North American Interventional Cardiology & Peripheral Vascular Devices Market by Angioplasty Balloon (Plain/Old, Cutting), Stent (Bioabsorbable, Drug-Eluting), Catheter (IVUS, OCT), IVC Filter (Retrievable), Endovascular Stent Graft - Forecast to 2018

The North American interventional cardiology devices market is expected to reach $5,947.5 million by 2018, at a meager CAGR of 2.9%. The slow growth of this market can be attributed to the declining growth in the coronary angioplasty procedural volume (decreasing at a CAGR of around 3.0% during the forecast period) in the U.S.

The North American interventional cardiology devices market study covers the surgical and diagnostic devices market for angioplasty, aneurysm repair, and deep vein thrombosis procedures. The devices market is further categorized into angioplasty balloons, angioplasty stents, catheters, endovascular aneurysm repair stent grafts, inferior vena cava filters, plaque modification devices, hemodynamic flow alteration devices, and accessory devices.

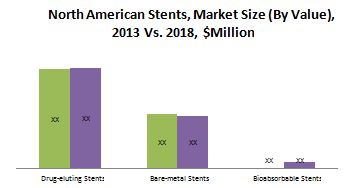

The bioabsorbable stents and retrievable inferior vena cava filters are expected to grow at higher CAGRs of 62.2% and 13.1%, respectively, in the coming years. The growth in the inferior vena cava filters market is primarily attributed to the rising incidence of deep vein thrombosis; whereas, lesser risk of restenosis drives the next-generation stent market. Besides surgical equipment, diagnostic catheters have also achieved market momentum over the years. The adoption of intravascular ultrasound (IVUS) and optical coherence tomography (OCT) catheters increased due to the advanced diagnosis of thrombus before angioplasty procedures.

A number of factors such as increasing peripheral intervention in the U.S., double digit growth in aging population, significant increase in the number of percutaneous coronary intervention (PCI) centers in the U.S., and long waiting time for care in Canada are the major drivers for the North American interventional cardiology devices market. On the other hand, declining coronary angioplasty procedures in the U.S. and conventional first level medication treatment are considered as hindrances for the growth of North American peripheral vascular devices market.

Market opportunity analysis identified that rising importance of IVUS and OCT catheters in better diagnosis during angioplasty, adoption of retrievable IVC filters in peripheral artery disease treatments, and growing demand for bioabsorbable stents to minimize restenosis allow considerable scope for revenue generation in the North American interventional cardiology devices market.

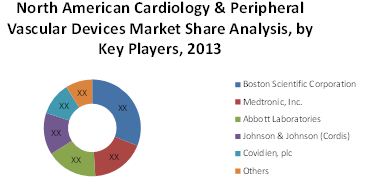

The notable players in the North American interventional cardiology devices market are Abbott Laboratories (U.S.), Cordis Corporation (U.S.), Medtronic, Inc. (U.S.), Boston Scientific Corporation (U.S.), and Covidien, Inc. (U.S.). Together, these companies accountedfor a share of over 90%.

Customer Interested in this report also can view

-

Interventional Cardiology & Peripheral Vascular Devices Market To 2016 (Embolic Protection, Chronic Total Occlusion, Coronary Atherectomy, Thrombectomy Devices, IVUS & Angiography Catheters, EVAR Stent Grafts, IVC Filters, Stents, Balloons and Accessory Devices) Global Trends & Competitive Analysis

The North American interventional cardiology devices market is expected to reach $5,947.5 million by 2018, at a meager CAGR of 2.9%. The North American interventional cardiology devices market is categorized into angioplasty balloons, angioplasty stents, catheters, endovascular aneurysm repair stent grafts, inferior vena cava filters, plaque modification devices, hemodynamic flow alteration devices, and accessory devices. The angioplasty balloons market is sub-categorized into old/normal balloons and cutting balloons; whereas, the angioplasty stents market is sub-segmented into bare-metal stents, drug eluting stents, and bioabsorbable stents. The catheter market includes both therapeutic devices (guiding catheters) and diagnostic devices (angioplasty catheters, intravascular ultrasounds, and optical coherence tomography catheters). The stent grafts market is categorized into abdominal and thoracic aortic aneurysm stent grafts; whereas, the IVC filters market is further segmented into permanent and retrievable inferior vena cava filters.The plaque modification devices market is segmented into thrombectomy and atherectomy while the hemodynamic flow alteration devices market covers embolic protection and chronic total occlusion devices. The accessory segment includes vascular closure devices, introducer sheaths, guide wires, and balloon inflation devices.

Amongst all product segments in North American interventional cardiology devices market, the angioplasty stent, catheters, and corresponding accessory devices market commanded a share of over 80% in 2013. On the other hand, the advanced diagnostic catheters such as intravascular ultrasound and optical coherence tomography catheters and the retrievable inferior vena cava filters market are expected to grow at higher CAGRs during the forecast period. The retrievable inferior vena cava filters market is poised to grow at a CAGR of 13.1% from 2013 to 2018, as it helps to reduce the long-term post surgical risk associated with permanent IVC filters.

Increasing growth in the aging population, significant increase in the number of PCI centers in the U.S., and long waiting time for care in Canada are identified as the major driving factors of the cardiac interventions market; whereas, the notable hindrance factors include declining coronary angioplasty procedures in the U.S. and conventional first level medication treatments. The rising importance of better diagnosis and increasing incidences of peripheral interventions and DVT/PE treatment procedures possess a significant growth opportunity in North America.

In 2013, Abbott Laboratories (U.S.), Cordis Corporation (U.S.), Medtronic, Inc. (U.S.), Boston Scientific Corporation (U.S.), and Covidien, Inc. (U.S.) accounted for a share of over 90%in the North American interventional cardiology devices market.

Table Of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Market Scope

1.6 Research Methodology

1.6.1 Market Size Estimation

1.6.2 Key Data Points From Primary Sources

1.6.3 Key Data From Secondary Sources

1.6.4 Market Share Analysis

1.6.5 Assumptions

2 Executive Summary (Page No. - 32)

3 Premium Insights (Page No. - 39)

3.1 U.S. & Canadian Interventional Cardiology & Peripheral Vascular Devices Market

3.2 Market Dynamics

3.3 North American Interventional Cardiology Devices Market, By Product Type

3.4 Angioplasty Stents & Catheters Market

3.5 Market Share Analysis

4 Market Overview (Page No. - 47)

4.1 North American Demographics

4.2 Interventional Procedures

4.2.1 Percutaneous Transluminal Coronary Angioplasty (PTCA)

4.2.2 Percutaneous Transluminal Angioplasty (PTA)

4.2.3 Endovascular Aneurysm Repair (EVAR) Stent Graft

4.2.4 Thromboembolism

4.3 Market Segmentation

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Increasing Peripheral Interventional Procedures to Drive the Market

4.4.1.2 Double-Digit Growth in Aging Population to Spur the Market Growth

4.4.1.3 Significant Increase in Pci Centers in the U.S. and Long Waiting Periods For Care in Canada Encourage Patients to Opt For Mis Procedures

4.4.1.4 New Cpt Codes to Boost Complex Stenting Procedures

4.4.2 Restraints & Threats

4.4.2.1 Declining Coronary Angioplasty Procedures in the U.S. to Restrict Technology Adoption

4.4.2.2 Conventional First-Level Medication Treatments to Limit the Market Scope

4.4.3 Opportunities

4.4.3.1 Rising Importance of Better Diagnosis Will Lead to Increase in Adoption of IVUS and OCT Catheters

4.4.3.2 Retrievable IVC Filters Market to Witness the Highest Cagr in Pad Treatment Devices Market

4.4.3.3 Bioabsorbable StentsA Promising Future For the North American Interventional Cardiology Devices Market

4.5 North American Interventional Cardiology Devices Market Share Analysis

5 Angioplasty Balloons (Page No. - 63)

5.1 Introduction

5.2 Old/Normal Balloons

5.2.1 Increasing Adoption of New Technologies Impedes Adoption Rate

5.3 Cutting Balloons

5.4 Scoring Balloons

5.5 Drug-Eluting Balloons

6 Angioplasty Stents (Page No. - 76)

6.1 Introduction

6.1.1 Introduction of Self-Expandable Stents in 2012 in Canada

6.2 Drug-Eluting Stents

6.2.1 Drug-Eluting Stents to Witness A Sluggish Growth

6.3 Bare-Metal Stents

6.3.1 Bare-Metal Stents to Show Sluggish Growth Owing to Severe Side-Effects

6.4 Bioabsorbable Stents

6.4.1 Fewer Post-Surgical Side-Effects to Encourage Faster Adoption

7 Catheters Market (Page No. - 88)

7.1 Introduction

7.2 Guiding Catheters

7.3 Angiography Catheters

7.4 Intravascular Ultrasound (IVUS) Catheters

7.5 Optical Coherence tomography (OCT) Catheters

7.5.1 Adoption of OCT Catheters to Help in Easy Diagnosis of Calcified Lesions

8 Endovascular Aneurysm Repair (EVAR) Stent Grafts Market (Page No. - 100)

8.1 Introduction

8.2 Abdominal Aortic Aneurysm (AAA) Stent Grafts

8.3 Thoracic Aortic Aneurysm (TAA) Stent Grafts

9 Inferior Vena Cava (IVC) Filters Market (Page No. - 108)

9.1 Introduction

9.2 Retrievable Inferior Vena Cava Filters

9.3 Permanent Inferior Vena Cava Filters

10 Plaque Modification Devices Market (Page No. - 116)

10.1 Introduction

10.2 Thrombectomy Devices

10.3 Atherectomy Devices

11 Hemodynamic Flow Alteration Devices Market (Page No. - 124)

11.1 Introduction

11.2 Embolic Protection Devices (EPD)

11.3 Chronic Total Occlusion (CTO) Devices

12 Accessory Devices Market (Page No. - 132)

12.1 Introduction

12.2 Vascular Closure Devices

12.3 Introducer Sheaths

12.4 Guide Wires

12.5 Balloon Inflation Devices

13 Geographic Analysis (Page No. - 144)

13.1 Introduction

13.1.1 U.S.

13.1.1.1 Over 20% Growth in Pci Facilities to Drive Technology Adoption

13.1.1.2 Consistent Growth in Peripheral Intervention Procedures Drive the Market Momentum

13.1.1.3 Lower Volume of Pci Procedures Remains A Major Concern

13.1.1.4 Stringent Regulations to Restrict Market Growth

13.1.2 Canada

13.1.2.1 Lesser Risk of Restenosis to Drive the Future Market Momentum

13.1.2.2 Poor Infrastructure to Hinder the Adoption of Interventional Cardiology Technologies

13.1.2.3 Growth in Aging Population and Lifestyle Diseases to Propel the Interventional Cardiology Market

14 Competitive Landscape (Page No. - 182)

14.1 Introduction

14.2 New Product Launches

14.3 Mergers & Acquisitions

14.4 Agreements, Partnerships, Collaborations, Contracts, and Joint Ventures

14.5 Other Developments

15 Company Profiles (Overview, Financials, Products & Services, Strategy, & Developments)* (Page No. - 191)

15.1 Abbott Laboratories

15.2 B. Braun Melsungen AG

15.3 Biotronik SE & Co. Kg

15.4 Boston Scientific Corporation

15.5 Cook Medical, Inc.

15.6 Cordis Corporation

15.7 Covidien Plc

15.8 C. R. Bard, Inc.

15.9 W.L.Gore & Associates, Inc.

15.1 Medtronic Inc.

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (108 Tables)

Table 1 North America: Peripheral Vascular Devices Market Size (Value), By Product, 20112018 ($Million)

Table 2 North America: Peripheral Vascular Devices Revenue Market Matrix

Table 3 North America: Interventional Cardiology Devices Market Size (Value), U.S. VS. Canada ($Million), 20112018

Table 4 North American Demographics, 2013

Table 5 North America: Angioplasty Balloons Market Size (Volume), By Type, 20112018 (Thousand Units)

Table 6 North America: Angioplasty Balloons Market Size (Value), By Type, 20112018 ($Million)

Table 7 North America: Old/Normal Angioplasty Balloon Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 8 North America: Old/Normal Angioplasty Balloons Market Size (Value), By Country, 20112018 ($Million)

Table 9 North America: Angioplasty Cutting Balloons Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 10 North America: Angioplasty Cutting Balloons Market Size (Value), By Country, 20112018 ($Million)

Table 11 North America: Angioplasty Stents Market Size (Volume), By Type, 20112018 (Thousand Units)

Table 12 North America: Angioplasty Stents Market Size (Value), By Type, 20112018 ($Million)

Table 13 North America: Drug-Eluting Stents Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 14 North America: Drug-Eluting Stents Market Size (Value), By Country, 20112018 ($Million)

Table 15 North America: Bare-Metal Stents Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 16 North America: Bare-Metal Stents Market Size (Value), By Country, 20112018 ($Million)

Table 17 North America: Bioabsorbable Stents Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 18 North America: Bioabsorbable Stents Market Size (Value), By Country, 20112018 ($Million)

Table 19 North America: Vascular Catheters Market Size (Volume), By Type, 20112018 (Thousand Units)

Table 20 North America: Vascular Catheters Market Size (Value), By Type, 20112018 ($Million)

Table 21 North America: Guiding Catheters Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 22 North America: Guiding Catheters Market Size (Value), By Country, 20112018 ($Million)

Table 23 North America: Angiography Catheters Market Size (Volume),By Country, 20112018 (Thousand Units)

Table 24 North America: Angiography Catheters Market Size (Value), By Country, 20112018 ($Million)

Table 25 North America: Intravascular Ultrasound Catheters Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 26 North America: Intravascular Ultrasound Catheters Market Size (Value), By Country, 20112018 ($Million)

Table 27 North America: Optical Coherence Tomography Catheters Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 28 North America: Optical Coherence Tomography Catheters Market Size (Value), By Country, 20112018 ($Million)

Table 29 North America: EVAR Stent Grafts Market Size (Volume), By Type, 20112018 (Thousand Units)

Table 30 North America: EVAR Stent Grafts Market Size (Value), By Type, 20112018 ($Million)

Table 31 North America: Abdominal Aortic Aneurysm Stent Grafts Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 32 North America: Abdominal Aortic Aneurysm Stent Grafts Market Size (Value), By Country, 20112018, ($Million)

Table 33 North America: Thoracic Aortic Aneurysm Stent Grafts Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 34 North America: Thoracic Aortic Aneurysm Stent Grafts Market Size (Value), By Country, 20112018 ($Million)

Table 35 North America: Inferior Vena Cava Filters Market Size (Volume), By Type, 20112018 (Thousand Units)

Table 36 North America: Inferior Vena Cava Filters Market Size (Value), By Type, 20112018 ($Million)

Table 37 North America: Retrievable Inferior Vena Cava Filters Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 38 North America: Retrievable Inferior Vena Cava Filters Market Size (Value), By Country, 20112018 ($Million)

Table 39 North America: Permanent Inferior Vena Cava Filters Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 40 North America: Permanent Inferior Vena Cava Filters Market Size (Value), By Country, 20112018 ($Million)

Table 41 North America: Plaque Modification Devices Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 42 North America: Plaque Modification Devices Market Size (Value), By Country, 20112018 ($Million)

Table 43 North America: Thrombectomy Devices Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 44 North America: Thrombectomy Devices Marketsize (Value), By Country, 20112018 ($Million)

Table 45 North America: Atherectomy Devices Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 46 North America: Atherectomy Devices Market Size (Value), By Country, 20112018 ($Million)

Table 47 North America: Hemodynamic Flow Alteration Devices Market Size (Volume), By Type, 20112018 (Thousand Units)

Table 48 North America: Hemodynamic Flow Alteration Devices Market Size (Value), By Type, 20112018 ($Million)

Table 49 North America: Embolic Protection Devices Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 50 North America: Embolic Protection Device Market Size (Value), By Country, 20112018 ($Million)

Table 51 North America: Chronic Total Occlusion Devices Market Size (Volume), By Country, 20112018 (Thousand Units)

Table 52 North America: Chronic Total Occlusion Devices Market Size (Value), By Country, 20112018 ($Million)

Table 53 North America: Accessory Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 54 North America: Accessory Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 55 North America: Vascular Closure Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 56 North America: Vascular Closure Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 57 North America: Introducer Sheaths Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 58 North America: Introducer Sheaths Market Size (Value), By Type, 2011-2018 ($Million)

Table 59 North America: Guide Wires Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 60 North America: Guide Wires Market Size (Value), By Type, 2011-2018 ($Million)

Table 61 North America: Balloon Inflation Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 62 North America: Balloon Inflation Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 63 North America: Peripheral Vascular Devices Market Size (Value), By Product Segment, 20112018 ($Million)

Table 64 U.S.: Peripheral Vascular Devices Market Size (Value), By Product, 20112018 ($Million)

Table 65 U.S.: Angioplasty Balloons Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 66 U.S.: Angioplasty Balloons Market Size (Value), By Type, 2011-2018 ($Million)

Table 67 U.S.: Angioplasty Stents Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 68 U.S.: Angioplasty Stents Market Size (Value), By Type, 2011-2018 ($Million)

Table 69 U.S.: Vascular Catheters Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 70 U.S.: Vascular Catheters Market Size (Value), By Type, 2011-2018 ($Million)

Table 71 U.S.: EVAR Stent Grafts Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 72 U.S.: EVAR Stent Grafts Market Size (Value), By Type, 2011-2018 ($Million)

Table 73 U.S.: Inferior Vena Cava Filters Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 74 U.S.: Inferior Vena Cava Filters Market Size (Value), By Type, 2011-2018 ($Million)

Table 75 U.S.: Plaque Modification Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 76 U.S.: Plaque Modification Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 77 U.S.: Hemodynamic Flow Alteration Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 78 U.S.: Hemodynamic Flow Alteration Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 79 U.S.: Accessory Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 80 U.S.: Accessory Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 81 Canada: Peripheral Vascular Devices Market Size (Value), By Product, 20112018 ($Million)

Table 82 Canada: Angioplasty Balloons Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 83 Canada: Angioplasty Balloons Market Size (Value), By Type, 2011-2018 ($Million)

Table 84 Canada: Angioplasty Stents Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 85 Canada: Angioplasty Stents Market Size (Value), By Type, 2011-2018 ($Million)

Table 86 Canada: Vascular Catheters Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 87 Canada: Vascular Catheters Market Size (Value), By Type, 2011-2018 ($Million)

Table 88 Canada: EVAR Stent Grafts Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 89 Canada: EVAR Stent Grafts Market Size (Value), By Type, 2011-2018 ($Million)

Table 90 Canada: Inferior Vena Cava Filters Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 91 Canada: Inferior Vena Cava Filters Market Size (Value), By Type, 2011-2018 ($Million)

Table 92 Canada: Plaque Modification Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 93 Canada: Plaque Modification Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 94 Canada: Hemodynamic Flow Alteration Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 95 Canada: Hemodynamic Flow Alteration Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 96 Canada: Accessory Devices Market Size (Volume), By Type, 2011-2018 (Thousand Units)

Table 97 Canada: Accessory Devices Market Size (Value), By Type, 2011-2018 ($Million)

Table 98 New Product Launches, 20112014

Table 99 Mergers and Acquisitions, 20112014

Table 100 Agreements, Partnerships, Collaborations, Contracts, and Joint Ventures, 20112014

Table 101 Other Developments, 20112014

Table 102 Abbott Laboratories: Total Revenue, By Segment, 20112013 ($Million)

Table 103 B. Braun Melsungen AG: Total Revenue, By Segment, 20112013 ($Million)

Table 104 Boston Scientific Corporation: Total Revenue, By Segment, 20112013 ($Million)

Table 105 Johnson & Johnson: Medical Devices and Diagnostic Segment Revenue, By Segment, 20112013 ($Million)

Table 106 Covedien, Plc: Total Revenue, By Segment, 20112013 ($Million)

Table 107 C.R.Bard, Inc.: Total Revenue, By Segment, 20112013 ($Million)

Table 108 Medtronic: Total Revenue, By Segment, 20112013 ($Million)

List of Figures (24 Figures)

Figure 1 Peripheral Vascular Devices Market Size Estimation Methodology & Data Triangulation

Figure 2 Forecast Model

Figure 3 Opportunity Matrix: North American Interventional Cardiology Devices Market

Figure 4 North American Interventional Cardiology Devices Market, By Country, 2013 VS. 2018 ($Million)

Figure 5 Geographic Analysis: North American Interventional Cardiology Devices Market, By Country (2013)

Figure 6 North American Interventional Cardiology Devices Market Dynamics

Figure 7 North American Interventional Cardiology Devices Market Size (Value), By Product Type, 2013 VS. 2018 ($Million)

Figure 8 Product Life Cycle: Angioplasty Stents & Catheters, 2013

Figure 9 Angioplasty Stents & Catheters Market Size (Value), By Product Type, 2013 ($Million)

Figure 10 North American Interventional Cardiology Devices Market Share, By Key Player, 2013

Figure 11 North American Interventional Cardiology Devices Market Segmentation

Figure 12 North American Interventional Cardiology Devices Market Dynamics

Figure 13 North America: Peripheral Vascular Devices Market Share, By Key Player, 2013

Figure 14 U.S.: Peripheral Vascular Devices Market Share, By Key Player, 2013

Figure 15 Canada: Peripheral Vascular Devices Market Share, By Key Player, 2013

Figure 16 North America: Angioplasty Balloons Market Size (Value), 2013 VS. 2018 ($Million)

Figure 17 North America: Angioplasty Stents Market Size (Value), 2013 VS. 2018 ($Million)

Figure 18 North America: Catheters Market Size (Value), 2013 VS. 2018 ($Million)

Figure 19 North America: Endovascular Aneurysm Repair (EVAR) Stent Grafts Market Size (Value), 2013 VS. 2018 ($Million)

Figure 20 North America: Inferior Vena Cava Filters Market Size (Value), 2013 VS. 2018 ($Million)

Figure 21 North America: Plaque Modification Devices Market Size (Value), 2013 VS. 2018 ($Million)

Figure 22 North America: Hemodynamic Flow Alteration Devices Market Size (Value), 2013 VS. 2018 ($Million)

Figure 23 North America: Angioplasty Balloon Market Size (Value), 2013 VS. 2018 ($Million)

Figure 24 Key Growth Strategies, North American Interventional Cardiology Devices Market, 20112014

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in North American Interventional Cardiology & Peripheral Vascular Devices Market