Leak Detection Market for Oil & Gas by Technology (Acoustic, E-RTTM, Fiber Optic, Mass/Volume Balance, Laser Absorption and LiDAR, Thermal Imaging), Medium (Oil and Condensate, Natural Gas), and Region - Global Forecast to 2025

Leak Detection Market for Oil & Gas Size & Growth

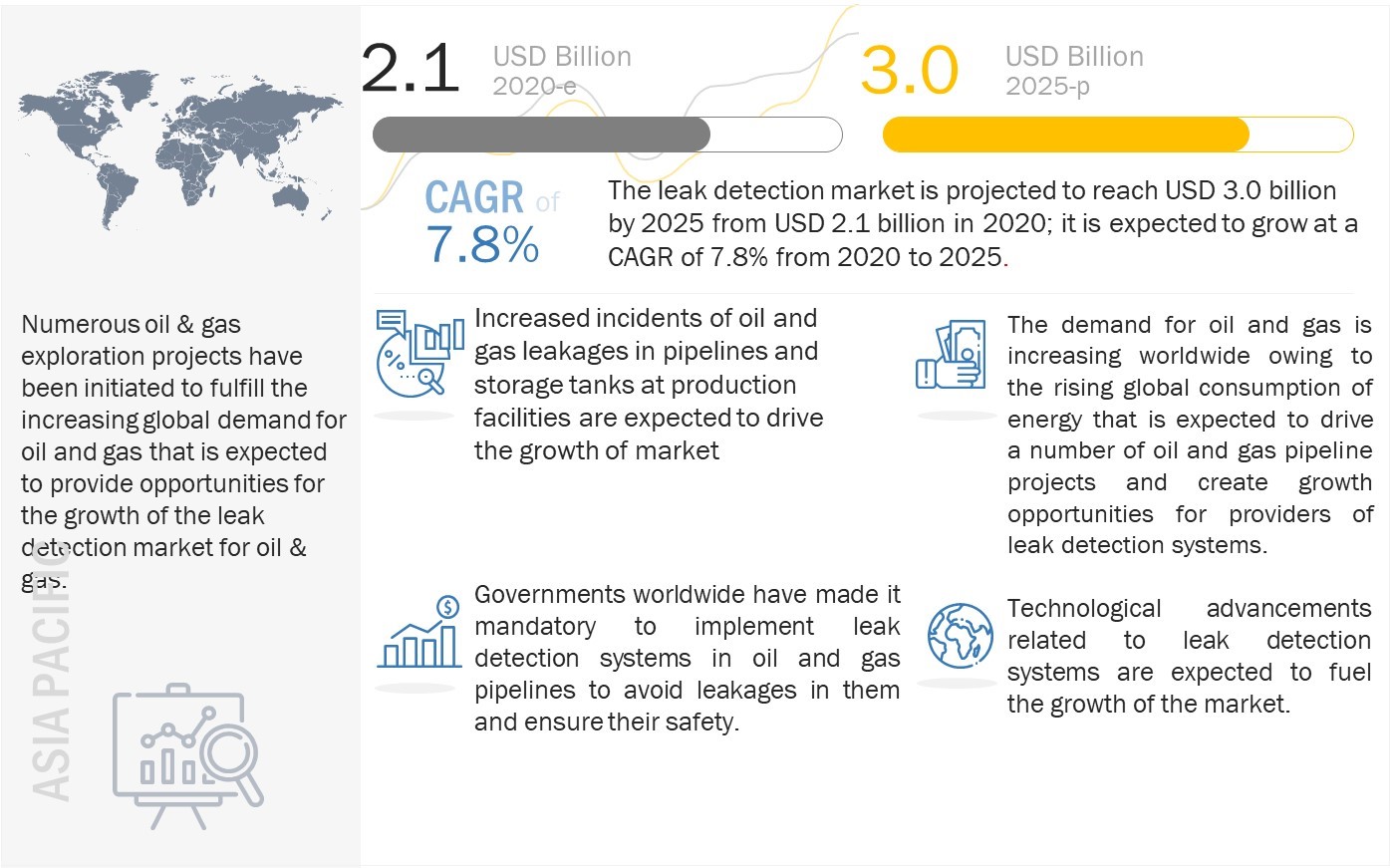

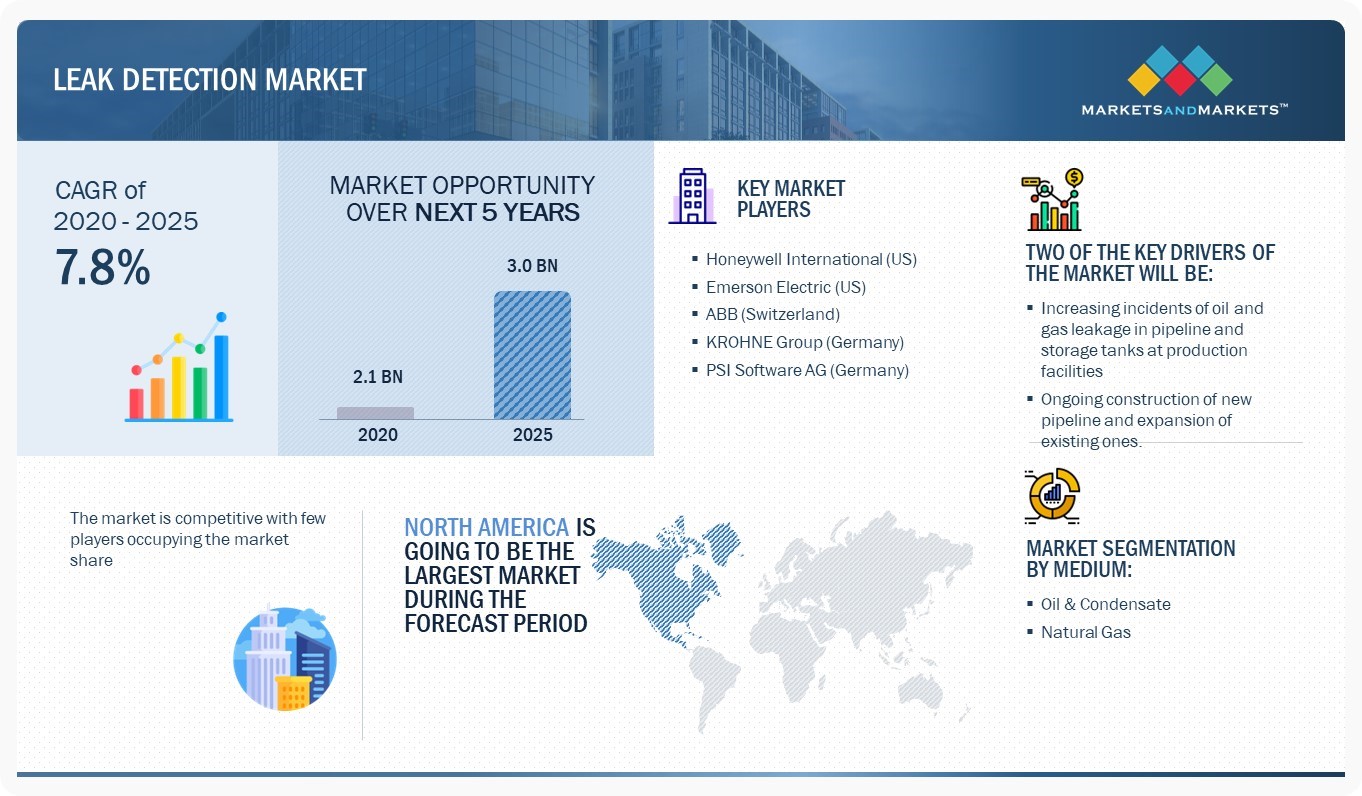

The leak detection market is projected to grow from USD 2.1 billion in 2020 to USD 3.0 Billion by 2025, growing at a CAGR of 7.8% during the forecast period from 2020 to 2025.

The Leak Detection Market for Oil & Gas is experiencing significant growth, driven by increasing demand for safety and environmental compliance in the industry. Key trends include the adoption of advanced technologies such as fiber optic sensors, ultrasonic detection, and remote monitoring systems that enhance leak identification and response times. As companies face stricter regulations and rising public awareness regarding environmental impacts, investments in leak detection solutions are becoming crucial. This growing focus on operational efficiency and sustainability positions the market for further expansion in the coming years.

The increasing global oil and natural gas consumption and ongoing technological advancements in leak detection systems create significant opportunities for the leak detection market for oil & gas.

Impact of AI in Leak Detection Market for Oil & Gas

The impact of artificial intelligence (AI) in the leak detection market for the oil and gas industry is transformative, enabling more accurate, efficient, and proactive detection of leaks in pipelines and storage systems. AI-powered systems can analyze real-time data from sensors, drones, and satellite imagery to identify potential leaks, predict their location, and assess the severity, allowing for faster response times and minimizing environmental and financial risks. Machine learning algorithms enhance the system's ability to detect even the smallest leaks, reducing false positives and ensuring more reliable monitoring. As a result, AI-driven leak detection solutions are significantly improving safety, compliance, and operational efficiency, driving growth and innovation in the oil and gas sector.

Leak Detection Market Forecast to 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Retrofitting complications related to some leak detection systems are expected to restrain the market's growth. Moreover, the lack of efficient leak detection systems that provide information related to different parameters of leakages and the decrease in global oil prices are expected to be prime challenges for the market players.

Oil is physically traded in different grades. The most popular traded grades are Brent North Sea Crude (commonly known as Brent crude) and West Texas Intermediate (widely known as WTI). A decrease in oil prices has significantly affected the global oil and gas industry. It also affected the financial position of leading oil and gas companies and caused delays in upcoming and ongoing projects.

Leak Detection Market for Oil & Gas Trends and Dynamics:

Driver: Ongoing construction of new pipelines and expansion of existing ones

Several projects on the oil and gas pipelines have been undertaken globally, and many projects are being planned owing to the increasing oil and gas consumption worldwide. Thus, operators worldwide are expanding their existing pipeline networks and constructing new pipelines to meet the growing demand for natural gas and oil.

Restraint: Retrofitting complications related to some leak detection systems

Retrofitting fiber-optic leak detection systems in existing pipelines is difficult and expensive. Multiple interrogator units are required for lengthy pipelines (>50km). This increases the installation costs of sensors and interrogator systems. Fiber-optic leak detection systems cannot detect and estimate the size of multiphase flow leakages if only gas escapes from them. Moreover, implementing fiber-optic leak detection systems along the subsea arctic pipelines is challenging. Deploying DTS systems close to cables in the existing subsea arctic pipelines can be tedious. The installation of interrogator units and repairs of cables in these subsea pipelines are also challenging. These factors limit the growth of the leak detection market for oil and gas to some extent.

Opportunity:Increasing global oil & natural gas consumption

The demand for oil and gas is increasing worldwide due to rising global energy consumption. The leading countries, in terms of oil consumption, include the US, China, Japan, India, Russia, Saudi Arabia, and Brazil. In contrast, the leading countries in the consumption of natural gas include the US, Russia, China, Iran, Japan, Saudi Arabia, Canada, Mexico, Germany, the UAE, and the UK. Operators worldwide are expanding their existing pipelines and constructing new pipelines to meet the growing demand for oil and gas. These operators must comply with regulatory standards to ensure the safety of people working at production sites or staying nearby.

The oil and gas companies must follow government regulations, considering the environmental concerns pertaining to oil and gas production, exploration, and transportation. These standards have also influenced companies providing leak detection systems to design and develop comprehensive and innovative solutions for the oil and gas industry.

Challenge: Lack of technological developments in offshore leak detection systems

A dependable leak detection system is essential to promptly identify leakage in a pipeline to shut down the line, isolate the leakage, initiate response actions, reduce the volume of the spill, and mitigate the safety, environmental, and economic issues caused by the leak.

The preferred subsea leak detection systems are required to carry out continuous operations and rapid detection of leakages. They should be cost-effective, independent of the flow conditions, and constructible and installable. These leak detection systems should generate minimal false alarms, cover pipelines for a length >15 miles without intermediate power requirements, and operate in arctic conditions.

Leak Detection Market for Oil & Gas Segment Insights:

Based on Medium, the Natural gas segment is estimated to account for the largest share of the market during the forecast period.

Increased natural gas exploration, production, and consumption to fuel leak detection market growth. There has been a significant increase in natural gas consumption in recent years. The presence of abundant natural gas resources and its increased production make it a competitive energy resource.

Natural gas remains a key fuel for power generation and industrial use. Natural gas is a preferred choice in the electric power generation sector due to its fuel efficiency. As governments of different countries are implementing national or regional plans to reduce carbon dioxide emissions, they are expected to encourage the use of natural gas more than carbon-intensive coal and liquid fuels. Therefore, the reliability and security of gas transportation infrastructures are of high priority in the energy sector.

Based on Technology, E-RTTM technology is to grow at the highest CAGR of the leak detection market for oil & gas.

E-RTTM refers to an extended real-time transient model. It is used for detecting leakages and identifying their location. The advantages of E-RTTM technology-based leak detection systems over systems based on other technologies are that these systems can detect small leakages, identify the size of the leakages accurately, and model all dynamic fluid characteristics (flow, pressure, and temperature). These systems consider the extensive configuration of physical pipeline characteristics (length, diameter, thickness, etc.) and product characteristics (density, viscosity, etc.). Hence, they provide highly accurate results regarding leak locations in less time.

An onshore segment to hold the largest market size of leak detection market for oil & gas during the forecast period

The onshore segment is projected to lead the market for oil & gas from 2020 to 2025. Leakages are extremely harmful to the environment and cause huge financial losses to onshore oil and gas production companies. Therefore, installing efficient and reliable leak detection technologies and systems in onshore facilities has become a mandate. Moreover, the increasing number of oil and gas onshore projects across the world is also responsible for the rising demand for leak detection technologies and systems.

Leak Detection Industry for Oil & Gas Regional Analysis

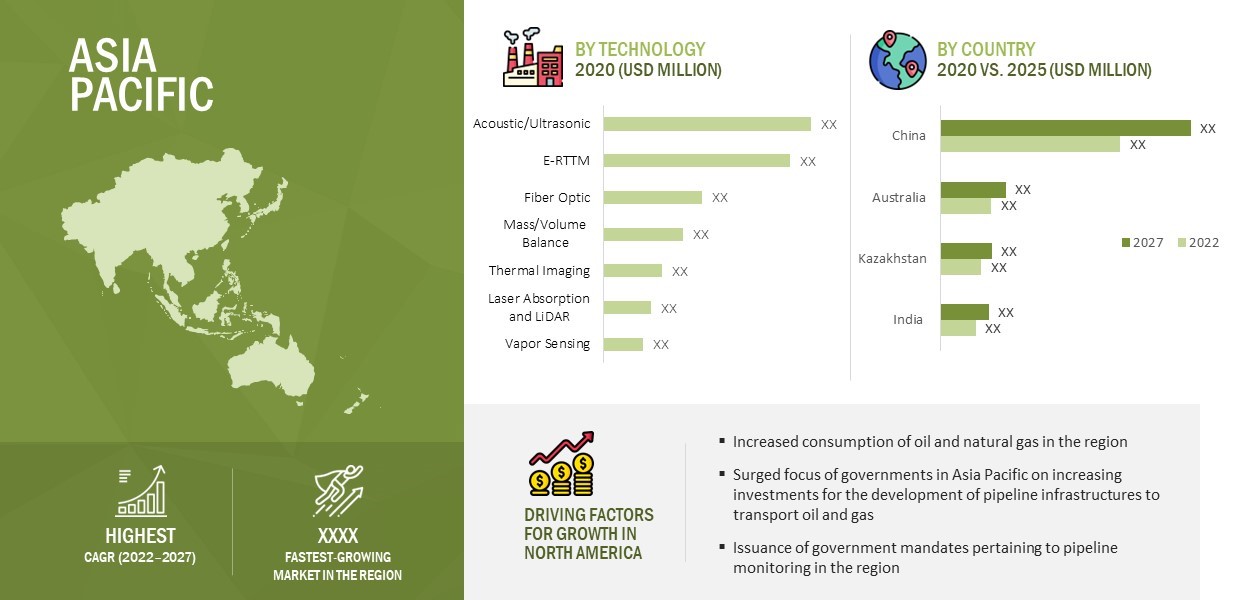

The leak detection market for oil & gas in the Asia Pacific is to grow at the highest CAGR from 2020 to 2025

The market's growth in Asia Pacific can be attributed to the increased global demand for natural gas. In China alone, the production of oil and gas increased as the country is developing and expanding its pipeline infrastructures and attracting investments pertaining to natural gas production projects. Therefore, the demand for leak detection technologies and systems is increasing in China as the production and consumption of natural gas are increasing in this country. The rising number of oil and gas exploration and production projects, along with the expansion of oil and gas pipelines, drive the growth of the market for oil & gas.

Leak Detection Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Leak Detection Market for Oil & Gas Companies - Key Market Players

Some of the Major players in the leak detection market for oil & gas are Honeywell International (US), Emerson Electric (US), ABB (Switzerland), KROHNE Group (Germany), and PSI Software (Germany). These players have adopted various growth strategies such as contracts, joint ventures, partnerships & agreements, acquisitions, and new product launches to expand their presence in the market.

Honeywell International - Honeywell offers efficient products and solutions for businesses, specialty chemicals, electronic and advanced materials, process technology for refining and petrochemicals, and productivity, sensing, safety, and security technologies for buildings and industries. It focuses on emerging technological trends and R&D to maximize growth. It has extensive offerings, ranging from integrated control and safety systems, SCADA and RTU platforms, security and telecommunications, and advanced software to a complete family of standalone pressure regulators, flow control valves, and metering and safety devices. Honeywell’s core offering in the leak detection market for oil & gas is the Experion Process Knowledge System (PKS). This includes a world-class SCADA system that drives critical information to the end user’s pipeline operations team while automating data logging and processing. This provides multiple benefits, including reduced project risk and operational complexity; lower maintenance and operating costs; increased operator effectiveness; and safer, more secure operations.

Emerson Electric - Emerson offers pipeline integrity & leak detection solutions for the oil and gas industry. Emerson’s pipeline management solutions help users safely detect, control, and manage leaks and other critical events to ensure pipelines' continued and efficient operation. Emerson offers cutting edge technologies to provide accurate flow rate measurement and optimized computational pipeline monitoring to ensure pipeline reliability and maximize return on leak detection investment. The company offers PipelineManager, one of the leading solutions for real-time pipeline monitoring for liquids and gas pipelines. The PipelineManager offers multiple leak detection technologies to find anything from pinhole leaks to ruptures. It also provides an offline tool that documents the actual performance of the leak detection system in terms of reliability, sensitivity, and accuracy for all flowing conditions. The company follows the strategies of mergers and acquisitions. Emerson also provides solutions that support a global shift to cleaner energy sources.

Leak Detection Market for Oil & Gas Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 2.1 Billion in 2020 |

| Market size value in 2025 | USD 3.0 Billion by 2025 |

| Growth rate | CAGR of 7.8% |

|

Market size available for years |

2017-2025 |

|

On Demand Data Available |

2030 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Technology, By Medium, By Location |

|

Geographies covered |

North America, Europe, APAC, South and Central America, Middle East, and Africa |

|

Companies covered |

The major market players Honeywell International Inc. (US), Emerson Electric Co. (US), ABB (Switzerland), KROHNE Group (Germany), PSI Software AG (Germany), Atmos (UK), AVEVA (UK), FLIR Systems Inc. (US), HIMA (Germany), and Yokogawa Electric Corporation (Japan) (Total 20 players are profiled) |

The study categorizes the leak detection market for oil & gas based on technology, medium and location at the regional and global level.

Leak detection market for oil & gas , By Technology

- Acoustic/Ultrasonic

- E-RTTM

- Fiber Optic

- Mass/Volume Balance

- Thermal Imaging

- Laser Absorption and LiDAR

- Vapor Sensing

Leak detection market for oil & gas , By Medium

- Oil and condensate

- Natural gas

Market for oil & gas , By Location

- Onshore

- Offshore

Leak detection market for oil & gas , By Region

- North America

- Europe

- APAC

- South and Central America

- Middle East

- Africa

Leak Detection Market for Oil & Gas Highlights:

What is new?

- Major developments that can change the business landscape as well as market forecasts

There is various development related to product launch, partnerships, contracts, and acquisitions from the leak detection ecosystem. For instance, in October 2020, Emerson was awarded a USD 14 million contract by BP to provide automation technologies for the new Azeri Central East offshore platform in the Caspian Sea, the latest development in the Azeri-Chirag-Deepwater Gunashli oilfield. Emerson will serve as the main automation contractor and apply its Project Certainty methodologies and digital technologies that transform capital project execution to help BP bring this fast-track project onstream in 2023.

On the other hand, the leak detection market for oil & gas players also focuses on their organic growth strategies, such as product launches. ABB introduced the first comprehensive gas leak detection solution for utilities to help safeguard city populations. The new ABB MicroGuard solution will work alongside ABB’s MobileGuard to pinpoint dangerous gas leaks. Faster and easier detection with this patented laser-based technology will help reduce fatalities, environmental damage, and material loss.

- Addition/refinement in segmentation–Increase in depth or width of segmentation of the market

Leak detection market for oil & gas, by medium

- Oil and Condensate

- Natural Gas

Leak detection market for oil & gas, by location

- Onshore

- Offshore

Different process stages for oil and gas leak detection

- Upstream

- Midstream

- Downstream

- Coverage of new market players and change in the market share of existing players in the leak detection market

Company profiles: Company profiles give a glimpse of the key players in the market with respect tobusiness overview, financials, product offerings, and recent developments. In the new edition of the report, many new companies are profiled in company profile chapters, and a total of 25 companies are profiled. The companies have been profiled as they have appeared as key and emerging players in recent years due to various strategic investments, partnerships, and product launches. These strategic developments have challenged the status quo of other industry players, and it was prudent to analyze the changing business landscape. The new research study includes an analysis of the top 5 players in the market for oil & gas.

- Updated financial information and product portfolios of players operating in the leak detection market

Newer and improved representation of financial information: The new edition of the report provides updated financial information in the context of the Leak detection market for oil & gas till 2021 for each listed company in the graphical representation in a single diagram (instead of multiple tables). This would help to easily analyze the present status of profiled companies in terms of their financial strength, profitability, key revenue generating region/country, business segment focus in terms of the highest revenue generating segment, and investment in research and development activities.

- Updated market developments of the profiled players

Recent Developments: Recent developments help us know the market trend and growth strategies players adopt. These developments, such as product launches, acquisitions, partnerships, and collaborations, have been updated to recent ones.

- Any new data points/analysis (frameworks) which was not present in the previous version of the report

The competitive leadership mapping includes information on the top 25 players involved in manufacturing leak detection solutions and maps them on how well each vendor performs in the market. The competitive leadership mapping methodology involves extensive research to identify the key vendors offering technologically advanced leak detection solutions in the leak detection market for oil & gas. A comprehensive list of leak detection solution providers was prepared through secondary research referring to annual reports, press releases, and investor presentations of companies, white papers, directories, and databases. Also, Historic Revenue Analysis and Startup Evaluation Matrix are provided for leak detection players.

The new edition of the report consists of trends/disruptions in customer business, tariff & regulatory landscape, pricing analysis, and a market ecosystem map to better understand the market dynamics for leak detection.

Recent Developments in Leak Detection Industry for Oil & Gas

- In October 2020, ABB introduced the first comprehensive gas leak detection solution for utilities to help safeguard city populations. The new ABB MicroGuard solution will work alongside ABB’s MobileGuard to pinpoint dangerous gas leaks. Faster and easier detection with this patented laser-based technology will help reduce fatalities, environmental damage, and material loss.

- In June 2020, Atmos created a unique regulation program compliance service for its customers. The service will provide dedicated support for customers wishing to achieve full API 1130 compliance in leak detection systems.

- In January 2020, Emerson introduced the Plantweb Insight Inline Corrosion Application suite to provide the oil and gas industry with real-time interpretation and analysis of critical data that helps prioritize maintenance and make informed integrity decisions.

Frequently Asked Questions (FAQs):

What is the current size of the Leak Detection market for oil & gas?

The leak detection market for oil & gas is estimated to be USD 2.1 Billion in 2020 and is projected to reach USD 3.0 billion by 2025; it is expected to grow at a CAGR of 7.8% from 2020 to 2025.

Who are the winners in the leak detection market for oil & gas?

Honeywell International (US), Emerson Electric (US), ABB (Switzerland), KROHNE Group (Germany), and PSI Software (Germany)

What are some of the technological advancements in the market?

One of the emerging technologies used in the leak detection market for oil & gas is an airborne leak detection system. An airborne LiDAR pipeline inspection service (ALPIS) is a revolutionary method to find leakages in natural gas transferring and gathering lines. Methane is the main component of natural gas. When released into the atmosphere, its climate impact is 25 times greater than carbon dioxide. Thus, pipeline directives have been formulated to prevent gas leakages and the resulting harmful impact on human lives and the environment. These directives instruct regular inspections of natural gas pipelines using helicopters. Companies are also testing new leak detection technologies across different oil and gas projects for optimum outcome <

What are the factors driving the growth of the leak detection market for oil and gas?

Increasing incidents of oil and gas leakages in pipelines and storage tanks at production facilities, ongoing construction of new pipelines and expansion of existing ones, and evolving government regulations pertaining to the implementation of leak detection systems are the key factors driving the growth of the leak detection market for oil & gas. Rising oil and gas exploration and production activities worldwide, increasing global oil and natural gas consumption, and ongoing technological advancements in leak detection systems are projected to create lucrative opportunities for the players operating in the leak detection market for oil & gas during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 GEOGRAPHIC SCOPE

1.4 INCLUSIONS AND EXCLUSIONS

1.5 YEARS CONSIDERED

1.6 CURRENCY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 LEAK DETECTION MARKET FOR OIL & GAS: PROCESS FLOW OF MARKET SIZE ESTIMATION

FIGURE 2 MARKET FOR OIL & GAS: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primaries

2.1.2.3 Key data from primary sources

2.2 MARKET SIZE ESTIMATION

FIGURE 3 LEAK DETECTION MARKET FOR OIL & GAS SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE) – IDENTIFICATION OF REVENUES GENERATED BY COMPANIES FROM LEAK DETECTION SYSTEM OFFERINGS

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size using bottom-up analysis (demand side)

FIGURE 5 MARKET FOR OIL & GAS: BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH FOR ESTIMATING SIZE OF MARKET FOR OIL & GAS

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for arriving at market size using top-down analysis (supply side)

FIGURE 7 MARKET FOR OIL & GAS: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

FIGURE 9 ASSUMPTIONS FOR RESEARCH STUDY

3 EXECUTIVE SUMMARY (Page No. - 51)

FIGURE 10 E-RTTM SEGMENT OF MARKET FOR OIL & GAS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

FIGURE 11 NATURAL GAS SEGMENT TO LEAD MARKET FOR OIL & GAS FROM 2020 TO 2025

FIGURE 12 MARKET FOR OIL & GAS IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN LEAK DETECTION MARKET FOR OIL & GAS

FIGURE 13 EVOLVING GOVERNMENT REGULATIONS TO IMPLEMENT LEAK DETECTION SOLUTIONS AND SYSTEMS IN OIL AND GAS INDUSTRY TO DRIVE MARKET GROWTH

4.2 MARKET FOR OIL & GAS IN NORTH AMERICA, BY MEDIUM AND COUNTRY

FIGURE 14 NATURAL GAS SEGMENT AND US TO HOLD LARGEST SHARES OF MARKET FOR OIL & GAS IN NORTH AMERICA IN 2020

4.3 MARKET FOR OIL & GAS IN APAC, BY TECHNOLOGY

FIGURE 15 E-RTTM SEGMENT TO LEAD OF MARKET FOR OIL & GAS BY 2025

4.4 MARKET FOR OIL & GAS, BY COUNTRY

FIGURE 16 MARKET FOR OIL & GAS IN CHINA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 EVOLVING GOVERNMENT REGULATIONS PERTAINING TO IMPLEMENTATION OF LEAK DETECTION SYSTEMS

FIGURE 18 LEAK DETECTION MARKET FOR OIL & GAS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Increasing incidents of oil and gas leakages in pipelines and storage tanks at production facilities

TABLE 1 OIL AND GAS LEAK INCIDENTS, JANUARY 2019–JUNE 2020

5.2.1.2 Ongoing construction of new pipelines and expansion of existing ones

5.2.1.3 Evolving government regulations pertaining to implementation of leak detection systems

5.2.2 RESTRAINTS

5.2.2.1 Retrofitting complications related to some leak detection systems

5.2.3 OPPORTUNITIES

5.2.3.1 Rising oil and gas exploration and production activities worldwide

5.2.3.2 Increasing global oil and natural gas consumption

FIGURE 19 GLOBAL OIL CONSUMPTION, 2011–2019 (THOUSAND BARRELS DAILY)

TABLE 2 OIL CONSUMPTION, BY REGION, 2011–2019 (THOUSAND BARRELS DAILY)

FIGURE 20 NATURAL GAS CONSUMPTION, BY REGION, 2011–2019 (BILLION CUBIC METERS)

TABLE 3 NATURAL GAS CONSUMPTION, BY REGION, 2011–2019 (BILLION CUBIC METERS)

5.2.3.3 Ongoing technological advancements related to leak detection systems

5.2.4 CHALLENGES

5.2.4.1 Lack of technological advancements in offshore leak detection systems

5.2.4.2 Decrease in global oil prices

TABLE 4 ASP ANALYSIS OF DIFFERENT OIL TYPES, 2018–2021

5.3 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS OF MARKET FOR OIL & GAS

5.4 GOVERNMENT REGULATIONS AND STANDARDS RELATED TO LEAK DETECTION SYSTEMS

5.5 TECHNOLOGY ANALYSIS

5.6 PATENT ANALYSIS

5.7 USE CASES FOR LEAK DETECTION MARKET FOR OIL & GAS

5.8 ASP ANALYSIS OF LEAK DETECTION SYSTEMS BASED ON DIFFERENT TECHNOLOGIES

TABLE 5 ASP ANALYSIS OF LEAK DETECTION SYSTEMS BASED ON DIFFERENT TECHNOLOGIES, 2020–2025 (USD)

5.9 TRADE ANALYSIS FOR OIL & GAS

FIGURE 22 OIL IMPORT DATA OF GEOGRAPHIES IN TERMS OF THOUSAND BARRELS DAILY FROM 2010 TO 2019

TABLE 6 OIL IMPORT DATA, BY GEOGRAPHY, 2010–2019 (THOUSAND BARRELS DAILY)

FIGURE 23 OIL EXPORT DATA OF GEOGRAPHIES IN TERMS OF THOUSAND BARRELS DAILY FROM 2010 TO 2019

TABLE 7 OIL EXPORT DATA, BY GEOGRAPHY, 2010–2019 (THOUSAND BARRELS DAILY)

FIGURE 24 NATURAL GAS IMPORTS, BY REGION, 2019 (BILLION CUBIC METERS)

TABLE 8 NATURAL GAS IMPORTS, BY REGION, 2019 (BILLION CUBIC METERS)

FIGURE 25 NATURAL GAS EXPORTS, BY REGION, 2019 (BILLION CUBIC METERS)

TABLE 9 NATURAL GAS EXPORTS, BY REGION, 2019 (BILLION CUBIC METERS)

5.1 OIL AND GAS INDUSTRY ECOSYSTEM

6 LEAK DETECTION MARKET FOR OIL & GAS, BY MEDIUM (Page No. - 87)

6.1 INTRODUCTION

FIGURE 26 NATURAL GAS SEGMENT TO LEAD MARKET FOR OIL & GAS FROM 2020 TO 2025

TABLE 10 MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 11 MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

6.2 OIL AND CONDENSATE

6.2.1 TRANSPORTATION OF CRUDE OIL THROUGH PIPELINES REQUIRE EFFICIENT LEAK DETECTION SYSTEMS FOR MINIMAL ECOLOGICAL IMPACT AND FINANCIAL LOSSES

TABLE 12 MARKET FOR OIL AND CONDENSATE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 13 MARKET FOR OIL AND CONDENSATE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 14 MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 15 MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

6.3 NATURAL GAS

6.3.1 INCREASED EXPLORATION, PRODUCTION, AND CONSUMPTION OF NATURAL GAS TO FUEL MARKET GROWTH

FIGURE 27 E-RTTM SEGMENT OF MARKET FOR NATURAL GAS TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 16 MARKET FOR NATURAL GAS, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 17 MARKET FOR NATURAL GAS, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 18 MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

6.4 IMPACT OF COVID-19

7 LEAK DETECTION MARKET FOR OIL & GAS, BY TECHNOLOGY (Page No. - 95)

7.1 INTRODUCTION

FIGURE 28 E-RTTM SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR OIL & GAS IN 2025

TABLE 20 MARKET FOR OIL & GAS, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 21 MARKET FOR OIL & GAS, BY TECHNOLOGY,2020–2025 (USD MILLION)

TABLE 22 MARKET FOR OIL & GAS, BY TECHNOLOGY, 2020–2025 (THOUSAND UNITS)

7.2 ACOUSTIC/ULTRASOUND

7.2.1 RISEN USE OF ACOUSTIC/ULTRASOUND TECHNOLOGY-BASED LEAK DETECTION SYSTEMS IN BOTH SINGLE-PHASE AND MULTI-PHASE FLOW PIPELINES

TABLE 23 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 24 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 25 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 27 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 29 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

FIGURE 29 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 30 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.3 EXTENDED REAL-TIME TRANSIENT MODEL (E-RTTM)

7.3.1 INCREASED DEMAND FOR E-RTTM TECHNOLOGY-BASED LEAK DETECTION SYSTEMS TO MEET EXISTING AND NEW LEAK DETECTION REGULATORY REQUIREMENTS

TABLE 31 E-RTTM TECHNOLOGY-BASED LEAK DETECTION MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 32 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 33 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 35 E-RTTM TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 36 E-RTTM TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

FIGURE 30 NORTH AMERICA TO ACCOUNT FOR LARGEST SIZE OF E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS FROM 2020 TO 2025

TABLE 37 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.4 FIBER OPTIC

7.4.1 LOWER OVERALL COSTS OF DISTRIBUTED FIBER-OPTIC SENSORS THAN TRADITIONAL SENSORS LEAD TO THEIR INCREASED USE

TABLE 39 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 40 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 41 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 43 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 44 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 45 FIBER-OPTIC TECHNOLOGY-BASED MARKET OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 46 FIBER-OPTIC TECHNOLOGY-BASED MARKET OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.5 MASS/VOLUME BALANCE

7.5.1 DISCREPANCY BETWEEN MEASURED MASS-VOLUME FLOWS AT DIFFERENT ENDS OF PIPELINE INDICATE PRESENCE OF LEAKAGES

TABLE 47 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 48 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 49 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 51 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

FIGURE 31 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 53 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 54 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.6 THERMAL IMAGING

7.6.1 INCREASED USE OF THERMAL IMAGERS MOUNTED ON VEHICLES, UAV, AND PORTABLE SYSTEMS TO INSPECT PIPELINES FOR DETECTION OF LEAKAGES

TABLE 55 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 56 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 57 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 58 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 59 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 60 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 61 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 62 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.7 LASER ABSORPTION AND LIDAR

7.7.1 HIGH SENSITIVITY OF LASER TECHNOLOGY-BASED LEAK DETECTION SYSTEMS DRIVE MARKET GROWTH

TABLE 63 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 64 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 65 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 66 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 67 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 68 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 69 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 70 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.8 VAPOR SENSING

7.8.1 LEAK DETECTION SYSTEMS BASED ON VAPOR SENSING TECHNOLOGY CAN DETECT SMALL LEAKAGES IN PIPELINES

TABLE 71 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 72 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 73 VAPOR SENSING TECHNOLOGY–BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2017–2019 (USD MILLION)

TABLE 74 VAPOR SENSING TECHNOLOGY–BASED MARKET FOR OIL AND CONDENSATE, BY REGION, 2020–2025 (USD MILLION)

TABLE 75 VAPOR SENSING TECHNOLOGY–BASED MARKET FOR NATURAL GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 76 VAPOR SENSING TECHNOLOGY–BASED MARKET FOR NATURAL GAS, BY REGION, 2020–2025 (USD MILLION)

TABLE 77 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 78 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

7.9 IMPACT OF COVID-19

8 LEAK DETECTION MARKET FOR OIL & GAS, BY LOCATION (Page No. - 127)

8.1 INTRODUCTION

FIGURE 32 ONSHORE SEGMENT TO LEAD MARKET FOR OIL & GAS FROM 2020 TO 2025

TABLE 79 MARKET FOR OIL & GAS, BY LOCATION, 2017–2019 (USD MILLION)

TABLE 80 MARKET FOR OIL & GAS, BY LOCATION, 2020–2025 (USD MILLION)

8.2 ONSHORE

8.2.1 RISEN ONSHORE PRODUCTION OF OIL AND GAS TO DRIVE MARKET GROWTH

8.3 OFFSHORE

8.3.1 DEGRADATION OF OCEAN WATERS DUE TO OIL AND GAS LEAKAGES EXPECTED TO DRIVE DEMAND FOR LEAK DETECTION SYSTEMS AND TECHNOLOGIES IN OFFSHORE FACILITIES

9 DIFFERENT PROCESS STAGES FOR OIL AND GAS LEAK DETECTION (Page No. - 131)

9.1 INTRODUCTION

9.2 UPSTREAM

9.3 MIDSTREAM

9.4 DOWNSTREAM

10 GEOGRAPHIC ANALYSIS (Page No. - 132)

10.1 INTRODUCTION

FIGURE 33 NORTH AMERICA TO ACCOUNT FOR LARGEST SIZE OF MARKET FOR OIL & GAS FROM 2020 TO 2025

TABLE 81 MARKET FOR OIL & GAS, BY REGION, 2017–2019 (USD MILLION)

TABLE 82 LEAK DETECTION MARKET FOR OIL & GAS, BY REGION, 2020–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 34 SNAPSHOT: MARKET FOR OIL & GAS IN NORTH AMERICA

FIGURE 35 NATURAL GAS SEGMENT TO LEAD MARKET FOR OIL & GAS IN NORTH AMERICA FROM 2020 TO 2025

TABLE 83 MARKET FOR OIL & GAS IN NORTH AMERICA, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 84 MARKET FOR OIL & GAS IN NORTH AMERICA, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 85 MARKET FOR OIL & GAS IN NORTH AMERICA, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 86 MARKET FOR OIL & GAS IN NORTH AMERICA,BY TECHNOLOGY, 2020–2025 (USD MILLION)

FIGURE 36 US TO LEAD MARKET FOR OIL & GAS IN NORTH AMERICA FROM 2020 TO 2025

TABLE 87 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 88 MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 89 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED LEAK DETECTION MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 90 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 91 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 92 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 93 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 94 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 95 MASS/VOLUME TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 96 MASS/VOLUME TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 97 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 98 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 99 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 100 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 101 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 102 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN NORTH AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

10.2.1 US

10.2.1.1 Ongoing development and expansion of existing pipelines and construction of new ones to drive market growth in US

10.2.2 CANADA

10.2.2.1 Increasing adoption of government regulations in Canada to provide guidance for best management practices related to leak detection in pipelines

10.2.3 MEXICO

10.2.3.1 Ongoing development of leak detection infrastructures in Mexico to drive market growth

10.3 EUROPE

FIGURE 37 SNAPSHOT: LEAK DETECTION MARKET FOR OIL & GAS IN EUROPE

TABLE 103 MARKET FOR OIL & GAS IN EUROPE, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 104 MARKET FOR OIL & GAS IN EUROPE, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 105 MARKET FOR OIL & GAS IN EUROPE, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 106 MARKET FOR OIL & GAS IN EUROPE, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 107 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 108 MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 109 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED LEAK DETECTION MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 110 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 111 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 112 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 113 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 114 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 115 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 116 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 117 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 118 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 119 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 120 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 121 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 122 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN EUROPE, BY COUNTRY, 2020–2025 (USD MILLION)

10.3.1 RUSSIA

10.3.1.1 Surging requirement of leak detection technologies and systems in Russia as it is second-largest producer of oil and gas in world

10.3.2 UKRAINE

10.3.2.1 Rising demand for leak detection technologies and systems for use in dense network of primary and secondary pipelines of Ukraine

10.3.3 GERMANY

10.3.3.1 Importing of petroleum and other liquids through several pipelines and seaports to contribute to demand for leak detection technologies and systems in Germany

10.3.4 UK

10.3.4.1 Launching of new oil and gas projects in UK to fuel demand for leak detection technologies and systems

10.3.5 FRANCE

10.3.5.1 Increasing focus on stringent implementation of government regulations pertaining to deployment of leak detection systems to fuel market growth in France

10.3.6 ITALY

10.3.6.1 Emerging of Italy as major transit country for crude oil increases requirement of leak detection technologies and systems

10.3.7 REST OF EUROPE

10.4 APAC

FIGURE 38 SNAPSHOT: LEAK DETECTION MARKET FOR OIL & GAS IN APAC

TABLE 123 MARKET FOR OIL & GAS IN APAC, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 124 MARKET FOR OIL & GAS IN APAC, BY MEDIUM, 2020–2025 (USD MILLION)

FIGURE 39 E-RTTM SEGMENT OF MARKET FOR OIL & GAS IN APAC TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 125 MARKET FOR OIL & GAS IN APAC, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 126 MARKET FOR OIL & GAS IN APAC, BY TECHNOLOGY, 2020–2025 (USD MILLION)

FIGURE 40 MARKET FOR OIL & GAS IN CHINA TO GROW AT HIGHEST CAGR FROM 2020 TO 2025

TABLE 127 MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 128 LEAK DETECTION MARKET MARKET FOR OIL & GAS IN APAC, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 129 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 130 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 131 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 132 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 133 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 134 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 135 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 136 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 137 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 138 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 139 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 140 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 141 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 142 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN APAC, BY COUNTRY, 2020–2025 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing demand for electricity and natural gas-fired power to contribute to growth of market for oil & gas in China

10.4.2 AUSTRALIA

10.4.2.1 Flourishing oil and gas industry to drive the market for leak detection technologies and systems in Australia

10.4.3 KAZAKHSTAN

10.4.3.1 Growing interest of Kazakhstan for development of its oil and natural gas industry to fuel demand for leak detection technologies and systems

10.4.4 INDIA

10.4.4.1 Increasing government support to promote production and consumption of natural gas in India

10.4.5 INDONESIA

10.4.5.1 Ongoing oil and gas exploration activities in Indonesia to contribute to demand for leak detection technologies and systems

10.4.6 JAPAN

10.4.6.1 Growing demand for leak detection systems in Japan as it is largest importer of oil

10.4.7 REST OF APAC (ROAPAC)

10.5 SOUTH AND CENTRAL AMERICA

TABLE 143 MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 144 MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 145 MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 146 MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 147 MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 148 MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 149 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 150 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 151 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 152 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 153 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 154 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 155 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 156 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY,2020–2025 (USD MILLION)

TABLE 157 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 158 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 159 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 160 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 161 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 162 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN SOUTH AND CENTRAL AMERICA, BY COUNTRY, 2020–2025 (USD MILLION)

10.5.1 ARGENTINA

10.5.1.1 Increasing investments in Argentina to harness natural gas resources contribute to growth of market for oil & gas

10.5.2 BRAZIL

10.5.2.1 Rising upstream, midstream, and downstream activities in Brazil to attract increased investments for leak detection technologies and systems

10.5.3 COLOMBIA

10.5.3.1 Growing natural gas and oil production in Colombia to contribute to demand for leak detection technologies and systems used in pipelines

10.5.4 VENEZUELA

10.5.4.1 Increasing incidents of leakages in oil and gas pipelines and storage tanks of production facilities to fuel demand for leak detection technologies and systems in Venezuela

10.5.5 REST OF SOUTH AND CENTRAL AMERICA

10.6 MIDDLE EAST

TABLE 163 LEAK DETECTION MARKET FOR OIL & GAS IN MIDDLE EAST, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 164 MARKET FOR OIL & GAS IN MIDDLE EAST, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 165 MARKET FOR OIL & GAS IN MIDDLE EAST, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 166 MARKET FOR OIL & GAS IN MIDDLE EAST, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 167 MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 168 MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 169 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED LEAK DETECTION MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 170 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 171 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 172 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 173 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 174 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 175 MASS/VOLUME TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 176 MASS/VOLUME TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 177 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 178 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 179 LASER ABSORPTION AND LIDAR MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 180 LASER ABSORPTION AND LIDAR MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 181 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 182 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN MIDDLE EAST, BY COUNTRY, 2020–2025 (USD MILLION)

10.6.1 IRAN

10.6.1.1 Ongoing developments in oil and gas pipeline infrastructures in Iran to drive demand for leak detection technologies and systems

10.6.2 SAUDI ARABIA

10.6.2.1 Rising number of oil and gas production projects in Saudi Arabia to fuel market growth

10.6.3 IRAQ

10.6.3.1 Upcoming oil and gas production projects in Iraq to contribute to demand for leak detection technologies and systems

10.6.4 OMAN

10.6.4.1 Rising demand for natural gas to fuel growth of market for oil & gas in Oman as it is recognized as one of its leading producers

10.6.5 UAE

10.6.5.1 Increasing natural gas imports by UAE to meet its domestic demand and support upcoming natural gas projects

10.6.6 REST OF MIDDLE EAST

10.7 AFRICA

TABLE 183 LEAK DETECTION MARKET FOR OIL & GAS IN AFRICA, BY MEDIUM, 2017–2019 (USD MILLION)

TABLE 184 MARKET FOR OIL & GAS IN AFRICA, BY MEDIUM, 2020–2025 (USD MILLION)

TABLE 185 MARKET FOR OIL & GAS IN AFRICA, BY TECHNOLOGY, 2017–2019 (USD MILLION)

TABLE 186 MARKET FOR OIL & GAS IN AFRICA, BY TECHNOLOGY, 2020–2025 (USD MILLION)

TABLE 187 MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 188 LEAK DETECTION MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 189 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 190 ACOUSTIC/ULTRASONIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 191 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 192 E-RTTM TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 193 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 194 FIBER-OPTIC TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 195 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 196 MASS/VOLUME BALANCE TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 197 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 198 THERMAL IMAGING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 199 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 200 LASER ABSORPTION AND LIDAR TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 201 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 202 VAPOR SENSING TECHNOLOGY-BASED MARKET FOR OIL & GAS IN AFRICA, BY COUNTRY, 2020–2025 (USD MILLION)

10.7.1 ALGERIA

10.7.1.1 Ongoing pipeline projects in Algeria to lead to market growth

10.7.2 EGYPT

10.7.2.1 Increasing investments in oil and gas industry of Egypt to fuel market growth

10.7.3 NIGERIA

10.7.3.1 Evolving government regulations regarding gas transportation to encourage private investments in pipeline projects in Nigeria

10.7.4 LIBYA

10.7.4.1 Increasing focus on new and advanced oil and gas projects to fuel growth of market for oil & gas in Libya

10.7.5 REST OF AFRICA

10.8 IMPACT OF COVID-19

11 COMPETITIVE LANDSCAPE (Page No. - 208)

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

TABLE 203 OVERVIEW OF STRATEGIES DEPLOYED BY KEY LEAK DETECTION OEMS

11.2.1 PRODUCT PORTFOLIO

11.2.2 REGIONAL FOCUS

11.2.3 MANUFACTURING FOOTPRINT

11.2.4 ORGANIC/INORGANIC GROWTH STRATEGIES

11.3 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS (2015–2019)

FIGURE 41 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS (2015–2019)

11.4 MARKET RANKING ANALYSIS: MARKET FOR OIL & GAS, 2019

TABLE 204 RANKING ANALYSIS OF MARKET FOR OIL & GAS, 2019

11.5 MARKET SHARE ANALYSIS: MARKET FOR OIL & GAS, 2019

FIGURE 42 SHARE OF TOP 5 PLAYERS IN MARKET FOR OIL & GAS IN 2019

11.6 COMPANY EVALUATION MATRIX

11.6.1 STAR

11.6.2 EMERGING LEADER

11.6.3 PERVASIVE

11.6.4 PARTICIPANT

FIGURE 43 COMPANY EVALUATION MATRIX, 2019

FIGURE 44 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS

11.7 START-UP EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANY

11.7.2 RESPONSIVE COMPANY

11.7.3 DYNAMIC COMPANY

11.7.4 STARTING BLOCK

FIGURE 45 START-UP (SME) EVALUATION MATRIX, 2019

11.8 KEY MARKET DEVELOPMENTS

11.8.1 PRODUCT LAUNCHES

TABLE 205 PRODUCT LAUNCHES, JANUARY 2019– OCTOBER 2020

11.8.2 PARTNERSHIPS AND CONTRACTS

TABLE 206 PARTNERSHIPS AND CONTRACTS, JANUARY 2019– OCTOBER 2020

11.8.3 MERGERS AND ACQUISITIONS

TABLE 207 MERGERS AND ACQUISITIONS, JANUARY 2018– OCTOBER 2020

11.8.4 EXPANSIONS

TABLE 208 EXPANSIONS, 2018

12 COMPANY PROFILES (Page No. - 223)

12.1 INTRODUCTION

(Business Overview, Products/solutions/services Offered, Recent Developments, COVID-19-related developments, SWOT Analysis, and MnM View (Key strengths/Right to win, Strategic choices made, Weakness and threats))*

12.2 KEY PLAYERS

12.2.1 HONEYWELL INTERNATIONAL INC.

FIGURE 46 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

12.2.2 EMERSON ELECTRIC CO.

FIGURE 47 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

12.2.3 ABB

FIGURE 48 ABB: COMPANY SNAPSHOT

12.2.4 KROHNE GROUP

12.2.5 PSI SOFTWARE AG

FIGURE 49 PSI SOFTWARE AG: COMPANY SNAPSHOT

12.2.6 ATMOS

12.2.7 AVEVA

FIGURE 50 AVEVA: COMPANY SNAPSHOT

12.2.8 FLIR SYSTEMS INC.

FIGURE 51 FLIR SYSTEMS INC.: COMPANY SNAPSHOT

12.2.9 HIMA

12.2.10 YOKOGAWA ELECTRIC CORPORATION

FIGURE 52 YOKOGAWA ELECTRIC CORPORATION: COMPANY SNAPSHOT

12.3 OTHER KEY PLAYERS

12.3.1 ASEL-TECH

12.3.2 BRIDGER PHOTONICS

12.3.3 FLYSCAN SYSTEMS

12.3.4 FOTECH GROUP

12.3.5 HAWK MEASUREMENT SYSTEMS

12.3.6 MAGNUM

12.3.7 MSA SAFETY

12.3.8 OPTASENSE LTD.

12.3.9 SIMULATION SOFTWARE LTD.

12.3.10 TTK

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, COVID-19-related developments, SWOT Analysis, and MnM View (Key strengths/Right to win, Strategic choices made, Weakness and threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 263)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

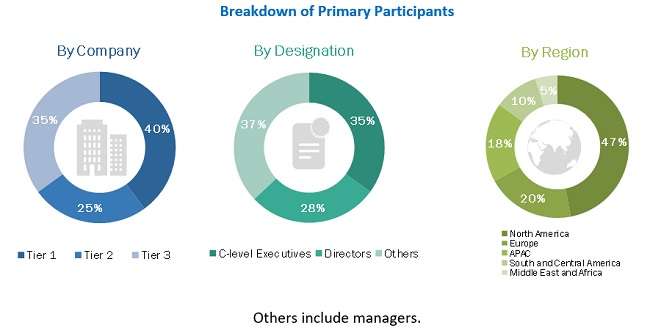

The study involved four major activities in estimating the leak detection market for oil & gas. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the leak detection market for oil & gas. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments. This research includes the study of annual reports of the market players to identify the top players, along with interviews of the key opinion leaders such as chief executive officers (CEOs), directors, and marketing personnel.

Secondary Research

Secondary sources used for this research study include government sources; corporate filings (such as annual reports, investor presentations, and financial statements); trade journals, articles, white papers, and industry news; and business and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research. Some important secondary sources referred to for this research study are the British Petroleum (BP), the US Environmental Protection Agency (EPA), the US Energy Information Administration (EIA), the US Department of Transportation (DOT), and the US Pipeline and Hazardous Materials Safety Administration (PHMSA).

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the leak detection market for oil & gas through secondary research. Several primary interviews have been conducted with the key opinion leaders from both demand and supply sides across major regions—North America, Europe, APAC, South and Central America, the Middle East, and Africa. Approximately 30% of the primary interviews have been conducted with the demand side, while approximately 70% with the supply side. Primary data has been mainly collected through telephonic interviews, which consist of approximately 80% of the overall primary interviews. Moreover, questionnaires and emails have also been used to collect the data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In this report, both top-down and bottom-up approaches have been implemented to estimate and validate the size of the leak detection market for oil & gas and various other dependent submarkets. The key players in the market for oil & gas have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire research methodology includes the study of annual and financial reports of the top companies, as well as interviews with experts such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives for both quantitative and qualitative key insights. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

The bottom-up approach has been used to arrive at the overall size of the leak detection market for oil & gas from revenues of the key players and their shares in the market. The overall market size has been calculated based on the revenues of the key players identified in the market. The research methodology used to estimate the market size by the bottom-up approach includes the following:

- Identifying key participants that influence the overall market for oil & gas, along with related component providers

- Analyzing key providers of leak detection systems, along with software suppliers and studying their portfolios to understand different components and products offered by them; examining developments undertaken by the key players during the pre-COVID-19 period, as well studying the measures/steps undertaken by them to deal with the COVID-19

- Predicting the anticipated change in demand for leak detection systems in the post-COVID-19 scenario

- Analyzing trends pertaining to the use of leak detection systems in different mediums, including oil and condensate, as well as natural gas

- Tracking the ongoing and identifying the upcoming developments in the market in the form of investments, research and development activities, product launches, collaborations, and partnerships, and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand different types of leak detection systems used in different processes and recent trends in the market, thereby analyzing the breakup of the scope of work carried out by the leading companies

- Arriving at the market estimates by analyzing revenues generated by companies and combining the same to get the market estimates

- Segmenting the overall market into different segments

- Verifying and crosschecking estimates at every level through discussions with the key opinion leaders such as CXOs, directors, and operations managers, and finally with the domain experts in MarketsandMarkets

- Studying various paid and unpaid sources of information such as annual reports, press releases, white papers, and databases

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits obtained from secondary and primary research. For the calculation of the sizes of specific market segments, the size of the most appropriate parent market has been considered to implement the top-down approach. Data from interviews has been consolidated, checked for consistency and accuracy, and inserted into a data model to arrive at the market numbers following the top-down approach. The market size in different geographies has been identified and analyzed through secondary research.

Upon the estimation and validation of the size of the leak detection market for oil & gas, further segmentation has been carried out based on consolidated inputs from the key players with respect to regional adoption trends of leak detection systems and pervasiveness of different types of leak detection systems across different processes and regions.

The research methodology used to estimate the market size by the top-down approach includes the following:

- Focusing on top-line investments and expenditures made in the leak detection market for oil & gas ecosystem

- Calculating the market size considering revenues generated by the key players through the sales of leak detection systems; estimating the market size for 2020 by considering COVID-19 impact across the value chain of the market for oil & gas; and analyzing recovery scenarios across the world to further forecast the market size

- Conducting multiple on-field discussions with the key opinion leaders of the key companies operating in the market for oil & gas to understand the pre-COVID-19 and post-COVID-19 scenarios

- Estimating the geographic split using secondary sources based on various factors such as the demand for leak detection systems in a specific country and region, length of oil and gas pipelines in each country, role of leading market players in the development of innovative products, and adoption and penetration rates of leak detection systems in particular countries for various mediums, including oil and condensate, as well as natural gas

Data Triangulation

After arriving at the overall size of the leak detection market for oil & gas through the process explained above, the overall market has been split into several segments. The market breakdown and data triangulation procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments. The data has been triangulated by studying various factors and trends from both demand and supply sides. The market size has also been validated using both the top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the leak detection market for oil & gas based on technology, medium, and location, in terms of value

- To describe and forecast the market size for the key regions, namely, North America, Europe, Asia Pacific (APAC), South and Central America, the Middle East, and Africa, in terms of value

- To provide qualitative information about stages of different processes used for leak detection in oil & gas pipelines

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the market growth

- To provide a detailed overview of the value chain pertaining to the market for oil & gas, along with the average selling price trends of leak detection systems

- To strategically analyze the ecosystem, patent landscape, and various case studies pertaining to the market for oil & gas

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies2, and provide a detailed competitive landscape of the market

- To analyze strategic approaches such as product launches, acquisitions, agreements, and partnerships in the leak detection market for oil & gas

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Leak Detection Market

Leak detection takes on more importance with the current climate of politicizing the pipeline approval process and the resistance to new projects especially in the developed world. In Canada there were 49 deaths due to a runaway oil train. Yet pipelines are many times safer than oil trains. I am interested in the latest technology for leak detection that will make new pipelines an easier sell to opposing parties.

Total Market Size Market size by Region/Country Market Size by Technology Market Shares by Competitor.

I am researching for suppliers of automobile gas oil for my customers. Is this report will be useful for me?

I am a freelance Pipeline consultant. I would like to advise clients about pipeline leakages which is a major cause of worry.

I have worked as a sales manager in O&G industry for more than 10 years, I´m starting up my new company as a free lance commercial agent. I think your system could be successful in my Country. If you are interested, I can represent you in Argentina.

I want the market for leak detection system, who are the competitors and the revenue we can generate.

Get a high-level understanding of the oil & gas leak detection market, especially market size breakdown by region and market share/growth rate breakdown by technology/solutions.

To reinforce my knowledge about leak detection and advice our clients on the best option based on the perennial causes.