Nisin Market by Application (Meat, Poultry & Seafood Products, Dairy Products, Beverages, Bakery & Confectionery Products, Canned & Frozen Food products, and Other applications) and Region - Global Trends and Forecast to 2025

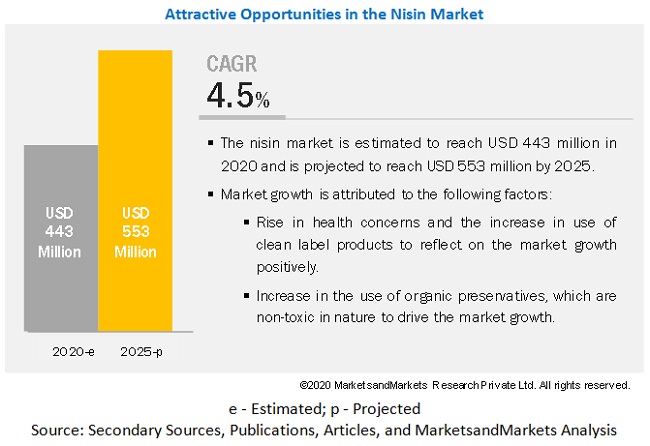

According to MarketsandMarkets, the global nisin market is estimated to be valued at USD 443 million in 2020 and is projected to reach USD 553 million by 2025, recording a CAGR of 4.5%. The rising number of health-conscious consumers and increasing awareness about organic ingredients in food & beverages have led to an increase in demand for nisin. The rise in awareness of easily digestible bacteriocin, which is non-toxic in nature, is projected to drive the growth of the market.

By application, the dairy ingredient segment is projected to account for the largest share in the nisin market

Dairy products are sensitive to thermal treatment. Therefore, non-thermal treatments are witnessing increased interests in the food industry due to their capability of assuring high-quality and safety of food products such as nisin. It is an antimicrobial peptide, which is considered safe since it can be easily degraded by proteolytic enzymes of the mammalian gastrointestinal tract.

For processed cheese, nisin is the most preferred and effective preservative, where typically, the heat treatment step of pasteurization does not eliminate all the spores. The lack of nisin application would result in the outgrowth of these spores and production of gas and off-flavors and possible liquefaction of the solid cheeses and other dairy products.

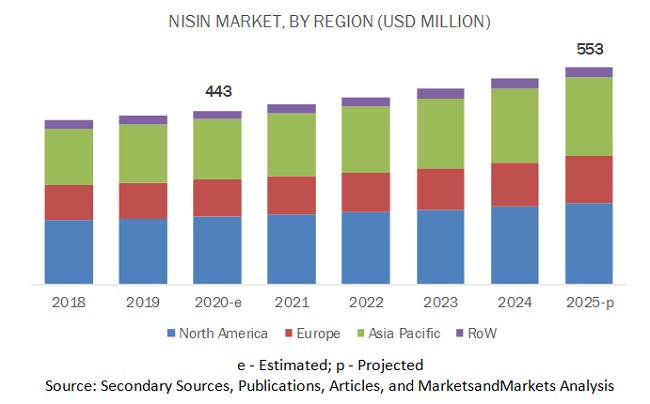

North America is projected to account for the largest nisin share during the forecast period

In 2019, North America accounted for the largest share in the market. The market in North America is largely driven due to the increase in consumer preference for synthetic food preservatives. It has encouraged market players to invest in organic options of biopreservatives. In the coming time period, the natural bio-preservatives are projected to witness an increase in popularity in developed economies as consumers can afford premium-priced products with high disposable income.

The increase in investment in R&D activities and technological advancements are projected to have a positive impact on the domestic production of nisin in North America. These factors are projected to drive the growth of the nisin market in the North American region.

Key Market Players:

Key players in this market include DSM (Netherlands), Galactic (Belgium), DuPont (US), Siveele B.V. (Netherlands), Zhejiang Silver-Elephant Bioengineering (China), Shandong Freda Biotechnology (China), Chihon Biotechnology (China), Mayasan Biotech (Turkey), Handary S.A. (Belgium), and Cayman Chemicals (US).

Scope of the report

|

Report Metric |

Details |

|

Market size estimation |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period considered |

2020–2025 |

|

Units considered |

Value (USD), Volume (Kilo Ton) |

|

Segments covered |

Application and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies studied |

|

This research report categorizes the nisin market based on application and region.

Target Audience:

- Raw material suppliers

- Food preservative manufacturers and suppliers

- Food safety agencies such as the FDA and EUFIC

- Food & beverage manufacturers/suppliers

- Commercial research & development (R&D) institutions and financial institutions

- Importers and exporters of food preservatives

- Food & beverage traders, distributors, and suppliers

- Government organizations, research organizations, consulting firms, trade associations, and industry bodies

- Associations, regulatory bodies, and other industry-related bodies:

Report Scope:

By Application

- Meat, poultry & seafood products

- Dairy products

- Beverages

- Bakery & confectionery products

- Canned & frozen food products

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (ROW)

Recent Developments

- In December 2019, Royal DSM completed the acquisition of Royal CSK (Friesland), which was a leading food ingredient company in the European region. This acquisition helped DSM to hold a major market share in the region.

Key Questions Addressed by the Report

- What are the growth opportunities in the nisin market?

- What are the key raw materials used for manufacturing nisin?

- What are the key factors affecting the market dynamics?

- What are the pricing trends in the market?

- Which are the key players operating in the market, and what initiatives have they undertaken over the past few years?

Frequently Asked Questions (FAQ):

Can you provide us historical data for the nisin market?

Yes, historical data for the market can be provided. Please provide further details about:

- Focused segments

- Targeted historic years

We need global level analysis and comparison for all Antimicrobial preservatives.

We can take this as a custom study for you, which will include insights on the overall (global/regional/country level) scenario of the antimicrobial preservative market with comparative qualitative and quantitative analysis.

We are distributors. Hence, we need distribution level estimations.

Please provide focused regions/countries. We can offer you segmental analysis by distribution channel.

Can you provide the impact analysis of COVID-19 in each country?

Yes, it can be provided based on the current market scenario. This can be taken as a separate customization.

Can you provide us detailed company profiles of start-up players by key countries?

Yes, we can provide you company profiles and competitive landscape of start-ups and SMEs. Please provide your target regions and countries.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 17)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 STUDY SCOPE

1.2.2 REGIONS COVERED

1.2.3 PERIODIZATION CONSIDERED

1.3 CURRENCY CONSIDERED

1.4 UNITS CONSIDERED

1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Secondary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

2.6 COVID-19 HEALTH ASSESSMENT

2.7 COVID-19 ECONOMIC ASSESSMENT

2.7.1 COVID-19 IMPACT ON THE ECONOMY—SCENARIO ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 34)

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 OVERVIEW OF THE MARKET

4.2 MAJOR REGIONAL SUBMARKETS

4.3 NORTH AMERICA: NISIN MARKET, BY KEY APPLICATION AND COUNTRY

4.4 MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW (Page No. - 39)

5.1 INTRODUCTION

5.2 EVOLUTION

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.1.1 Effective and Non-toxic Properties Than Other Natural Preservatives

5.3.1.2 Nisin Acts as a Natural Preservative with Therapeutic Benefits

5.3.1.3 Increase in the Use of Natural Preservatives for Meat & Poultry Products in Europe and North America

5.3.1.4 Consumer Awareness for Clean Label Products

5.3.1.5 Health Hazards of Chemical Preservatives

5.3.1.6 Growth in International Trade, Demand, and Investments in the Processed Food Market to Drive the Demand for Nisin

5.3.2 RESTRAINTS

5.3.2.1 Crucial and Sensitive Production

5.3.2.2 Use of Preservation Techniques to Discourage Demand for Nisin

5.3.3 OPPORTUNITIES

5.3.3.1 Availability of Resources and High Demand for Nisin in Emerging Markets to Create profitable opportunities for Manufacturers

5.3.3.2 Potential Applications in the Brewery Industry

5.3.3.3 High Demand for Functional Foods to Offer Growth Opportunities

5.3.3.4 Launch of Products from Non-GMO Sources to Drive Demand

5.3.4 CHALLENGES

5.3.4.1 Limited Resources and High Cost of Natural Preservatives

6 INDUSTRY TRENDS (Page No. - 50)

6.1 INDUSTRY INSIGHTS

6.2 VALUE CHAIN ANALYSIS

6.3 SUPPLY CHAIN ANALYSIS

6.4 FACTORS AFFECTING CHOICE OF PRESERVATIVES

6.4.1 REGULATIONS & ROLE OF PRESERVATIVES

6.4.2 PERMISSIBLE LIST FOR USE OF PRESERVATIVES

6.4.3 PREFERENCE FOR NATURAL PRESERVATIVE

6.4.4 SUPPLY OF PRESERVATIVES

6.5 IMPACT OF COVID-19 ON THE FOOD PRESERVATIVES AND NISIN MARKETS

6.6 NISIN PRODUCTION METHOD

6.7 TECHNOLOGY TRENDS

6.8 PRICE TRENDS

7 COMPARISONS OF NISIN WITH OTHER COMPETING BACTERIOCINS (Page No. - 59)

7.1 INTRODUCTION

7.2 BACTERIOCIN MARKET POTENTIAL

7.2.1 NISIN MARKET

7.2.2 PEDIOCIN PA-1/ACH MARKET

7.3 COMPARISON IN TERMS OF TECHNICAL PROPERTIES

7.4 ADVANTAGES OF NISIN BACTERIOCIN

7.4.1 OFFERS HEALTH BENEFITS SUCH AS PREVENTION OF TOOTH DECAY AND TERMINATION OF TUMOR CELLS

7.4.2 INCLUSION OF NISIN IN ACTIVE PACKAGING

7.4.3 SAFE TO USE AS PRESERVATIVES IN FOOD PRODUCTS

7.4.4 EFFECTIVE IN BOTH THERMAL AND NON-THERMAL TREATMENTS

8 MARKET FOR NISIN, BY APPLICATION (Page No. - 66)

8.1 INTRODUCTION

8.1.1 COVID-19 IMPACT ON NISIN MARKET, BY APPLICATION

8.1.1.1 Optimistic Scenario

8.1.1.2 Pessimistic Scenario

8.2 DAIRY PRODUCTS

8.2.1 NISIN TO WITNESS HIGH DEMAND IN THE DAIRY INDUSTRY AS DAIRY PRODUCTS ARE SENSITIVE TO THERMAL AND CHEMICAL PRESERVATIVES

8.3 MEAT, POULTRY & SEAFOOD PRODUCTS

8.3.1 MEAT, POULTRY & SEAFOOD PRODUCTS ARE PRONE TO SPORE AND MOLD INFECTIONS, AND THEREFORE, ARE PROFITABLE MARKETS FOR NISIN

8.4 BEVERAGES

8.4.1 INCREASE IN CONSUMPTION AND EXPORT OF BEVERAGES TO DRIVE THE DEMAND FOR NISIN AS A BIOPRESERVATIVE IN THE FOOD INDUSTRY

8.5 BAKERY & CONFECTIONERY PRODUCTS

8.5.1 RISE IN POPULARITY FOR CLEAN LABEL PRESERVATIVES IN THE BAKERY AND CONFECTIONERY INDUSTRIES TO DRIVE THE DEMAND FOR NISIN

8.6 CANNED & FROZEN FOOD PRODUCTS

8.6.1 THE INCREASE IN DEMAND FOR CANNED AND FROZEN FOOD PRODUCTS DUE TO THE CHANGE IN LIFESTYLE OF CUSTOMERS TO DRIVE THE GROWTH OF THE MARKET

8.7 OTHER APPLICATIONS

9 MARKET for NISIN , BY REGION (Page No. - 86)

9.1 INTRODUCTION

9.1.1 COVID-19 IMPACT ON THE NISIN MARKET

9.1.1.1 Optimistic Scenario

9.1.1.2 Pessimistic Scenario

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 Increase in consumption of vegetarian food products to drive the growth of the dairy market in the US, which, in turn, encourages the demand for nisin

9.2.2 CANADA

9.2.2.1 Increase in demand for meat and processed meat products to drive the growth of the market

9.2.3 MEXICO

9.2.3.1 Unavailability of substitutes for nisin to drive the growth of the market

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Increase in consumption of beverages encourages the growth of the dairy market in Germany, driving the demand for nisin

9.3.2 UK

9.3.2.1 Rise in canned food production and exports to drive the growth of the market in the UK

9.3.3 FRANCE

9.3.3.1 The personal care product market to witness high demand for nisin as an organic preservative

9.3.4 ITALY

9.3.4.1 The lack of alternatives of non-toxic preservatives to drive the demand for nisin in personal care and cosmetics products

9.3.5 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.1.1 The presence of major manufacturers in China has led to a rise in the marketing of nisin

9.4.2 INDIA

9.4.2.1 Increase in consumption of dairy and processed food products to drive the demand for nisin

9.4.3 JAPAN

9.4.3.1 Change in the lifestyle of consumers has led to an increase in demand for clean label products, driving the growth of the market

9.4.4 AUSTRALIA & NEW ZEALAND

9.4.4.1 Nisin is gaining high popularity as meat product preservatives in the country

9.4.5 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD

9.5.1 BRAZIL

9.5.1.1 Increase in food exports to drive the growth of the market in Brazil

9.5.2 ARGENTINA

9.5.2.1 Key applications of biopreservatives have led to an increase in demand for nisin

9.5.3 SOUTH AFRICA

9.5.3.1 Changing consumer demands for organic and clean label products to drive the growth of the market

9.5.4 OTHERS IN ROW

10 NISIN MARKET: GLOBAL CONSUMPTION AND REGULATORY TRENDS (Page No. - 116)

10.1 FACTORS AFFECTING CONSUMPTION

10.1.1 MAJOR MARKET PLAYERS

10.2 REGULATORY PERMISSIBLE LIMITS FOR NISIN

11 COMPETITIVE LANDSCAPE (Page No. - 122)

11.1 INTRODUCTION

11.2 COMPETITIVE LEADERSHIP MAPPING

11.2.1 STAR

11.2.2 PERVASIVE

11.2.3 EMERGING LEADERS

11.2.4 EMERGING COMPANIES

11.3 STRENGTH OF PRODUCT PORTFOLIO

11.4 BUSINESS STRATEGY EXCELLENCE

11.5 RANKING OF KEY PLAYERS, 2019

12 COMPANY PROFILES (Page No. - 126)

(Business Overview, Products Offered, Recent Developments, right to win)*

12.1 DSM

12.2 DUPONT

12.3 GALACTIC SA

12.4 HANDARY S.A.

12.5 SIVEELE B.V.

12.6 ZHEJIANG SILVER-ELEPHANT BIOENGINEERING

12.7 SHANDONG FREDA BIOTECHNOLOGY

12.8 CHIHON BIOTECHNOLOGY

12.9 MAYASAN BIOTECH

12.10 CAYMAN CHEMICAL

*Details on Business Overview, Products Offered, Recent Developments, right to win might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 140)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

LIST OF TABLES (101 Tables)

TABLE 1 USD EXCHANGE RATES CONSIDERED, 2015–2019

TABLE 2 CRITERIA IMPACTING THE GLOBAL ECONOMY

TABLE 3 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

TABLE 4 MARKET SNAPSHOT, 2019 VS. 2025

TABLE 5 CHARACTERISTICS OF NISIN

TABLE 6 MODES OF USING NISIN

TABLE 7 BENEFITS FROM CERTIFICATIONS AND BRANDING OF DIFFERENT INTEREST GROUPS

TABLE 8 NISIN ACTIVITY IN DIFFERENT PH MEDIUM

TABLE 9 CONDITIONS FOR THE GROWTH OF MICROORGANISMS LEADING TO FOOD SPOILAGE

TABLE 10 APPLICATION OF NISIN IN VARIOUS FOOD CATAGORIES

TABLE 11 MAXIMUM PERMISSIBLE LIMIT OF NISIN, BY COUNTRY

TABLE 12 ANTIMICROBIAL APPLICATION AREAS IN FOOD & BEVERAGES

TABLE 13 BACTERIOCIN CLASSIFICATION

TABLE 14 BACTERIOCIN PRODUCING LACTIC ACID BACTERIA (LAB)

TABLE 15 FACTORS AFFECTING NISIN PRODUCTION

TABLE 16 NISIN COMPARISON WITH PEDIOCIN PA-1

TABLE 17 APPLICATIONS OF NISIN & OTHER BACTERIOCIN IN FOOD PRODUCTS

TABLE 18 MARKET SIZE FOR NISIN, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 19 MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 20 OPTIMISTIC SCENARIO: COVID-19 IMPACT ON THE NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 21 PESSIMISTIC SCENARIO: COVID-19 IMPACT ON THE NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 22 DAIRY PRODUCTS: MARKET SIZE FOR NISIN, BY REGION, 2018–2025 (USD MILLION)

TABLE 23 MARKET SIZE FOR DAIRY PRODUCTS, BY REGION, 2018–2025 (TON)

TABLE 24 NORTH AMERICA: MARKET SIZE FOR DAIRY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 25 EUROPE: NISIN MARKET SIZE FOR DAIRY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 ASIA PACIFIC: MARKET SIZE FOR DAIRY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 ROW: MARKET SIZE FOR DAIRY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 28 NISIN MARKET SIZE FOR MEAT, POULTRY & SEAFOOD PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 29 MARKET SIZE FOR MEAT, POULTRY & SEAFOOD PRODUCTS, BY REGION, 2018–2025 (TON)

TABLE 30 NORTH AMERICA: NISIN MARKET SIZE FOR MEAT, POULTRY & SEAFOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 EUROPE: MARKET SIZE FOR MEAT, POULTRY & SEAFOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 32 ASIA PACIFIC: NISIN MARKET SIZE FOR MEAT, POULTRY & SEAFOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 33 ROW:MARKET SIZE FOR MEAT, POULTRY & SEAFOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 MARKET SIZE FOR BEVERAGES, BY REGION, 2018–2025 (USD MILLION)

TABLE 35 MARKET SIZE FOR BEVERAGES, BY REGION, 2018–2025 (TON)

TABLE 36 NORTH AMERICA: NISIN MARKET SIZE FOR BEVERAGES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 37 EUROPE: MARKET SIZE FOR BEVERAGES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 38 ASIA PACIFIC: MARKET SIZE FOR BEVERAGES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 ROW: NISIN MARKET SIZE FOR BEVERAGES, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 NISIN MARKET SIZE FOR BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 41 MARKET SIZE FOR BAKERY & CONFECTIONERY PRODUCTS, BY REGION, 2018–2025 (TON)

TABLE 42 NORTH AMERICA: NISIN MARKET SIZE FOR BAKERY & CONFECTIONERY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 EUROPE: NISIN MARKET SIZE FOR BAKERY & CONFECTIONARY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 44 ASIA PACIFIC: NISIN MARKET SIZE FOR BAKERY & CONFECTIONERY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 45 ROW: NISIN MARKET SIZE FOR BAKERY & CONFECTIONERY PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 46 NISIN MARKET SIZE FOR CANNED & FROZEN FOOD PRODUCTS, BY REGION, 2018–2025 (USD MILLION)

TABLE 47 NISIN MARKET SIZE FOR CANNED & FROZEN FOOD PRODUCTS, BY REGION, 2018–2025 (TON)

TABLE 48 NORTH AMERICA: NISIN MARKET SIZE FOR CANNED & FROZEN FOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 49 EUROPE: NISIN MARKET SIZE FOR CANNED & FROZEN FOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 50 ASIA PACIFIC: NISIN MARKET SIZE FOR CANNED & FROZEN FOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 51 ROW: NISIN MARKET SIZE FOR CANNED & FROZEN FOOD PRODUCTS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 52 NISIN MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

TABLE 53 MARKET SIZE FOR OTHER APPLICATIONS, BY REGION, 2018–2025 (TON)

TABLE 54 NORTH AMERICA: NISIN MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 EUROPE: NISIN MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 56 ASIA PACIFIC: NISIN MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 57 ROW: NISIN MARKET SIZE FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 58 NISIN MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 59 MARKET SIZE, BY REGION, 2018–2025 (TON)

TABLE 60 OPTIMISTIC SCENARIO: MARKET SIZE FOR NISIN, BY REGION, 2018–2021 (USD MILLION)

TABLE 61 PESSIMISTIC SCENARIO: MARKET SIZE FOR NISIN, BY REGION, 2018–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: NISIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 64 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (TON)

TABLE 66 US: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 67 CANADA: PERMITTED NISIN LEVEL

TABLE 68 CANADA: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 MEXICO: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 MAXIMUM PERMITTED LEVELS FOR DIETARY EXPOSURE OF NISIN IN EUROPE (µG/KG BW PER DAY)

TABLE 71 EUROPE: NISIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 73 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 75 GERMANY: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 76 UK: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 77 FRANCE: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 78 ITALY: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 79 REST OF EUROPE: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET SIZE FOR NISIN, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 82 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 84 CHINA: MARKET SIZE FOR NISIN, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 85 INDIA: MARKET SIZE FOR NISIN, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 86 JAPAN: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 AUSTRALIA: MARKET SIZE FOR NISIN, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 REST OF ASIA PACIFIC: MARKET SIZE FOR NISIN, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 89 REST OF WORLD: NISIN MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 90 REST OF WORLD: MARKET SIZE, BY COUNTRY, 2018–2025 (TON)

TABLE 91 REST OF WORLD: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 92 REST OF WORLD: MARKET SIZE, BY APPLICATION, 2018–2025 (TON)

TABLE 93 BRAZIL: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 94 ARGENTINA: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 95 SOUTH AFRICA: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 96 OTHERS IN ROW: NISIN MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 97 NORTH AMERICA NISIN USAGE/ PERMISSIBLE LIMIT, BY COUNTRY

TABLE 98 ASIA PACIFIC NISIN USAGE/ PERMISSIBLE LIMIT, BY COUNTRY

TABLE 99 EUROPE NISIN USAGE/ PERMISSIBLE LIMIT, BY COUNTRY

TABLE 100 NISIN (E234) SPECIFICATIONS DEFINED IN COMMISSION REGULATION (EU) NO231/2012

TABLE 101 ROW NISIN USAGE/ PERMISSIBLE LIMIT, BY COUNTRY

LIST OF FIGURES (43 Figures)

FIGURE 1 MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN

FIGURE 3 DATA TRIANGULATION METHODOLOGY

FIGURE 4 COVID-19 THE GLOBAL PROPAGATION

FIGURE 5 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 6 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 7 NISIN MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET SHARE (VALUE), BY REGION, 2019

FIGURE 9 HEALTH BENEFITS ASSOCIATED WITH PRESERVATION TO DRIVE THE GROWTH OF THE MARKET

FIGURE 10 THE US WAS THE LARGEST MARKET GLOBALLY FOR NISIN IN 2019

FIGURE 11 THE US ACCOUNTED FOR THE LARGEST SHARE IN THE NORTH AMERICAN MARKET IN 2019

FIGURE 12 NORTH AMERICA IS PROJECTED TO DOMINATE THE MARKET FOR NISIN DURING THE FORECAST PERIOD

FIGURE 13 EVOLUTION OF NISIN

FIGURE 14 MARKET DYNAMICS

FIGURE 15 GLOBAL MEAT PRODUCTION, BY REGION, 2014—2018 (MILLION TON)

FIGURE 16 INDIA: AVERAGE ANNUAL GROWTH RATE (AAGR) OF GROSS VALUE-ADDED (GVA) BY FOOD PROCESSING INDUSTRIES, 2012—2018

FIGURE 17 WORLD’S LARGEST FOOD EXPORTING COUNTRIES, 2016 (USD BILLION)

FIGURE 18 INDIA: TWELFTH FIVE YEAR PLAN: EXPENDITURE SHARE ON FOOD PROCESSING SECTOR, 2012–2017

FIGURE 19 GLOBAL AGRI-FOOD EXPORT, 2016—2018 (USD BILLION)

FIGURE 20 INVESTMENT OPPORTUNITIES IN INDIA, 2019

FIGURE 21 ANNUAL GDP GROWTH IN EMERGING ECONOMIES, 2011—2018 (%)

FIGURE 22 NUMBER OF OPERATIONAL CRAFT BREWERIES IN THE US, 2014—2018

FIGURE 23 NUMBER OF COUNTRIES MANDATING FOOD FORTIFICATION, 2011—1019

FIGURE 24 VALUE CHAIN ANALYSIS

FIGURE 25 NATURAL FOOD PRESERVATIVES: SUPPLY CHAIN ANALYSIS

FIGURE 26 FACTORS AFFECTING FOOD SPOILAGE

FIGURE 27 NISIN PRODUCTION PROCESS

FIGURE 28 NISIN: GLOBAL AVERAGE SELLING PRICE (ASP) TREND, 2013-2025

FIGURE 29 MARKET SIZE, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 30 ASIA PACIFIC TO RECORD SIGNIFICANT MARKET GROWTH IN THE NISIN MARKET 2020–2025

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 32 EUROPE: MARKET SNAPSHOT, 2019

FIGURE 33 ASIA PACIFIC: NISIN MARKET SNAPSHOT, 2019

FIGURE 34 MAJOR MARKET PLAYERS, BY REGION

FIGURE 35 INFLUENCING FACTORS ON THE MARKET

FIGURE 36 FACTS & FIGURES, BY APPLICATION

FIGURE 37 NISIN MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 38 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN THE NISIN MARKET

FIGURE 39 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN THE MARKET

FIGURE 40 DSM ACCOUNTED FOR A MAJOR SHARE IN THE NISIN MARKET IN 2019

FIGURE 41 DSM: COMPANY SNAPSHOT

FIGURE 42 DUPONT: COMPANY SNAPSHOT

FIGURE 43 GALACTIC SA: COMPANY SNAPSHOT

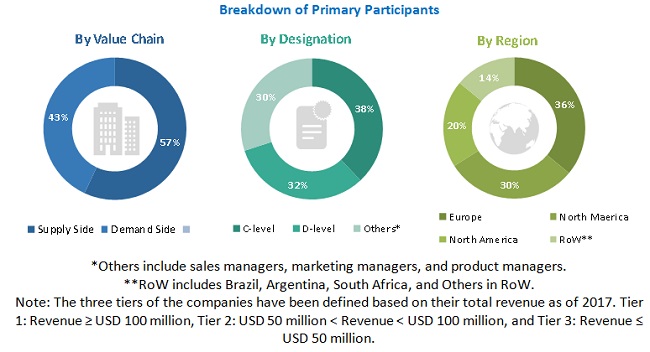

The study involved four major activities in estimating the nisin market size. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to, in order to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

The market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand-side of the market is characterized by the presence of various industrial products processors, such as food & beverage, which includes meat and seafood processors, alcoholic drinks processors and carbonated drinks processors, and research institutions. The supply-side is characterized by the presence of raw material manufacturers, suppliers, distributors, researchers, and service providers. Various primary sources from both the supply- and demand-sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of the primary respondents

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Data Triangulation

After arriving at the overall market size from the estimation process described above, the total nisin market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both top-down and bottom-up approaches. It was then verified through primary interviews. Hence, three approaches were adopted—top-down approach, bottom-up approach, and the one involving expert interviews. Only when the values arrived at from the three points matches, the data is assumed to be correct.

Report Objectives

- To describe and forecast the nisin market, in terms of application, and region

- To describe and forecast the nisin market, in terms of value, by region–Asia Pacific, Europe, North America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the nisin market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the nisin market

- To strategically profile the key players and comprehensively analyze their market position, in terms of ranking and core competencies, along with details on the competitive landscape of market leaders

- To analyze strategic approaches, such as acquisitions & divestments, expansions, product launches & approvals, and agreements, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe into key countries

- Further breakdown of the Rest of Asia Pacific market into key countries.

- Further breakdown of the rest of the world in Brazil, Argentina ,South Africa, and Rest of the World

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Nisin Market