Microwave Transmission Equipment Market by Network Technology (Hybrid, Packet Microwave, Small Cell), Component (IDU, ODU), Frequency Band, Mounting Type (Full Indoor, Split Mount, Full Outdoor), Application, and Geography - Global Forecast to 2022

The microwave transmission equipment market market was valued at USD 4.88 Billion in 2015 and is expected to reach USD 6.18 Billion by 2022, at a CAGR of 3.38% between 2016 and 2022. The base year considered for the study is 2015, and the forecast period is between 2016 and 2022.

The objectives of the study are as follows:

- To define, describe, and forecast the global microwave transmission equipment market on the basis of network technology, component, frequency band, mounting type, and application

- To forecast the market size, in terms of value, for various segments with regard to four main regions North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the market dynamics influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the global microwave transmission equipment market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the global microwave transmission equipment landscape

- To provide a detailed Porter’s analysis for the microwave transmission equipment market

- To analyze the competitive intelligence from the company profiles, key player strategies, and significant developments such as product launches and acquisitions

The microwave transmission equipment market is expected to be valued at USD 6.18 Billion by 2022, growing at a CAGR of 3.38% between 2016 and 2022. The growth of this market is propelled by the rise of 4G, LTE advanced, and other new standards, along with increased spectrum efficiency.

The market, considered in this report, has been classified on the basis of network technology into packet microwave, hybrid microwave, small-cell backhaul, and time division multiplexing (TDM). Packet microwave is expected to be the largest market for network technology by 2022, by replacing the hybrid microwave, which was the most widely deployed technology in the last decade. The packet microwave is a low power radio access node that provides flexibility and cost effective microwave solution for various communication applications. Modern data transmissions have evolved from standard definition broadcasts to high definition (HD) and ultra-high definition (UHD) broadcasts, which are not efficiently supported by hybrid microwave networks. That is why the demand has started shifting toward packet microwave which offers higher data transmission rates and lesser signal loss.

Microwave transmission equipment can be used for various communication applications such as cellular, radio telecommunication, broadband, satellite, radar, and navigation. The report provides a description of each of these application areas of microwave transmission equipment. Cellular communication is expected to account for the largest share of the market between 2016 and 2022. The demand for cellular communication is largely driven by the increasing spectrum efficiency and growing automation level. The growing demand for cellular communication for consumer and industrial applications is driving the growth of the microwave transmission equipment market.

The market for full-outdoor mounted microwave equipment is expected to grow at the highest rate between 2016 and 2022. The type of microwave transmission equipment requires lesser space (for installation) compared to split-mount-based systems. Moreover, split-mount-based systems consume more power as both the indoor and outdoor units in these systems need power for transmission. This further adds to the overall operational costs of the microwave transmission equipment. Hence, operators are switching toward full-outdoor mounting type equipment.

APAC accounted for the largest share of the microwave transmission equipment market in 2015, and it is also expected to grow at a the highest rate between 2016 and 2022. The market in APAC is estimated to grow at the highest rate during the forecast period. The demand for microwave transmission equipment in the APAC region is expected to be driven by increasing the growth deployment of cellular infrastructure, growing network establishment coverage and rise in high bandwidth intensive applications which are key part of cellular industry.

One of the key restraining factors for the market is the technological limitations of microwave transmission equipment pertaining to the line-of-sight communication. Microwave signals cannot pass through buildings, hills, or trees and are also affected by heavy rains, hails, snow, and storms that can block microwave communication and cause distortion. This report describes the drivers, restraints, opportunities, and challenges pertaining to the microwave transmission equipment market. In addition, it analyzes the current market scenario and forecasts the market till 2022, including the market segmentation based on network technology, component, frequency band, mounting type, and application, and geography

Some of the major companies operating in the microwave transmission equipment market are Huawei Technologies Co., Ltd. (China), LM Ericsson Telefon AB (Sweden), Alcatel-Lucent S.A. (France), and NEC Corp. (Japan). These companies have developed innovative products catering to the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

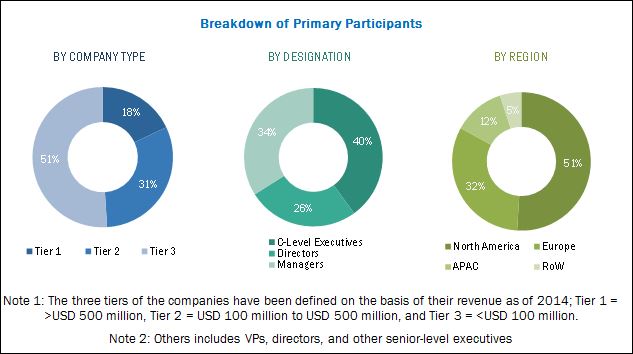

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 30)

4.1 Lucrative Opportunities in the Microwave Transmission Equipment Market

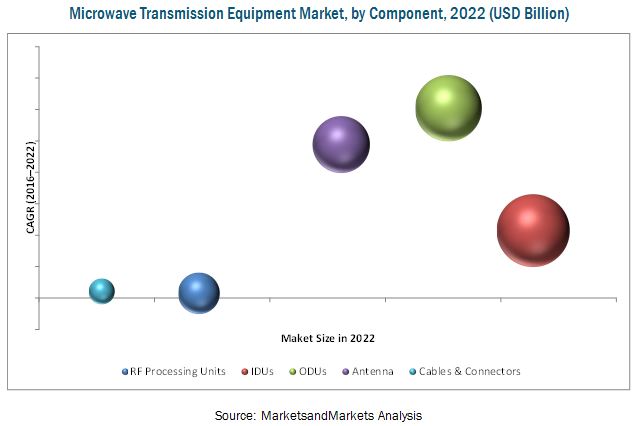

4.2 Microwave Transmission Equipment Market – Comparison of Growth Patterns of Components in Microwave Transmission Equipment

4.3 Microwave Transmission Equipment Market in APAC, 2015

4.4 Market Share of Major Countries and Regions, 2015

4.5 Microwave Transmission Equipment Market, By Mounting Type

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 History of the Microwave Transmission Equipment Market

5.3 Market Segmentation

5.3.1 By Network Technology

5.3.2 By Component

5.3.3 By Frequency Band

5.3.4 By Mounting Type

5.3.5 By Application

5.3.6 By Geography

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rise of 4g, Lte Advanced, and Other New Standards

5.4.1.2 Increased Spectrum Efficiency and Growing Level of Automation

5.4.1.3 Increasing Use of Cellular Network for Facilitating M2m Connectivity

5.4.2 Restraints

5.4.2.1 Technological Limitations Pertaining to Microwave Transmission

5.4.3 Opportunities

5.4.3.1 Growing Adoption of Small-Cell Radio Access

5.4.3.2 Increasing Demand for High-Capacity Cellular Connectivity From India and the Middle East

5.4.4 Challenges

5.4.4.1 High Development Costs

6 Industry Trends (Page No. - 44)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Intensity of Competitive Rivalry

7 Market, By Network Technology (Page No. - 51)

7.1 Introduction

7.2 Time Division Multiplexing (TDM)

7.3 Hybrid Microwave

7.4 Packet Microwave

7.5 Small Cell Backhaul

8 Market, By Component (Page No. - 72)

8.1 Introduction

8.2 Antennas

8.3 RF Processing Units

8.4 Indoor Units (IDU)

8.5 Outdoor Units (ODU)

8.6 Cables & Connectors

9 Market By Frequency Band (Page No. - 76)

9.1 Introduction

9.2 L Band

9.3 S Band

9.4 C Band

9.5 X Band

9.6 KU Band

9.7 KA Band

9.8 V Band

9.9 E Band

9.10 W Band

10 Market, By Mounting Type (Page No. - 81)

10.1 Introduction

10.2 Full Indoor

10.3 Split Mount

10.4 Full Outdoor

11 Market, By Application (Page No. - 86)

11.1 Introduction

11.2 Navigation

11.3 Cellular Communication

11.4 Radio Telecommunication

11.5 Satellite Communication

11.6 Radar

11.7 Broadband Communication

12 Geographical Analysis (Page No. - 94)

12.1 Introduction

12.2 North America

12.2.1 U.S.

12.2.2 Canada

12.2.3 Mexico

12.3 Europe

12.3.1 U.K.

12.3.2 Germany

12.3.3 France

12.3.4 Italy

12.3.5 Rest of Europe

12.4 Asia-Pacific

12.4.1 China

12.4.2 Japan

12.4.3 India

12.4.4 Rest of APAC

12.5 Rest of the World

12.5.1 Middle East

12.5.2 Africa

13 Competitive Landscape (Page No. - 112)

13.1 Overview

13.2 Market Ranking Analysis

13.3 Competitive Situation and Trends

13.3.1 New Product Launches

13.3.2 Agreements, Partnerships, and Contracts

13.3.3 Mergers and Acquisitions

13.3.4 Expansions

14 Company Profiles (Page No. - 117)

14.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

14.2 Huawei Technology Co., Ltd.

14.3 NEC Corp.

14.4 LM Ericsson Telefon AB

14.5 Alcatel-Lucent S.A.

14.6 Giga-Tronics Inc.

14.7 Aviat Networks Inc.

14.8 Ceragon Networks Ltd.

14.9 Intracom S.A. Telecom Solutions

14.10 Dragonwave Inc.

14.11 Anritsu Corp.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 142)

15.1 Insights of Industry Experts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (66 Tables)

Table 1 Microwave Transmission Equipment Market, By Network Technology, 2013–2022 (USD Million)

Table 2 Market for Hybrid Microwave Network Technology, By Component, 2013–2022 (USD Million)

Table 3 Microwave Transmission Equipment Market for Hybrid Microwave Network Technology, By Frequency Band, 2013–2022 (USD Million)

Table 4 Microwave Transmission Equipment Market for Hybrid Microwave Network Technology, By Mounting Type, 2013–2022 (USD Million)

Table 5 Microwave Transmission Equipment Market for Hybrid Microwave Network Technology, By Application, 2013–2022 (USD Million)

Table 6 Microwave Transmission Equipment Market for Hybrid Microwave Network Technology, By Region, 2013–2022 (USD Million)

Table 7 Market for Hybrid Microwave Network Technology for Navigation Application, By Region, 2013–2022 (USD Million)

Table 8 Market for Hybrid Microwave Network Technology for Cellular Communication Application, By Region, 2013–2022 (USD Million)

Table 9 Market for Hybrid Microwave Network Technology for Radio Telecommunication Application, By Region, 2013–2022 (USD Million)

Table 10 Market for Hybrid Microwave Network Technology for Satellite Communication Application, By Region, 2013–2022 (USD Million)

Table 11 Market for Hybrid Microwave Network Technology for Radar Application, By Region, 2013–2022 (USD Million)

Table 12 Market for Hybrid Microwave Network Technology for Broadband Communication Application, By Region, 2013–2022 (USD Million)

Table 13 Microwave Transmission Equipment Market for Packet Microwave Network Technology, By Component, 2013–2022 (USD Million)

Table 14 Microwave Transmission Equipment Market for Packet Microwave Network Technology, By Frequency Band, 2013–2022 (USD Million)

Table 15 Microwave Transmission Equipment Market for Packet Microwave Network Technology, By Mounting Type, 2013–2022 (USD Million)

Table 16 Microwave Transmission Equipment Market for Packet Microwave Network Technology, By Application, 2013–2022 (USD Million)

Table 17 Microwave Transmission Equipment Market for Packet Microwave Network Technology, By Region, 2013–2022 (USD Million)

Table 18 Market for Packet Microwave Network Technology for Cellular Communication Application, By Region, 2013–2022 (USD Million)

Table 19 Market for Packet Microwave Network Technology for Radio Telecommunication Application, By Region, 2013–2022 (USD Million)

Table 20 Market for Packet Microwave Network Technology for Satellite Communication Application, By Region, 2013–2022 (USD Million)

Table 21 Market for Packet Microwave Network Technology for Broadband Communication Application, By Region, 2013–2022 (USD Million)

Table 22 Microwave Transmission Equipment Market for Small Cell Backhaul Network Technology, By Component, 2013–2022 (USD Million)

Table 23 Market for Microwave Transmission Equipment for Small Cell Backhaul Network Technology, By Frequency Band, 2013–2022 (USD Million)

Table 24 Microwave Transmission Equipment Market for Small Cell Backhaul Network Technology, By Mounting Type, 2013–2022 (USD Million)

Table 25 Microwave Transmission Equipment Market for Small Cell Backhaul Network Technology, By Application, 2013–2022 (USD Million)

Table 26 Microwave Transmission Equipment Market for Small Cell Backhaul Network Technology, By Region, 2013–2022 (USD Million)

Table 27 Market for Small Cell Backhaul Network Technology for Cellular Communication Application, By Region, 2013–2022 (USD Million)

Table 28 Market for Small Cell Backhaul Network Technology for Radio Telecommunication Application, By Region, 2013–2022 (USD Million)

Table 29 Market for Small Cell Backhaul Network Technology for Satellite Communication Application, By Region, 2013–2022 (USD Million)

Table 30 Market for Small Cell Backhaul Network Technology for Radar Application, By Region, 2013–2022 (USD Million)

Table 31 Market for Small Cell Backhaul Network Technology for Broadband Communication Application, By Region, 2013–2022 (USD Million)

Table 32 Microwave Transmission Equipment Market, By Component, 2013–2022 (USD Million)

Table 33 Market, By Frequency Band, 2013–2022 (USD Million)

Table 34 Market, By Mounting Type, 2013–2022 (USD Million)

Table 35 Market for Full-Indoor Mounting Type, By Region, 2013–2022 (USD Million)

Table 36 Microwave Transmission Equipment Market for Split-Mount Mounting Type, By Region, 2013–2022 (USD Million)

Table 37 Microwave Transmission Equipment Market for Full-Outdoor Mounting Type, By Region, 2013–2022 (USD Million)

Table 38 Microwave Transmission Equipment Market, By Application, 2013–2022 (USD Million)

Table 39 Market for Navigation, By Region, 2013–2022 (USD Million)

Table 40 Market for Cellular Communication, By Region, 2013–2022 (USD Million)

Table 41 Microwave Transmission Equipment Market for Radio Telecommunication, By Region, 2013–2022 (USD Million)

Table 42 Microwave Transmission Equipment Market for Satellite Communication, By Region, 2013–2022 (USD Million)

Table 43 Microwave Transmission Equipment Market for Radar, By Region, 2013–2022 (USD Million)

Table 44 Market for Broadband Communication, By Region, 2013–2022 (USD Million)

Table 45 Market, By Region, 2013–2022 (USD Million)

Table 46 Market in North America, By Network Technology, 2013–2022 (USD Million)

Table 47 Market in North America, By Mounting Type, 2013–2022 (USD Million)

Table 48 Microwave Transmission Equipment Market in North America, By Application, 2013–2022 (USD Million)

Table 49 Market in North America, By Country, 2013–2022 (USD Million)

Table 50 Microwave Transmission Equipment Market in Europe, By Network Technology, 2013–2022 (USD Million)

Table 51 Market in Europe, By Mounting Type, 2013–2022 (USD Million)

Table 52 Market in Europe, By Application, 2013–2022 (USD Million)

Table 53 Market in Europe, By Country, 2013–2022 (USD Million)

Table 54 Microwave Transmission Equipment Market in APAC, By Network Technology, 2013–2022 (USD Million)

Table 55 Market in APAC, By Mounting Type, 2013–2022 (USD Million)

Table 56 Market in APAC, By Application, 2013–2022 (USD Million)

Table 57 Market in APAC, By Country, 2013–2022 (USD Million)

Table 58 Microwave Transmission Equipment Market in RoW, By Network Technology, 2013–2022 (USD Million)

Table 59 Market in RoW, By Mounting Type, 2013–2022 (USD Million)

Table 60 Market in RoW, By Application, 2013–2022 (USD Million)

Table 61 Market in RoW, By Region, 2013–2022 (USD Million)

Table 62 Market Ranking, 2015

Table 63 New Product Launches, 2013–2016

Table 64 Agreements, Partnerships, and Contracts, 2013–2016

Table 65 Mergers and Acquisitions, 2016

Table 66 Expansions, 2014–2015

List of Figures (59 Figures)

Figure 1 Microwave Transmission Equipment Market Segmentation

Figure 2 Microwave Transmission Equipment Market: Research Design

Figure 3 Market Size Estimation Meth0dology: Bottom-Up Approach

Figure 4 Market Size Estimation Meth0dology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 Microwave Transmission Equipment Market Snapshot (2016 vs 2022): Packet Microwave to Hold the Largest Market Size By 2022

Figure 7 Cellular Communication to Hold the Largest Size of the Microwave Transmission Equipment Market During the Forecast Period

Figure 8 IDU to Hold the Largest Size of the Microwave Transmission Equipment Market Between 2016 and 2022

Figure 9 APAC Held the Largest Share of the Microwave Transmission Equipment Market in 2015

Figure 10 Increasing Demand for Packet Microwaves to Drive the Market Between 2016 and 2022

Figure 11 Market for ODU to Grow at the Highest Rate During the Forecast Period

Figure 12 China Held the Largest Share of the Microwave Transmission Equipment Market in APAC in 2015

Figure 13 U.S. Held the Largest Share of the Market in 2015

Figure 14 Split Mount to Hold the Largest Size of the Microwave Transmission Equipment Market Between 2016 and 2022

Figure 15 Microwave Transmission Equipment Market: Evolution

Figure 16 Major Markets for Microwave Transmission Equipment Across Different Geographies

Figure 17 Increased Spectrum Efficiency and Rising Use of Cellular Networks to Drive the Market During the Forecast Period

Figure 18 Value Chain Analysis: Microwave Transmission Equipment Market

Figure 19 Porter’s Five Forces Analysis: Microwave Transmission Equipment Market (2015)

Figure 20 Porter’s Five Forces: Impact Analysis

Figure 21 Microwave Transmission Equipment Market: Threat of New Entrants

Figure 22 Market: Threat of Substitutes

Figure 23 Market: Bargaining Power of Suppliers

Figure 24 Market: Bargaining Power of Buyers

Figure 25 Market: Intensity of Competitive Rivalry

Figure 26 Packet Microwave Expected to Lead the Market for Microwave Transmission Equipment By 2022

Figure 27 APAC to Be the Largest Market for Hybrid Microwave During the Forecast Period

Figure 28 APAC to Be the Leading Market for Packet Microwave During the Forecast Period

Figure 29 APAC to Be the Leading Market for Small Cell Backhaul Network Technology During the Forecast Period

Figure 30 Indoor Units to Hold the Largest Size of the Microwave Transmission Equipment Market By 2022

Figure 31 L Band to Hold the Largest Size of the Market During the Forecast Period

Figure 32 Split Mount to Account for the Largest Size of the Microwave Transmission Equipment Market During the Forecast Period

Figure 33 APAC Expected to Hold the Largest Size for Split Mount During the Forecast Period

Figure 34 Cellular Communication to Hold the Largest Market During the Forecast Period

Figure 35 APAC to Be the Largest Market for Cellular Communication By 2022

Figure 36 APAC to Hold the Largest Share of the Satellite Communication Market By 2022

Figure 37 U.S. Expected to Hold the Largest Share of Microwave Transmission Equipment Market Between 2016 and 2022

Figure 38 Attractive Growth Opportunity in APAC During the Forecast Period

Figure 39 Market Snapshot in North America, 2015

Figure 40 Market Snapshot in Europe, 2015

Figure 41 Market Snapshot in APAC, 2015

Figure 42 Market Snapshot in RoW, 2015

Figure 43 Organic and Inorganic Strategies Adopted By the Companies Operating in the Market

Figure 44 Battle for Market Share: “Agreements, Partnerships, and Contracts” Was the Key Strategy

Figure 45 Geographic Revenue Mix of Top Market Players

Figure 46 Huawei Technology Co., Ltd.: Company Snapshot

Figure 47 Huawei Technology Co., Ltd.: SWOT Analysis

Figure 48 NEC Corp.: Company Snapshot

Figure 49 NEC Corp.: SWOT Analysis

Figure 50 LM Ericsson Telefon AB: Company Snapshot

Figure 51 LM Ericsson Telefon AB.: SWOT Analysis

Figure 52 Alcatel-Lucent S.A.: Company Snapshot

Figure 53 Alcatel-Lucent S.A.: SWOT Analysis

Figure 54 Giga-Tronics Inc.: Company Snapshot

Figure 55 Aviat Networks Inc.: Company Snapshot

Figure 56 Ceragon Networks Ltd.: Company Snapshot

Figure 57 Intracom S.A. Telecom Solutions: Company Snapshot

Figure 58 Dragonwave Inc.: Company Snapshot

Figure 59 Anritsu Corp.: Company Snapshot

The research methodology used to estimate and forecast the microwave transmission equipment market begins with obtaining data on key vendor revenue through secondary research (IEEE Microwave Theory & Techniques Society, European Microwave Association, The Federal Communications Commission (FCC), The International Telecommunication Union (ITU), and the GSM Association). The vendor offerings have been taken into consideration to determine the market segmentation. A combination of top-down and bottom-up approaches has been employed to arrive at the overall size of the global microwave transmission equipment market from the revenues of key players in the market. After arriving at the overall market size, the total market has been split into several segments and subsegments, which have then been verified through primary research by conducting extensive interviews with people holding key positions such as CEOs, VPs, directors, and executives. The market breakdown and data triangulation procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primaries has been depicted in the figure given below.

To know about the assumptions considered for the study, download the pdf brochure

The microwave transmission equipment market comprises major players such as LM Ericsson Telefon AB (Sweden), Huawei Technologies Co., Ltd. (China), Alcatel-Lucent (France), NEC Corp. (Japan), Aviat Network (U.S.), Intracom Telecom (Greece), Ceragon (Israel), DragonWave Inc. (Canada), and Anritsu (Japan), among others.

All the above mentioned companies have their own R&D facilities and extensive sales offices and distribution channels. The products of these companies have applications in various industries. The report provides the competitive landscape of the key players, which indicates their growth strategies pertaining to the microwave transmission equipment market.

Target Audience:

- Raw material suppliers

- Semiconductor foundries

- Microwave transmission integrated circuits (ICs) manufacturers

- OEMs – white label manufacturing for others in bulk volume

- System/network integrators

- Intellectual property (IP) and licensing providers

- Governments, financial institutions, and investment communities

- Product manufacturers

- Suppliers and distributors

- Technology investors

- Technology standards organizations, forums, alliances, and associations

“The study answers several questions for the stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report:

The report scope covers the microwave transmission equipment market based on following segments:

-

By Network Technology

- Packet Microwave

- Hybrid Microwave

- Small-Cell Backhaul

- Time Division Multiplexing (TDM)

-

By Component

- Antennas

- RF Processing Units

- IDUs

- ODUs

- Cables and Connectors

-

By Frequency Band

- L Band

- S Band

- C Band

- X Band

- Ku Band

- Ka Band

- V Band

- E Band

- W Band

-

By Mounting Type

- Full-Indoor

- Split-Mount

- Full-Outdoor

-

By Application

- Navigation

- Cellular Communication

- Radio Telecommunication

- Satellite Communication

- Radar

- Broadband Communication

-

By Geography

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- U.K.

- Germany

- France

- Italy

- Rest of Europe

-

Asia-Pacific

- China

- Japan

- India

- Rest of APAC

-

RoW

- South America

- Middle East

- Africa

-

North America

Competitive Landscape: Market share analysis

Company Profiles: Detailed analysis of the major companies present in the microwave transmission equipment market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information:

Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Microwave Transmission Equipment Market

We want to know more only about Microwave Transmission Equipment Market by Network Technology (Hybrid, Packet Microwave, Small Cell).