Mushroom Market by Type (Button, Shiitake, and Oyster), by Application (Fresh Mushrooms and Processed Mushrooms (Dried, Frozen, and Canned)), & by Region - Global Trends & Forecast to 2019

Often grouped as vegetables, mushrooms are a rich source of nutrients such as vitamins, selenium, and potassium. They are fat-free, cholesterol-free, and are very low in sodium and gluten content. The market for mushrooms is projected to grow significantly in most regions of the world in the next five years.

The mushroom market, in terms of value, is projected to reach $50,034.12 million by 2019, at a CAGR of 9.5% from 2014. The growth of this market is primarily triggered by factors such as a rise in the consumption of processed food and growing awareness about health and wellness. Also, R&D and innovations to enhance applicability and continuously improving technologies to increase their shelf-life are projected to drive this market.

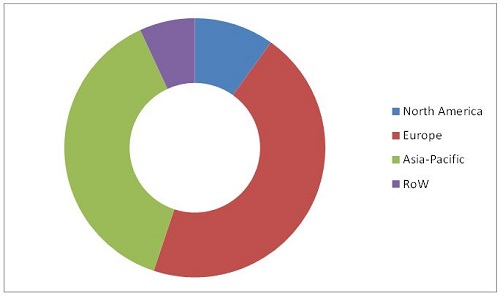

Mushroom Market Share (Value), by Region, 2013

Source: Expert Interviews and MarketsandMarkets Analysis

This report has estimated the size of the market for mushroom in terms of value ($million). In this report, the market has broadly been segmented on the basis of types, applications, and regions. Market drivers, restraints, opportunities, and challenges; and raw material and product price trends have been discussed in detail. Share of participants in the overall market have been discussed in detail. The market has grown significantly in the last few years and this growth is projected to continue.

Scope of the Report

Based on type, the market has been segmented as follows:

- Button

- Shiitake

- Oyster

- Others (winter mushrooms, paddy straw mushrooms, milky mushrooms, and reishi mushrooms)

Based on application, the market has been segmented as follows:

- Fresh

- Processed

Processed mushrooms have been further segmented into:

- Dried

- Frozen

- Canned

- Others (pickled mushrooms, mushroom powder, and mushroom sauces)

Based on region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (The Middle East and Africa)

Mushrooms are in prime focus in the food industry for their multi-functional benefits. They are gaining popularity owing to their high nutritional values and are gradually approaching a “super food” status. Mushrooms are a rich source of proteins and have very low or zero fat and cholesterol, and hence are widely accepted in most of the regions of the world. Increase in the consumption of processed food across the world is one of the major driving factors of the mushroom market. Being a promising and profitable business, mushroom cultivation is widely adopted by growers. Factors such as R&D and innovations to enhance the acceptability and continuous improving technologies to increase mushroom shelf-life are also projected to drive the mushroom market in the next five years.

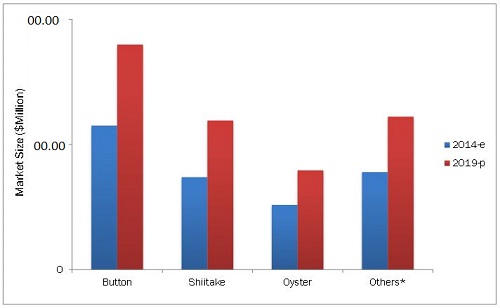

Mushroom Market Size, by Type, 2014 vs. 2019 ($Million)

E – Estimated; P - Projected

Source: Expert Interviews and MarketsandMarkets Analysis

The mushroom market is projected to grow at a CAGR of 9.5% between 2014 and 2019. The market was dominated by Europe in 2013, which accounted for around 45% of the total market. The region is also projected to be the fastest-growing during the period considered for this study. Consumers prefer healthy and low-fat food and are aware about health and wellness and hence there has been a significant change in their food preferences and eating habits.

In terms of types, button mushrooms are projected to have the largest market, globally; however, the shiitake mushrooms market is projected to be the fastest growing from 2014 to 2019.

The market for mushroom is characterized by intense competition due to the presence of a large number of both large- and small-scale firms. Expansions, acquisitions, agreements, and new product launches are the key strategies adopted by market players to ensure their growth in the market. The market is dominated by players such as Costa Pty Ltd. (Australia), Phillips Mushroom Farms, Inc. (U.S.), Shanghai FINC Bio-Tech Inc. (China), and Bonduelle Fresh Europe (France).

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Periodization Considered for the Market

1.4 Base Currency Consideration for Mushroom Market

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data Taken From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand Side Analysis

2.2.2.1 Rising Population and Rising Diversified Food Demand

2.2.2.2 Increasing Consumer Preference for Convenience Foods & Ready-To-Eat Meals

2.2.2.3 Demand for Convenience Foods in Developing Economies

2.2.2.4 Rising Demand for Meat Substitutes

2.2.3 Supply Side Analysis

2.2.3.1 Growing Fruits & Vegetables Processing Industry

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in this Market

4.2 Mushroom Market: Product Segment, By Application

4.3 European Mushroom Market

4.4 Mushroom Market: Product Segment, By Type

4.5 China Accounted for Nearly One-Fourth of the Global Market Share, 2013

4.6 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 41)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 Mushroom Market, By Type

5.3.2 Market, By Application

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increase in Consumption of Processed Foods

5.4.1.2 Rise in Consumer Awareness About Health and Wellness

5.4.1.3 Promising and Profitable Business

5.4.1.4 R&D and Innovations to Expand Applicability & Accelerate Growth

5.4.1.5 Improving Technologies to Increase the Shelf-Life

5.4.2 Restraint

5.4.2.1 Limited Shelf-Life of Mushrooms

5.4.3 Opportunities

5.4.3.1 Technological Advancements

5.4.3.2 Growing Concerns About Obesity

5.4.4 Challenges

5.4.4.1 Proper Process Management

5.4.4.2 Consumer Credibility

6 Industry Trends (Page No. - 52)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

6.4 Industry Analysis

6.5 Porter’s Five Forces Analysis

6.5.1 Threat of New Entrants

6.5.2 Threat of Substitutes

6.5.3 Bargaining Power of Suppliers

6.5.4 Bargaining Power of Buyers

6.5.5 Intensity of Competitive Rivalry

6.6 Pest Analysis

6.6.1 Political Factors

6.6.2 Economic Factors

6.6.3 Social Factors

6.6.4 Technological Factors

7 Mushroom Market, By Type (Page No. - 61)

7.1 Introduction

7.2 Button Mushroom

7.3 Shiitake Mushroom

7.4 Oyster Mushroom

7.5 Other Mushroom

8 Mushroom Market, By Application (Page No. - 69)

8.1 Introduction

8.2 Mushroom Market, By Application

8.3 Fresh Mushrooms Market

8.4 Processed Mushroom Market

8.5 Processed Mushroom Market, By Sub-Application

8.5.1 Dried Mushroom

8.5.2 Frozen Mushroom

8.5.3 Canned Mushroom

8.5.4 Other Mushroom

9 Mushroom Market, By Region (Page No. - 79)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 The Netherlands

9.3.2 Germany

9.3.3 Italy

9.3.4 France

9.3.5 U.K.

9.3.6 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Japan

9.4.3 India

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World

9.5.1 Brazil

9.5.2 South Africa

9.5.3 Rest of ROW

10 Competitive Landscape (Page No. - 118)

10.1 Overview

10.2 Market Share Analysis

10.3 Competitive Situation & Trends

10.3.1 Expanions & Investments

10.3.2 Acquisitions

10.3.3 New Product & Technology Launches

10.3.4 Agreements, Collaborations, Joint Ventures, & Partnerships

11 Company Profiles (Page No. - 125)

11.1 Introduction

11.2 Bonduelle Fresh Europe

11.2.1 Business Overview

11.2.2 Product Offerings

11.2.3 Key Strategies

11.2.4 Recent Developments

11.2.5 SWOT Analysis

11.2.6 MNM View

11.3 Costa Pty Ltd.

11.3.1 Business Overview

11.3.2 Product Offerings

11.3.3 Key Strategy

11.3.4 Recent Developments

11.3.5 SWOT Analysis

11.3.6 MNM View

11.4 Drinkwater’s Mushrooms Limited

11.4.1 Business Overview

11.4.2 Product Offering

11.4.3 Key Strategy

11.5 Lutece Holdings B.V.

11.5.1 Business Overview

11.5.2 Product Offerings

11.5.3 Key Strategy

11.6 Monaghan Mushrooms Ireland

11.6.1 Business Overview

11.6.2 Product Offerings

11.6.3 Key Strategies

11.6.4 SWOT Analysis

11.6.5 MNM View

11.7 Monterey Mushrooms Inc.

11.7.1 Business Overview

11.7.2 Product Offerings

11.7.3 Key Strategy

11.7.4 Recent Developments

11.8 Okechamp S.A.

11.8.1 Business Overview

11.8.2 Product Offerings

11.8.3 Key Strategy

11.8.4 Recent Development

11.8.5 Okechamp S.A: SWOT Analysis

11.8.6 MNM View

11.9 Shanghai Finc Bio-Tech Inc.

11.9.1 Business Overview

11.9.2 Product Offerings

11.9.3 Key Strategies

11.9.4 Recent Developments

11.10 The Mushroom Company

11.10.1 Business Overview

11.10.2 Product Offerings

11.10.3 Key Strategy

12 Appendix (Page No. - 149)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

List of Tables (73 Tables)

Table 1 Impact of Key Drivers on the Global Market

Table 2 Impact of Key Restraints on the Global Market

Table 3 Consumer Credibility is the Challenge for Mushroom Market

Table 4 List of Common Mushroom Species Grown Under Suitable Ecological Conditions

Table 5 Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 6 Button Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 7 Shiitake Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 8 Oyster Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 9 Other Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 10 Mushroom Market Size, By Application, 2012-2019 ($Million)

Table 11 Fresh Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 12 Processed Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 13 Processed Mushroom Market Size, By Sub-Application, 2012-2019 ($Million)

Table 14 Dried Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 15 Frozen Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 16 Canned Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 17 Other Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 18 Mushroom Market Size, By Region, 2012-2019 ($Million)

Table 19 North America: Mushroom Market Size, By Country, 2012–2019 ($Million)

Table 20 North America: Market Size, By Type, 2012–2019 ($Million)

Table 21 North America: Market Size, By Application, 2012-2019 ($Million)

Table 22 North America: Processed Mushroom Market Size, By Sub-Application, 2012-2019 ($Million)

Table 23 U.S.: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 24 U.S.: Market Size, By Application, 2012-2019 ($Million)

Table 25 Canada: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 26 Canada: Market Size, By Application, 2012-2019 ($Million) Table 27 Mexico: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 28 Mexico: Market Size, By Application, 2012-2019 ($Million)

Table 29 Europe: Mushroom Market Size, By Country, 2012–2019 ($Million)

Table 30 Europe: Market Size, By Type, 2012-2019 ($Million)

Table 31 Europe: Market Size, By Application, 2012-2019 ($Million) Table 32 Europe: Processed Mushroom Market Size, By Sub-Application, 2012-2019 ($Million)

Table 33 The Netherlands: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 34 The Netherlands: Market Size, By Application, 2012-2019 ($Million)

Table 35 Germany: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 36 Germany: Market Size, By Application, 2012-2019 ($Million)

Table 37 Italy: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 38 Italy: Market Size, By Application, 2012-2019 ($Million)

Table 39 France: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 40 France: Market Size, By Application, 2012-2019 ($Million)

Table 41 U.K.: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 42 U.K.: Market Size, By Application, 2012-2019 ($Million)

Table 43 Rest of Europe: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 44 Rest of Europe: Market Size, By Application, 2012-2019 ($Million)

Table 45 GDP Per Capita (PPP) for Key Emerging Economies, 2013

Table 46 Asia-Pacific: Mushroom Market Size, By Country, 2012–2019 ($Million)

Table 47 Asia-Pacific: Market Size, By Type, 2012-2019 ($Million)

Table 48 Asia-Pacific: Market Size, By Application, 2012–2019 ($Million)

Table 49 Asia-Pacific: Processed Mushroom Market Size, By Sub-Application, 2012–2019 ($Million)

Table 50 China: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 51 China: Market Size, By Application, 2012-2019 ($Million)

Table 52 Japan: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 53 Japan: Market Size, By Application, 2012-2019 ($Million)

Table 54 India: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 55 India: Market Size, By Application, 2012-2019 ($Million)

Table 56 Australia: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 57 Australia: Market Size, By Application, 2012-2019 ($Million)

Table 58 Rest of Asia-Pacific: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 59 Rest of Asia-Pacific: Market Size, By Application, 2012-2019 ($Million)

Table 60 Rest of the World: Market Size, By Country, 2012-2019 ($Million)

Table 61 Rest of the World: Market Size, By Type, 2012-2019 ($Million)

Table 62 Rest of the World: Market Size, By Application, 2012-2019 ($Million)

Table 63 Rest of the World: Processed Mushroom Market Size, By Sub-Application, 2012-2019 ($Million)

Table 64 Brazil: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 65 Brazil: Market Size, By Application, 2012-2019 ($Million)

Table 66 South Africa: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 67 South Africa: Market Size, By Application, 2012-2019 ($Million)

Table 68 Rest of ROW: Mushroom Market Size, By Type, 2012-2019 ($Million)

Table 69 Rest of ROW: Market Size, By Application, 2012-2019 ($Million)

Table 70 Expansions & Investments, 2010-2014

Table 71 Acquisitions, 2010-2014

Table 72 New Product Launches & Developments, 2010-2014

Table 73 Agreements, Collaborations, Consolidations, & Partnerships, 2010-2014

List of Figures (58 Figures)

Figure 1 Market Segmentation

Figure 2 Research Design

Figure 3 Population Growth Trend, 1961-2050

Figure 4 Annual Ready Meals Retail Market Value, By Product Type, 2006-2011 ($Million)

Figure 5 U.S. Food Preparations (Vegetable, Fruit, & Nut) Import Value Share, 2013

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Assumptions of the Study

Figure 9 Market Snapshot (2014 vs. 2019)

Figure 10 Canned Mushrooms Projected to Be the Fastest-Growing Market By 2019

Figure 11 Mushroom Market Trend, By Region, 2014

Figure 12 High Growth Rate Observed in European Countries

Figure 13 Attractive Opportunities in this Market

Figure 14 Processed Mushrooms Segment to Grow at the Fastest Rate & Account for the Largest Share in Next Five Years

Figure 15 Processed Mushrooms Segment Accounted for Largest Share in the European Mushroom Market, 2013

Figure 16 Shiitake Mushrooms Will Continue to Dominate the Market in Next Five Years

Figure 17 China Dominates the Global Market

Figure 18 Asia-Pacific Region to Provide Immense Potential Opportunities for Mushroom Market Growth

Figure 19 Development of the Mushroom Market

Figure 20 Mushroom Market, By Type

Figure 21 Market, By Application

Figure 22 Key Drivers: Rise in Consumer Awareness About Health & Wellness & Increasing Consumption of Processed Foods

Figure 23 Mushroom Market: Value Chain Analysis

Figure 24 Mushroom Market: Supply Chain Management

Figure 25 Increasing Demand for Specialty Mushrooms is the Leading Trend of the Industry

Figure 26 Porter’s Five Forces Analysis: Less Product Differentiation is Increasing Competition in Mushroom Industry

Figure 27 Mushroom Market, By Type: A Snapshot, 2013

Figure 28 Button Mushroom: Projected to Be the Fastest-Growing Market (2014-2019)

Figure 29 Asia-Pacific to Boast the Highest CAGR in Fresh Mushroom Market

Figure 30 Europe: Fastest Growing Market for Processed Mushrooms, 2014-2019

Figure 31 Canned Mushroom: Largest & Fastest-Growing Market, 2014-2019

Figure 32 Geographic Snapshot (2014-2019): Rapidly Growing Markets Are Emerging as New Hot Spots

Figure 33 U.S.: Per Capita Mushroom Consumption, 2000-2012

Figure 34 European Mushroom Market: A Snapshot

Figure 35 European Mushroom Market, By Type: A Snapshot, 2013

Figure 36 Per Capita Consumption of Mushroom in European Nations, 2007

Figure 37 Netherlands: Largest Share in the European Mushroom Market, 2013

Figure 38 China is the Market Leader in the Asia-Pacific Region

Figure 39 Companies Adopted Expansions & Investments as the Key Growth Strategy Over the Last Five Years

Figure 40 Mushroom Market Share, By Key Player, 2013

Figure 41 Market Evaluation Framework – Expansions, Investments, & Acquisitions Were the Most Preferred Strategies in the Mushroom Market (2010-2014)

Figure 42 Battle for Market Share: Expansions & Investments Were the Key Strategies

Figure 43 Geographical Revenue Mix of Top Five Players

Figure 44 Bonduelle Fresh Europe: Business Overview

Figure 45 Bonduelle Fresh Europe: SWOT Analysis

Figure 46 Costa Pty Ltd.: Business Overview

Figure 47 Costa Pty Ltd.: SWOT Analysis

Figure 48 Drinkwater’s Mushrooms Limited: Business Overview

Figure 49 Lutece Holding B.V.: Business Overview

Figure 50 Monaghan Mushrooms Ireland: Business Overview

Figure 51 Monaghan Mushrooms Ireland: SWOT Analysis

Figure 52 Monterey Mushrooms Inc.: Business Overview

Figure 53 Okechamp S.A: Business Overview

Figure 54 Okechamp S.A.: SWOT Analysis

Figure 55 Phillips Mushroom Farms, Inc.: Business Overview

Figure 56 Phillips Mushroom Farms: SWOT Analysis

Figure 57 Shanghai Finc Bio-Tech Inc.: Business Overview

Figure 58 The Mushroom Company: Business Overview

Growth opportunities and latent adjacency in Mushroom Market