Military Battery Market Size, Share, Trends & Growth Analysis by Type (Rechargeable, Non-rechargeable), Installation (OEM, Aftermarket), Application (Propulsion, Non-propulsion), Platform (Ground, Airborne, Marine), Composition, Voltage, Power Density and Region

Updated on : Oct 22, 2024

The Military Battery market is experiencing significant growth due to increasing demand for advanced power solutions across various defense applications. As modern military operations become more technology-driven, the need for reliable, long-lasting, and efficient batteries has escalated. Technological advancements in battery chemistry, energy density, and lightweight materials are driving innovation in the field, enabling the development of high-performance batteries for applications such as drones, military vehicles, communication systems, and portable power devices. Additionally, the growing focus on renewable energy and sustainable technologies in defense is further boosting the demand for cutting-edge military battery solutions.

Military Batterry Market Size & Share

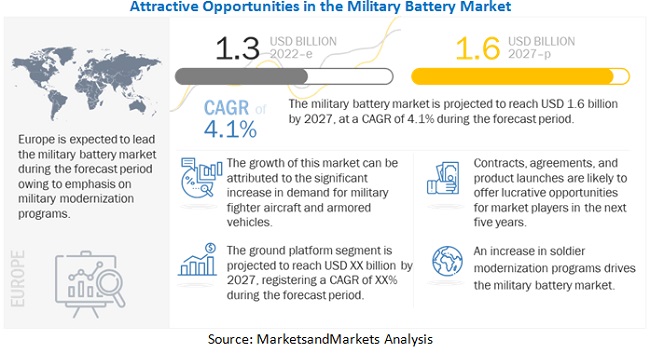

The Military Battery Market size was valued at $1.3 billion in 2022 and is estimated to grow from $1.4 billion in 2023 to $1.6 Billion by 2027 at a CAGR (Compound Annual Growth Rate) of 4.1%. The military battery industry is driven by increased use of lightweight and high-power density batteries in sophisticated military systems. The demand for lightweight and high-power density military batteries is increasing across the globe due to the growing use of various types of sophisticated systems such as air defense systems and electronic warfare systems by defense forces.

The increasing deployment of Unmanned Aerial Vehicles (UAVs) and man-portable devices, among others, by defense forces has further fueled the demand for lightweight, high power, and long endurance batteries, as these batteries lead to the reduction in the overall size of the systems. For instance, the large D-sized lithium primary battery packs, which are used by UAVs to ensure their safe landing during power failures, are being replaced by small-sized and high-powered lithium AA batteries. These batteries not only reduce the overall size of UAVs but also increase their endurance. Various players such as EnerSys (US), GS Yuasa International Ltd (Japan), Saft (France), Exide Industries (India), and EaglePicher Technologies (US) among others, are prominent players operating in the military battery market.

To know about the assumptions considered for the study, Request for Free Sample Report

Military battery Market Dynamics:

Driver: Growing adoption of ground vehicles and UAVs

Various countries are adopting Unmanned Aerial Vehicles (UAVs), military vehicles, and military vessels for intelligence, surveillance, and reconnaissance missions. New generation UAVs such as Predator and Heron, developed by the US and Israel, respectively, are being employed for various combat missions, including attacks on hostile ground targets. The US Army initiated a new program to replace its existing platforms with new advanced combat vehicles. The program called the Next Generation Combat Vehicle project involves the development of Optionally Manned Fighting Vehicle, Armored Multi-Purpose Vehicle, Mobile Protected Firepower, Robotic Combat Vehicle, and Decisive Lethality Platform. The program is projected to be completed by 2035. Such new projects taken up by the armed forces require military batteries and wires. Countries such as the US and the UK are investing in military vehicles and UAVs for combat, surveillance, and intelligence missions. The increasing adoption of ground vehicles and UAVs by defense forces will drive the market for military batteries.

Restraint: Regulations on lithium batteries

Lithium batteries can provide extremely high currents when required and tend to undergo rapid discharging when short-circuited. This often causes the batteries to overheat. Lithium-thionyl chloride and lithium cobalt batteries are particularly more susceptible to overheating, and a short circuit with these batteries may cause the batteries to rupture and explode. The International Air Transport Association (IATA) has therefore placed some restrictions on the transportation of lithium batteries by air. Several postal administrations from countries like the UK, the US, Japan, etc. have banned the transportation of lithium batteries by air.

Military Battery Market Opportunity: Advancements in material sciences and battery technology

There have been significant developments in the field of material science. The specific energies of batteries have increased in recent years. There is a stark difference in the specific energies of lead-acid batteries (30 Wh/Kg) and lithium-ion batteries (205-220 Wh/kg). This has resulted in the development of small, lighter, and more compact batteries with large energy storage capacities. For instance, Sion Power developed a lithium-sulfur battery with specific energies of over 400 Wh/Kg. This battery has twice the energy storage capacity of a standard lithium-ion battery. Similarly, Exellatron developed and patented its experimental Lithium Thin Film batteries, which have a specific energy of about 300 to 350 Wh/Kg and can operate in a wide temperature range from -25C to +80C. These technological advances can benefit the drone battery industry where parameters like specific energy and temperature ranges are some of the key parameters for the selection of batteries.

Military Battery Market Challenges: Design challenges associated with manufacturing batteries

Due to a lack of standardization within the drone battery industry, the battery manufacturers must manufacture their batteries as per customized designs. The manufacturers must also conform to the size, energy density, and weight profile for specific applications while also maintaining a competitive cost. Manufacturers are looking into several economically feasible avenues for manufacturing drone batteries and are also looking at developing other adjacent technologies such as hydrogen fuel cells for drone applications. Designers of drone batteries are investing increasingly in R&D activities to reduce the size and weight of these batteries and developing new technologies like lithium-sulfur and thin-film lithium cells, among others.

Military battery Market Ecosystem:

The key stakeholders in the military battery market ecosystem include companies which provide platforms and soldier systems. The major influencers in this market are investors, funders, academic researchers, integrators, service providers, and licencing agencies.

Military Battery Market Segmental Analysis

OEM segment held largest market share in terms of value in military battery market

Military battery market size has been segmented into OEM and aftermarket. OEMs design, develop, and manufacture military batteries for various applications and integrate them on different platforms, such as airborne, marine, and land-based systems. The military battery market is directly linked to the defense market. The growing military spendings directly affect the military market OEMs as they produce more batteries for military applications.

The electrification of military equipment, vehicles, and aircraft will drive the OEM segment, as new batteries will be required for changing technology. In January 2021, Nexans won a contract from Airbus to develop new high voltage batteries for next-generation electric and hybrid aircraft

100-200 Wh/Kg power density is anticipated to grow at highest CAGR during forecast period

Military battery market share has been segmented into three parts: less than 100 Wh/kg, 100-200 Wh/kg, and more than 200 Wh/kg. In the 100-200 Wh/Kg segment, all the batteries installed on unmanned vehicles, soldiers, and some weapons are considered. The battery chemistries in this segment are lithium-ion and zinc-air. The 100-200 Wh/Kg segment is estimated to be USD 291 million in 2022 and is projected to reach USD 372 million by 2027, at a CAGR of 5.0% during the forecast period. Increasing plans for the modernization and procurement of weapons and unmanned systems are expected to drive this segment.

Regional Analysis - Military Battery Market

In terms of value, Europe led the market

The UK, France, Germany, Italy, Russia, and the Rest of Europe are considered under Europe for market analysis. Europe is a manufacturing hub for various military battery manufacturers, such as Saft (Total), BAE Systems, and ECOBAT Battery Technologies. The demand for military batteries has been increasing in Europe due to the presence of the defense manufacturing industry, growing demand for defense platforms across the globe, and ongoing upgradation programs for existing defense systems.

To know about the assumptions considered for the study, download the pdf brochure

Top Military Battery Companies - Key Market Players

Some of the key players profiled in the military battery market report include EnerSys (US), GS Yuasa International Ltd (Japan), Saft (France), Exide Industries (India), and EaglePicher Technologies (US). The players are mostly engaged in new product launches & developments and having a strong global presence will enhance their position in the military battery industry. These players are primarily focusing on entering new markets by launching technologically advanced and cost-effective platforms and infrastructure. Apart from new product launches & developments, these players also adopted the partnerships contracts, & agreements strategy.

Scope of the Military Battery Market Report

|

Report Metric |

Details |

|

Estimated Market Size |

USD 1.3 Billion by 2022 |

|

Projected Market Size |

USD 1.6 Billion by 2027 |

|

CAGR |

4.1% |

|

Market size available for years |

2018-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By Platform, Type, Application, Composition, Installation, Voltage, Power Density |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East, Rest of the World |

|

Companies covered |

EnerSys (US), GS Yuasa International Ltd (Japan), Saft (France), Exide Industries (India), and EaglePicher Technologies (US) among others |

This research report categorizes the Military battery Market based on Platform, Type, Application, Composition, Installation, Voltage, Power Density, and Region.

By Platform

- Ground

- Airborne

- Marine

By Type

- Non-rechargeable

- Rechargeable

- Propulsion

- Non-propulsion

By Composition

- Rotary Lithium-based

- Lead-acid

- Nickel-based

- Thermal

- Others

By Installation

- OEM

- Aftermarket

By Voltage

- Less than 12V

- 12–24V

- More than 24V

By Power Density

- Less than 100 Wh/Kg

- 100–200 Wh/Kg

- More than 200 Wh/Kg

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments in Military Battery Industry

- In January 2022, C&L Aerospace signed a distribution agreement with Concorde for the distribution of ERJ 135/145 sealed lead-acid (SLA) batteries.

- In November 2021, Lincad won a contract from Thales Group for supplying its SquadNet batteries. The batteries will be used for Thale’s industry-leading networking soldier radios.

- In October 2021, EaglePicher won a contract from IARPA for the development of innovative battery technologies. The contract will include the development of high energy density, long life, sulfur-based batteries.

- In May 2021, Ultralife, along with three other companies, won a firm-fixed-price indefinite-delivery/ indefinite-quantity contract from the US Army for supplying conformal wearable batteries. The contract was awarded by the US Army under its Tactical Power Generation Program.

- In May 2021, Bren-Tronics was among the four awardees who won a contract from the US Army for supplying conformal wearable batteries (CWBs).

Frequently Asked Questions (FAQ):

What is the current size of the military battery market?

The global military battery market size is projected to grow from USD 1.3 billion in 2022 to USD 1.6 billion by 2027, at a CAGR of 4.1% from 2022 to 2027

Who are the winners in the military battery market?

EnerSys (US), GS Yuasa International Ltd (Japan), Saft (France), Exide Industries (India), and EaglePicher Technologies (US) are some of the winners in the market.

What are some of the technological advancements in the market?

Wireless charging for drones, conformal wearable batteries, lithium-ion film technology and next-generation solid-state battery technology are some of the technological advancements in the military battery market.

What are the factors driving the growth of the market?

The military battery market is being driven by factors such as rising demand for smart battery technology and high power density batteries. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

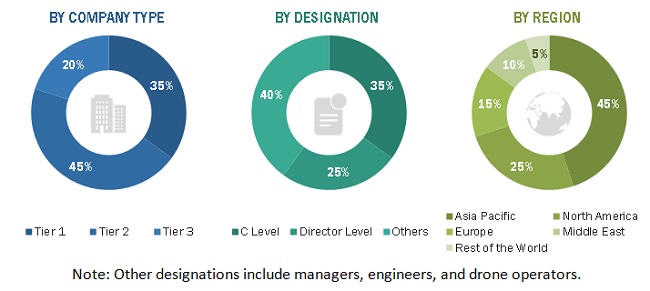

This research study involved the extensive use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the military battery market. Primary sources included industry experts from the core and related industries as well as preferred suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all the segments of this industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as to assess prospects for the growth of the market during the forecast period.

Secondary Research:

The share of companies in the military battery market was determined using secondary data made available through paid and unpaid sources and by analyzing their product portfolios. The companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources that were referred to for this research study on the military battery market included financial statements of companies offering and developing military battery products and solutions and information from various trade, business, and professional associations, among others. Secondary data was collected and analyzed to arrive at the overall size of the military battery market, which was further validated by primary respondents.

Primary Research:

Extensive primary research was conducted after obtaining information about the current scenario of the military battery market through secondary research. Several primary interviews were conducted with market experts from both, the demand- and supply-side across 5 major regions, namely, North America, Europe, Asia Pacific, Latin America and the Middle East and Africa. This primary data was collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

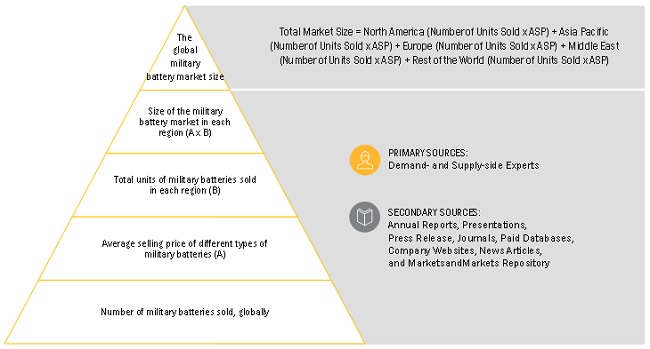

Market Size Estimation

Both, the top-down and bottom-up approaches were used to estimate and validate the size of the military battery market.

The research methodology that was used to estimate the size of the military battery market includes the following details.

Key players in the military battery market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of the top market players and extensive interviews of leaders such as chief executive officers, directors, and marketing executives of the leading companies operating in the military battery market.

All percentage shares, splits, and breakdowns were determined using secondary sources and were verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the military battery market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the military battery market from the market size estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures explained below have been implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both, top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the size of the military battery market based on platform, type, application, composition, installation, voltage, power density, and region for the forecast period from 2022 to 2027

- To forecast the size of various segments of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, the Middle East, and the Rest of the World (RoW), along with the major countries in each of these regions

- To identify and analyze the key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify opportunities for stakeholders in the market by studying key market and technology trends

- To analyze competitive developments such as contracts, agreements, acquisitions & partnerships, new product launches & developments, and R&D activities in the market

- To estimate the procurement of military batteries by different countries to track the market size of military batteries

- To provide a comprehensive competitive landscape of the market along with an overview of the different strategies adopted by key players to strengthen their position in the market

- To identify transportation industry trends, market trends, and technology trends currently prevailing in the market

- To analyze micromarkets1 with respect to individual technological trends and their contribution to the total market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market share and core competencies2

- To provide a detailed competitive landscape of the market, along with an analysis of business and strategies such as mergers & acquisitions, partnerships, agreements, and product developments in the military battery market

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

Available Customizations:

Along with market data, MarketsandMarkets offers customizations as per the specific needs of a company. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Market analysis of additional countries (subject to the data availability)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Battery Market