Occlusion Devices Market by Product (Occlusion Balloon, Stent Retriever, Suction Device, Coil Embolization, Liquid Embolics), Application (Cardiology, Neurology, Peripheral Vascular, Urology, Oncology, Gyno), End User - Global Forecasts to 2023

The global occlusion devices market is projected to reach USD 3.55 Billion by 2023, at a CAGR of 5.3%. The growth witnessed by occlusion devices is mainly driven by the growing target patient population, continuous product launches by major manufacturers, increasing availability of medical reimbursements for occlusion devices across developed countries, and rising adoption of minimally invasive surgical procedures across major countries.

Objectives of the study are:

- To define, describe, segment, and forecast the occlusion devices market on the basis of product, application, end user, and region

- To provide detailed information regarding the major factors influencing global market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the global market

- To analyze growth opportunities in the global market for key stakeholders and provide details of the competitive landscape for leading market players

- To forecast the size of market segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile the key market players active in the global occlusion devices industry and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as product developments & commercialization, acquisitions, market expansions, and agreements & collaborations in the occlusion devices market

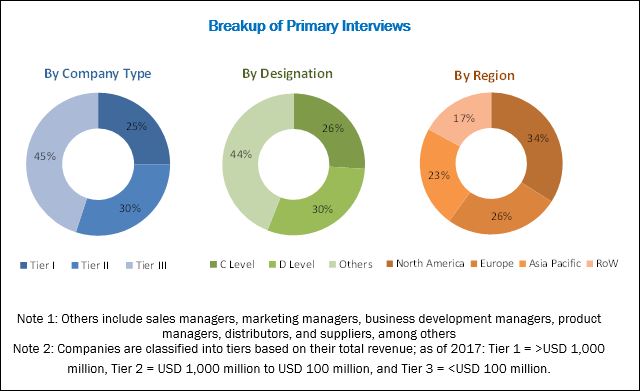

This research study involves the extensive usage of secondary sources, directories, and databases, in order to identify and collect information useful for this technical, market-oriented, and financial study of the occlusion devices market. In-depth interviews were conducted with various primary respondents, including subject-matter experts (SMEs), C-level executives of key market players, and industry consultants to obtain and verify qualitative and quantitative information and to assess market prospects.

To know about the assumptions considered for the study, download the pdf brochure

In 2017, Boston Scientific (US), Medtronic (Ireland), Terumo Corporation (Japan), Stryker Corporation (US), and Penumbra (US) held the leading position in the global occlusion devices market. In the past three years, these companies adopted product developments & commercialization, acquisitions, market expansions, and agreements & collaborations as their key business strategies to ensure market dominance. Cardinal Health (US), Asahi Intecc (Japan), Avinger (US), B. Braun (Germany), and C.R. Bard (US) are some of the other major players in this market.

Stakeholders

- Original equipment manufacturers (OEMs)

- Product sales and distribution companies

- Healthcare service providers (such as hospitals, diagnostic, and surgical centers)

- Non-government organizations

- Government regulatory authorities

- Research laboratories and academic institutes

- Clinical research organizations (CROs)

- Research and development companies

- Market research and consulting firms

Scope of the Report

This report categorizes the global market into the following segments and subsegments:

Global Occlusion Devices Market, by Product

-

Occlusion Removal Devices

- Balloon Occlusion Devices

- Stent Retrievers

- Coil Retrievers

- Suction & Aspiration Devices

-

Embolization Devices

- Embolic Coils

- Liquid Embolic Agents

- Tubal Occlusion Devices

-

Support Devices

- Microcatheters

- Guidewires

Global Occlusion Devices Market, by Application

- Neurology

- Cardiology

- Peripheral Vascular Diseases

- Urology

- Oncology

- Gynecology

Global Occlusion Devices Market, by End User

- Hospitals, Diagnostic Centers, & Surgical Centers

- Ambulatory Care Centers

- Research Laboratories & Academic Institutes

Global Occlusion Devices Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the regional market into countries:

- RoW into Latin America, the Middle East, and Africa

This report broadly segments the occlusion devices market into product, application, end user, and region. On the basis of product, the global market is segmented into occlusion removal devices (balloon occlusion devices, stent retrievers, coil retrievers, and suction and aspiration devices), embolization devices (embolic coils and liquid embolic agents), tubal occlusion devices, and support catheters (microcatheters and guidewires). In 2018, the occlusion removal devices segment is expected to account for the largest share of the market. This can be attributed to the increasing research activity to validate the clinical efficacy of novel occlusion removal devices (such as stent retrievers, coil retrievers, and balloon occlusion devices) and growing patient preference for minimally invasive surgeries.

Based on application, the market is categorized into neurology, cardiology, peripheral vascular diseases, urology, oncology, and gynecology. The neurology applications segment accounted for the largest share of the market in 2017. The increasing number of target neurosurgical procedures across major countries, growing research in the field of interventional neurology, strengthening research capabilities of major product manufacturers, and favorable reimbursement scenario for neurovascular surgeries across developed countries are the key factors supporting the growth of the occlusion devices market for neurology applications.

Based on end user, the market is segmented into three categories, namely, hospitals, diagnostic centers, and surgical centers; ambulatory care centers; and research laboratories & academic institutes. In 2018, the hospitals, diagnostic centers, and surgical centers segment is expected to account for the largest share of the market due to the growing adoption of minimally invasive surgical procedures, increasing purchasing power of major end users across developed countries, and the availability of reimbursements for target procedures in the US and major European countries.

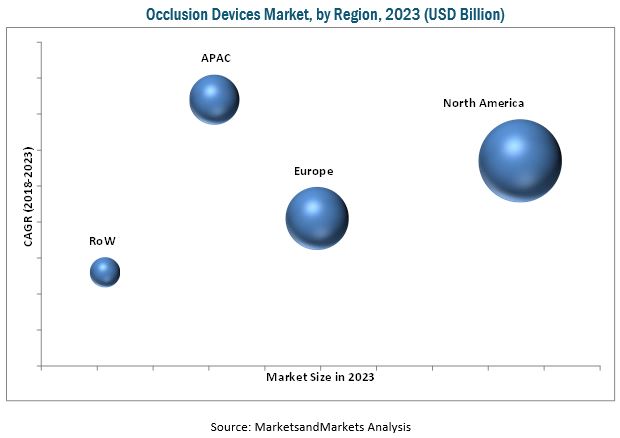

This report covers the market across four major regions, namely, North America, Europe, Asia Pacific, and RoW. North America is expected to command the largest share of the market in 2018. The large share of North America in the global occlusion devices market is attributed to the increasing availability of medical reimbursements for cardiovascular procedures, increasing patient preference for minimally invasive surgical procedures (including occlusion treatment), and strong market presence of key OEMs (that replicates into the easy availability of occlusion devices).

Factors such as stringent regulatory framework for product commercialization, procedural limitations associated with CTO treatment, and dearth of skilled surgeons for minimally invasive surgeries are expected to restrain the growth of the market during the forecast period.

The major players in the market are Boston Scientific (US), Medtronic (Ireland), Terumo (Japan), Stryker Corporation (US), and Penumbra (US).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for the Study

1.4 Currency Used

1.5 Major Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.2.3 Epidemiology-Based Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

2.5 Research Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Occlusion Devices: Market Overview

4.2 Regional Analysis: Market, By Product

4.3 Regional Analysis: Market, By End User (2018)

4.4 Asia Pacific: Market, By Application, 2018 vs 2023 (USD Million)

4.5 Global Market, By Country (2018–2023)

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Expansion of Target Patient Population Base

5.2.1.2 Technological Advancements

5.2.1.3 Favorable Reimbursement Scenario for Minimally Invasive Surgeries

5.2.1.4 Rising Number of Minimally Invasive Vascular Surgeries

5.2.1.5 Focus on Expansion of Manufacturing & Distribution Capabilities in Emerging Markets

5.2.1.6 Clinical Evidence for Safety and Efficacy of Occlusion Devices

5.2.2 Restraints

5.2.2.1 Procedural Limitations Associated With Cto Treatment

5.2.2.2 Stringent Regulatory Framework for Product Commercialization

5.2.3 Opportunities

5.2.3.1 Rising Healthcare Expenditure Across Developing Countries

5.2.4 Challenge

5.2.4.1 Dearth of Skilled Surgeons

6 Occlusion Devices Market, By Product (Page No. - 47)

6.1 Introduction

6.2 Occlusion Removal Devices

6.2.1 Balloon Occlusion Devices

6.2.2 Stent Retrievers

6.2.3 Coil Retrievers

6.2.4 Suction & Aspiration Devices

6.3 Embolization Devices

6.3.1 Embolic Coils

6.3.2 Liquid Embolic Agents

6.4 Tubal Occlusion Devices

6.5 Support Devices

6.5.1 Microcatheters

6.5.2 Guidewires

7 Occlusion Devices Market, By Application (Page No. - 70)

7.1 Introduction

7.2 Cardiology

7.3 Peripheral Vascular Disease

7.4 Neurology

7.5 Urology

7.6 Oncology

7.7 Gynecology

8 Occlusion Devices Market, By End User (Page No. - 79)

8.1 Introduction

8.2 Hospitals, Diagnostic Centers, and Surgical Centers

8.3 Ambulatory Care Centers (ACCS)

8.4 Research Laboratories & Academic Institutes

9 Occlusion Devices Market, By Region (Page No. - 85)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 Germany

9.3.2 UK

9.3.3 France

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.4.4 Rest of Asia Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 112)

10.1 Overview

10.2 Global Market Share, By Key Players (2017)

10.3 Competitive Scenario

10.3.1 Key Product Launches and Enhancements

10.3.2 Key Agreements, Partnerships, and Collaborations

10.3.3 Key Expansions

10.3.4 Major Mergers & Acquisitions

11 Company Profiles (Page No. - 116)

(Business Overview, Products Offered, Recent Developments, MnM View)*

11.1 Introduction

11.2 Abbott Laboratories

11.3 Acrostak

11.4 Angiodynamics

11.5 Asahi Intecc

11.6 Avinger

11.7 Boston Scientific

11.8 B. Braun

11.9 Cardinal Health

11.10 Cook Group

11.11 C.R. Bard (A Part of Becton Dickinson)

11.12 Edwards Lifesciences

11.13 Medtronic

11.14 Penumbra

11.15 Stryker Corporation

11.16 Terumo Corporation

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 148)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (77 Tables)

Table 1 Medical Reimbursement Codes for Occlusion-Based Surgical Procedures in the US (As of December 2017)

Table 2 Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 3 Global Market for Occlusion Removal Devices, By Type, 2016–2023 (USD Million)

Table 4 Global Market for Occlusion Removal Devices, By Application, 2016–2023 (USD Million)

Table 5 Global Market for Occlusion Removal Devices, By Region, 2016–2023 (USD Million)

Table 6 Global Market for Balloon Occlusion Devices, By Application, 2016–2023 (USD Million)

Table 7 Occlusion Removal Devices Market for Balloon Occlusion Devices, By Region, 2016–2023 (USD Million)

Table 8 Occlusion Devices Market for Stent Retrievers, By Application, 2016–2023 (USD Million)

Table 9 Occlusion Removal Devices Market for Stent Retrievers, By Region, 2016–2023 (USD Million)

Table 10 Global Market for Coil Retrievers, By Application, 2016–2023 (USD Million)

Table 11 Occlusion Removal Devices Market for Coil Retrievers, By Region, 2016–2023 (USD Million)

Table 12 Global Market for Suction & Aspiration Devices, By Application, 2016–2023 (USD Million)

Table 13 Occlusion Removal Devices Market for Suction & Aspiration Devices, By Region, 2016–2023 (USD Million)

Table 14 Global Market for Embolization Devices, By Type, 2016–2023 (USD Million)

Table 15 Global Market for Embolization Devices, By Application, 2016–2023 (USD Million)

Table 16 Global Market for Embolization Devices, By Region, 2016–2023 (USD Million)

Table 17 Occlusion Devices Market for Embolic Coils, By Application, 2016–2023 (USD Million)

Table 18 Embolization Devices Market for Embolic Coils, By Region, 2016–2023 (USD Million)

Table 19 Global Market for Liquid Embolic Agents, By Application, 2016–2023 (USD Million)

Table 20 Embolization Devices Market for Liquid Embolic Agents, By Region, 2016–2023 (USD Million)

Table 21 Global Market for Tubal Occlusion Devices, By Region, 2016–2023 (USD Million)

Table 22 Global Market for Support Devices, By Type, 2016–2023 (USD Million)

Table 23 Global Market for Support Devices, By Application, 2016–2023 (USD Million)

Table 24 Global Market for Support Devices, By Region, 2016–2023 (USD Million)

Table 25 Occlusion Devices Market for Microcatheters, By Application, 2016–2023 (USD Million)

Table 26 Global Market for Microcatheters, By Region, 2016–2023 (USD Million)

Table 27 Global Market for Guidewires, By Application, 2016–2023 (USD Million)

Table 28 Global Market for Guidewires, By Region, 2016–2023 (USD Million)

Table 29 Global Market, By Application, 2016–2023 (USD Million)

Table 30 Global Market for Cardiology Applications, By Region, 2016–2023 (USD Million)

Table 31 Occlusion Devices Market for Peripheral Vascular Disease, By Region, 2016–2023 (USD Million)

Table 32 Global Market for Neurology Applications, By Region, 2016–2023 (USD Million)

Table 33 Global Market for Urology Applications, By Region, 2016–2023 (USD Million)

Table 34 Global Market for Oncology Applications, By Region, 2016–2023 (USD Million)

Table 35 Global Market for Gynecology Applications, By Region, 2016–2023 (USD Million)

Table 36 Global Market, By End User, 2016–2023 (USD Million)

Table 37 Occlusion Devices Market for Hospitals, Diagnostic Centers, and Surgical Centers, By Region, 2016–2023 (USD Million)

Table 38 Global Market for Ambulatory Care Centers, By Region, 2016–2023 (USD Million)

Table 39 Global Market for Research Laboratories & Academic Institutes, By Region, 2016–2023 (USD Million)

Table 40 Global Market, By Region, 2016–2023 (USD Million)

Table 41 North America: Occlusion Devices Market, By Country, 2016–2023 (USD Million)

Table 42 North America: Market, By Product, 2016–2023 (USD Million)

Table 43 North America: Occlusion Removal Devices Market, By Type, 2016–2023 (USD Million)

Table 44 North America: Embolization Devices Market, By Type, 2016–2023 (USD Million)

Table 45 North America: Support Devices Market, By Type, 2016–2023 (USD Million)

Table 46 North America: Market, By Application, 2016–2023 (USD Million)

Table 47 North America: Occlusion Devices Market, By End User, 2016–2023 (USD Million)

Table 48 US: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 49 Canada: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 50 Europe: Occlusion Devices Market, By Country, 2016–2023 (USD Million)

Table 51 Europe: Market, By Product, 2016–2023 (USD Million)

Table 52 Europe: Occlusion Removal Devices Market, By Type, 2016–2023 (USD Million)

Table 53 Europe: Embolization Devices Market, By Type, 2016–2023 (USD Million)

Table 54 Europe: Support Devices Market, By Type, 2016–2023 (USD Million)

Table 55 Europe: Market, By Application, 2016–2023 (USD Million)

Table 56 Europe: Market, By End User, 2016–2023 (USD Million)

Table 57 Germany: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 58 UK: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 59 France: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 60 RoE: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 61 Asia Pacific: Occlusion Devices Market, By Country, 2016–2023 (USD Million)

Table 62 Asia Pacific: Market, By Product, 2016–2023 (USD Million)

Table 63 Asia Pacific: Occlusion Removal Devices Market, By Type, 2016–2023 (USD Million)

Table 64 Asia Pacific: Embolization Devices Market, By Type, 2016–2023 (USD Million)

Table 65 Asia Pacific: Support Devices Market, By Type, 2016–2023 (USD Million)

Table 66 Asia Pacific: Market, By Application, 2016–2023 (USD Million)

Table 67 Asia Pacific: Market, By End User, 2016–2023 (USD Million)

Table 68 Japan: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 69 China: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 70 India: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 71 RoAPAC: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 72 RoW: Occlusion Devices Market, By Product, 2016–2023 (USD Million)

Table 73 RoW: Occlusion Removal Devices Market, By Type, 2016–2023 (USD Million)

Table 74 RoW: Embolization Devices Market, By Type, 2016–2023 (USD Million)

Table 75 RoW: Support Devices Market, By Type, 2016–2023 (USD Million)

Table 76 RoW: Market, By Application, 2016–2023 (USD Million)

Table 77 RoW: Market, By End User, 2016–2023 (USD Million)

List of Figures (41 Figures)

Figure 1 Research Design: Occlusion Devices Market

Figure 2 Breakdown of Primaries: Occlusion Devices Market

Figure 3 Market Estimation: Bottom-Up Approach

Figure 4 Market Estimation: Top-Down Approach

Figure 5 Market Estimation: Epidemiology-Based Approach

Figure 6 Data Triangulation Methodology

Figure 7 Occlusion Removal Devices to Account for the Largest Market Share in 2023

Figure 8 Neurology Applications Will Continue to Dominate the Global Market in 2023

Figure 9 Hospitals, Diagnostic Centers, & Surgical Centers to Register the Highest Growth During the Forecast Period

Figure 10 Geographical Snapshot of the Global Market, 2018

Figure 11 Rising Healthcare Expenditure Across Developing Countries to Support the Growth of the Global Market During the Forecast Period

Figure 12 Asia Pacific is Estimated to Be the Fastest-Growing Market for Occlusion Devices During the Forecast Period

Figure 13 North America Dominated the Occlusion Devices Market for All End-User Segments in 2018

Figure 14 Cardiology Applications Will Continue to Dominate the Global Market in 2023

Figure 15 China & India to Be the Fastest-Growing Countries in the Global Market

Figure 16 Occlusion Devices Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Geriatric Population: By Region (2017 vs 2050)

Figure 18 Ongoing Clinical Research Projects in Occlusion Devices Across the Globe (As of December 2017)

Figure 19 Healthcare Expenditure Across Major Countries (2011 vs 2016)

Figure 20 Occlusion Removal Devices to Hold Largest Share of the Market, By Region

Figure 21 Neurology Segment to Dominate the Global Market By Region, 2018

Figure 22 Hospitals, Diagnostic Centers, and Surgical Centers Segment to Dominate the Occlusion Devices End-User Market By Region, 2018

Figure 23 North America: Market Snapshot

Figure 24 Europe: Market Snapshot

Figure 25 Asia Pacific: Market Snapshot

Figure 26 RoW: Market Snapshot

Figure 27 Key Developments By Leading Market Players in the Global Market (2013–2018)

Figure 28 Boston Scientific Held the Leading Position in the Global Market as of 2017

Figure 29 Geographic Revenue Mix of the Top Five Market Players (2017)

Figure 30 Abbott Laboratories: Company Snapshot (2017)

Figure 31 Angiodynamics: Company Snapshot (2017)

Figure 32 Avinger: Company Snapshot (2016)

Figure 33 Boston Scientific: Company Snapshot (2017)

Figure 34 B. Braun: Company Snapshot (2016)

Figure 35 Cardinal Health: Company Snapshot (2017)

Figure 36 C.R.Bard: Company Snapshot (2016)

Figure 37 Edwards Lifesciences: Company Snapshot (2017)

Figure 38 Medtronic: Company Snapshot (2017)

Figure 39 Penumbra: Company Snapshot (2017)

Figure 40 Stryker Corporation: Company Snapshot (2017)

Figure 41 Terumo Corporation: Company Snapshot (2016)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Occlusion Devices Market