Motion Simulation Market by Type (Hydraulic and Actuator), Degree of Freedom (Two DOF, Three DOF, and Six DOF), Application (Automotive, Defense, Entertainment, Healthcare, Mining, R&D, Sports, and Textile), and Region - Forecast to 2020

Motion simulation involves training and simulation to enable a person to specialize in a specific task. Simulation-based training is cost-effective and helps to increase productivity and achieve accuracy by eliminating mistakes on the field. The main objective of motion simulation is to provide the trainee operator real life experience in a virtual environment and to train them for specific situations. The motion simulation market is segmented on the basis of types, applications, degree of freedom, and region. The market segmented on the basis of type includes hydraulics and actuators. Actuator-based motion simulation is expected to grow at a higher CAGR than the hydraulic-based market. The applications of motion simulation include automotive, defense, entertainment, healthcare, and mining. The defense application held the major share of the market, while the entertainment application is expected to grow at the highest CAGR during the forecast period.

Motion simulation systems create a virtual environment to synchronize the simulated motion with visual display. They are primarily used to replicate the real world issues and problems in a virtual environment. It has become increasingly important to train the operator using realistic effects to increase the productivity and avoids mistake on the field. The motion simulation market is developing rapidly in various applications such as automotive, defense, mining, entertainment, and healthcare. The automotive, entertainment, and mining applications are expected to record high growth rate between 2015 and 2020. However, the major market share was contributed by the defense industry in 2014 and this trend and is expected to continue during the forecast period.

This report also includes the human motion simulation market, which has been separately analyzed according to its applications, which include automotive, defense, research and development, sport, and textile. The human motion simulation market, also termed as digital human modeling (DHM) is expected to grow rapidly during the forecast period. Initially it was developed mainly for the automotive and defense applications; however with the advancement in technology, human motion simulation is now implemented in other applications such as sport and textile as well. The defense and automotive applications of human motion simulation held high market shares in 2014; but, the sport and textile applications are estimated to grow at high CAGRs between 2015 and 2020. Some of the important human motion simulation software include DELMIA (Dassault Systems), SANTOS (SantosHuman Inc.), JACK (Siemens Product Lifecycle Management Software, Inc.), RAMSIS (Human Solutions GmbH), and SANTOS (SantosHuman Inc.).

The report includes a brief description of the factors driving and restraining the growth of the market as well as its opportunities and challenges. The factors which are driving the market include the stringent regulation in the aviation industry for simulated training, huge opportunity for cost saving, growing emphasis on patient safety, and digitization of the human body structure. The huge research and development requirement and the availability of limited for healthcare systems are the factors restraining the growth of the market. The high cost of implementation of motion simulation systems presents a major challenge for the market.

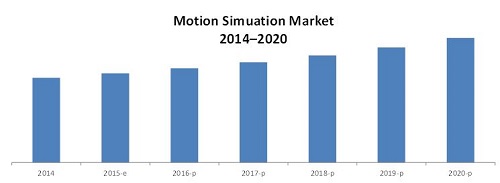

E – Estimated; P – Projected

Source: Press Releases, Investor Relation Presentations, Annual Reports, Expert Interviews, and MarketsandMarkets Analysis

The market is estimated to reach $45.72 billion by 2020, at a CAGR of 6.97% between 2015 and 2020. The actuator-based motion simulation market accounted for a market share of ~72% in 2014, and it is expected to grow at a CAGR of ~9% between 2015 and 2020. The implementation of simulator systems facilitates the development of training process and helps improve productivity. The implementation of simulation systems can offer a virtual experience to the operator, thereby eliminating the mistakes and minimizing the risk of accident in the actual work environment. APAC is expected to be the fastest-growing region for the market; it is expected to grow at a CAGR of ~10% between 2015 and 2020. North America dominates the market with the highest market share of ~56% in 2014; it is expected to grow at a CAGR of 5.50% between 2015 and 2020.

The major players involved in the development of the motion simulation market include CAE Inc. (Canada), Moog Inc. (U.S.), Siemens AG (Germany), Dassault Systems SA (France), Laerdal Medical AS (Norway), Human Solutions GmbH (Germany), Bosch Rexroth AG (Germany), Exponent Inc. (U.S.), SantosHuman Inc. (U.S.), and Thoroughbred Technologies (Pty) Ltd. (South Africa).

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Demand-Side Analysis

2.2.1 Introduction

2.2.1.1 Huge Long Term Growth is Expected in the Aviation Industry By 2033

2.2.1.2 Death Due to Medical Errors

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insight (Page No. - 32)

4.1 Motion Simulation Market, 2015–2020 ($ Billion)

4.2 Degree of Freedom (DOF) Segment in the Market

4.3 Market, By Region and Application

4.4 Market, By Region

4.5 Applications in the Market

4.6 Market, By Type

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By Application

5.3.2 By Motion Simulation Type

5.3.3 By Degree of Freedom (DOF)

5.3.4 By Human Motion Simulation

5.3.5 By Region

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Stringent Regulation in the Aviation Industry is Expected to Boost the Demand for Simulators

5.4.1.2 the Implementation of Simulators Would Greatly Help in Cost Saving

5.4.1.3 Growing Emphasis on Patient Safety is Expected to Create Demand for Motion Simulators

5.4.1.4 Digitization of Human Body Structure Helps in the Development of Efficient Products

5.4.2 Restraints

5.4.2.1 High Amount of Research and Development is Required for Commercial Application

5.4.2.2 Limited Availability of Funding for Healthcare Systems Acts as A Restraint for the Development of Motion Simulation Systems

5.4.3 Opportunities

5.4.3.1 Major Opportunity for the Growth of Motion Simulation Systems is Expected From Healthcare

5.4.3.2 Motion Simulation Systems are Expected to Have Huge Opportunity in Industrial Activities

5.4.4 Challenges

5.4.4.1 High Cost of Implementation of Motion Simulation Systems Presents A Major Challenge

6 Industry Trend (Page No. - 47)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

6.4 Strategic Benchmarking

6.4.1 Technology Integration & Product Enhancement

7 Market Analysis, Motion Simulation (Page No. - 53)

7.1 Introduction

7.2 Market Analysis, By Type

7.2.1 Hydraulic

7.2.2 Actuator

7.3 Market Analysis, By Degree of Freedom (DOF)

7.3.1 Two DOF

7.3.2 Three DOF

7.3.3 Six DOF

7.4 Market Analysis, By Application

7.4.1 Automotive

7.4.2 Defense

7.4.3 Entertainment

7.4.4 Healthcare

7.4.4.1 Healthcare Simulation Products

7.4.4.2 Web-Based Simulation

7.4.4.3 Healthcare Simulation Software

7.4.4.4 Healthcare Simulation Training Services

7.4.5 Mining

8 Market Analysis, Human Motion Simulation (Page No. - 75)

8.1 Introduction

8.2 Defense

8.3 Automotive

8.4 Textile

8.5 Sport

8.6 Research and Development

9 Regional Analysis (Page No. - 82)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia–Pacific

9.5 Rest of the World

10 Competitive Landscape (Page No. - 110)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 New Product Launches

10.2.2 Agreements & Contracts, Partnerships, Collaborations, and Joint Ventures

10.2.3 Expansions

10.2.4 Others

11 Company Profiles (Page No. - 117)

(Overview, Products and Services, Financials, Strategy & Development)*

11.1 Introduction

11.2 Bosch Rexroth AG

11.3 CAE Inc.

11.4 Dassault Systems S.A

11.5 Exponent Inc.

11.6 Human Solutions GMBH

11.7 Laerdal Medical as

11.8 Moog Inc.

11.9 Santoshuman Inc.

11.10 Siemens AG

11.11 Thoroughbred Technologies (Pty) Ltd

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 142)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (73 Tables)

Table 1 Motion Simulation and Human Motion Simulation Market Size, 2014–2020 ($Billion)

Table 2 Stringent Regulation in Aviation Industry is Expected to Boost the Demand

Table 3 Development of Motion Simulation Requires A Large Amount of R&D Activities

Table 4 Huge Opportunity for Motion Simulation Systems is Expected From Industrial Activities

Table 5 High Cost of Implementation Acts as A Major Challenge

Table 6 Market, By Type, 2014–2020 ($Billion)

Table 7 Hydraulic-Based Motion Simulation Market Size, By Application, 2014–2020 ($Billion)

Table 8 Actuator-Based Motion Simulation Market Size, By Application, 2014–2020 ($Billion)

Table 9 Market, By Degree of Freedom, 2014–2020 ($Billion)

Table 10 Two DOF-Based Motion Simulation Market Size, By Application, 2014–2020 ($Billion)

Table 11 Three DOF-Based Motion Simulation Market Size, By Application, 2014–2020 ($Billion)

Table 12 Six DOF-Based Motion Simulation Market Size, By Application, 2014–2020 ($Billion)

Table 13 Market, By Application, 2014–2020 ($Billion)

Table 14 Automotive Motion Simulation Market Size, By Type,2014–2020 ($Billion)

Table 15 Automotive Motion Simulation Market Size, By DOF,2014–2020 ($Million)

Table 16 Automotive Motion Simulation Market Size, By Region,2014–2020 ($Million)

Table 17 Defense Motion Simulation Market Size, By Type, 2014–2020 ($Billion)

Table 18 Defense Motion Simulation Market Size, By DOF, 2014–2020 ($Billion)

Table 19 Defense Motion Simulation Market Size, By Region,2014–2020 ($Billion)

Table 20 Entertainment Motion Simulation Market Size, By Type,2014–2020 ($Billion)

Table 21 Entertainment Motion Simulation Market Size, By DOF,2014–2020 ($Million)

Table 22 Entertainment Motion Simulation Market Size, By Region, 2014–2020 ($Million)

Table 23 Market, By Healthcare, 2014–2020 ($Billion)

Table 24 Healthcare Motion Simulation Market Size, By Type,2014–2020 ($Billion)

Table 25 Healthcare Motion Simulation Market Size, By DOF,2014–2020 ($Million)

Table 26 Healthcare Motion Simulation Market Size, By Region,2014–2020 ($Million)

Table 27 Mining Motion Simulation Market Size, By Type, 2014–2020 ($Million)

Table 28 Mining Motion Simulation Market Size, By DOF, 2014–2020 ($Million)

Table 29 Mining Motion Simulation Market Size, By Region, 2014–2020 ($Million)

Table 30 Human Motion Simulation Market Size, By Application,2014–2020 ($Million)

Table 31 HMS in Defense Market Size, By Region, 2014–2020 ($Million)

Table 32 HMS in Automotive Market Size, By Region, 2014–2020 ($Million)

Table 33 HMS in Textile Market Size, By Region, 2014–2020 ($Million)

Table 34 HMS in Sports Market Size, By Region, 2014–2020 ($Million)

Table 35 HMS in Research and Development Market Size, By Region, 2014–2020 ($Million)

Table 36 Market Size, By Region, 2014–2020 ($Billion)

Table 37 Human Motion Simulation Market Size, By Region, 2014–2020 ($Million)

Table 38 NA: Motion Simulation in Automotive Market Size, By Type, 2014–2020 ($Million)

Table 39 NA: Motion Simulation in Defense Market Size, By Type,2014–2020 ($Billion)

Table 40 NA: Motion Simulation in Entertainment Market Size, By Type, 2014–2020 ($Million)

Table 41 NA: Motion Simulation in Healthcare Market Size, By Type, 2014–2020 ($Million)

Table 42 NA: Motion Simulation in Mining Market Size, By Type,2014–2020 ($Million)

Table 43 NA: Market Size, By Type, 2014–2020 ($Billion)

Table 44 NA: Market Size, By Application, 2014–2020 ($Billion)

Table 45 NA: Human Motion Simulation Market Size, By Application, 2014–2020 ($Million)

Table 46 Europe: Motion Simulation in Automotive Market Size, By Type, 2014–2020 ($Million)

Table 47 Europe: Motion Simulation in Defense Market Size, By Type, 2014–2020 ($Billion)

Table 48 Europe: Motion Simulation in Entertainment Market Size, By Type, 2014–2020 ($Million)

Table 49 Europe: Motion Simulation in Healthcare Market Size, By Type, 2014–2020 ($Million)

Table 50 Europe: Motion Simulation in Mining Market Size, By Type, 2014–2020 ($Million)

Table 51 Europe: Market Size, By Type, 2014–2020 ($Billion)

Table 52 Europe: Market Size, By Application,2014–2020 ($Billion)

Table 53 Europe: Human Motion Simulation Market Size, By Application, 2014–2020 ($Million)

Table 54 APAC: Motion Simulation in Automotive Market Size, By Type, 2014–2020 ($Million)

Table 55 APAC: Motion Simulation in Defense Market Size, By Type,2014–2020 ($Billion)

Table 56 APAC: Motion Simulation in Entertainment Market Size, By Type,2014–2020 ($Million)

Table 57 APAC: Motion Simulation in Healthcare Market Size, By Type, 2014–2020 ($Million)

Table 58 APAC: Motion Simulation in Mining Market Size, By Type,2014–2020 ($Million)

Table 59 APAC: Market Size, By Type, 2014–2020 ($Billion)

Table 60 APAC: Market Size, By Application,2014–2020 ($Billion)

Table 61 APAC: Human Motion Simulation Market Size, By Application, 2014–2020 ($Million)

Table 62 RoW: Motion Simulation in Automotive Market Size, By Type, 2014–2020 ($Million)

Table 63 RoW: Motion Simulation in Defense Market Size, By Type,2014–2020 ($Billion)

Table 64 RoW: Motion Simulation in Entertainment Market Size, By Type, 2014–2020 ($Million)

Table 65 RoW: Motion Simulation in Healthcare Market Size, By Type, 2014–2020 ($Million)

Table 66 RoW: Motion Simulation in Mining Market Size, By Type,2014–2020 ($Million)

Table 67 RoW: Market Size, By Type, 2014–2020 ($Billion)

Table 68 RoW: Market Size, By Application,2014–2020 ($Billion)

Table 69 RoW: Human Motion Simulation Market Size, By Application, 2014–2020 ($Million)

Table 70 New Product Launches, 2014–2015

Table 71 Agreements & Contracts, Partnerships, Collaborations, and Joint Ventures, 2014–2015

Table 72 Expansions, 2012–2015

Table 73 Research & Development, 2014

List of Figures (65 Figures)

Figure 1 Market, By Application

Figure 2 Research Design

Figure 3 Growth in Number of Passenger and Freight Aircraft

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Assumptions of the Research Study

Figure 7 Motion Simulation Application Market Snapshot (2015 vs. 2020): Market for Defense is Expected to Hold Major Share During the Forecast Period

Figure 8 Market, By Application, 2015

Figure 9 Market, By Region, 2014

Figure 10 Battle for Market Share: Partnerships, Agreements and Contracts, Joint Ventures, & Collaborations Were the Key Strategies 2011–2014

Figure 11 Attractive Opportunities in the Market

Figure 12 Six DOF is Likely to Hold the Largest Market Share in the Market Between 2015 and 2020

Figure 13 Defense Segment is Expected to Hold Major Market Share Between 2015 and 2020

Figure 14 APAC is Expected to Grow at the Highest CAGR During the Forecast Period in the Market

Figure 15 Entertainment and Mining Industries are Expected to Grow at the Highest CAGR During 2015 and 2020

Figure 16 The Actuator Market is Expected to Be Dominant in the Market By 2020

Figure 17 Evolution of Simulation Systems

Figure 18 Market, By Application

Figure 19 Demand for Motion Simulation System is Expected to Increase in the Near Future

Figure 20 Value Chain Analysis: Maximum Value is Added During Manufacturing of Motion Simulator System

Figure 21 Porter’s Five Forces Analysis

Figure 22 Competitive Rivalry

Figure 23 Threat of Substitutes

Figure 24 Bargaining Power of Buyers

Figure 25 Bargaining Power of Suppliers

Figure 26 Threat of New Entrants

Figure 27 Strategic Benchmarking: CAE and Dassault Largely Adopted Inorganic Growth Strategies for Technology Integration and Product Enhancement

Figure 28 Actuator-Based Motion Simulation is Expected to Be the Future of Motion Simulation

Figure 29 Actuator-Based Entertainment and Mining Applications are Expected to Show High Growth Rates Between 2015 and 2020

Figure 30 Six DOF Motion Simulation is Expected to Hold A Large Market Size By 2020

Figure 31 Six DOF With Three Translations and Three Rotations

Figure 32 Entertainment Application is Expected to Grow at A High CAGR Between 2015 and 2020

Figure 33 Automotive Motion Simulation is Expected to Grow at A High CAGR in Asia-Pacific Between 2015 and 2020

Figure 34 Defense Motion Simulation With Six DOF is Likely to Hold A Large Market Size in 2020

Figure 35 Entertainment Motion Simulation With Two DOF is Expected to Grow at A High CAGR Between 2015 and 2020

Figure 36 Healthcare Simulation Products is Expected to Hold A Large Market Size By 2020

Figure 37 Healthcare Motion Simulation in Asia-Pacific is Expected to Grow at a High CAGR Between 2015 and 2020

Figure 38 Actuator-Based Mining Simulation Market is Expected to Grow at A High CAGR Between 2015 and 2020

Figure 39 Defense and Automotive Segments Had A High Market Share in 2014

Figure 40 HMS in Textile Market is Expected to Grow at A High CAGR in Asia-Pacific

Figure 41 Geographic Snapshot (2014) – Rapidly Growing Markets are Emerging as New Hotspots

Figure 42 North America Held A Major Market Share in 2014

Figure 43 North America Market Snapshot: Demand is Expected to Be High From Defense and Automotive Industry

Figure 44 North America: Actuator-Based Motion Simulation is Expected to Grow at CAGR of 16.71% in Automotive Segment During the Forecast Period

Figure 45 The Market for Hydraulic-Based Motion Simulation Systems is Expected to Decline During the Forecast Period

Figure 46 Defense Segment in North America Had A Major Market Share in the Market in 2014

Figure 47 Defense Segment Held A High Market Share in Human Motion Simulation Market in 2014

Figure 48 Automotive Motion Simulation Systems Based on Actuator are Expected to Double By 2020

Figure 49 Actuator-Based Mining Motion Simulation Systems are Likely to Show Exponential Growth Between 2015 and 2020

Figure 50 Entertainment Industry is Expected to Grow at A High CAGR in Europe

Figure 51 Asia-Pacific Motion Simulation Market Snapshot

Figure 52 Hydraulic-Based Motion Simulation Systems are Expected to Grow at A Low CAGR Between 2015 and 2020

Figure 53 APAC Market : Entertainment and Mining are Expected to Show High Growth Between 2015 and 2020

Figure 54 RoW Market for Actuator-Based Motion Simulation is Expected to Grow at A High CAGR During the Forecast Period

Figure 55 Entertainment Industry is Expected to Show A High Growth in the Market in RoW Between 2015 and 2020

Figure 56 Companies Adopted Product Innovation and Partnerships, Agreements, and Collaborations as the Key Growth Strategies (2013–2015)

Figure 57 CAE Inc. Showed the Highest Growth Rate Between 2011 and 2013

Figure 58 Market Evolution Framework—Significant Partnerships, Agreements& Contracts, Joint Ventures, & Collaborations Boosted Growth

Figure 59 Battle for Market Share: Partnerships, Agreements and Contracts, Joint Ventures, & Collaborations Were the Key Strategies, 2011–2014

Figure 60 Geographic Revenue Mix of Top 5 Market Players

Figure 61 CAE Inc.: Company Snapshot

Figure 62 Dassault Systems S.A.: Company Snapshot

Figure 63 Exponent Inc.: Company Snapshot

Figure 64 Moog Inc.: Company Snapshot

Figure 65 Siemens AG: Company Snapshot

This report also includes the market analysis of human motion simulation. Human motion simulation, also known as digital human modeling (DHM), is high-end software used for scaling the human body. It may be defined as the digital representation of humans in a virtual environment to help analyze human performance, comfort, and above all, safety. Human motion simulation software includes RAMSIS (Human Solutions GmbH), DELMIA (Dassault Systems), SANTOS (SantosHuman Inc.), and JACK (Siemens Product Lifecycle Management Software Inc.). Human motion simulation market has been analyzed on the basis of application (defense, automotive, textile, sport, and research & development) and region.

The report provides the profiles of major companies in the market. It also provides the competitive landscape of key players, detailing their growth strategy in the market. The report covers the entire value chain for the market, including an in-depth analysis of the market. The major players in the motion simulation and human motion simulation markets include CAE Inc. (Canada), Moog Inc. (U.S.), Siemens AG (Germany), Dassault Systems SA (France), Laerdal Medical AS (Norway), Human Solutions GmbH (Germany), Bosch Rexroth AG (Germany), Exponent Inc. (U.S.), SantosHuman Inc. (U.S.), and Thoroughbred Technologies (Pty) Ltd. (South Africa).

The report includes a brief description of the factors driving and restraining the market as well as its opportunities and challenges. The factors driving the market include the stringent regulation in the aviation industry for simulated training, huge opportunity for cost saving, growing emphasis on patient safety, and digitization of the human body structure. The huge research and development requirement and the availability of limited funding for healthcare systems are the major restraining factors for the development of the market. The report also provides Porter’s five forces analysis along with a description of each of the forces and its respective impact on the motion simulation market.

The detailed explanation of the different market segments is given below:

Market by Type:

The motion simulation market has been segmented into hydraulic- and actuator-based motion simulation systems.

Market by Degree of Freedom:

The motion simulation market has been segmented on the basis of degree of freedom into two, three, and six degree of freedom.

Market by Application:

The motion simulation market has been segmented into different applications including automotive, defense, entertainment, healthcare, and mining.

Market for Human Motion Simulation:

Human motion simulation has been separately analyzed in the report and is segmented on the basis of application (defense, automotive, textile, sport, and research & development) and region.

Market by Region:

The motion simulation market has been segmented into four regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW).

Growth opportunities and latent adjacency in Motion Simulation Market