Middle East Critical Infrastructure Protection (CIP) Market - Advancements, Business Models, Technology Roadmap & Market Forecasts & Analysis (2013 2018)

[195 Pages Report] The global Middle East Critical Infrastructure Protection (CIP) Market size was USD 5.74 billion in 2013 and is projected to reach USD 13.07 billion by 2018, growing at a Compound Annual Growth Rate (CAGR) of 17.9% during the forecast period.

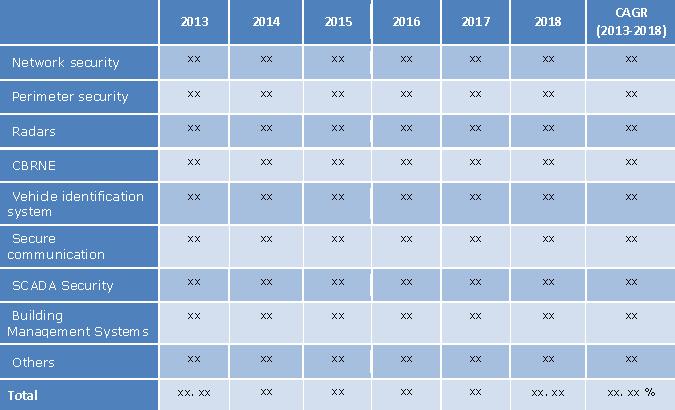

Middle East Critical Infrastructure Protection (CIP) market report constitutes the technologies and services deployed for physical and network security of key assets across the critical infrastructure market. Overall market size for Middle East CIP is found by adding up the market size of various technologies such as network security technologies, perimeter security technologies such as screening and scanning, video surveillance, intrusion detection and access control, and technologies such as ground based surveillance radars, CBRNE detection technologies, secure communication technologies, SCADA network security solutions and building management systems, and services such as risk management services, design, integration and consultation services, maintenance services and managed services.

Though these markets can exist independently, but the playing fields are the same. For example, there are applications of the above mentioned technologies across the verticals such as energy sector (oil and gas, thermal, nuclear, hydro, geothermal and solar), transportation sector (airports, seaports, railways, tunnels and bridges) and sensitive infrastructures (BFSI, stadiums, government monuments, holy places, manufacturing, chemical, communication systems and defence establishments) in the Middle East Critical Infrastructure Protection (CIP) market.

Various advanced technologies and solutions such as ground based surveillance radars, building management systems, SCADA network security and intrusion detection technologies are making their way in the Middle East Critical Infrastructure Protection (CIP) market. Security solutions such as CCTV surveillance, access control, Human Machine Interfaces (HMI) have networking capabilities wherein they are controlled using a centrally located command and control units, leading to more efficiency in the systems. Distant users can access these control systems by connecting through their local networks.

Due to the complexity in networks and the need to develop sophisticated tools to counter the emergency situation, the solution vendors need to constantly upgrade their solutions and develop new technologies. Companies are spending a large amount of money to develop these advanced technologies, thereby increasing the cost of procurement for the enterprises and government agencies. The implementation of these technologies demand heavy centralized processing units and technologies, thereby increasing the costs incurred to provide complete and fool proof protection to these infrastructures.

One challenge in protection is integrating the security technologies over a single user interface, when multiple solutions are used in the control mechanism. For example, in case of deployment of new security technologies (or in the plan to add new ones in future), the user is overburdened with learning several different interfaces. Several vendors provide invaluable frameworks that integrate and manage a wide variety of products under one interface. Such frameworks protect the assets and key infrastructures with automatic and semi-automatic solutions and tools, to detect, verify and resolve security breach events in real-time.

There are various assumptions that we have taken into consideration for market sizing and forecasting exercise. Few of the global assumptions include political, economic, social, technological and economic factors. For instance, exchange rates, one of the economic factors, are expected to have moderate rating of impact on this market. Therefore, dollar fluctuations are expected to not seriously affect the forecasts in the MEA regions.

The Middle East Critical Infrastructure Protection (CIP) market research report will help the market leaders/new entrants in this market in the following ways

- This report segments the market into components and services, covering this market comprehensively. The report provides the closest approximations of the revenue numbers for the overall market and the sub-segments. The market numbers are further split across the different verticals and regions.

- This report will help them better understand the competitor and gain more insights to better position their business. There is a separate section on competitive landscape, including competitor ecosystem, mergers and acquisition and venture capital funding. Besides, there are company profiles of 15 top players in this market. In this section, market internals are provided that can put them ahead of the competitors.

- The report helps them understand the overall growth of the market. The report provides information on key market drivers, restraints, challenges, and opportunities.

Eminent players such as Raytheon, Thales, Siemens, Kaspersky, BAE Systems and McAfee offer better integrated security solutions in the Middle East Critical Infrastructure Protection (CIP) market.

Customer Interested in this report also can view

-

Critical Infrastructure Protection Market by Security Technology (Network, Physical, RADARS, CBRNE, Vehicle Identification, Secure Communication, SCADA, Building Management), by Service, by Vertical & by Region - Global Forecast to 2019

The recent growing political instability and increase in spending on infrastructure across various countries in the middle-east is one of the primary factors driving the growth of Middle East Critical Infrastructure Protection (CIP) market. CIP solutions procured by the government and the organizations are primarily used to secure infrastructure, processes and related critical information from cyber intrusions, for undisrupted and sustained productivity of utilities, energy, power grids, transportation systems and manufacturing sector. Securing the infrastructures premises and control networks has become very important over the years, owing to the increase in trend of attacks from terrorists as well as cyber predators.

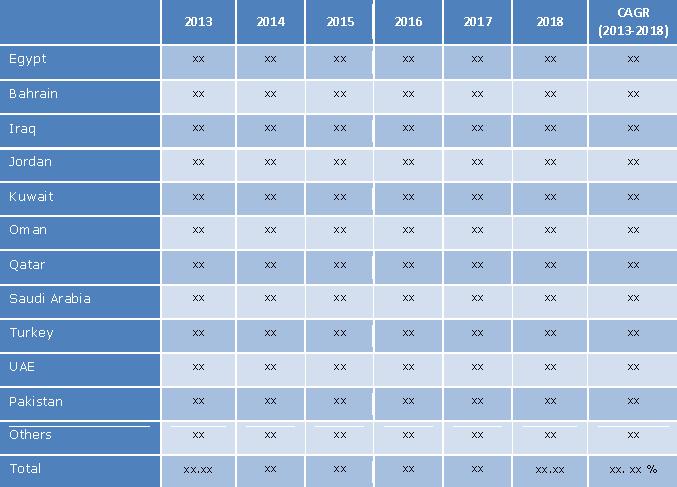

The regional market share in the report highlights the regions (Egypt, Bahrain, Iraq, Jordan, Kuwait, Oman, Qatar, Saudi Arabia, Turkey, UAE, Pakistan and others) based on their current market share across energy and power, transportation and sensitive infrastructure of the Middle East Critical Infrastructure Protection (CIP) market. The information presented illustrates the significant differences in the position of the Middle Eastern countries in terms of their market size, exports and population. Middle East accounts for nearly 35% of the world oil exports. Saudi Arabia, Iraq and Egypt are the leading oil and gas producing nations in the Middle East region. Oil production in most of the countries is likely to remain stable in the coming years. Most of the Middle East countries are highly dependent on oil and gas exports and hence share a similar market trend. They are expected to invest huge amounts across upstream activities in oil and gas and energy sector.

GCC countries are also investing enormous amounts in infrastructure to support economic diversification. For example, increase in the airport capacity, setting up of new railway lines across the six nations. Existing airports are also being expanded in Bahrain, Kuwait, Saudi Arabia and Abu Dhabi and Oman.

Middle East energy (oil and gas) and transportation sector are highly targeted to such attacks because of the increasing levels of dependence on the information communication technologies or the information infrastructure across these sectors. Middle East has also deployed Critical Infrastructure Protection (CIP) security technologies across a wide portfolio of applications across manufacturing industry, sensitive infrastructures such as stadiums, government facilities, manufacturing, banking facilities, historical monuments, holy places and defense establishments. Along with the outside attacks, there are always threats of insider attacks due to lack of comprehensive solutions for securing the infrastructures. There are companies which provide sophisticated physical and network system security solutions which include highly sophisticated intrusion detection and prevention systems, access control systems and also continuous monitoring systems. Many companies also provide network security and cyber security solutions for preventing the complicated cyber attacks, thus securing the plants from such attacks and keep the processes uninterrupted.

MarketsandMarkets expects an increasing uptake of these solutions across enterprises and investments to improve business process agility will gain prominence across the ME countries. MarketsandMarkets expects the Middle East Critical Infrastructure Protection (CIP) market to grow from $5.74 billion in 2013 to $13.07 billion by 2018, at a CAGR of 17.9%.

Middle East Critical Infrastructure Protection (CIP) Market Revenue and Forecast 2013 2018 ($Million)

Source: MarketsandMarkets Analysis

Middle East Critical Infrastructure Protection (CIP) Market Revenue and Forecast By Countries 2013 2018 ($million)

Source: MarketsandMarkets Analysis

Table Of Contents

1 Introduction (Page No. - 23)

1.1 Research Overview

1.1.1 Purpose And Scope

1.1.2 Report Description

1.1.3 Key Take-Aways

1.2 Research Methodology

1.2.1 Secondary And Primary Research

1.2.2 Data Triangulation And Forecasting

1.2.3 Forecast Assumptions

1.3 Market Overview

1.3.1 Markets Covered

1.3.2 Industry Trends

2 Executive Summary (Page No. - 29)

2.1 Abstract

2.2 Overall Market Size

3 Middle East Critical Infrastructure Protection (CIP): Market Ecosystem And Dynamics (Page No. - 35)

3.1 Market Ecosystem

3.1.1 Mapping Trends

3.1.2 Market Players And Roles

3.2 Market Dynamics

3.2.1 Drivers

3.2.1.1 Political Pressure, Regulations And Best Practices

3.2.1.2 Threat Of Terrorist Attacks And Natural Disasters

3.2.1.3 Smart Grid

3.2.1.4 The Need To Develop A Comprehensive Solution

3.2.1.5 Physical Attacks And Insider Threats

3.2.2 Restraints And Challenges

3.2.2.1 High Implementation Costs

3.2.2.2 Integrating Interfaces

3.2.2.3 Lack Of Resources

3.2.3 Opportunities

3.2.3.1 Cloud Computing For Oil And Gas Infrastructures

3.2.3.2 Global Increase In It Spending For Network Security Of Oil And Gas Infrastructure.

3.2.3.3 Technological Advancement And New Functions

3.2.4 Time-Impact Analysis Of Dynamics

4 Middle East Critical Infrastructure Protection (CIP): Market Size And Forecast, By Security Technologies (Page No. - 46)

4.1 Overview And Introduction

4.2 Network Security

4.2.1 Overview

4.2.2 Market Size And Forecast

4.3 Perimeter Security

4.3.1 Overview

4.3.2 Screening And Scanning

4.3.2.1 Overview

4.3.2.2 Market Size And Forecast

4.3.3 Video Surveillance

4.3.3.1 Overview

4.3.3.2 Market Size And Forecast

4.3.3.3 Video Hardware

4.3.3.3.1 Overview

4.3.3.3.2 Market Size And Forecast

4.3.3.4 Video Analytics

4.3.3.4.1 Overview

4.3.3.4.2 Market Size And Forecast

4.3.4 Psim And Piam

4.3.4.1 Overview

4.3.4.2 Market Size And Forecast

4.3.5 Intrusion Detection

4.3.5.1 Overview

4.3.5.2 Market Size And Forecast

4.3.6 Access Control

4.3.6.1 Overview

4.3.6.2 Market Size And Forecast

4.3.6.3 Biometrics

4.3.6.3.1 Overview

4.3.6.3.2 Market Size And Forecast

4.3.6.4 Id Management System

4.3.6.4.1 Overview

4.3.6.4.2 Market Size And Forecast

4.4 Radars

4.4.1 Overview

4.4.2 Market Size And Forecast

4.5 Cbrne

4.5.1 Overview

4.5.2 Market Size And Forecast

4.6 Vehicle Identification Management

4.6.1 Overview

4.6.2 Market Size And Forecast

4.7 Secure Communication

4.7.1 Overview

4.7.2 Market Size And Forecast

4.8 Scada Security

4.8.1 Overview

4.8.2 Market Size And Forecast

4.9 Building Management Systems

4.9.1 Overview

4.9.2 Market Size And Forecast

4.10 Others

4.10.1 Overview

4.10.2 Market Size And Forecast

5 Middle East CIP: Market Size And Forecast, By Services (Page No. - 84)

5.1 Overview And Introduction

5.2 Risk Management Services

5.2.1 Overview

5.2.2 Market Size And Forecast

5.3 Designing, Integration And Consultation

5.3.1 Overview

5.3.2 Market Size And Forecast

5.4 Managed Services

5.4.1 Overview

5.4.2 Market Size And Forecast

5.5 Maintenance And Support

5.5.1 Overview

5.5.2 Market Size And Forecast

6 Middle East Critical Infrastructure Protection (CIP): Market Size And Forecast, By Verticals (Page No. - 96)

6.1 Overview And Introduction

6.2 Energy And Power

6.2.1 Overview

6.2.2 Power Grids

6.2.2.1 Overview

6.2.2.2 Market Size And Forecast

6.2.3 Thermal Power Plants

6.2.3.1 Overview

6.2.3.2 Market Size And Forecast

6.2.4 Nuclear Power Plants

6.2.4.1 Overview

6.2.4.2 Market Size And Forecast

6.2.5 Oil And Gas

6.2.5.1 Overview

6.2.5.2 Market Size And Forecast

6.2.6 Solar Power Plants

6.2.6.1 Overview

6.2.6.2 Market Size And Forecast

6.2.7 Hydropower Plants

6.2.7.1 Overview

6.2.7.2 Market Size And Forecast

6.2.8 Geothermal And Wind Power Plants

6.2.8.1 Overview

6.2.8.2 Market Size And Forecast

6.3 Transportation Systems

6.3.1 Overview

6.3.2 Highways And Bridges

6.3.2.1 Overview

6.3.2.2 Market Size And Forecast

6.3.3 Railway Infrastructure

6.3.3.1 Overview

6.3.3.2 Market Size And Forecast

6.3.4 Seaports

6.3.4.1 Overview

6.3.4.2 Market Size And Forecast

6.3.5 Airports

6.3.5.1 Overview

6.3.5.2 Market Size And Forecast

6.4 Sensitive Infrastructures

6.4.1 Overview

6.4.2 Banking, Financial Services And Insurance (BFSI)

6.4.2.1 Overview

6.4.2.2 Market Size And Forecast

6.4.3 Government Facilities And Defense Establishments

6.4.3.1 Overview

6.4.3.2 Market Size And Forecast

6.4.4 Stadiums, Holy Places And Public Places

6.4.4.1 Overview

6.4.4.2 Market Size And Forecast

6.4.5 Communication Systems

6.4.5.1 Overview

6.4.5.2 Market Size And Forecast

6.4.6 Chemical And Manufacturing

6.4.6.1 Overview

6.4.6.2 Market Size And Forecast

6.4.7 Others

6.4.7.1 Overview

6.4.7.2 Market Size And Forecast

7 Middle East CIP: Market Size And Segmentation By Countries (Page No. - 134)

7.1 Overview And Introduction

7.1.1 Parfait Charts

7.2 Egypt

7.2.1 Overview

7.2.2 Market Size And Forecast By Technologies

7.3 Bahrain

7.3.1 Overview

7.3.2 Market Size And Forecast By Technologies

7.4 Iraq

7.4.1 Overview

7.4.2 Market Size And Forecast By Technologies

7.5 Jordan

7.5.1 Overview

7.5.2 Market Size And Forecast By Technologies

7.6 Kuwait

7.6.1 Overview

7.6.2 Market Size And Forecast By Technologies

7.7 Oman

7.7.1 Overview

7.7.2 Market Size And Forecast By Technologies

7.8 Qatar

7.8.1 Overview

7.8.2 Market Size And Forecast By Technologies

7.9 Saudi Arabia

7.9.1 Overview

7.9.2 Market Size And Forecast By Technologies

7.10 Turkey

7.10.1 Overview

7.10.2 Market Size And Forecast By Technologies

7.11 Uae

7.11.1 Overview

7.11.2 Market Size And Forecast By Technologies

7.12 Others

7.12.1 Overview

7.12.2 Market Size And Forecast By Technologies

7.13 Pakistan

7.13.1 Overview

7.13.2 Market Size And Forecast By Technologies

8 Middle East Critical Infrastructure Protection (CIP): Market Analysis, Trends And Insights (Page No. - 154)

8.1 Market Evolution

8.1.1 Market Uptake

8.2 Trends And Roadmaps

8.2.1 Adoption Roadmaps

8.3 Overall Go To Market (GTM)

8.4 Market Opportunity Analysis

8.4.1 Technological Impact

8.4.2 Opportunity Plots

9 Competitive Landscape (Page No. - 160)

9.1 Venture Capital (VC) Funding Analysis

9.2 Mergers And Aquisitions (M&A)

10 Company Profiles (Mnm View, Overview, Products & Services, Financials, Swot Analysis And Strategy & Analyst Insights)* (Page No. - 165)

10.1 Accenture

10.2 Aegis Defense Services

10.3 Bae

10.4 Cassidian

10.5 Ericsson

10.6 Ge Security

10.7 General Dynamics

10.8 Honeywell International Inc

10.9 Industrial Defender

10.10 Intergraph

10.11 Lockheed Martin

10.12 Mcafee, Inc (Subsidiary Of Intel Corporation)

10.13 Raytheon

10.14 Siemens Ag

10.15 Thales Group

10.16 Waterfall Security Solutions *Details On Marketsandmarkets View, Overview, Products & Services, Financials, Swot Analysis And Strategy & Analyst Insights Might Not Be Captured In Case Of Unlisted Companies.

10.17 Other Key Innovators

10.17.1 Esri

10.17.2 Lieberman Software

10.17.3 Quintron

10.17.4 Smiths Detection

10.17.5 Sentry 360

10.17.6 Terma

10.17.7 Ultra Electronics, 3eti

10.17.8 Watchguard Technologies

List Of Tables (109 Tables)

Table 1 Forecast Assumptions

Table 2 Middle East Critical Infrastructure Protection : Market Size And Forecast, 2013 2018 ($Billion, Y-O-Y %)

Table 3 Middle East CIP: Market Size And Forecast, By Type, 2013 2018 ($Billion)

Table 4 Middle East CIP: Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 5 Middle East CIP: Market Size And Forecast, By Technology, 2013 2018 ($Million)

Table 6 Middle East Critical Infrastructure Protection (CIP) Market, By Technology, 2014 2018 (Y-O-Y %)

Table 7 Middle East CIP: Network Security Market Size And Forecast, By Country, 2013 2018 ($Million)

Table 8 Network Security Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 9 Perimeter Security Market Size And Forecast, By Country, 2013 2018 ($Million)

Table 10 Perimeter Security Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 11 Perimeter Security Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 12 Screening And Scanning Security Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 13 Video Surveillance Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 14 Video Surveillance: Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 15 Video Surveillance: Video Hardware Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 16 Video Surveillance: Video Analytics Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 17 Perimeter Security: Psim And Piam Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 18 Perimeter Security: Intrusion Detection Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 19 Perimeter Security: Access Control Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 20 Perimeter Security: Access Control Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 21 Access Control: Biometrics Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 22 Access Control: Id Management System Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 23 Middle East CIP: Radars Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 24 Radars Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 25 Cbrne Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 26 Cbrne Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 27 Vehicle Identification Management Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 28 Vehicle Identification Management Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 29 Secure Communication Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 30 Secure Communication Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 31 Scada Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 32 Scada Security Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 33 Building Management Systems Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 34 Building Management System Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 35 Middle East CIP: Others Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 36 Middle East CIP: Others Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 37 Professional Services Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 38 Middle East CIP: Services Market, By Type, 2014 2018 (Y-O-Y %)

Table 39 Middle East CIP: Services Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 40 Risk Management Services: Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 41 Design, Integration And Consultation: Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 42 Managed Services: Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 43 Maintenance And Support: Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 44 Middle East Critical Infrastructure Protection (CIP): Market Size And Forecast, By Vertical, 2013 2018 ($Million)

Table 45 Middle East CIP: Energy And Power Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 46 Energy And Power Market, By Type, 2014 2018 (Y-O-Y %)

Table 47 Energy And Power: Power Grids Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 48 Energy And Power: Thermal Power Plants Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 49 Energy And Power: Nuclear Power Plants Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 50 Energy And Power: Oil And Gas Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 51 Energy And Power: Solar Power Plants Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 52 Energy And Power: Hydropower Plants Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 53 Energy And Power: Geothermal And Wind Power Plants Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 54 Transportation Systems Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 55 Transportation Systems Market, By Type, 2014 2018 (Y-O-Y %)

Table 56 Transportation Systems: Highways/Bridges Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 57 Transportation Systems: Railway Infrastructure Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 58 Transportation Systems: Seaports Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 59 Transportation Systems: Airports Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 60 Sensitive Infrastructures Market Size And Forecast, By Type, 2013 2018 ($Million)

Table 61 Sensitive Infrastructures Market, By Type, 2014 2018 (Y-O-Y %)

Table 62 Sensitive Infrastructures: Bfsi Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 63 Sensitive Infrastructures: Government Facilities And Defense Establishments Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 64 Sensitive Infrastructures: Stadiums, Holy Places And Public Places Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 65 Sensitive Infrastructures: Communication Systems Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 66 Sensitive Infrastructures: Chemical And Manufacturing Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 67 Sensitive Infrastructures: Others Security Market Size And Forecast, By Countries, 2013 2018 ($Million)

Table 68 Egypt Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 69 Bahrain Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 70 Iraq Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 71 Jordan Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 72 Kuwait Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 73 Oman Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 74 Qatar Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 75 Saudi Arabia Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 76 Turkey Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 77 Uae Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 78 Others Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 79 Pakistan Market Size And Forecast, By Technologies, 2013 2018 ($Million)

Table 80 CIP: Venture Capital Funding Analysis

Table 81 CIP: Impact Analysis Of Merger And Acquisitions

Table 82 Accenture: Revenue, 2011 2012 ($Million)

Table 83 Accenture: Revenue By Segment, 2011 2012 ($Million)

Table 84 Accenture: Revenue By Region, 2011 2012 ($Million)

Table 85 BAE Systems: Revenue, 2011 2012 ($Million)

Table 86 BAE Systems: Revenue By Segment, 2011 2012 ($Million)

Table 87 Ericsson: Revenue, 2011 2012 ($Million)

Table 88 Ericsson: Revenue By Segment, 2011 2012 ($Million)

Table 89 Ericsson: Revenue By Region, 2011 2012 ($Million)

Table 90 General Electric: Revenue, 2011 2012 ($Million)

Table 91 General Electric: Revenue By Segment, 2011 2012 ($Million)

Table 92 General Electric: Revenue By Region, 2011 2012 ($Million)

Table 93 General Dynamics: Revenue, 2011 2012 ($Million)

Table 94 General Dynamics: Revenue By Segment, 2011 2012 ($Million)

Table 95 General Dynamics: Revenue By Region, 2011 2012 ($Million)

Table 96 Honeywell: Revenue, 2011 2012 ($Million)

Table 97 Honeywell: Revenue By Segment, 2011 2012 ($Million)

Table 98 Honeywell: Revenue By Region, 2011 2012 ($Million)

Table 99 Lockheed Martin: Revenue, 2011 2012 ($Million)

Table 100 Lockheed Martin: Revenue By Segment, 2011 2012 ($Million)

Table 101 Raytheon: Revenue, 2011 2012 ($Million)

Table 102 Raytheon: Revenue By Segment,2011 2012 ($Million)

Table 103 Raytheon: Revenue By Region, 2011 2012 ($Million)

Table 104 Siemens: Revenue, 2011 2012 ($Million)

Table 105 Siemens: Revenue By Segment, 2011 2012 ($Million)

Table 106 Siemens: Revenue By Region, 2011 2012 ($Million)

Table 107 Thales: Revenue, 2011 2012 ($Million)

Table 108 Thales: Revenue By Segment, 2011 2012 ($Million)

Table 109 Thales: Revenue By Region, 2011 2012 ($Million)

List Of Figures (38 Figures)

Figure 1 Data Triangulation, Top-Down And Bottom-Up Approach

Figure 2 Middle East Critical Infrastructure Protection (CIP) Market, 2013 2018 (Y-O-Y %)

Figure 3 Middle East Critical Infrastructure Protection (CIP) Market, By Type, 2013 2018 (Y-O-Y %)

Figure 4 Middle East Critical Infrastructure Protection (CIP) Market, By Countries,2013 2018 (Y-O-Y %)

Figure 5 CIP: Value-Chain

Figure 6 CIP: Ecosystem

Figure 7 CIP: Key Market Players

Figure 8 Life Cycle Of Critical Infrastructure Protection

Figure 9 Time-Impact Analysis Of Dynamics

Figure 10 Middle East Critical Infrastructure Protection (CIP) Market,By Technology, 2014 2018 (Y-O-Y %)

Figure 11 Perimeter Security Market, By Type, 2013 2018 (Y-O-Y %)

Figure 12 Middle East CIP: Services Market, By Type, 2014 2018 (Y-O-Y %)

Figure 13 Middle East CIP Market, By Vertical, 2014 2018 (Y-O-Y %)

Figure 14 Middle East CIP: Energy And Power Market, By Type, 2014 2018 (Y-O-Y %)

Figure 15 Middle East CIP: Transportation Systems Market, By Type, 2014 2018 (Y-O-Y %)

Figure 16 Middle East CIP: Sensitive Infrastructures Market, By Type, 2014 2018 (Y-O-Y %)

Figure 17 Country-Wise CIP Market Revenue

Figure 18 Cip Risk Management Framework

Figure 19 Middle East CIP: Vertical-Wise Market Uptake, 2013 2018 ($Million)

Figure 20 Middle East CIP: Adoption Roadmap

Figure 21 Overall Go-To-Market (GTM)

Figure 22 CIP: 2013 Opportunity Plot

Figure 23 Accenture: Swot Analysis

Figure 24 Aegis Defence Services: Swot Analysis

Figure 25 Bae: Swot Analysis

Figure 26 Cassidian: Swot Analysis

Figure 27 Ericsson: Swot Analysis

Figure 28 Ge Security: Swot Analysis

Figure 29 General Dynamics: Swot Analysis

Figure 30 Honeywell: Swot Analysis

Figure 31 Industrial Defender: Swot Analysis

Figure 32 Intergraph: Swot Analysis

Figure 33 Lockheed Martin: Swot Analysis

Figure 34 Mcafee: Swot Analysis

Figure 35 Raytheon: Swot Analysis

Figure 36 Siemens Ag: Swot Analysis

Figure 37 Thales Group: Swot Analysis

Figure 38 Waterfall Security Solutions: Swot Analysis

Growth opportunities and latent adjacency in Middle East Critical Infrastructure Protection (CIP) Market