Moisture Curing Adhesives Market by Chemistry (Polyurethane, Silicone, Cyanoacrylate, Polyolefin), Application (Construction, Automotive, Wood Working, Textile, Others), and Region - Global Forecast to 2021

[151 Pages Report] The Moisture Curing Adhesives Market was valued at USD 3.80 Billion in 2015 and is projected to reach USD 5.77 Billion by 2021, at a CAGR of 7.4% from 2016 to 2021. In this study, 2015 has been considered the base year and 2016 to 2021 the forecast period to project the market size of moisture cure adhesives.

Objectives of the study:

- To define, describe, and project the global moisture cure adhesives market based on chemistry, application, and region

- To forecast the market size, in terms of value and volume, of five main regional markets, namely, Europe, North America, Asia-Pacific, Middle East & Africa, and South America

- To provide detailed information on the key factors influencing market growth, such as drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze competitive developments, such as, mergers & acquisitions, expansions, new product developments/ launches, and partnerships/agreements & collaborations, in the moisture cure adhesives market

- To strategically profile the key players and comprehensively analyze their market strategies and core competencies as well as provide competitive benchmarking of various players

Research Methodology:

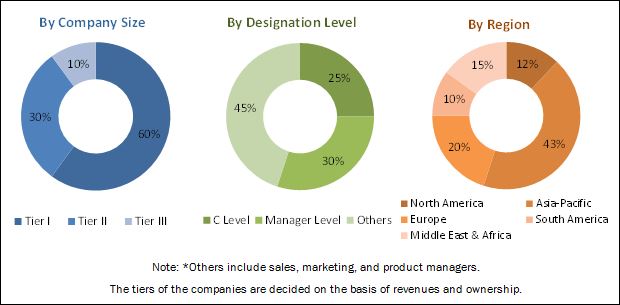

The research methodology used to estimate and forecast the market size included both, top-down and bottom-up approaches. The total market size for moisture cure adhesives is identified through both, primary and secondary research. The overall moisture cure adhesives market was further segmented, based on chemistries and applications. Percentages were allotted to the different sectors in each of the segments. These allotments and calculations were done on the basis of extensive primary interviews and secondary research. The secondary resources include annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as, Factiva, ICIS, Bloomberg, and so on. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as, CEOs, VPs, directors, and other executives. The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The global market for moisture cure adhesives is led by players such as Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), 3M Company (U.S.), Sika AG (Switzerland), Royal Adhesives & Sealants, LLC (U.S.), The Dow Chemical Company (U.S.), Illinois Tool Works Inc. (U.S.), Bostik SA (France), Dow Corning Corporation (U.S.) and Jowat SE (Germany), among others.

Target Audience:

- Manufacturers of moisture cure adhesives

- Manufacturers in end-use industries such as construction, automotive, wood working, packaging, textile and others

- Traders, distributors, and suppliers of moisture cure adhesives

- Regional manufacturers’ associations and general adhesives associations

- Government and regional agencies and research organizations

Scope of the Report:

This report categorizes the global moisture cure adhesives market based on chemistry, application, and region.

Market Segmentation, by Chemistry:

- Polyurethane

- Silicone

- Cyanoacrylate

- Polyolefin

Market Segmentation, by Application:

- Construction

- Automotive

- Wood Working

- Textiles

- Others

Market Segmentation, by Region:

- Europe

- North America

- Asia-Pacific

- Middle East & Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the customer’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Asia-Pacific moisture cure adhesives market into Thailand, Singapore, Malaysia, Philippines, Australia, and others

- Further breakdown of the Rest of Europe moisture cure adhesives market into Poland, Netherlands, Belgium, and others

Company Information

- Detailed analysis and profiles of additional market players (Up to five)

The moisture curing adhesives market is projected to reach USD 5.77 Billion by 2021, at a CAGR of 7.4% from 2016 to 2021. The moisture cure adhesives market is driven by the increasing demand from the construction and wood working industries, and its superior advantages over conventional adhesives. The moisture cure adhesives market is witnessing high growth owing to the increasing end-use applications such as automobiles, textile and footwear, and the increasing demand from emerging economies.

The moisture cure adhesives market is segmented on the basis of chemistries into, polyurethane, silicone, cyanoacrylate, and polyolefin. Polyurethane chemistry accounted for the largest share in the moisture cure adhesives market in 2015 and is expected to continue to lead during the forecast period 2016-2021.

Automotive is estimated to be the fastest growing application of moisture cure adhesives. The automotive segment is projected to drive the moisture cure adhesives market from 2016 to 2021 due to the growing automobile industry, increasing disposable incomes of the middle class population and the increasing demand for lightweight materials in automobiles. The construction application is also projected to grow at a high rate as a result of the wide applications of moisture cure adhesives in several construction activities such as flooring, tiling, insulation, roofing, and wall covering. Moisture cure adhesives offer excellent adhesion to a range of substrates comprising wood & wood based materials, composite materials, metal, concrete, glass, ceramic, and other substrate materials that are commonly used in the construction industry.

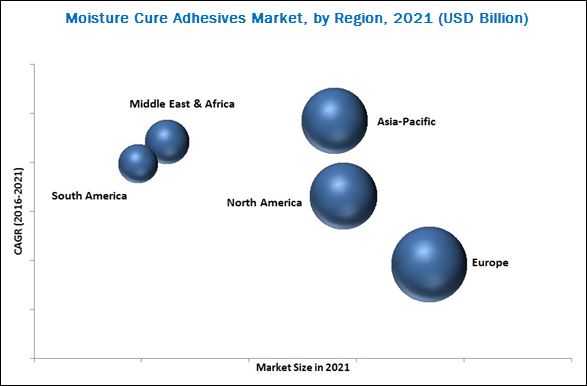

The Asia-Pacific region is expected to grow at the highest CAGR in the moisture cure adhesives market in terms of value and volume. Infrastructure development, backed by rapid industrialization and favorable government policies has offered significant growth opportunities for the moisture cure adhesives market in the Asia-Pacific region. The growing construction industry, increasing production of automobiles, growing population, and rising disposable incomes are expected to drive the moisture cure adhesives market in the region.

Development of alternatives such as UV cured adhesives, bio-based adhesives, and comparatively high curing time are factors restraining the growth of the moisture cure adhesives market.

Mergers & acquisitions, expansions as well as new product developments were the major strategies adopted by most players in the market during 2013-2017. Companies such as Bostik SA (France), Henkel AG & Co. KGaA (Germany), H.B. Fuller (U.S.), Sika AG (Switzerland), Royal Adhesives & Sealants, LLC (U.S.) Momentive Performance Materials Inc. (U.S.), The Dow Chemical Company (U.S.), Illinois Tool Works Inc. (U.S.), and Dow Corning Corporation (U.S.) were the key players who adopted these strategies to expand customer base, increase their product offerings, and to stay ahead of their competitors.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Scope of the Study

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 21)

2.1 Research Data

2.1.1 Key Data From Secondary Sources

2.1.2 Key Data From Primary Sources

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions and Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Moisture Cure Adhesives Market

4.2 Moisture Cure Adhesives Market: By Chemistry

4.3 Moisture Cure Adhesives Market, By Application

4.4 Moisture Cure Adhesives Market in Europe

4.5 Moisture Cure Adhesives Market

4.6 Moisture Cure Adhesives Market: Top 6 Country Markets

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand From Construction and Wood Working Industry

5.2.1.2 Superior Advantages Over Conventional Adhesives

5.2.1.3 Increasing Demand of Automobiles

5.2.2 Restraints

5.2.2.1 Development of Alternatives

5.2.2.2 Comparatively High Curing Time

5.2.3 Opportunities

5.2.3.1 Technological Advancement

5.2.3.2 Rising Demand From Emerging Economies

5.2.4 Challenges

5.2.4.1 Compliance to Stringent Regulations and Standards

6 Industry Trends (Page No. - 47)

6.1 Porter’s Five Forces Analysis

6.1.1 Threat of New Entrants

6.1.2 Threat of Substitutes

6.1.3 Bargaining Power of Suppliers

6.1.4 Bargaining Power of Buyers

6.1.5 Intensity of Competitive Rivalry

7 Moisture Cure Adhesives Market, By Chemistry (Page No. - 52)

7.1 Introduction

7.2 Moisture Cure Adhesives Market, By Chemistry

7.3 Polyurethane

7.4 Silicone

7.5 Cyanoacrylate

7.6 Polyolefin

8 Moisture Cure Adhesives Market, By Application (Page No. - 57)

8.1 Introduction

8.2 Moisture Cure Adhesives Market, By Application

8.3 Construction

8.4 Automotive

8.5 Wood Working

8.6 Textile

8.7 Others

9 Moisture Cure Adhesives Market, By Region (Page No. - 62)

9.1 Introduction

9.1.1 Moisture Cure Adhesives Market Size, By Region

9.2 Europe

9.2.1 Europe: Moisture Cure Adhesives Market Size, By Country

9.2.2 Europe: Moisture Cure Adhesives Market Size: By Application

9.2.3 Germany

9.2.4 Germany: Moisture Cure Adhesives Market Size, By Application

9.2.5 France

9.2.6 France: Moisture Cure Adhesives Market Size, By Application

9.2.7 U.K.

9.2.8 UK: Moisture Cure Adhesives Market Size, By Application

9.2.9 Italy: Moisture Cure Adhesives Market Size, By Application

9.2.10 Russia

9.2.11 Russia: Moisture Cure Adhesives Market Size, By Application

9.2.12 Turkey

9.2.13 Turkey: Moisture Cure Adhesives Market Size, By Application

9.2.14 Rest of Europe

9.2.15 Rest of Europe: Moisture Cure Adhesives Market Size, By Application

9.3 North America

9.3.1 North America: Moisture Cure Adhesives Market Size, By Country

9.3.2 North America: Moisture Cure Adhesives Market Size, By Application

9.3.3 U.S.

9.3.4 U.S.: Moisture Cure Adhesives Market Size, By Application

9.3.5 Canada

9.3.6 Canada: Moisture Cure Adhesives Market Size, By Application

9.3.7 Mexico

9.3.8 Mexico: Moisture Cure Adhesives Market Size, By Application

9.4 Asia Pacific

9.4.1 Asia Pacific: Moisture Cure Adhesives Market Size, By Country

9.4.2 Asia Pacific: Moisture Cure Adhesives Market Size, By Application

9.4.3 China

9.4.4 China: Moisture Cure Adhesives Market Size, By Application

9.4.5 Japan

9.4.6 Japan: Moisture Cure Adhesives Market Size, By Application

9.4.7 India

9.4.8 India: Moisture Cure Adhesives Market Size, By Application

9.4.9 South Korea

9.4.10 South Korea: Moisture Cure Adhesives Market Size, By Application

9.4.11 Indonesia

9.4.12 Indonesia: Moisture Cure Adhesives Market Size: By Application

9.4.13 Taiwan

9.4.14 Taiwan: Moisture Cure Adhesives Market Size, By Application

9.4.15 Rest of Asia Pacific

9.4.16 Rest of Asia Pacific: Moisture Cure Adhesives Market Size, By Application

9.5 Middle East & Africa

9.5.1 Middle East & Africa: Moisture Cure Adhesives Market Size, By Country

9.5.2 Middle East & Africa: Moisture Cure Adhesives Market Size, By Application

9.5.3 Saudi Arabia

9.5.4 Saudi Arabia: Moisture Cure Adhesives Market Size, By Application

9.5.5 UAE

9.5.6 UAE: Moisture Cure Adhesives Market Size, By Application

9.5.7 South Africa

9.5.8 South Africa: Moisture Cure Adhesives Market Size, By Application

9.5.9 Rest of Middle East & Africa

9.5.10 Rest of Middle East & Africa: Moisture Cure Adhesives Market Size, By Application

9.6 South America

9.6.1 South America: Moisture Cure Adhesives Market Size, By Country

9.6.2 South America: Moisture Cure Adhesives Market Size, By Application

9.6.3 Brazil

9.6.4 Brazil: Moisture Cure Adhesives Market Size, By Application

9.6.5 Argentina

9.6.6 Argentina: Moisture Cure Adhesives Market Size, By Application

9.6.7 Colombia

9.6.8 Colombia: Moisture Cure Adhesives Market Size, By Application

9.6.9 Rest of South America

9.6.10 Rest of South America: Moisture Cure Adhesives Market Size, By Application

10 Dive, Moisture Cure Adhesives (Page No. - 108)

10.1 Introduction

10.1.1 Dynamics

10.1.2 Innovators

10.1.3 Vanguards

10.1.4 Emerging

10.2 Overview

10.3 Product Offering

10.4 Business Strategy

11 Company Profiles (Page No. - 112)

11.1 Henkel AG & Co. KGaA

11.1.1 Business Overview

11.1.2 Products Offering Scorecard

11.1.3 Business Strategy Scorecard

11.1.4 Recent Developments

11.2 H.B. Fuller

11.2.1 Business Overview

11.2.2 Products Offered

11.2.2.1 Scorecard

11.2.3 Business Strategy Scorecard

11.2.4 Recent Developments

11.3 3M Company

11.3.1 Business Overview

11.3.2 Products Offering Scorecard

11.3.3 Business Strategy Scorecard

11.3.4 Recent Developments

11.4 Sika AG

11.4.1 Business Overview

11.4.2 Products Offered Scorecard

11.4.3 Business Strategy Scorecard

11.4.4 Recent Developments

11.5 Royal Adhesives & Sealants, LLC

11.5.1 Business Overview

11.5.2 Products Offered Scorecard

11.5.3 Business Strategy Scorecard

11.5.4 Recent Developments

11.6 The DOW Chemical Company

11.6.1 Business Overview

11.6.2 Products Offering Scorecard

11.6.2.1 Scorecard

11.6.3 Business Strategy Scorecard

11.6.4 Recent Developments

11.7 Illinois Tool Works Inc.

11.7.1 Business Overview

11.7.2 Products Offering Scorecard

11.7.3 Business Strategy Scorecard

11.7.4 Recent Developments

11.8 Bostik SA (An Arkema Company)

11.8.1 Business Overview

11.8.2 Products Offering Scorecard

11.8.3 Business Strategy Scorecard

11.8.4 Recent Developments

11.9 DOW Corning Corporation

11.9.1 Business Overview

11.9.2 Products Offering Scorecard

11.9.3 Business Strategy Scorecard

11.9.4 Recent Developments

11.10 Jowat SE

11.10.1 Business Overview

11.10.2 Products Offering Scorecard

11.10.3 Business Strategy Scorecard

11.10.4 Recent Developments

11.11 Momentive Performance Materials Inc.

11.12 Permabond LLC

11.13 Paramelt B.V.

11.14 Apollo Adhesives Ltd.

11.15 Advatac Ltd.

11.16 Pidilite Industries

11.17 Master Bond Inc.

11.18 Dymax Corporation

11.19 Delo Industrial Adhesives

11.20 Tosoh Corporation

11.21 Franklin International

11.22 Threebond Group

11.23 Daubert Chemical Company Inc.

11.24 Lord Corporation

11.25 Huntsman Corporation

12 Appendix (Page No. - 145)

12.1 Insights From Industry Experts

12.2 Discussion Guide

12.3 Introducing RT: Real Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

List of Tables (81 Tables)

Table 1 Curing Time of Several Types of Adhesives

Table 2 Regulations & Standards Related to Voc Adhesives

Table 3 Moisture Cure Adhesives Market, By Chemistry, 2014–2021 (USD Million)

Table 4 Moisture Curing Adhesives Market Size, By Chemistry, 2014-2021 (KT)

Table 5 Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 6 Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 7 Moisture Cure Adhesives Market Size, By Region, 2014-2021 (USD Million)

Table 8 Moisture Curing Adhesives Market, By Region, 2014-2021 (KT)

Table 9 Europe: Moisture Cure Adhesives Market Size, By Country, 2014-2021 (USD Million)

Table 10 Europe: Moisture Curing Adhesives Market Size, By Country, 2014-2021 (KT)

Table 11 Europe: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 12 Europe: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 13 Germany, Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 14 Germany: Moisture Curing Adhesives Market Size, By Application 2014-2021 (KT)

Table 15 France: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 16 France: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 17 UK: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 18 UK: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 19 Italy: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 20 Italy: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 21 Russia: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 22 Russia: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 23 Turkey: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 24 Turkey: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 25 Rest of Europe: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 26 Rest of Europe: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 27 North America: Moisture Cure Adhesives Market Size, By Country, 2014-2021 (USD Million)

Table 28 North America: Moisture Curing Adhesives Market Size, By Country, 2014-2021 (KT)

Table 29 North America: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 30 North America: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 31 U.S.: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 32 U.S.: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 33 Canada: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 34 Canada: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 35 Mexico: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 36 Mexico: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 37 Asia Pacific: Moisture Cure Adhesives Market Size, By Country, 2014-2021 (USD Million)

Table 38 Asia Pacific: Moisture Curing Adhesives Market Size, By Country, 2014-2021 (KT)

Table 39 Asia Pacific: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 40 Asia Pacific: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 41 China: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 42 China: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 43 Japan’s Motor Vehicle Production Statistics

Table 44 Japan: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 45 Japan: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 46 India: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 47 India: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 48 South Korea: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 49 South Korea: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 50 Indonesia: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 51 Indonesia: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 52 Taiwan: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 53 Taiwan: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 54 Rest of Asia Pacific: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 55 Rest of Asia Pacific: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 56 Middle East & Africa: Moisture Cure Adhesives Market Size, By Country, 2014-2021 (USD Million)

Table 57 Middle East & Africa: Moisture Curing Adhesives Market Size, By Country, 2014-2021 (KT)

Table 58 Middle East & Africa: Moisture Cure Adhesives Market, By Application, 2014-2021 (USD Million)

Table 59 Middle East & Africa: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 60 Planned Infrastructure Projects

Table 61 Saudi Arabia’s Automotive Investment Projects

Table 62 Saudi Arabia: Moisture Cure Adhesives Market, By Application, 2014-2021 (USD Million)

Table 63 Saudi Arabia: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 64 UAE: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 65 UAE: Moisture Curing Adhesives Market Size, By Application, 2014-2021 (KT)

Table 66 South Africa: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 67 South Africa: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

Table 68 Rest of Middle East & Africa: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 69 Rest of Middle East & Africa: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

Table 70 South America: Moisture Cure Adhesives Market Size, By Country, 2014-2021 (USD Million)

Table 71 South America: Moisture Curing Adhesive Market Size, By Country, 2014-2021 (KT)

Table 72 South America: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 73 South America: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

Table 74 Brazil: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 75 Brazil: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

Table 76 Argentina: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 77 Argentina: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

Table 78 Colombia: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 79 Colombia: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

Table 80 Rest of South America: Moisture Cure Adhesives Market Size, By Application, 2014-2021 (USD Million)

Table 81 Rest of South America: Moisture Curing Adhesive Market Size, By Application, 2014-2021 (KT)

List of Figures (43 Figures)

Figure 1 Market Segmentation

Figure 2 Moisture Cure Adhesives: Research Design

Figure 3 Breakdown of Primary Interviews

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Research Methodology: Data Triangulation

Figure 7 Moisture Cure Adhesives Chart for Applications (KT)

Figure 8 Moisture Cure Adhesive Market for Chemistries (KT)

Figure 9 Asia-Pacific to Witness the Highest Growth Rate in Moisture Cure Adhesives Market During the Forecast Period

Figure 10 Emerging Economies Offer Attractive Opportunities for Growth in the Moisture Curing Adhesive Market

Figure 11 Polyurethane Based Moisture Cure Adhesives to Be the Largest Segment During the Forecast Period

Figure 12 Construction Segment Projected to Dominate the Moisture Curing Adhesive Market,2016-2021 )

Figure 13 European Moisture Cure Adhesives Market By Application (USD Million)

Figure 14 Europe Dominates the Moisture Curing Adhesive Market,2016

Figure 15 U.S. is Expected to Dominate the Moisture Cure Adhesives Market, 2016-2021

Figure 16 Moisture Cure Adhesives Market Dynamics

Figure 17 Market Value of Global Construction Industry (USD Trillion)

Figure 18 Production Volume of Automobile Across Countries (Million Units)

Figure 19 Porter’s Five Forces Analysis

Figure 20 Polyurethane Chemistry is Expected to Dominate the Moisture Cure Adhesives Market, 2016-2021

Figure 21 Construction Segment is Projected to Dominate the Application Segment in Terms of Demand, 2016- 2021

Figure 22 Regional Snapshot (2016-2021)

Figure 23 European Market Snapshot

Figure 24 Automobile Production in Germany, 2012-2016 (Thousand Units)

Figure 25 House Sales in Turkey 2014-2015 (Million Units)

Figure 26 North America Market Snapshot

Figure 27 Construction Spending in the U.S. 2012-2016 (USD Trillion)

Figure 28 Automobile Production in the U.S. 2012-2016 (Million Units)

Figure 29 Export of Canadian Furniture Products 2011-2015 (USD Million)

Figure 30 Cars and Commercial Vehicles Production in Mexico (Thousand

Figure 31 Automotive Production in China 2012-2016 (Million Vehicles)

Figure 32 Light Commercial Vehicles Production in Taiwan 2015-2016

Figure 33 Dive Chart

Figure 34 Henkel AG & Co. KGaA: Company Snapshot

Figure 35 H.B. Fuller: Company Snapshot

Figure 36 3M Company: Company Snapshot

Figure 37 Sika AG: Company Snapshot

Figure 38 Royal Adhesives & Sealants, LLC: Company Snapshot

Figure 39 The DOW Chemical Company: Company Snapshot

Figure 40 ITW Inc.: Company Snapshot

Figure 41 Bostik SA: Company Snapshot

Figure 42 DOW Corning Corporation: Business Overview

Figure 43 Jowat SE: Business Overview

Growth opportunities and latent adjacency in Moisture Curing Adhesives Market