Mushroom Cultivation Market by Type (Button mushroom, Oyster mushroom, Shiitake mushroom, Other types), By Phase, By Region (North America, Europe, Asia Pacific, South America, Rest of the World) - Global Forecast to 2025

Mushroom Cultivation Market

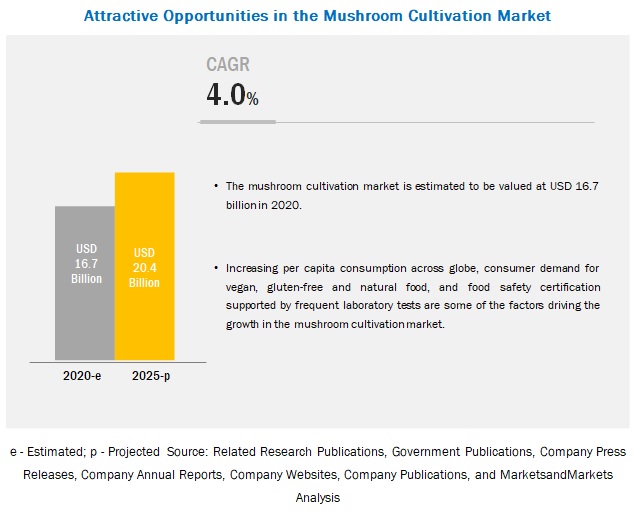

Global Mushroom Cultivation Market is expected to grow at a CAGR of 4.0%.

Drivers and Restraints:

Market dynamics for mushroom cultivation continue to evolve on the basis key drivers and restraints. The rising demand for organic and healthy food products and owing its multiple health benefits and growing adaption in vegetarian diets among consumers at a global level increases the demand for mushroom cultivation. The key drivers and restraints in mushroom cultivation market are enlisted below.

Key drivers for mushroom cultivation include:

- Multifunctionality of mushrooms

- Cost-effectiveness associated with mushroom cultivation

Restraints impeding the market include:

- Spawn production in developing countries

The total number of edible and medicinal fungi is over 2300 species. Cultivated mushrooms have become popular with over 200 genera of macrofungi and are useful for consumption. Most of them are cultivated on lignocelluloses (plant dry matter) waste materials and contribute to their recycling. The most common mushrooms that are produced and consumed are button mushrooms (Agaricus bisporus), shiitake mushrooms (Lentinula spp.), and oyster mushrooms (Pleurotus spp). The major mushroom types are enlisted below:

Top mushroom types of mushroom cultivation:

- Button mushroom

- Oyster mushroom

- Shiitake mushroom

- Paddy straw mushroom

Mushroom cultivation serves as a profitable business, as it can be grown indoors and provides income throughout the year since it can be grown in any season. As the cost of mushroom cultivation is low, and it requires less labor and promotes sustainable options, since it uses agriculture wastes as a substrate for growth, several companies are opting for mushroom cultivation. The leading players in mushroom cultivation market are listed below.

Top 10 players in mushroom cultivation include:

- Monaghan Mushrooms

- Walsh Mushrooms Group

- Mycelia

- South Mill Mushrooms Sales

- Smithy Mushrooms Ltd.

- Mushroom S.A.S

- Hirano Mushroom LLC

- Societa Agricola Italspawn di Valentino e Massimo Sartor

- Fujishukin Co.Ltd.

- Gourmet Mushrooms Inc.

Top 5 Start-ups in mushroom cultivation include:

- Rheinische Pilz Zentrale GmbH

- Fresh Mushroom Europe

- Commercial Mushroom Producers

- Societa Agricola Porretta

- Lambert Spawn

[140 Pages Report] The mushroom cultivation market is estimated to account for a value of USD 16.7 billion in 2020 and is projected to grow at a CAGR of 4.0% from 2020, to reach a value of USD 20.4 billion by 2025. The global mushroom cultivation market is projected to witness significant growth due to factors such as the multiple health benefits of mushrooms, increasing per capita mushroom consumption, cost-effective production and rising demand for vegan and natural food in the diet and increasing health conscious population across the globe are some of the major factors fueling the demand for mushroom cultivation .

By type, the button mushroom segment is projected to dominate the global mushroom cultivation market during the forecast period.

The button mushroom segment accounted for the largest market share in 2019. The button mushroom is a widely consumed mushroom type across the world and can potentially offer many health benefits. The mushroom type is commercially grown in almost all the major mushroom producing countries such as China, Japan, the US, the UK, Germany, and Poland. Increased R&D on the white mushroom to find the potential to prevent cancer, along with its availability at affordable prices as compared to special mushroom varieties, is projected to escalate the demand for button mushroom during the forecast period. It contributes more than 40% of global production.

The higher per capita mushroom consumption and adoption of modern mushroom cultivation techniques in the Asia Pacific region is projected to drive the growth of the mushroom cultivation market

According to the China Business Research Institute, the country was the largest edible mushroom producer at a global level and reached an estimated annual yield of 38.42 million tonnes in 2017. This accounted for about 75% of the total global output. Furthermore, the CCCFNA Edible Mushroom Branch (2018) stated that the export of edible mushrooms was valued at USD 3.8 billion in the same year. According to a research paper, mushroom cultivation is the fifth-largest agricultural sector in the country, valued at USD 24.0 billion. The Asia Pacific is the leading region in the global mushroom production market. The per capita consumption in China, the largest producer of mushrooms in the world, is higher than any other country. The consumption of mushroom in Asian countries such as Japan, India, and others are increasing at a significant rate accredited by increasing production. Increasing vegan population and shifting trend toward nutrition-rich food have led to the market growth of mushrooms in Asian countries.

Key Market Players

Key players in this market include Monaghan Mushrooms (Ireland), Walsh Mushrooms Group (Ireland), Mycelia (Belgium), South Mill Mushrooms Sales (US), Smithy Mushrooms Ltd. (UK), Rheinische Pilz Zentrale GmbH (Germany), Italspwan (Italy), Mushroom SAS (Italy), Hirano Mushroom LLC (Kosovo), Fujishukin Co. Ltd. (Japan). These major players in this market are focusing on increasing their presence through mergers & acquisitions, new product launches and agreements. These companies have a strong presence in Asia Pacific, Europe and North America. They also have substrate manufacturing facilities and strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2018-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020-2025 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type |

|

Geographies covered |

North America, Europe, Asia Pacific, South America, and Rest of World (RoW) |

|

Companies covered |

Monaghan Mushrooms (Ireland), Walsh Mushrooms Group (Ireland), Mycelia (Belgium), South Mill Mushrooms Sales (US), Smithy Mushrooms Ltd. (UK), Rheinische Pilz Zentrale GmbH (Germany), Italspwan (Italy), Mushroom SAS (Italy) Hirano Mushroom LLC (Kosovo), Fujishukin Co. Ltd. (Japan), Societa Agricola Porretta (Italy), Gourmet Mushrooms, Inc. (US), Fresh Mushroom Europe (Belgium), Commercial Mushroom Producers (Ireland), Lambert Spawn (US), F.H.U Julita Kucewicz (Poland), Polar Shiitake Oy (Finland), Heereco BV (Netherlands), Bluff City Fungi (US), and Mycoterra Farm (US). |

This research report categorizes the mushroom cultivation market based on type and region.

Based on type, the market for mushroom cultivation has been segmented as follows:

- Button mushroom

- Oyster mushroom

- Shiitake mushroom

- Others (maitake, nameko, enoki, mane, straw, and shimji)

Based on the region, mushroom cultivation market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW) (the Middle East & Africa)

Recent Developments:

- In August 2019, Walsh Mushrooms Group expanded to supply its mushrooms to ALDI, which is a supermarket company. A new five-year deal began in 2019 to supply mushrooms for ALDI by the growers of Evesham (England-based center).

- In October 2018, Walsh Mushrooms Group launched a vitamin D enriched mushroom following a USD 279,492 investment in a two-year project, which was granted Novel Food Status.

- In September 2018, South Mill Mushrooms Sales acquired Champs Fresh Farm Inc., one of the leading premium-quality mushroom producers in Western North America. This helped the company to become one of the largest mushrooms growers in North America.

Key questions addressed by the report:

- What are the new application areas for the mushroom cultivation market that companies are exploring?

- Who are some of the key players operating in the market, and how intense is the competition?

- What kind of competitors and stakeholders would be interested in this market? What will be their go-to-market strategy, and which emerging market will be of significant interest?

- How are the current R&D activities and M&As in the market projected to create a disrupting environment in the coming years?

- What will be the level of impact of new product launches on the revenues of stakeholders due to the benefits, such as increasing revenue, environmental regulatory compliance, and sustainable profits for the suppliers, offered by the mushroom cultivation market?

Frequently Asked Questions (FAQ):

What is the value chain framework for mushroom cultivation market?

There are phase for mushroom cultivation. Phase I, where the raw materials are mixed such as straw, manure etc. In phase II, spawning is done. Phase III, casing soil is done. Phase IV, pinning happens, and lastly harvesting of mushroom is done.

Which is the most widely produced and consumed mushroom in key countries of the world?

Button mushroom is the most produced mushroom in the world and even widely consumed across the globe. According to FAO and EUROSTAT, more than 50% of the world mushroom production is button mushroom. It has also been forecasted that there is a increasing consumption of shiitake mushroom in most of the developed and developing countries.

What is the major driver for the largest type in mushroom cultivation market?

there has been increasing awareness among the people regarding the health benefits of the mushroom, an increasing vegan population across the globe is expected to continue driving the growth of this segment during the forecast period.

What is the ration in which compost and spawn is mixed for cultivation?

In different parts of the world there is different ration opted by the growers. Ideally it has been studied that 1kg of spawn is mixed in 110-120 kg of compost.

Which region is expected to witness significant demand for mushroom cultivation in the coming years?

in terms of consumption European people have more per capita consumption compared to global average of 3.5kg. When we talk about the production, Asian countries have huge potential in mushroom cultivation. China has became world leader in mushroom production producing more than 50% of the worlds total mushroom. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 16)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 UNITS CONSIDERED

1.8 STAKEHOLDERS

1.9 INCLUSIONS & EXCLUSIONS

2 RESEARCH METHODOLOGY (Page No. - 21)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS & LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 30)

4 PREMIUM INSIGHTS (Page No. - 33)

4.1 OPPORTUNITIES IN THE MUSHROOM CULTIVATION MARKET

4.2 MUSHROOM CULTIVATION MARKET, BY TYPE

4.3 BUTTON MUSHROOM, BY REGION

4.4 KEY MARKETS, BY KEY COUNTRY

5 MARKET OVERVIEW (Page No. - 36)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Multifunctionality of mushrooms

5.2.1.2 Cost-effectiveness associated with mushroom cultivation

5.2.2 RESTRAINTS

5.2.2.1 Spawn production in developing countries

5.2.3 OPPORTUNITIES

5.2.3.1 Economic viability of mushroom cultivation and trade by developing countries

5.2.4 CHALLENGES

5.2.4.1 Lack of improvised mushroom farm management practices

6 MUSHROOM CULTIVATION MARKET, BY PHASE (Page No. - 41)

6.1 INTRODUCTION

6.2 PHASE I COMPOSTING

6.3 PHASE II SPAWNING

6.4 PHASE III CASING

6.5 PHASE IV PINNING

6.6 PHASE V HARVESTING

6.7 VALUE CHAIN

6.8 MARKET SIZE, BY PHASE, 2019 (USD MILLION)

7 MUSHROOM CULTIVATION MARKET, BY TYPE (Page No. - 44)

7.1 INTRODUCTION

7.2 BUTTON MUSHROOM

7.2.1 ABUNDANCE OF VITAMIN B AND POTASSIUM MAKES BUTTON MUSHROOM THE MOST PREFERABLE

7.3 OYSTER MUSHROOM

7.3.1 ABUNDANCE OF PROTEIN AND NIACIN MAKES OYSTER MUSHROOM A PREFERRED TYPE

7.4 SHIITAKE MUSHROOM

7.4.1 SHIITAKE MUSHROOM CONSIDERED A MEDICINAL TYPE

7.5 OTHER MUSHROOM TYPES

8 MUSHROOM CULTIVATION MARKET, BY REGION (Page No. - 52)

8.1 INTRODUCTION

8.2 NORTH AMERICA

8.2.1 US

8.2.1.1 Increase in demand for fresh mushrooms to drive the market growth

8.2.2 CANADA

8.2.2.1 More than 90% of the mushrooms produced in the country is agaricus (button mushroom)

8.2.3 MEXICO

8.2.3.1 The mushroom fungus is increasingly cultivated by various producers due to low investments, ease of cultivation, adaptation to the environment, and fewer cultivation spaces

8.3 EUROPE

8.3.1 GERMANY

8.3.1.1 The button mushroom has witnessed significant growth in recent years

8.3.2 FRANCE

8.3.2.1 High imports of mushrooms from the Netherlands, Spain, and China

8.3.3 ITALY

8.3.3.1 Rise in demand for more exotic mushrooms to drive the market growth

8.3.4 UK

8.3.4.1 Shiitake is the most preferred type of mushrooms by consumers in the UK

8.3.5 SPAIN

8.3.5.1 The country accounted for the third-largest market share for mushroom cultivation in the region

8.3.6 POLAND

8.3.6.1 Mushrooms cultivated in the country are mainly exported to the UK due to their high consumption

8.3.7 NETHERLANDS

8.3.7.1 The country accounted for the largest share for mushroom cultivation in the region

8.3.8 IRELAND

8.3.8.1 Most growers in Ireland have vertically integrated businesses, i.e., they produce mushrooms and substrates or compost for growing them

8.3.9 REST OF EUROPE

8.3.9.1 Rise in awareness about the health benefits of mushrooms among consumers

8.4 ASIA PACIFIC

8.4.1 CHINA

8.4.1.1 The health benefits of mushrooms have further encouraged the use of the fungi as a high-protein meat alternative in the country

8.4.2 INDIA

8.4.2.1 Increase in the export of button mushrooms to drive the market growth

8.4.3 JAPAN

8.4.3.1 Improving the cultivation techniques that have stabilized mushroom supplies and health effects of mushrooms

8.4.4 AUSTRALIA

8.4.4.1 Increasing consumption of mushrooms due to the changing lifestyle and rising need for nutritious foods

8.4.5 INDONESIA

8.4.5.1 Oyster mushroom is a mushroom species of wood that has a higher nutrient content than other types of wood mushrooms

8.4.6 IRAN

8.4.6.1 High demand for healthier foods with multiple benefits drives the market demand for mushrooms in the country

8.4.7 REST OF ASIA PACIFIC

8.5 SOUTH AMERICA

8.5.1 BRAZIL

8.5.1.1 Oyster mushroom has witnessed significant growth in recent years

8.5.2 ARGENTINA

8.5.2.1 Growing mushrooms in Argentina could be profitable due to low investments

8.5.3 CHILE

8.5.3.1 The country accounted for the second-largest share for mushroom cultivation in the region

8.5.4 REST OF SOUTH AMERICA

8.5.4.1 Rise in awareness about the health benefits of mushrooms among consumers

8.6 REST OF THE WORLD (ROW)

8.6.1 MIDDLE EAST

8.6.1.1 Availability of abundant agriculture waste used as a substrate for mushroom cultivation

8.6.2 AFRICA

8.6.2.1 Increased domestic demand for mushrooms in the region and the rise in the number of growers investing in mushroom cultivation as a cost-effective farming alternative to drive the market growth

9 COMPETITIVE LANDSCAPE (Page No. - 96)

9.1 OVERVIEW

9.2 COMPETITIVE LEADERSHIP MAPPING

9.2.1 VISIONARY LEADERS

9.2.2 INNOVATORS

9.2.3 DYNAMIC DIFFERENTIATORS

9.2.4 EMERGING COMPANIES

9.3 COMPETITIVE LEADERSHIP MAPPING (FOR SMES/START-UPS)

9.3.1 PROGRESSIVE COMPANIES

9.3.2 STARTING BLOCKS

9.3.3 RESPONSIVE COMPANIES

9.3.4 DYNAMIC COMPANIES

9.4 COMPETITIVE SCENARIO

9.4.1 NEW PRODUCT LAUNCHES

9.4.2 AGREEMENTS

9.4.3 MERGERS & ACQUISITIONS

10 COMPANY PROFILES (Page No. - 102)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

10.1 MONAGHAN MUSHROOMS

10.2 WALSH MUSHROOMS GROUP

10.3 MYCELIA

10.4 SOUTH MILL MUSHROOMS SALES

10.5 SMITHY MUSHROOMS LIMITED

10.6 RHEINISCHE PILZ ZENTRALE GMBH

10.7 SOCIETA AGRICOLA ITALSPAWN DI VALENTINO E MASSIMO SARTOR SS

10.8 MUSHROOM S.A.S

10.9 HIRANO MUSHROOM LLC

10.10 FUJISHUKIN CO. LTD.

10.11 SOCIETA AGRICOLA PORRETTA

10.12 GOURMET MUSHROOMS, INC.

10.13 FRESH MUSHROOM EUROPE

10.14 COMMERCIAL MUSHROOM PRODUCERS

10.15 LAMBERT SPAWN

10.16 F.H.U JULITA KUCEWICZ

10.17 POLAR SHIITAKE OY

10.18 HEERECO BV

10.19 BLUFF CITY FUNGI

10.20 MYCOTERRA FARM

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 134)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

LIST OF TABLES (187 Tables)

TABLE 1 USD EXCHANGE RATES, 20152019

TABLE 2 MUSHROOM PRODUCTION, 20152018 (000 TONNES)

TABLE 3 MUSHROOM CULTIVATION MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 4 MUSHROOM CULTIVATION MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 5 BUTTON MUSHROOM MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 6 BUTTON MUSHROOM MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 7 OYSTER MUSHROOM MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 8 OYSTER MUSHROOM MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 9 SHIITAKE MUSHROOM MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 10 SHIITAKE MUSHROOM MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 11 OTHER MUSHROOM TYPES MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 12 OTHER MUSHROOM TYPES MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 13 MUSHROOM CULTIVATION MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 14 MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 15 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 16 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 17 NORTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 18 NORTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 19 US: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 20 US: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 21 CANADA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 22 CANADA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 23 MEXICO: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 24 MEXICO: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 25 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 26 EUROPE: MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 27 EUROPE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 28 EUROPE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 29 GERMANY: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 30 GERMANY: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 31 FRANCE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 32 FRANCE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 33 ITALY: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 34 ITALY: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 35 UK: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 36 UK: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 37 SPAIN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 38 SPAIN: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 39 POLAND: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 40 POLAND: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 41 NETHERLANDS: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 42 NETHERLANDS: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 43 IRELAND: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 44 IRELAND: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 45 REST OF EUROPE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 46 REST OF EUROPE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 47 ASIA PACIFIC: MUSHROOM CULTIVATION MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 48 ASIA PACIFIC MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 51 CHINA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 52 CHINA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 53 INDIA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 54 INDIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 55 JAPAN: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 56 JAPAN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 57 AUSTRALIA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 58 AUSTRALIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 59 INDONESIA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 60 INDONESIA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 61 IRAN: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 62 IRAN: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 63 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 64 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 65 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 20182025 (USD MILLION)

TABLE 66 SOUTH AMERICA: MUSHROOM CULTIVATION MARKET SIZE, BY COUNTRY, 20182025 (KT)

TABLE 67 SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 68 SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 69 BRAZIL: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 70 BRAZIL: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 71 ARGENTINA: MARKET SIZE, BY TYPE, 20182025 (USD THOUSAND)

TABLE 72 ARGENTINA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 73 CHILE: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 74 CHILE: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 75 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 76 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 77 ROW: MUSHROOM CULTIVATION MARKET SIZE, BY REGION, 20182025 (KT)

TABLE 78 ROW: MARKET SIZE, BY REGION, 20182025 (USD MILLION)

TABLE 79 ROW: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 80 ROW: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 81 MIDDLE EAST: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 82 MIDDLE EAST: MARKET SIZE, BY TYPE, 20182025 (USD MILLION)

TABLE 83 AFRICA: MARKET SIZE, BY TYPE, 20182025 (KT)

TABLE 84 AFRICA: MARKET SIZE, BY TYPE,20182025 (USD MILLION)

TABLE 85 NEW PRODUCT LAUNCHES, 20172019

TABLE 86 AGREEMENTS

TABLE 87 MERGERS & ACQUISITIONS

LIST OF FIGURES (19 Figures)

FIGURE 1 MUSHROOM CULTIVATION MARKET SEGMENTATION

FIGURE 2 RESEARCH DESIGN: MUSHROOM CULTIVATION MARKET

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

FIGURE 6 MUSHROOM CULTIVATION MARKET SIZE, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 ASIA PACIFIC WAS THE LARGEST MARKET IN 2019

FIGURE 8 INCREASING PER CAPITA CONSUMPTION IS DRIVING THE GROWTH OF THE MARKET

FIGURE 9 BUTTON MUSHROOM WAS THE LARGEST SEGMENT IN THE MUSHROOM CULTIVATION MARKET IN 2019

FIGURE 10 ASIA PACIFIC WITNESSED THE LARGEST MARKET SHARE FOR BUTTON MUSHROOM IN 2019

FIGURE 11 CHINA IS PROJECTED TO BE THE LARGEST MARKET DURING THE FORECAST PERIOD

FIGURE 12 TOP MUSHROOM PRODUCING COUNTRIES, 2015

FIGURE 13 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 14 MARKET SHARE, BY TYPE, 2019 VS. 2025

FIGURE 15 ASIA PACIFIC SNAPSHOT

FIGURE 16 MUSHROOM CULTIVATION: COMPANY RANKINGS, 2019

FIGURE 17 MUSHROOM CULTIVATION MARKET: COMPETITIVE LEADERSHIP MAPPING, 2019

FIGURE 18 KEY DEVELOPMENTS OF THE LEADING PLAYERS IN THE MUSHROOM CULTIVATION MARKET, 20172019

FIGURE 19 MUSHROOM CULTIVATION MARKET: COMPETITIVE LEADERSHIP MAPPING FOR SMES/START-UPS, 2019

The study involves four major activities to estimate the current market size for mushroom cultivation. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. These findings, assumptions, and market size were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, food safety organizations, regulatory bodies, trade directories, and databases.

Primary Research

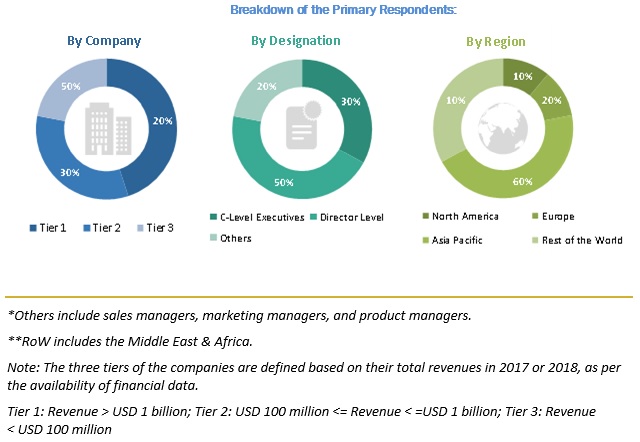

The mushroom cultivation market comprises several stakeholders such as mushroom cultivators and suppliers of raw materials.The demand-side of this market is characterized by the rising demand for from end-use industries such as supermarkets, hypermarkets, and mushroom product processors.Supply-side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the mushroom cultivation market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary respondents

Data Triangulation

After arriving at the overall market size-using the market size estimation processes, as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, and project the global market size for the mushroom cultivation market

- To understand the structure of the mushroom cultivation market by identifying its various subsegments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the micro-markets, with respect to individual growth trends, future prospects, and their contribution to the total mushroom cultivation market

- To project the size of the market and its submarkets, in terms of value, with respect to the regions (along with their respective key countries)

- To profile the key players and comprehensively analyze their core competencies

- To understand the competitive landscape and identify the major growth strategies adopted by the players across key regions

- To analyze the competitive developments such as expansions & investments, mergers & acquisitions, new product launches, partnerships, joint ventures, and agreements

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per client-specific requirements. The available customization options are as follows:

Regional Analysis

- Further breakdown of the Rest of Asia Pacific mushroom cultivation market, by country

- Further breakdown of other Rest of Europe mushroom cultivation market, by country

- Further breakdown of other Rest of the World mushroom cultivation market, by region

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Mushroom Cultivation Market