North American Nuclear Medicine Market / Radiopharmaceuticals Market Size by Type (Diagnostic (SPECT - Technetium, PET- F-18), Therapeutic (Beta Emitters – I-131, Alpha Emitters, Brachytherapy – Y-90)), Application (Oncology, Cardiology) & Region - Global Forecast to 2024

Market Growth Outlook Summary

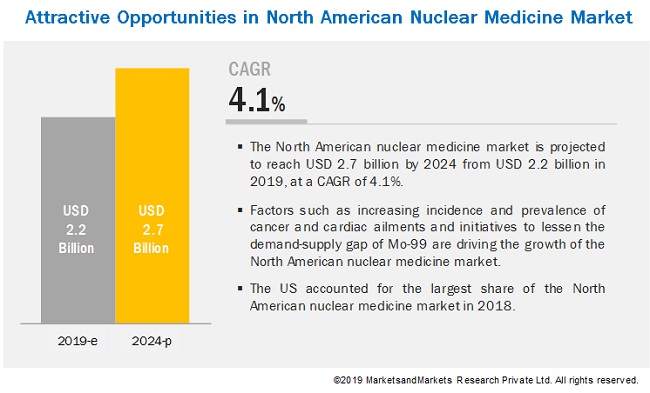

North american nuclear medicine market growth forecasted to transform from $2.2 billion in 2019 to $2.7 billion by 2024, driven by a CAGR of 4.1%. Growth in the market can primarily be attributed to factors such as the increasing incidence and prevalence of cancer & cardiac ailments and initiatives to lessen the demand-supply gap of Mo-99. However, the short half-life of radiopharmaceuticals reduces their potential adoption, while hospital budget cuts and high equipment prices are expected to limit market growth to a certain extent.

The alpha emitters segment is expected to command the largest share of the north american nuclear medicine industry in 2019

Based on type, the north american nuclear medicine market is categorized into diagnostic and therapeutic nuclear medicine. The therapeutic nuclear medicine segment is further segmented into alpha emitters, beta emitters, and brachytherapy isotopes. In 2013, the FDA approved the first and only product for alpha emitters in the market, launched by Bayer AG under the name Xofigo (a Ra-223 dichloride molecule). The North American market for Ra-223 is expected to command the largest share owing to its targeted properties over beta emitters and being the only alpha-emitter product available in the market.

Thyroid application segment of north american nuclear medicine industry is expected to register the highest growth during the forecast period

Based on application, the North American nuclear medicine market is segmented into SPECT, PET, and therapeutic applications. The SPECT applications segment is further segmented into cardiology, bone scans, thyroid applications, pulmonary scans, and other SPECT applications. The thyroid applications segment is projected to register the highest growth rate in the forecast period. The high growth of this segment can be attributed to the increasing incidence and prevalence of thyroid disorders.

Intravascular route of administration is expected to register the highest growth in the north american nuclear medicine industry during the forecast period

Based on procedural volume assessment, the north american nuclear medicine market is segmented into SPECT, PET, and therapeutic procedures. The PET procedural volume segment by type is further segmented into F-18, Ru-82, and other PET Isotopes. The F-18 segment is expected to account for the largest share of the PET procedural volume assessment in 2019. The large share of this segment can be attributed to the increasing use of F-18 in diagnostic PET applications.

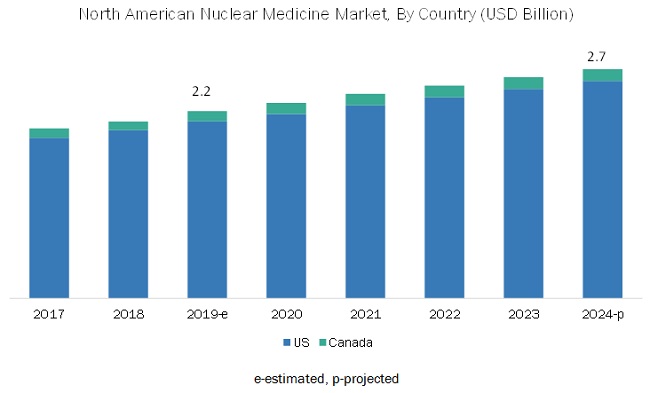

The US accounted for the largest share of the north american nuclear medicine industry in 2018

Geographically, the north american nuclear medicine market comprises of US and Canada. In 2018, the US accounted for the largest share of the nuclear medicine market. The large share can be attributed to the development of novel technologies for radioisotope production, government funding, and company initiatives in the country.

Cardinal Health (US), GE Healthcare (US), Curium (France), Lantheus Medical Imaging (US), Bayer AG (Germany), Bracco Imaging (Italy), Eczacýbaþý-Monrol Nuclear Products (Turkey), Nordion (Canada), Advanced Accelerator Applications (France), and NTP Radioisotopes (South Africa).

Scope of the North American Nuclear Medicine Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2019 |

$2.2 billion |

|

Projected Revenue Size by 2024 |

$2.7 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 4.1% |

|

Market Driver |

Forthcoming Trends |

|

Market Opportunity |

Emerging Markets |

This research report categorizes the North American nuclear medicine market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Diagnostic Nuclear Medicine

-

SPECT Radiopharmaceuticals

- Technetium-99m

- Thallium-201

- Gallium-67

- Iodine-123

- Other SPECT Isotopes

-

PET Radiopharmaceuticals

- F-18

- Ru-82

- Other PET Isotopes

-

SPECT Radiopharmaceuticals

-

Therapeutic Nuclear Medicine

-

Alpha Emitters

- Ra-223

-

Beta Emitters

- Iodine-131

- Yttrium-90

- Samarium-153

- Lutetium-177

- Rhenium-186

- Other Beta Emitters

-

Brachytherapy Isotopes

- Iodine-125

- Palladium-103

- Cesium-131

- Iridium-192

- Other Brachytherapy Isotopes

-

Alpha Emitters

By Application

-

Diagnostic Applications

-

SPECT Applications

- Cardiology

- Bone Scans

- Thyroid Applications

- Pulmonary Scans

- Other SPECT Applications

-

PET Applications

- Oncology

- Cardiology

- Neurology

- Other PET Applications

-

Therapeutic Applications

- Thyroid Indications

- Bone Metastasis

- Lymphoma

- Endocrine Tumors

- Other Indications

-

SPECT Applications

By Procedural Volume Assessment

-

Diagnostic Procedures

- SPECT Procedures

- PET Procedures

-

Therapeutic Procedures

- Beta Emitter Procedures

- Alpha Emitter Procedures

- Brachytherapy Procedures

By Region

-

North America

- US

- Canada

Key Questions Addressed by the Report

- Which product segment will dominate the North American nuclear medicine market in the future?

- Which application segment will dominate the market in the future?

- Emerging countries offer immense opportunities for the growth and adoption of nuclear medicine; will this scenario continue in the coming five years?

- Where will technology advancements offered by various companies take the industry in the mid- to long-term?

- What are the upcoming products in the nuclear medicine market?

Frequently Asked Questions (FAQ):

What is the projected market value of the North America nuclear medicine market?

The North America nuclear medicine market is projected to reach USD 2.6 billion by 2024.

Which is the leading application of SPECT applications of the North America nuclear medicine market?

On the basis of applications, SPECT applications is segmented into cardiology, bone scans, pulmonary scans,thyroid applications, other SPECT applications. Cardiology accounted for the largest share of the market. Market growth is mainly driven by the increasing incidences and mortality rate of CVDs.

Who are the major players in the North America nuclear medicine market?

Cardinal Health (US), Curium (France), GE Healthcare (US), Bayer AG(Germany), Lantheus Medical Imaging (US) and Bracco Imaging S.p.A (Italy) are the major players in the North America nuclear medicine market.

On the basis of type, which segment will command the largest market share?

On the basis of type, North America nuclear medicine market is segmented into diagnostic and therapeutic North America nuclear medicine. The diagnostic North America nuclear medicine market accounted for the largest share of the North America nuclear medicine market. The rising prevalence of cancer and cardiovascular diseases, increasing use of SPECT and PET imaging and advancements in radiotracers are driving the growth of this segment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Market Scope

1.2.2 Markets Covered

1.2.3 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.2 Research Methodology Steps

2.2.1 Secondary Data

2.2.1.1 Secondary Sources

2.2.2 Primary Data

2.2.3 Primary Sources

2.2.4 Key Insights From Primary Sources

2.2.5 Market Size Estimation Methodology

2.2.6 Revenue Mapping-Based Market Estimation

2.2.7 Market Data Estimation and Triangulation

2.2.8 Assumptions of the Study

3 Executive Summary (Page No. - 34)

4 Premium Insights (Page No. - 37)

4.1 North American Nuclear Medicine Market Overview

4.2 Market, By Type, (2019)

4.3 North American Diagnostic Nuclear Medicine Procedures Market, By Type, 2019–2024

4.4 North American Therapeutic Procedures Market, By Type (2019–2024)

5 Market Overview (Page No. - 40)

5.1 Introduction

5.1.1 Market Dynamics

5.1.2 Drivers

5.1.2.1 Increasing Incidence and Prevalence of Target Conditions

5.1.2.2 Alpha Radioimmunotherapy-Based Targeted Cancer Treatment

5.1.2.3 Initiatives to Lessen the Demand-Supply Gap of Mo-99

5.1.3 Restraints

5.1.3.1 Short Half-Life of Radiopharmaceuticals

5.1.4 Opportunities

5.1.4.1 Use of Radiopharmaceuticals in Neurological Applications

6 North American Nuclear Medicine/ Radiopharmaceuticals Market: Pipeline Assessment (Page No. - 43)

6.1 Introduction

6.2 Diagnostic Radioisotopes

6.3 Therapeutic Radioisotopes

7 North American Nuclear Medicine/ Radiopharmaceuticals Market, By Type (Page No. - 49)

7.1 Introduction

7.2 Diagnostic Nuclear Medicine

7.2.1 SPECT Radiopharmaceuticals

7.2.1.1 TC-99m

7.2.1.2 TL-201

7.2.1.3 GA-67

7.2.1.4 I-123

7.2.1.5 Other SPECT Isotopes

7.2.2 Pet Radiopharmaceuticals

7.2.2.1 F-18

7.2.2.2 RU-82

7.2.2.3 Other Pet Isotopes

7.3 Therapeutic Nuclear Medicine

7.3.1 Alpha Emitters

7.3.1.1 RA-223

7.3.2 Beta Emitters

7.3.2.1 Iodine-131

7.3.2.2 Y-90

7.3.2.3 SM-153

7.3.2.4 LU-177

7.3.2.5 RH-186

7.3.2.6 Other Beta Emitters

7.3.3 Brachytherapy Isotopes

7.3.3.1 Iodine-125

7.3.3.2 Iridium-192

7.3.3.3 Palladium-103

7.3.3.4 Cesium-131

7.3.3.5 Other Brachytherapy Isotopes

8 North American Nuclear Medicine/Radiopharmaceuticals Market, By Application (Page No. - 69)

8.1 Introduction

8.2 Diagnostic Applications

8.2.1 SPECT Applications

8.2.1.1 Cardiology

8.2.1.1.1 Rising Incidence of CVD has Increased Demand for Cardiac Diagnostic Scans

8.2.1.2 Bone Scans

8.2.1.2.1 Precision of SPECT in Bone Scanning has Driven Dependence on the Technology

8.2.1.3 Thyroid Applications

8.2.1.3.1 Introduction of Dual SPECT/CT Imaging is an Important Trend in the Thyroid Applications Segment

8.2.1.4 Pulmonary Scans

8.2.1.4.1 SPECT/CT has Shown High Accuracy and Sensitivity in Pulmonary Embolism Applications

8.2.1.5 Other SPECT Applications

8.2.2 PET Applications

8.2.2.1 Oncology

8.2.2.1.1 Increasing Cancer Incidence Will Fuel Market Growth

8.2.2.2 Cardiology

8.2.2.2.1 Growing Preference for FDG in Cardiac Imaging is Likely to Boost Market Growth

8.2.2.3 Neurology

8.2.2.3.1 R&D Into Alzheimer’s Disease has Positively Affected Demand for Nuclear Medicine

8.2.2.4 Other PET Applications

8.3 Therapeutic Applications

8.3.1 Thyroid Indications

8.3.1.1 Increasing Prevalence of Thyroid Disorders Will Fuel Market Growth

8.3.2 Bone Metastasis

8.3.2.1 Introduction of Novel Therapies for Bone Metastasis Will Positively Impact the Market

8.3.3 Lymphoma

8.3.3.1 Development of New Isotopes for the Treatment of Lymphoma Presents Huge Growth Opportunities

8.3.4 Endocrine Tumors

8.3.4.1 US Dominates the Therapeutic Nuclear Medicine Market for Endocrine Tumor Applications

8.3.5 Other Indications

9 North American Nuclear Medicine/Radiopharmaceuticals Market: Procedural Volume Assessment (Page No. - 81)

9.1 Introduction

9.2 Diagnostic Procedures

9.2.1 SPECT Procedures

9.2.2 PET Procedures

9.3 Therapeutic Procedures

9.3.1 Beta Emitter Procedures

9.3.2 Alpha Emitter Procedures

9.3.3 Brachytherapy Procedures

10 North American Nuclear Medicine/Radiopharmaceuticals Market, By Country (Page No. - 86)

10.1 Introduction

10.1.1 US

10.1.1.1 The US Holds the Largest Share of the North American Market

10.1.2 Canada

10.1.2.1 Investments to Secure Medical Isotope Supply are Likely to Boost Market Growth

11 Competitive Landscape (Page No. - 100)

11.1 Overview

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

11.3 Competitive Scenario

11.3.1 Product Launches & Approvals

11.3.2 Expansions

11.3.3 Acquisitions

11.3.4 Agreements,Partnerships, & Collaborations

12 Company Profile (Page No. - 106)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 Cardinal Health

12.2 GE Healthcare

12.3 Curium

12.4 Lantheus Medical Imaging, Inc.

12.5 Bayer AG

12.6 Bracco Imaging S.P.A.

12.7 Eczacibaþi-Monrol Nuclear Products

12.8 Nordion, Inc. (A Subsidiary of Sterigenics International)

12.9 Advanced Accelerator Applications (AAA) (A Part of Novartis)

12.10 NTP Radioisotopes Soc, LTD. (A Subsidiary of South African Nuclear Energy Corporation)

12.11 Joint Stock Company Isotope (JSC Isotope)

12.12 Northstar Medical Radioisotopes, LLC

12.13 Eckert & Ziegler

12.14 Jubilant Draximage, Inc. (A Subsidiary of Jubilant Pharma)

12.15 Pharmalogic

12.16 Institute of Isotopes Co., LTD.

12.17 Sinotau Pharmaceuticals Group

12.18 Isotopia Molecular Imaging Limited

12.19 Shine Medical Technologies

12.20 Global Medical Solutions, LTD.

12.21 FDA Approved Radiopharmaceuicals

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 150)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Available Customizations

13.4 Related Reports

13.5 Author Details

List of Tables (96 Tables)

Table 1 New Reactors Expected to Open During the Forecast Period

Table 2 North American Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 3 North American Diagnostic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 4 North American Diagnostic Nuclear Medicine Market, By Country 2017–2024 (USD Million)

Table 5 Table 1.2. Alternatives to Common TC-99m-Based Diagnostic Procedures in the Setting of Severe TC-99m Shortages

Table 6 North American SPECT Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 7 North American SPECT Radiopharmaceuticals Market, By Country, 2017–2024 (USD Million)

Table 8 North American TC-99m Market, By Country, 2017–2024 (USD Million)

Table 9 North American Ti-201 Market, By Country, 2017–2024 (USD Million)

Table 10 North American GA-67 Market, By Country, 2017–2024 (USD Million)

Table 11 North American I-123 Market, By Country, 2017–2024 (USD Million)

Table 12 North American Other SPECT Isotopes Market, By Country, 2017–2024 (USD Million)

Table 13 North American PET Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 14 North American PET Radiopharmaceuticals Market, By Country, 2017–2024 (USD Million)

Table 15 North American F-18 Market, By Region, 2017–2024 (USD Million)

Table 16 North American RU-82 Market, By Country, 2017–2024 (USD Million)

Table 17 North American Other PET Isotopes Market, By Country, 2017–2024 (USD Million)

Table 18 North American Therapeutic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 19 North American Therapeutic Nuclear Medicine Market, By Country, 2017–2024 (USD Million)

Table 20 North American RA-223 Market, By Country, 2017–2024 (USD Million)

Table 21 North American Beta Emitters Market, By Type, 2017–2024 (USD Million)

Table 22 North American Beta Emitters Market, By Country, 2017–2024 (USD Million)

Table 23 North American Iodine-131 Market, By Country, 2017–2024 (USD Million)

Table 24 North American Y-90 Market, By Country, 2017–2024 (USD Million)

Table 25 North American SM-153 Market, By Country, 2017–2024 (USD Million)

Table 26 North American LU-177 Market, By Country, 2017–2024 (USD Million)

Table 27 North American Re-186 Market, By Country, 2017–2024 (USD Million)

Table 28 North American Other Beta Emitters Market, By Country, 2017–2024 (USD Million)

Table 29 North American Brachytherapy Isotopes Market, By Type, 2017–2024 (USD Million)

Table 30 North American Brachytherapy Isotopes Market, By Country, 2017–2024 (USD Million)

Table 31 North American I-125 Market, By Country, 2017–2024 (USD Million)

Table 32 North American Iridium-192 Market, By Country, 2017–2024 (USD Million)

Table 33 North American Palladium-103 Market, By Country, 2017–2024 (USD Million)

Table 34 North American Cesium-131 Market, By Country, 2017–2024 (USD Million)

Table 35 North American Other Brachytherapy Isotopes Market, By Country, 2017–2024 (USD Million)

Table 36 North American SPECT Applications Market, By Type, 2017–2024 (USD Million)

Table 37 North American SPECT Cardiology Applications Market, By Country, 2017–2024 (USD Million)

Table 38 North American SPECT Bone Scans Market, By Country, 2017–2024 (USD Million)

Table 39 North American SPECT Thyroid Applications Market, By Country, 2017–2024 (USD Million)

Table 40 North American SPECT Pulmonary Scans Market, By Country, 2017–2024 (USD Million)

Table 41 North American Other SPECT Applications Market, By Country, 2017–2024 (USD Million)

Table 42 North American PET Applications Market, By Type, 2017–2024 (USD Million)

Table 43 North American PET Oncology Applications Market, By Country, 2017–2024 (USD Million)

Table 44 North American PET Cardiology Applications Market, By Country, 2017–2024 (USD Million)

Table 45 North American PET Neurology Applications Market, By Country, 2017–2024 (USD Million)

Table 46 North American Other PET Applications Market, By Country, 2017–2024 (USD Million)

Table 47 North American Therapeutic Nuclear Medicine Applications Market, By Indication, 2017–2024 (USD Million)

Table 48 North American Therapeutic Nuclear Medicine Market for Thyroid Indications, By Country, 2017–2024 (USD Million)

Table 49 North American Therapeutic Nuclear Medicine Market for Bone Metastasis, By Country, 2017–2024 (USD Million)

Table 50 North American Therapeutic Nuclear Medicine Market for Lymphoma, By Country, 2017–2024 (USD Million)

Table 51 North American Therapeutic Nuclear Medicine Market for Endocrine Tumors, By Country, 2017–2024 (USD Million)

Table 52 North American Therapeutic Nuclear Medicine Market for Other Indications, By Country, 2017–2024 (USD Million)

Table 53 North American Nuclear Medicine Market, By Procedure, 2019–2024 (Thousand Procedures)

Table 54 North American Diagnostic Nuclear Medicine Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 55 North American SPECT Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 56 North American PET Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 57 North American Therapeutic Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 58 North American Beta Emitter Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 59 North American Alpha Emitter Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 60 North American Brachytherapy Procedures Market, By Type, 2019–2024 (Thousand Procedures)

Table 61 North American Nuclear Medicine Market, By Country, 2017–2024 (USD Million)

Table 62 North American Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 63 North American Diagnostic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 64 North American SPECT Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 65 North American SPECT Applications Market, By Type, 2017–2024 (USD Million)

Table 66 North American PET Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 67 North American PET Applications Market, By Type, 2017–2024 (USD Million)

Table 68 North American Therapeutic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 69 North American Beta Emitters Market, By Type, 2017–2024 (USD Million)

Table 70 North American Brachytherapy Isotopes Market, By Type, 2017–2024 (USD Million)

Table 71 North American Therapeutic Nuclear Medicine Applications Market, By Indication, 2017–2024 (USD Million)

Table 72 US: Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 73 US: Diagnostic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 74 US: SPECT Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 75 US: SPECT Applications Market, By Type, 2017–2024 (USD Million)

Table 76 US: PET Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 77 US: PET Applications Market, By Type, 2017–2024 (USD Million)

Table 78 US: Therapeutic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 79 US: Beta Emitters Market, By Type, 2017–2024 (USD Million)

Table 80 US: Brachytherapy Isotopes Market, By Type, 2017–2024 (USD Million)

Table 81 US: Therapeutic Nuclear Medicine Applications Market, By Indication, 2017–2024 (USD Million)

Table 82 Canada: Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 83 Canada: Diagnostic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 84 Canada: SPECT Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 85 Canada: SPECT Applications Market, By Type, 2017–2024 (USD Million)

Table 86 Canada: PET Radiopharmaceuticals Market, By Type, 2017–2024 (USD Million)

Table 87 Canada: PET Applications Market, By Type, 2017–2024 (USD Million)

Table 88 Canada: Therapeutic Nuclear Medicine Market, By Type, 2017–2024 (USD Million)

Table 89 Canada: Beta Emitters Market, By Type, 2017–2024 (USD Million)

Table 90 Canada: Brachytherapy Isotopes Market, By Type, 2017–2024 (USD Million)

Table 91 Canada: Therapeutic Nuclear Medicine Applications Market, By Indication, 2017–2024 (USD Million)

Table 92 Product Launches & Approvals (2017–2019)

Table 93 Expansions (2017–2019)

Table 94 Acquisitions (2017–2019)

Table 95 Agreements, Partnerships, & Collaborations (2017–2019)

Table 96 FDA Approved Radiopharmaceuicals

List of Figures (30 Figures)

Figure 1 Research Methodology: North American Nuclear Medicine Market

Figure 2 Research Design

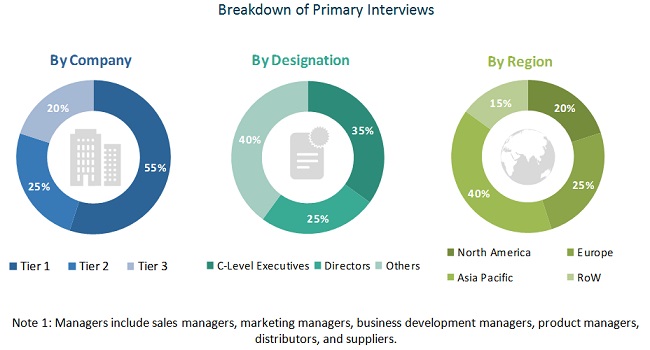

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Research Methodology: Hypothesis Building

Figure 5 Data Triangulation Methodology

Figure 6 North American Nuclear Medicine Market, By Type, 2019 vs 2024 (USD Million)

Figure 7 North American SPECT Applications Market, By Type, 2019 vs 2024 (USD Million)

Figure 8 North American PET Applications Market, By Type, 2019 vs 2024 (USD Million)

Figure 9 North American Therapeutic Nuclear Medicine Applications Market, By Indication, 2019 vs 2024 (USD Million)

Figure 10 High Prevalence of Cancer to Drive the Market During the Forecast Period

Figure 11 The US Accounted for the Largest Share of the North American Nuclear Medicine Market

Figure 12 SPECT Procedures Segment to Account for the Largest Share of the Market

Figure 13 Alpha Emitters to Account for the Largest Share of the North American Therapeutic Procedures Market

Figure 14 Drivers, Restraints, and Opportunities

Figure 15 Clinical Trials for Diagnostic & Therapeutic Radioisotopes, By Phase, 2011–2025

Figure 16 Clinical Trials for Radioisotopes, By Type, 2011–2025

Figure 17 Clinical Trials for Diagnostic Radioisotopes, By Subtype, 2011–2025

Figure 18 Clinical Trials for Diagnostic Radioisotopes, By Application, 2011–2025

Figure 19 Clinical Trials for Diagnostic Radioisotopes, By Phase, 2011–2025

Figure 20 Clinical Trials for Therapeutic Radioisotopes, By Subtype, 2011–2025

Figure 21 Clinical Trials for Therapeutic Radioisotopes, By Indication, 2011–2025

Figure 22 Clinical Trials for Therapeutic Radioisotopes, By Phase, 2011–2025

Figure 23 North American Nuclear Medicine Market Snapshot

Figure 24 Key Developments in the North American Nuclear Medicine Market, 2017–2019

Figure 25 North American Nuclear Medicine Market: Competitive Leadership Mapping (2018)

Figure 26 Cardinal Health: Company Snapshot (2018)

Figure 27 GE Healthcare: Company Snapshot (2018)

Figure 28 Lantheus Medical Imaging, Inc.: Company Snapshot (2018)

Figure 29 Bayer AG: Company Snapshot (2018)

Figure 30 Eckert & Ziegler: Company Snapshot (2018)

The study involved four major activities in estimating the current size for the North American nuclear medicine market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, to identify and collect information for the market study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

The North American nuclear medicine market comprises several stakeholders, such as preferred suppliers and distributors, healthcare institutions (hospitals, medical schools, group practices, individual surgeons, and governing bodies), medical device vendors/service providers, research institutes, and research and consulting firms. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Mentioned below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the North American nuclear medicine market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall North American nuclear medicine market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the nuclear medicine industry

Report Objectives

- To define, describe, and forecast the North American nuclear medicine market on the basis of type, application, procedural volume, and country

- To provide detailed information regarding the major factors influencing the growth of this market (such as drivers, restraints, and opportunities)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to North America (the US and Canada)

- To strategically analyze the market structure and profile key players and their core competencies in the market

To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, and collaborations in North American nuclear medicine.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the North American nuclear medicine market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the software portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in North American Nuclear Medicine Market