MRO Protective Coatings Market by Product Type (Abrasion Resistant, Low Friction, Corrosion Resistance, Intumescent), Application (Marine, Oil & Gas, Petrochemicals, Infrastructure, Power Generation) and Region - Global Forecast to 2027

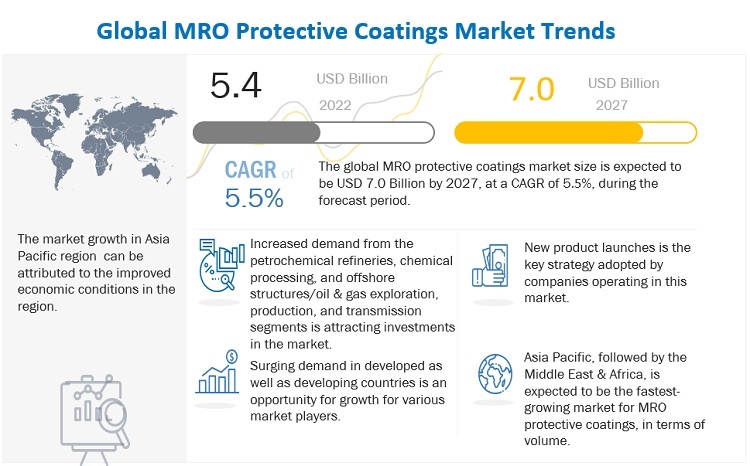

[239 Pages Report] The global MRO protective coatings market size is expected to grow from USD 5.4 billion in 2022 to USD 7.0 billion by 2027, at a CAGR of 5.5% during the forecast period. Factors such as high demand for extended product lifetime and reduced maintenance, growing demand from the infrastructure industry, and increasing need for efficient processes and longer life of equipment and devices are expected to drive the growth of the market during the forecast period. However, high prices of raw materials & energy and stringent regulatory policies are some of the challenges which restrict the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

MRO Protective Coatings Market Dynamics

Driver: Inclination of facility managers toward having effective coating maintenance plan

with a solution that optimizes applications and reduces costs by enabling precise coating thickness specifications for onshore assets. In May 2021, Hempel launched Hempafire Pro 400, a new passive fire protection coating that maintains the stability of steel structures in the event of a fire for up to 120 minutes and has been optimized for maximum efficiency in the loadings for a 90-minute duration.

Challenge: Development of cost-effective products under stringent environmental regulations

Increasingly stringent regulations governing the use of protective coatings have compelled manufacturers to develop products with low VOCs, high solid content, and less harmful biocides. Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), Green Seal, Solvent Emissions Directive (SED), and Biocidal Products Directive (BPD) are stringent environmental regulations limiting the emission of VOCs and HAPs (hazardous air pollutants). This has resulted in technical difficulties in the use of solvent-based coatings. These regulations also make the industries shift toward the use of environmentally friendly coatings. However, the challenge exists in the development of new products that conform to these stringent regulations and make them economically efficient for industries.

MRO Protective Coatings Market Ecosystem

Corrosion resistance protective coatings accounted for the largest market share, in terms of value and volume

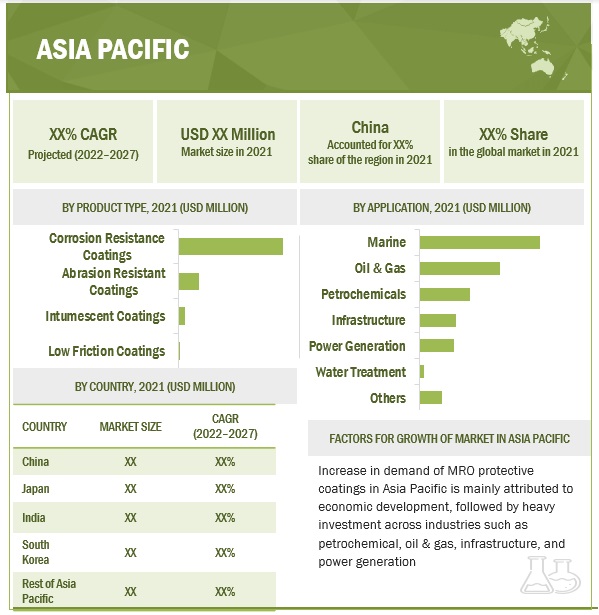

The MRO protective coatings market is segmented, by product type, into four categories, namely, abrasion resistant coatings, low friction coatings, corrosion resistance coatings, and intumescent coatings. Corrosion resistance protective coatings accounted for the largest market share in 2021, in terms of value and volume. Protective coatings with anti-corrosive properties ensure metal components have the longest possible lifespan. There are various protective coatings, but epoxy-based protective coatings generally cover the greatest area on a vessel, particularly when used in seawater ballast tanks. These coatings are expected to provide the maximum possible performance from a coating in terms of anti-corrosion protection, long life, and low maintenance. The market for corrosion protection coatings is expanding primarily as a result of rising demand in the Asia Pacific region. Over the past three decades, China's industrialization has accelerated due to changes in industrial policies, the liberalization of foreign commerce and investments, and other factors. This is fueling the Asia Pacific region's expanding need for MRO corrosion resistance coatings.

Marine segment dominated the MRO protective coatings market, in terms of value and volume

The MRO protective coatings market is segmented, by application, into seven categories, namely, marine, oil & gas, petrochemicals, infrastructure, power generation, water treatment, and others. The marine segment is expected to lead the MRO protective coatings market during the forecast period, in terms of value and volume. Due to its association with operation in corrosive environments, the marine industry has a huge demand for MRO protective coatings. These coatings are generally applied on marine parts made of steel, aluminum, fiberglass, and other substrates. They are used for cargo vessels, tankers, tug-barge, workboats, motor launches, and hydrofoils.

To know about the assumptions considered for the study, download the pdf brochure

North America is the second largest market in the MRO protective coatings market

North America is the second major consumer of MRO protective coatings Market. Technological advancements in the manufacturing sector and presence of major players, such as Exxon Mobil and Chevron, in the oil & gas market has contributed to the growth of the MRO protective coatings market, as these companies have undertaken various expansion projects in the oil & gas sector, which is expected to drive the growth of the MRO protective coatings market in this region during the forecast period.

Key Market Players

Some of the key players in the global MRO protective coatings market are The Sherwin-Williams Company (US), H.B. Fuller (US), Akzo Nobel N.V. (Netherlands), Henkel AG & Co, KGaA (Netherlands), BASF SE (Germany), Hempel A/S (Denmark), PPG Industries Inc. (US), Jotun (Norway), Axalta Coating Systems, Ltd. (US), and Nippon Paint Holdings Co. Ltd. (Japan).

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the MRO protective coatings industry. The study includes an in-depth competitive analysis of these key players in the MRO protective coatings market, with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Value (USD Million/Billion), Volume (Kiloton) |

|

Segments |

Product type, Application and Region |

|

Regions |

Europe, North America, Asia Pacific, Middle East & Africa, and South America |

|

Companies |

The Sherwin-Williams Company (US), Akzo Nobel N.V. (Netherlands), Henkel (Netherlands), BASF SE (Germany), H.B. Fuller (US), PPG Industries (US), Jotun (Norway), Nippon Paint Holdings Co., Ltd. (UK), Axalta Coatings Systems (US), and Hempel A/S (Denmark) |

This research report categorizes the MRO protective coatings market based on product type, application, and region.

By Product Type:

- Abrasion Protective Coatings

- Low Friction Coatings

- Corrosion Resistance Coatings

- Intumescent Coatings

By Application

- Marine

- Oil & Gas

- Petrochemical

- Infrastructure

- Power Generation

- Water Treatment

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In April 2022, The Sherwin-Williams Company signed an agreement to acquire European Industrial Coatings Business of Sika AG and the transaction was closed in April 2022. The company hopes that this acquisition will fit its strategy of acquiring complementary, high quality, differentiated business that would add to their profitable growth momentum.

- In June 2022, Akzo Nobel expanded its business in South and Central America after signing an agreement to acquire Grupo Orbis, a Columbia-based paints and coatings company. Grupo Orbis is present in ten countries in South America, Central America, and Antilles.

- In January 2022, H.B. Fuller completed the acquisition of Apollo, the UK’s largest independent manufacturer of liquid adhesives, coatings, and primers for the roofing, industrial, and construction markets in the beginning of 2022. The addition of this business will expand the company’s share in key construction markets in the UK and across Europe and enable global expansion of its leading position in the roofing industry.

- In June 2021, Hempel A/S acquired a unique technology developed by Das Lack Enertherm (DLE), a German-English company. The acquisition is a part of Hempel's double impact strategy that is expected to double the company revenue to USD 3.51 billion by 2025. The company considers it important to support its journey towards segment leadership with Corrosion Under Insulation (CUI), high heat, and insulation.

- In November 2021, Henkel and Nexa3D signed a material development agreement for next-generation functional polymer. Henkel and Nexa3D are working on a new industrial metal casting material that will be used in applications like automotive, robotics, heavy machinery, and hydraulics. Manufacturers can employ the material to create complicated shapes that reduce weight and consolidate pieces, resulting in cost-effective lightweight parts that can be produced in large quantities.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the MRO protective coatings market?

The global MRO Protective Coatings market is driven by the oil & gas, marine end-use industry and infrastructure market.

Which is the largest country-level market for MRO protective coatings?

China is the largest market in MRO protective coatings in 2021.

What are the challenges in the MRO protective coatings market?

Development of cost-effective products under stringent environmental regulations is the major challenge in the MRO protective coatings market.

Which type of MRO protective coatings holds the largest market share?

Corrosion resistance coatings hold the largest share in terms of value and volume, in the MRO protective coatings market.

How is the MRO protective coatings market aligned?

The market is growing at the fastest pace. It is a potential market, and many manufacturers are undertaking business strategies to expand their business.

Who are the major manufacturers?

The AkzoNobel (Netherlands), Henkel (Netherlands), BASF SE (Germany), H.B. Fuller (US), PPG Industries Inc. (US), Jotun (Norway), Nippon Paint Holdings Co., Ltd. (Japan), Axalta Coating Systems, Ltd. (US), and Hempel A/S (Denmark).

What is the biggest restraint in the MRO protective coatings market?

High prices of raw materials and energy is one of the biggest restraining factors for the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MRO PROTECTIVE COATINGS MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 RESEARCH LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH APPROACH

FIGURE 1 MRO PROTECTIVE COATINGS MARKET: RESEARCH DESIGN

2.2 BASE NUMBER CALCULATION

2.2.1 MARKET SIZE ESTIMATION

2.2.2 MARKET SIZE CALCULATION, BY APPLICATION

2.3 FORECAST NUMBER CALCULATION

2.3.1 SECONDARY DATA

2.3.1.1 Key data from secondary sources

2.3.2 PRIMARY DATA

2.3.2.1 Key data from primary sources

2.3.2.2 Primary interviews from top MRO protective coating manufacturers

2.3.2.3 Breakdown of primary interviews

2.3.2.4 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 MRO PROTECTIVE COATINGS MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MRO PROTECTIVE COATINGS MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 MRO PROTECTIVE COATINGS MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 RESEARCH ASSUMPTIONS

2.8 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.9 RESEARCH LIMITATIONS

2.10 RISKS ASSOCIATED WITH MRO PROTECTIVE COATINGS MARKET

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 5 CORROSION RESISTANCE COATINGS SEGMENT LED MRO PROTECTIVE COATINGS MARKET IN 2021

FIGURE 6 MARINE APPLICATION LED MRO PROTECTIVE COATINGS MARKET IN 2021

FIGURE 7 CHINA TO LEAD GLOBAL MRO PROTECTIVE COATINGS MARKET DURING FORECAST PERIOD

FIGURE 8 ASIA PACIFIC LED GLOBAL MRO PROTECTIVE COATINGS MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MRO PROTECTIVE COATINGS MARKET

FIGURE 9 INCREASING DEMAND FROM END-USE INDUSTRIES ATTRACTING INVESTMENTS

4.2 MRO PROTECTIVE COATINGS MARKET, BY PRODUCT TYPE

FIGURE 10 CORROSION RESISTANCE COATINGS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

4.3 MRO PROTECTIVE COATINGS MARKET, BY APPLICATION

FIGURE 11 MARINE INDUSTRY WAS LARGEST APPLICATION SEGMENT IN 2021

4.4 MRO PROTECTIVE COATINGS MARKET, BY KEY COUNTRY

FIGURE 12 MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 MARKET DYNAMICS

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MRO PROTECTIVE COATINGS MARKET

5.1.1 DRIVERS

5.1.1.1 High demand for longer product lifetime and reduced maintenance

5.1.1.2 Growing demand from infrastructure industry

5.1.1.3 Increasing need for efficient processes and longer life of equipment and devices

5.1.1.4 Inclination of facility managers toward having effective coating maintenance plan

5.1.2 RESTRAINTS

5.1.2.1 High prices of raw materials and energy

5.1.2.2 Stringent regulatory policies

TABLE 1 ALLOWABLE VOC CONTENT BY THE OZONE TRANSPORT COMMISSION (OTC), GRAMS/LITER

5.1.3 OPPORTUNITIES

5.1.3.1 Increasing demand for maintenance of existing substrates

5.1.3.2 New products drive use of MRO protective coatings

5.1.3.3 Increasing use of nano-coatings

5.1.4 CHALLENGES

5.1.4.1 Acceptance of new technologies among end users

5.1.4.2 Development of cost-effective products under stringent environmental regulations

5.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 14 MRO PROTECTIVE COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.2.1 BARGAINING POWER OF BUYERS

5.2.2 BARGAINING POWER OF SUPPLIERS

5.2.3 THREAT OF NEW ENTRANTS

5.2.4 THREAT OF SUBSTITUTES

5.2.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 2 MRO PROTECTIVE COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3 SUPPLY CHAIN ANALYSIS

TABLE 3 MRO PROTECTIVE COATINGS MARKET: SUPPLY CHAIN

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE, BY APPLICATION

FIGURE 15 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP 3 APPLICATIONS (USD/TON)

5.4.2 AVERAGE SELLING PRICE, BY REGION

TABLE 4 MRO PROTECTIVE COATINGS AVERAGE SELLING PRICE, BY REGION

TABLE 5 MRO PROTECTIVE COATINGS AVERAGE SELLING PRICE, BY PRODUCT TYPE

5.5 KEY STAKEHOLDERS & BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

5.5.2 BUYING CRITERIA

FIGURE 17 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

TABLE 7 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

5.6 TECHNOLOGY ANALYSIS

5.7 MRO PROTECTIVE COATINGS MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 8 MRO PROTECTIVE COATINGS MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.7.1 OPTIMISTIC SCENARIO

5.7.2 PESSIMISTIC SCENARIO

5.7.3 REALISTIC SCENARIO

5.8 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 9 COSMETIC PRESERVATIVES MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.9 GLOBAL REGULATORY FRAMEWORK AND ITS IMPACT ON MRO PROTECTIVE COATINGS MARKET

5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.9.2 REGULATIONS IN THE MRO PROTECTIVE COATINGS MARKET

5.9.2.1 Coatings standard

TABLE 14 BASIC COATING SYSTEM REQUIREMENTS FOR DEDICATED SEAWATER BALLAST TANKS OF ALL TYPES OF SHIPS AND DOUBLE-SIDE SKIN SPACES OF BULK CARRIERS OF 150 M AND UPWARDS

5.10 MRO PROTECTIVE COATINGS MARKET ECOSYSTEM

5.11 VALUE CHAIN ANALYSIS

FIGURE 18 VALUE CHAIN ANALYSIS

5.12 TRADE ANALYSIS

TABLE 15 COUNTRY-WISE EXPORT DATA: PAINTS AND VARNISHES BASED ON ACRYLIC OR VINYL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM, 2021

TABLE 16 COUNTRY-WISE EXPORT DATA: PAINTS AND VARNISHES BASED ON ACRYLIC OR VINYL POLYMERS, DISPERSED OR DISSOLVED IN A NON-AQUEOUS MEDIUM, 2021

TABLE 17 COUNTRY-WISE IMPORT DATA: PAINTS AND VARNISHES BASED ON ACRYLIC OR VINYL POLYMERS, DISPERSED OR DISSOLVED IN AN AQUEOUS MEDIUM, 2021

TABLE 18 COUNTRY-WISE IMPORT DATA: PAINTS AND VARNISHES BASED ON ACRYLIC OR VINYL POLYMERS, DISPERSED OR DISSOLVED IN A NON-AQUEOUS MEDIUM, 2021

5.13 CASE STUDY ANALYSIS

5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.15 PATENT ANALYSIS

5.15.1 INTRODUCTION

5.15.2 METHODOLOGY

5.15.3 DOCUMENT TYPE

TABLE 19 MRO PROTECTIVE COATINGS MARKET: GLOBAL PATENTS

FIGURE 19 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

FIGURE 20 GLOBAL PATENT PUBLICATION TREND ANALYSIS: LAST TEN YEARS

5.15.4 INSIGHTS

5.15.5 LEGAL STATUS OF PATENTS

FIGURE 21 MRO PROTECTIVE COATINGS MARKET: LEGAL STATUS OF PATENTS

5.15.6 JURISDICTION ANALYSIS

FIGURE 22 GLOBAL JURISDICTION ANALYSIS

5.15.7 ANALYSIS OF TOP APPLICANTS

FIGURE 23 INSTITUTE OF METAL RESEARCH, CHINESE ACADEMY OF SCIENCES HAS HIGHEST NUMBER OF PATENTS

5.15.8 LIST OF PATENTS BY INSTITUTE OF METAL RESEARCH (IMR), CHINESE ACADEMY OF SCIENCES (CAS)

5.15.9 LIST OF PATENTS BY GENERAL ELECTRIC COMPANY

5.15.10 LIST OF PATENTS BY HONEYWELL INTERNATIONAL INC.

5.15.11 LIST OF PATENTS BY HYUNDAI MOTOR COMPANY

5.15.12 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

6 MRO PROTECTIVE COATINGS MARKET, BY PRODUCT TYPE (Page No. - 90)

6.1 INTRODUCTION

FIGURE 24 CORROSION RESISTANCE COATINGS TO LEAD THE MRO PROTECTIVE COATINGS MARKET

TABLE 20 MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 21 MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

6.2 MRO ABRASION RESISTANT COATINGS

6.2.1 MOST WIDELY USED IN POWER GENERATION INDUSTRY

FIGURE 25 EUROPE TO LEAD MRO ABRASION RESISTANT COATINGS MARKET

TABLE 22 MRO ABRASION RESISTANT COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 MRO ABRASION RESISTANT COATINGS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.3 MRO LOW FRICTION COATINGS

6.3.1 OFFER FRICTION CONTROL AND SURFACE RELEASE SOLUTIONS WHERE LIQUID LUBRICANTS CANNOT BE USED

FIGURE 26 ASIA PACIFIC TO LEAD MRO LOW FRICTION COATINGS MARKET

TABLE 24 MRO LOW FRICTION COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 25 MRO LOW FRICTION COATINGS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.4 MRO CORROSION RESISTANCE COATINGS

6.4.1 INCREASE IN LIFE SPAN OF PRODUCTS WHILE ENHANCING THEIR EFFICIENCY

TABLE 26 MRO CORROSION RESISTANCE COATINGS MARKET SIZE, BY RESIN TYPE, 2021

FIGURE 27 ASIA PACIFIC TO LEAD MRO CORROSION RESISTANCE COATINGS MARKET

TABLE 27 MRO CORROSION RESISTANCE COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 MRO CORROSION RESISTANCE COATINGS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

6.5 MRO INTUMESCENT COATINGS

6.5.1 WIDELY USED AS FIRE-RESISTANT BARRIER FOR SUBSTRATES

FIGURE 28 EUROPE TO LEAD MRO INTUMESCENT COATINGS MARKET

TABLE 29 MRO INTUMESCENT COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 30 MRO INTUMESCENT COATINGS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

7 MRO PROTECTIVE COATINGS MARKET, BY APPLICATION (Page No. - 100)

7.1 INTRODUCTION

FIGURE 29 MARINE SEGMENT TO LEAD MRO PROTECTIVE COATINGS MARKET

TABLE 31 MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 32 MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

7.2 MARINE

7.2.1 SHIPPING STANDARDS TO INCREASE SALES OF PROTECTIVE COATINGS

FIGURE 30 ASIA PACIFIC TO LEAD MARINE INDUSTRY IN MRO PROTECTIVE COATINGS MARKET

TABLE 33 MRO PROTECTIVE COATINGS MARKET SIZE IN MARINE APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 34 MRO PROTECTIVE COATINGS MARKET SIZE IN MARINE APPLICATION, BY REGION, 2020–2027 (KILOTON)

7.3 OIL & GAS

7.3.1 THERMAL RESISTANCE AND FIRE PROTECTION COATINGS TO DRIVE MARKET IN OFFSHORE AND OIL & GAS INDUSTRIES

FIGURE 31 ASIA PACIFIC TO LEAD OIL & GAS INDUSTRY IN MRO PROTECTIVE COATINGS MARKET

TABLE 35 MRO PROTECTIVE COATINGS MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 36 MRO PROTECTIVE COATINGS MARKET SIZE IN OIL & GAS APPLICATION, BY REGION, 2020–2027 (KILOTON)

7.4 PETROCHEMICALS

7.4.1 TANK LININGS AND SAFETY COATINGS TO INCREASE DEMAND

FIGURE 32 ASIA PACIFIC TO LEAD PETROCHEMICALS INDUSTRY IN MRO PROTECTIVE COATINGS MARKET

TABLE 37 MRO PROTECTIVE COATINGS MARKET SIZE IN PETROCHEMICALS APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 38 MRO PROTECTIVE COATINGS MARKET SIZE IN PETROCHEMICALS APPLICATION, BY REGION, 2020–2027 (KILOTON)

7.5 INFRASTRUCTURE

7.5.1 MULTIPURPOSE PROPERTIES TO LEAD TO EXPANSION OF MARKET IN INFRASTRUCTURE INDUSTRY

FIGURE 33 ASIA PACIFIC TO LEAD INFRASTRUCTURE INDUSTRY IN MRO PROTECTIVE COATINGS MARKET

TABLE 39 MRO PROTECTIVE COATINGS MARKET SIZE IN INFRASTRUCTURE APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 40 MRO PROTECTIVE COATINGS MARKET SIZE IN INFRASTRUCTURE APPLICATION, BY REGION, 2020–2027 (KILOTON)

7.6 POWER GENERATION

7.6.1 MAINTENANCE SYSTEMS AND STRUCTURES PROTECTED WITH COATINGS

FIGURE 34 ASIA PACIFIC TO LEAD POWER GENERATION INDUSTRY IN MRO PROTECTIVE COATINGS MARKET

TABLE 41 MRO PROTECTIVE COATINGS MARKET SIZE IN POWER GENERATION APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 42 MRO PROTECTIVE COATINGS MARKET SIZE IN POWER GENERATION APPLICATION, BY REGION, 2020–2027 (KILOTON)

7.7 WATER TREATMENT

7.7.1 ABRASION AND CHEMICAL RESISTANCE PROPERTIES

FIGURE 35 ASIA PACIFIC TO LEAD WATER TREATMENT INDUSTRY IN MRO PROTECTIVE COATINGS MARKET

TABLE 43 MRO PROTECTIVE COATINGS MARKET SIZE IN WATER TREATMENT APPLICATION, BY REGION, 2020–2027 (USD MILLION)

TABLE 44 MRO PROTECTIVE COATINGS MARKET SIZE IN WATER TREATMENT APPLICATION, BY REGION, 2020–2027 (KILOTON)

7.8 OTHERS

FIGURE 36 ASIA PACIFIC TO LEAD OTHER INDUSTRIES IN MRO PROTECTIVE COATINGS MARKET

TABLE 45 MRO PROTECTIVE COATINGS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 46 MRO PROTECTIVE COATINGS MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2020–2027 (KILOTON)

8 MRO PROTECTIVE COATINGS MARKET, BY REGION (Page No. - 115)

8.1 INTRODUCTION

FIGURE 37 INDIA TO BE FASTEST-GROWING MRO PROTECTIVE COATINGS MARKET DURING FORECAST PERIOD

FIGURE 38 MRO PROTECTIVE COATINGS MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR BETWEEN 2022 AND 2027

TABLE 47 MRO PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2020–2027 (USD MILLION)

TABLE 48 MRO PROTECTIVE COATINGS MARKET SIZE, BY REGION, 2020–2027 (KILOTON)

8.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SNAPSHOT

TABLE 49 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 50 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 51 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 52 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 53 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 54 ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.2.1 CHINA

8.2.1.1 Rising demand from renovation activities

TABLE 55 CHINA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 56 CHINA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.2.2 INDIA

8.2.2.1 Increased FDI and shifting of manufacturing facilities

TABLE 57 INDIA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 58 INDIA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.2.3 JAPAN

8.2.3.1 Investments in natural gas pipelines

TABLE 59 JAPAN: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 60 JAPAN: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.2.4 SOUTH KOREA

8.2.4.1 Rising demand from infrastructure and oil & gas industries

TABLE 61 SOUTH KOREA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 62 SOUTH KOREA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.2.5 REST OF ASIA PACIFIC

TABLE 63 REST OF ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 64 REST OF ASIA PACIFIC: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.3 NORTH AMERICA

FIGURE 40 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 67 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 69 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.3.1 US

8.3.1.1 Presence of major manufacturers in oil & gas sector

TABLE 71 US: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 72 US: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.3.2 CANADA

8.3.2.1 Presence of numerous oil & gas industries

TABLE 73 CANADA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 74 CANADA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.3.3 MEXICO

8.3.3.1 Major expansion plans in oil & gas sector

TABLE 75 MEXICO: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 76 MEXICO: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4 EUROPE

FIGURE 41 EUROPE: MRO PROTECTIVE COATINGS MARKET SNAPSHOT

TABLE 77 EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 78 EUROPE: MRO PROTECTIVE COATINGS MARKET, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 79 EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 80 EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 81 EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 82 EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.1 GERMANY

8.4.1.1 Increasing demand from power generation and marine industries

TABLE 83 GERMANY: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 84 GERMANY: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.2 FRANCE

8.4.2.1 Large-scale investments in infrastructure and chemical industries

TABLE 85 FRANCE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 86 FRANCE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.3 UK

8.4.3.1 Growing power generation industry

TABLE 87 UK: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 88 UK: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.4 ITALY

8.4.4.1 Construction industry to fuel growth

TABLE 89 ITALY: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 90 ITALY: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.5 RUSSIA

8.4.5.1 Increased requirement for power generation

TABLE 91 RUSSIA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 92 RUSSIA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.6 TURKEY

8.4.6.1 Dependence on natural gas supply impacts market growth

TABLE 93 TURKEY: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 94 TURKEY: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.4.7 REST OF EUROPE

TABLE 95 REST OF EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

TABLE 96 REST OF EUROPE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

8.5 MIDDLE EAST & AFRICA

TABLE 97 MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 98 MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 99 MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 100 MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 101 MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 102 MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.5.1 SAUDI ARABIA

8.5.1.1 Upgrades to infrastructure fueling growth of industrial maintenance coatings market

TABLE 103 SAUDI ARABIA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 104 SAUDI ARABIA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.5.2 UAE

8.5.2.1 Presence of major manufacturers in industrial maintenance coatings market

TABLE 105 UAE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 106 UAE: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.5.3 SOUTH AFRICA

8.5.3.1 Surge in demand for coated products in oil & gas industry

TABLE 107 SOUTH AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 108 SOUTH AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 109 REST OF MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 REST OF MIDDLE EAST & AFRICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.6 SOUTH AMERICA

TABLE 111 SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 112 SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY COUNTRY, 2020–2027 (KILOTON)

TABLE 113 SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (USD MILLION)

TABLE 114 SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY PRODUCT TYPE, 2020–2027 (KILOTON)

TABLE 115 SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 116 SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.6.1 BRAZIL

8.6.1.1 Presence of major oil & gas manufacturer

TABLE 117 BRAZIL: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 118 BRAZIL: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.6.2 ARGENTINA

8.6.2.1 Increase in population and improved economic conditions

TABLE 119 ARGENTINA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 120 ARGENTINA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

8.6.3 REST OF SOUTH AMERICA

TABLE 121 REST OF SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 REST OF SOUTH AMERICA: MRO PROTECTIVE COATINGS MARKET SIZE, BY APPLICATION, 2020–2027 (KILOTON)

9 COMPETITIVE LANDSCAPE (Page No. - 162)

9.1 INTRODUCTION

9.2 MARKET SHARE ANALYSIS

FIGURE 42 MRO PROTECTIVE COATINGS MARKET SHARE OF TOP COMPANIES

TABLE 123 DEGREE OF COMPETITION: MRO PROTECTIVE COATINGS MARKET

9.3 MARKET RANKING

FIGURE 43 RANKING OF TOP FIVE PLAYERS IN MRO PROTECTIVE COATINGS MARKET

9.4 MARKET EVALUATION FRAMEWORK

TABLE 124 MRO PROTECTIVE COATINGS MARKET: DEALS, 2018–2022

TABLE 125 MRO PROTECTIVE COATINGS MARKET: OTHERS, 2018–2022

TABLE 126 MRO PROTECTIVE COATINGS MARKET: NEW PRODUCT DEVELOPMENT, 2018–2022

9.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 44 REVENUE ANALYSIS OF TOP MARKET PLAYERS

9.6 COMPANY EVALUATION MATRIX

TABLE 127 COMPANY FOOTPRINT

TABLE 128 COMPANY PRODUCT TYPE FOOTPRINT

TABLE 129 COMPANY APPLICATION FOOTPRINT

TABLE 130 COMPANY REGION FOOTPRINT

9.6.1 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 45 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MRO PROTECTIVE COATINGS MARKET

9.6.2 BUSINESS STRATEGY EXCELLENCE

FIGURE 46 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MRO PROTECTIVE COATINGS MARKET

9.7 COMPANY EVALUATION QUADRANT (TIER 1)

9.7.1 STAR

9.7.2 PERVASIVE

9.7.3 PARTICIPANTS

9.7.4 EMERGING LEADERS

FIGURE 47 MRO PROTECTIVE COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2021

9.8 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

TABLE 131 MRO PROTECTIVE COATINGS MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 132 MRO PROTECTIVE COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

9.9 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

9.9.1 PROGRESSIVE COMPANIES

9.9.2 RESPONSIVE COMPANIES

9.9.3 DYNAMIC COMPANIES

9.9.4 STARTING BLOCKS

FIGURE 48 MRO PROTECTIVE COATINGS MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2021

10 COMPANY PROFILES (Page No. - 180)

(Business Overview, Products Offered, New product/Technology development, Deals, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) *

10.1 KEY PLAYERS

10.1.1 THE SHERWIN-WILLIAMS COMPANY

TABLE 133 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

FIGURE 49 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

10.1.2 AKZO NOBEL N.V.

TABLE 134 AKZO NOBEL N.V.: COMPANY OVERVIEW

FIGURE 50 AKZO NOBEL N.V.: COMPANY SNAPSHOT

10.1.3 HENKEL AG & CO. KGAA

TABLE 135 HENKEL AG & CO, KGAA: COMPANY OVERVIEW

FIGURE 51 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

10.1.4 BASF SE

TABLE 136 BASF SE: COMPANY OVERVIEW

FIGURE 52 BASF SE: COMPANY SNAPSHOT

10.1.5 H.B. FULLER

TABLE 137 H.B. FULLER: COMPANY OVERVIEW

FIGURE 53 H.B. FULLER: COMPANY SNAPSHOT

10.1.6 PPG INDUSTRIES

TABLE 138 PPG INDUSTRIES: COMPANY OVERVIEW

FIGURE 54 PPG INDUSTRIES: COMPANY SNAPSHOT

10.1.7 JOTUN

TABLE 139 JOTUN: COMPANY OVERVIEW

FIGURE 55 JOTUN: COMPANY SNAPSHOT

10.1.8 NIPPON PAINT HOLDINGS CO., LTD.

TABLE 140 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

FIGURE 56 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

10.1.9 AXALTA COATING SYSTEMS

TABLE 141 AXALTA COATINGS SYSTEMS: COMPANY OVERVIEW

FIGURE 57 AXALTA COATING SYSTEMS: COMPANY SNAPSHOT

10.1.10 HEMPEL A/S

TABLE 142 HEMPEL A/S: COMPANY OVERVIEW

FIGURE 58 HEMPEL A/S: COMPANY SNAPSHOT

10.2 OTHER PLAYERS

10.2.1 GENERAL MAGNAPLATE CORPORATION

10.2.2 TEKNOS GROUP

10.2.3 WEILBURGER COATINGS GMBH

10.2.4 SIKA AG

10.2.5 CHUGOKU MARINE PAINTS LTD.

10.2.6 RPM INTERNATIONAL INC.

10.2.7 KANSAI PAINT CO., LTD.

10.2.8 REMA TIP TOP

10.2.9 BELZONA INTERNATIONAL LTD.

10.2.10 CHEMCO INTERNATIONAL LTD.

*Details on Business Overview, Products Offered, New product/Technology development, Deals, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 234)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

11.3 CUSTOMIZATION OPTIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

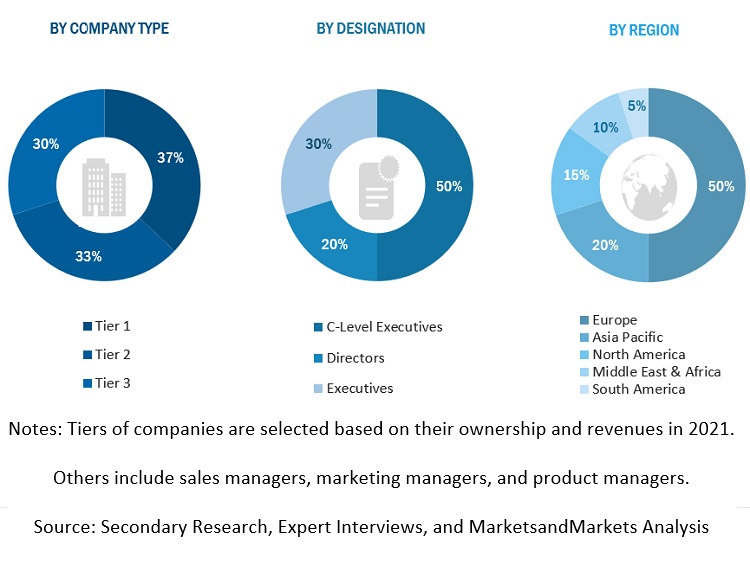

The study involves two major activities in estimating the current size of the MRO protective coatings market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information has been sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; and databases. Secondary research has been used to obtain critical information about the industry's value chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. These have also been utilized to obtain information about the key developments from a market-oriented perspective.

Primary Research

The stakeholders in the value chain of the MRO protective coatings market include raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end use-industries of MRO protective coatings. Primary sources from the supply-side include experts from companies manufacturing MRO protective coatings.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the MRO protective coatings market. Key players in the industry have been identified through extensive secondary research. The supply chain of the industry and the market size, in terms of volume, have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. The research process includes the study of reports, reviews, and newsletters of the key market players and extensive interviews for opinions from leaders such as directors and marketing executives.

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To analyze and forecast the global MRO protective coatings market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on product type and application

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and South America

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of Asia Pacific MRO protective coatings market

- Further breakdown of Rest of European MRO protective coatings market

- Further breakdown of Rest of North American MRO protective coatings market

- Further breakdown of Rest of Middle East & Africa MRO protective coatings market

- Further breakdown of Rest of South American MRO protective coatings market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in MRO Protective Coatings Market