Network Engineering Services Market by Service Type (Network Assessment, Network Design, Network Deployment), Transmission Mode (Wired, Wireless), Organization Size (Large Enterprises, SMEs), Vertical and Region - Global Forecast to 2027

Updated on : March 19, 2024

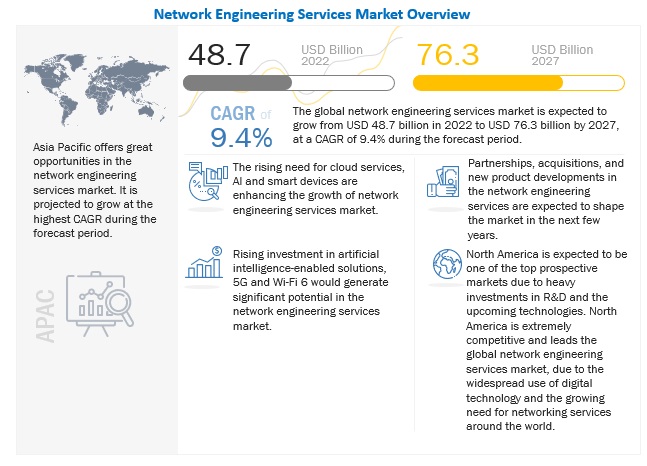

The Network Engineering Services Market is anticipated to expand at a compound annual growth rate (CAGR) of 9.4% from an estimated USD 48.7 billion in 2022 to USD 76.3 billion by 2027.

Dependance of growing data based services on Web hosting

Without a dependable internet connection to keep their servers connected and active all the time, web hosting firms would struggle to stay viable. To guarantee that their clients' sites are live with little downtime, internet dependability is essential. Regular outages will result in negative reviews, irate customers, and a continuous decline in clients who will lose money if their websites are offline. Possible solutions include investing in latest , more reliable and dependable networking solutions and technologies, relying on multiple servers and connections, and upgrading the networking capabilties to a more faster and secure design. All these factors are driving the growth of network engineering services market.

Growing scope of digital marketing

One of the most crucial methods for bringing in new clients and increasing company recognition among the general public is internet marketing. In order to engage with clients, set up and manage ad campaigns, social media, and viral content, internet marketing companies depend on the network availability. Regular internet outages may be very bad for company since they make it virtually impossible for them to do their job effectively which drives the need for scalable and reliable networking solutions.These business and market segments are a driving force for mushrooming network engineering services market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Driver: Growing need of networking services

The increasing investments in sensing technology for automating industrial activities have led to the increased revenue growth of the IoT connectivity industry. The market is experiencing a continuous expansion due to the rising demand for audio devices, automotive entertainment and diagnostic devices, smart city projects, and automation and wearable electronics stacked with networking capabilities. With the introduction of machine-generated data, which is ever growing, these massive amounts of data require fast and wide network bandwidth, which is also a leading factor for the growth of the network engineering services market.

Restraint: Concerns about data security

The risks of data abuse and theft are increasing alongside digitalization. Enterprises possess confidential data, which needs to be protected to avoid data breaches and theft, as it may affect the reputation of enterprises overall. The leaked data could also potentially risk organizations losing their technological advantages, designs, and sourcing information among other sensitive business-oriented data.

Opportunity: Growing network dependent industries

With upcoming industries such as gaming industry, OTT, smart wearables, and smart home devices there are numerous opportunities for growth as all these industries utilize the networking services as a primary component in their own offerings, services, and solutions. AI and cloud services are also providing opportunities for growth of network engineering services market.

Challenge: Security and unauthorized access

Society uses new technologies to decrease the scope of defection what attackers can get away with, and attackers use new technologies to increase it. Society must implement any new security technology as a group, which implies agreement and coordination and, in some instances, a lengthy bureaucratic procurement process. These processes and coordination activities take a long time and security leaks can be exploited in meantime which presents a concern for businesses and service providers.

Based on service type, the network design segment is projected to account for the highest CAGR during the forecast period

There is a considerable growing need for cloud computing, data storage services and AI solutions due to a sequentially increasing growth in markets of data consuming products and services such as smart wearable devices, OTT, smart factories, connected logistic systems among others. These markets consume networking services as an input for their own products which leads to a direct requirement for a design custom tailored for the particular business and market. These designs define the efficiency, scalability for future needs and the costs for development and deployment. An efficient design is especially important in case of machine generated data and big data analytics where each click by customer on an ecommerce platform is utilized by organization for decision making. A suitable and scalable solution could save a business considerable cost at time of upgrading and avoiding missed opportunities due to a frequent fault sensitive system. In such cases, adopting a suitable network design has become vital for sustainability of any networking dependent business. Network design form an integral part of network engineering services.

Based on vertical, BFSI segment is projected to account for the highest CAGR during the forecast period.

Online deposits, mobile wallets, e-bill payments, and so on have fundamentally become a norm for how financial transactions are carried out nowadays. Open banking is a crucial component of financial firms' growth and competition strategies. Banks establish a single interface through which clients may access their services by integrating their financial solutions into software developed by third parties. Banks make their services available to their clients across applications for simple payments by collaborating with fintech. Open banking services enable online payments when using popular food delivery apps to place a meal order or digital payments while using famous cab ride apps.

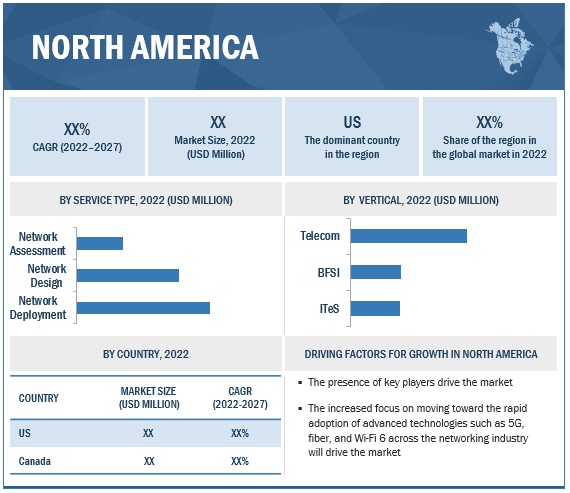

By Region, North America to account for the largest market size during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

North America to account for the largest market size during the forecast period

North America’s strong financial position allows it to invest heavily in the adoption of the latest, leading tools and technologies for ensuring effective business operations. Such advantages help organizations in this region gain a competitive edge over organizations in other regions. The region is an early adopter of network solutions and has advanced IT infrastructure. The advancements in technologies and automation across industries have transformed the way customers interact and engage with organizations across industries. The growing ICT investments in North America are expected to boost the demand for network engineering services during the forecast period.

Market Players

The report includes the study of key players offering network engineering services market offerings. It profiles major vendors in the global network engineering services market. The major vendors include Cisco (US), IBM (US), Ericsson (Sweden), Huawei (China), Juniper Networks (US), HCL Technologies (India), Infosys (India), NTT Global Networks (US), Fujitsu (Japan), Cyient (Hyderabad), CSS Corp (US), Accenture (Ireland), Aviat Networks (US), AT&T (US), Wipro (India), TCS (India), Tech Mahindra (India), Mphasis (India), CODETRU (US), Inspira Enterprise (India), Advance Digital Systems (US), Nexius (US), Hughes Systique (US), CHR Solutions (US), Velocis Systems (India), IMMCO (US), Sincera (US), and Vertikal6 (US). These vendors have a strong foothold in local and global markets due to their strong product portfolios and well-established strategic alliances. Besides, in the unorganized sector, there are several vendors who collectively hold a considerable share in the market.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2027 |

USD 76.3 Billion |

|

Market size value in 2022 |

USD 48.7 Billion |

|

Growth rate |

9.4% CAGR |

|

Largest Market |

North America |

|

Market Drivers |

|

|

Market Opportunities |

|

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Segments Covered |

Service type (Assessment, Design, Deployment), Transmission Mode (Wired, Wireless), Organization Size, Vertical, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Cisco (US), IBM (US), Ericsson (Sweden), Huawei (China), Juniper Networks (US), HCL Technologies (India), Infosys (India), NTT Global Networks (US), Fujitsu (Japan), Cyient (Hyderabad), CSS Corp (US), Accenture (Ireland), Aviat Networks (US), AT&T (US), Wipro (India), TCS (India), Tech Mahindra (India), Mphasis (India), CODETRU (US), Inspira Enterprise (India), Advance Digital Systems (US), Nexius (US), Hughes Systique (US), CHR Solutions (US), Velocis Systems (India), IMMCO (US), Sincera (US), and Vertikal6 (US). |

This research report categorizes the network engineering services market to forecast revenues and analyze trends in each of the following submarkets:

Based on Service type, the network engineering services market has the following segments:

- Network Assessment

- Network Design

- Network Deployment

Based on Transmission mode, the market has the following segments:

- Wired

- Wireless

Based on Organization Size, the network engineering services market has the following segments:

- SMEs

- Large Enterprises

Based on Vertical, the market has the following segments:

- Telecom

- Banking, Financial Services, and Insurance

- Education

- Energy and Utilities

- Healthcare

- ITeS

- Manufacturing

- Media and Entertainment

- Government

- Other Verticals

Based on regions, the network engineering services market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

MEA

- United Arab Emirates

- Kingdom of Saudi Arabia

- South Africa

- Rest of MEA

Recent Developments:

- In July 2022, Mphasis grants ?21 crore to IIT M for fundamental and applied research in quantum technologies. Indian Institute of Technology Madras and Mphasis, an IT solutions provider signed a Memorandum of Understanding (MoU) to create a hub for quantum science and technology that produces top-quality graduates by promoting fundamental and applied research in quantum technologies.

- In Aug 2022, SkyMax and Ericsson have signed a Memorandum of Understanding (MoU) to create a partnership aimed at building a next generation 5G broadband network, inclusive of a digital services delivery platform, across Sub-Saharan Africa (SSA).

- In Aug 2022, Achieving the Compliance and Privacy distinction in the AWS Security Competency differentiates TCS as an AWS Partner that provides specialized consulting services designed to help the largest global enterprises adopt, develop and deploy security into their AWS environments increasing their overall security posture on AWS.

- In Aug 2022, Ericsson introduced a new triple-band, tri-sector radio that can do the job of nine radios. Radio 6646 cuts energy consumption by 40 percent compared to triple-band single-sector radios and, with reduced weight – including use of aluminum – by 60 percent, minimizes site footprint as well.

- In Sep 2022, Juniper Networks announced Apstra Freeform, the newest expansion to its multivendor data center automation and assurance platform. This capability allows Juniper’s enterprise, service provider and cloud provider customers to manage and automate their data center operations regardless of topology and protocols used.

Frequently Asked Questions (FAQ):

What is the projected market value of the global network engineering services market?

The global network engineering services market is expected to grow from USD 48.7 Billion in 2022 to USD 76.3 Billion by 2027, at a CAGR of 9.4% during the forecast period.

Which region has the highest market share in the network engineering services market?

North America is expected to hold the largest market share in the network engineering services market. The region being an early adopter of technologies with major investments in R&D and the advent of upcoming technologies, such as 6G and Wi-Fi 6, are factors expected to drive the growth of the network engineering services market in the region.

Who are the major vendors in the market?

Major vendors in the network engineering services market are Cisco (US), IBM (US), Ericsson (Sweden), Huawei (China), Juniper Networks (US), HCL Technologies (India), Infosys (India), NTT Global Networks (US), Fujitsu (Japan), Cyient (Hyderabad), CSS Corp (US), Accenture (Ireland), Aviat Networks (US), AT&T (US), Wipro (India), TCS (India), Tech Mahindra (India), Mphasis (India). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 NETWORK ENGINEERING SERVICES MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

FIGURE 2 MARKET: REGIONAL SCOPE

1.3.3 INCLUSIONS AND EXCLUSIONS

1.3.4 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2019–2021

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 3 NETWORK ENGINEERING SERVICES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Primary interviews with experts

2.1.2.2 List of key primary interview participants

2.1.2.3 Breakdown of primaries

2.1.2.4 Primary sources

2.1.2.5 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES

2.2.2 TOP-DOWN APPROACH

FIGURE 6 TOP-DOWN APPROACH

2.2.3 NETWORK ENGINEERING SERVICES MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

2.2.4 MARKET ESTIMATION: SUPPLY-SIDE ANALYSIS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.4.1 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: MARKET

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 10 MARKET: REGIONAL AND COUNTRY-WISE SHARE, 2022

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 NETWORK ENGINEERING SERVICES: BRIEF OVERVIEW

FIGURE 11 ADVANCEMENTS IN NETWORKING TECHNOLOGY TO DRIVE MARKET

4.2 NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE

FIGURE 12 NETWORK DEPLOYMENT TO DOMINATE BY 2027

4.3 MARKET, BY TRANSMISSION MODE

FIGURE 13 WIRED SEGMENT TO DOMINATE IN 2022

4.4 MARKET, BY ORGANIZATION SIZE

FIGURE 14 LARGE ENTERPRISES TO DOMINATE BY 2027

4.5 MARKET, BY VERTICAL

FIGURE 15 TELECOM TO DOMINATE BY 2027

4.6 ASIA PACIFIC: MARKET, BY SERVICE TYPE AND VERTICAL

FIGURE 16 NETWORK DEPLOYMENT AND TELECOM TO ACCOUNT FOR SIGNIFICANT MARKET SHARES IN 2022

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 NETWORK ENGINEERING SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing investments in IoT devices

5.2.1.2 Trend of connected wearables gaining momentum

5.2.1.3 Growing need for Big Data

5.2.1.4 Shift toward OTT

5.2.2 RESTRAINTS

5.2.2.1 Growing concerns over data security

5.2.3 OPPORTUNITIES

5.2.3.1 Immersive gaming and virtual reality market

5.2.3.2 Unleashing AI

5.2.4 CHALLENGES

5.2.4.1 Concerns about unauthorized access

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 18 NETWORK ENGINEERING SERVICES MARKET: VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

TABLE 3 MARKET: ECOSYSTEM

5.5 TECHNOLOGY ANALYSIS

5.5.1 5G

5.5.2 FIBER OPTIC CONNECTION

5.5.3 SD-LAN

5.6 PATENT ANALYSIS

FIGURE 19 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS

TABLE 4 TOP 20 PATENT OWNERS (US)

FIGURE 20 NUMBER OF PATENTS GRANTED YEARLY, 2012–2021

5.7 KEY CONFERENCES AND EVENTS DURING 2022–2023

TABLE 5 NETWORK ENGINEERING SERVICES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2022-2023

5.8 REGULATORY LANDSCAPE

5.8.1 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION

5.8.2 INSTITUTE OF ELECTRICAL AND ELECTRONICS ENGINEERS

5.8.3 GENERAL DATA PROTECTION REGULATION

5.8.4 CEN/ISO

5.8.5 CEN/CENELEC

5.8.6 EUROPEAN TELECOMMUNICATIONS STANDARDS INSTITUTE

5.8.7 ITU-T

5.8.8 FEDERAL COMMUNICATIONS COMMISSION (FCC)

5.8.9 STATE RADIO REGULATORY COMMISSION (SRRC)

5.8.10 WIRELESS PLANNING & COORDINATION WING (WPC)

5.8.11 MINISTRY OF INTERNAL AFFAIRS AND COMMUNICATIONS (MIC)

5.9 PORTER’S FIVE FORCES MODEL

FIGURE 21 NETWORK ENGINEERING SERVICES: PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES IMPACT ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

TABLE 7 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

5.10.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

TABLE 8 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY 1: BUILDING CAAS & PAAS PLATFORM WITH 5G

5.11.2 CASE STUDY 2: INSTALLING WIRELESS NETWORK FOR 5 KM RADIUS CAMPUS

5.11.3 CASE STUDY 3: ENERGY SAVINGS USING NETWORKED WAREHOUSES

5.11.4 CASE STUDY 4: CONNECTED SERVICE DELIVERY PLATFORM

6 NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE (Page No. - 63)

6.1 INTRODUCTION

6.1.1 SERVICE TYPE: MARKET DRIVERS

FIGURE 24 NETWORK DESIGN TO GROW AT HIGHEST CAGR

TABLE 9 MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 10 MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

6.2 NETWORK ASSESSMENT

6.2.1 NEED TO IDENTIFY NETWORK’S CAPABILITIES

TABLE 11 NETWORK ASSESSMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 12 NETWORK ASSESSMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 NETWORK DESIGN

6.3.1 NEED FOR EFFECTIVE NETWORK DESIGN TO DRIVE DEMAND

TABLE 13 NETWORK DESIGN: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 14 NETWORK DESIGN: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.4 NETWORK DEPLOYMENT

6.4.1 SOFTWARE-DRIVEN APPROACH TO DRIVE MARKET

TABLE 15 NETWORK DEPLOYMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 16 NETWORK DEPLOYMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 NETWORK ENGINEERING SERVICES MARKET, BY TRANSMISSION MODE (Page No. - 69)

7.1 INTRODUCTION

7.1.1 TRANSMISSION MODE: MARKET DRIVERS

TABLE 17 MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 18 MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

FIGURE 25 WIRELESS SEGMENT TO GROW AT HIGHER CAGR

7.2 WIRED

7.2.1 NEED TO PROVIDE BETTER CONNECTIVITY AND SECURED SERVICES

TABLE 19 WIRED: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 WIRED: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 WIRELESS

7.3.1 NEED FOR SECURE, ROBUST, AND HIGH-PERFORMANCE NETWORKS

TABLE 21 WIRELESS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 22 WIRELESS: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 NETWORK ENGINEERING SERVICES MARKET, BY ORGANIZATION SIZE (Page No. - 74)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZE: MARKET DRIVERS

FIGURE 26 SMES TO GROW AT HIGHER CAGR

TABLE 23 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 24 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 NEED TO SUSTAIN IN COMPETITIVE MARKET ALONG WITH INVESTMENT IN R&D AND LATEST TECHNOLOGIES

TABLE 25 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 DIGITALIZATION ACROSS SMES TO DRIVE MARKET

TABLE 27 SMES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 28 SMES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 NETWORK ENGINEERING SERVICES MARKET, BY VERTICAL (Page No. - 79)

9.1 INTRODUCTION

9.1.1 VERTICAL: MARKET DRIVERS

FIGURE 27 BFSI TO GROW AT HIGHEST CAGR

TABLE 29 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 30 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 TELECOM

9.2.1 NEED FOR CSPS TO LEVERAGE AND INTEGRATE ADVANCED TECHNOLOGIES

TABLE 31 TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

9.3.1 NEED TO EMPHASIZE ON IMPROVING CUSTOMER SERVICES AND INSTANT QUERY RESOLUTION

TABLE 33 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 EDUCATION

9.4.1 GROWING NUMBER OF COMPUTER & MOBILE PERIPHERAL DEVICES AND HIGH-SPEED NETWORKING

TABLE 35 EDUCATION: NETWORK ENGINEERING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 EDUCATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 ENERGY AND UTILITIES

9.5.1 MODERNIZATION AND DIGITALIZATION TO DRIVE MARKET

TABLE 37 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 HEALTHCARE

9.6.1 GROWING ADOPTION OF CONNECTED AND WEARABLE DEVICES

TABLE 39 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 ITES

9.7.1 INCREASE IN VOLUMINOUS DATA GENERATION AND UPSURGE IN INTERNET TRAFFIC

TABLE 41 ITES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MANUFACTURING

9.8.1 GROWING ADOPTION OF CONNECTED DEVICES AND SMART MANUFACTURING

TABLE 43 MANUFACTURING: NETWORK ENGINEERING SERVICES MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 MEDIA AND ENTERTAINMENT

9.9.1 NEED TO IMPROVE USER EXPERIENCE BY MIGRATING CREATIVE CONTENT TO EDGE OF ROBUST 5G NETWORK

TABLE 45 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 GOVERNMENT

9.10.1 EMPHASIS ON DIGITAL TRANSFORMATION ACROSS GOVERNMENT SECTORS

TABLE 47 GOVERNMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHER VERTICALS

TABLE 49 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 50 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 NETWORK ENGINEERING SERVICES MARKET, BY REGION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 28 MARKET: REGIONAL SNAPSHOT (2022)

FIGURE 29 MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 PESTLE ANALYSIS: NORTH AMERICA

FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

TABLE 53 NORTH AMERICA: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.2 US

10.2.2.1 Presence of key players to drive market

TABLE 63 US: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 64 US: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 65 US: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 66 US: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 67 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 68 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 69 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 70 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Upcoming smart cities and innovative technologies

TABLE 71 CANADA: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 72 CANADA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 73 CANADA: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 74 CANADA: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 75 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 76 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 77 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 78 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 PESTLE ANALYSIS: EUROPE

TABLE 79 EUROPE: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 86 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 88 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Government measures to protect IoT devices

TABLE 89 UK: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 90 UK: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 91 UK: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 92 UK: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 93 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 94 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 95 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 96 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 France to be leading country for smart home devices

10.3.4 GERMANY

10.3.4.1 Healthcare sector to opt for wearable devices

10.3.5 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 PESTLE ANALYSIS: ASIA PACIFIC

FIGURE 31 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 97 ASIA PACIFIC: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 99 ASIA PACIFIC: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 100 ASIA PACIFIC: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Growing market for modules and transmitters

TABLE 107 CHINA: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 108 CHINA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 109 CHINA: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 110 CHINA: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 111 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 112 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 113 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 114 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Globalization of Japanese entertainment media

10.4.4 INDIA

10.4.4.1 Increasing adoption of smart devices

10.4.5 REST OF ASIA PACIFIC

10.4.5.1 Need to modernize legacy systems to drive market

10.5 MIDDLE EAST AND AFRICA

10.5.1 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

TABLE 115 MIDDLE EAST AND AFRICA: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 116 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 117 MIDDLE EAST AND AFRICA: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 118 MIDDLE EAST AND AFRICA: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 119 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 120 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 121 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 122 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 123 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 124 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.2 UNITED ARAB EMIRATES

10.5.2.1 Adoption of smart technology

TABLE 125 UNITED ARAB EMIRATES: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 126 UNITED ARAB EMIRATES: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 127 UNITED ARAB EMIRATES: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 128 UNITED ARAB EMIRATES: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 129 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 130 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 131 UNITED ARAB EMIRATES: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 132 UNITED ARAB EMIRATES: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.3 KINGDOM OF SAUDI ARABIA

10.5.3.1 Government initiatives to develop networked logistics and transportation systems

10.5.4 SOUTH AFRICA

10.5.4.1 Incremental spending on IT infrastructure to drive market

10.5.5 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 PESTLE ANALYSIS: LATIN AMERICA

TABLE 133 LATIN AMERICA: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 134 LATIN AMERICA: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 135 LATIN AMERICA: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 136 LATIN AMERICA: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 137 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 138 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 139 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 140 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 141 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 142 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.2 BRAZIL

10.6.2.1 Growing volume of smart medical devices

TABLE 143 BRAZIL: NETWORK ENGINEERING SERVICES MARKET, BY SERVICE TYPE, 2016–2021 (USD MILLION)

TABLE 144 BRAZIL: MARKET, BY SERVICE TYPE, 2022–2027 (USD MILLION)

TABLE 145 BRAZIL: MARKET, BY TRANSMISSION MODE, 2016–2021 (USD MILLION)

TABLE 146 BRAZIL: MARKET, BY TRANSMISSION MODE, 2022–2027 (USD MILLION)

TABLE 147 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 148 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 149 BRAZIL: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 150 BRAZIL: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.3 MEXICO

10.6.3.1 Digital transformation to drive market growth

10.6.4 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 142)

11.1 KEY PLAYER STRATEGIES

TABLE 151 KEY PLAYER STRATEGIES IN NETWORK ENGINEERING SERVICES MARKET

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 32 MARKET EVALUATION FRAMEWORK

11.3 MARKET SHARE ANALYSIS

FIGURE 33 MARKET SHARE ANALYSIS OF COMPANIES IN NETWORK ENGINEERING SERVICES

FIGURE 34 MARKET SHARE ANALYSIS

TABLE 152 NETWORK ENGINEERING SERVICES: DEGREE OF COMPETITION

11.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 35 REVENUE ANALYSIS OF TOP FIVE LEADING PLAYERS, 2019–2021

11.5 COMPETITIVE BENCHMARKING

TABLE 153 COMPANY FOOTPRINT, BY TOP 3 VERTICALS

TABLE 154 COMPANY FOOTPRINT, BY REGION

TABLE 155 NETWORK ENGINEERING SERVICE MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 156 NETWORK ENGINEERING SERVICE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

11.6 COMPANY EVALUATION MATRIX

11.6.1 DEFINITIONS AND METHODOLOGY

TABLE 157 COMPANY EVALUATION MATRIX: CRITERIA AND WEIGHTAGE

11.6.2 STARS

11.6.3 EMERGING LEADERS

11.6.4 PERVASIVE PLAYERS

11.6.5 PARTICIPANTS

FIGURE 36 NETWORK ENGINEERING SERVICES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

11.7 SMALL AND MEDIUM ENTERPRISES/START-UPS: EVALUATION MATRIX

11.7.1 DEFINITIONS AND METHODOLOGY

TABLE 158 EVALUATION MATRIX OF SMES AND START-UPS: CRITERIA WEIGHTAGE

11.7.2 PROGRESSIVE COMPANIES

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.7.5 STARTING BLOCKS

FIGURE 37 NETWORK ENGINEERING SERVICES MARKET (GLOBAL): SME/START-UP EVALUATION MATRIX, 2022

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES

TABLE 159 PRODUCT LAUNCHES, 2019–2022

11.8.2 DEALS

TABLE 160 DEALS, 2019–2022

12 COMPANY PROFILES (Page No. - 165)

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

12.1 MAJOR PLAYERS

12.1.1 CISCO

TABLE 161 CISCO: BUSINESS OVERVIEW

FIGURE 38 CISCO: COMPANY SNAPSHOT

TABLE 162 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 163 CISCO: DEALS

12.1.2 IBM

TABLE 164 IBM: BUSINESS OVERVIEW

FIGURE 39 IBM: COMPANY SNAPSHOT

TABLE 165 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 166 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 167 IBM: DEALS

12.1.3 ERICSSON

TABLE 168 ERICSSON: BUSINESS OVERVIEW

FIGURE 40 ERICSSON: COMPANY SNAPSHOT

TABLE 169 ERICSSON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 170 ERICSSON: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 171 ERICSSON: DEALS

12.1.4 HUAWEI

TABLE 172 HUAWEI: BUSINESS OVERVIEW

TABLE 173 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 174 HUAWEI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 175 HUAWEI: DEALS

12.1.5 JUNIPER NETWORKS

TABLE 176 JUNIPER NETWORKS: BUSINESS OVERVIEW

FIGURE 41 JUNIPER NETWORKS: COMPANY SNAPSHOT

TABLE 177 JUNIPER NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 178 JUNIPER NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 179 JUNIPER NETWORKS: DEALS

12.1.6 HCL TECHNOLOGIES

TABLE 180 HCL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 42 HCL TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 181 HCL TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 182 HCL TECHNOLOGIES: DEALS

12.1.7 INFOSYS

TABLE 183 INFOSYS: BUSINESS OVERVIEW

FIGURE 43 INFOSYS: COMPANY SNAPSHOT

TABLE 184 INFOSYS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 185 INFOSYS: DEALS

12.1.8 NTT GLOBAL NETWORKS

TABLE 186 NTT GLOBAL NETWORKS: BUSINESS OVERVIEW

TABLE 187 NTT GLOBAL NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.9 FUJITSU

TABLE 188 FUJITSU: BUSINESS OVERVIEW

TABLE 189 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 190 FUJITSU: DEALS

12.1.10 CYIENT

TABLE 191 CYIENT: BUSINESS OVERVIEW

FIGURE 44 CYIENT: COMPANY SNAPSHOT

TABLE 192 CYIENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.11 CSS CORP

TABLE 193 CSS CORP: BUSINESS OVERVIEW

TABLE 194 CSS CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 195 CSS CORP: DEALS

12.1.12 ACCENTURE

TABLE 196 ACCENTURE: BUSINESS OVERVIEW

FIGURE 45 ACCENTURE: COMPANY SNAPSHOT

TABLE 197 ACCENTURE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 198 ACCENTURE: DEALS

12.1.13 AVIAT NETWORKS

TABLE 199 AVIAT NETWORKS: BUSINESS OVERVIEW

FIGURE 46 AVIAT NETWORKS: COMPANY SNAPSHOT

TABLE 200 AVIAT NETWORKS: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 201 AVIAT NETWORKS: DEALS

12.1.14 AT&T

TABLE 202 AT&T: BUSINESS OVERVIEW

FIGURE 47 AT&T: COMPANY SNAPSHOT

TABLE 203 AT&T: SOLUTIONS OFFERED

TABLE 204 AT&T: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 205 AT&T: DEALS

12.1.15 WIPRO

12.1.16 TCS

12.1.17 TECH MAHINDRA

12.1.18 MPHASIS

*Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 START-UPS/SMES

12.2.1 HUGHES SYSTIQUE CORPORATION

12.2.2 NEXIUS

12.2.3 ADVANCE DIGITAL SYSTEMS

12.2.4 INSPIRA ENTERPRISE

12.2.5 CODETRU

12.2.6 CHR SOLUTIONS

12.2.7 VELOCIS SYSTEMS

12.2.8 IMMCO

12.2.9 VERTIKAL6

12.2.10 SINCERA

13 ADJACENT MARKETS (Page No. - 220)

13.1 INTRODUCTION

13.1.1 LIMITATIONS

13.1.2 NETWORK AS A SERVICE MARKET

13.1.2.1 Market definition

13.1.2.2 Network as a Service Market, by type

TABLE 206 NETWORK AS A SERVICE MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 207 NETWORK AS A SERVICE MARKET, BY TYPE, 2022–2027 (USD MILLION)

13.1.2.3 Network as a Service Market, by application

TABLE 208 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 209 NETWORK AS A SERVICE MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

13.1.2.4 Network as a Service Market, by organization size

TABLE 210 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 211 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.1.2.5 Network as a Service Market, by end user

TABLE 212 NETWORK AS A SERVICE MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 213 NETWORK AS A SERVICE MARKET, BY END USER, 2022–2027 (USD MILLION)

13.1.2.6 Network as a Service Market, by region

TABLE 214 NETWORK AS A SERVICE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 215 NETWORK AS A SERVICE MARKET, BY REGION, 2022–2027 (USD MILLION)

13.1.3 NETWORK MANAGEMENT SYSTEM MARKET

13.1.3.1 Market definition

13.1.3.2 Network management system market, by component

TABLE 216 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 217 NETWORK MANAGEMENT SYSTEM MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13.1.3.3 Network management system market, by solution

TABLE 218 NETWORK MANAGEMENT SOLUTIONS MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 219 NETWORK MANAGEMENT SOLUTIONS MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

13.1.3.4 Network management system market, by service

TABLE 220 NETWORK MANAGEMENT SERVICES MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 221 NETWORK MANAGEMENT SERVICES MARKET, BY SERVICE, 2022–2027 (USD MILLION)

13.1.3.5 Network Management System market, by deployment mode

TABLE 222 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2016–2021 (USD MILLION)

TABLE 223 NETWORK MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

13.1.3.6 Network management system market, by organization size

TABLE 224 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 225 NETWORK MANAGEMENT SYSTEM MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

13.1.3.7 Network Management System market, by end user

TABLE 226 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2016–2021 (USD MILLION)

TABLE 227 NETWORK MANAGEMENT SYSTEM MARKET, BY END USER, 2022–2027 (USD MILLION)

13.1.3.8 Network Management System market, by service provider

TABLE 228 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE PROVIDER, 2016–2021 (USD MILLION)

TABLE 229 NETWORK MANAGEMENT SYSTEM MARKET, BY SERVICE PROVIDER, 2022–2027 (USD MILLION)

13.1.3.9 Network Management System market, by vertical

TABLE 230 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 231 NETWORK MANAGEMENT SYSTEM MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

13.1.3.10 Network management system market, by region

TABLE 232 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 233 NETWORK MANAGEMENT SYSTEM MARKET, BY REGION, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 234)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

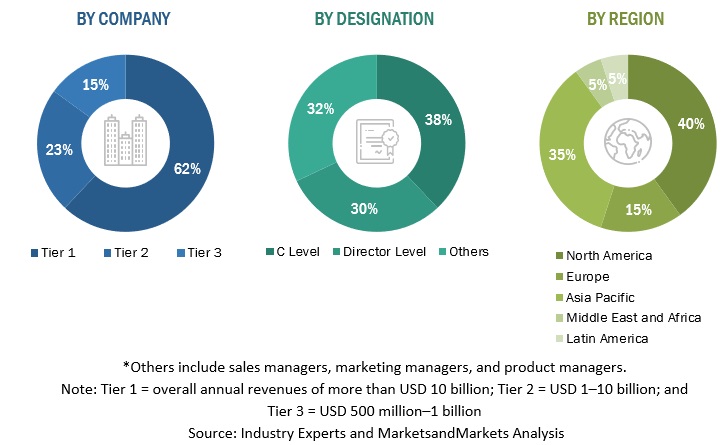

This research study involved the usage of extensive secondary sources, directories, and databases such as D&B Hoovers and Bloomberg BusinessWeek to identify and collect information useful for this technical, market-oriented, and commercial study of the global network engineering services market. The primary sources were mainly several industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess prospects. The following illustration shows the market research methodology applied in making this report on the network engineering services market.

Secondary Research

In the secondary research process, various sources were referred to, to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendor websites.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing experts; related key executives from network engineering service providers, system integrators, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using network engineering services, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of network engineering services impacting the overall market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the network engineering services market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each offering of various vendors was evaluated based on the breadth of services, deployment modes, interaction types, business functions, applications, and verticals. The aggregate revenue of all companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Report Objectives

- To determine and forecast the global network engineering services market By Service type (Network Assessment, Network Design, Network Deployment), Transmission Mode (Wired, Wireless), Organization Size, Vertical, and Region from 2022 to 2027, and analyze the various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the network engineering services market

- To profile the key market players; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product developments, and partnerships and collaborations in the market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Network Engineering Services Market