EMR. The company has geographic presence in the US, Canada, Asia, Europe, the Middle East/Africa, and Latin America.

Honeywell International, Inc.

Honeywell International Inc. offers manufacturing products, solutions, and services. It operates through 4 segments: Aerospace, Honeywell Building Technologies, Performance Materials and Technologies, and Safety and Productivity Solutions. Honeywell offers industrial automation and control solutions through the Honeywell Process Solutions (HPS) business unit, which provides services for oil & gas, refining, power generation, chemicals, pulp & paper, metals, minerals, and mining industries. Honeywell UOP, a Honeywell company, formerly known as UOP LLC or Universal Oil Products, provides software services and technologies to refining, petrochemicals, and oil & gas industries. Honeywell UOP and HPS together provide fully integrated solutions to customers to improve the safety of manufacturing plants. Honeywell has a presence in North America, Europe, the Middle East, Asia Pacific, Africa, and South America. It is listed in the Nasdaq Stock Market in the US and is among the Fortune 100 companies.

Rockwell Automation Inc

Rockwell Automation is one of the largest companies offering power, control, and information solutions for industrial automation. It operates through three business segments: Intelligent Devices, Software & Control, and Lifecycle Services. The Software & Control segment offers a comprehensive portfolio of production automation and operations platforms, including hardware and software. This integrated portfolio merges information technology (IT) and operational technology (OT) to provide the benefits of the connected enterprise to production systems. The company offers industrial sensors under the Allen-Bradley brand. The sensors and devices of the company consist of presence-sensing devices, limit switches, and condition-sensing devices. Industrial automation sensors come under condition sensing devices. The company also provides comprehensive MES solutions in the operational technology market. Rockwell Automation Inc. serves customers across more than 80 countries. The company continues the business founded as the Allen-Bradley Company in 1903, which it purchased in 1985. The company garners 55% of its sales from the US. Other countries where the company has a presence include China, Canada, Mexico, Italy, the UK, Germany, and Brazil.

Operational Technology Market and Top Industries

Power & Energy

The energy and power industry is expected to grow at the highest CAGR of 7.1% during the forecast period. The demand for energy and power is continuously growing; however, the problems of environmental impact and scarcity associated with conventional sources might lead to a probable energy crisis, which makes optimizing the production processes a necessity for the industry. Manufacturers face problems such as growing cost pressures, increasing regulatory and safety guidelines, and rising demand for diverse product portfolios. Technologies such as Manufacturing Execution System (MES), and Human-Machine Interface (HMI) help manufacturers standardize their workflow and minimize lead times by eliminating the time required for the approvals of various associations and the FDA. MES also maintains data and processes that need to be followed for regulatory compliance during production. Using MES helps in eliminating the need for maintaining records on paper. Plant Asset Management (PAM) and machine condition monitoring enable the proper functioning of systems used in the manufacturing process by providing continuous maintenance activities in these industries.

Machine Manufacturing

The machine manufacturing industry dominates the operational technology market with the highest market share and is expected to grow at a CAGR of 9.6% during the forecast period. The operational technology market for the machine manufacturing industry was valued at USD 6,571 million in 2021 and is projected to reach USD 11,415 million by 2027. Increasing demand for industrial machines in developing countries, technological innovations, and growing competition in the market are expected to drive the demand for operational technologies in the machine manufacturing industry. This trend is expected to continue as sustainability, high productivity, and energy-saving measures are becoming important. Factors such as the growing market for aftersales spare parts, increasing levels of customizations in machines, and the surging need to ensure the availability of various manufacturing parts are driving the implementation of operational technologies in the machine manufacturing industry.

Operational Technology Market By Information Technology

Warehouse Management System

The market for warehouse management systems (WMSs) is expected to grow at the highest CAGR of 16.7 from 2022 to 2027. WMS solutions are used to manage various operations at a warehouse, including receiving and putaway, sorting, inventory control, picking, labor management, shipping, yard management, and dock management. It manages the flow of inventory into, within, and out of a company’s warehouse or multiple warehouses. With continuous changes in materials, technologies, and markets, manufacturing plants need to be highly efficient, productive, and flexible. Implementing WMS in the production processes ensures optimal supply chain management; it automates the processes and helps reduce manufacturing costs.

Updated on : Oct 23, 2024

The global operational technology market size was valued at USD 157.9 billion in 2022 and is projected to reach USD 216.3 billion by 2027, growing at a CAGR of 6.5% during the forecast period.

The major drivers of the market include the surging adoption of Industry 4.0, rising emphasis on industrial automation in manufacturing processes, increasing government involvement in supporting industrial automation, growing emphasis on regulatory compliances, increasing complexities in the supply chain, and surging demand for software systems that reduce time and cost.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on the Operational Technology Market

COVID-19 has severely impacted the global economy and all the industries throughout the globe. Governments of various countries have imposed lockdowns to contain the spread of the epidemic.

The complete global lockdown in the initial stage of the pandemic in various countries severely impacted the livelihoods of people and quality of life. This has resulted into the disruptions in the supply chain across the globe. The economies across the world have declined as there is a major decline in the demand for products. The production across industries has been limited due to the pandemic resulting in the shortage of raw material.

The decline in exports and the disruptions in the supply chain are the major factors contributing to the decline in production. During this period, the main objective of the companies was to sustain their businesses, where operational technology played a critical role in companies performing efficiently with limited available resources and workforce.

Operational Technology Market Segment Overview

The market has been segmented by component, networking technology, industry, and geography.

“Market for industrial sensors expected to grow at the highest CAGR during the forecast period”

The industrial sensors segment of the operational technology industry for field instruments is expected to grow at the highest CAGR of 9.0% from 2022 to 2027, reaching USD 34,751 million by 2027 from USD 66,386 million in 2021.

The growth of the industrial sensors segment is driven by the growing adoption of Industry 4.0 and the expansion of the wireless sensors market. Predictive maintenance is expected to offer lucrative opportunities to the players operating in the industrial sensors market in the coming years. Predictive maintenance is enabled by 3 major solution enhancements over traditional maintenance: capturing sensor data, facilitating data communications, and making predictions. As the sensor is an important part of predictive maintenance solutions, the demand for industrial sensors is expected to increase significantly in the coming years.

“DCS Segment to Hold Largest Share Throughout Forecast Period”

The market for DCS is expected to hold the largest share throughout the forecast period among operational technology control systems, reaching USD 24,507 million by 2027 from USD 17,454 million in 2021.

However, the market for WMS is expected to grow at the highest CAGR of 16.7% from 2022 to 2027, reaching USD 4,502 million by 2027 from USD 1,815 million in 2021. A significant shift in consumer purchasing behavior has resulted in the increased implementation of real-time WMS software solutions for efficient order processing, picking, packaging, shipment tracking, and route planning. WMS helps companies quickly adapt to the changing customer requirements in the e-commerce and online shopping space. Furthermore, the implementation of WMS helps manage warehouses at an optimum level, with increased productivity and efficiency of warehouse operations and reduced product delivery time.

“Market for energy & power industry to grow at highest CAGR between 2022 and 2027”

The process industry segment includes oil & gas, chemicals, energy & power, food & beverages, pharmaceuticals, mining & metals, and others. Among these, the energy & power industry is expected to grow at the highest CAGR of 7.1% during the forecast period.

The demand for energy is growing continuously; however, the problems of environmental impact and scarcity associated with conventional sources might lead to a probable energy crisis, which makes optimizing the production processes necessary for the industry. Manufacturers face growing cost pressures and increasing demand for diverse product portfolios, coupled with regulatory and safety guidelines. Technologies such as MES, PAM, and HMI help manufacturers standardize their workflow and minimize lead times by eliminating the time required for the approval of various associations and the FDA. MES also maintains data and processes that need to be followed for regulatory compliance during production. Using MES helps in eliminating the need for maintaining records on paper. PAM and machine condition monitoring enable the proper functioning of systems used in the manufacturing process by providing continuous maintenance activities in these industries.

“Operational Technology market in APAC to grow at the highest CAGR”

The market in APAC is projected to reach USD 73,523 million by 2027 from USD 49,195 million in 2021; it is anticipated to grow at the highest CAGR of 7.1% from 2022 to 2027.

The major factors driving the growth of the market in APAC are the rising demand for smart tools due to increasing automation in industries; growing adoption of technologies such as Industry 4.0, smart factory, IoT, and IIoT; and increasing need to optimize productivity and reduce operational and maintenance costs. Government support in various APAC countries to drive industrialization is one of the important factors that will boost demand for operational technologies in the coming years. Various initiatives taken by governments in the region, such as China’s Made in China 2025, Japan’s Industrial Value Chain Initiative (IVI), South Korea’s The Manufacturing Innovation Strategy 3.0 (Strategy 3.0), and India’s Samarth Udyog Bharat 4.0, are likely to play a major role in industrial advancement and consequently create growth opportunities for the market.

To know about the assumptions considered for the study, download the pdf brochure

Top Operational Technology Companies - Key Market players

- ABB (Switzerland),

- Siemens (Germany),

- Schneider Electric (France),

- Rockwell Automation (US),

- Honeywell International Inc. (US),

- Emerson Electric Co. (US),

- IBM (US), and

- General Electric (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Operational Technology Market Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Billion/Million) |

|

Segments Covered |

Components, Networking Technology, and Industry |

|

Geographic Regions Covered |

North America, APAC, Europe, and RoW |

|

Companies Covered |

Major Players: ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), General Electric (US), and Others- total 25 players have been covered |

Operational Technology Market Market Dynamics

Drivers: Strategic initiatives by governments to promote adoption of operational technologies

Governments worldwide are becoming aware of the significant potential of operational technologies; therefore, they are supporting and funding R&D for technologies such as IIoT and industrial 3D printing.

The governments of various countries are supporting IIoT innovations, as they expect themselves to become potential adopters of the technology. They are financially supporting new IoT research projects and implementations to build and run smart cities in the future.

Governments worldwide are undertaking initiatives and providing funding to educational institutions, research centers, and research and technology organizations to further explore the possibilities of operational technologies. Governments of APAC countries are actively undertaking projects and initiatives to digitalize manufacturing facilities. For instance, in December 2018, the Government of South Korea, along with its nine economy-related ministries, unveiled measures to boost the small- and mid-sized manufacturing companies in South Korea and establish 10 industrial zones and 30,000 smart factories by 2022 to upgrade its manufacturing industry. Made in China 2025 is a strategic plan of the Government of China. Its goals include increasing the Chinese domestic content of core materials to 70% by 2025. The government is committed to investing ~USD 300 billion to achieve this plan.

Restraint: High installation and maintenance costs

The establishment of new automated manufacturing plants requires the deployment of the latest automation technologies such as SCADA, DCS, PAM, and HMI.

Gathering data with the help of SCADA helps in reducing errors in calculations while improving the quality of products and production efficiency of manufacturing plants. The setting up of these manufacturing plants requires large capital investments for equipment, software, and training. Investing such a large amount is difficult for new entrants who are setting up their first plant.

As such, these companies have to carry out an in-depth analysis of their return on investments before implementing industrial automation systems and solutions. Moreover, it is not feasible for several companies to replace their existing legacy systems owing to the high costs of new and advanced systems and the lack of interoperability in legacy systems, which rely on their proprietary protocols to communicate, making it difficult to connect them to systems based on new technologies. The additional costs incurred by manufacturers to upgrade their existing systems are high.

Also, the automation software systems used in industries require continuous maintenance and upgrade. Hence, small businesses cannot bear such expenses. Thus, cost is a key factor restraining the growth of the operational technology market.

Opportunities: Rapid industrial growth in emerging economies

Companies from developed economies are looking to expand their operations in emerging economies due to cheap labor costs and lower real estate rates.

Additionally, rapid industrialization in emerging economies, such as India, Japan, Africa, Brazil, Mexico, and Indonesia, has resulted in significant investments in infrastructure development, which, in turn, is attracting global companies to these economies to set up manufacturing plants.

The FDI by global companies are generally used for setting up new manufacturing plants in emerging economies. The predominant contributing factor behind the conversion of developing economies into major manufacturing hubs is the low manufacturing cost and low-cost labor. However, as manufacturing in these economies is dominantly driven by labor or a manual workforce, the chances of errors and accidents are quite high.

Additionally, these developments have created a requirement for advanced and sophisticated warehousing facilities to integrate and manage supply chains. The surge in investments toward enhancing the capability of supply chains in emerging economies has opened new growth opportunities for operational technologies. Various solutions, such as WMS and MES, have penetrated the industries in developing countries.

Challenges: Rise in instances of automated cyber attacks

Cyberattacks have always been a major threat to the companies adopting digitalization. The large-scale integration of technologies, cloud, digitalization, and automation implies a high risk of cyber threats.

Though the security of these automated systems has increased to a significant extent, they are still prone to cyberattacks. Earlier, cyberattacks were carried out by individuals, which then upgraded to a group of people undertaking synchronized attacks. Presently, it has reached the stage wherein automated attacks are carried out by machines.

Automated cyberattacks mainly target industrial control systems such as distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, and human–machine interfaces (HMI), as these can be hacked easily. These systems are less secure owing to their installation in remote locations, inadequate firewall safety, and lack of strong connectivity networks.

Industrial Control Systems-Computer Emergency Response Team (ICS-CERT) conducts onsite cybersecurity assessments of ICS. Cybersecurity breaches reported to the US federal agencies by the Computer Emergency Response Team (CERT) increased rapidly in energy, water & wastewater management, food and agriculture, dams, critical manufacturing, and emergency services segments, according to CERT. Hence, automated cyberthreats act as a challenge for the growth of the operational technology market. To prevent cyberattacks, governments of various countries are making investments and plans to implement cybersecurity and support businesses to grow.

Operational Technology Market Categorization

This research report categorizes the market by information technology, enabling technology, industry, and region.

By Components:

-

Human-machine interface

- Industrial valves

- Transmitters

- Industrial sensors

- Actuators

-

Control Systems

- SCADA

- PAM

- MES

- WMS

- DCS

- HMI

- Functional Safety

By Networking Technology:

- Wired

- Wireless

By Industry:

-

Process Industry

- Oil & Gas

- Food & Beverages

- Pharmaceuticals

- Chemicals

- Energy & Power

- Metals & Mining

- Pulp & Paper

- Others

-

Discrete Industry

- Automotive

- Aerospace & Defense

- Semiconductor & Electronics

- Medical Devices

- Machine Manufacturing

- Others

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments in Operational Technology Market

- In October 2021, Schneider Electric launched the EcoStruxure Automation Expert Version 21.2, which manages the automation lifecycle of the water & wastewater industry.

- In September 2021, Siemens launched Sitrans IQ, a new digitalization portfolio designed for targeted monitoring of critical measurement points to complete asset management covering instrumentation for multiple plants. This solution meets all types of requirements, including apps for smart asset management, smart inventory management, remote monitoring, Bluetooth connectivity for field devices, and condition monitoring of capital assets.

- In September 2021, Yokogawa Electric Corporation announced a major upgrade to its Exaquantum Safety Function Monitoring (SFM) software, an OpreX Asset Operations and Optimization solution that helps identify whether actual operating performance meets safety design targets.

Frequently Asked Questions (FAQ):

What is the total CAGR expected to be recorded for the operational technology market during 2022-2027?

The global operational technology market is expected to record the CAGR of 6.5% from 2022–2027.

Does this report include the impact of COVID-19 on the operational technology market?

Yes, the report includes the impact of COVID-19 on the operational technology market. It illustrates the post- COVID-19 market scenario.

What are the driving factors for the operational technology market?

The major driving factors of the operational technology market include the growing adoption of Industry 4.0, rising emphasis on industrial automation in manufacturing processes, increasing government involvement in supporting industrial automation, growing emphasis on regulatory compliances, increasing complexities in the supply chain, and surging demand for software systems that reduce time and cost.

Which are the significant players operating in the operational technology market?

Major companies offering operational technology technologies include ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), and General Electric (US).

Which region will lead the operational technology market in the future?

APAC is expected to lead the operational technology market during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 OPERATIONAL TECHNOLOGY MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.5 YEARS CONSIDERED

1.6 CURRENCY & PRICING

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 OPERATIONAL TECHNOLOGY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SCADA IN OPERATIONAL TECHNOLOGY MARKET

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis (demand side)

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 7 ANALYSIS OF IMPACT OF COVID-19 ON OPERATIONAL TECHNOLOGY MARKET

3.1 REALISTIC SCENARIO

3.2 PESSIMISTIC SCENARIO

3.3 OPTIMISTIC SCENARIO

FIGURE 8 MARKET FOR INDUSTRIAL SENSORS TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 9 DCS SEGMENT TO HOLD LARGEST SHARE THROUGHOUT FORECAST PERIOD

FIGURE 10 MARKET FOR ENERGY & POWER INDUSTRY TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 11 MARKET FOR MACHINE MANUFACTURING TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

FIGURE 12 OPERATIONAL TECHNOLOGY MARKET, BY REGION

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR OPERATIONAL TECHNOLOGY MARKET

FIGURE 13 MARKET TO HAVE HUGE GROWTH OPPORTUNITIES IN APAC

4.2 MARKET, BY FIELD INSTRUMENTS

FIGURE 14 INDUSTRIAL SENSORS SEGMENT TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

4.3 MARKET, BY CONTROL SYSTEMS

FIGURE 15 DCS TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

4.4 MARKET, BY PROCESS INDUSTRY

FIGURE 16 MARKET FOR ENERGY & POWER INDUSTRY TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

4.5 OPERATIONAL TECHNOLOGY MARKET, BY DISCRETE INDUSTRY

FIGURE 17 MACHINE MANUFACTURING TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

4.6 MARKET, BY GEOGRAPHY

FIGURE 18 APAC TO HOLD LARGEST SHARE OF MARKET THROUGHOUT FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 19 GLOBAL OPERATIONAL TECHNOLOGY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing emphasis on real-time data analysis and predictive maintenance

5.2.1.2 Emergence of connected enterprises

5.2.1.3 Strategic initiatives by governments to promote adoption of operational technologies

5.2.1.4 Emphasis on optimum utilization of resources

FIGURE 20 DRIVERS FOR GLOBAL MARKET AND THEIR IMPACT

5.2.2 RESTRAINTS

5.2.2.1 High installation and maintenance costs

5.2.2.2 Requirement of maintenance and frequent software upgrades

5.2.2.3 Lack of skilled professionals

FIGURE 21 RESTRAINTS FOR GLOBAL MARKET AND THEIR IMPACT

5.2.3 OPPORTUNITIES

5.2.3.1 Increased demand for safety compliance automation solutions

5.2.3.2 Adoption of emerging technologies such as IIoT and cloud computing in industrial environments

5.2.3.3 Development of machine learning and big data analytics

5.2.3.4 Rapid industrial growth in emerging economies

FIGURE 22 OPPORTUNITIES FOR GLOBAL OPERATIONAL TECHNOLOGY MARKET AND THEIR IMPACT

5.2.4 CHALLENGES

5.2.4.1 Lack of standardization in industrial communication protocols and interfaces

5.2.4.2 Rise in instances of automated cyber attacks

FIGURE 23 CHALLENGES FOR GLOBAL MARKET AND THEIR IMPACT

5.3 VALUE CHAIN ANALYSIS

FIGURE 24 OPERATIONAL TECHNOLOGY MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 25 MARKET: ECOSYSTEM

TABLE 1 COMPANIES AND THEIR ROLE IN MARKET ECOSYSTEM

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

FIGURE 26 MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.6 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 CASE STUDY

5.7.1 USE CASE 1: ARB MIDSTREAM

5.7.2 USE CASE 2: CANADIAN CRUDE OIL PRODUCER

5.7.3 USE CASE 3: BARCELONA

5.7.4 USE CASE 4: HIETA

5.8 PRICING ANALYSIS

5.8.1 LEVEL TRANSMITTERS

5.8.2 INDUSTRIAL SENSORS

TABLE 3 PRICE RANGE OF INDUSTRIAL SENSORS

5.8.3 AVERAGE SELLING PRICES OF MARKET PLAYERS, BY FIELD DEVICES

FIGURE 27 AVERAGE SELLING PRICES OF KEY PLAYERS, BY FIELD DEVICES

TABLE 4 AVERAGE SELLING PRICES OF KEY PLAYERS, BY FIELD DEVICES (USD)

5.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 5 OPERATIONAL TECHNOLOGY MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.10 TRADE ANALYSIS

5.10.1 VALVES

FIGURE 28 IMPORTS DATA FOR VALVES, 2016–2020 (USD MILLION)

FIGURE 29 EXPORTS DATA FOR VALVES, 2016–2020 (USD MILLION)

5.11 PATENTS ANALYSIS

FIGURE 30 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2021

FIGURE 31 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 6 LIST OF TOP PATENT OWNERS IN LAST 10 YEARS

5.11.1 LIST OF MAJOR PATENTS

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 32 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 INDUSTRIES

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

5.12.2 BUYING CRITERIA

FIGURE 33 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

TABLE 8 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

5.13 TECHNOLOGY TRENDS

5.13.1 INDUSTRY 4.0

5.13.2 ARTIFICIAL INTELLIGENCE (AI)

5.13.3 INTERNET OF THINGS (IOT)

5.13.4 BLOCKCHAIN

5.13.5 AUGMENTED REALITY (AR) & VIRTUAL REALITY (VR)

5.13.6 PREDICTIVE MAINTENANCE

5.13.7 DIGITAL TWIN

5.14 STANDARDS & REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 REGULATORY STANDARDS

5.14.2.1 IEC TS 62832-1: 2020

5.14.2.2 ISO/IEC TR 63306-1:2020

5.14.2.3 ISO 55001: 2014

TABLE 13 MAJOR COMMUNICATION STANDARDS FOR SCADA SYSTEMS

TABLE 14 INDUSTRIAL SAFETY STANDARDS

6 OPERATIONAL TECHNOLOGY MARKET, BY COMPONENT (Page No. - 93)

6.1 INTRODUCTION

FIGURE 34 MARKET, BY COMPONENT

TABLE 15 MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 16 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 FIELD INSTRUMENTS

FIGURE 35 MARKET FOR INDUSTRIAL SENSORS TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 17 OPERATIONAL TECHNOLOGY MARKET, BY FIELD INSTRUMENTS, 2018–2021 (USD MILLION)

TABLE 18 MARKET, BY FIELD INSTRUMENTS, 2022–2027 (USD MILLION)

TABLE 19 MARKET FOR FIELD INSTRUMENTS, BY REGION, 2018–2021 (USD MILLION)

TABLE 20 MARKET FOR FIELD INSTRUMENTS, BY REGION, 2022–2027 (USD MILLION)

TABLE 21 MARKET FOR FIELD INSTRUMENTS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 22 OPERATIONAL TECHNOLOGY MARKET FOR FIELD INSTRUMENTS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 23 MARKET FOR FIELD INSTRUMENTS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 24 MARKET FOR FIELD INSTRUMENTS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.2.1 INDUSTRIAL VALVES

6.2.1.1 Growth of process and discrete industries leads to growing demand for industrial valves

TABLE 25 OPERATIONAL TECHNOLOGY MARKET FOR INDUSTRIAL VALVES, BY REGION, 2018–2021 (USD MILLION)

TABLE 26 MARKET FOR INDUSTRIAL VALVES, BY REGION, 2022–2027 (USD MILLION)

TABLE 27 MARKET FOR INDUSTRIAL VALVES, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 28 MARKET FOR INDUSTRIAL VALVES, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

6.2.2 TRANSMITTERS

TABLE 29 TYPES OF TRANSMITTERS USED IN FIELD INSTRUMENTS

6.2.2.1 Pressure transmitters

6.2.2.1.1 Pressure transmitters can determine pressure of liquid, gas, and steam in different industries

6.2.2.2 Temperature transmitters

6.2.2.2.1 Temperature transmitters are used for determining temperature of fluids in various industries

6.2.2.3 Level transmitters

6.2.2.3.1 Level transmitters determine the level of given liquid or solid bulk in process industries

TABLE 30 OPERATIONAL TECHNOLOGY MARKET FOR TRANSMITTERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 MARKET FOR TRANSMITTERS, BY REGION, 2022–2027 (USD MILLION)

TABLE 32 MARKET FOR TRANSMITTERS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 33 MARKET FOR TRANSMITTERS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

6.2.3 INDUSTRIAL SENSORS

6.2.3.1 Rise in use of industrial sensors to ensure connectivity in manufacturing plants to boost market growth

6.2.3.2 Wired industrial sensors

6.2.3.3 Wireless industrial sensors

TABLE 34 OPERATIONAL TECHNOLOGY MARKET FOR INDUSTRIAL SENSORS, BY REGION, 2018–2021 (USD MILLION)

TABLE 35 MARKET FOR INDUSTRIAL SENSORS, BY REGION, 2022–2027 (USD MILLION)

TABLE 36 MARKET FOR INDUSTRIAL SENSORS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 37 MARKET FOR INDUSTRIAL SENSORS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 38 MARKET FOR INDUSTRIAL SENSORS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 39 MARKET FOR INDUSTRIAL SENSORS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.2.4 ACTUATORS

6.2.4.1 Growing requirement for improved control over movement of equipment in manufacturing facilities to boost market growth

6.2.4.2 Linear actuators

6.2.4.2.1 Rod type linear actuators

6.2.4.2.1.1 Increasing use of rod-less type linear actuators in aircraft structures to drive demand

6.2.4.2.2 Screw type linear actuators

6.2.4.2.2.1 Growing use with servomotors in drive and control hardware to fuel demand

6.2.4.2.3 Belt type linear actuators

6.2.4.2.3.1 Rising use to increase operational efficiency of process automation to drive demand

6.2.4.3 Rotary actuators

6.2.4.3.1 Motors

6.2.4.3.1.1 Surging sales of industrial robots to drive demand

6.2.4.3.2 Bladder & vane

6.2.4.3.2.1 Increasing use in gates and valves deployed in process industries to drive demand

6.2.4.3.3 Piston type

6.2.4.3.3.1 Growing use for precision control applications in electronics industry to drive demand

6.3 CONTROL SYSTEMS

FIGURE 36 DCS TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

TABLE 40 OPERATIONAL TECHNOLOGY MARKET, BY CONTROL SYSTEMS, 2018–2021 (USD MILLION)

TABLE 41 MARKET, BY CONTROL SYSTEMS, 2022–2027 (USD MILLION)

TABLE 42 MARKET FOR CONTROL SYSTEMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 MARKET FOR CONTROL SYSTEMS, BY REGION, 2022–2027 (USD MILLION)

TABLE 44 OPERATIONAL TECHNOLOGY MARKET FOR CONTROL SYSTEMS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 45 MARKET FOR CONTROL SYSTEMS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 46 MARKET FOR CONTROL SYSTEMS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 47 MARKET FOR CONTROL SYSTEMS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.3.1 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

6.3.1.1 Surge in adoption of SCADA for collecting real-time data from remote locations and controlling different devices to fuel market growth

FIGURE 37 SCOPE OF SCADA IN OPERATIONAL TECHNOLOGY MARKET

TABLE 48 MARKET FOR SCADA, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 MARKET FOR SCADA, BY REGION, 2022–2027 (USD MILLION)

TABLE 50 MARKET FOR SCADA, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 51 MARKET FOR SCADA, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 52 MARKET FOR SCADA, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 53 MARKET FOR SCADA, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.3.2 PLANT ASSET MANAGEMENT

6.3.2.1 Surging adoption of PAM systems to reduce downtime and wastage in manufacturing plants to fuel market growth

6.3.2.2 By offering

6.3.2.2.1 PAM solutions help improve operational efficiency of business processes

6.3.2.3 By deployment

6.3.2.3.1 Cloud (online) deployment mode is gaining popularity due to growing demand for advanced technologies

6.3.2.4 By asset type

6.3.2.4.1 PAM solutions are in demand for production assets such as monitoring, rotating, and reciprocating equipment

TABLE 54 OPERATIONAL TECHNOLOGY MARKET FOR PAM, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 MARKET FOR PAM, BY REGION, 2022–2027 (USD MILLION)

TABLE 56 MARKET FOR PAM, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 57 MARKET FOR PAM, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 58 MARKET FOR PAM, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 59 MARKET FOR PAM, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.3.3 DISTRIBUTED CONTROL SYSTEM (DCS)

6.3.3.1 Rise in demand for process automation and control in industrial manufacturing plants to drive growth of DCS segment

FIGURE 38 BENEFITS OF DCS IN INDUSTRIAL PLANTS

TABLE 60 SOME MODELS OF DCS OFFERED BY DIFFERENT COMPANIES

FIGURE 39 DCS TYPE

TABLE 61 OPERATIONAL TECHNOLOGY MARKET FOR DCS, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 MARKET FOR DCS, BY REGION, 2022–2027 (USD MILLION)

TABLE 63 MARKET FOR DCS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 64 MARKET FOR DCS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

FIGURE 40 BENCHMARKING OF TOP 3 COMPANIES IN DCS MARKET

6.3.4 HUMAN–MACHINE INTERFACE (HMI)

6.3.4.1 Improvements in data visualization offered by HMI to fuel its adoption rate

TABLE 65 OPERATIONAL TECHNOLOGY MARKET FOR HMI, BY REGION, 2018–2021 (USD MILLION)

TABLE 66 MARKET FOR HMI, BY REGION, 2022–2027 (USD MILLION)

TABLE 67 MARKET FOR HMI, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 68 MARKET FOR HMI, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 69 MARKET FOR HMI, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 70 MARKET FOR HMI, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.3.5 MANUFACTURING EXECUTION SYSTEM (MES)

6.3.5.1 Cost-saving and operation optimization benefits of MES to drive their demand

TABLE 71 OPERATIONAL TECHNOLOGY MARKET FOR MES, BY REGION, 2018–2021 (USD MILLION)

TABLE 72 MARKET FOR MES, BY REGION, 2022–2027 (USD MILLION)

TABLE 73 MARKET FOR MES, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 74 MARKET FOR MES, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 75 MARKET FOR MES, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 76 MARKET FOR MES, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.3.6 WAREHOUSE MANAGEMENT SYSTEM (WMS)

6.3.6.1 By offering

6.3.6.1.1 Digitization of supply chain management propels growth of warehouse management system market

6.3.6.2 Implementation type

6.3.6.2.1 Increasing adoption of on-cloud WMS solutions

6.3.6.3 By tier type

6.3.6.3.1 Rising demand for WMS from several industries

TABLE 77 OPERATIONAL TECHNOLOGY MARKET FOR WMS, BY REGION, 2018–2021 (USD MILLION)

TABLE 78 MARKET FOR WMS, BY REGION, 2022–2027 (USD MILLION)

TABLE 79 MARKET FOR WMS, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 80 MARKET FOR WMS, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

TABLE 81 MARKET FOR WMS, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 82 OPERATIONAL TECHNOLOGY MARKET FOR WMS, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

6.3.7 FUNCTIONAL SAFETY

6.3.7.1 Growing adoption of functional safety systems in different industries to boost market growth

TABLE 83 MARKET FOR FUNCTIONAL SAFETY, BY REGION, 2018–2021 (USD MILLION)

TABLE 84 MARKET FOR FUNCTIONAL SAFETY, BY REGION, 2022–2027 (USD MILLION)

TABLE 85 MARKET FOR FUNCTIONAL SAFETY, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 86 MARKET FOR FUNCTIONAL SAFETY, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

6.4 SERVICES

6.4.1 PREDICTIVE MAINTENANCE SERVICES

6.4.1.1 Increasing adoption of predictive maintenance services to reduce risk and failure of machine

6.4.1.2 Professional services

6.4.1.3 Managed services

6.4.2 OTHERS

6.4.2.1 OEM services

6.4.2.2 Remote diagnostics and maintenance services

7 OPERATIONAL TECHNOLOGY MARKET, BY NETWORKING TECHNOLOGY (Page No. - 141)

7.1 INTRODUCTION

FIGURE 41 MARKET, BY NETWORKING TECHNOLOGY

7.2 WIRED NETWORKING TECHNOLOGY

7.2.1 PROFIBUS

7.2.1.1 PROFIBUS links automation systems and controllers with decentralized field devices

7.2.2 MODBUS

7.2.2.1 Modbus can run over almost all communication media such as wired media, wireless media, optical networks, and others

7.2.3 PROFINET

7.2.3.1 PROFINET supplements existing PROFIBUS technologies by providing faster data communication

7.2.4 ETHERNET/IP

7.2.4.1 Ethernet/IP is among leading industrial protocols and is widely used in hybrid and process industries

7.2.5 OTHERS

7.3 WIRELESS NETWORKING TECHNOLOGY

7.3.1 WLAN

7.3.1.1 WLAN provides wide area coverage and faster communication

7.3.2 ISA100.11A

7.3.2.1 ISA 100 operates in 2.4 MHz frequency range and can support up to 15 channels

7.3.3 CELLULAR

7.3.3.1 Cellular networks can be ideal for IIoT applications that require operations over long distances

7.3.4 ZIGBEE

7.3.4.1 ZIGBEE offers easy network expansion, low power consumption, good coverage area, and reliable network structure

7.3.5 WHART

7.3.5.1 WHART is open industry standard specifically designed for particular requirements of wireless networking technology

7.3.6 OTHERS

8 OPERATIONAL TECHNOLOGY MARKET, BY INDUSTRY (Page No. - 147)

8.1 INTRODUCTION

FIGURE 42 GLOBAL OPERATIONAL TECHNOLOGY MARKET, BY INDUSTRY

TABLE 87 MARKET, BY INDUSTRY, 2018–2021 (USD MILLION)

TABLE 88 MARKET, BY INDUSTRY, 2022–2027 (USD MILLION)

8.2 PROCESS INDUSTRY

FIGURE 43 MARKET FOR ENERGY & POWER INDUSTRY TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 89 MARKET, BY PROCESS INDUSTRY, 2018–2021 (USD MILLION)

TABLE 90 MARKET, BY PROCESS INDUSTRY, 2022–2027 (USD MILLION)

8.2.1 OIL & GAS

8.2.1.1 Opportunity to increase process efficiency and gain competitive edge is driving market in oil & gas industry

8.2.2 CHEMICALS

8.2.2.1 Control systems provide operational solutions to chemicals industry

8.2.3 PHARMACEUTICALS

8.2.3.1 Automated machine solutions are required for smooth functioning of pharmaceuticals industry

8.2.4 METALS & MINING

8.2.4.1 Growing adoption of MES to integrate workflow of mining operations to fuel market growth

8.2.5 FOOD & BEVERAGES

8.2.5.1 Operational technologies used in food & beverages industry offer flexibility, safety solutions, and software tools to control operations of machines

8.2.6 ENERGY & POWER

8.2.6.1 Fastest growing process industry for operational technology market

8.2.7 PULP & PAPER

8.2.7.1 Growing digitalization in paper industry to increase implementation of operational process

8.2.8 OTHERS

8.3 DISCRETE INDUSTRY

FIGURE 44 MACHINE MANUFACTURING TO HOLD LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

TABLE 91 MARKET, BY DISCRETE INDUSTRY, 2018–2021 (USD MILLION)

TABLE 92 MARKET, BY DISCRETE INDUSTRY, 2022–2027 (USD MILLION)

8.3.1 AUTOMOTIVE

8.3.1.1 Adoption of PLM systems and technological innovations in automotive industry drive operational technology market growth

8.3.2 AEROSPACE & DEFENSE

8.3.2.1 Demand for MES system solutions in aerospace & defense industry to drive market

8.3.3 SEMICONDUCTOR & ELECTRONICS

8.3.3.1 Technological advancements and adoption of control systems in semiconductor & electronics industry to drive demand for operational technologies

8.3.4 MEDICAL DEVICES

8.3.4.1 Increasing demand for control systems for higher efficiency in medical devices industry

8.3.5 MACHINE MANUFACTURING

8.3.5.1 Surging demand for predictive maintenance to propel operational technology market growth for machine manufacturing

8.3.6 OTHERS

9 GEOGRAPHIC ANALYSIS (Page No. - 163)

9.1 INTRODUCTION

FIGURE 45 GEOGRAPHIC SNAPSHOT: OPERATIONAL TECHNOLOGY MARKET

FIGURE 46 APAC TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

TABLE 93 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 94 MARKET, BY REGION, 2022–2027 (USD MILLION)

9.2 NORTH AMERICA

9.2.1 IMPACT OF COVID-19 ON OPERATIONAL TECHNOLOGY MARKET IN NORTH AMERICA

FIGURE 47 SNAPSHOT: MARKET IN NORTH AMERICA

FIGURE 48 US TO ACCOUNT FOR LARGEST SHARE OF MARKET IN NORTH AMERICA IN 2027

TABLE 95 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 96 MARKET IN NORTH AMERICA, BY COUNTRY, 2022–2027 (USD MILLION)

9.2.2 US

9.2.2.1 Increasing adoption of control system solutions by leading industrial players and startups to drive market growth

9.2.3 CANADA

9.2.3.1 Growth of process and discrete industries to contribute to operational technology market growth in Canada

9.2.4 MEXICO

9.2.4.1 Rapidly developing aerospace industry to create lucrative growth opportunities for market in Mexico

9.3 EUROPE

9.3.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

FIGURE 49 SNAPSHOT: MARKET IN EUROPE

FIGURE 50 GERMANY TO ACCOUNT FOR LARGEST SHARE OF OPERATIONAL TECHNOLOGY MARKET IN EUROPE IN 2027

TABLE 97 MARKET IN EUROPE, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 98 MARKET IN EUROPE, BY COUNTRY, 2022–2027 (USD MILLION)

9.3.2 UK

9.3.2.1 Need to improve safety and quality of operations to boost demand for control systems in UK

9.3.3 GERMANY

9.3.3.1 Chemicals and pharmaceuticals industries will drive market growth in Germany

9.3.4 FRANCE

9.3.4.1 Medical devices industry to favor growth of market in France

9.3.5 REST OF EUROPE

9.4 APAC

9.4.1 IMPACT OF COVID-19 ON OPERATIONAL TECHNOLOGY MARKET IN APAC

FIGURE 51 SNAPSHOT: MARKET IN ASIA PACIFIC

FIGURE 52 CHINA TO ACCOUNT FOR LARGEST SHARE OF MARKET IN APAC IN 2027

TABLE 99 MARKET IN APAC, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 100 MARKET IN APAC, BY COUNTRY, 2022–2027 (USD MILLION)

9.4.2 CHINA

9.4.2.1 Increasing government initiatives for development of automotive industry to drive market in China

9.4.3 JAPAN

9.4.3.1 Semiconductor & electronics industries would create growth opportunities for market in Japan

9.4.4 INDIA

9.4.4.1 Make in India initiative to support growth of market

9.4.5 REST OF APAC

9.5 ROW

9.5.1 IMPACT OF COVID-19 ON OPERATIONAL TECHNOLOGY MARKET IN ROW

FIGURE 53 MIDDLE EAST TO ACCOUNT FOR LARGEST SHARE OF MARKET IN ROW IN 2027

TABLE 101 MARKET IN ROW, BY REGION, 2018–2021 (USD MILLION)

TABLE 102 MARKET IN ROW, BY REGION, 2022–2027 (USD MILLION)

9.5.2 SOUTH AMERICA

9.5.2.1 Rising adoption of IoT technologies in different industries to drive growth of operation technology market

9.5.3 MIDDLE EAST & AFRICA

9.5.3.1 Rising adoption of advanced operational technologies in oil & gas and mining industries to propel market growth

10 COMPETITIVE LANDSCAPE (Page No. - 186)

10.1 INTRODUCTION

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

TABLE 103 OVERVIEW OF STRATEGIES DEPLOYED BY KEY PLAYERS IN OPERATIONAL TECHNOLOGY MARKET

10.3 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 54 TOP 5 PLAYERS IN MARKET, 2016–2020

10.4 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2020-2021

TABLE 104 GLOBAL SCADA MARKET: MARKET SHARE ANALYSIS

10.5 COMPETITIVE EVALUATION QUADRANT, 2020

10.5.1 STAR

10.5.2 EMERGING LEADER

10.5.3 PERVASIVE

10.5.4 PARTICIPANT

FIGURE 55 SCADA MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

10.6 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION QUADRANT, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 56 SCADA MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

10.6.5 OPERATIONAL TECHNOLOGY MARKET: COMPANY FOOTPRINT

TABLE 105 COMPANY COMPONENT FOOTPRINT

TABLE 106 COMPANY INDUSTRY FOOTPRINT

TABLE 107 COMPANY REGION FOOTPRINT

TABLE 108 COMPANY FOOTPRINT

10.6.6 MARKET: STARTUP MATRIX

TABLE 109 OPERATIONAL TECHNOLOGY MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 110 MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

10.7 COMPETITIVE SITUATIONS AND TRENDS

10.7.1 PRODUCT LAUNCHES

TABLE 111 MARKET: PRODUCT LAUNCHES

10.7.2 DEALS

10.7.2.1 Operational technology market: Deals

11 COMPANY PROFILES (Page No. - 212)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 ABB

TABLE 112 ABB: BUSINESS OVERVIEW

FIGURE 57 ABB: COMPANY SNAPSHOT

TABLE 113 ABB: PRODUCT OFFERINGS

11.1.2 SIEMENS

TABLE 114 SIEMENS: BUSINESS OVERVIEW

FIGURE 58 SIEMENS: COMPANY SNAPSHOT

TABLE 115 SIEMENS: PRODUCT OFFERINGS

11.1.3 HONEYWELL INTERNATIONAL INC

TABLE 116 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 59 HONEYWELL: COMPANY SNAPSHOT

TABLE 117 HONEYWELL INTERNATIONAL INC.: PRODUCT OFFERINGS

11.1.4 GENERAL ELECTRIC

TABLE 118 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 60 GENERAL ELECTRIC: COMPANY SNAPSHOT

TABLE 119 GENERAL ELECTRIC: PRODUCT OFFERINGS

11.1.5 SCHNEIDER ELECTRIC

TABLE 120 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 61 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 121 SCHNEIDER ELECTRIC: PRODUCT OFFERINGS

11.1.6 ROCKWELL AUTOMATION INC

TABLE 122 ROCKWELL AUTOMATION INC: BUSINESS OVERVIEW

FIGURE 62 ROCKWELL AUTOMATION INC.: COMPANY SNAPSHOT

TABLE 123 ROCKWELL AUTOMATION INC: PRODUCT OFFERINGS

11.1.7 EMERSON ELECTRIC CO.

TABLE 124 EMERSON ELECTRIC CO.: BUSINESS OVERVIEW

FIGURE 63 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

TABLE 125 EMERSON ELECTRIC CO.: PRODUCT OFFERINGS

TABLE 126 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.8 ORACLE

TABLE 127 ORACLE: BUSINESS OVERVIEW

FIGURE 64 ORACLE: COMPANY SNAPSHOT

TABLE 128 ORACLE: PRODUCT OFFERINGS

11.1.9 IBM

TABLE 129 IBM: BUSINESS OVERVIEW

FIGURE 65 IBM: COMPANY SNAPSHOT

TABLE 130 IBM: PRODUCT OFFERINGS

11.1.10 YOKOGAWA ELECTRIC CORPORATION

TABLE 131 YOKOGAWA ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 66 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 132 YOKOGAWA ELECTRIC CORPORATION: PRODUCT OFFERINGS

TABLE 133 YOKOGAWA ELECTRIC CORPORATION: PRODUCT LAUNCHES AND DEVELOPMENTS

11.1.11 FUJI ELECTRIC CO., LTD.

TABLE 134 FUJI ELECTRIC CO., LTD.: BUSINESS OVERVIEW

FIGURE 67 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT

TABLE 135 FUJI ELECTRIC CO., LTD.: PRODUCT OFFERINGS

11.1.12 MITSUBISHI ELECTRIC CORPORATION

TABLE 136 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 68 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

TABLE 137 MITSUBISHI ELECTRIC CORPORATION: PRODUCT OFFERINGS

11.1.13 OMRON CORPORATION

TABLE 138 OMRON CORPORATION: BUSINESS OVERVIEW

FIGURE 69 OMRON CORPORATION: COMPANY SNAPSHOT

TABLE 139 OMRON CORPORATION: PRODUCT OFFERINGS

11.1.14 HITACHI, LTD.

TABLE 140 HITACHI, LTD.: BUSINESS OVERVIEW

FIGURE 70 HITACHI, LTD.: COMPANY SNAPSHOT

TABLE 141 HITACHI, LTD.: PRODUCT OFFERINGS

11.1.15 HOLLYSYS

TABLE 142 HOLLYSYS: BUSINESS OVERVIEW

FIGURE 71 HOLLYSYS: COMPANY SNAPSHOT

TABLE 143 HOLLYSYS: PRODUCT OFFERINGS

11.2 OTHER KEY PLAYERS

11.2.1 KROHNE MESSTECHNIK GMBH

11.2.2 GRAYMATTER

11.2.3 WUNDERLICH-MALEC ENGINEERING, INC.

11.2.4 SCADAFENCE LTD.

11.2.5 SAP SE

11.2.6 TESCO CONTROLS, INC.

11.2.7 ADVANTECH CO., LTD.

11.2.8 NEC CORPORATION

11.2.9 AZBIL CORPORATION

11.2.10 ENDRESS+HAUSER GROUP SERVICES AG

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 ADJACENT & RELATED MARKETS (Page No. - 286)

12.1 INTRODUCTION

12.2 LIMITATIONS

12.3 DIGITAL TWIN MARKET

12.4 DIGITAL TWIN MARKET, BY APPLICATION

12.4.1 INTRODUCTION

TABLE 144 DIGITAL TWIN MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 145 DIGITAL TWIN MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

12.4.2 PRODUCT DESIGN & DEVELOPMENT

12.4.2.1 Product design & development segment to register steady growth in digital twin market

TABLE 146 DIGITAL TWIN MARKET FOR PRODUCT DESIGN & DEVELOPMENT, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 147 DIGITAL TWIN MARKET FOR PRODUCT DESIGN & DEVELOPMENT, BY INDUSTRY, 2020–2026 (USD MILLION)

12.4.3 PERFORMANCE MONITORING

12.4.3.1 Performance management plays a vital role in digital twin market

TABLE 148 DIGITAL TWIN MARKET, FOR PERFORMANCE MONITORING, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 149 DIGITAL TWIN MARKET FOR PERFORMANCE MONITORING, BY INDUSTRY, 2020–2026 (USD MILLION)

12.4.4 PREDICTIVE MAINTENANCE

12.4.4.1 Predictive maintenance segment to witness healthy growth in market

TABLE 150 DIGITAL TWIN MARKET FOR PREDICTIVE MAINTENANCE, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 151 DIGITAL TWIN MARKET FOR PREDICTIVE MAINTENANCE, BY INDUSTRY, 2020–2026 (USD MILLION)

12.4.5 INVENTORY MANAGEMENT

12.4.5.1 Inventory management will play a major role in transportation & logistics industry for digital twin solutions

TABLE 152 DIGITAL TWIN MARKET FOR INVENTORY MANAGEMENT, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 153 DIGITAL TWIN MARKET FOR INVENTORY MANAGEMENT, BY INDUSTRY, 2020–2026 (USD MILLION)

12.4.6 BUSINESS OPTIMIZATION

12.4.6.1 Business optimization segment to dominate digital twin market during forecast period

TABLE 154 DIGITAL TWIN MARKET FOR BUSINESS OPTIMIZATION, BY INDUSTRY, 2016–2019 (USD MILLION)

TABLE 155 DIGITAL TWIN MARKET FOR BUSINESS OPTIMIZATION, BY INDUSTRY, 2020–2026 (USD MILLION)

12.4.7 OTHERS

TABLE 156 DIGITAL TWIN MARKET FOR OTHERS, BY INDUSTRY 2016–2019 (USD MILLION)

TABLE 157 DIGITAL TWIN MARKET FOR OTHERS, BY INDUSTRY 2020–2026 (USD MILLION)

13 APPENDIX (Page No. - 296)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the operational technology market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. Two sources of information—secondary and primary—have been used to identify and collect information for an extensive technical and commercial study of the operational technology market.

Secondary Research

Secondary sources include company websites, magazines, industry news, associations, and databases (Factiva and Bloomberg). These secondary sources include annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

The impact and implication of COVID-19 on various industries, as well as smart technologies, have also been discussed in this section. Various secondary sources include corporate filings such as annual reports, investor presentations, and financial statements, trade, business and professional associations, white papers, manufacturing associations, and more.

Primary Research

Primary sources mainly consist of several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, technology developers, alliances, standards, and certification organizations related to various segments of this industry’s value chain.

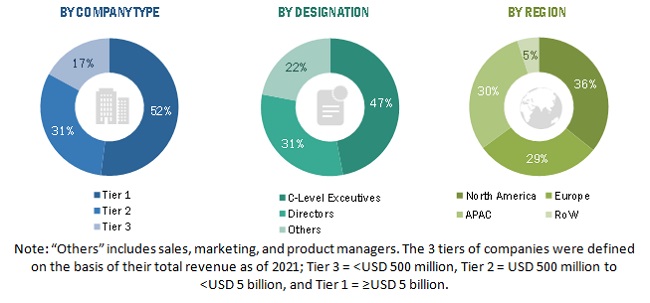

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply-side included various industry experts (with a key focus on the impact of COVID-19), such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from operational technology solutions and components manufacturers, such as ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell Automation (US), Honeywell International Inc. (US), Emerson Electric Co. (US), IBM (US), and General Electric (US); research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Following is the breakdown of primary respondents

The breakdown of primary respondents is provided below.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the operational technology market. These methods have also been used extensively to estimate the size of various subsegments in the market. The following research methodology has been used to estimate the market size:

- Major players in the industry and markets have been identified through extensive secondary research.

- The industry’s value chain and market size (in terms of value) have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global operational technology market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the operational technology market, in terms of information technology, enabling technology, and industry.

- To describe and forecast the market, in terms of value, with regard to four main regions: Asia Pacific (APAC), Europe, North America, and Rest of the World (RoW) along with their respective countries

- To provide detailed information regarding major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To provide a detailed overview of the value chain of operational technology solutions and components

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the operational technology market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the operational technology market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for market leaders.

- To analyze competitive strategies, such as product launches, expansions, and acquisitions, adopted by key market players in the operational technology market

Available Customizations:

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Operational Technology Market