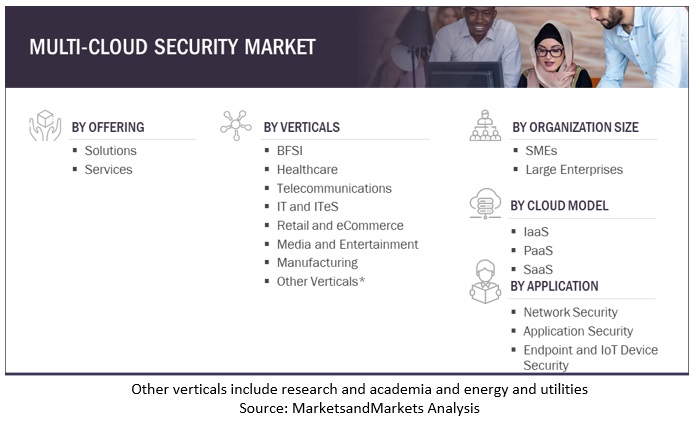

Multi-cloud Security Market by Offering (Solution and Services), Cloud Model (IaaS, PaaS, and SaaS), Application (Network, Endpoint), Verticals (BFSI, Healthcare, IT and ITeS, Retail and eCommerce), Organization Size Region - Global Forecast to 2027

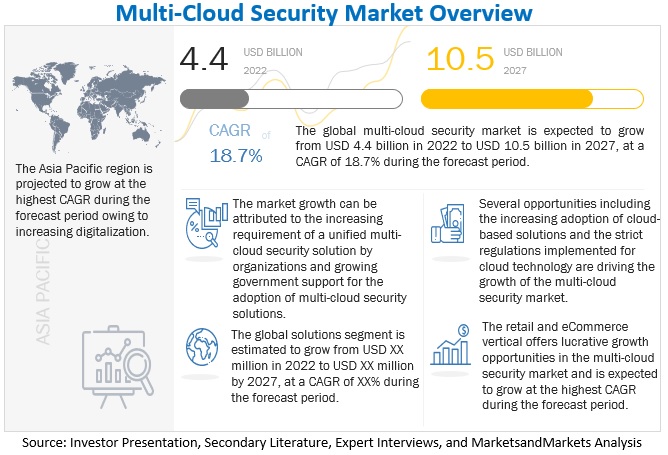

[277 Pages Report] The global multi-cloud security market is projected to grow from an estimated value of USD 4.4 billion in 2022 to USD 10.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 18.7% from 2022 to 2027. There has been a rise in the cyberattacks faced by organizations in the recent years. This factor is expected to contribute to the growth of the multi-cloud security market. There is a significant demand for multi-cloud security solutions across verticals, such as BFSI, healthcare, telecommunication, IT & ITeS, retail and eCommerce, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Multi-Cloud Security Market Dynamics

Driver: Growing government support for multi-cloud security solutions

Several regulations control the operation of the multi-cloud security market. Organizations and governments worldwide are opting for initiatives in multi-cloud environments. The National Institute of Standards and Technology is establishing a Multi-Cloud Security Public Working Group (MCSPWG) to research the best practices for securing complex cloud solutions involving multiple service providers and clouds. The MCSPWG research will focus on identifying the challenges of implementing secure multi-cloud systems and developing guidance and best practices for mitigating the identified challenges. The Cloud Smart Federal Computing Strategy encourages US federal agencies to accelerate cloud adoption and modernize their IT infrastructures, leverage cloud technology scalability, and speed-to-market by expanding and diversifying cloud portfolios to incorporate multi-party cloud solutions. Organizations using cloud computing technologies must comply with PCI DSS and HIPAA regulations. These initiatives and regulations implemented by the government have prompted organizations to adopt multi-cloud security solutions to secure multi-cloud environments.

Restraint: Limited skilled expertise for deployment of multi-cloud security solutions

The deployment of multi-cloud security solutions requires the necessary technical skills and knowledge. Additionally, the increasing establishment of cloud-native startups and companies requires a talent pool with strong expertise. The increasing use of cloud technology worldwide has contributed to the growing demand for employees possessing skills in the usage of sophisticated technologies. As the organizations are rebounding from the economically impeding lockdowns of Covid-19, hiring people with the required skill set is challenging. As data integrity and security have grown extremely important in recent years, sourcing technical talent has also gained significant importance. With talent shortages worldwide, training existing staff has become more important to meet the rising demand for data migration and storage. The 2021 Open Source Jobs Report by Linux Foundation provides data on specific areas wherein skill requirements are most acute. For instance, the report reveals that cloud-native skills are more in demand than other technical disciplines. 61% of the professionals surveyed reported that organizations using the cloud have increased since 2020. Therefore, the increasing adoption of the cloud is expected to drive the need for personnel to handle security solutions.

Opportunity: Adoption of BYOD and remote working models to offer lucrative growth

Organizations are increasingly adopting the BYOD (Bring Your Own Device) and work-from-home model. Organizations using the BYOD concept and cloud-based systems enable employees to work remotely while using the office network. With the increasing popularity of different cloud offerings and BYOD policies, enterprises are eventually moving toward a multi-cloud deployment model. Remote work helps companies avoid loss of productivity and protects public health. The health and economic crisis related to the Covid-19 pandemic and the physical distancing measures required has prompted many firms to introduce work-from-home for their employees on a large scale. Additionally, many organizations are adopting the BYOD trend to reduce initial infrastructure deployment and maintenance expenses. High dependence on the BYOD and WFH trend urges organizations to secure their office cloud servers to enhance their security and enable business continuity, thus driving the demand for multi-cloud security solutions.

Challenge: Disaster Recovery Planning

In multi-cloud deployment, reliability and disaster recovery play an important role. Disasters occur for cloud providers; therefore, organizations plan to recover when they occur. Understanding the failure modes of each cloud provider and how they affect the application stack is important for building reliable applications. Recovering from a disaster across multiple cloud providers can prove to be difficult. Often, each cloud provider has a different method of enacting a recovery process. The increased complexity can further inhibit the predefined recovery point and time objectives. Compromised recovery point and recovery time objectives could lead to service level agreement violations with time. Therefore, a reliable disaster recovery plan must be in place for the smooth operations of multi-cloud environments.

Multi-Cloud Security Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By offering, services segment to grow at higher CAGR, during the forecast period

Multi-cloud security services include professional and managed services. The professional services comprise deployment, operation, and optimization. It enables planning the security design, creating a robust security platform, and optimizing the security performance by reducing vulnerabilities, errors, and costs. Multi-cloud security services allow the implementation and deployment of multi-cloud security solutions. Professional services help optimize security performance and minimize risk exposure. For instance, Fujitsu (Japan) provides for a range of public and private sector customers delivering services in on-premises, hybrid IT, and multi-cloud environments. The service portfolio comprises managed services for cloud-native security controls. It augments cloud-native security controls with cloud-agnostic security controls that help meet customers' broadening multi-cloud and hybrid IT security requirements. Its managed security service portfolio comprises CASB services, cloud-agnostic encryption services, and security services for Microsoft 365.

By cloud model, SaaS segment is to grow at the highest CAGR during the forecast period

Software-as-a-Service is a method for software applications to be delivered over the internet through the Cloud. SaaS is often referred to as cloud software due to its ability to be delivered via the internet. Unlike previous methods of purchasing software and installing it onto a device, SaaS is usually subscription based. This software isn't localized on a specific PC; it is accessed via an internet connection. The benefits of SaaS include that it eradicates initial costs, users can pay as per the requirement, data security, and flexibility. SaaS is usually delivered on a subscription basis, and it eliminates the initial costs associated with implementing software. Another benefit of subscription SaaS is that it can be utilized as long as one requires the software. Cloud-connected software systems help eliminate the vulnerabilities associated with storing files on a local device. SaaS vendors are increasingly focusing on cloud infrastructure security owing to the increasing cyberattacks and threats, thus driving the uptake of multi-cloud security solutions.

Application security is a system of policies, processes, and controls that enable enterprises to protect applications and data in collaborative cloud environments. It is the process of securing cloud-based software applications throughout the development lifecycle. It includes application-level policies, tools, technologies, and rules to maintain visibility into all Cloud-based assets, protect Cloud-based applications from cyberattacks, and limit access to only authorized users. Application security is crucial for organizations operating in a multi-cloud environment hosted by a third-party cloud provider such as Amazon, Microsoft, or Google, as well as for those utilizing collaborative web applications such as Slack, Microsoft Teams, or Box. The need for organizations to maintain application-level policies and protect cloud applications from cyber threats is expected to drive the use of application security across organizations.

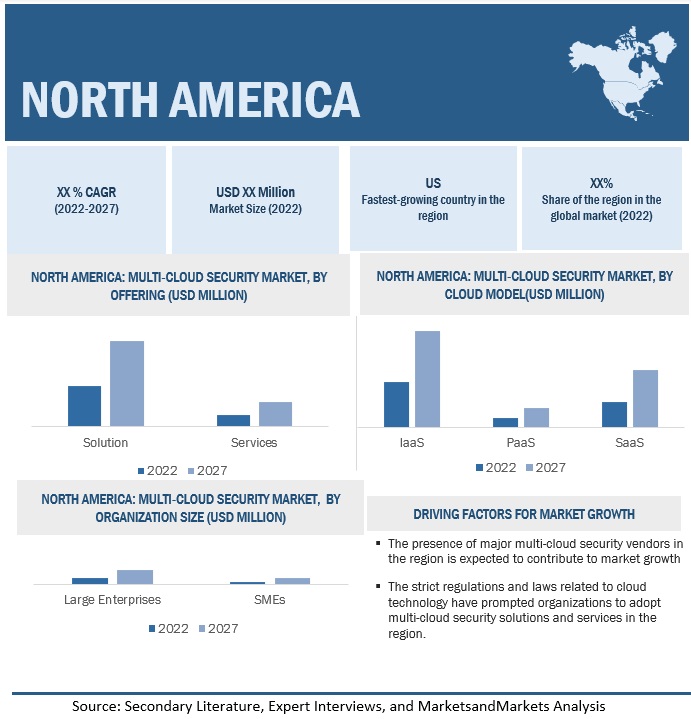

By region, North America to account for the largest market size during the forecast period

North America is expected to be the largest contributor in terms of the market size in the global multi-cloud security market. It is one of the most advanced regions in terms of security technology adoption and infrastructure. The region is experiencing increasing digitalization in the recent years. Organizations are increasingly shifting their systems from the on-premises environments to the cloud infrastructure. The increasing digitalization in the region has contributed to a rise in the use of multi-cloud security solutions. The increasing deployment of multi-cloud infrastructure has further led to rise in the use of multi-cloud security solutions by organizations, to increase the security posture of the deployed infrastructure. Several regulatory bodies and laws govern the multi-cloud security market. PCI DSS is one such compliance that requires the cloud deployments to follow the standards set by it. The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment. Multi-cloud security systems are increasingly being deployed to ensure security of the cloud infrastructure deployed. In December 2021, outages occurred in the AWS network. Multiple services became unavailable due to this in the region. Multi-cloud strategy helps in such cases as hosting IT across multiple cloud providers under one ecosystem helps enterprises mitigate cyberattacks and data breaches while also offering greater mobility and flexibility. Moreover, multi cloud security solutions help to maintain the security posture of the deployment in such cases. The key multi-cloud security market vendors functioning in the region include Microsoft, VMware, F5, Entrust, Cloudflare, among others. The presence of major vendors in the multi-cloud security in the region is expected to contribute to the growth of the market.

Key Market Players

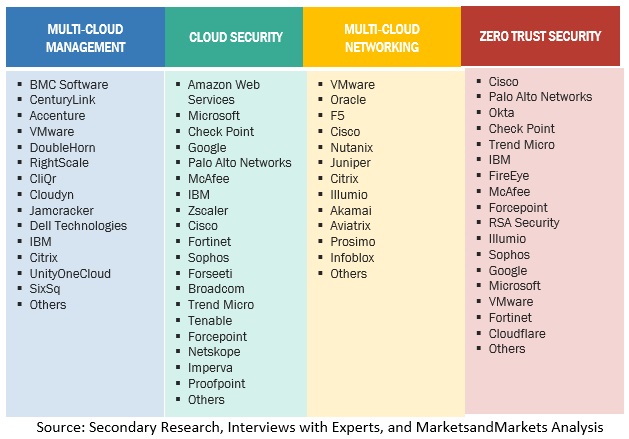

The major vendors in the multi-cloud security market include Microsoft (US), VMware (US), Rackspace (UK), Check Point (Israel), F5 (US), Amazon Web Services (US), Fujitsu (Japan), Entrust (US), Google Cloud (US), Cloudflare (US), IBM (US), Cloud4C (Singapore), Proofpoint (US), Lacework (US), BMC Software (US), SonicWall (US), Atos (France), Imperva (US), Micro Focus (UK), Aqua Security (Israel), Aviatrix (US), Saviynt (US), Tufin (US), Distology (UK), Fortanix (US), Illumio (US), Fidelis Cybersecurity (US), Valtix (US), Orca Security (US), Ascend Technologies (US), Ermetic (US), Caveonix (US), and AccuKnox (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

Offering, Cloud Model, Organization Size, Application, Verticals, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Major companies covered |

Microsoft (US), VMware (US), Rackspace (UK), Check Point (Israel), F5 (US), Amazon Web Services (US), Fujitsu (Japan), Entrust (US), Google Cloud (US), Cloudflare (US), IBM (US), Cloud4C (Singapore), Proofpoint (US), Lacework (US), BMC Software (US), SonicWall (US), Atos (France), Imperva (US), Micro Focus (UK), Aqua Security (Israel), Aviatrix (US), Saviynt (US), Tufin (US), Distology (UK), Fortanix (US), Illumio (US), Fidelis Cybersecurity (US), Valtix (US), Orca Security (US), Ascend Technologies (US), Ermetic (US), Caveonix (US), and AccuKnox (US). |

Market Segmentation

Recent Developments

- In April 2022, Imperva launched the Imperva Data Security Fabric to modernize and simplify data governance, security, and workflow management for all data across multi-cloud and hybrid environments. Imperva DSF standardizes data security controls across enterprise environments to provide full visibility of what is happening across all file stores and assets, on-premises, and across clouds. Its flexible architecture supports many data repositories, ensuring security policies are applied consistently.

- In February 2022, Check Point acquired Spectral, an Israeli startup and key innovator in developer-first security tools designed for developers. With this acquisition, Check Point will expand its cloud solution, Check Point CloudGuard, and provide the widest range of cloud application security use cases.

- In July 2022, Rackspace extended its partnership with Datadog, a cloud application monitoring and security platform. As Rackspace helps customers modernize multi-cloud adoption, the ability to maintain visibility into application environments is critical. Datadog’s observability solutions provide this visibility through a unified view across private & public clouds.

Frequently Asked Questions (FAQ):

What is the definition of multi-cloud security?

According to MarketsandMarkets, Multi-cloud security is a cloud security solution and service that protects multiple public cloud platforms. The solution protects cyber breaches across multiple cloud infrastructures and caters to applications such as network security, endpoint and IoT device security, and application security”.

What is the projected market value of the global multi-cloud security market?

The global multi-cloud security market is projected to grow from an estimated value of USD 4.4 billion in 2022 to USD 10.5 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 18.7% from 2022 to 2027.

Who are the key companies influencing market growth?

Microsoft, VMware, Rackspace, Check Point, F5, are the leaders in the multi-cloud security market, recognized as the star players. These companies account for a major share of the multi-cloud security market. They offer wide solutions related to multi-cloud security. These vendors offer customized solutions per user requirements and are adopting growth strategies to consistently achieve the desired growth and make their presence in the market.

Which emerging startups/SMEs are significantly supporting market growth?

Aqua Security, Aviatrix, Saviynt, Tufin, Distology, are some emerging startups that nurture market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising need for unified multi-cloud security solutions due to Increasing cyberattacks- Growing government support for multi-cloud security solutionsRESTRAINTS- Shortage of skills necessary to deploy multi-cloud security solutionsOPPORTUNITIES- Adoption of BYOD and remote working modelsCHALLENGES- Complexities associated with multi-cloud security solutions and services- Disaster recovery planning

-

5.3 ECOSYSTEM MAPPING

-

5.4 TECHNOLOGY ANALYSISAI/ML AND MULTI-CLOUD SECURITYBIG DATA ANALYTICS AND MULTI-CLOUD SECURITYBLOCKCHAIN TECHNOLOGY WITH MULTI-CLOUD SECURITYZERO TRUST NETWORK ACCESSCLOUD-NATIVE APPLICATION PROTECTION PLATFORM

-

5.5 REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI–DSS)GENERAL DATA PROTECTION REGULATION (GDPR)CALIFORNIA CONSUMER PRIVACY ACT (CCPA)PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT (PIPEDA)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.6 PATENT ANALYSIS

-

5.7 USE CASESUSE CASE 1: AQUA SECURITY HELPS NCR CORPORATION TO SECURELY TRANSIT TO MULTI-CLOUD MICROSERVICES APPLICATIONUSE CASE 2: VIUTV CHOOSES CLOUDGUARD CLOUD SECURITY POSTURE MANAGEMENT TO SECURE MULTI-CLOUD ENVIRONMENTUSE CASE 3: O.C. TANNER PROTECTS CUSTOMER DATA ACROSS HYBRID, MULTI-CLOUD, AND MULTI-SITE ENVIRONMENTSUSE CASE 4: CADENCE USES CLOUDGUARD POSTURE MANAGEMENT FOR ROBUST SECURITY ACROSS ITS MULTI-CLOUD ENVIRONMENT

-

5.8 PRICING ANALYSISAVERAGE SELLING PRICE (ASP) TREND

-

5.9 SUPPLY CHAIN ANALYSISMULTI-CLOUD SECURITY SOLUTION AND SERVICE PROVIDERSSYSTEM INTEGRATORSSALES SERVICE PROVIDERS AND DISTRIBUTERSEND USERS

-

5.10 PORTER’S FIVE FORCES MODEL ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAIMPACT OF KEY STAKEHOLDERS ON BUYING PROCESS

- 5.13 KEY CONFERENCES AND EVENTS, 2022–2023

- 6.1 INTRODUCTION

-

6.2 SOLUTIONSINCREASING CYBER THREATS TO FUEL DEMANDSOLUTIONS: MULTI-CLOUD SECURITY MARKET DRIVERS

-

6.3 SERVICESRISING DEPLOYMENT OF MULTI-CLOUD SECURITY SOLUTIONS TO CREATE NEED FOR SERVICESSERVICES: MULTI-CLOUD SECURITY MARKET DRIVERS

- 7.1 INTRODUCTION

-

7.2 INFRASTRUCTURE-AS-A-SERVICE (IAAS)VIRTUALIZATION OF HARDWARE AND ENHANCED SCALABILITY TO DRIVE MARKETIAAS: MULTI-CLOUD SECURITY MARKET DRIVERS

-

7.3 PLATFORM-AS-A-SERVICE (PAAS)SUBSCRIPTION-BASED MODELS WITH STREAMLINED INTEGRATION TO SUPPORT MARKET GROWTHPAAS: MULTI-CLOUD SECURITY MARKET DRIVERS

-

7.4 SOFTWARE-AS-A-SERVICE (SAAS)COST-EFFICIENT MODEL WITH ENHANCED FLEXIBILITY TO DRIVE MARKETSAAS: MULTI-CLOUD SECURITY MARKET DRIVERS

- 8.1 INTRODUCTION

-

8.2 LARGE ENTERPRISESMINIMIZED VENDOR LOCK-INS AND REGULATORY COMPLIANCE TO DRIVE ADOPTIONLARGE ENTERPRISES: MULTI-CLOUD SECURITY MARKET DRIVERS

-

8.3 SMESENHANCED CUSTOMER EXPERIENCE AND SECURITY INFRASTRUCTURE TO FUEL DEMAND FOR MULTI-CLOUD SOLUTIONSSMES: MULTI-CLOUD SECURITY MARKET DRIVERS

- 9.1 INTRODUCTION

-

9.2 NETWORK SECURITYINTEGRATION OF CLOUD PLATFORMS AND DEPLOYMENT OF VIRTUAL SECURITY GATEWAYS TO DRIVE MARKETNETWORK SECURITY: MULTI-CLOUD SECURITY MARKET DRIVERS

-

9.3 APPLICATION SECURITYABILITY TO PROTECT APPLICATIONS AND DATA IN COLLABORATIVE CLOUD ENVIRONMENTS TO DRIVE MARKETAPPLICATION SECURITY: MULTI-CLOUD SECURITY MARKET DRIVERS

-

9.4 ENDPOINT AND IOT DEVICE SECURITYSTRONG FOCUS ON REMEDIATING THREATS AND SECURING ENDPOINT NETWORKS TO DRIVE MARKETENDPOINT AND IOT DEVICE SECURITY: MULTI-CLOUD SECURITY MARKET DRIVERS

- 10.1 INTRODUCTION

-

10.2 BFSIRISING NEED TO PROTECT SENSITIVE DATA FROM CLOUD ATTACKS TO INCREASE NEED FOR SECURITY SOLUTIONSBFSI: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.3 HEALTHCARERISING NEED TO PROTECT CRITICAL DIGITAL DATA TO INCREASE REQUIREMENT FOR VIRTUALIZED SOLUTIONSHEALTHCARE: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.4 TELECOMMUNICATIONGROWING TREND TO DELIVER ENHANCED DIGITAL EXPERIENCES AND RISING NEED TO ENCOUNTER CLOUD-BASED CYBER ATTACKS TO DRIVE MARKETTELECOMMUNICATION: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.5 IT AND ITESRISING TREND OF REMOTE WORK TO DRIVE UTILIZATION OF SECURITY SERVICESIT AND ITES: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.6 RETAIL AND E-COMMERCEGROWING TREND OF RETAIL APPS AND E-COMMERCE TO DRIVE MARKETRETAIL AND E-COMMERCE: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.7 MEDIA AND ENTERTAINMENTRISING NEED FOR SCALABILITY AND STORAGE OF DATA TO BOOST DEMAND FOR SECURITY SOLUTIONSMEDIA AND ENTERTAINMENT: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.8 MANUFACTURINGDATA BREACHES TO SUPPORT ADOPTION OF MULTI-CLOUD SECURITY SOLUTIONS BY MANUFACTURING FIRMSMANUFACTURING: MULTI-CLOUD SECURITY MARKET DRIVERS

-

10.9 OTHER VERTICALSOTHER VERTICALS: MULTI-CLOUD SECURITY MARKET DRIVERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: REGULATORY LANDSCAPEUNITED STATES- Presence of key multi-cloud security vendors and stringent regulatory requirements to drive marketCANADA- Favorable government initiatives and support to drive market

-

11.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: REGULATORY LANDSCAPEUNITED KINGDOM- Rising government-initiated awareness to propel growthGERMANY- Cloud strategy initiative to drive adoption of security solutionsFRANCE- Rising collaborative efforts on cloud security among organizations to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: REGULATORY LANDSCAPECHINA- Rising utilization of multi-cloud deployments in organizations to drive marketJAPAN- Digital transformation initiatives to drive marketINDIA- Growing adoption of multi-cloud technology by SMEs and large enterprises to drive marketSINGAPORE- Increasing adoption of multi-cloud technology to support market growthREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: MARKET DRIVERSMIDDLE EAST AND AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Increasing business expansion projects by cloud service providers to support market growthAFRICA- Rising cybercrimes witnessed by organizations to support adoption of multi-cloud security solutions

-

11.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Growing adoption of cost-effective cloud solutions to support market growthMEXICO- Rising investments in cloud solutions by enterprises to support market growthREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 HISTORICAL REVENUE ANALYSIS

- 12.4 MULTI-CLOUD SECURITY MARKET: RANKING OF KEY PLAYERS

- 12.5 MARKET SHARE ANALYSIS

-

12.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPETITIVE BENCHMARKING FOR KEY PLAYERS

-

12.7 EVALUATION QUADRANT FOR STARTUPS AND SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR STARTUPS

-

12.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

-

13.1 KEY PLAYERSMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVMWARE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRACKSPACE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewF5- Business overview- Products/Solutions/Services offered- MnM viewAMAZON WEB SERVICES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFUJITSU- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewENTRUST- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOOGLE CLOUD- Business overview- Products/Solutions/Services offeredCLOUDFLARE- Business overview- Products/Solutions/Services offeredIBM- Business overview- Products/Solutions/Services offered- Recent developmentsCLOUD4C- Business overview- Products/Solutions/Services offeredPROOFPOINT- Business overview- Products/Solutions/Services offered- Recent developmentsLACEWORK- Business overview- Products/Solutions/Services offered- Recent developmentsBMC SOFTWARE- Business overview- Products/Solutions/Services offeredSONICWALL- Business overview- Products/Solutions/Services offeredATOS- Business overview- Products/Solutions/Services offeredIMPERVA- Business overview- Products/Solutions/Services offered- Recent developmentsMICRO FOCUS- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSAQUA SECURITYAVIATRIXSAVIYNTTUFINDISTOLOGYFORTANIXILLUMIOFIDELIS CYBERSECURITYVALTIXORCA SECURITYASCEND TECHNOLOGIESERMETICCAVEONIXACCUKNOX

-

14.1 LIMITATIONSCLOUD SECURITY MARKETMULTI-CLOUD MANAGEMENT MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 MULTI-CLOUD SECURITY MARKET: ECOSYSTEM ROLE

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 MULTI-CLOUD SECURITY MARKET: AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS

- TABLE 6 MULTI-CLOUD SECURITY MARKET: IMPACT OF PORTER’S FIVE FORCES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 8 MULTI-CLOUD SECURITY MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 9 MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 10 MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 11 SOLUTIONS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 12 SOLUTIONS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 13 SERVICES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 14 SERVICES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 15 MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 16 MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 17 IAAS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 18 IAAS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 19 PAAS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 20 PAAS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 21 SAAS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 22 SAAS: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 23 MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 24 MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 25 LARGE ENTERPRISES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 26 LARGE ENTERPRISES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 27 SMES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 28 SMES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 29 MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 30 MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 31 NETWORK SECURITY: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 32 NETWORK SECURITY: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 33 APPLICATION SECURITY: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 34 APPLICATION SECURITY: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 35 ENDPOINT AND IOT DEVICE SECURITY: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 36 ENDPOINT AND IOT DEVICE SECURITY: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 37 MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 38 MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 39 BFSI: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 40 BFSI: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 41 HEALTHCARE: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 42 HEALTHCARE: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 43 TELECOMMUNICATION: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 44 TELECOMMUNICATION: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 45 IT AND ITES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 46 IT AND ITES: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 47 RETAIL AND E-COMMERCE: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 48 RETAIL AND E-COMMERCE: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 49 MEDIA AND ENTERTAINMENT: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 50 MEDIA AND ENTERTAINMENT: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 51 MANUFACTURING: MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 52 MANUFACTURING: MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 53 MULTI-CLOUD SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 54 MULTI-CLOUD SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 55 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 56 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 57 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 67 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 68 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 69 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 70 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 71 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 72 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 73 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 74 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 75 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 76 UNITED STATES: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 77 CANADA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 78 CANADA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 79 CANADA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 80 CANADA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 81 CANADA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 82 CANADA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 83 CANADA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 84 CANADA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 85 CANADA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 86 CANADA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 87 EUROPE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 88 EUROPE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 89 EUROPE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 90 EUROPE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 91 EUROPE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 92 EUROPE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 93 EUROPE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 94 EUROPE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 95 EUROPE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 96 EUROPE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 97 EUROPE: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 98 EUROPE: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 99 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 100 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 101 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 102 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 103 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 104 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 105 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 106 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 107 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 108 UNITED KINGDOM: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 109 GERMANY: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 110 GERMANY: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 111 GERMANY: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 112 GERMANY: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 113 GERMANY: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 114 GERMANY: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 115 GERMANY: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 116 GERMANY: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 117 GERMANY: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 118 GERMANY: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 119 FRANCE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 120 FRANCE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 121 FRANCE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 122 FRANCE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 123 FRANCE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 124 FRANCE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 125 FRANCE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 126 FRANCE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 127 FRANCE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 128 FRANCE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 129 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 130 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 131 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 132 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 133 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 134 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 135 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 136 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 137 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 138 REST OF EUROPE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 139 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 140 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 141 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 142 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 143 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 144 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 145 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 146 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 147 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 148 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 149 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 150 ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 151 CHINA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 152 CHINA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 153 CHINA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 154 CHINA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 155 CHINA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 156 CHINA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 157 CHINA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 158 CHINA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 159 CHINA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 160 CHINA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 161 JAPAN: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 162 JAPAN: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 163 JAPAN: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 164 JAPAN: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 165 JAPAN: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 166 JAPAN: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 167 JAPAN: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 168 JAPAN: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 169 JAPAN: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 170 JAPAN: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 171 INDIA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 172 INDIA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 173 INDIA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 174 INDIA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 175 INDIA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 176 INDIA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 177 INDIA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 178 INDIA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 179 INDIA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 180 INDIA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 181 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 182 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 183 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 184 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 185 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 186 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 187 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 188 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 189 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 190 SINGAPORE: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 198 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 201 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 202 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 203 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 204 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 205 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 206 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 207 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 208 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 209 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 210 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 211 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 212 MIDDLE EAST AND AFRICA: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 213 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 214 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 215 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 216 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 217 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 218 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 219 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 220 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 221 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 222 MIDDLE EAST: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 223 AFRICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 224 AFRICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 225 AFRICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 226 AFRICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 227 AFRICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 228 AFRICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 229 AFRICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 230 AFRICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 231 AFRICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 232 AFRICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 233 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 234 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 235 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 236 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 237 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 238 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 239 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 240 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 241 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 242 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 243 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

- TABLE 244 LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 245 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 246 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 247 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 248 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 249 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 250 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 251 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 252 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 253 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 254 BRAZIL: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 255 MEXICO: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 256 MEXICO: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 257 MEXICO: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 258 MEXICO: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 259 MEXICO: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 260 MEXICO: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 261 MEXICO: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 262 MEXICO: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 263 MEXICO: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 264 MEXICO: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 265 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2016–2021 (USD MILLION)

- TABLE 266 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY OFFERING, 2022–2027 (USD MILLION)

- TABLE 267 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2016–2021 (USD MILLION)

- TABLE 268 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY CLOUD MODEL, 2022–2027 (USD MILLION)

- TABLE 269 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 270 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 271 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

- TABLE 272 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 273 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2016–2021 (USD MILLION)

- TABLE 274 REST OF LATIN AMERICA: MULTI-CLOUD SECURITY MARKET, BY VERTICALS, 2022–2027 (USD MILLION)

- TABLE 275 MULTI-CLOUD SECURITY MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 276 LIST OF STARTUPS/SMES AND TOTAL FUNDING

- TABLE 277 REGIONAL FOOTPRINT OF STARTUPS/SMES

- TABLE 278 MULTI-CLOUD SECURITY MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2020–2022

- TABLE 279 MULTI-CLOUD SECURITY MARKET: DEALS, 2020–2022

- TABLE 280 MICROSOFT: BUSINESS OVERVIEW

- TABLE 281 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 MICROSOFT: DEALS

- TABLE 283 VMWARE: BUSINESS OVERVIEW

- TABLE 284 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 VMWARE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 286 RACKSPACE: BUSINESS OVERVIEW

- TABLE 287 RACKSPACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 RACKSPACE: DEALS

- TABLE 289 CHECK POINT: BUSINESS OVERVIEW

- TABLE 290 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 CHECK POINT: DEALS

- TABLE 292 F5: BUSINESS OVERVIEW

- TABLE 293 F5: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 F5: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 295 F5: DEALS

- TABLE 296 AWS: BUSINESS OVERVIEW

- TABLE 297 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 AWS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 299 FUJITSU: BUSINESS OVERVIEW

- TABLE 300 FUJITSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 FUJITSU: DEALS

- TABLE 302 ENTRUST: BUSINESS OVERVIEW

- TABLE 303 ENTRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 ENTRUST: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 305 ENTRUST: DEALS

- TABLE 306 GOOGLE CLOUD: BUSINESS OVERVIEW

- TABLE 307 GOOGLE CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 CLOUDFLARE: BUSINESS OVERVIEW

- TABLE 309 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 IBM: BUSINESS OVERVIEW

- TABLE 311 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 IBM: DEALS

- TABLE 313 CLOUD4C: BUSINESS OVERVIEW

- TABLE 314 CLOUD4C: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 PROOFPOINT: BUSINESS OVERVIEW

- TABLE 316 PROOFPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 PROOFPOINT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 318 LACEWORK: BUSINESS OVERVIEW

- TABLE 319 LACEWORK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 LACEWORK: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 321 BMC SOFTWARE: BUSINESS OVERVIEW

- TABLE 322 BMC SOFTWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 323 SONICWALL: BUSINESS OVERVIEW

- TABLE 324 SONICWALL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 ATOS: BUSINESS OVERVIEW

- TABLE 326 ATOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 IMPERVA: BUSINESS OVERVIEW

- TABLE 328 IMPERVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 IMPERVA: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 330 IMPERVA: DEALS

- TABLE 331 MICRO FOCUS: BUSINESS OVERVIEW

- TABLE 332 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 MICRO FOCUS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 334 MICRO FOCUS: DEALS

- TABLE 335 ADJACENT MARKETS AND FORECAST

- TABLE 336 CLOUD SECURITY MARKET, BY SECURITY TYPE, 2015–2020 (USD MILLION)

- TABLE 337 CLOUD SECURITY MARKET, BY SECURITY TYPE, 2020–2026 (USD MILLION)

- TABLE 338 CLOUD SECURITY MARKET, BY APPLICATION, 2015–2020 (USD MILLION)

- TABLE 339 CLOUD SECURITY MARKET, BY APPLICATION, 2020–2026 (USD MILLION)

- TABLE 340 CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2015–2020 (USD MILLION)

- TABLE 341 CLOUD SECURITY MARKET, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

- TABLE 342 CLOUD SECURITY MARKET, BY VERTICALS, 2015–2020 (USD MILLION)

- TABLE 343 CLOUD SECURITY MARKET, BY VERTICALS, 2020–2026 (USD MILLION)

- TABLE 344 CLOUD SECURITY MARKET, BY REGION, 2015–2020 (USD MILLION)

- TABLE 345 CLOUD SECURITY MARKET, BY REGION, 2020–2026 (USD MILLION)

- TABLE 346 MULTI-CLOUD MANAGEMENT MARKET SIZE, BY APPLICATION, 2015–2022 (USD MILLION)

- TABLE 347 MULTI-CLOUD MANAGEMENT MARKET SIZE, BY SERVICE TYPE, 2015–2022 (USD MILLION)

- TABLE 348 MULTI-CLOUD MANAGEMENT MARKET SIZE, BY DEPLOYMENT MODEL, 2015–2022 (USD MILLION)

- TABLE 349 MULTI-CLOUD MANAGEMENT MARKET SIZE, BY VERTICALS, 2015–2022 (USD MILLION)

- TABLE 350 MULTI-CLOUD MANAGEMENT MARKET SIZE, BY REGION, 2015–2022 (USD MILLION)

- FIGURE 1 MULTI-CLOUD SECURITY MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOFTWARE/SERVICES OF MULTI-CLOUD SECURITY VENDORS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE) ANALYSIS

- FIGURE 4 MULTI-CLOUD SECURITY MARKET ESTIMATION APPROACH: RESEARCH FLOW

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2, BOTTOM-UP (DEMAND-SIDE)

- FIGURE 6 MULTI-CLOUD SECURITY MARKET: DATA TRIANGULATION

- FIGURE 7 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

- FIGURE 8 EVALUATION QUADRANT FOR STARTUPS: CRITERIA WEIGHTAGE

- FIGURE 9 MULTI-CLOUD SECURITY MARKET: LIMITATIONS

- FIGURE 10 MULTI-CLOUD SECURITY MARKET TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- FIGURE 11 MULTI-CLOUD SECURITY MARKET: SEGMENTATION SNAPSHOT

- FIGURE 12 MULTI-CLOUD SECURITY MARKET: REGIONAL SNAPSHOT

- FIGURE 13 INCREASING ADOPTION OF MULTI-CLOUD SECURITY SOLUTIONS DUE TO RISING CYBERATTACKS TO DRIVE MARKET GROWTH

- FIGURE 14 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 IAAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 16 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 BFSI SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC REGION TO OFFER LUCRATIVE OPPORTUNITIES FOR GROWTH DURING FORECAST PERIOD

- FIGURE 19 MULTI-CLOUD SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 MULTI-CLOUD SECURITY MARKET: ECOSYSTEM

- FIGURE 21 MULTI-CLOUD SECURITY MARKET: PATENT ANALYSIS

- FIGURE 22 MULTI-CLOUD SECURITY MARKET: SUPPLY CHAIN

- FIGURE 23 MULTI-CLOUD SECURITY MARKET: PORTER’S FIVE FORCE ANALYSIS

- FIGURE 24 MULTI-CLOUD SECURITY MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 26 SERVICES SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 27 SAAS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 SMES SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 APPLICATION SECURITY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 RETAIL AND E-COMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 34 MULTI-CLOUD SECURITY: MARKET EVALUATION FRAMEWORK

- FIGURE 35 HISTORICAL REVENUE ANALYSIS OF KEY MULTI-CLOUD SECURITY VENDORS, 2020–2021 (USD MILLION)

- FIGURE 36 RANKING OF KEY PLAYERS

- FIGURE 37 MULTI-CLOUD SECURITY MARKET SHARE (2021)

- FIGURE 38 MULTI-CLOUD SECURITY MARKET: KEY COMPANY EVALUATION QUADRANT (2022)

- FIGURE 39 PRODUCT FOOTPRINT OF KEY COMPANIES

- FIGURE 40 MULTI-CLOUD SECURITY MARKET: STARTUP EVALUATION QUADRANT (2022)

- FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 42 VMWARE: COMPANY SNAPSHOT

- FIGURE 43 RACKSPACE: COMPANY SNAPSHOT

- FIGURE 44 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 45 F5: COMPANY SNAPSHOT

- FIGURE 46 AWS: COMPANY SNAPSHOT

- FIGURE 47 FUJITSU: COMPANY SNAPSHOT

- FIGURE 48 GOOGLE CLOUD: COMPANY SNAPSHOT

- FIGURE 49 CLOUDFLARE: COMPANY SNAPSHOT

- FIGURE 50 IBM: COMPANY SNAPSHOT

- FIGURE 51 PROOFPOINT: COMPANY SNAPSHOT

- FIGURE 52 ATOS: COMPANY SNAPSHOT

- FIGURE 53 MICRO FOCUS: COMPANY SNAPSHOT

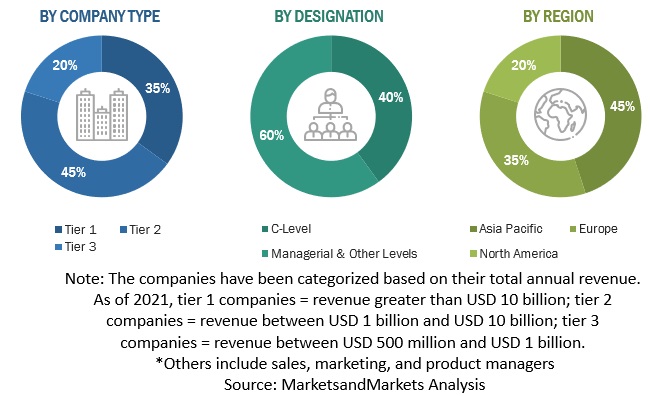

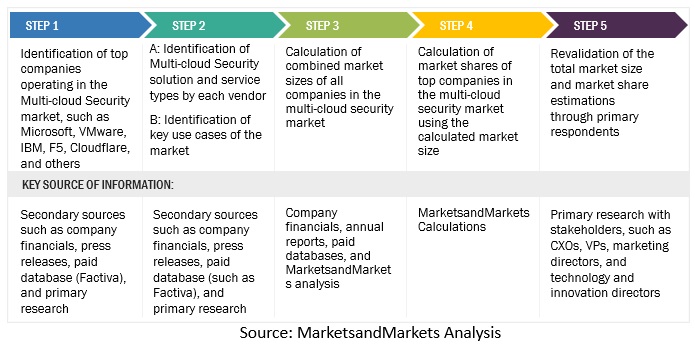

The study involved major activities in estimating the current market size of the multi-cloud security market. Exhaustive secondary research was done to collect information on the multi-cloud security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down, bottom-up, etc., were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the multi-cloud security market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of multi-cloud security vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry's value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives. The factors considered for estimating regional level market size include gross domestic product growth, ICT security spending, recent market developments, technology adoption, and market ranking analysis of primary multi-cloud security solution and service providers.

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the multi-cloud security market.

Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the multi-cloud security market. In the market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes, as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To describe and forecast the global multi-cloud security market on the basis of offering, cloud model, organization size, application, vertical, and region

- To predict the market size of five main regions: North America, Europe, the Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall multi-cloud security market

- To provide detailed information related to significant factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the multi-cloud security market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions (M&A), new product developments, partnerships, and collaborations in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Data Privacy in Multi-Cloud Market & Its Impact on the Multi-Cloud Security Market

Data privacy in multi-cloud is the practice of protecting sensitive data from unauthorized access or disclosure, and it is a key component of any security strategy in a multi-cloud environment where data is distributed across multiple cloud platforms, making it more challenging to manage and protect.

Data privacy in multi-cloud is expected to have a significant impact on the multi-cloud security market. As organizations increasingly adopt multi-cloud environments to store and process their data, the need for strong data privacy measures and robust security technologies is becoming more important than ever before.

Data privacy regulations such as GDPR, CCPA, and HIPAA require organizations to ensure that the personal data they process is protected from unauthorized access, disclosure, or misuse. In a multi-cloud environment, where data is distributed across multiple clouds, it is important to ensure that the data is secure throughout its lifecycle. This means that organizations will need to invest in security solutions that can protect data across different cloud platforms and ensure compliance with relevant regulations.

The complexity of multi-cloud environments can make it challenging to manage and secure data. Organizations need to ensure that their security solutions can provide visibility and control across multiple cloud platforms, which can be achieved by tools such as security information and event management (SIEM) systems and cloud access security brokers (CASBs). Additionally, organizations need to implement strong authentication and access control mechanisms to ensure that only authorized users can access data.

As the adoption of multi-cloud environments continues to grow, so too does the demand for security solutions that are purpose-built for multi-cloud environments. This is leading to the development of new security technologies and services that can address the unique security challenges of multi-cloud environments. This includes solutions that can provide centralized security management, automated security policy enforcement, and real-time threat detection and response across multiple clouds.

Futuristic Growth Use-Cases of Data Privacy in Multi-Cloud

- Federated Machine Learning: Federated Machine Learning is a distributed machine learning technique that enables organizations to train machine learning models across multiple cloud environments without transferring sensitive data. In a federated machine learning environment, data privacy is critical, as each cloud environment must ensure that sensitive data is protected. Data privacy technologies such as differential privacy, homomorphic encryption, and secure multi-party computation can be used to protect sensitive data in a federated machine learning environment.

- Cross-Cloud Data Analytics: In a multi-cloud environment, data is often distributed across different cloud platforms, making it challenging to perform cross-cloud data analytics. Data privacy technologies such as secure data sharing and access control can enable organizations to securely share data across different clouds, while ensuring that sensitive data is protected.

- Blockchain-based Multi-Cloud Environments: Blockchain technology can be used to create a secure and decentralized multi-cloud environment, where data is stored and processed across multiple cloud platforms. Data privacy technologies such as zero-knowledge proofs and differential privacy can be used to protect sensitive data in a blockchain-based multi-cloud environment.

- Hybrid Cloud Environments: Hybrid cloud environments, which combine public cloud, private cloud, and on-premises infrastructure, are becoming increasingly popular. Data privacy technologies such as data masking and tokenization can be used to protect sensitive data in a hybrid cloud environment, enabling organizations to maintain control over their sensitive data while leveraging the benefits of public cloud services.

Top Players in Data Privacy in Multi-Cloud Market

- Microsoft

- Amazon Web Services (AWS)

- Google Cloud Platform (GCP)

- IBM

- VMware

- Dell Technologies

- Oracle

- McAfee

- Cisco

- Palo Alto Networks

Industries Getting Impacted in the Future by Data Privacy in Multi-Cloud Market

- Healthcare: The healthcare industry collects and stores large amounts of sensitive data, including patient health records and personal information. Data privacy in multi-cloud can enable healthcare organizations to store and process this data securely while ensuring compliance with regulations such as HIPAA.

- Finance: The finance industry is highly regulated and requires strict data privacy and security measures to protect sensitive financial data. Multi-cloud environments can enable financial institutions to store and process data in a secure and compliant manner, while also allowing for greater flexibility and scalability.

- Retail: The retail industry collects large amounts of data on consumer behavior and purchasing patterns. Multi-cloud environments can enable retailers to store and process this data in a secure and compliant manner, while also allowing for advanced analytics and personalization.

- Manufacturing: The manufacturing industry collects and stores large amounts of data on production processes, supply chain management, and product quality. Multi-cloud environments can enable manufacturers to store and process this data in a secure and compliant manner, while also allowing for advanced analytics and real-time monitoring of production processes.

- Government: The government collects and stores sensitive data on citizens, including personal information, health records, and financial data. Multi-cloud environments can enable government agencies to store and process this data in a secure and compliant manner, while also allowing for greater efficiency and collaboration between agencies.

- Education: The education industry collects and stores sensitive data on students, including personal information and academic records. Multi-cloud environments can enable educational institutions to store and process this data in a secure and compliant manner, while also allowing for advanced analytics and personalized learning.

New Business Opportunities in Data Privacy in Multi-Cloud Market

- Cloud Security Consulting: As more organizations move their data to multi-cloud environments, there is a growing need for cloud security consulting services to help organizations ensure their data is protected and compliant with industry and regulatory standards.

- Cloud Access Security Broker (CASB): A CASB is a security control point positioned between cloud service consumers and cloud service providers that provides visibility and control over cloud usage. CASBs can help organizations ensure their data is secure across multiple cloud environments.

- Data Encryption: Data encryption solutions can help organizations protect their data by encrypting it at rest and in transit, ensuring that only authorized users can access the data.

- Identity and Access Management (IAM): IAM solutions can help organizations manage user access to their data in multi-cloud environments, ensuring that only authorized users can access the data.

- Compliance Management: Compliance management solutions can help organizations ensure that their data is compliant with industry and regulatory standards, such as HIPAA and GDPR.

- Threat Detection and Response: Threat detection and response solutions can help organizations detect and respond to threats in real time, ensuring that their data is protected from cyberattacks and other security threats.

- Cloud Storage: Cloud storage providers can offer secure and compliant storage solutions for organizations that want to store their data in multi-cloud environments.

- Cloud Backup and Recovery: Cloud backup and recovery solutions can help organizations ensure that their data is protected and can be recovered in the event of a disaster or data loss.

- Cloud Governance and Compliance: Cloud governance and compliance solutions can help organizations manage their multi-cloud environments, ensuring that their data is compliant with industry and regulatory standards.

Hypothetic Challenges of Data Privacy in Multi-Cloud Business in the Future

- Compliance with Regulatory Standards: Multi-cloud environments can make it challenging for organizations to ensure that their data is compliant with industry and regulatory standards. For example, if an organization operates in multiple countries, it may need to comply with different data protection regulations in each country.

- Security Threats: Multi-cloud environments can increase the risk of security threats such as data breaches and cyberattacks. As data is stored and processed across multiple clouds, it can be difficult for organizations to maintain visibility and control over their data.

- Integration Challenges: Integrating multi-cloud environments can be complex and time-consuming and may require significant investments in technology and resources. For example, integrating different cloud platforms with on-premises infrastructure can be challenging.

- Vendor Lock-In: Multi-cloud environments can lead to vendor lock-in, as organizations may become dependent on specific cloud providers for their data storage and processing needs. This can make it difficult for organizations to switch providers or make changes to their infrastructure.

- Data Sovereignty: Multi-cloud environments can raise concerns about data sovereignty, as organizations may need to ensure that their data is stored and processed within specific geographical boundaries. For example, some countries may require organizations to store and process their data within their borders.

- Data Portability: Multi-cloud environments can make it challenging for organizations to ensure that their data is portable, meaning it can be moved between different cloud platforms. This can make it difficult for organizations to switch providers or make changes to their infrastructure.

- Cost: Multi-cloud environments can be costly, as organizations may need to pay for multiple cloud services and invest in additional infrastructure and resources to manage their data across different clouds.

Speak to our Analyst today to know more about "Data Privacy in Multi-Cloud Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Multi-cloud Security Market