Neuroscience Antibodies & Assays Market by Product (Reagent (Media, Sera, Stain, Enzymes, Probe), Instruments), Technology (Immunoassay (Elisa), Molecular Diagnostics), Application (IVD) & End User (Research Institute, Hospital) - Global Forecast to 2023

The global neuroscience antibodies and assays market is expected to reach USD 4.18 Billion by 2023, at a CAGR of 10.2%. Growth in this market is driven by the rising incidence of neurological diseases, increasing investments in neuroscience research, and growth in the pharmaceutical and biotechnology industries.

The objectives of this study are as follows:

- To define, describe, and forecast the neuroscience antibodies and assays market on the basis of product, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, opportunities, and restraints)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the market size of market segments with respect to four main regions, namely, North America, Europe, Asia, and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, agreements, collaborations, partnerships, new product developments, expansions, and R&D activities in the neuroscience antibodies and assays market

Research Methodology

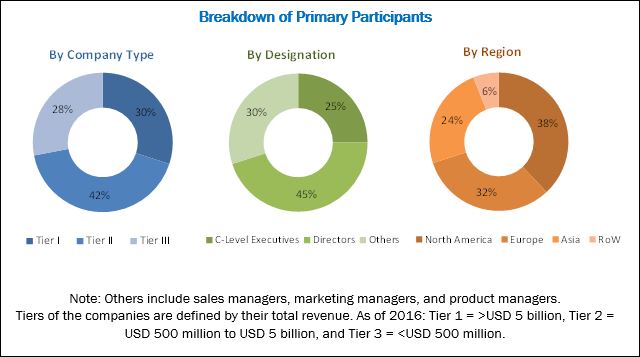

The study estimates the neuroscience antibodies and assays market size for 2018 and projects its demand till 2023. In the primary research process, various sources from both demand side and supply side were interviewed to obtain qualitative and quantitative information for the report. Primary sources from the demand side include research scientists, specialists in neuroscience antibodies and assays, laboratory technicians, and R&D professionals of pharmaceutical & biotechnology companies and academic research institutes.

For the market estimation process, both top-down and bottom-up approaches were used to estimate and validate the market size of the market as well as to estimate the market size of various other dependent submarkets. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report. Secondary sources such as directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies were referred.

To know about the assumptions considered for the study, download the pdf brochure

The market is fragmented, with the presence of several large as well as emerging players. In 2017, Thermo Fisher Scientific (US), Abcam (UK), Bio-Rad (US), and Merck KGaA (Germany) were the leading players in the neuroscience antibodies and assays market. Other major players include BioLegend (US), Cell Signaling Technology (US), F. Hoffmann-La Roche (Switzerland), GenScript (China), Rockland Immunochemicals (US), Santa Cruz Biotechnology (US), Siemens (Germany), and Tecan (Switzerland).

Target Audience for this Report:

- Manufacturers of neuroscience antibodies and assays

- Pharmaceutical and biopharmaceutical companies

- Contract research organizations

- Research and consulting firms

- Life science companies

- Academic research institutes

- In vitro diagnostic product manufacturers

- Distributors and wholesalers of neuroscience antibodies and assays

- Clinical laboratories and hospitals

Neuroscience Antibodies & Assays Market Scope

This report categorizes the neuroscience antibodies and assays market into following segments and subsegments:

By Product

-

Consumables

-

Reagents

- Media & Sera

- Stains & Dyes

- Fixatives

- Buffers

- Solvents

- Probes

- Enzymes, Proteins, & Peptides

- Other Reagents

-

Antibodies

- Primary antibodies

- Secondary Antibodies

- Assay Kits

-

Reagents

-

Instruments

- Microplate Readers

- Immunoassay Analyzers

- Other Instruments

By Technology

-

Immunochemistry/Immunoassays

- ELISA

- Western Blotting

- Others Immunoassays Technologies

- Molecular Diagnostics

- Clinical Chemistry

- Other Technologies

By Application

- Research

- In Vitro Diagnostics

- Drug Discovery and Development

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Hospitals & Diagnostic Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- RoE

- Asia

- Rest of the World

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company‘s specific needs.

The following customization options are available for this report.

Company Information

Detailed analysis and profiling of additional market players (up to 5)

This report segments the market into product, technology, application, end user, and region. Based on product, the neuroscience antibodies and assays market is segmented into equipment and consumables. The consumables segment accounted for the largest market share in 2017 and is expected to register the highest CAGR during the forecast period. The consistent usage of consumables and their frequent purchases, and rising government initiatives in the Genomics and Proteomics research sector are the major factors supporting the growth of this segment.

Based on technology, the market is segmented into immunoassays/immunochemistry, molecular diagnostics, clinical chemistry, and other technologies. The immunoassays/immunochemistry segment is expected to register the highest CAGR during the forecast period. The high growth of this segment is attributed to the development of novel antibodies and assays for immunoassay techniques, technological developments in immunoassays, and rising government initiatives in the genomics and proteomics research sector.

Based on application, the market is segmented into research, drug discovery and development, and in vitro diagnostics. The In Vitro Diagnostics applications segment is expected to register the highest CAGR during the forecast period. The high growth of this segment is attributed to the increasing incidence and prevalence of neurological diseases across the globe, especially in developing countries.

Based on end user, the market is segmented into pharmaceutical and biotechnology companies, academic and research institutes, and hospitals and diagnostic centers. The pharmaceutical and biotechnology companies segment is expected to account for the largest share of the neuroscience antibodies and assays market in 2018. The large share of this segment can be attributed to the high uptake of neuroscience antibodies in the drug discovery and development process and rising government initiatives in the genomics and proteomics research sectors.

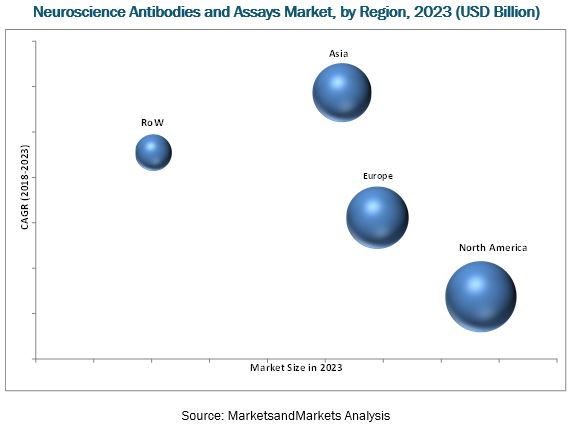

In 2017, North America accounted for the largest market share followed by Europe and Asia. The increasing investments for the development of structure-based drug designs, growing research in the field of genomics and proteomics, rising demand for high-quality research tools for data reproducibility, and the focus of stakeholders on research projects involving proteins, associated biomolecules, and genes are the key factors driving the growth of the market in North America. However, the market in Asia is expected to register the highest CAGR during the forecast period. The high growth in the Asian market is attributed to factors such as growing research on proteomics and genomics, favorable funding scenario, and rising incidence of neurological diseases in the Asian region.

The neuroscience antibodies and assays market is highly competitive with the presence of several small and big players. Prominent players in the market include Thermo Fisher Scientific (US), Abcam (UK), Bio-Rad (US), and Merck KGaA (Germany) were the leading players in the neuroscience antibodies and assays market. Other major players include BioLegend (US), Cell Signaling Technology (US), F. Hoffmann-La Roche (Switzerland), GenScript (China), Rockland Immunochemicals (US), Santa Cruz Biotechnology (US), Siemens (Germany), and Tecan (Switzerland).

Frequently Asked Questions (FAQs):

What is the size of Neuroscience Antibodies & Assays Market?

The global neuroscience antibodies and assays market is expected to reach USD 4.18 Billion by 2023, at a CAGR of 10.2%.

What are the major growth factors of Neuroscience Antibodies & Assays Market?

Growth in this market is driven by the rising incidence of neurological diseases, increasing investments in neuroscience research, and growth in the pharmaceutical and biotechnology industries.

Who all are the prominent players of Neuroscience Antibodies & Assays Market?

Thermo Fisher Scientific (US), Abcam (UK), Bio-Rad (US), and Merck KGaA (Germany) were the leading players in the neuroscience antibodies and assays market. Other major players include BioLegend (US), Cell Signaling Technology (US), F. Hoffmann-La Roche (Switzerland), GenScript (China), Rockland Immunochemicals (US), Santa Cruz Biotechnology (US), Siemens (Germany), and Tecan (Switzerland).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Secondary Data

2.1.1 Secondary Source

2.2 Primary Data

2.2.1 Key Data From Primary Sources

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Neuroscience Antibodies and Assays: Market Overview

4.2 Market, By Product (2018 vs 2023)

4.3 Europe: Market, By Technology (2018)

4.4 Market, By End User (2018–2023)

4.5 Neuroscience Antibodies and Assays Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Incidence of Neurological Diseases

5.2.1.2 Increasing Investments in Neuroscience Research

5.2.1.3 Growth in the Pharmaceutical and Biotechnology Industries

5.2.2 Restraints

5.2.2.1 Quality and Cost Concerns Over the Production of Antibodies

5.2.3 Opportunities

5.2.3.1 Increasing Demand for Personalized Medicine

5.2.3.2 Emerging Markets to Offer Significant Growth Opportunities

5.2.3.3 Growing Focus on Biomarker Discovery

6 Neuroscience Antibodies and Assays Market, By Product (Page No. - 42)

6.1 Introduction

6.2 Consumables

6.2.1 Reagents

6.2.1.1 Media and Sera

6.2.1.2 Stains and Dyes

6.2.1.3 Fixatives

6.2.1.4 Buffers

6.2.1.5 Solvents

6.2.1.6 Enzymes, Proteins, and Peptides

6.2.1.7 Probes

6.2.1.8 Other Reagents

6.2.2 Antibodies

6.2.2.1 Primary Antibodies

6.2.2.2 Secondary Antibodies

6.2.3 Assay Kits

6.3 Instruments

6.3.1 Immunoassay Analyzers

6.3.2 Microplate Readers

6.3.3 Other Instruments

7 Neuroscience Antibodies and Assays Market, By Technology (Page No. - 60)

7.1 Introduction

7.2 Immunoassays/Immunochemistry

7.2.1 Enzyme-Linked Immunosorbent Assay (Elisa)

7.2.2 Western Blotting

7.2.3 Other Immunoassay Technologies

7.3 Molecular Diagnostics

7.4 Clinical Chemistry

7.5 Other Technologies

8 Neuroscience Antibodies and Assays Market, By Application (Page No. - 68)

8.1 Introduction

8.2 Drug Discovery & Development

8.3 Research

8.4 in Vitro Diagnostics

9 Neuroscience Antibodies and Assays Market, By End User (Page No. - 73)

9.1 Introduction

9.2 Pharmaceutical & Biotechnology Companies

9.3 Academic & Research Institutes

9.4 Hospitals & Diagnostics Centers

10 Neuroscience Antibodies and Assays Market, By Region (Page No. - 78)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.3 Europe

10.3.1 Germany

10.3.2 UK

10.3.3 France

10.3.4 Rest of Europe (RoE)

10.4 Asia

10.5 Rest of the World (RoW)

11 Competitive Landscape (Page No. - 113)

11.1 Overview

11.2 Market Share Analysis, 2017

11.3 Competitive Scenario

11.3.1 Agreements, Partnerships, and Collaborations (2015–2018)

11.3.2 Expansions (2015–2018)

11.3.3 Product Launches (2015–2018)

11.3.4 Acquisitions (2015–2018)

12 Company Profiles (Page No. - 120)

(Business Overview, Products Offered, Recent Developments, MnM View)*

12.1 Thermo Fisher Scientific

12.2 Abcam

12.3 Bio-Rad

12.4 Merck KGaA

12.5 Cell Signaling Technology

12.6 Genscript

12.7 Rockland Immunochemicals

12.8 BioLegend

12.9 Santa Cruz Biotechnology

12.10 Tecan

12.11 F. Hoffmann-La Roche

12.12 Siemens

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 148)

13.1 Insights Form Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (103 Tables)

Table 1 Market, By Product, 2016–2023 (USD Million)

Table 2 Market for Consumables, By Type, 2016–2023 (USD Million)

Table 3 Market for Consumables, By Region, 2016–2023 (USD Million)

Table 4 Reagents Market, By Type, 2016–2023 (USD Million)

Table 5 Reagents Market, By Region, 2016–2023 (USD Million)

Table 6 Media & Sera Market, By Region, 2016–2023 (USD Million)

Table 7 Stains and Dyes Market, By Region, 2016–2023 (USD Million)

Table 8 Fixatives Market, By Region, 2016–2023 (USD Million)

Table 9 Buffers Market, By Region, 2016–2023 (USD Million)

Table 10 Solvents Market, By Region, 2016–2023 (USD Million)

Table 11 Enzymes, Proteins, and Peptides Market, By Region, 2016–2023 (USD Million)

Table 12 Probes Market, By Region, 2016–2023 (USD Million)

Table 13 Other Reagents Market, By Region, 2016–2023 (USD Million)

Table 14 Antibodies Market, By Type, 2016–2023 (USD Million)

Table 15 Antibodies Market, By Region, 2016–2023 (USD Million)

Table 16 Primary Antibodies Market, By Region, 2016–2023 (USD Million)

Table 17 Secondary Antibodies Market, By Region, 2016–2023 (USD Million)

Table 18 Assay Kits Market, By Region, 2016–2023 (USD Million)

Table 19 Market for Instruments, By Type, 2016–2023 (USD Million)

Table 20 Market for Instruments, By Region, 2016–2023 (USD Million)

Table 21 Immunoassay Analyzers Market, By Region, 2016–2023 (USD Million)

Table 22 Microplate Readers Market, By Region, 2016–2023 (USD Million)

Table 23 Other Instruments Market, By Region, 2016–2023 (USD Million)

Table 24 Market, By Technology, 2016–2023 (USD Million)

Table 25 Immunoassays/Immunochemistry Market, By Type, 2016–2023 (USD Million)

Table 26 Immunoassays/Immunochemistry Market, By Region, 2016–2023 (USD Million)

Table 27 Elisa Market, By Region, 2016–2023 (USD Million)

Table 28 Western Blotting Market, By Region, 2016–2023 (USD Million)

Table 29 Other Immunoassay Technologies Market, By Region, 2016–2023 (USD Million)

Table 30 Molecular Diagnostics Market, By Region, 2016–2023 (USD Million)

Table 31 Clinical Chemistry Market, By Region, 2016–2023 (USD Million)

Table 32 Other Technologies Market, By Region, 2016–2023 (USD Million)

Table 33 Market, By Application, 2016–2023 (USD Million)

Table 34 Market for Drug Discovery and Development, By Region, 2016–2023 (USD Million)

Table 35 Market for Research Applications, By Region, 2016–2023 (USD Million)

Table 36 Market for in Vitro Diagnostics, By Region, 2016–2023 (USD Million)

Table 37 Market, By End User, 2016–2023 (USD Million)

Table 38 Market for Pharmaceutical & Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 39 Market for Academic & Research Institutes, By Region, 2016–2023 (USD Million)

Table 40 Market for Hospitals & Diagnostic Centers, By Region, 2016–2023 (USD Million)

Table 41 Market, By Region, 2016–2023 (USD Million)

Table 42 North America: Market, By Country, 2016–2023 (USD Million)

Table 43 North America: Market, By Product, 2016–2023 (USD Million)

Table 44 North America: Market for Consumables, By Type, 2016–2023 (USD Million)

Table 45 North America: Reagents Market, By Type, 2016–2023 (USD Million)

Table 46 North America: Antibodies Market, By Type, 2016–2023 (USD Million)

Table 47 North America: Market for Instruments, By Type, 2016–2023 (USD Million)

Table 48 North America: Market, By Technology, 2016–2023 (USD Million)

Table 49 North America: Immunoassays/Immunochemistry Market, By Type, 2016–2023 (USD Million)

Table 50 North America: Market, By Application, 2016–2023 (USD Million)

Table 51 North America: Market, By End User, 2016–2023 (USD Million)

Table 52 US: Market, By Product, 2016–2023 (USD Million)

Table 53 US: Market, By Technology, 2016–2023 (USD Million)

Table 54 US: Market, By Application, 2016–2023 (USD Million)

Table 55 US: Market, By End User, 2016–2023 (USD Million)

Table 56 Canada: Market, By Product, 2016–2023 (USD Million)

Table 57 Canada: Market, By Technology, 2016–2023 (USD Million)

Table 58 Canada: Market, By Application, 2016–2023 (USD Million)

Table 59 Canada: Market, By End User, 2016–2023 (USD Million)

Table 60 Europe: Market, By Country, 2016–2023 (USD Million)

Table 61 Europe: Market, By Product, 2016–2023 (USD Million)

Table 62 Europe: Market for Consumables, By Type, 2016–2023 (USD Million)

Table 63 Europe: Reagents Market, By Type, 2016–2023 (USD Million)

Table 64 Europe: Antibodies Market, By Type, 2016–2023 (USD Million)

Table 65 Europe: Market for Instruments, By Type, 2016–2023 (USD Million)

Table 66 Europe: Market, By Technology, 2016–2023 (USD Million)

Table 67 Europe: Immunoassays/Immunochemistry Market, By Type, 2016–2023 (USD Million)

Table 68 Europe: Market, By Application, 2016–2023 (USD Million)

Table 69 Europe: Market, By End User, 2016–2023 (USD Million)

Table 70 Germany: Market, By Product, 2016–2023 (USD Million)

Table 71 Germany: Market, By Technology, 2016–2023 (USD Million)

Table 72 Germany: Market, By Application, 2016–2023 (USD Million)

Table 73 Germany: Market, By End User, 2016–2023 (USD Million)

Table 74 UK: Market, By Product, 2016–2023 (USD Million)

Table 75 UK: Market, By Technology, 2016–2023 (USD Million)

Table 76 UK: Market, By Application, 2016–2023 (USD Million)

Table 77 UK: Market, By End User, 2016–2023 (USD Million)

Table 78 France: Market, By Product, 2016–2023 (USD Million)

Table 79 France: Market, By Technology, 2016–2023 (USD Million)

Table 80 France: Market, By Application, 2016–2023 (USD Million)

Table 81 France: Market, By End User, 2016–2023 (USD Million)

Table 82 RoE: Market, By Product, 2016–2023 (USD Million)

Table 83 RoE: Market, By Technology, 2016–2023 (USD Million)

Table 84 RoE: Market, By Application, 2016–2023 (USD Million)

Table 85 RoE: Market, By End User, 2016–2023 (USD Million)

Table 86 Asia: Market, By Product, 2016–2023 (USD Million)

Table 87 Asia: Market for Consumables, By Type, 2016–2023 (USD Million)

Table 88 Asia: Reagents Market, By Type, 2016–2023 (USD Million)

Table 89 Asia: Antibodies Market, By Type, 2016–2023 (USD Million)

Table 90 Asia: Market for Instruments, By Type, 2016–2023 (USD Million)

Table 91 Asia: Market, By Technology, 2016–2023 (USD Million)

Table 92 Asia: Immunoassays/Immunochemistry Market, By Type, 2016–2023 (USD Million)

Table 93 Asia: Market, By Application, 2016–2023 (USD Million)

Table 94 Asia: Market, By End User, 2016–2023 (USD Million)

Table 95 RoW: Market, By Product, 2016–2023 (USD Million)

Table 96 RoW: Market for Consumables, By Type, 2016–2023 (USD Million)

Table 97 RoW: Reagents Market, By Type, 2016–2023 (USD Million)

Table 98 RoW: Antibodies Market, By Type, 2016–2023 (USD Million)

Table 99 RoW: Market for Instruments, By Type, 2016–2023 (USD Million)

Table 100 RoW: Market, By Technology, 2016–2023 (USD Million)

Table 101 RoW: Immunoassays/Immunochemistry Market, By Type, 2016–2023 (USD Million)

Table 102 RoW: Market, By Application, 2016–2023 (USD Million)

Table 103 RoW: Market, By End User, 2016–2023 (USD Million)

List of Figures (35 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Market, By Product, 2018 vs 2023 (USD Billion)

Figure 7 Market, By Technology, 2018 vs 2023 (USD Billion)

Figure 8 Market, By Application, 2018 vs 2023 (USD Billion)

Figure 9 Market, By End User, 2018 vs 2023 (USD Billion)

Figure 10 Geographical Snapshot of the Neuroscience Antibodies and Assays Market

Figure 11 Increasing Prevalence of Neurological Diseases–Key Factor Propelling the Market for Neuroscience Antibodies and Assays

Figure 12 Consumables Will Continue to Dominate the Neuroscience Antibodies and Assays Market in 2023

Figure 13 Immunoassays/Immunochemistry to Command the Largest Share of the European Neuroscience Antibodies and Assays Market in 2018

Figure 14 Hospitals and Diagnostics Centers to Register the Highest Growth Rate Between 2018 & 2023

Figure 15 Asia to Witness the Highest Growth in the Neuroscience Antibodies and Assays Market During the Forecast Period (2018–2023)

Figure 16 Market: Drivers, Restraints, and Opportunities

Figure 17 Market, By Product, 2018 vs 2023 (USD Million)

Figure 18 Market, By Technology, 2018 vs 2023 (USD Million)

Figure 19 Market, By Application, 2018 vs 2023 (USD Million)

Figure 20 Market, By End User, 2018 vs 2023 (USD Million)

Figure 21 North America: Market Snapshot

Figure 22 Europe: Market Snapshot

Figure 23 Asia: Market Snapshot

Figure 24 RoW: Market Snapshot

Figure 25 Key Developments in the Market Between 2015 to 2018

Figure 26 Market Evolution Framework

Figure 27 Market Share Analysis, By Key Player, 2017

Figure 28 Thermo Fisher Scientific: Company Snapshot

Figure 29 Abcam: Company Snapshot

Figure 30 Bio-Rad: Company Snapshot

Figure 31 Merck KGaA: Company Snapshot

Figure 32 Genscript: Company Snapshot

Figure 33 Tecan: Company Snapshot

Figure 34 F. Hoffmann-La Roche: Company Snapshot

Figure 35 Siemens: Company Snapshot

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Neuroscience Antibodies & Assays Market