European Nuclear Medicine/Radiopharmaceuticals Market by Type (Diagnostic (SPECT - Technetium, PET - F-18), Therapeutic (Beta Emitters - I-131, Alpha Emitters, Brachytherapy - Y-90)), Application (Oncology, Thyroid, Cardiology), Procedures - Forecasts to 2020

Over the years, the European nuclear medicine/radiopharmaceuticals market has witnessed various advancements in radiopharmaceuticals. The European radiopharmaceuticals market is witnessing growth owing to an increasing number of radioisotope approvals for different clinical indications. Tc-99m and F-18 radioisotopes are estimated to contribute the highest to the European nuclear medicine diagnostic market in 2015, whereas Ra-223, I-131 and Y-90 ensured their leading position in the therapeutic market.

In 2015, the diagnostic segment accounts for the largest share of the European nuclear medicine/radiopharmaceuticals market, by type. The SPECT segment accounts for the largest share of the diagnostic radiopharmaceuticals market, while the beta emitters segment accounts for the largest share of the therapeutic radiopharmaceuticals market.

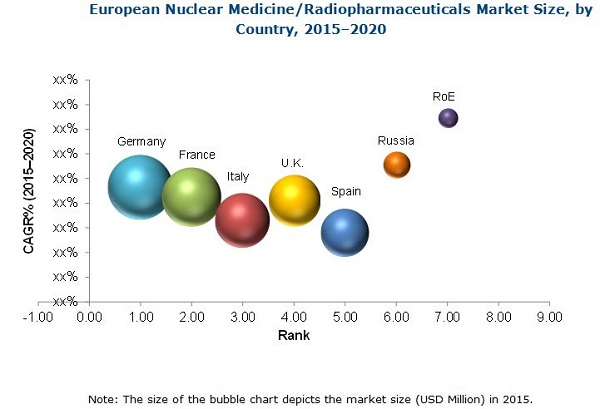

In 2015, Germany accounts for the largest share of the European nuclear medicine/radiopharmaceuticals market, followed by France, Italy, U.K., Spain, Russia, and the Rest of Europe (RoE). In the coming years, the European nuclear medicine/radiopharmaceuticals market is expected to witness the highest growth in the Rest of Europe, especially in Switzerland, Poland, Denmark, Sweden, and The Netherlands.

The European nuclear medicine/radiopharmaceuticals market witnesses high-competitive intensity as there are several big and many small firms with similar product offerings. These companies adopt various strategies (agreements, contracts, acquisitions, market developments, expansions, website launch, marketing and promotional activities, and technological enhancements) to increase their market shares and to establish a strong foothold in the European market.

European Nuclear Medicine Market : Scope of the Report

This research report categorizes the European nuclear medicine/radiopharmaceuticals market into the following segments and sub-segments:

European Nuclear Medicine/Radiopharmaceuticals Market, by Type

- Diagnostic

- SPECT Radiopharmaceuticals

- Tc-99

- Tl-201

- Ga-67

- I-123

- Others

- PET Radiopharmaceuticals

- F-18

- Ru-82

- Others

- SPECT Radiopharmaceuticals

- Therapeutic

- Beta Emitters

- I-131

- Sm-153

- Rh-186

- Y-90

- Lu-177

- Others

- Alpha Emitters

- Ra-223

- Brachytherapy

- I-125

- Ir-192

- Pa-103

- Cs-131

- Others

- Beta Emitters

European Nuclear Medicine/Radiopharmaceuticals Procedural Volumes

- Diagnostic

- SPECT Radiopharmaceuticals

- PET Radiopharmaceuticals

- Therapeutic

- Beta Emitters

- Alpha Emitters

- Brachytherapy

European Nuclear Medicine/Radiopharmaceuticals Market, by Application

- Diagnostic

- SPECT

- Cardiology

- Lymphoma

- Thyroid

- Neurology

- Others

- PET

- Oncology

- Cardiology

- Neurology

- Others

- SPECT

- Therapeutic

- Thyroid

- Bone Metastasis

- Lymphoma

- Endocrine Tumors

- Others

European Nuclear Medicine/Radiopharmaceuticals Market, by Country

- Germany

- France

- Italy

- U.K.

- Spain

- Russia

- Rest of the Europe (RoE)

Please click here to get the global report of Nuclear Medicine/Radiopharmaceuticals Market by Type (Diagnostic (SPECT - Technetium, PET - F-18), Therapeutic (Beta Emitters - I-131, Alpha Emitters, Brachytherapy - Y-90) & by Application (Oncology, Thyroid, Cardiology) - Global Forecasts to 2020

Radiopharmaceuticals are drugs that contain radionuclide-emitting ionizing radiation, used in the nuclear imaging field to diagnose and treat various diseases. The European nuclear medicine/radiopharmaceuticals market is segmented on the basis of types, applications, and countries.

The radiopharmaceuticals market, by type is broadly classified into two segments, namely, diagnostic and therapeutic. Radioisotopes in the diagnostic market are categorized as SPECT and PET; while the therapeutic market is classified into beta emitters, brachytherapy isotopes, and alpha emitters. In 2015, the diagnostic segment accounts for the largest share of the European nuclear medicine/radiopharmaceuticals market, with the SPECT segment accounting for the largest share of the diagnostic market.

Based on application, the European nuclear medicine/radiopharmaceuticals market is segmented into SPECT, PET, and therapeutic applications.

Factors such increasing preference for SPECT and PET scans, advances in radiotracers, Alpha radio immunotherapy-based targeted cancer treatment, increasing incidence and mortality rate of cancer and cardiac ailments are driving the growth of European Nuclear Medicine/Radiopharmaceuticals market. Moreover, potential radioisotopes in the pipeline, cyclotron based production are likely to create huge opportunities for European Nuclear Medicine/Radiopharmaceuticals market in the coming years. However, factors such as shorter half-life of radiopharmaceuticals, competition from conventional diagnostic procedures are hindering the growth of European Nuclear Medicine/Radiopharmaceuticals market.

On the basis of countries, European Nuclear Medicine/Radiopharmaceuticals market is classified into Germany, France, Italy, U.K., Spain, Russia, and the Rest of Europe (RoE).

Source: Organisation for Economic Co-operation and Development (OECD) Publications, European Association of Nuclear Medicine (EANM), European Board of Nuclear Medicine (EBNM), National Institutes of Health (NIH), World Nuclear Association (WNA), International Atomic Energy Agency (IAEA), Nuclear Regulatory Commission (NRC), Society of Nuclear Medicine and Molecular Imaging (SNMMI), Nuclear Energy Agency (NEA), Board of Radiation and Isotope Technology (BRIT), Nuclear Medicine Associations, Cancer Research UK, British Nuclear Medicine Society (BNMS), Spanish Society of Nuclear Medicine (SEMN), Italian Association of Nuclear Medicine & Molecular Imaging, French Society of Nuclear Medicine, Experts Interviews, and MarketsandMarkets Analysis

The European nuclear medicine/radiopharmaceuticals market is expected to reach $1.62 Billion by 2020 from $1.09 Billion in 2015, growing at a CAGR of 8.2% from 2015 to 2020. European Nuclear Medicine/Radiopharmaceuticals market is dominated by Germany, followed by France, Italy, Italy, U.K., Spain, Russia, and the Rest of Europe (RoE). Rest of Europe (RoE) is expected to grow at the fastest rate during the forecast period.

Some of the major players in the European nuclear medicine/radiopharmaceuticals market include Cardinal Health Inc. (U.S.), GE Healthcare (U.K.), Bracco Imaging S.p.A (Italy), Eczacibasi-Monrol Nuclear Products (Turkey), Nordion, Inc. (Canada), Advanced Accelerator Applications S.A. (France), Bayer Healthcare (Germany), Lantheus Medical Imaging, Inc. (U.S.), IBA Molecular Imaging (Belgium), and Mallinckrodt plc (Ireland).

Table of Contents

1 Introduction (Page No. - 20)

1.1 Objectives of Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.2 Primary Research

2.2.3 Key Industry Insights

2.3 Key Data From Primary Sources

2.4 Key Insights From Primary Sources

2.5 Market Size Estimation Methodology

2.6 Research Design

2.7 Market Data Validation and Triangulation

2.8 Assumptions for the Study

3 Executive Summary (Page No. - 31)

3.1 Introduction

3.2 Current Scenario

3.3 Future Outlook

4 Premium Insights (Page No. - 35)

4.1 European Nuclear Medicine/Radiopharmaceuticals Market

4.2 Spect Nuclear Medicine/Radiopharmaceuticals Diagnostic Market, By Country and Application

4.3 European Nuclear Medicine/Radiopharmaceuticals Market, By Country

4.4 European Nuclear Medicine/Radiopharmaceuticals Market, By Type (2015 vs 2020)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Preference for Spect and PET Scans

5.2.1.2 Advances in Radiotracers

5.2.1.3 Alpha Radioimmunotherapy-Based Targeted Cancer Treatment

5.2.1.4 Growing Incidence Rate of Cancer and Cardiac Ailments

5.2.2 Restraints

5.2.2.1 Shorter Half-Life of Radiopharmaceuticals

5.2.2.2 Competition From Conventional Diagnostic Procedures

5.2.3 Opportunities

5.2.3.1 Potential Radioisotopes in the Pipeline

5.2.3.2 Cyclotron-Based Production

5.2.4 Challenge

5.2.4.1 Shutdown of Nuclear Reactors

5.2.5 Burning Issue

5.2.5.1 Low Healthcare Spending in Europe

5.3 Regulatory Scenario

5.3.1 Introduction

5.3.2 Germany

5.3.2.1 German Medicinal Products Act (AMG)

5.3.2.2 Amendments to the German Medicinal Products Act (AMG)

5.3.3 France

5.3.3.1 Agence Nationale De Sιcuritι Du Mιdicament Et Des Produits De Santι (ANSM)

5.3.4 U.K.

5.3.4.1 The Medicines and Healthcare Products Regulatory Agency (MHRA)

5.3.5 Spain

5.3.6 Italy

5.3.6.1 The Italian Pharmaceutical Agency (AIFA)

5.3.7 Russia

5.3.7.1 The Federal Law

5.3.8 Switzerland

5.3.8.1 Federal Department of Home Affairs (Fdha)- the Ultimate Decision Maker

5.3.8.2 The Swiss Agency for Therapeutic Products (SATP)

6 European Nuclear Medicine/Radiopharmaceuticals Market, Pipeline Assessment (Page No. - 50)

6.1 Introduction

6.2 Diagnostic Radioisotopes

6.2.1 F-18

6.3 Therapeutic Radioisotopes

6.3.1 RA-223

6.3.2 Lu-177

7 European Nuclear Medicine/Radiopharmaceuticals Market, By Type (Page No. - 63)

7.1 Introduction

7.2 Diagnostic Nuclear Medicine/Radiopharmaceuticals

7.2.1 Spect Radiopharmaceuticals

7.2.1.1 Technetium-99m

7.2.1.2 Thallium-201

7.2.1.3 Gallium-67

7.2.1.4 Iodine-123

7.2.1.5 Others

7.2.2 PET Radiopharmaceuticals

7.2.2.1 Fluorine-18

7.2.2.2 Rubidium-82

7.2.2.3 Others

7.3 Therapeutic Nuclear Medicine/Radiopharmaceuticals

7.3.1 Beta Emitters

7.3.1.1 Iodine-131

7.3.1.2 Yttrium-90

7.3.1.3 Samarium-153

7.3.1.4 Rhenium-186

7.3.1.5 Lutetium-177

7.3.1.6 Others

7.3.2 Alpha Emitters

7.3.2.1 Radium-223

7.3.3 Brachytherapy

7.3.3.1 Iodine-125

7.3.3.2 Iridium-192

7.3.3.3 Palladium-103

7.3.3.4 Cesium-131

7.3.3.5 Others

8 European Nuclear Medicine/Radiopharmaceuticals Market, By Application (Page No. - 92)

8.1 Introduction

8.2 Diagnostic Applications

8.2.1 Spect Applications

8.2.1.1 Cardiology

8.2.1.2 Lymphoma

8.2.1.3 Neurology

8.2.1.4 Thyroid

8.2.1.5 Other Spect Applications

8.2.2 PET Applications

8.2.2.1 Oncology

8.2.2.2 Cardiology

8.2.2.3 Neurology

8.2.2.4 Other PET Applications

8.3 Therapeutic Applications

8.3.1 Thyroid

8.3.2 Bone Metastasis

8.3.3 Lymphoma

8.3.4 Endocrine Tumors

8.3.5 Other Therapeutic Applications

9 European Nuclear Medicine/Radiopharmaceuticals, Procedural Volume (Page No. - 116)

9.1 Introduction

9.2 European Diagnostic Nuclear Medicine/Radiopharmaceuticals Procedural Volume

9.2.1 Spect Radiopharmaceuticals

9.2.2 PET Radiopharmaceuticals

9.3 European Therapeutic Nuclear Medicine/Radiopharmaceuticals Procedural Volume

9.3.1 Beta Emitters

9.3.2 Alpha Emitters

9.3.3 Brachytherapy

10 European Nuclear Medicine/Radiopharmaceuticals Market, By Country/Region (Page No. - 122)

10.1 Introduction

10.2 Germany

10.3 France

10.4 Italy

10.5 U.K.

10.6 Spain

10.7 Russia

10.8 Rest of Europe (RoE)

11 Competitive Landscape (Page No. - 162)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 Introduction

11.2.2 Agreements & Contracts

11.2.3 Acquisitions

11.2.4 European Nuclear Medicine/Radiopharmaceuticals Market Developments

11.2.5 Expansions

11.2.6 Other Strategies

12 Company Profiles (Page No. - 166)

(Overview, Financials, Products & Services, Strategy, and Developments)*

12.1 Cardinal Health, Inc.

12.2 Mallinckrodt PLC

12.3 GE Healthcare

12.4 Lantheus Medical Imaging, Inc.

12.5 Bayer Healthcare

12.6 Bracco Imaging S.P.A

12.7 Eczacibasi-Monrol Nuclear Products

12.8 Nordion, Inc.

12.9 Advanced Accelerator Applications S.A.

12.10 Iba Molecular Imaging

*Details on Overview, Financials, Product & Services, Strategy, and Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 186)

13.1 Discussion Guide

13.2 Available Customizations

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Related Reports

List of Tables (145 Tables)

Table 1 Alpha Radio Immunotherapy-Based Targeted Cancer Treatment to Boost the Growth of the European Nuclear Medicine/Radiopharmaceuticals Market

Table 2 Shorter Half-Life of Radiopharmaceuticals Restraining the Growth of the European Nuclear Medicine/Radiopharmaceuticals Market

Table 3 Potential Radioisotopes in the Pipeline Offer Significant Growth Opportunities for the European Nuclear Medicine/Radiopharmaceuticals Market

Table 4 Shutdown of Nuclear Reactors is A Major Challenge in the European Nuclear Medicine/Radiopharmaceuticals Market

Table 5 Low Healthcare Spending in Europe is A Major Burning Issue in the European Nuclear Medicine/Radiopharmaceuticals Market

Table 6 Details of Radiopharmaceuticals for Upcoming Diagnostic Applications

Table 7 Details of Radiopharmaceuticals for Upcoming Therapeutic Applications

Table 8 Europe Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 2013-2020 (USD Million)

Table 9 Europe Diagnostic Nuclear Medicine/Radiopharmaceuticals Market Size, By Country, 2013-2020 (USD Million)

Table 10 Europe: Diagnostic Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 2013-2020 (USD Million)

Table 11 Europe: Spect Nuclear Medicine/Radiopharmaceuticals Market Size, By Country, 2013-2020 (USD Million)

Table 12 Europe: Spect Nuclear Medicine/Radiopharmaceuticals Market Size, By Isotope Type, 2013-2020 (USD Million)

Table 13 Europe: Technetium-99m Market Size, By Country, 2013-2020 (USD Million)

Table 14 Europe: Thallium-201 Market Size, By Country, 2013-2020 (USD Million)

Table 15 Europe: Gallium-67 Market Size, By Country, 2013-2020 (USD Million)

Table 16 Europe: Iodine-123 Market Size, By Country, 2013-2020 (USD Million)

Table 17 Europe: Other Spect Isotopes Market Size, By Country, 2013-2020 (USD Million)

Table 18 Europe: PET Nuclear Medicine/Radiopharmaceuticals Market Size, By Country, 2013-2020 (USD Million)

Table 19 Europe: PET Nuclear Medicine/Radiopharmaceuticals Market Size, By Isotope Type, 2013-2020 (USD Million)

Table 20 Europe: Fluorine-18 Market Size, By Country, 2013-2020 (USD Million)

Table 21 Europe: Rubidium-82 Market Size, By Country, 2013-2020 (USD Million)

Table 22 Europe: Other PET Isotopes Market Size, By Country, 2013-2020 (USD Million)

Table 23 Europe: Therapeutic Nuclear Medicine/Radiopharmaceuticals Market Size, By Country, 2013-2020 (USD Million)

Table 24 Europe: Therapeutic Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 2013-2020 (USD Million)

Table 25 Europe: Beta Emitters Market Size, By Country, 2013-2020 (USD Million)

Table 26 Europe: Beta Emitters Market Size, By Isotope Type, 2013-2020 (USD Million)

Table 27 Europe: Iodine-131 Market Size, By Country, 2013-2020 (USD Million)

Table 28 Europe: Yttrium-90 Market Size, By Country, 2013-2020 (USD Million)

Table 29 Europe: Samarium-153 Market Size, By Country, 2013-2020 (USD Million)

Table 30 Europe: Rhenium-186 Market Size, By Country, 2013-2020 (USD Million)

Table 31 Europe: Lutetium-177 Market Size, By Country, 2013-2020 (USD Million)

Table 32 Europe: Other Beta Emitter Isotopes Market Size, By Country, 2013-2020 (USD Million)

Table 33 Europe: Alpha Emitters Market Size, By Country, 2013-2020 (USD Million)

Table 34 Europe: Brachytherapy Isotopes Market Size, By Country, 2013-2020 (USD Million)

Table 35 Europe: Brachytherapy Isotopes Market Size, By Isotope Type, 2013-2020 (USD Million)

Table 36 Europe: Iodine-125 Market Size, By Country, 2013-2020 (USD Million)

Table 37 Europe: Iridium-192 Market Size, By Country, 2013-2020 (USD Million)

Table 38 Europe: Palladium-103 Market Size, By Country, 2013-2020 (USD Million)

Table 39 Europe: Cesium-131 Market Size, By Country, 2013-2020 (USD Million)

Table 40 Europe: Other Brachytherapy Isotopes Market Size, By Country, 2013-2020 (USD Million)

Table 41 Nuclear Medicine/Radiopharmaceuticals Market Size for Spect Applications, By Country, 2013-2020 (USD Million)

Table 42 Nuclear Medicine/Radiopharmaceuticals Market Size for Spect Applications, By Type, 2013-2020 (USD Million)

Table 43 Nuclear Medicine/Radiopharmaceuticals Market Size for Cardiology Spect Applications, By Country, 2013-2020 (USD Million)

Table 44 Nuclear Medicine/Radiopharmaceuticals Market Size for Lymphoma Spect Applications, By Country, 2013-2020 (USD Million)

Table 45 Nuclear Medicine/Radiopharmaceuticals Market Size for Neurology Spect Applications, By Country, 2013-2020 (USD Million)

Table 46 Nuclear Medicine/Radiopharmaceuticals Market Size for Thyroid Spect Applications, By Country, 2013-2020 (USD Million)

Table 47 Nuclear Medicine/Radiopharmaceuticals Market Size for Other Spect Applications, By Country, 2013-2020 (USD Million)

Table 48 Nuclear Medicine/Radiopharmaceuticals Market Size for PET Applications, By Country, 2013-2020 (USD Million)

Table 49 Nuclear Medicine/Radiopharmaceuticals Market Size for PET Applications, By Type, 2013-2020 (USD Million)

Table 50 Nuclear Medicine/Radiopharmaceuticals Market Size for Oncology PET Applications, By Country, 2013-2020 (USD Million)

Table 51 Nuclear Medicine/Radiopharmaceuticals Market Size for Cardiology PET Applications, By Country, 2013-2020 (USD Million)

Table 52 Nuclear Medicine/Radiopharmaceuticals Market Size for Neurology PET Applications, By Country, 2013-2020 (USD Million)

Table 53 Nuclear Medicine/Radiopharmaceuticals Market Size for Other PET Applications, By Country, 2013-2020 (USD Million)

Table 54 Nuclear Medicine/Radiopharmaceuticals Market Size for Therapeutic Applications, By Country, 2013-2020 (USD Million)

Table 55 Nuclear Medicine/Radiopharmaceuticals Market Size for Therapeutic Applications, By Type, 2013-2020 (USD Million)

Table 56 Nuclear Medicine/Radiopharmaceuticals Market Size for Thyroid Therapeutic Applications, By Country, 2013-2020 (USD Million)

Table 57 Nuclear Medicine/Radiopharmaceuticals Market Size for Bone Metastasis Therapeutic Applications, By Country, 2013-2020 (USD Million)

Table 58 Nuclear Medicine/Radiopharmaceuticals Market Size for Lymphoma Therapeutic Applications, By Country, 2013-2020 (USD Million)

Table 59 Nuclear Medicine/Radiopharmaceuticals Market Size for Endocrine Therapeutic Applications, By Country, 2013-2020 (USD Million)

Table 60 Nuclear Medicine/Radiopharmaceuticals Market Size for Other Therapeutic Applications, By Country, 2013-2020 (USD Million)

Table 61 European Nuclear Medicine/Radiopharmaceuticals Procedural Volume, By Type, 20132020 (Thousand)

Table 62 European Nuclear Medicine/Radiopharmaceuticals Procedural Volume, By Country, 20132020 (Thousand)

Table 63 European Nuclear Medicine/Radiopharmaceuticals Diagnostic Procedural Volume, By Type, 20132020 (Thousand)

Table 64 European Nuclear Medicine Procedural Volume for Spect Radiopharmaceuticals, By Type, 20132020 (Thousand)

Table 65 European Nuclear Medicine Procedural Volume for PET Radiopharmaceuticals, By Type, 20132020 (Thousand)

Table 66 European Nuclear Medicine/Radiopharmaceuticals Therapeutic Procedural Volume, By Type, 20132020 (Thousand)

Table 67 European Nuclear Medicine Procedural Volume for Beta Emitters, By Type, 20132020 (Thousand)

Table 68 European Nuclear Medicine Procedural Volume for Alpha Emitters, By Type, 20132020 (Thousand)

Table 69 European Nuclear Medicine Procedural Volume for Brachytherapy, By Type, 20132020 (Thousand)

Table 70 European Nuclear Medicine/Radiopharmaceuticals Market Size, By Country, 20132020 (USD Million)

Table 71 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 72 Germany: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 73 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 74 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 75 Germany: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 76 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 77 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 78 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 79 Germany: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 80 Germany: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 81 France: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 82 France: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 83 France: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 84 France: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 85 France: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 86 France: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 87 France: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 88 France: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 89 France: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 90 France: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 91 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 92 Italy: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 93 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 94 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 95 Italy: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 96 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 97 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 98 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 99 Italy: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 100 Italy: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 101 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 102 U.K.: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 103 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 104 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 105 U.K.: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 106 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 107 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 108 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 109 U.K.: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 110 U.K.: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 111 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 112 Spain: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 113 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 114 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 115 Spain: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 116 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 117 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 118 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 119 Spain: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 120 Spain: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 121 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 122 Russia: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 123 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 124 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 125 Russia: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 126 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 127 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 128 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 129 Russia: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 130 Russia: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 131 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size, By Type, 20132020 (USD Million)

Table 132 RoE: Nuclear Medicine/Radiopharmaceuticals Diagnostic Market Size, By Type, 20132020 (USD Million)

Table 133 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Type, 20132020 (USD Million)

Table 134 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Type, 20132020 (USD Million)

Table 135 RoE: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Type, 20132020 (USD Million)

Table 136 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size for Beta Emitters, By Type, 20132020 (USD Million)

Table 137 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size for Brachytherapy, By Type, 20132020 (USD Million)

Table 138 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size for Spect, By Application, 20132020 (USD Million)

Table 139 RoE: Nuclear Medicine/Radiopharmaceuticals Market Size for PET, By Application, 20132020 (USD Million)

Table 140 RoE: Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Size, By Application, 20132020 (USD Million)

Table 141 Agreements & Contracts, 2012-2015

Table 142 Acquisitions, 2012-2015

Table 143 Market Developments, 2012-2015

Table 144 Expansions, 2012-2015

Table 145 Other Strategies, 2012-2015

List of Figures (60 Figures)

Figure 1 European Nuclear Medicine/Radiopharmaceutical Market Segmentation

Figure 2 European Nuclear Medicine/Radiopharmaceuticals Market: Research Methodology Steps

Figure 3 Key Data From Secondary Sources

Figure 4 Break Down of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Research Design

Figure 8 Data Triangulation Methodology

Figure 9 Therapeutic Market to Witness High Growth Rate From 2015 to 2020

Figure 10 European Nuclear Medicine/Radiopharmaceuticals Therapeutic Market Share, By Type, 2015 vs 2020

Figure 11 Geographical Snapshot of the European Nuclear Medicine/Radiopharmaceuticals Market, 2015

Figure 12 European Nuclear Medicine/Radiopharmaceuticals Spect Applications Market Size, 2015 vs 2020

Figure 13 Advances in Radiotracers to Propel Market Growth

Figure 14 Germany Dominates the European Spect Nuclear Medicine Diagnostic Market in 2015

Figure 15 Rest of Europe to Grow at the Highest Rate During the Forecast Period

Figure 16 Diagnostic Segment to Command the Largest Market Share During the Forecast Period

Figure 17 European Nuclear Medicine/Radiopharmaceuticals Market: Drivers, Restraints, Opportunities, & Challenges

Figure 18 Clinical Trials Studies of Radioisotopes, By Country

Figure 19 Clinical Trials for Diagnostic & Therapeutic Radioisotopes, By Phase

Figure 20 Clinical Trials for Diagnostic & Therapeutic Radioisotopes, By Company & Institute

Figure 21 Clinical Trials for Radioisotopes, By Type

Figure 22 Clinical Trials for Diagnostic Radioisotopes, By Subtype

Figure 23 Clinical Trials for Diagnostic Radioisotopes, By Indication

Figure 24 Clinical Trials for F-18, By Country

Figure 25 Clinical Trials for F-18, By Phase

Figure 26 Clinical Trials for F-18, By Indication

Figure 27 Clinical Trials for F-18, By Company/Institute

Figure 28 Clinical Trials for Therapeutic Radioisotopes, By Subtype

Figure 29 Clinical Trials for Therapeutic Radioisotopes, By Indication

Figure 30 Clinical Trials for RA-223, By Country

Figure 31 Clinical Trials for RA-223, By Phase

Figure 32 Clinical Trials for RA-223, By Indication

Figure 33 Clinical Trials for RA-223, By Company/Institute

Figure 34 Clinical Trials for Lu-177, By Country

Figure 35 Clinical Trials for Lu-177, By Phase

Figure 36 Clinical Trials for Lu-177, By Indication

Figure 37 Clinical Trials for Lu-177, By Company/Institute

Figure 38 European Nuclear Medicine/Radiopharmaceuticals Market Segmentation, By Type

Figure 39 Therapeutic Segment to Grow at A Higher CAGR of 10.2%

Figure 40 PET Segment to Grow at the Higher CAGR of 13.1% During the Forecast Period

Figure 41 Alpha Emitters Segment to Grow at the Highest CAGR of 12.7% During the Forecast Period

Figure 42 Segmentation of European Nuclear Medicine/Radiopharmaceuticals Market for Spect Applications, By Type

Figure 43 Rest of Europe Region to Grow at the Highest CAGR of 13.2% During the Forecast Period

Figure 44 Neurology Application Segment to Grow at the Highest CAGR of 8.1% During the Forecast Period

Figure 45 Segmentation of European Nuclear Medicine/Radiopharmaceuticals Market for PET Applications, By Type

Figure 46 Rest of Europe Region to Grow at the Highest CAGR of 20.1% During the Forecast Period

Figure 47 Neurology Application Segment to Grow at the Highest CAGR of 16.4% During the Forecast Period

Figure 48 Segmentation of European Nuclear Medicine/Radiopharmaceuticals Market for Therapeutic Applications, By Type

Figure 49 Rest of Europe Region to Grow at the Highest CAGR of 16.5% During the Forecast Period

Figure 50 The Endocrine Tumors Application Segment to Grow at the Highest CAGR of 13.0% During the Forecast Period

Figure 51 Germany to Command the Largest Share of the European Nuclear Medicine Market for Diagnostic in 2015

Figure 52 The European Nuclear Medicine/Radiopharmaceuticals Market to Grow at A CAGR of 8.2% During the Forecast Period

Figure 53 Battle for Market Share: Agreements & Contracts Was the Key Strategy Adopted By Players Between 2012 & 2015

Figure 54 Cardinal Health, Inc.: Company Snapshot

Figure 55 Mallinckrodt PLC: Company Snapshot

Figure 56 GE Healthcare: Company Snapshot

Figure 57 Lantheus Medical Imaging, Inc.: Company Snapshot

Figure 58 Bayer Healthcare: Company Snapshot

Figure 59 Nordion, Inc.: Company Snapshot

Figure 60 Advanced Accelerator Applications S.A.: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in European Nuclear Medicine/Radiopharmaceuticals Market