Mirror Coatings Market by Resin Type (Polyurethane, Epoxy, Acrylic), Technology (Water-based, Solvent-based, & Nanotechnology-based coatings), Substrate (Silver, Aluminum), End-Use Industry, & Region - Global Forecast to 2026

Mirror Coatings Market

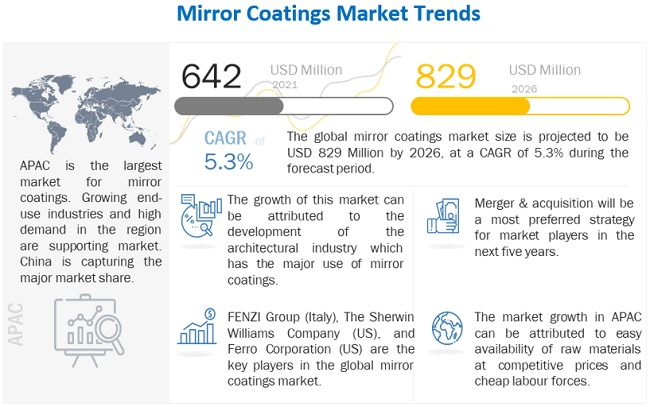

The global mirror coatings market was valued at USD 642 million in 2021 and is projected to reach USD 829 million by 2026, growing at a cagr 5.3% from 2021 to 2026. The demand and use of mirror coatings is rapidly increasing due to the growth in industries such as architectural, automotive & transportation, decorative and solar power especially in the APAC region.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Mirror Coatings Market

COVID-19 has made a significant economic impact on various financial as well as industrial sectors, such as travel and tourism, manufacturing, and aviation. The worst economic recession is expected during 2020-2021, according to World Bank and IMF. With the increasing number of countries imposing and extending lockdowns, economic activities are declining, impacting the global economy.

In the recent past, the global economy became substantially more interconnected. The adverse consequences of various steps related to the containment of COVID-19 are evident from global supply chain disruptions, weaker demand for imported products and services, and an increase in the unemployment rate. Risk aversion has increased in the financial market, with all-time low interest rates and sharp declines in equity and commodity prices. Consumer and business confidence have also reduced significantly.

Mirror Coatings Market Dynamics

Driver: Rising demand for mirror coatings in the construction and automotive industries

Reflective glass is a type of annealed or standard glass that has a thin layer of mirror coating. As this coating is applied to only one side of a glass, it has a mirror-like appearance. This mirror coating is applied during the float process to enhance the amount of heat reflected by the glass. This enables it to absorb and reflect the harmful UV and infrared rays of the sun yet allows natural visible light to pass through. It also prevents excessive solar glare. Mirror coatings on glass are used to combat the rising rate of energy consumption because it helps block solar heat and glare from entering inside. In architectural designs they are used as green and sustainable elements due to their high performance against heat ingress and delectable visual appeal.

Restraint: Drawbacks of water-based coatings

Drying and curing processes are highly time-consuming for water-based coatings than for solvent-based coatings. Water-based coatings have flow properties that change with humidity, affecting the overall coating application. Under conditions of high humidity, water does not easily evaporate, resulting in a poor cure and decreased performance. Water-based coatings are also sensitive to cold temperatures and are usually not usable after freezing. Therefore, these coatings are susceptible to frost damage.

Opportunity: Rising demand for low-VOC, green, and sustainable mirror coatings

Owing to the rising trend in various applications in environment-friendly or green products, the demand for green coatings or low-VOC coatings is increasing. Stringent regulations implemented by Europe’s Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), United States Environmental Protection Agency (USEPA), Leadership in Energy and Environmental Design (LEED), and other regional regulatory authorities led manufacturers to manufacture environment-friendly coatings with low VOC levels.

Challenge: Stringent regulatory policies and environmental challenges

Due to the increasing focus on meeting state and local regulations with regards to VOCs, manufacturers in the mirror coatings market face various regulatory and environmental challenges. During the drying process, solvent-based coatings evaporate, releasing VOCs into the atmosphere, and create a negative and toxic impact on the environment. Owing to this, governments across the globe have imposed stringent regulations and have mandated organizations in the use of environment-friendly technologies.

Polyurethane resin type accounted for the largest share of the Mirror Coatings market.

A polyurethane coating is a polyurethane layer which is applied to the surface of a substrate for the purpose of protecting it. This coating protects the surface from corrosion, abrasion, weathering, and other deteriorating elements. Polyurethane coating seems to be similar in comparison with the other coatings, but it has several different properties which make it different and ideal for specific situations. Polyurethane coatings are relatively durable and more elastic in comparison with the other resins available. The durability of polyurethane coatings is one of the major selling points in the market.

Automotive & Transportation is the second-largest end-use industry of Mirror Coatings market in 2021.

In the automotive & transportation application, mirror coatings are used in rear-view mirrors and vanity mirrors in a wide range of automobiles. Mirror coatings provide optimal visibility, higher esthetic appeal, and help ensure safety and security, among other advantages. Rear-view and vanity mirrors find use in cars, buses, trucks, and trains as well as ships and boats. This application segment can be divided into two segments—original equipment manufacturers (OEM) and automotive glass replacement (AGR) products supplied to the aftermarket.

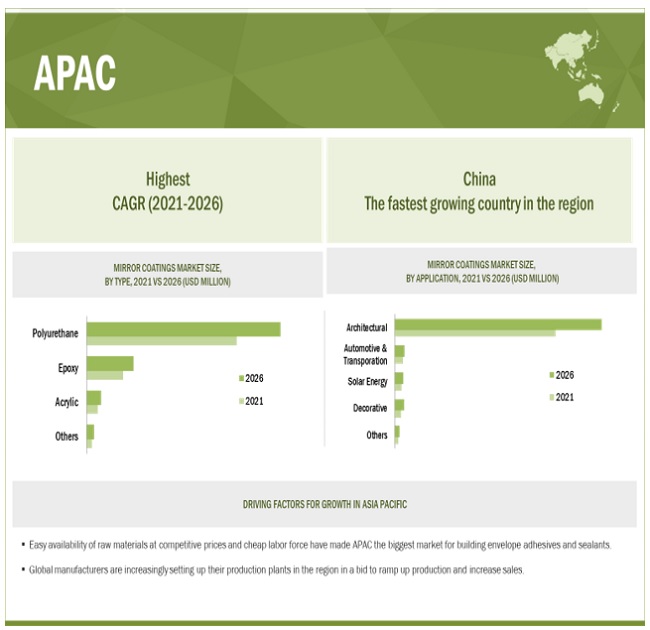

APAC is the largest mirror coatings market in the forecast period

APAC has emerged as one of the leading producers as well as consumers of mirror coatings. In India, low-cost labor, government initiatives, such as Make in India, and the proposed scheme on entrepreneurship development may open up opportunities in the industrial and infrastructure segments. The major applications of mirror coatings in the APAC region are architectural, automotive & transportation, and solar power. The increasing middle-class population in the region (with a high disposable income) and the rising demand for sustainable construction, transportation, and power are major factors supporting the growth of these application segments.

China is the leading market for mirror coatings in the APAC. The Chinese market for mirror coatings has grown rapidly and is projected to witness high growth in the near future due to the continuous shift of mirror coatings production facilities from several countries to China. Most of the leading players in North America and Europe are planning to shift their production bases to China as it offers comparatively inexpensive raw materials, low cost of production, and the ability to serve the emerging local market.

To know about the assumptions considered for the study, download the pdf brochure

Mirror Coatings Market Players

The key players operating in the market are FENZI Group (Italy), The Sherwin Williams Company (US), and Ferro Corporation (US).

Please visit 360Quadrants to see the vendor listing of Top paint and coating companies

Mirror Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2021 |

USD 642 million |

|

Revenue Forecast in 2026 |

USD 829 million |

|

CAGR |

5.3% |

|

Years considered for the study |

2016-2026 |

|

Base year |

2020 |

|

Forecast period |

2021-2026 |

|

Units considered |

Value (USD) and Volume (Kiloton) |

|

Segments |

By Resin Type, By Technology, By Substrate, By End-use Industry, By Region |

|

Regions covered |

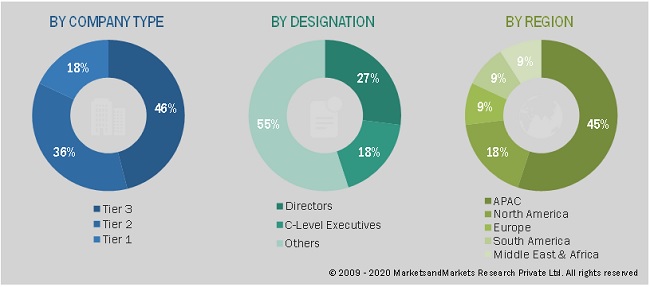

APAC, Europe, North America, South America, and Middle East & Africa |

|

Companies profiled |

The major market players are FENZI Group (Italy), The Sherwin Williams Company (US), and Ferro Corporation (US) (Total of 20 companies) |

This research report categorizes the mirror coatings market based on resin type, technology, substrate end-use industry, and region.

By Type:

- Polyurethane resin

- Epoxy resin

- Acrylic resin

- Others (Alkyd and Silicone resin)

By Technology:

- Water-based coatings

- Solvent-based coatings

- Nanotechnology-based coatings

By Substrate:

- Silver-based coatings

- Aluminum-based coatings

- Other

By End-use Industry:

- Architectural

- Automotive & Transportation

- Decorative

- Solar power

- Others

By Region:

- APAC

- Europe

- North America

- South America

- Middle East & Africa

Recent Developments

- In August 2021, The Sherwin Williams Company has signed an agreement to acquire the European Industrial Coatings Business of Sika. This transaction will add to the profitable growth momentum of the company.

- In July 2020, Fenzi group has done partnership with Arsenal Capital Partners. This deal will provide additional capital to help accelerate the growth of the company. This transaction will enable the company to grow and expand by accelerating investment in capacity, R&D capabilities, and talent, as well as strategic acquisitions.

Frequently Asked Questions (FAQ):

What is the current size of the global mirror coatings market?

Mirror Coatings market is projected to grow from USD 642 Million in 2021 to USD 829 Million by 2026, at a CAGR of 5.3% between 2021 and 2026.

Who are the major players of mirror coatings market?

Companies such as are FENZI Group (Italy), The Sherwin Williams Company (US), and Ferro Corporation (US) are the major players in the market.

Where will all these developments take the industry in the mid-to-long term?

Continuous developments in the market, including new product launches, mergers & acquisitions, investments & expansions, and partnership and agreement are expected to help the market grow. Joint venture & partnership and merger & acquisition are the key strategies adopted by companies operating in this market.

Which segment has the potential to register the highest market share for mirror coatings market?

Architectural is the largest end-use industry segment, in terms of both value and volume, in 2020.

Which is the fastest-growing region in the market?

APAC is projected to be the fastest-growing market for mirror coatings market during the forecast period. Easy availability of raw materials at competitive prices and cheap labor force have made APAC the biggest market for mirror coatings. Global manufacturers are increasingly setting up their production plants in the region in a bid to ramp up production and increase sales. The major end-use industries of mirror coatings are architectural, automotive & transportation, decorative, and solar power. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 MIRROR COATINGS MARKET SEGMENTATION

1.3.1 INCLUSIONS AND EXCLUSIONS

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 MIRROR COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

2.1.2.3 Key industry insights

2.1.2.4 Primary data sources

2.2 MARKET SIZE ESTIMATION

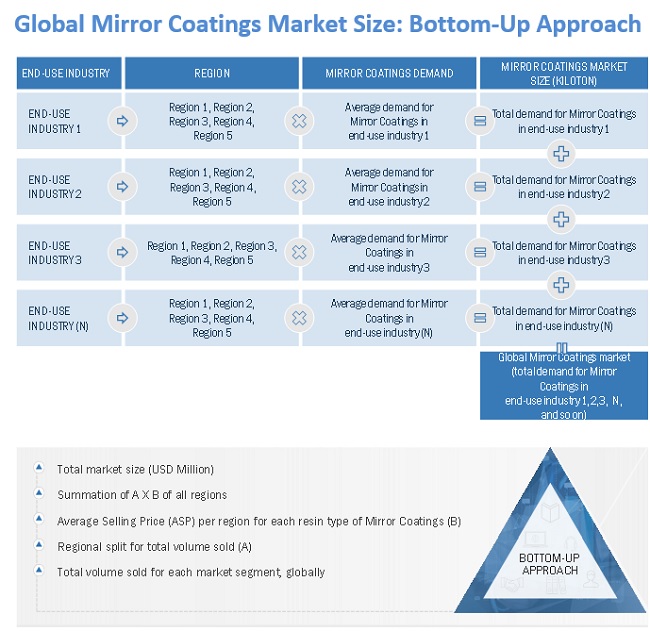

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION: MIRROR COATINGS MARKET

2.4 ASSUMPTIONS

2.5 LIMITATIONS

2.6 RISK ANALYSIS ASSESSMENT

2.7 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY (Page No. - 43)

TABLE 1 MIRROR COATINGS MARKET SNAPSHOT (2021 VS. 2026)

FIGURE 7 MIRROR COATINGS MARKET, BY RESIN TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 8 MIRROR COATINGS MARKET, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

FIGURE 9 MIRROR COATINGS MARKET, BY END-USE INDUSTRY

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF THE MIRROR COATINGS MARKET: APAC IS THE LARGEST AND FASTEST-GROWING MARKET

4 PREMIUM INSIGHTS (Page No. - 47)

4.1 MIRROR COATINGS: MARKET OVERVIEW

FIGURE 11 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH OPPORTUNITIES FOR PLAYERS IN THE MIRROR COATINGS MARKET

4.2 MIRROR COATINGS MARKET, BY RESIN TYPE

FIGURE 12 POLYURETHANE RESINS SEGMENT TO LEAD THE MARKET DURING THE FORECAST PERIOD

4.3 MIRROR COATINGS MARKET: DEVELOPED VS. EMERGING COUNTRIES

FIGURE 13 MARKETS IN EMERGING COUNTRIES TO GROW AT HIGHER CAGRS FROM 2021 TO 2026

4.4 APAC: MIRROR COATINGS MARKET, BY END-USE INDUSTRY (2020)

FIGURE 14 ARCHITECTURAL END-USE INDUSTRY AND CHINA ACCOUNTED FOR THE HIGHEST MARKET SHARES IN 2020

4.5 APAC: MIRROR COATINGS MARKET, BY COUNTRY/REGION, 2021 VS. 2026

FIGURE 15 MARKET IN INDIA TO GROW AT THE HIGHEST CAGR IN THE APAC DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 OVERVIEW OF FACTORS GOVERNING THE MIRROR COATINGS MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand for mirror coatings in the construction and automotive industries

5.2.1.2 Increased demand from the APAC

5.2.1.3 Increasing focus on concentrated solar power (CSP)

5.2.2 RESTRAINTS

5.2.2.1 Drawbacks of water-based coatings

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for low-VOC, green, and sustainable mirror coatings

5.2.4 CHALLENGES

5.2.4.1 Stringent regulatory policies and environmental challenges

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 MIRROR COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 MIRROR COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 INTENSITY OF COMPETITIVE RIVALRY

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 THREAT OF SUBSTITUTES

5.3.5 THREAT FROM NEW ENTRANTS

5.4 MACROECONOMIC INDICATORS

5.4.1 INTRODUCTION

5.4.2 TRENDS AND FORECAST OF GDP

TABLE 3 GDP TRENDS AND FORECASTS, PERCENTAGE CHANGE, 2019-2026

5.4.3 TRENDS AND FORECASTS FOR THE GLOBAL CONSTRUCTION INDUSTRY

FIGURE 18 GLOBAL SPENDING IN THE CONSTRUCTION INDUSTRY, 2014–2035

5.4.4 TRENDS AND FORECASTS FOR THE GLOBAL AUTOMOTIVE INDUSTRY

TABLE 4 AUTOMOTIVE INDUSTRY PRODUCTION (2019–2020)

5.4.5 TRENDS IN THE CONCENTRATED SOLAR POWER (CSP) INDUSTRY

FIGURE 19 SOLAR PV MARKET, GLOBAL CUMULATIVE INSTALLED CAPACITY (GW), 2010–2030

5.5 IMPACT OF COVID-19

5.6 COVID-19 ECONOMIC ASSESSMENT

FIGURE 20 ECONOMIC OUTLOOK FOR MAJOR COUNTRIES

5.6.1 ECONOMIC IMPACT OF COVID-19: SCENARIO ASSESSMENT

FIGURE 21 FACTORS THAT IMPACTED THE ECONOMIES OF SELECT G20 COUNTRIES IN 2020

5.7 IMPACT OF COVID-19 ON END-USE INDUSTRIES

5.7.1 IMPACT ON THE CONSTRUCTION INDUSTRY

5.7.2 IMPACT ON THE AUTOMOTIVE INDUSTRY

5.8 IMPACT OF COVID-19 ON REGIONS

5.8.1 IMPACT OF COVID-19 ON THE APAC

5.8.2 IMPACT OF COVID-19 ON NORTH AMERICA

5.8.3 IMPACT OF COVID-19 ON EUROPE

5.8.4 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA

5.8.5 IMPACT OF COVID-19 ON SOUTH AMERICA

5.9 VALUE CHAIN ANALYSIS

FIGURE 22 MIRROR COATINGS MARKET: VALUE CHAIN ANALYSIS

5.10 PRICING ANALYSIS

FIGURE 23 AVERAGE PRICE COMPETITIVENESS IN MIRROR COATINGS MARKET, BY REGION

5.11 PAINTS & COATINGS ECOSYSTEM AND INTERCONNECTED MARKETS

FIGURE 24 PAINTS & COATINGS: ECOSYSTEM

5.12 EXPORT-IMPORT TRADE STATISTICS

5.12.1 TOP EXPORTERS OF GLASS MIRRORS, 2019

5.12.2 TOP IMPORTERS OF GLASS MIRRORS, 2019

5.12.3 TARIFFS

5.12.4 COUNTRIES WITH HIGHEST IMPORT TARIFFS, 2018

5.13 REGULATIONS

5.13.1 IATF 16949

5.13.2 ISO 9001

5.14 PATENT ANALYSIS

5.14.1 METHODOLOGY

5.14.2 PUBLICATION TRENDS

FIGURE 25 NUMBER OF PATENTS PUBLISHED, 2015-2021

5.14.3 TOP JURISDICTION

FIGURE 26 PATENTS PUBLISHED BY JURISDICTION, 2015-2021

5.14.4 TOP APPLICANTS

FIGURE 27 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2015-2021

TABLE 5 RECENT PATENTS BY OWNERS

5.15 CASE STUDY ANALYSIS

5.16 TECHNOLOGY ANALYSIS

6 MIRROR COATINGS MARKET, BY RESIN TYPE (Page No. - 76)

6.1 INTRODUCTION

TABLE 6 MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (USD MILLION)

TABLE 7 MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 8 MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (TON)

TABLE 9 MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (TON)

6.2 POLYURETHANE

6.2.1 POLYURETHANE ENABLES A COATING SOLUTION WHICH CAN BE USED FOR ALL MARKET END USES

TABLE 10 POLYURETHANE RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 11 POLYURETHANE RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 12 POLYURETHANE RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 13 POLYURETHANE RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

6.3 EPOXY

6.3.1 OUTSTANDING MECHANICAL PROPERTIES ARE LEADING TO MARKET GROWTH

TABLE 14 EPOXY RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 EPOXY RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 16 EPOXY RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 17 EPOXY RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

6.3.2 ACRYLIC

6.3.2.1 Low weight and shatter resistance makes it a preferred choice for various industries

TABLE 18 ACRYLIC RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 ACRYLIC RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 20 ACRYLIC RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 21 ACRYLIC RESIN MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

6.3.3 OTHER RESINS

6.3.3.1 Alkyd resins

6.3.3.2 Silicone

TABLE 22 OTHER RESINS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 OTHER RESINS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 24 OTHER RESINS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 25 OTHER RESINS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

7 MIRROR COATINGS MARKET, BY TECHNOLOGY (Page No. - 87)

7.1 INTRODUCTION

TABLE 26 MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 27 MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 28 MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (TON)

TABLE 29 MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (TON)

7.2 WATER-BASED COATINGS

7.2.1 THE QUALITY AND STRENGTH OF COATINGS MANUFACTURED USING THE WATER-BASED TECHNOLOGY DEPEND UPON THE USE OF RAW MATERIALS

7.2.2 ADVANTAGES OF WATER-BASED COATINGS

TABLE 30 WATER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 WATER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 32 WATER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 33 WATER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

7.3 SOLVENT-BASED COATINGS

7.3.1 SOLVENT-BASED COATINGS ARE MORE FLEXIBLE THAN WATER-BASED COATINGS DURING THE CURING PROCESS

TABLE 34 SOLVENT-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 SOLVENT-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 36 SOLVENT-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 37 SOLVENT-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

7.4 NANOTECHNOLOGY-BASED COATINGS

7.4.1 USE OF NANOTECHNOLOGY-BASED COATINGS ALSO RESULTS IN PERFORMANCE ENHANCEMENTS AND WEAR AND FATIGUE RESISTANCE

TABLE 38 NANOTECHNOLOGY-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 39 NANOTECHNOLOGY-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 40 NANOTECHNOLOGY-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 41 NANOTECHNOLOGY-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, 2020–2026 (TON)

8 MIRROR COATINGS MARKET, BY SUBSTRATE (Page No. - 95)

8.1 INTRODUCTION

TABLE 42 MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (USD MILLION)

TABLE 43 MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (USD MILLION)

TABLE 44 MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (TON)

TABLE 45 MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (TON)

8.2 SILVER-BASED MIRROR COATINGS

8.2.1 SILVER-BASED MIRRORS ARE MORE REFLECTIVE THAN ALUMINUM AND PREFERRED DUE TO THIS PROPERTY

TABLE 46 SILVER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 SILVER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 48 SILVER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 49 SILVER-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

8.3 ALUMINUM-BASED MIRROR COATINGS

8.3.1 ALUMINUM-BASED MIRROR COATING HAS A HIGH DEMAND BECAUSE OF ITS HIGH REFLECTANCE IN THE UV AND INFRARED RANGES

TABLE 50 ALUMINUM-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 ALUMINUM-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 52 ALUMINUM-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 53 ALUMINUM-BASED COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

8.4 OTHER MIRROR COATINGS

TABLE 54 OTHER COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 OTHER COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 56 OTHER COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 57 OTHER COATINGS MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

9 MIRROR COATINGS MARKET, BY END-USE INDUSTRY (Page No. - 102)

9.1 INTRODUCTION

TABLE 58 MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 59 MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 60 MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 61 MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (TON)

9.2 ARCHITECTURAL

9.2.1 INCREASE IN THE USE OF MIRRORS IN THE ARCHITECTURAL INDUSTRY IS LEADING TO MARKET GROWTH

TABLE 62 ARCHITECTURAL MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 63 ARCHITECTURAL MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 64 ARCHITECTURAL MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 65 ARCHITECTURAL MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

9.3 AUTOMOTIVE & TRANSPORTATION

9.3.1 GROWTH IN SALES OF CARS AND HIGH DEPENDENCE UPON THE MIRROR IS ACCOUNTING FOR A MAJOR SHARE OF THE MARKET

TABLE 66 AUTOMOTIVE & TRANSPORTATION MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 67 AUTOMOTIVE & TRANSPORTATION MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 68 AUTOMOTIVE & TRANSPORTATION MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 69 AUTOMOTIVE & TRANSPORTATION MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

9.4 DECORATIVE

9.4.1 THE ILLUSION OF OPENNESS IN SMALL SPACES IS INCREASING THE USAGE OF DECORATIVE MIRRORS

TABLE 70 DECORATIVE MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 71 DECORATIVE MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 72 DECORATIVE MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 73 DECORATIVE MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

9.5 SOLAR POWER

9.5.1 USE OF MIRROR COATINGS HAS BROUGHT THE ERA DEFINING REVOLUTIONARY CHANGE

9.5.2 CONCENTRATED SOLAR POWER SYSTEMS

9.5.3 CSP CONSIDERATIONS

TABLE 74 CSP GLOBAL CAPACITIES AND ADDITIONS, 2020 (MW)

TABLE 75 CSP VS. PV TECHNOLOGY

TABLE 76 SOLAR POWER MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 77 SOLAR POWER MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 78 SOLAR POWER MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 79 SOLAR POWER MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

9.6 OTHER END-USE INDUSTRIES

TABLE 80 OTHER END-USE INDUSTRIES MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (USD MILLION)

TABLE 81 OTHER END-USE INDUSTRIES MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (USD MILLION)

TABLE 82 OTHER END-USE INDUSTRIES MARKET SIZE IN MIRROR COATINGS, BY REGION, 2016–2019 (TON)

TABLE 83 OTHER END-USE INDUSTRIES MARKET SIZE IN MIRROR COATINGS, BY REGION, 2020–2026 (TON)

10 MIRROR COATINGS MARKET, BY REGION (Page No. - 116)

10.1 INTRODUCTION

TABLE 84 MIRROR COATINGS MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 85 MIRROR COATINGS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

TABLE 86 MIRROR COATINGS MARKET SIZE, BY REGION, 2016–2019 (TON)

TABLE 87 MIRROR COATINGS MARKET SIZE, BY REGION, 2020–2026 (TON)

10.2 APAC

10.2.1 IMPACT OF COVID-19 ON THE APAC

FIGURE 28 APAC: SNAPSHOT

TABLE 88 APAC: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 89 APAC: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 90 APAC: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 91 APAC: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 92 APAC: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (USD MILLION)

TABLE 93 APAC: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 94 APAC: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (TON)

TABLE 95 APAC: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (TON)

TABLE 96 APAC: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 97 APAC: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 98 APAC: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (TON)

TABLE 99 APAC: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (TON)

TABLE 100 APAC: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (USD MILLION)

TABLE 101 APAC: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (USD MILLION)

TABLE 102 APAC: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (TON)

TABLE 103 APAC: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (TON)

TABLE 104 APAC: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 105 APAC: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 106 APAC: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 107 APAC: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (TON)

10.2.2 CHINA

10.2.2.1 Growing industries to drive market

10.2.3 JAPAN

10.2.3.1 Government initiatives to increase the use of renewable energy sources is helping growth of the mirror coatings market

10.2.4 SOUTH KOREA

10.2.4.1 Automotive and electronics industries to support market growth

10.2.5 MALAYSIA

10.2.5.1 Significant auto manufacturing hub to boost demand

10.2.6 INDIA

10.2.6.1 Government initiatives to help grow end-use industries

10.2.7 TAIWAN

10.2.7.1 Capacities of solar power plants are increasing and helping boost the mirror coatings market

10.2.8 VIETNAM

10.2.8.1 Growing construction industry and urbanization

10.2.9 REST OF APAC

10.3 NORTH AMERICA

10.3.1 IMPACT OF COVID-19 ON NORTH AMERICA

FIGURE 29 NORTH AMERICA: SNAPSHOT

TABLE 108 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 110 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 111 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 112 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (USD MILLION)

TABLE 113 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 114 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (TON)

TABLE 115 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (TON)

TABLE 116 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 117 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 118 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (TON)

TABLE 119 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (TON)

TABLE 120 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (USD MILLION)

TABLE 121 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (USD MILLION)

TABLE 122 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (TON)

TABLE 123 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (TON)

TABLE 124 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 125 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 126 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 127 NORTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (TON)

10.3.2 US

10.3.2.1 Largest mirror coatings market in North America

10.3.3 CANADA

10.3.3.1 Increasing automobile production to lead to high demand

10.3.4 MEXICO

10.3.4.1 Low-cost manufacturing to play a key role in driving the market

10.4 EUROPE

10.4.1 IMPACT OF COVID-19 ON EUROPE

FIGURE 30 EUROPE: SNAPSHOT

TABLE 128 EUROPE: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 129 EUROPE: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 130 EUROPE: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 131 EUROPE: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 132 EUROPE: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (USD MILLION)

TABLE 133 EUROPE: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 134 EUROPE: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (TON)

TABLE 135 EUROPE: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (TON)

TABLE 136 EUROPE: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 137 EUROPE: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 138 EUROPE: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (TON)

TABLE 139 EUROPE: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (TON)

TABLE 140 EUROPE: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (USD MILLION)

TABLE 141 EUROPE: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (USD MILLION)

TABLE 142 EUROPE: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (TON)

TABLE 143 EUROPE: MIRROR COATING MARKET SIZE, BY SUBSTRATE, 2020–2026 (TON)

TABLE 144 EUROPE: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 145 EUROPE: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 146 EUROPE: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 147 EUROPE: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (TON)

10.4.2 GERMANY

10.4.2.1 Industrial production hub is making it a major market for mirror coatings

10.4.3 FRANCE

10.4.3.1 COVID-19 has impacted industries and they are in the stages of recovery

10.4.4 ITALY

10.4.4.1 Increasing automobile production and exports to drive demand

10.4.5 UK

10.4.5.1 Strong presence in the automotive market is boosting the mirror coatings market

10.4.6 TURKEY

10.4.6.1 Growth in public and private infrastructure projects driving the market

10.4.7 NETHERLANDS

10.4.7.1 Increased investments on the development of industries

10.4.8 BELGIUM

10.4.8.1 The establishment of multinational firms is driving the market

10.4.9 SPAIN

10.4.9.1 Large automotive sector to lead to market growth

10.4.10 REST OF EUROPE

10.5 SOUTH AMERICA

10.5.1 IMPACT OF COVID-19 ON SOUTH AMERICA

TABLE 148 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 149 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 150 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 151 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 152 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (USD MILLION)

TABLE 153 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 154 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (TON)

TABLE 155 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (TON)

TABLE 156 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 157 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 158 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (TON)

TABLE 159 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (TON)

TABLE 160 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (USD MILLION)

TABLE 161 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (USD MILLION)

TABLE 162 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (TON)

TABLE 163 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (TON)

TABLE 164 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 165 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 166 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 167 SOUTH AMERICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (TON)

10.5.2 BRAZIL

10.5.2.1 Emerging economy and growth in automotive industry to fuel the market

10.5.3 ARGENTINA

10.5.3.1 Increase in affordability and demand for modernization is leading to market growth

10.5.4 REST OF SOUTH AMERICA

10.6 MIDDLE EAST & AFRICA

10.6.1 IMPACT OF COVID-19 ON THE MIDDLE EAST & AFRICA

TABLE 168 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 169 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

TABLE 170 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2016–2019 (TON)

TABLE 171 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY COUNTRY, 2020–2026 (TON)

TABLE 172 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (USD MILLION)

TABLE 173 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (USD MILLION)

TABLE 174 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2016–2019 (TON)

TABLE 175 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY RESIN TYPE, 2020–2026 (TON)

TABLE 176 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 177 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 178 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2016–2019 (TON)

TABLE 179 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY TECHNOLOGY, 2020–2026 (TON)

TABLE 180 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (USD MILLION)

TABLE 181 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (USD MILLION)

TABLE 182 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2016–2019 (TON)

TABLE 183 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY SUBSTRATE, 2020–2026 (TON)

TABLE 184 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (USD MILLION)

TABLE 185 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2016–2019 (TON)

TABLE 187 MIDDLE EAST & AFRICA: MIRROR COATINGS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (TON)

10.6.2 SOUTH AFRICA

10.6.2.1 Automotive industry to boost demand

10.6.3 SAUDI ARABIA

10.6.3.1 Saudi Arabia is investing significantly in upgrading infrastructure

10.6.4 UAE

10.6.4.1 Infrastructure development to boost the coatings demand

10.6.5 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE (Page No. - 169)

11.1 COMPETITIVE SCENARIO

11.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MIRROR COATINGS PLAYERS

11.2 COMPETITIVE SCENARIO

11.2.1 MARKET EVALUATION MATRIX

TABLE 188 COMPANY FOOTPRINT

TABLE 189 COMPANY INDUSTRY FOOTPRINT

TABLE 190 COMPANY REGION FOOTPRINT

11.3 COMPANY EVALUATION QUADRANT

11.3.1 STARS

11.3.2 EMERGING LEADERS

11.3.3 PERVASIVE

11.3.4 EMERGING COMPANIES

FIGURE 31 MIRROR COATINGS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

11.4 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 32 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MIRROR COATINGS MARKET

11.5 MARKET RANKING

11.5.1 MARKET RANKING OF KEY PLAYERS (2010)

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 MERGERS & ACQUISITIONS

TABLE 191 MERGERS & ACQUISITIONS, 2014–2021

11.6.2 JOINT VENTURES AND PARTNERSHIPS

TABLE 192 JOINT VENTURES AND PARTNERSHIPS, 2014–2021

12 COMPANY PROFILES (Page No. - 176)

12.1 KEY PLAYERS

(Business overview, Products offered, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats)*

12.1.1 FENZI GROUP

TABLE 193 FENZI GROUP: BUSINESS OVERVIEW

TABLE 194 FENZI GROUP: OTHERS

12.1.2 TIANJIN XIN LIHUA COLOR MATERIALS CO., LTD (NBC)

TABLE 195 TIANJIN XIN LIHUA COLOR MATERIALS CO. LTD (NBC): BUSINESS OVERVIEW

12.1.3 THE SHERWIN-WILLIAMS COMPANY

TABLE 196 THE SHERWIN-WILLIAMS COMPANY: BUSINESS OVERVIEW

TABLE 197 THE SHERWIN WILLIAMS COMPANY: DEALS

12.1.4 CASIX

TABLE 198 CASIX: BUSINESS OVERVIEW

12.1.5 FERRO CORPORATION

TABLE 199 FERRO CORPORATION: BUSINESS OVERVIEW

FIGURE 33 FERRO CORPORATION: COMPANY SNAPSHOT

TABLE 200 FERRO CORPORATION: DEALS

12.1.6 GLAS TRÖSCH HOLDING AG

TABLE 201 GLAS TRÖSCH HOLDING AG: BUSINESS OVERVIEW

12.1.7 GENERAL OPTICS (ASIA) LIMITED

TABLE 202 GENERAL OPTICS (ASIA) LIMITED: BUSINESS OVERVIEW

12.1.8 NEWPORT THIN FILM LABORATORY (NTFL)

TABLE 203 NEWPORT THIN FILM LABORATORY: BUSINESS OVERVIEW

12.1.9 GRINCOAT COMPANY LTD.

TABLE 204 GRINCOAT COMPANY LTD.: BUSINESS OVERVIEW

12.1.10 DYNASIL CORPORATION

TABLE 205 DYNASIL CORPORATION: BUSINESS OVERVIEW

12.1.11 AGC GROUP

TABLE 206 AGC GROUP: BUSINESS OVERVIEW

12.1.12 EVAPORATED COATINGS, INC.

TABLE 207 EVAPORATED COATINGS, INC.: BUSINESS OVERVIEW

12.1.13 ACCUCOAT INC.

TABLE 208 ACCUCOAT INC: BUSINESS OVERVIEW

12.1.14 JENOPTIK AG

TABLE 209 JENOPTIK AG: BUSINESS OVERVIEW

TABLE 210 JENOPTIK AG: DEALS

12.1.15 ASML BERLIN (BERLINER GLAS)

TABLE 211 ASML BERLIN (BERLINER GLAS): BUSINESS OVERVIEW

TABLE 212 ASML BERLIN (BERLINER GLAS): DEALS

12.1.16 GUARDIAN INDUSTRIES

TABLE 213 GUARDIAN INDUSTRIES: BUSINESS OVERVIEW

12.1.17 JML OPTICAL

TABLE 214 JML OPTICAL: BUSINESS OVERVIEW

12.1.18 THE MADER GROUP

TABLE 215 THE MADER GROUP: BUSINESS OVERVIEW

12.1.19 OPHIR OPTICS GROUP

TABLE 216 OPHIR OPTICS GROUP: BUSINESS OVERVIEW

12.1.20 SAINT-GOBAIN

TABLE 217 SAINT GOBAIN: BUSINESS OVERVIEW

*Details on Business overview, Products offered, MnM view, Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 201)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

The study of global mirror coatings market involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, ICIS, and OneSource. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research.

Mirror Coatings Market Secondary Research

Secondary sources of data include company information from annual reports, press releases, investor presentations, white papers, and articles from recognized authors and databases. In the market engineering process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), both top-down and bottom-up approaches have been extensively used, along with several data triangulation methods, to gather, verify, and validate the market figures.

Mirror Coatings Market Primary Research

The mirror coatings market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations. The demand side of this market is characterized by the development in end-use industries, such as architectural, automotive & transportation, decorative, solar power and others. The supply side is characterized by advancements in technology. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Mirror Coatings Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the market sizes of mirror coatings for various end-use industries in each region. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Mirror Coatings Market Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Mirror Coatings Market Report Objectives

- To define, describe, and forecast the size of the mirror coatings market, in terms of both value (USD million/billion) and volume (Kiloton)

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To forecast the market size by resin type, technology, substrate, end-use industry, and region

- To forecast the market size with respect to five main regions: North America, Europe, APAC, Middle East & Africa, and South America

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for the market leaders

- To analyze competitive developments in the market, such as Joint venture & partnership, and merger & acquisition.

- To strategically profile the key players and comprehensively analyze their market shares.

Mirror Coatings Market Report Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Mirror Coatings Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Mirror Coatings Market Regional Analysis

- Further breakdown of the market, by country

Mirror Coatings Market Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mirror Coatings Market