Military Wearables Market by End User (Army, Navy, Air Force), Wearable Type (Headwear, Eyewear, Wristwear, Hearables and Bodywear), Technology (Vision and Surveillance, Exoskeleton, Smart Textiles, Others), and Region- Global Forecast to 2027

Military wearables are smart electronic devices and equipment incorporated into a soldier’s clothing or worn on the body as implants or accessories. The Military Wearables Market size is projected to grow from USD 3.1 Billion in 2022 to USD 3.4 Billion by 2027, at a CAGR of 1.8% from 2022 to 2027.

Armed forces from various nations around the world have been working to empower their soldiers with innovative technologies like advanced head mounted displays, body diagnostics sensors, advanced personal clothing, improved navigation & communication devices, and other types of military wearables in an effort to increase the level of protection for their soldiers.

To know about the assumptions considered for the study, download the pdf brochure

Simulators Market Dynamics:

Driver: Boosting the development of advanced and lightweight wearable systems

New and advanced military wearables have been developed to improve the combat capabilities of the soldiers because of advancements in networked soldier technology and future soldier clothing. As the geopolitical divergence among nations increases, soldiers are being upgraded to achieve tactical superiority, which has increased the use of advanced weaponry technology to assure their protection from threats.

Mature markets such as Asia Pacific, Europe & North America are seeing a gradual revival in demand for military wearables due to initiatives by governments top provide advanced wearables. Countries all over the world are investing in soldier modernization programs to provide the highest level of protection for their soldiers and decrease the number of casualties they sustain in order to fight the risk associated by asymmetrical warfare. Advance Protection Modern gadgets, equipment, and electronics are stitched inside soldiers' uniforms to assist military forces drastically lower the number of casualties.

Restraint:In developing nations, traditional military systems are preferred over advanced ones.

Financial instability is becoming more prevalent in emergency economies, which is a significant issue restricting market expansion. Developing nations like South Africa, Sudan, and the Philippines, among others, are forced to purchase more conventional weapons systems rather than investing in advanced military equipment due to high inflation and low GDP. The defence spending and expenditure in these nations have significantly decreased because of growing economic worries. Because of this, the defence ministries of various nations are unable to invest in enhancing the capabilities of their army systems, which is limiting the expansion of the market for military goods.

Opportunity: Enhancing the capabilities of current generation military equipment through the development and integration of advanced technology.

Global manufacturers of military wearables are continually aiming to provide a range of advanced technologies in the areas of communication and intelligence to help soldiers take immediate action and strategically on the battlefield. Companies creating modern military wearables have a strong emphasis on creating integrated modular military wearables to address deficiencies in lethality, mobility, survivability, sustainability and C4I. Defense forces from several nations are working to design and produce materials with ballistic content or even superior properties. When injured soldiers are unable to transmit a message for help, advanced technologies come in useful. In these situations, smart clothing recognises the concerns and delivers the appropriate messages via radio communication devices.

Challenge: Strategic and technological disorganization

Due to the rapidly changing nature of warfare, most nations now lack clarity on their combat requirements. Additionally, there is a discrepancy between the predicted performance of technologies and their availability. This lack of technical preparedness hinders the overall system approach-based projects now in place for upgrading soldiers from moving forward as expected. Furthermore, due to the lack of clarity on the long-term military needs of many nations and the inability of technologies to live up to their anticipated performance standards. Governments in nations like India, South Korea, and Brazil have recognized the difficulties that the pioneers of the soldier modernization programme have encountered and have chosen the incremental approach, which modernizes military wearables in stages, to ensure sustained procurements and prevent prolonged delays in doing so.

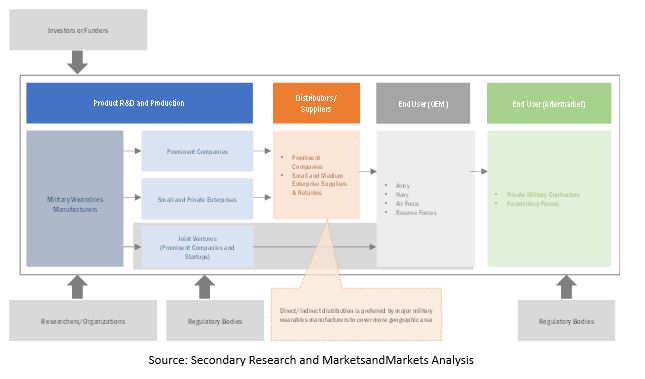

Military Wearables Market Ecosystem

Prominent companies and start-ups that provide military wearables and their services, distributors/ suppliers/ retailers, and end customers are the key stakeholders in the military wearables market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries serve

The land forces segment is estimated to account for the largest share of the military wearables market during the forecast period

Based on end user, the land forces are projected to witness highest market share on account of the current design features of military wearable which augment the augment the capabilities of the land forces as the soldiers are constantly exposed to hazardous working conditions leading to an increased risk of loss of life.

The vision & surveillance segment projected to lead military wearables market during forecast period

Based on technology, the video & surveillance segment is projected to lead the military wearables market during the forecast period. Companies have been undertaking extensive research to develop integrated military wearables with enhanced capabilities to provide soldiers with survivability, sustainability, safety, mobility, command, control, communication, and intelligence. Advancements in the technology for military wearables has helped soldiers combat the tough situations whether it is war or weather. The new generation of night vision goggles is designed to provide improved vision in various environments, including dust, smoke, zero illumination, and subterranean. Thus, thermal cameras and night vision goggles are being widely adopted among soldiers, thereby driving the growth of the vision & surveillance segment of the market.

Headwear segment is expected to account for the largest share in 2022

Based on wearables type, the headwear segment is projected to lead the military wearables market during the forecast period. There is huge demand due to the integration of the headwear with advanced technology (Augmented Reality (AR) & Virtual Reality (VR)) is the driven factor for wearables segment. Modern military wearables include a fire control computer, an integrated camera, and a display for enhanced low-light capability. For instance, Surface Optics Corporation developed a 3D camera technology for multispectral imaging that captures the information required to generate complete multispectral cubes with each focal plane exposure.

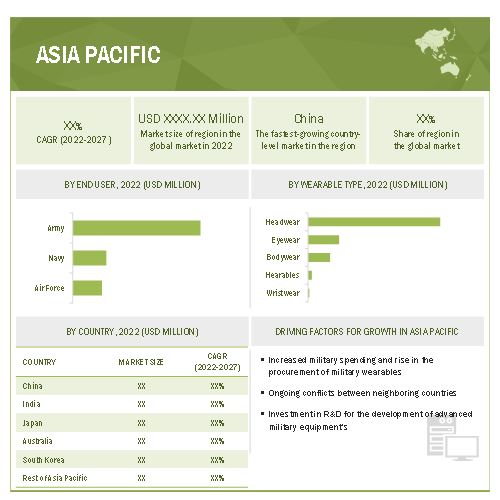

Asia Pacific segment is expected to account for the largest share in 2022

Asia Pacific accounted for the largest market share in 2022 due to enhanced adoption driven by threats such as terrorism, cross-border disputes, and sensitive multi-cultural issues. Most countries in the region envision to ensure infantry soldiers have increased lethality, survivability, and mobility while becoming self-contained combat machines. Increased defence expenditure and investments in the modernisation of various law enforcement agencies in these countries are also boosting the growth of the Military Wearables Industry in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Military Wearables Companies are dominated by a few globally established players such as BAE Systems PLC (UK), Elbit Systems Ltd. (Israel), Rheinmetall AG(Germany), Thales Group (France), Saab AB (Sweden), Aselsan A.S (Turkey), General Dynamic Corporation (US) are some of the market players.

Scope of the report

|

Report Metric |

Details |

|

Estimated Value

|

USD 3.1 billion in 2022 |

| Projected Value | USD 3.4billion by 2027 |

| Growth Rate | CAGR of 1.8% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

By End User, Technology, Wearable Type, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, the Middle East, and Rest of the World |

|

Companies covered |

BAE Systems PLC (UK), Elbit Systems Ltd. (Israel), Thales Group (France), Saab AB (Sweden), General Dynamics Corporation (US), Rheinmetall AG (Germany), L3Harris Corporation (US) among others |

This research report categorizes the Military Wearables Market based on End User, Technology, Wearable Type and Region

Military Wearables Market, By End User

- Land Forces

- Naval Forces

- Air Forces

Military Wearables Market, By Technology

- Communication & Computing

- Network and Connectivity Management

- Navigation

- Vision & Surveillance

- Exoskeleton

- Monitoring

- Power and Energy Source

- Smart Textiles

Military Wearables Market, By Wearable Type

- Headwear

- Eyewear

- Wristwear

- Hearables

- Bodywear

Military Wearables Market, By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In May 2022, Elbit Systems was awarded the contract to provide the DRICM (Direct infrared Countermeasures and EW (Electronic Warfare) systems for Airbus A330-200 MRTT Aircraft of European Air Force.

- In May 2022, Elbit Systems Ltd of America was awarded the contract to supply Squad Binocular Night Vision Goggles systems to the U. S Marines Corps worth USD 49 million.

- In May 2022, Thales was awarded with the contract to deliver the advance tactical radio to U. S army under the Combat Net Radio (CNR) Modernization Program. This contract was granted as part of the company's endeavor to replace its single-channel ground and airborne radio system (SINCGARS), which was outdated worth USD 6 Billion.

- In March 2022, Aselsan A.S. was awarded with the contract that deals with the sale of communication equipment and services for ground platforms used by the Qatari military.

Frequently Asked Questions (FAQs):

What is the current size of the Military Wearables Market?

The military wearables market size is projected to grow from USD 3.1 Billion in 2022 to USD 3.4 Billion by 2027, at a CAGR of 1.8% from 2022 to 2027.

Who are the winners in the Military Wearables Market?

Major players operating in the military wearables market are BAE Systems PLC (UK), Elbit Systems Ltd. (Israel), Rheinmetall AG (Germany), Thales Group(France), Saab AB (Sweden), Aselsan A.S (Turkey), General Dynamic Corporation (US)are some of the winners in the market.

What are some of the technological advancements in the market?

The military wearables sector is being revolutionized by the advent of IoT technologies such as the US’ Nett Warrior program for an integrated dismounted situational awareness and mission command system, and the Force XXI Battle Command Brigade and Below (FBCB2) for battle command and control, communications, and real-time situational awareness. The defense agencies are also actively developing the third generation of smart clothing that features a flexible, stretching material wherein the embedded sensors can collect a variety of data and also use it to predict outcomes and adapt itself to a changing environment without the need for pre-configuration.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

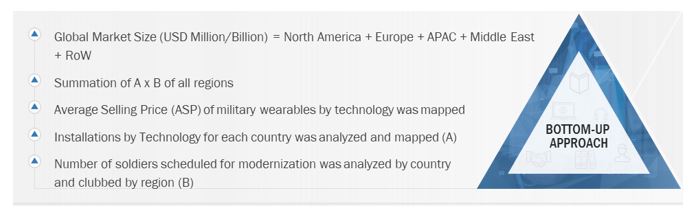

The study involved four major activities in estimating the current market size for the military wearables market. Exhaustive secondary research was conducted to collect information on the market, the peer markets, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg, BusinessWeek, and different magazines were referred to identify and collect information for this study. Secondary sources also included annual reports, press releases & investor presentations of companies, certified publications, articles by recognized authors, and simulators databases.

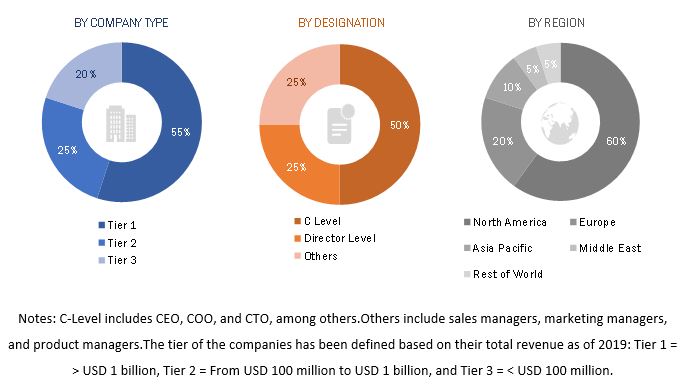

Primary Research

The military wearables market comprises several stakeholders, such as raw material providers, military wearables manufacturers and suppliers, and regulatory organizations in the supply chain. While the demand side of this market is characterized by various end users, the supply side is characterized by technological advancements in military wearables. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the military wearables market. These methods were also used extensively to estimate the size of various subsegments of the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market size estimation methodology: Bottom-up approach

The bottom-up approach was employed to arrive at the overall size of the global military wearables market from the demand of wearable technologies by the armed forces of each nation and the average cost of modernizing a soldier was multiplied with the number of soldiers being modernized in each country. These calculations led to the estimation of the overall market size.

Market size estimation methodology: Top-down approach

In the top-down approach, the overall market size was used to estimate the size of the individual markets (mentioned in market segmentation) through percentage splits obtained from secondary and primary research.

For calculation of the specific market segments, the most appropriate and immediate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented to validate the market segment revenues obtained.

Market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With data triangulation procedure and validation of data through primaries, the overall parent market size and each market size were determined and confirmed in this study. The data triangulation procedure used for this study is explained in the market breakdown and triangulation section.

Report Objectives

- To identify and analyze key drivers, restraints, challenges, and opportunities influencing the growth of the military wearables market

- To analyze the impact of macro and micro indicators on the market

- To forecast the market size of segments for five regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with major countries in each of these regions

- To strategically analyze micromarkets with respect to individual technological trends, prospects, and their contribution to the overall market

- To strategically profile key market players and comprehensively analyze their market ranking and core competencies

- To provide a detailed competitive landscape of the market, along with an analysis of business and corporate strategies, such as contracts, agreements, partnerships, expansions, and new product developments

- To identify detailed financial positions, key products, unique selling points, and key developments of leading companies in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Wearables Market