Military Power Solutions Market by Type (Portable, Non-Portable), Source (Batteries, Generators, Fuel Cells, Solar Power, Energy Harvesters), Application (Air, Land, Naval), Wattage (Low, Medium, and High Power) and Region - Global Forecast to 2022

[161 Pages Report] The military power solutions market is projected to grow from USD 5.35 Billion in 2016 to USD 9.01 Billion by 2022, at a CAGR of 9.07% during the forecast period. The base year considered for the study is 2015 and the forecast period is from 2016 to 2022.

Objectives of the Study:

The report analyzes the military power solutions market based on type (portable and non-portable), source (batteries, generators, fuel cells, solar power, and energy harvesters), application (air, land and naval), and wattage (low, medium, and high power), and subsegments across major regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

The report provides in-depth market intelligence regarding the military power solutions market and major factors, including drivers, restraints, opportunities, and challenges that may influence the growth of the market, along with an analysis of micromarkets with respect to individual growth trends, growth prospects, and their contribution.

The report also covers competitive developments, such as long-term contracts, new product launches and developments, and research & development activities in the military power solutions market, in addition to business and corporate strategies adopted by key market players.

The military power solutions market is projected to grow from USD 5.35 Billion in 2016 to USD 9.01 Billion by 2022, at a CAGR of 9.07% during the forecast period. This growth can be attributed to the emergence of modern warfare techniques. Furthermore, requirement for durable and maintenance free power sources for the military sector and increasing defense electronics budget in several emerging countries are factors that are expected to fuel the growth of the military power solutions market.

The market has been segmented based on source, type, application, wattage, and region. Based on source, the military power solutions market has been segmented into batteries, generators, fuel cells, and solar power, among others. Fuel cells is expected to be the fastest-growing segment of the market, as they are being increasingly adopted due to their high storage capacity.

Based on type, the military power solutions market has been segmented into portable and non-portable. The portable segment is expected to witness high growth, owing to the rising need for compact and lightweight power solutions.

The military power solutions market, based on application, has been segmented into air, land, and naval. The land segment is projected to be the largest segment of the market. Rise in the demand of power sources used by soldiers, armored vehicles, UGVs, and tanks is estimated to increase the demand for military power solutions in the land segment.

The military power solutions market, based on wattage, has been segmented into low, medium, and high power. The medium segment is projected to be the largest segment of the market. Rise in the demand of power sources used by soldiers, armored vehicles, UGVs, tanks is estimated to increase the demand for military power solutions in the medium power segment. Medium power sources are majorly used in ground vehicles that consume approximately 250 Watts of power.

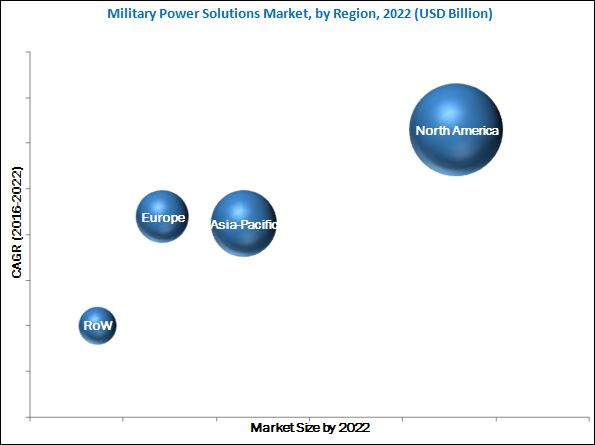

The geographical analysis of the military power solutions market includes regions, such as North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is estimated to be the largest market for military power solutions in 2016. Countries such as the U.S. and Canada in the region have witnessed increasing military power solution deliveries in recent years. The markets in Europe and Asia-Pacific are also expected to witness significant growth, owing to the increase in demand for reliable, efficient, and long-lasting military power solutions in these regions.

High initial cost of deployment can act as a challenge for the growth of the military power solution market.

Products offered by various companies in the military power solution market have been listed in the report. The recent developments section of the report includes recent and key developments by various companies between 2006 and 2017. Major companies profiled in the report include Raytheon Company (U.S.), SAFT Groupe S.A. (France), Arotech Corporation (U.S.), and SFC Energy AG (Germany), among others. Contracts and new product launches were the key strategies adopted by the leading players in the military power solution market. These strategies have enabled companies to strengthen their market share in the military power solution market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Regional Scope

1.3.3 Years Considered for the Study

1.4 Currency & Pricing

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

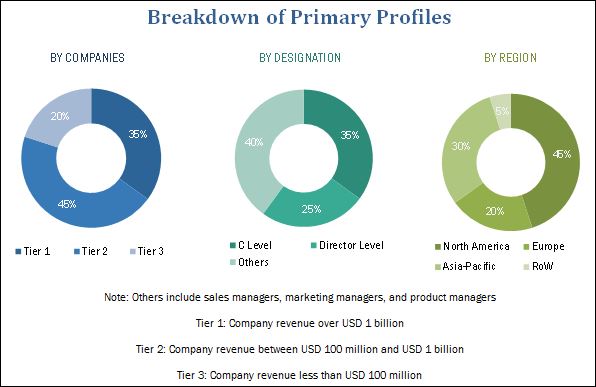

2.1.2.2 Breakdown of Primaries

2.2 Factor Analysis

2.2.1 Demand-Side Analysis

2.2.1.1 Growing Defense Budgets of Emerging Nations

2.2.1.2 Global Militarization Index

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions of the Research Study

3 Executive Summary (Page No. - 33)

4 Premium Insights (Page No. - 37)

4.1 Attractive Market Opportunities in the Military Power Solution Market

4.2 Military Power Solution Market, By Source

4.3 Military Power Solution Market, By Type

4.4 Military Power Solution Market, By Application

4.5 Military Power Solution Markets, By Wattage

4.6 Market Share and Growth Analysis, By Region

5 Market Overview (Page No. - 40)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Military Power Solution Market, By Type

5.2.2 Military Power Solution Market, By Source

5.2.3 Military Power Solution Market, By Application

5.2.4 Military Power Solution Market, By Wattage

5.2.5 Military Power Solution Market, By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Defense Electronics Budget

5.3.1.2 Emergence of Modern Warfare Techniques

5.3.1.3 Requirement for Durable and Maintenance Free Power Sources

5.3.1.4 Increasing Demand for Portable Power Solution

5.3.2 Restraints

5.3.2.1 Declining Defense Budgets of Developed Countries

5.3.2.2 High Cost of Thermoelectric Materials

5.3.2.3 Stringent Military Regulations

5.3.2.4 Inefficiency to Generate High Output Power

5.3.2.5 High Initial Cost of Deployment

5.3.3 Opportunities

5.3.3.1 Need for Safe and Reliable Power Solution

5.3.3.2 Increasing Popularity and Need for Renewable Sources of Energy

5.3.3.3 Increasing Demand for UAVS Which Require Long-Lasting Power Supply

5.3.3.4 Inclination of Defense Bodies Towards Miniaturized Power Sources

5.3.3.5 High-Efficiency Material Reshaping the Thermoelectric Generators Market

5.3.4 Challenges

5.3.4.1 Replacement of Batteries and Generators By Renewable Energy Sources

5.3.4.2 Underdeveloped Nuclear Power Technologies

6 Industry Trends (Page No. - 51)

6.1 Introduction

6.2 Technology Evolution

6.3 Emerging Trends

6.3.1 Fuel Cells

6.3.2 Solar Power

6.3.3 Nuclear Power Battery

6.4 Porter’s Five Forces Analysis

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

6.5 Innovation & Patent Registrations

7 Military Power Solution Market, By Type (Page No. - 58)

7.1 Introduction

7.2 Portable

7.3 Non-Portable

8 Military Power Solution Market, By Source (Page No. - 62)

8.1 Introduction

8.2 Batteries

8.2.1 Lithium-Based Batteries

8.2.2 Nickel-Based Batteries

8.2.3 Others

8.3 Fuel Cells

8.4 Solar Power

8.5 Generators

8.6 Energy Harvesters

9 Military Power Solution Market, By Application (Page No. - 68)

9.1 Introduction

9.2 Air

9.3 Land

9.4 Naval

10 Military Power Solution Market, By Wattage (Page No. - 72)

10.1 Introduction

10.2 Low Power

10.3 Medium Power

10.4 High Power

11 Regional Analysis (Page No. - 75)

11.1 Introduction

11.2 North America

11.2.1 By Type

11.2.2 By Source

11.2.3 By Application

11.2.4 By Wattage

11.2.5 By Country

11.2.5.1 U.S.

11.2.5.1.1 By Type

11.2.5.1.2 By Source

11.2.5.1.3 By Application

11.2.5.2 Canada

11.2.5.2.1 By Type

11.2.5.2.2 By Source

11.2.5.2.3 By Application

11.3 Europe

11.3.1 By Type

11.3.2 By Source

11.3.3 By Application

11.3.4 By Wattage

11.3.5 By Country

11.3.6 U.K.

11.3.6.1 By Type

11.3.6.2 By Source

11.3.6.3 By Application

11.3.7 France

11.3.7.1 By Type

11.3.7.2 By Source

11.3.7.3 By Application

11.3.8 Germany

11.3.8.1 By Type

11.3.8.2 By Source

11.3.8.3 By Application

11.3.9 Italy

11.3.9.1 By Type

11.3.9.2 By Source

11.3.9.3 By Application

11.3.10 Rest of Europe

11.3.10.1 By Type

11.3.10.2 By Source

11.3.10.3 By Application

11.4 Asia-Pacific

11.4.1 By Type

11.4.2 By Source

11.4.3 By Application

11.4.4 By Wattage

11.4.5 By Country

11.4.5.1 China

11.4.5.1.1 By Type

11.4.5.1.2 By Source

11.4.5.1.3 By Application

11.4.5.2 Japan

11.4.5.2.1 By Type

11.4.5.2.2 By Source

11.4.5.2.3 By Application

11.4.5.3 South Korea

11.4.5.3.1 By Type

11.4.5.3.2 By Source

11.4.5.3.3 By Application

11.4.5.4 India

11.4.5.4.1 By Type

11.4.5.4.2 By Source

11.4.5.4.3 By Application

11.4.5.5 Rest of APAC

11.4.5.5.1 By Type

11.4.5.5.2 By Source

11.4.5.5.3 By Application

11.5 Rest of the World

11.5.1 By Type

11.5.2 By Source

11.5.3 By Application

11.5.4 By Wattage

11.5.5 By Country

11.5.5.1 Saudi Arabia

11.5.5.1.1 By Type

11.5.5.1.2 By Source

11.5.5.1.3 By Application

11.5.5.2 Brazil

11.5.5.2.1 By Type

11.5.5.2.2 By Source

11.5.5.2.3 By Application

11.5.5.3 Israel

11.5.5.3.1 By Type

11.5.5.3.2 By Source

11.5.5.3.3 By Application

11.5.5.4 Others

11.5.5.4.1 By Type

11.5.5.4.2 By Source

11.5.5.4.3 By Application

12 Competitive Landscape (Page No. - 119)

12.1 Introduction

12.2 Brand Analysis

12.3 Rank Analysis

12.4 Competitive Situations and Trends

12.4.1 Contracts

12.4.2 New Product Launches

12.4.3 Partnerships, Expansions, and Acquisitions

13 Company Profiles (Page No. - 128)

(Overview, Products and Services, Financials, Strategy & Development)*

13.1 Introduction

13.2 Raytheon Company

13.3 Saft Groupe S.A.

13.4 Enersys Inc.

13.5 Arotech Corporation

13.6 SFC Energy AG

13.7 Eaglepicher Technologies, LLC

13.8 Denchi Power Ltd.

13.9 Advanced Conversion Technology, Inc.

13.10 Concorde Battery Corporation

13.11 Energy Technologies, Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

14 Appendix (Page No. - 153)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (93 Tables)

Table 1 Periodization

Table 2 Defense Market Size (USD Million) and CAGR (2016-2021)

Table 3 The Table Below Illustrates the Price Range of Materials Used in Thermoelectric Generators:

Table 4 Batteries Needed for A 5-Day Mission - Team of 4 Soldiers

Table 5 Innovation & Patent Registrations, 2016

Table 6 Market Size, By Type, 2014-2022 (USD Million)

Table 7 Portable Segment, By Region, 2014-2022 (USD Million)

Table 8 Non-Portable Segment , By Region, 2014-2022 (USD Million)

Table 9 Market, By Source, 2014-2022 (USD Million)

Table 10 Batteries: Market, By Region, 2014-2022 (USD Million)

Table 11 Batteries Market, By Type, 2014-2022 (USD Million)

Table 12 Fuel Cells: Market, By Region, 2014-2022 (USD Million)

Table 13 Solar Power: Market, By Region, 2014-2022 (USD Million)

Table 14 Generators: Market, By Region, 2014-2022 (USD Million)

Table 15 Energy Harvesters: Market, By Region, 2014-2022 (USD Million)

Table 16 Market, By Application, 2014-2022 (USD Million)

Table 17 Air: Market, By Region, 2014-2022 (USD Million)

Table 18 Land: Market, By Region, 2014-2022 (USD Million)

Table 19 Naval: Market, By Region, 2014-2022 (USD Million)

Table 20 Market Size, By Wattage, 2014-2022 (USD Million)

Table 21 Market Size, By Region, 2014-2022 (USD Million)

Table 22 North America Market Size, By Type, 2014-2022 (USD Million)

Table 23 North America Market Size, By Source, 2014-2022 (USD Million)

Table 24 North America Market Size, By Application, 2014-2022 (USD Million)

Table 25 North America Market Size, By Wattage, 2014-2022 (USD Million)

Table 26 North America Market Size, By Country, 2014-2022 (USD Million)

Table 27 U.S.: Market Size, By Type, 2014-2022 (USD Million)

Table 28 U.S.: Market Size, By Source, 2014-2022 (USD Million)

Table 29 U.S.: Size, By Application, 2014-2022 (USD Million)

Table 30 Canada: Market Size, By Type, 2014-2022 (USD Million)

Table 31 Canada: Market Size, By Source, 2014-2022 (USD Million)

Table 32 Canada: Market Size, By Application, 2014-2022 (USD Million)

Table 33 Europe Market Size, By Type, 2014-2022 (USD Million)

Table 34 Europe Market Size, By Source, 2014-2022 (USD Million)

Table 35 Europe Market Size, By Application, 2014-2022 (USD Million)

Table 36 Europe Market Size, By Wattage, 2014-2022 (USD Million)

Table 37 Europe Market Size, By Country, 2014-2022 (USD Million)

Table 38 U.K.: Market Size, By Type, 2014-2022 (USD Million)

Table 39 U.K.: Market Size, By Source, 2014-2022 (USD Million)

Table 40 U.K.: Market Size, By Application, 2014-2022 (USD Million)

Table 41 France: Market Size, By Type, 2014-2022 (USD Million)

Table 42 France: Market Size, By Source, 2014-2022 (USD Million)

Table 43 France: Market Size, By Application, 2014-2022 (USD Million)

Table 44 Germany: Market Size, By Type, 2014-2022 (USD Million)

Table 45 Germany: Market Size, By Source, 2014-2022 (USD Million)

Table 46 Germany: Market Size, By Application, 2014-2022 (USD Million)

Table 47 Italy: Market Size, By Type, 2014-2022 (USD Million)

Table 48 Italy: Market Size, By Source, 2014-2022 (USD Million)

Table 49 Italy: Market Size, By Application, 2014-2022 (USD Million)

Table 50 Rest of Europe: Market Size, By Type, 2014-2022 (USD Million)

Table 51 Rest of Europe: Market Size, By Source, 2014-2022 (USD Million)

Table 52 Rest of Europe: Market Size, By Application, 2014-2022 (USD Million)

Table 53 Asia-Pacific Market Size, By Type, 2014-2022 (USD Million)

Table 54 Asia-Pacific Market Size, By Source, 2014-2022 (USD Million)

Table 55 Asia-Pacific Market Size, By Application, 2014-2022 (USD Million)

Table 56 Asia-Pacific Market Size, By Wattage, 2014-2022 (USD Million)

Table 57 Asia-Pacific Market Size, By Country, 2014-2022 (USD Million)

Table 58 China: Market Size, By Type, 2014-2022 (USD Million)

Table 59 China: Market Size, By Source, 2014-2022 (USD Million)

Table 60 China: Market Size, By Application, 2014-2022 (USD Million)

Table 61 Japan: Market Size, By Type, 2014-2022 (USD Million)

Table 62 Japan: Market Size, By Source, 2014-2022 (USD Million)

Table 63 Japan: Market Size, By Application, 2014-2022 (USD Million)

Table 64 South Korea: Market Size, By Type, 2014-2022 (USD Million)

Table 65 South Korea: Market Size, By Source, 2014-2022 (USD Million)

Table 66 South Korea: Market Size, By Application, 2014-2022 (USD Million)

Table 67 India: Market Size, By Type, 2014-2022 (USD Million)

Table 68 India: Market Size, By Source, 2014-2022 (USD Million)

Table 69 India: Market Size, By Application, 2014-2022 (USD Million)

Table 70 Rest of APAC: Market Size, By Type, 2014-2022 (USD Million)

Table 71 Rest of APAC: Market Size, By Source, 2014-2022 (USD Million)

Table 72 Rest of APAC: Market Size, By Application, 2014-2022 (USD Million)

Table 73 Rest of the World Market, By Type, 2014-2022 (USD Million)

Table 74 Rest of the World Market, By Source, 2014-2022 (USD Million)

Table 75 Rest of the World Market, By Application, 2014-2022 (USD Million)

Table 76 Rest of the World Market, By Wattage, 2014-2022 (USD Million)

Table 77 Rest of the World Market, By Country, 2014-2022 (USD Million)

Table 78 Saudi Arabia: Market Size, By Type, 2014-2022 (USD Million)

Table 79 Saudi Arabia: Market Size, By Source, 2014-2022 (USD Million)

Table 80 Saudi Arabia: Market Size, By Application, 2014-2022 (USD Million)

Table 81 Brazil: Market Size, By Type, 2014-2022 (USD Million)

Table 82 Brazil: Market Size, By Source, 2014-2022 (USD Million)

Table 83 Brazil: Market Size, By Application, 2014-2022 (USD Million)

Table 84 Israel: Market Size, By Type, 2014-2022 (USD Million)

Table 85 Israel: Market Size, By Source, 2014-2022 (USD Million)

Table 86 Israel: Market Size, By Application, 2014-2022 (USD Million)

Table 87 Others: Market Size, By Type, 2014-2022 (USD Million)

Table 88 Others: Market Size, By Source, 2014-2022 (USD Million)

Table 89 Others: Market Size, By Application, 2014-2022 (USD Million)

Table 90 Brand Analysis of Top Players in the Military Power Solution Market

Table 91 Contracts, January 2006–January 2017

Table 92 New Product Launches, November 2009–April 2016

Table 93 Partnerships, Expansions, and Acquisitions, February 2008–October 2016

List of Figures (53 Figures)

Figure 1 Market: Market Segmentation

Figure 2 Market: Research Flow

Figure 3 Market: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Global Militarization Index, By Country, 2015

Figure 6 Market Size Estimation Process: Bottom-Up Approach

Figure 7 Market Size Estimation Process: Top-Down Approach

Figure 8 Data Triangulation

Figure 9 Market, By Type, 2016 & 2022 (USD Million)

Figure 10 The Batteries Segment Led the Military Power Solution Market in 2016

Figure 11 North America Was the Largest Market for Military Power Solutions in 2016

Figure 12 Contracts Was the Key Growth Strategy, Between January 2006 and January 2017

Figure 13 Increase in Defense Electronics Spending is Expected to Drive the Market Growth During the Forecast Period

Figure 14 Batteries Segment is Estimated to Lead the Military Power Solution Market in 2016

Figure 15 Non-Portable Segment to Dominate the Military Power Solution Market By 2022

Figure 16 Land Application Segment Projected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Medium Power Segment Projected to Be the Largest Segment By 2022

Figure 18 North America Estimated to Contribute the Largest Share to the Military Power Solution Market in 2016

Figure 19 Market Segmentation, By Type

Figure 20 Market Segmentation, By Source

Figure 21 Market Segmentation, By Application

Figure 22 Market Segmentation, By Wattage

Figure 23 Market Segmentation, By Region

Figure 24 Market Dynamics of the Market

Figure 25 Global Defense Electronics Market (2007-2016)

Figure 26 Military UAVS Market (2015-2022)

Figure 27 Power Solutions Market

Figure 28 Global Fuel Cell Market, 2014-2021

Figure 29 Porter’s Five Forces Analysis (2016)

Figure 30 The Non-Portable Segment Led the Military Power Solution Market in 2016

Figure 31 Fuel Cells Segment to Grow at the Highest CAGR During the Forecast Period

Figure 32 Land Application Segment to Grow at the Highest CAGR During the Forecast Period

Figure 33 The Medium Power Segment Led the Military Power Solution Market in 2016

Figure 34 Market: Regional Snapshot, 2016-2022

Figure 35 North America Market Snapshot (2016)

Figure 36 Europe Market Snapshot (2016)

Figure 37 Asia-Pacific Market Snapshot (2016)

Figure 38 Rest of the World Market Snapshot (2016)

Figure 39 Companies Adopted Contract as the Key Growth Strategy From January 2006 to January 2017

Figure 40 Revenue and Product-Based Rank Analysis of Top Players in the Market

Figure 41 Contract Was the Most Preferred Strategy Adopted By Leading Players From 2014 to 2016

Figure 42 Contract and New Product Launch Were the Key Growth Strategies

Figure 43 Regional Revenue Mix of Top 5 Market Players, 2015

Figure 44 Raytheon Company: Company Snapshot

Figure 45 Raytheon Company: SWOT Analysis

Figure 46 Saft Groupe S.A.: Company Snapshot

Figure 47 SWOT Analysis: Saft Groupe S.A.

Figure 48 Enersys Inc.: Company Snapshot

Figure 49 SWOT Analysis: Enersys Inc.

Figure 50 Arotech Corporation: Company Snapshot

Figure 51 SWOT Analysis: Arotech Corporation

Figure 52 SFC Energy AG: Company Snapshot

Figure 53 SWOT Analysis: SFC Energy AG

Research Methodology:

Market size estimation for various segments and subsegments of the military power solutions market has been arrived at through extensive secondary research sources, such as Hoovers, Bloomberg Businessweek, Factiva annual reports and publications, among others, and in corroboration with primaries. Further market triangulation has been done with the help of statistical techniques using econometric tools. All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to acquire the final quantitative and qualitative data. This data is consolidated with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The military power solutions market ecosystem comprises power solutions manufacturers, such as Raytheon Company (U.S.), Arotech Corporation (U.S.), SAFT Groupe S.A. (France), SFC Energy AG (Germany), Advanced Conversion Technology, Inc. (U.S.), Concorde Battery Corporation (U.S.), and Energy Technologies, Inc. (U.S.), among others.

Key Target Audience

- Military power solutions manufacturer

- MRO service providers and power solutions distributors

Scope of the Report

This research report categorizes the military power solutions market into the following segments and subsegments:

-

Military power solutions market, by type

- Portable

- Non- Portable

-

Military power solutions market, by source

- Batteries Engine

- Generators

- Fuel Cells

- Solar Power

- Energy Harvesters

-

Military power solutions market, by application

- Air

- Land

- Naval

-

Military power solutions market, by wattage

- Low Power

- Medium Power

- High Power

-

Military power solutions market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World

Customizations available for the report:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the company. The following customization options are available for the report:

-

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Military Power Solutions Market