Nasal Drug Delivery Technology Market by Dosage Form (Nasal Drops, Sprays, Powder, Gel), System (Multidose, Unit Dose, BI-Dose), Therapeutic Applications (Rhinitis, Congestion, Vaccinations), End User (Hospitals, Homecare) - Global Forecast to 2021

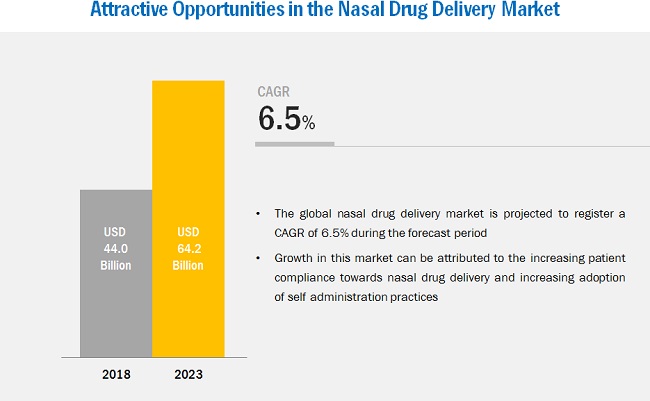

[212 Pages Report] The global nasal drug delivery technology market is projected to reach USD 64.20 billion by 2021 from USD 44.00 billion in 2016, at a CAGR of 6.5% during the forecast period. Increasing patient preference for nasal drug delivery as a result of easy administration & better efficacy and growing adoption of self-administration practices are some of the major factors driving the growth of the nasal drug delivery technology market. Intranasal drug delivery is one of the most preferred drug delivery routes among patients as well as healthcare providers. This can be majorly attributed to the non-invasive nature of this route of delivery and the fact that drug absorbability is higher through the nasal route.

Market Dynamics

Drivers

- Increasing patient preference for nasal drug delivery as a result of easy administration and better efficacy

- Growing adoption of self-administration practices

Restraints

- Complications associated with the overuse of nasal sprays

Challenges

- Regulatory hurdles

Increasing patient preference for nasal drug delivery as a result of easy administration and better efficacy

Intranasal drug delivery is one of the most preferred drug delivery routes among patients as well as healthcare providers. This can majorly be attributed to the non-invasive nature of this route of delivery and the fact that drug absorbability is higher through the nasal route. In addition, the nasal route offers a less hostile environment as compared to the gastro-intestinal route; this enables better absorption of drugs. Moreover, nasal drug delivery, unlike some other routes of drug delivery, dose not require any sterile method for administering drugs into the body.The easy administration of these drugs plays a crucial role in improving the compliance to drug therapies among patients, which in turn drives patient outcomes.Considering these factors, the preference for nasal drug delivery is increasing among patients as well as healthcare providers.

The following are the major objectives of the study.

- To define, describe, and forecast the nasal drug delivery technology market on the basis of product, type, distribution channel, application, and end user

- To provide detailed information regarding the major factors influencing growth of the nasal drug delivery technology market (drivers, restraints, opportunities, challenges)

- To analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the nasal drug delivery technology market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to four main regions, namely, North America, Asia, Europe, and the Rest of the World (RoW)2

- To strategically profile the key players and comprehensively analyze their market shares and core competencies3

- To track and analyze competitive developments such as joint ventures, mergers and acquisitions, new product developments, and expansions in the nasal drug delivery technologies market

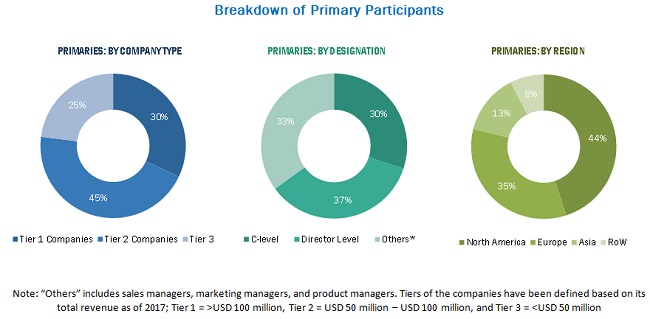

During this research study, major players operating in the nasal drug delivery technology market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the nasal drug delivery technology market include Merck & Co., Inc. (U.S.), Novartis AG (Switzerland), Johnson& Johnson Services, Inc. (U.S.), Pfizer, Inc. (U.S.), AstraZeneca Plc.(U.S.), Aptar Group (U.S.), and GlaxoSmithKline plc (U.K.)

Major Market Developments

- In 2016, Pfizer collaborated with Western Oncolytics to advance Western Oncolytics’ novel oncolytic vaccinia virus. This collaboration helped Pfizer to enhance its novel technology platform for cancer Vaccines and strengthened its immuno-oncology portfolio.

- In 2016, GlaxoSmithKline collaborated with Vaccine Research Center at the NIH (US) to evaluate a new vaccine technology for Zika, known as SAM.

- In 2017, Merck collaborated with Premier, Inc. (US) to develop a preventive care model that seeks to improve adolescent and adult vaccination rates.

- In 2016, Sanofi Pasteur collaborated with The Oswaldo Cruz Foundation (Brazil) and WRAIR (US) to conduct R&D for a Zika vaccine.

Target Audience:

- Nasal Drug Delivery Technology Manufacturers

- Public and Private Physicians

- Healthcare Institutions (Medical Data Centers)

- Research & Clinical Laboratories

- Distributors and Suppliers of Nasal Drug Delivery Technologies

- Health Insurance Payers

- Market Research and Consulting Firms

Scope of the Report

This report categorizes the nasal drug delivery technology market into the following segments and subsegments.

By Dosage Form

- Sprays

- Drops & Liquids

- Powders

- Gels

By Container

- Pressurized Containers

- Non-pressurized Containers

By System

- Multi-dose Systems

- Bi-dose Systems

- Unit-dose Systems

By Therapeutic Application

- Allergic And Non-allergic Rhinitis

- Nose Congestion

- Vaccination

- Other Therapeutic Applications

By End User

- Home Care Settings

- Hospitals

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- France

- U.K.

- Rest of Europe (RoE)

- Asia

- China

- India

- Japan

- Rest of Asia (RoA)

- Rest of the World (RoW)

Critical questions which the report answers

- What are new applications which the nasal drug delivery companies are exploring?

- Which are the key players in the market and how intense is the competition?

The global nasal drug delivery technology market is projected to reach USD 64.20 billion by 2021 from USD 44.00 billion in 2016, at a CAGR of 6.5% during the forecast period. Increasing patient preference for nasal drug delivery as a result of easy administration & better efficacy and growing adoption of self-administration practices are some of the major factors driving the growth of the nasal drug delivery technology market.

Furthermore, growth among over-the-counter nasal drugs and increasing focus on alternative routes of drug delivery such as nasal drug delivery offer significant growth opportunities for player operating in the market. On the other hand, complications associated with the overuse of nasal sprays may restraint the growth of the nasal drug delivery technology market.

The nasal drug delivery technology market is segmented based on dosage form, therapeutic application, end user, system, container, and region. On the basis of system, the market is segmented into multi-dose systems, bi-dose systems, and unit-dose systems. In 2016, the multi-dose drug delivery systems segment is expected to account for the largest share of the nasal drug delivery technology market. This can primarily be attributed to the growing preference for multi-dose drug delivery as these systems provide quick and effective delivery of drugs into the bloodstream.

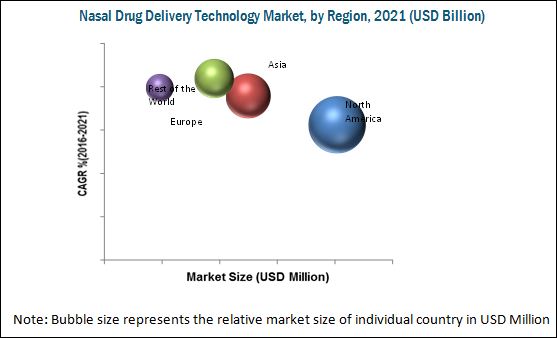

The nasal drug delivery technology market in Asia is expected to grow at the highest CAGR during the forecast period. Opportunities in the Asian market have attracted huge investments by major companies in the area of R&D activities. In addition, the region has low costs of labor and clinical trials, which has further served to draw market players to Asia.

On the basis of container, the nasal drug delivery technology market is segmented into pressurized and non-pressurized containers. In 2016, the non-pressurized containers segment is expected to account for the largest share of the market. This can be primarily attributed to advantages such as better versatility and reliability, instant availability, self-containment, better portability, and low-cost medical aerosol delivery. In addition, the increasing usage of these devices for the treatment of reversible airflow obstruction resulting from asthma and chronic obstructive pulmonary disease (COPD) is expected to further drive the growth of this market in the coming years.

Homecare settings drive the growth of nasal drug delivery market

Homecare settings

Homecare settings is the largest and the fastest growing end-user segment in the nasal drug delivery technology market. The growth of this segment is attributed to increasing patient preference for self-administration of drugs among patients and the increasing usage of nasal powders and sprays that can be easily administered by patientsMoreover, the self-administration of drugs in the home care settings helps patients save time and money, thereby bringing down healthcare costs incurred by the patient.

Drug administration in the home care settings is most beneficial for long term therapy.

Hospitals

Hospitals are among the major end users for nasal drug delivery; the substantial growth in the number of patients suffering from chronic rhinitis is a key market driver for this end-user segment.

Several nasal drugs require trained staff for their administration so as to avoid over-dosage; this is expected to further drive growth for this end-user segment.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are applications areas which the nasal drug delivery companies are exploring?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The overuse of nasal sprays results in various complications, such as irritation in the nasal mucosa, dryness within the nose, temporary burning sensation, and runny nose. This is because nasal sprays comprise a chemical that is used for shrinking blood vessels in the nose. Thus, the continuous use of these sprays may render the blood vessels to be less responsive to the medication.Also, overuse of nasal sprays usually causes addiction among patients, which may lead to serious long-term conditions such as chronic sinusitis. According to the U.S. Department of Health & Human Services, in 2014, there were 29.4 million adults diagnosed with sinusitis in the U.S.; this represented 12.3% of thetotal population in the country. In the nasal route of drug delivery, doctors and physicians usually cannot control the dosage of medicine consumed by patients. This can result in decongested nose and other chronic problems. These drawbacks are expected to limit the growth of the nasal drug delivery technology market (specifically for nasal sprays).

Prominent players in the nasal drug delivery technology market include Merck & Co., Inc. (U.S.), Novartis AG (Switzerland), Johnson & Johnson Services, Inc. (U.S.), Pfizer, Inc. (U.S.), AstraZeneca plc. (U.S.), AptarGroup (U.S.), and GlaxoSmithKline plc (U.K.).

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Limitations

1.5 Market Stakeholders

2 Research Methodology

2.1 Market Size Estimation

2.2 Market Breakdown and Data Triangulation

2.3 Key Data Point From Secondary Sources

2.4 Key Data Point From Primary Sources

2.5 Key Industry Insights

2.6 Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Market Drivers

5.3.1.1 Increasing Patient Preference for Nasal Drug Delivery as A Result of Easy Administration and Better Efficacy

5.3.1.2 Growing Adoption of Self-Administration Practices

5.3.2 Market Restraints

5.3.2.1 Complications Associated With the Overuse of Nasal Sprays

5.3.3 Market Opportunities

5.3.3.1 Over-The-Counter Nasal Drugs

5.3.3.2 Increasing Focus on Alternative Routes Such as Nasal Drug Delivery

5.3.4 Market Challenges

5.3.4.1 Regulatory Hurdles

6 Regulatory Scenario

7 Global Nasal Drug Delivery Technology Market, By Dosage Form

7.1 Introduction

7.2 Nasal Spray

7.3 Nasal Drops and Liquids

7.4 Nasal Gels

7.5 Nasal Powders

7.6 Others

8 Global Nasal Drug Delivery Technology Market, By Containers

8.1 Introduction

8.2 Non-Pressurized Containers

8.3 Pressurized Containers

9 Global Nasal Drug Delivery Technology Market, By Systems

9.1 Introduction

9.2 Multi Dose

9.3 Bi-Dose

9.4 Unit Dose

10 Global Market, By Therapeutic Application

10.1 Allergic and Non-Allergic Rhinitis

10.2 Nasal Congestion

10.3 Vaccinations

10.5 Other Applications

11 Global Market, By End User

11.1 Introduction

11.2 Hospitals

11.3 Home Health Care

12 Geographic Analysis

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.3 Europe

12.3.1 Germany

12.3.2 France

12.3.3 U.K.

12.3.4 Rest of the Europe (RoE)

12.4 Asia

12.4.1 Japan

12.4.2 India

12.4.3 China

12.4.4 Roa

12.5 Rest of the World (RoW)

13 Competitive Landscape

13.1 Overview

13.2 Market Share Analysis

13.3 Competitive Situations & Trends

14 Company Profiles**

14.1 Introduction

14.2 Merck & Co., Inc.

14.3 Novartis AG

14.4 Glaxosmithkline PLC

14.5 Johnson & Johnson Services, Inc.

14.6 Pfizer Inc.

14.7 Astrazeneca PLC

14.8 Aptargroup, Inc.

14.9 Aegis Therapeutics LLC

14.10 3M

14.10.1 MnM View

14.11 Becton, Dickinson and Company

* The Segment/Chapters Will Be Added According to the Availability of the Information

** Tentative List of Companies Added, This is Subjected to the Addition and Deletion of Companies

15 Appendix

15.1 Insights From Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store

15.4 Introducing RT: Real Time Market Intelligence

15.5 Related Reports

15.6 Authors Details

List of Tables (95 Tables)

Table 1 Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 2 Nasal Sprays Drug Delivery Technology Market Size, By Region, 2014–2021 (USD Million)

Table 3 Nasal Drops & Liquids Drug Delivery Technology Market Size, By Region, 2014–2021 (USD Million)

Table 4 Nasal Drops & Liquids Drug Delivery Technology Market Size, By Region, 2014–2021 (USD Million)

Table 5 Nasal Drug Delivery Market Size, By Container Type, 2014-2021 (USD Million)

Table 6 Nasal Drug Delivery Market Size for Non-Pressurized Containers, By Region, 2014-2021 (USD Million)

Table 7 Nasal Drug Delivery Market Size for Pressurized Containers, By Region, 2014-2021 (USD Million)

Table 8 Market Size, By System, 2014–2021 (USD Million)

Table 9 Market Size for Multi-Dose Systems, By Region, 2014–2021 (USD Million)

Table 10 Market Size for Bi-Dose Systems, By Region, 2014–2021 (USD Million)

Table 11 Market Size for Unit-Dose Systems, By Region, 2014–2021 (USD Million)

Table 12 Nasal Drug Delivery Market Size, By Therapeutic Application, 2014-2021 (USD Million)

Table 13 Nasal Drug Delivery Market Size for Allergic and Non-Allergic Rhinitis, By Region, 2014–2021 (USD Million)

Table 14 Nasal Drug Delivery Market Size for Nasal Congestion, By Region, 2014-2021 (USD Million)

Table 15 Nasal Drug Delivery Market Size for Vaccination, By Region, 2014-2021 (USD Million)

Table 16 Nasal Drug Delivery Market Size for Other Therapeutic Applications, By Region, 2014-2021 (USD Million)

Table 17 Nasal Drug Delivery Market Size for Other Therapeutic Applications, By Region, 2014-2021 (USD Million)

Table 18 Nasal Drug Delivery Market Size for Homecare Settings, By Region, 2014–2021 (USD Million)

Table 19 Nasal Drug Delivery Market Size for Hospitals, By Region, 2014–2021 (USD Million)

Table 20 Global Market Size, By Region, 2014–2021 (USD Million)

Table 21 North America: Market Size, By Country, 2014–2021 (USD Million)

Table 22 North America: Market Size, By System, 2014–2021 (USD Million)

Table 23 North America: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 24 North America: Market Size, By End User, 2014–2021 (USD Million)

Table 25 North America: Market Size, By Container, 2014–2021 (USD Million)

Table 26 North America: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 27 U.S.: Market Size, By System, 2014–2021 (USD Million)

Table 28 U.S.: Nasal Drug Delivery Market, By Dosage Form, 2014–2021 (USD Million)

Table 29 U.S.: Market Size, By End User, 2014–2021 (USD Million)

Table 30 U.S.: Market Size, By Container, 2014–2021 (USD Million)

Table 31 U.S.: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 32 Canada: Market Size, By System, 2014–2021 (USD Million

Table 33 Canada: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 34 Canada: Market Size, By End User, 2014–2021 (USD Million)

Table 35 Canada: Market Size, By Container, 2014–2021 (USD Million)

Table 36 Canada: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 37 Europe: Market Size, By System, 2014–2021 (USD Million)

Table 38 Europe: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 39 Europe: Market Size, By End User, 2014–2021 (USD Million)

Table 40 Europe: Market Size, By Container, 2014–2021 (USD Million)

Table 41 Europe: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 42 Germany: Market Size, By System, 2014–2021 (USD Million)

Table 43 Germany: Nasal Drug Delivery Technology Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 44 Germany: Market Size, By End User, 2014–2021 (USD Million)

Table 45 Germany: Market Size, By Container, 2014–2021 (USD Million)

Table 46 Germany: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 47 U.K.: Market Size, By System, 2014–2021 (USD Million)

Table 48 U.K.: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 49 U.K.: Market Size, By End User, 2014–2021 (USD Million)

Table 50 U.K.: Market Size, By Container, 2014–2021 (USD Million)

Table 51 U.K.: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 52 France: Market Size, By System, 2014–2021 (USD Million)

Table 53 France: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 54 France: Market Size, By End User, 2014–2021 (USD Million)

Table 55 France: Market Size, By Container, 2014–2021 (USD Million)

Table 56 France: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 57 RoE: Market Size, By System, 2014–2021 (USD Million)

Table 58 RoE: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 59 RoE: Market Size, By End User, 2014–2021 (USD Million)

Table 60 RoE: Market Size, By Container, 2014–2021 (USD Million)

Table 61 RoE: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 62 Asia: Market Size, By System, 2014–2021 (USD Million)

Table 63 Asia: Market, By Dosage Form, 2014–2021 (USD Million)

Table 64 Asia: Market Size, By End User, 2014–2021 (USD Million)

Table 65 Asia: Market Size, By Container, 2014–2021 (USD Million)

Table 66 Asia:Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 67 Japan: Market Size, By System, 2014–2021 (USD Million)

Table 68 Japan: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 69 Japan: Market Size, By End User, 2014–2021 (USD Million)

Table 70 Japan: Market Size, By Container, 2014–2021 (USD Million)

Table 71 Japan: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 72 China: Market Size, By System, 2014–2021 (USD Million)

Table 73 China: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 74 China: Market Size, By End User, 2014–2021 (USD Million)

Table 75 China: Market Size, By Container, 2014–2021 (USD Million)

Table 76 China: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 77 India: Market Size, System, 2014–2021 (USD Million)

Table 78 India: Nasal Drug Delivery Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 79 India: Market Size, By End User, 2014–2021 (USD Million)

Table 80 India: Market Size, By Container, 2014–2021 (USD Million)

Table 81 India: Nasal Drug Delivery Technology Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 82 RoA: Market Size, By System, 2014–2021 (USD Million)

Table 83 RoA: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 84 RoA: Market Size, By End User, 2014–2021 (USD Million)

Table 85 RoA: Market Size, By Container, 2014–2021 (USD Million

Table 86 RoA: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 87 RoW: Market Size, By System, 2014–2021 (USD Million)

Table 88 RoW: Market Size, By Dosage Form, 2014–2021 (USD Million)

Table 89 RoW: Market Size, By End User, 2014–2021 (USD Million)

Table 90 RoW: Market Size, By Container, 2014–2021 (USD Million)

Table 91 RoW: Market Size, By Therapeutic Application, 2014–2021 (USD Million)

Table 92 Product Launches and Approvals, 2014–2016

Table 93 Collaborations, 2014–2016

Table 94 Expansions, 2014–2016

Table 95 Nasal Drug Delivery Technology Market Ranking for the Key Players in 2016

List of Figures (36 Figures)

Figure 1 Segmentation & Coverage

Figure 2 Research Design

Figure 3 Nasal Drug Delivery Market: Top Down Approach

Figure 4 Nasal Drug Delivery Market: Bottom Up Approach

Figure 5 Data Triangulation Methodology

Figure 6 Assumptions for the Study

Figure 7 Market, By Dosage Form, 2016 vs 2021

Figure 8 Market, By Systems, 2016 vs 2021

Figure 9 Market, By End User, 2016 vs 2021

Figure 10 Market, By Therapeutic Application, 2016 vs 2021

Figure 11 Market, By Container, 2016 vs 2021

Figure 12 Market, By Region, 2016-2021

Figure 13 Global Market to Showcase Lucrative Growth Opportunities During the Forecast Period

Figure 14 Home Care Settings Segment is Expected to Grow at A Highest CAGR, By End User, (2016-2021)

Figure 15 Multi-Dose Systems Segment to Account for the Largest Share of the Market, By System, in 2016

Figure 16 Alleric and Non-Allergic Rhinitis to Dominate the Nasal Drug Delivery Technology Market, By Therapeutic Application, in 2016

Figure 17 Nasal Drug Delivery Technology Market in Japan to Register the Highest CAGR (2016–2021)

Figure 18 Nasal Drug Delivery Technology Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 North America: Market Snapshot

Figure 20 Europe: Market Snapshot

Figure 21 Asia: Market Snapshot

Figure 22 Key Players Adopted Organic and Inorganic Growth Strategies Between 2014 and 2016

Figure 23 Market Evolution Framework

Figure 24 Battle for Market Share: Product Launches and Approvals—Key Strategies Adopted By Market Players

Figure 25 Geographic Revenue Mix of Top Five Market Players (2015)

Figure 26 Merck & Co., Inc.: Company Snapshot (2015)

Figure 27 Novartis AG: Company Snapshot (2015)

Figure 28 Glaxosmithkline PLC: Company Snapshot (2015)

Figure 29 Johnson & Johnson Services, Inc.: Company Snapshot (2015)

Figure 30 Pfizer, Inc: Company Snapshot (2015)

Figure 31 Astrazeneca PLC: Company Snapshot (2015)

Figure 32 Aptargroup, Inc.: Company Snapshot (2015)

Figure 33 Aegis Therapeutics, LLC: Company Snapshot (2015)

Figure 34 3M: Company Snapshot (2015)

Figure 35 Becton, Dickinson and Company: Company Snapshot (2015)

Figure 36 Insights From Industry Experts

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Nasal Drug Delivery Technology Market