Mobile Edge Computing Market by Component (Hardware and Software), Application (Location-Based Services, Video Surveillance, Unified Communication, Optimized Local Content Distribution, Data Analytics), Organization Size and Region - Global Forecast to 2022

[98 Pages Report] The overall Mobile Edge Computing (MEC) market is expected to grow from USD 148.2 million in 2016 to USD 838.6 million by 2022, at a CAGR of 35.2% from 2017 to 2022. The increasing need to improve end-user's Quality of Experience (QoE) and rising demand for ultra-low latency and high bandwidth are some of the factors fueling the growth of the MEC market across the globe. The MEC market is expanding with the emergence of new applications and technologies. The base year considered for the study is 2016, and the forecast has been provided for the period between 2017 and 2022.

Request for Customization to get the Mobile Edge Computing market forecasts to 2024

Market Dynamics

Drivers

- Increasing need among enterprises to deliver QoE

- Rising focus on delivering high bandwidth and low latency

Restraints

- Lack of required infrastructure and deployment capabilities

Opportunities

- Opportunities for enterprises in emerging MEC application areas of AV/VR

- New revenue stream for service providers

Challenges

- Integration of different technologies at the edge of mobile network

Increasing need among enterprises to deliver QoE drives the global MEC market

With increase in the number of interconnected devices, mobile data is exponentially growing, leading to upsurge in the demand for telecom and network services. MNOs are persistently facing pressure to deliver quality services to subscribers since the desire for mobile data including mobile video services is rapidly increasing. MEC is a network architecture that enables operators to deliver new services at the edge of mobile networks. Operators leverage advanced technologies such as Network Functions Virtualization (NFV), virtualized RAN (vRAN), and SDN, which enable them to develop new types of context-aware and value-added services. Application providers, MNOs, and infrastructure providers are developing innovative applications to leverage the advantage of RAN capabilities. MEC enables the deployment of services within the RAN to improve user experience and provide a capability that enables operators to better handle latency-sensitive services. Moreover, the close proximity of MEC components at the edge significantly improves the QoE. To deliver Quality of Service (QoS) and QoE to the subscribers, MNOs are immensely adopting the MEC technology.

The following are the major objectives of the study.

- To describe and forecast the MEC market on the basis of components, applications, organization sizes, and regions

- To describe and forecast the MEC market size, by region–Asia Pacific (APAC), Europe, North America, Middle East and Africa (MEA), and Latin America

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the MEC ecosystem

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze strategic approaches such as product launches, acquisitions, contracts, agreements, and partnerships in the MEC market

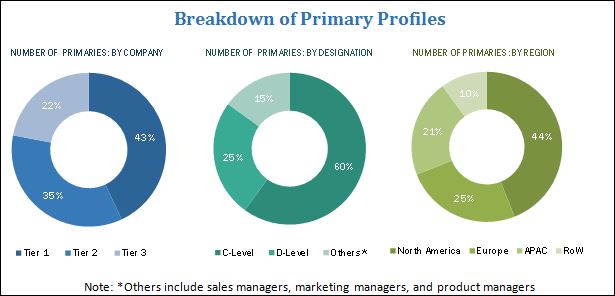

During this research study, major players operating in the MEC market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as D&B Hoovers, Bloomberg Businessweek, Let’s Talk Payments, CoinDesk, EconoTimes, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries on the basis of the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

The MEC market comprises a network of players involved in the research and product development; raw material supply; component manufacturing; distribution and sale; and post-sales services. Key players considered in the analysis of the MEC market are Adlink Technology Inc. (Taiwan), Advantech Co., Ltd. (Taiwan), Artesyn Embedded Technologies Inc. (US), Brocade Communications Systems, Inc. (US), Huawei Technologies Co., Ltd. (China), Juniper Networks, Inc. (US), Nokia Corporation (Finland), Saguna Networks Ltd. (Israel), Vapor IO, Inc. (US), and Vasona Networks, Inc. (US). These Mobile Edge Computing Software Vendors are rated and listed by us on the basis of product quality, reliability, and their business strategy. Please visit 360Quadrants to see the vendor listing of Mobile Edge Computing Software.

Major Market Developments

- In July 2017, Huawei partnered with China Mobile to launch a pilot project for a smart stadium at Beijing South Railway Station, based on MEC. Huawei's CloudEdge solution would enable China Mobile to integrate specific video content sources into the edge gateway. China Mobile users at the stadium would be able to watch videos from content sources by scanning a QR code and signing up for video package subscriptions.

- In September 2016, Nokia launched 3 new MEC-based enterprise applications, namely, object tracking, video surveillance, and video analytics. These applications enable enterprises to fulfill their communication needs, enhance operations, and reduce costs. Moreover, the company provided an AppFactory environment to develop these applications and support the integration of the existing enterprise applications with the MEC environment.

- In June 2017, Vapor IO launched the Project Volutus, a colocation and data center as a platform service, driven by Vapor Edge Computing. This would enable wireless carriers, webscale companies, and cloud providers to deliver cloud-based edge computing applications.

Key Target Audience Of Mobile Edge Computing Market

- MEC technology providers

- Communication Service Providers (CSPs)

- Telecom equipment providers

- Mobile Network Operators (MNOs)

- Mobile Virtual Network Operators (MVNOs)

- Mobile Virtual Network Enablers (MVNEs)

- Mobile Virtual Network Aggregators (MVNAs)

- System integrators

- Research organizations

- Consulting companies

- Government agencies

Scope Of The Mobile Edge Computing Market Research Report

By Component

- Hardware

- Servers

- Routers

- Switches

- Controllers

- Gateways

- Software

- MEC Platform

- Application Software

By Application

- Location-based Services

- Video Surveillance

- Unified Communication

- Optimized Local Content Distribution

- Data Analytics

- Environmental Monitoring

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Critical questions which the report answers

- What are new application areas which the MEC companies are exploring?

- Which are the key players in the market and how intense is the competition?

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The overall MEC market is expected to grow from USD 185.8 million in 2017 to USD 838.6 million by 2022 at a CAGR of 35.2%. Increasing need among enterprises to deliver Quality of Experience (QoE) and rising focus on delivering high bandwidth and low latency are the key factors driving the growth of this market.

With voluminous rise in data, generated from millions of subscribers streaming terabytes of videos, music, and social networking every day, enterprises are facing various challenges such as high network load and increasing demand for network bandwidth. To overcome these challenges, enterprises are significantly focused on optimizing and densifying their RAN. Thus, to enhance user experience and better utilize the bandwidth, the MEC technology is a feasible option. MEC allows operators to optimize the traffic within the prevailing radio conditions, enhance service quality, and improve network efficiency. Traditionally, the computational power was centralized at the core network, but in MEC, cloud servers are also deployed in each base station. MEC environment provides real-time radio information, which can be used by applications and services to optimize content delivery and utilize the network efficiently. Moreover, it enables MNOs to quickly deploy various monetizing services for content delivery, Internet of Things (IoT), retail, and enterprise applications.

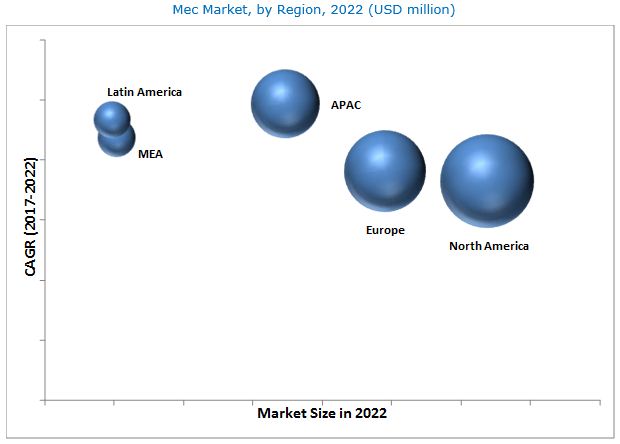

The MEC market has been segmented on the basis of components into hardware and software. On the basis of applications, the market has been segmented into location-based services, video surveillance, unified communications, optimized local content distribution, data analytics, and environmental monitoring. On the basis of organization sizes, it has been segmented into Small and Medium Enterprises (SMEs) and large enterprises. On the basis of regions, it has been segmented into North America, Europe, APAC, MEA, and Latin America.

The MEC market in APAC is expected to grow at the highest CAGR during the forecast period. APAC is the fastest-growing market for MEC. The increasing adoption of MEC solutions in this region is due to the large subscriber base, which seems to be positive for enterprises. The MEC technology would help MNOs monetize their applications and improve the profitability margins. As a result, APAC holds a significant share of the overall MEC market.

Location-Based Services

Location-based services make use of real-time geographical data from a mobile device in order to provide information, entertainment, and security. In other words, location-based services allow a variety of services linked to a particular place, to be recommended to a user at the right time. Furthermore, to improve the QoE with respect to the usefulness of the recommended service, the user’s behavior log and preference can be collected in the users' mobile terminal, and then be delivered to the location-based service application. For instance, if a user is nearby a mall, then discount coupons can be recommended to him for shopping. Henceforth, it would provide an opportunity to deliver higher value to consumers as well as the vendors.

Video Surveillance

In the recent years, video surveillance is being extended from the operations room to mobile devices, allowing the security personnel to access any feed reliably at any time and location. MEC is used for analyzing the raw video streams from surveillance cameras connected over LTE, and for forwarding the relevant incidents to the city command center. The camera streams can be broken out to the local control room to reduce the latency and relieve the burden on backhauls. MEC is expected to provide an exceptional performance and quality, while at the same time provide savings in the backhaul capacity by being able to provide content as close to the edge as possible. The biggest gains can likely be achieved in a scenario with a dense population of consumers in a small geographical area.

Unified Communication

Unified communication refers to the integration of communication tools that help people exchange ideas and do their jobs more effectively. The proliferation of mobile devices has gradually replaced fixed communications hardware and office services by leveraging native desktop interfaces and value-added applications. Thus, many devices and physical world technologies are being extensively replaced by smartphones, tablets, and cloud platforms. The presence of a mobile edge deployment of small cells on enterprise premises enables them to support the MEC technology for enterprise applications.

Optimized Local Content Distribution

The display and graphic processing technologies are evolving rapidly and high-resolution videos can be played on-the-go on handheld devices. Furthermore, with the presence of social media and viral spreading, the content is accessed several times from the same region at about the same time. A mobile edge application can store locally, the most popular content consumed in the geographical area, and once requested, it can provide the content from the local cache.

Data Analytics

The reason for the fastest growth rate of this segment is because MEC applications are specifically used for the analysis of a plethora of data due to its close proximity to the source of information. MEC may also have direct access to mobile devices, which can be easily leveraged using business-specific applications. Henceforth, if the optimization is based on rich sets of data from multiple network elements and more importantly, from intelligent network elements, the decision time is expected to be reduced considerably, thereby steering traffic on a real-time basis.

Environmental Monitoring

Environmental monitoring communicates the observations to a base station, which resides at the edge of the sensor network and acts as a gateway to analyze the data. Some of the instances include Closed-Circuit Television (CCTV) surveillance and environmental monitoring to detect wildfires, tsunamis, earthquakes, and other natural disasters.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for MEC?

Lack of required infrastructure and deployment capabilities is a major factor restraining the growth of the market. The MEC market is at a very early stage. It deploys cloud computing capabilities at the edge of the mobile network through the integration of application platform and MEC applications with virtualized network infrastructure. Though MNOs are eagerly adopting this technology to fulfill subscribers’ bandwidth demand, they require better deployment capabilities. Technology providers are majorly focusing on R&D to improve existing and emerging applications. MNOs need 5G network at the edge to execute MEC ecosystem and 5G is still not deployed everywhere.

Key players in the market include Adlink Technology Inc. (Taiwan), Advantech Co., Ltd. (Taiwan), Artesyn Embedded Technologies Inc. (California, US), Brocade Communications Systems, Inc. (California, US), Huawei Technologies Co., Ltd. (Shenzhen, China), Juniper Networks, Inc. (California, US), Nokia Corporation (Espoo, Finland), Saguna Networks Ltd. (Israel), Vapor IO, Inc. (Texas, US), and Vasona Networks, Inc. (California, US). These players are increasingly undertaking mergers and acquisitions, and product launches to develop and introduce new technologies and products in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 10)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 13)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Microquadrant Research Methodology

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Attractive Opportunities in MEC Market

4.2 MEC Market: Market Shares of Applications and Regions, 2017

4.3 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 27)

5.1 Introduction

5.2 Ecosystem

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Need Among Enterprises to Deliver QOE

5.3.1.2 Rising Focus on Delivering High Bandwidth and Low Latency

5.3.2 Restraints

5.3.2.1 Lack of Required Infrastructure and Deployment Capabilities

5.3.3 Opportunities

5.3.3.1 Opportunities for Enterprises in Emerging MEC Application Areas of AR/VR

5.3.3.2 New Revenue Streams for Service Providers

5.3.4 Challenges

5.3.4.1 Integration of Different Technologies at the Edge of Mobile Network

6 MEC Market Analysis, By Component (Page No. - 32)

6.1 Introduction

6.2 Hardware

6.2.1 Servers

6.2.2 Routers

6.2.3 Switches

6.2.4 Controllers

6.2.5 Gateways

6.3 Software

6.3.1 MEC Platform

6.3.2 Application Software

7 MEC Market Analysis, By Application (Page No. - 37)

7.1 Introduction

7.2 Location-Based Services

7.3 Video Surveillance

7.4 Unified Communications

7.5 Optimized Local Content Distribution

7.6 Data Analytics

7.7 Environmental Monitoring

8 MEC Market Analysis, By Organization Size (Page No. - 44)

8.1 Introduction

8.2 SMEs

8.3 Large Enterprises

9 Geographic Analysis (Page No. - 48)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 APAC

9.5 MEA

9.6 Latin America

10 Competitive Landscape (Page No. - 58)

10.1 Microquadrant Overview

10.1.1 Visionary Leaders

10.1.2 Innovators

10.1.3 Dynamic Differentiators

10.1.4 Emerging Companies

10.2 Competitive Benchmarking

11 Company Profiles (Page No. - 62)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments)*

11.1 Adlink

11.2 Advantech

11.3 Artesyn

11.4 Brocade

11.5 Huawei

11.6 Juniper Networks

11.7 Nokia

11.8 Saguna Networks

11.9 Vapor IO

11.10 Vasona Networks

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, and Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 90)

12.1 Key Industry Insights

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Related Reports

12.6 Author Details

List of Tables (31 Tables)

Table 1 United States Dollar Exchange Rate, 2014–2016

Table 2 MEC Market Size, By Component, 2015–2022 (USD Million)

Table 3 Hardware: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 4 Software: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 5 MEC Market Size, By Application, 2015–2022 (USD Million)

Table 6 Location-Based Services: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 7 Video Surveillance: MEC Market Size, By Region, 2015–2022(USD Million)

Table 8 Unified Communications: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 9 Optimized Local Content Distribution: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 10 Data Analytics: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 11 Environmental Monitoring: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 12 MEC Market Size, By Organization Size, 2015–2022 (USD Million)

Table 13 SMEs: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 14 Large Enterprises: MEC Market Size, By Region, 2015–2022 (USD Million)

Table 15 Global MEC Market Size, By Region, 2015–2022 (USD Million)

Table 16 North America: MEC Market Size, By Component, 2015–2022 (USD Million)

Table 17 North America: MEC Market Size, By Application, 2015–2022 (USD Million)

Table 18 North America: MEC Market Size, By Organization Size, 2015–2022 (USD Million)

Table 19 Europe: MEC Market Size, By Component, 2015–2022 (USD Million)

Table 20 Europe: MEC Market Size, By Application, 2015–2022 (USD Million)

Table 21 Europe: MEC Market Size, By Organization Size, 2015–2022 (USD Million)

Table 22 APAC: MEC Market Size, By Component, 2015–2022 (USD Million)

Table 23 APAC: MEC Market Size, By Application, 2015–2022 (USD Million)

Table 24 APAC: MEC Market Size, By Organization Size, 2015–2022 (USD Million)

Table 25 MEA: MEC Market Size, By Component, 2015–2022 (USD Million)

Table 26 MEA: MEC Market Size, By Application, 2015–2022 (USD Million)

Table 27 MEA: MEC Market Size, By Organization Size, 2015–2022 (USD Million)

Table 28 Latin America: MEC Market Size, By Component, 2015–2022 (USD Million)

Table 29 Latin America: MEC Market Size, By Application, 2015–2022 (USD Million)

Table 30 Latin America: MEC Market Size, By Organization Size, 2015–2022 (USD Million)

Table 31 MEC Market Vendor Ranking, 2017

List of Figures (31 Figures)

Figure 1 MEC Market: Market Segmentation

Figure 2 MEC Market: Research Design

Figure 3 Data Triangulation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Vendor Analysis: Criteria Weightage

Figure 7 MEC Market: Assumptions

Figure 8 Software Segment is Expected to Hold the Larger Market Size in the MEC Market, By Component, 2017-2022 (USD Million)

Figure 9 Large Enterprises Segment is Expected to Hold the Larger Market Size in the MEC Market, By Organization Size, 2017-2022 (USD Million)

Figure 10 MEC Market: Largest Share, By Segment

Figure 11 North America is Expected to Hold the Largest Market Share in 2017

Figure 12 Increasing Need for Improving End-User's QOE and Focus on Delivering High Bandwidth and Low Latency to Drive MEC Market

Figure 13 Location-Based Services and North America to Have the Largest Market Shares in 2017

Figure 14 APAC to Emerge as the Best Market for Investments in the Next 5 Years

Figure 15 MEC Ecosystem

Figure 16 MEC Market: Drivers, Restraints, Opportunities, and Challenges

Figure 17 Software Segment is Expected to Have A Larger Market Size, 2017-2022 (USD Million)

Figure 18 Location-Based Services Segment to Have Largest Market Size, 2017-222 (USD Million)

Figure 19 Large Enterprises Segment is Expected to Hold A Larger Market Size, 2017-2022 (USD Million)

Figure 20 North America is Expected to Have the Largest Market Size During the Forecast Period, 2017-2022 (USD Million)

Figure 21 North America: Market Snapshot

Figure 22 APAC: Market Snapshot

Figure 23 MEC Market Competitive Leadership Mapping, 2017

Figure 24 Strength of Product Portfolio in the MEC Market (10 Players)

Figure 25 Business Strategy Excellence Adopted in the MEC Market (10 Players)

Figure 26 Adlink: Company Snapshot

Figure 27 Advantech: Company Snapshot

Figure 28 Brocade: Company Snapshot

Figure 29 Huawei: Company Snapshot

Figure 30 Juniper Networks: Company Snapshot

Figure 31 Nokia: Company Snapshot

Growth opportunities and latent adjacency in Mobile Edge Computing Market