Microwave Devices Market Size, Share & Industry Growth Analysis Report by Product (Active Devices, Passive Devices), Frequency (Ku-band, C-band, Ka-band, L-band, X-band, S-band), End User (Space & Communication, Military & Defense, Healthcare), and Geography - Global Forecast to 2027

Updated on : Oct 23, 2024

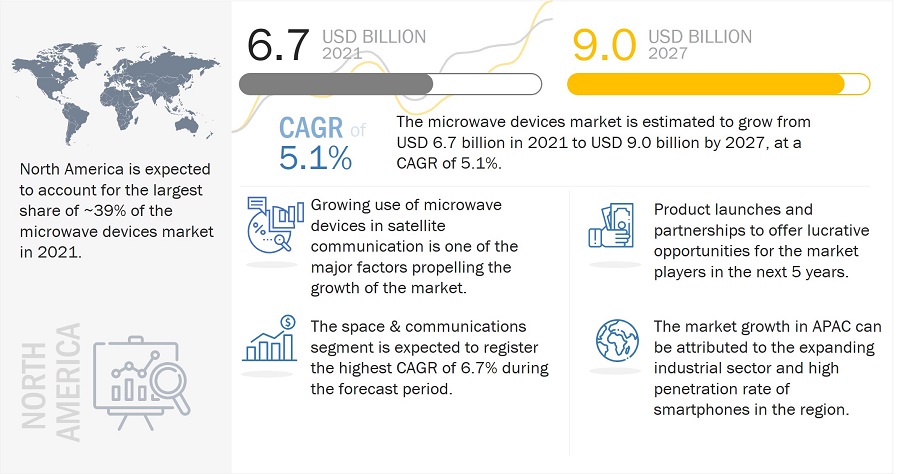

The Microwave Devices Market is projected to grow from USD 6.7 billion in 2021 to USD 9.0 billion by 2027; it is expected to grow at a CAGR of 5.1% during the forecast period.

The key factors fueling the growth of the market by rising military & defense expenditure, growing need for secure and fast communications, and rising demand for microwave devices in patient monitoring. The rising penetration of 5G and IoT infrastructure is expected to attract lucrative opportunities for microwave devices industry.

Global Microwave Devices Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Microwave Devices Market Dynamics

Driver: Rising military & defense expenditure

The global political situation is likely to remain uncertain for a long period owing to the increasing disagreements between two or more nations, for instance, the oil price war between Saudi Arabia and Russia and the drawdown of the US military forces in Afghanistan, among others. In an attempt to tackle this situation, the regulatory bodies of various countries are seeking higher budgets from respective governments.

Although the defense budgets across the globe declined during the COVID-19 pandemic period as the governments highly focused on curbing the spread of the virus and providing emergency relief, they may foresee a substantial rise post-2021. As the global military sector is focusing on developing state-of-the-art warfare infrastructure for defense purposes in the current uncertain political conditions, the demand for microwave devices is increasing significantly.

High precision systems play a vital role in data security, intensive signal processing, and proficient information transmission in the military sector. Automation of vital equipment related to microwave components and sub-systems may help defense forces to perform secure and reliable operations in critical environments. The microwave devices integrated into defense equipment such as airplanes, missiles, radars, and other communication systems enable efficient warfare operations. Thus, governments are allocating a substantial share of their military budgets for developing and deploying microwave and other communication devices.

Restraint: Device complexity

The microwave device is a combination of active components, including transistors and tubes, and passive components, such as isolators, resistors, and filters, in electronic circuitry. Thus, design complexity makes it difficult to understand the working of the microwave products, leading to inefficient end results. Furthermore, bulky electronic circuits require high energy for efficient working and exhibit slow operations. With the rapid developments in smartphone designs, cellular network requirements, and increasing deployment of modern warfare infrastructure, device complexity is expected to major hindrance in the adoption of microwave devices.

Opportunity: Technological breakthroughs in microwave infrastructure

The manufacturers of microwave devices are constantly involved in research and development (R&D) to upgrade and develop new products for their potential customers. The R&D units of the market participants are focusing on overcoming the holistic challenges in their microwave devices, which could lead to effective communication and transmission of signals. One of such technological upgrades was accomplished to overcome the drawback of microwaves to pass through solid objects. The market players are forcing end users to deploy point-to-point repeaters and placing them in a clear line of sight to avoid fluctuations and loss of microwave signals. Reduction in power consumption and better propagation are other advancements made in this market. The market players are working on upgrading their products with these features with a high focus on miniaturization.

Challenge: Electromagnetic interference

Over the recent years, electromagnetic radiation has emerged as an alarming threat for the advanced equipment operating in GHz range. Electromagnetic radiations arise from wind turbines, electric motors, and transmission lines. They can penetrate through the infrastructure equipped with microwave devices and propagate as normal signals. These radiations create an unwanted and deteriorating noise known as Electromagnetic Interference (EMI), which can hamper the operations of electronic infrastructure. EMI causes false-out and fluctuations in the microwave signal execution, degrading the performance of equipment. Electronic malfunctions may further hamper the effective use of frequency bands or lead to ignition. However, efforts are being made by the manufacturers to develop EMI shielding materials that can reduce the risk of EMI disruptions.

Based on range, Ku-band segment is the largest microwave devices market during the forecast period

The Ku-band (Ku stands for Kurz under) represents the mid-frequency range of 12 GHz to 18 GHz. It is used for satellite communication, specifically for direct transmission for television, space shuttle, maritime, and industrial control systems. Ku-band has been a pioneer in implementing high-speed communication channels as it has lower throughput and is less susceptible to attenuation. Furthermore, it has shorter wavelengths, improved spot beam coverage, and requires less investment. These attributes have paved the way for Ku-band compatible microwave devices over the recent years, and the trend is expected to continue during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The microwave devices companies players have implemented major types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market are Thales Group (France), L3 Harris Technologies, Inc. (US), Teledyne Technologies Incorporated (US), CPI International Inc. (US), Qorvo, Inc. (US), Toshiba Corporation (Japan), Richardson Electronics, Ltd. (US), Analog Devices, Inc. (US), General Dynamics Corporation (US), Honeywell International Inc. (US), Cobham Limited (UK), Texas Instruments Incorporated (US), API Microelectronics (UK), Astra Microwave Products Limited (India), Cytec Corporation (US), Kratos Defense And Security Solutions Inc. (US), MACOM (US), Microchip Technology Inc (US), MicroWave Technologies (US), Mitsubishi Electric Corporation (Japan), Panasonic Corporation (Japan), Sylatech (UK), TMD Technologies Ltd.(UK), Triton Services, Inc. (US), And Wolfspeed Inc. (US).

The study includes an in-depth competitive analysis of these key players in the microwave devices market with their company profiles, recent developments, and key market strategies.

Microwave Devices Market Report Scope:

|

Report Metric |

Details |

| Estimated Market Size | USD 6.7 Billion |

| Projected Market Size | USD 9.0 Billion |

| Growth Rate | CAGR of 5.1% |

|

Market size available for years |

2021–2027 |

|

On Demand Data Available |

2030 |

|

Report Coverage |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

| Key Market Driver | Rising Military & Defense Expenditure |

| Largest Growing Region | North America (NA) |

| Largest Market Share Segment | Ku-band Segment |

| Highest CAGR Segment | Space & Communication Segment |

In this report, the overall microwave device ecosystem has been segmented based on product, frequency, end user and region.

Based on product, the microwave devices market has been segmented as follows:

-

Active Microwave Devices

-

Solid-State Microwave Devices, By Type

- Solid-State Power Amplifier

- Other Solid-State Microwave Devices

-

Solid-State Microwave Devices, By Material

- Gallium Arsenide (GAAS)

- Silicon

- Gallium Nitride (GAN)

- Silicon Carbide (SIC)

- Other Materials

-

Vacuum Electron Microwave Devices, By Type

- Travelling Wave Tube Amplifier (TWTA)

- Klystron

- Magnetron

- Crossed-Field Amplifier

- Other Vacuum Electron Microwave Devices

-

Solid-State Microwave Devices, By Type

- Passive Microwave Devices

Based on frequency, the microwave devices market has been segmented as follows:

- Ku-Band

- C-Band

- Ka-Band

- L-Band

- X-Band

- S-Band

- Other Bands

Based on end-user, the microwave devices market has been segmented as follows:

- Space & Communication

- Military & Defense

- Healthcare

- Others

Based on Region, the microwave devices market has been segmented as follows:

-

North America

- US

- Canada

- Mexico

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Rest of APAC

-

Rest of the World (RoW)

- Middle East & Africa

- South America

Recent Developments

- In September 2021, Qorvo, Inc. launched two Bulk Acoustic Wave (BAW) filters. The QPQ3500 and QPQ3501 filters are pin-compatible, offer reduced insertion loss, and better out-of-band rejection to the OEMs offering 5G base stations.

- In June 2021, Thales Group launched a product line of L-band satellite solutions. This series is made with increased mobility with the same benefits Iridium offers. It has an embedded 802.11b/g Wi-Fi access point; with multiple user capabilities.

- In June 2021, Teledyne Technologies RESON SeaBat T51-R Multibeam Echosounder that offers full swath coverage shallow water operations at 800 kHz without better efficiency.

- In July 2020, Analog Devices, Inc. launched ADRV9002 RF transceiver that deciphers wideband and offers narrowband operations into a single device. The products tend to operate in the frequency of 30 MHz to 6 GHz.

Frequently Asked Questions (FAQ):

What is the Market Size for Microwave Devices ?

The size of the microwave devices market is anticipated to increase from USD 6.7 billion in 2021 to USD 9.0 billion by 2027, growing at a CAGR of 5.1%.

What are the major applications of microwave devices?

The major applications of microwave devices include telecommunications, radar, medical equipment, industrial heating, and consumer electronics.

What Company Leading the North America Microwave devices market?

Key players in the microwave devices market include L3 Harris, Technologies, Inc., Teledyne Technologies Incorporated, Qorvo, Inc., and CPI International, Inc.

What factors are driving the growth of the Microwave Devices Market?

The growth of the microwave devices market is driven by the increasing demand for high-speed data transmission and the development of new technologies such as 5G and the Internet of Things (IoT).

What are the challenges facing the microwave devices market?

Challenges facing the microwave devices market include intense competition, high R&D costs, and difficulties in obtaining regulatory approval for new products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 23)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 MICROWAVE DEVICES MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 VOLUME UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 2 MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key industry insights

2.1.3.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Methodology for arriving at market size using bottom-up approach

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM UP (SUPPLY SIDE)— REVENUE GENERATED BY COMPANIES IN MICROWAVE DEVICES MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 2

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Methodology for capturing market size using top-down approach

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 41)

3.1 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 7 IMPACT OF COVID-19 ON MICROWAVE DEVICES MARKET

3.2 POST-COVID-19 SCENARIO

TABLE 2 POST-COVID-19 SCENARIO: MARKET, 2021–2027 (USD MILLION)

3.3 OPTIMISTIC SCENARIO (POST-COVID-19)

TABLE 3 OPTIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2027 (USD MILLION)

3.4 PESSIMISTIC SCENARIO (POST-COVID-19)

TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): MARKET, 2021–2027 (USD MILLION)

FIGURE 8 ACTIVE DEVICES SEGMENT TO LEAD MARKET FROM 2021 TO 2027

FIGURE 9 KA-BAND SEGMENT TO WITNESS FASTEST GROWTH IN MARKET FROM 2021 TO 2027

FIGURE 10 SPACE & COMMUNICATIONS SEGMENT TO LEAD MARKET FROM 2021 TO 2027

FIGURE 11 NORTH AMERICA TO HOLD LARGEST SHARE OF MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MICROWAVE DEVICES MARKET

FIGURE 12 GROWING USE OF MICROWAVE DEVICES IN SATCOMS TO FUEL MARKET GROWTH FROM 2021 TO 2027

4.2 MARKET, BY PRODUCT

FIGURE 13 ACTIVE DEVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE OF MICROWAVE DEVICES FROM 2021 TO 2027

4.3 MARKET, BY FREQUENCY

FIGURE 14 KU-BAND SEGMENT TO HOLD LARGEST SHARE OF MARKET DURING FORECAST PERIOD

4.4 MARKET, BY END USER AND REGION

FIGURE 15 SPACE & COMMUNICATIONS SEGMENT AND NORTH AMERICA TO HOLD LARGEST SHARES OF MARKET IN 2021

4.5 MICROWAVE DEVICES ANALYSIS, BY COUNTRY

FIGURE 16 INDIA TO REGISTER HIGHEST CAGR IN MARKET FROM 2021 TO 2027

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 17 DYNAMICS: MICROWAVE DEVICES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing military & defense expenditure

FIGURE 18 GLOBAL MILITARY EXPENDITURE, 2020

5.2.1.2 Growing need for secure and fast satellite communication

5.2.1.3 Rising demand for microwave devices in patient monitoring

5.2.2 RESTRAINTS

5.2.2.1 High cost of microwave devices

5.2.2.2 Device complexity

5.2.3 OPPORTUNITIES

5.2.3.1 Technological breakthroughs in microwave infrastructure

5.2.3.2 Miniaturization of microwave devices

5.2.3.3 Rising penetration of 5G and IoT into telecom sector

5.2.4 CHALLENGES

5.2.4.1 Electromagnetic interference

5.2.4.2 Inability to pass signals through solid objects, fog, and snow

5.3 VALUE CHAIN ANALYSIS

FIGURE 19 MICROWAVE DEVICES MARKET: VALUE CHAIN

5.4 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5 MICROWAVE DEVICE ECOSYSTEM ANALYSIS

FIGURE 20 ECOSYSTEM OF MICROWAVE DEVICE MARKET

TABLE 6 MARKET: ECOSYSTEM

5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MICROWAVE DEVICE MANUFACTURERS

FIGURE 21 REVENUE SHIFT FOR MICROWAVE DEVICE MANUFACTURERS

5.7 CASE STUDY ANALYSIS

TABLE 7 USE CASE 1: NATIONAL SCIENCE FOUNDATION SELECTED ANALOG DEVICES, INC. TO OFFER RUGGED MICROWAVE COMPONENTS

TABLE 8 USE CASE 2: US ARMY ORDERED COMPACT TEAM RADIOS FROM L3 HARRIS TECHNOLOGIES, INC.

TABLE 9 USE CASE 3: NASA SELECTED MICROWAVE COMPONENTS FROM QORVO, INC. FOR ITS MARS EXPLORATION INITIATIVES

5.8 TECHNOLOGY ANALYSIS

5.8.1 ADVANCEMENTS IN FREQUENCY BANDS

5.8.2 5G COMMERCIALIZATION

5.8.2.1 5G in space & communications vertical

5.8.2.2 Advancements in healthcare sector

5.9 PRICING ANALYSIS

TABLE 10 PRICING RANGE TREND OF MICROWAVE DEVICES BY TOP COMPANIES

5.10 TRADE ANALYSIS AND TARIFF ANALYSIS

5.10.1 TRADE ANALYSIS

5.10.1.1 Trade data for HS Code 854079

FIGURE 22 IMPORT DATA, BY COUNTRY, 2016−2020 (USD MILLION)

FIGURE 23 EXPORT DATA, BY COUNTRY, 2016−2020 (USD MILLION)

5.10.1.2 Trade data for HS Code 854081

FIGURE 24 IMPORT DATA, BY COUNTRY, 2016−2020 (USD MILLION)

FIGURE 25 EXPORT DATA, BY COUNTRY, 2016−2020 (USD MILLION)

5.10.2 TARIFF ANALYSIS

TABLE 11 TARIFFS DATA FOR HS 854081

5.11 PATENT ANALYSIS

FIGURE 26 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

TABLE 12 TOP 10 PATENT OWNERS IN US IN LAST 10 YEARS

FIGURE 27 NUMBER OF PATENTS GRANTED PER YEAR FROM 2011 TO 2021

TABLE 13 LIST OF PATENTS

5.12 REGULATORY LANDSCAPE

5.12.1 UTILIZATION OF RADIO FREQUENCIES BY INTERNATIONAL TELECOMMUNICATION UNION

5.12.2 FCC REGULATIONS

5.12.3 RESTRICTION OF HAZARDOUS SUBSTANCES (ROHS) AND WASTE ELECTRICAL AND ELECTRONIC EQUIPMENT (WEEE)

6 MICROWAVE DEVICES MARKET, BY PRODUCT (Page No. - 70)

6.1 INTRODUCTION

FIGURE 28 MICROWAVE DEVICES SIZE ANALYSIS, BY PRODUCT

FIGURE 29 ACTIVE DEVICES SEGMENT TO GROW AT HIGHER RATE DURING FORECAST PERIOD

TABLE 14 MARKET, BY PRODUCT, 2018–2020 (USD MILLION)

TABLE 15 MARKET, BY PRODUCT, 2021–2027 (USD MILLION)

6.2 ACTIVE DEVICES

6.2.1 ACTIVE DEVICES SEGMENT TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

TABLE 16 ACTIVE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 17 MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2 SOLID-STATE MICROWAVE DEVICES

TABLE 18 SOLID-STATE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 SOLID-STATE MICROWAVE DEVICES, BY REGION, 2021–2027 (USD MILLION)

6.2.2.1 Solid-state power amplifier

TABLE 20 SOLID-STATE MICROWAVE POWER AMPLIFIER MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 21 SOLID-STATE MICROWAVE POWER AMPLIFIER MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.2.2 Other solid-state microwave devices

TABLE 22 OTHER SOLID-STATE MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 OTHER SOLID-STATE MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.3 SOLID-STATE MICROWAVE DEVICES, BY MATERIAL

6.2.3.1 Gallium arsenide (GaAs)

TABLE 24 SOLID-STATE MARKET BY GALLIUM ARSENIDE, BY REGION, 2018–2020 (USD MILLION)

TABLE 25 SOLID-STATE MICROWAVE DEVICES BY GALLIUM ARSENIDE, BY REGION, 2021–2027 (USD MILLION)

6.2.3.2 Silicon

TABLE 26 SOLID-STATE MARKET BY SILICON, BY REGION, 2018–2020 (USD MILLION)

TABLE 27 SOLID-STATE MICROWAVE DEVICES BY SILICON, BY REGION, 2021–2027 (USD MILLION)

6.2.3.3 Gallium nitride (GaN)

TABLE 28 SOLID-STATE MARKET BY GALLIUM NITRIDE, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 SOLID-STATE MICROWAVE DEVICES BY GALLIUM NITRIDE, BY REGION, 2021–2027 (USD MILLION)

6.2.3.4 Silicon carbide (SiC)

TABLE 30 SOLID-STATE MARKET BY SILICON CARBIDE, BY REGION, 2018–2020 (USD MILLION)

TABLE 31 SOLID-STATE MICROWAVE DEVICES MARKET BY SILICON CARBIDE, BY REGION, 2021–2027 (USD MILLION)

6.2.3.5 Other materials

TABLE 32 MARKET BY OTHER MATERIALS, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 MARKET BY OTHER MATERIALS, BY REGION, 2021–2027 (USD MILLION)

6.2.4 VACUUM ELECTRON MICROWAVE DEVICES

TABLE 34 VACUUM ELECTRON MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 35 VACUUM ELECTRON MICROWAVE DEVICES, BY REGION, 2021–2027 (USD MILLION)

6.2.4.1 Traveling-wave tube amplifier (TWTA)

TABLE 36 MICROWAVE TWTA MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 MICROWAVE TWTA MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.4.2 Klystron

TABLE 38 MICROWAVE KLYSTRON MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 39 MICROWAVE KLYSTRON MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.4.3 Magnetron

TABLE 40 MICROWAVE MAGNETRON MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 41 MICROWAVE MAGNETRON MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.4.4 Crossed-field amplifier

TABLE 42 MICROWAVE CROSSED-FIELD AMPLIFIER MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 43 MICROWAVE CROSSED-FIELD AMPLIFIER MARKET, BY REGION, 2021–2027 (USD MILLION)

6.2.4.5 Other vacuum electron microwave devices

TABLE 44 OTHER VACUUM ELECTRON - MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 45 OTHER VACUUM ELECTRON MICROWAVE DEVICES MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 PASSIVE DEVICES

6.3.1 PASSIVE DEVICES SEGMENT HELD MAJOR MARKET SHARE IN 2020

TABLE 46 PASSIVE - MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 47 PASSIVE - MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3.2 WAVEGUIDES

6.3.3 COUPLERS

6.3.4 ATTENUATORS

6.3.5 ISOLATORS

6.3.6 CIRCULATORS

6.3.7 OTHERS

7 MICROWAVE DEVICES MARKET, BY FREQUENCY (Page No. - 89)

7.1 INTRODUCTION

TABLE 48 MICROWAVE FREQUENCY BANDS AND CORRESPONDING RANGES

FIGURE 30 MARKET, BY FREQUENCY

FIGURE 31 KA-BAND SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 49 MARKET, BY FREQUENCY, 2018–2020 (USD MILLION)

TABLE 50 MICROWAVE DEVICES ECOSYSTEM, BY FREQUENCY, 2021–2027 (USD MILLION)

7.2 KU-BAND

7.2.1 KU-BAND SEGMENT HELD LARGEST MARKET SHARE IN 2020

7.2.2 USE CASE - TRACKING DATA RELAY SATELLITE BY NATIONAL AERONAUTICS AND SPACE ADMINISTRATION (NASA)

TABLE 51 MARKET FOR KU-BAND, BY REGION, 2018–2020 (USD MILLION)

TABLE 52 MARKET FOR KU-BAND, BY REGION, 2021–2027 (USD MILLION)

7.3 C-BAND

7.3.1 C-BAND SEGMENT ACCOUNTED FOR SIGNIFICANT REVENUE SHARE OF MARKET IN 2020

7.3.2 USE CASE – 5G SPECTRUM

TABLE 53 MARKET FOR C-BAND, BY REGION, 2018–2020 (USD MILLION)

TABLE 54 MARKET FOR C-BAND, BY REGION, 2021–2027 (USD MILLION)

7.4 KA-BAND

7.4.1 KA-BAND SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

7.4.2 USE CASE - CLOSE-RANGE TARGETING RADARS

TABLE 55 MICROWAVE DEVICES INDUSTRY FOR KA-BAND, BY REGION, 2018–2020 (USD MILLION)

TABLE 56 MARKET FOR KA-BAND, BY REGION, 2021–2027 (USD MILLION)

7.5 L-BAND

7.5.1 L-BAND SEGMENT CAPTURED SIGNIFICANT REVENUE SHARE OF OVERALL MARKET IN 2020

7.5.2 USE CASE - SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

TABLE 57 MARKET FOR L-BAND, BY REGION, 2018–2020 (USD MILLION)

TABLE 58 MARKET FOR L-BAND, BY REGION, 2021–2027 (USD MILLION)

7.6 X-BAND

7.6.1 X-BAND SEGMENT TO WITNESS HEALTHY GROWTH DURING FORECAST PERIOD

7.6.2 USE CASE – WEATHER RADARS

TABLE 59 MARKET FOR X-BAND, BY REGION, 2018–2020 (USD MILLION)

TABLE 60 MARKET FOR X-BAND, BY REGION, 2021–2027 (USD MILLION)

7.7 S-BAND

7.7.1 S-BAND SEGMENT TO GROW AT SUBSTANTIAL CAGR FROM 2021 TO 2027

7.7.2 USE CASE – MICROWAVE OVENS

TABLE 61 MARKET FOR S-BAND, BY REGION, 2018–2020 (USD MILLION)

TABLE 62 MARKET FOR S-BAND, BY REGION, 2021–2027 (USD MILLION)

7.8 OTHER BANDS

TABLE 63 MARKET FOR OTHER BANDS, BY REGION, 2018–2020 (USD MILLION)

TABLE 64 MARKET FOR OTHERS BANDS, BY REGION, 2021–2027 (USD MILLION)

8 MICROWAVE DEVICES MARKET, BY END USER (Page No. - 101)

8.1 INTRODUCTION

FIGURE 32 MICROWAVE DEVICES INDUSTRY, BY END USER

FIGURE 33 SPACE & COMMUNICATIONS SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 65 MARKET, BY END USER, 2018–2020 (USD MILLION)

TABLE 66 MARKET, BY END USER, 2021–2027 (USD MILLION)

8.2 SPACE & COMMUNICATIONS

8.2.1 SPACE & COMMUNICATIONS SEGMENT ACCOUNTED FOR LARGEST REVENUE SHARE IN 2020

8.2.2 RECENT DEVELOPMENTS

TABLE 67 MARKET FOR SPACE & COMMUNICATIONS, BY REGION, 2018–2020 (USD MILLION)

TABLE 68 MARKET FOR SPACE & COMMUNICATIONS, BY REGION, 2021–2027 (USD MILLION)

8.3 MILITARY & DEFENSE

8.3.1 MILITARY & DEFENSE SEGMENT HELD SIGNIFICANT REVENUE SHARE OF MARKET IN 2020

8.3.2 RECENT DEVELOPMENTS – MILITARY & DEFENSE

TABLE 69 MARKET FOR MILITARY & DEFENSE, BY REGION, 2018–2020 (USD MILLION)

TABLE 70 MARKET FOR MILITARY & DEFENSE, BY REGION, 2021–2027 (USD MILLION)

8.4 HEALTHCARE

8.4.1 HEALTHCARE SEGMENT TO EXHIBIT MODERATE GROWTH DURING FORECAST PERIOD

TABLE 71 MARKET FOR HEALTHCARE, BY REGION, 2018–2020 (USD MILLION)

TABLE 72 MARKET FOR HEALTHCARE, BY REGION, 2021–2027 (USD MILLION)

8.5 OTHERS

8.5.1 RECENT DEVELOPMENTS – OTHERS

TABLE 73 MARKET FOR OTHERS, BY REGION, 2018–2020 (USD MILLION)

TABLE 74 MARKET FOR OTHERS, BY REGION, 2021–2027 (USD MILLION)

9 GEOGRAPHIC ANALYSIS (Page No. - 110)

9.1 INTRODUCTION

FIGURE 34 MICROWAVE DEVICES MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 75 MARKET, BY REGION, 2018–2020 (USD MILLION)

TABLE 76 MARKET, BY REGION, 2021–2027 (USD MILLION)

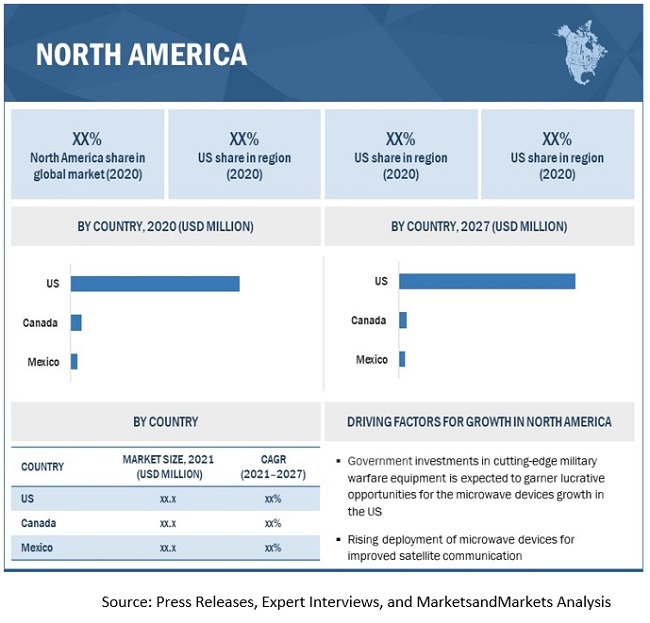

9.2 NORTH AMERICA

FIGURE 35 NORTH AMERICA: SNAPSHOT OF MICROWAVE DEVICES ECOSYSTEM

9.2.1 US

9.2.1.1 Government investments in cutting-edge military warfare equipment to garner lucrative opportunities for microwave devices growth

9.2.2 CANADA

9.2.2.1 Rising emphasis on improvising healthcare infrastructure to offer growth opportunities for market

9.2.3 MEXICO

9.2.3.1 Rapid developments in high-speed connectivity to accelerate market growth

TABLE 77 MARKET IN NORTH AMERICA, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 78 MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2027 (USD MILLION)

9.3 EUROPE

FIGURE 36 EUROPE: SNAPSHOT OF MICROWAVE DEVICES INDUSTRY

9.3.1 GERMANY

9.3.1.1 Rising integration of IoT and AI-related solutions to offer in-vehicle infotainment, resulting in market growth

9.3.2 UK

9.3.2.1 Increasing demand for high-speed connectivity to boost market growth

9.3.3 FRANCE

9.3.3.1 Continuous efforts to facilitate healthcare sector with modernized equipment to drive market

9.3.4 ITALY

9.3.4.1 Rapid deployment of 5G to attract opportunities in telecommunications sector for microwave devices

9.3.5 SPAIN

9.3.5.1 Smart factory initiatives to propel deployment of microwave devices

9.3.6 REST OF EUROPE

TABLE 79 MARKET IN EUROPE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 80 MARKET IN EUROPE, BY COUNTRY, 2021–2027 (USD MILLION)

9.4 APAC

FIGURE 37 APAC: SNAPSHOT OF MICROWAVE DEVICES MARKET

9.4.1 CHINA

9.4.1.1 Rising need to reinforce military personnel with modernized equipment driving market

9.4.2 JAPAN

9.4.2.1 Country’s dominance in automotive manufacturing accelerating market growth

9.4.3 INDIA

9.4.3.1 Make in India initiative to propel market growth

9.4.4 SOUTH KOREA

9.4.4.1 Significant presence of consumer electronics manufacturers to drive market growth

9.4.5 REST OF APAC

TABLE 81 MARKET IN APAC, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 82 MARKET IN APAC, BY COUNTRY, 2021–2027 (USD MILLION)

9.5 ROW

FIGURE 38 ROW: SNAPSHOT OF MARKET

9.5.1 SOUTH AMERICA

9.5.1.1 Expanding electronics industry to drive market growth

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Favorable government initiatives promoting high-speed connectivity and high military investments to drive market growth

TABLE 83 MARKET IN ROW, BY REGION, 2018–2020 (USD MILLION)

TABLE 84 MARKET IN ROW, BY REGION, 2021–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 127)

10.1 OVERVIEW

10.2 TOP 3 PLAYERS – 3-YEAR COMPANY REVENUE ANALYSIS

FIGURE 39 MARKET SHARE OF TOP 3 COMPANIES IN MICROWAVE DEVICES MARKET, 2018 TO 2020

10.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 40 KEY STRATEGIES OF TOP PLAYERS IN MARKET

10.4 MARKET SHARE ANALYSIS (2020)

TABLE 85 GLOBAL MARKET: MARKET SHARE ANALYSIS

10.5 COMPANY EVALUATION QUADRANT, 2020

10.5.1 STAR

10.5.2 PERVASIVE

10.5.3 EMERGING LEADER

10.5.4 PARTICIPANT

FIGURE 41 GLOBAL MARKET - COMPANY EVALUATION QUADRANT, 2020

10.6 SMALL AND MEDIUM ENTERPRISE (SME) EVALUATION QUADRANT, 2020

10.6.1 PROGRESSIVE COMPANY

10.6.2 RESPONSIVE COMPANY

10.6.3 DYNAMIC COMPANY

10.6.4 STARTING BLOCK

FIGURE 42 MARKET (GLOBAL), SME EVALUATION QUADRANT, 2020

TABLE 86 MARKET: COMPANY FOOTPRINT

TABLE 87 COMPANY: PRODUCT FOOTPRINT

TABLE 88 COMPANY: END USER FOOTPRINT

TABLE 89 COMPANY: REGIONAL FOOTPRINT

10.7 COMPETITIVE SCENARIO

TABLE 90 MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020 TO OCTOBER 2021

TABLE 91 MARKET: DEALS, SEPTEMBER 2020 TO OCTOBER 2021

11 COMPANY PROFILES (Page No. - 139)

(Business Overview, Products/ Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY PLAYERS

11.1.1 THALES GROUP

TABLE 92 THALES GROUP: BUSINESS OVERVIEW

FIGURE 43 THALES GROUP: COMPANY SNAPSHOT

11.1.2 L3 HARRIS TECHNOLOGIES, INC.

TABLE 93 L3 HARRIS TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 44 L3 HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

11.1.3 TELEDYNE TECHNOLOGIES INCORPORATED

TABLE 94 TELEDYNE TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 45 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

11.1.4 CPI INTERNATIONAL INC.

TABLE 95 CPI INTERNATIONAL INC: BUSINESS OVERVIEW

11.1.5 QORVO, INC

TABLE 96 QORVO, INC: BUSINESS OVERVIEW

FIGURE 46 QORVO, INC.:COMPANY SNAPSHOT

11.1.6 TOSHIBA CORPORATION

TABLE 97 TOSHIBA CORPORATION: BUSINESS OVERVIEW

FIGURE 47 TOSHIBA CORPORATION: COMPANY SNAPSHOT

11.1.7 RICHARDSON ELECTRONICS, LTD.

TABLE 98 RICHARDSON ELECTRONICS: BUSINESS OVERVIEW

FIGURE 48 RICHARDSON ELECTRONICS, LTD: COMPANY SNAPSHOT

11.1.8 ANALOG DEVICES, INC.

TABLE 99 ANALOG DEVICES, INC.: BUSINESS OVERVIEW

FIGURE 49 ANALOG DEVICES, INC: COMPANY SNAPSHOT

11.1.9 GENERAL DYNAMICS CORPORATION

TABLE 100 GENERAL DYNAMICS CORPORATION: BUSINESS OVERVIEW

FIGURE 50 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

11.1.10 HONEYWELL INTERNATIONAL INC.

TABLE 101 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

FIGURE 51 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

11.2 OTHER PLAYERS

11.2.1 COBHAM LIMITED

11.2.2 TEXAS INSTRUMENTS INCORPORATED

11.2.3 API MICROELECTRONICS

11.2.4 ASTRA MICROWAVE PRODUCTS LIMITED

11.2.5 CYTEC CORPORATION

11.2.6 KRATOS DEFENSE AND SECURITY SOLUTIONS INC.

11.2.7 MACOM

11.2.8 MICROCHIP TECHNOLOGY INC

11.2.9 MICROWAVE TECHNOLOGIES

11.2.10 MITSUBISHI ELECTRIC CORPORATION

11.2.11 PANASONIC CORPORATION

11.2.12 SYLATECH

11.2.13 TMD TECHNOLOGIES LTD.

11.2.14 TRITON SERVICES, INC.

11.2.15 WOLFSPEED INC.

*Details on Business Overview, Products/ Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 180)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

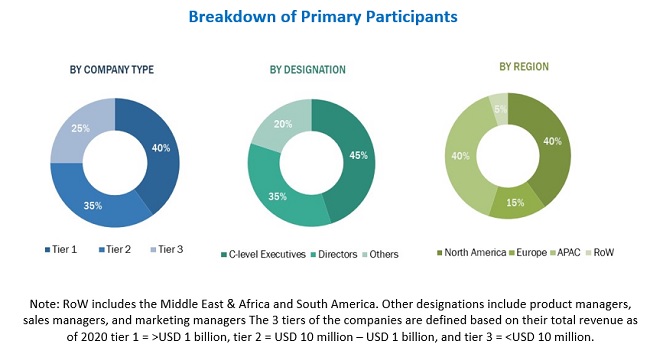

The study involves four major activities for estimating the size of the artificial microwave devices market. Exhaustive secondary research has been conducted to collect information related to the market. The next step has been the validation of these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Top-down and bottom-up approaches have been used to estimate and validate the size of market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for the key insights.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as the Global System for Mobile Communications Association (GSMA), Multidisciplinary Digital Publishing Institute (MDPI), International Telecommunication Union (ITU), Institute of Electrical and Electronics Engineers (IEEE), Stockholm International Peace Research Institute (SIPRI), and Federal Communications Commission (FCC)have been used to identify and collect information for an extensive technical and commercial study of the microwave devices market.

Primary Research

Extensive primary research was conducted after understanding and analyzing the microwave devices market through secondary research. Several primary interviews were conducted with key opinion leaders from both the demand- and supply-side vendors across four major regions—North America, Europe, APAC, and RoW. RoW comprises the Middle East, Africa, and South America. Approximately 45% of the primary interviews were conducted with the demand-side vendors and 55% with the supply-side vendors. This primary data was mainly collected through telephonic interviews/web conferences, which consist of 80% of total primary interviews, as well as questionnaires and e-mails.

Global Microwave Devices Market Size by Region's

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The microwave devices market consists of various frequency bands such as Ku-band, C-band, Ka-band, L-band, S-band, X-bands, among others. Microwave devices are highly used in military & defense, space & communication, healthcare, industrial, consumer electronics, automotive, and various others for security, surveillance, data streaming, patient monitoring, point-to-point communication links, cancer treatments, radio astronomy, remote sensing, and various other application areas.

Top-down and bottom-up approaches have been used to estimate and validate the size of market and other dependent submarkets. The leading players in the market have been identified through secondary research, and their market share in the key regions has been determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top players and extensive interviews with the industry experts such as chief executive officers, vice presidents, directors, and marketing executives for the key insights.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the Microwave devices market has been validated using both top-down and bottom-up approaches.

Study Objectives:

- To define and forecast the market based on product, frequency, end user, and region in terms of value and volume

- To forecast the microwave devices market based on four key regions, namely, North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To study the complete value chain of the market

- To provide a detailed impact of the COVID-19 pandemic on the microwave devices market, its segments, and the market players

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the microwave devices ecosystem

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, and provide a detailed competitive landscape

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report.

Company information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Microwave Devices Market