Microsegmentation Market by Component (Software and Services), Security Type (Network Security, Database Security, and Application Security), Service, Organization Size, Deployment Type, Vertical, and Region - Global Forecast to 2022

[142 Pages Report] The microsegmentation market accounted for USD 576.1 Million in 2016 and is projected to reach USD 2,038.7 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 24.9% during the forecast period.

Years considered for the report:

- Base Year: 2016

- Estimated Year: 2017

- Projected Year: 2022

Objectives of the Microsegmentation Market Study:

The main objective of the report is to define, describe, and forecast the microsegmentation market size on the basis of components (software and services), services, security types, deployment types, organization size, verticals, and regions. The report provides detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the microsegmentation market. The report attempts to forecast the market size of the 5 main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. The report strategically profiles the key market players and comprehensively analyzes their core competencies. It also tracks and analyzes the competitive developments, such as joint ventures, mergers and acquisitions, and new product developments, in the market.

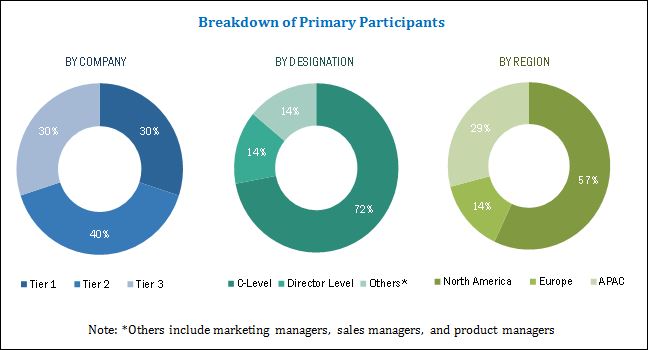

The research methodology used to estimate and forecast the microsegmentation market size began with the collection and analysis of data on the key vendor revenues through secondary sources, including annual reports and press releases, investor presentations, technology journals, certified publications, articles from recognized authors, directories, and databases. The vendor offerings were also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the market from the revenue of the key players and their market shares. The microsegmentation market spending across all regions along with the geographical split in various verticals was considered to arrive at the overall market size. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and executives. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The breakdown of the profiles of the primary participants is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The microsegmentation market includes various vendors who provide microsegmentation services, inclusive of managed and professional services. Further, professional services include consulting and advisory, training and education, support and maintenance, and design and integration services. Companies such as VMware (US), Cisco (US), Unisys (US), vArmour (US), Juniper Networks (US), OPAQ Networks (US), Nutanix (US), Cloudvisory (US), GuardiCore (Israel), ExtraHop (US), ShieldX Networks (US), and Bracket Computing (US), have adopted various growth strategies, including partnerships, agreements, and collaborations, to enhance their presence in the microsegmentation market.

Key Target Audience for Microsegmentation Market

- Microsegmentation software providers

- Microsegmentation service providers

- System integrators

- Consultancy and advisory firms

- Managed service providers

- Governments

- Data center and cloud security providers

The study answers several questions for the stakeholders, primarily, which market segments to focus on in the next 2 to 5 years for prioritizing efforts and investments.

Scope of the Report

The research report segments the microsegmentation market into the following submarkets:

By Component

- Software

- Services

By Service

- Managed services

- Professional services

Microsegmentation Market research report By Security Type

- Network security

- Database security

- Application security

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large enterprises

By Vertical

- Government and defense

- Baking, Financial Services, and Insurance (BFSI)

- IT and telecom

- Healthcare

- Retail

- Manufacturing

- Energy and utilities

- Others (education, media and entertainment, and automotive)

By Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the North American market into the US and Canada

- Further breakdown of the European market into the UK, Germany, and France

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the global microsegmentation market size to grow from USD 670.3 Million in 2017 to USD 2,038.7 Million by 2022, at a Compound Annual Growth Rate (CAGR) of 24.9%. The major factors driving the growth of the market are increasing ransomware attacks on connected devices, and increasing usage of security virtualization and cloud computing. Furthermore, the rise in network connectivity and data theft, and need for maintaining safe third party access are some of the other factors supporting the overall growth of the market.

The microsegmentation market is segmented on the basis of components (software and services), services, security types, deployment types, organization size, verticals, and regions. Microsegmentation services are segmented into managed and professional services. Further, professional services include consulting and advisory services, training and education, support and maintenance, and design and integration services.

The managed services segment is expected to grow at the highest CAGR during the forecast period. Managed service providers play a huge role in the deployment of microsegmentation software according to requirement of client. Managed services include all the pre-and-post deployment queries and needs of the customers. These services may include planning, designing, testing, integrating, maintenance, and support. These services are mainly outsourced for on-time delivery, reduction of capital expenditure, operating expenses.

On the basis of verticals, the government and defense vertical is expected to have the largest market share during the forecast period. The government and defense vertical is one of the most dominating verticals with respect to the deployment of microsegmentation solutions. The government and defense sector comprises different government operations and the national security functions such as the security through air, land, and sea. This sector is equipping itself with the advancements in the IT infrastructure. The integration of technology with different functions in the government and defense is facilitating the sector to execute operations efficiently.

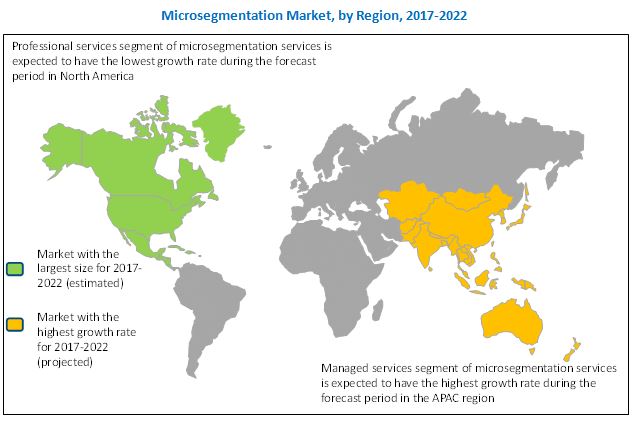

North America has the major presence of sustainable and well-established economies who invest heavily in Research and Development (R&D) activities, thereby contributing to the development of new technologies. The startup culture in North America is growing at a faster pace as compared to the other regions. The rising number of developing Small and Medium-sized Enterprises (SMEs) and the increasing digitization in large organizations have aided the growth of the North American microsegmentation market. SMEs are flexible in incorporating new technologies into their existing systems, whereas large organizations have heavy budgets for digitization. All these factors are driving the growth of the market in North America. The storage requirements of the US are boosting the demand for current data center capacity expansion, need for new data centers, and their security. The advanced security solutions and improved data functionality are expected to drive the microsegmentation market in this region.

Asia Pacific (APAC) has witnessed the advanced and dynamic adoption of new technologies, and it has always been a lucrative market. The region is expected to grow at the highest CAGR during the forecast period in the microsegmentation market, as the governments in the APAC countries are continuously investing in the R&D of microsegmentation services. The growing demand for security upgradation and the governments efforts to standardize security policies are some of the growth drivers for the market in the APAC region.

The high cost of advanced security solutions and limited security budgets are some of the restraining factors in the microsegmentation market. However, the recent developments, including new product launches and acquisitions, undertaken by the major market players are boosting the growth of the market.

The study measures and evaluates the offerings and key strategies undertaken by the major market players, including VMware (US), Cisco (US), Unisys (US), vArmour (US), Juniper Networks (US), OPAQ Networks (US), Nutanix (US), Cloudvisory (US), GuardiCore (Israel), ExtraHop (US), ShieldX Networks (US), and Bracket Computing (US). These companies have been at the forefront in offering reliable microsegmentation solutions to commercial clients across the globe.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 USD Exchange Rate, 2014-2016

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Research Assumptions

2.4 Limitations

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in Microsegmentation Market

4.2 Market By Region (2017 vs 2022)

4.3 Market Investment Scenario (20172022)

4.4 Market By Security Type, 20172022

4.5 Market Share of Top 3 Verticals and Regions, 2017

5 Market Overview and Industry Trends (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Ransomware Attacks on Connected Devices/Systems

5.2.1.2 Increasing Use of Security Virtualization and Cloud Computing

5.2.1.3 Increase in Network Connectivity and Data Theft

5.2.1.4 Maintaining Safe Third-Party Access

5.2.2 Restraints

5.2.2.1 High Cost of Advanced Security Solutions

5.2.2.2 Limited Security Budgets

5.2.3 Opportunities

5.2.3.1 Stringent Security Laws and Regulations

5.2.3.2 Increasing Adoption of Cloud-Based Applications and Services

5.2.4 Challenges

5.2.4.1 Implementation Challenges

5.2.4.2 Lack of Competent Security Professionals

5.3 Use Cases

5.3.1 Cisco Application-Centric Infrastructure Ecosystem Brings Digital Innovation to Dutch Healthcare

5.3.2 Vmware Nsx Helps Western Carolina University By Boosting Security, Intelligent Operations, and Disaster Recovery

5.3.3 Varmour Strengthens Security at National Institute of Natural Sciences By Using Microsegmentation

5.3.4 Juniper Networks Helps Symantec Build Security Multi-Tenant Cloud Platform

5.4 Innovation Spotlight

6 Microsegmentation Market Analysis, By Component (Page No. - 36)

6.1 Introduction

6.2 Software

6.3 Services

7 Microsegmentation Market Analysis, By Service (Page No. - 40)

7.1 Introduction

7.2 Managed Services

7.3 Professional Services

7.3.1 Consulting and Advisory

7.3.2 Training and Education

7.3.3 Support and Maintenance

7.3.4 Design and Integration

8 Microsegmentation Market Analysis, By Security Type (Page No. - 46)

8.1 Introduction

8.2 Network Security

8.3 Database Security

8.4 Application Security

9 Microsegmentation Market Analysis, By Deployment Type (Page No. - 51)

9.1 Introduction

9.2 On-Premises

9.3 Cloud

10 Market Analysis By Organization Size (Page No. - 54)

10.1 Introduction

10.2 SMEs

10.3 Large Enterprises

11 Microsegmentation Market Analysis, By Vertical (Page No. - 58)

11.1 Introduction

11.2 Government and Defense

11.3 BFSI

11.4 It and Telecom

11.5 Healthcare

11.6 Retail

11.7 Manufacturing

11.8 Energy and Utilities

11.9 Others

12 Geographic Analysis (Page No. - 66)

12.1 Introduction

12.2 North America

12.2.1 Us

12.2.2 Canada

12.3 Europe

12.4 APAC

12.5 MEA

12.6 Latin America

13 Competitive Landscape (Page No. - 97)

13.1 Overview

13.2 Ranking Analysis, By Company

13.3 New Solution Launches

13.4 Partnerships, Agreements, and Collaborations

13.5 Mergers and Acquisitions

14 Company Profiles (Page No. - 100)

(Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments)*

14.1 Vmware

14.2 Cisco

14.3 Unisys

14.4 Varmour

14.5 Juniper Networks

14.6 Opaq Networks

14.7 Nutanix

14.8 Cloudvisory

14.9 Guardicore

14.10 Extrahop

14.11 Shieldx Networks

14.12 Bracket Computing

*Details on Overview, Strength of Product Portfolio, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

15 Appendix (Page No. - 132)

15.1 Industry Excerpts

15.2 Discussion Guide

15.3 Knowledge Store: Marketsandmarkets Subscription Portal

15.4 Introducing RT: Real-Time Market Intelligence

15.5 Available Customizations

15.6 Related Reports

15.7 Author Details

List of Tables (85 Tables)

Table 1 Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 2 Software: Market Size By Region, 20152022 (USD Million)

Table 3 Services: Market Size By Region, 20152022 (USD Million)

Table 4 Microsegmentation Market Size, By Service, 20152022 (USD Million)

Table 5 Managed Services: Market Size By Region, 20152022 (USD Million)

Table 6 Professional Services: Market Size By Region, 20152022 (USD Million)

Table 7 Professional Services: Market Size By Type, 20152022 (USD Million)

Table 8 Consulting and Advisory: Market Size By Region, 20152022 (USD Million)

Table 9 Training and Education: Market Size By Region, 20152022 (USD Million)

Table 10 Support and Maintenance: Market Size By Region, 20152022 (USD Million)

Table 11 Design and Integration: Market Size By Region, 20152022 (USD Million)

Table 12 Microsegmentation Market Size, By Security Type, 20152022 (USD Million)

Table 13 Network Security: Market Size By Region, 20152022 (USD Million)

Table 14 Database Security: Market Size By Region, 20152022 (USD Million)

Table 15 Application Security: Market Size By Region, 20152022 (USD Million)

Table 16 Microsegmentation Market Size By Deployment Type, 20152022 (USD Million)

Table 17 On-Premises: Market Size By Region, 20152022 (USD Million)

Table 18 Cloud: Market Size By Region, 20152022 (USD Million)

Table 19 Market Size By Organization Size, 20152022 (USD Million)

Table 20 SMEs: Market Size By Region, 20152022 (USD Million)

Table 21 Large Enterprises: Market Size By Region, 20152022 (USD Million)

Table 22 Microsegmentation Market Size By Vertical, 20152022 (USD Million)

Table 23 Government and Defense: Market Size By Region, 20152022 (USD Million)

Table 24 BFSI: Market Size By Region, 20152022 (USD Million)

Table 25 It and Telecom: Market Size By Region, 20152022 (USD Million)

Table 26 Healthcare: Market Size By Region, 20152022 (USD Million)

Table 27 Retail: Market Size By Region, 20152022 (USD Million)

Table 28 Manufacturing: Market Size By Region, 20152022 (USD Million)

Table 29 Energy and Utilities: Market Size By Region, 20152022 (USD Million)

Table 30 Others: Market Size By Region, 20152022 (USD Million)

Table 31 Microsegmentation Market Size, By Region, 20152022 (USD Million)

Table 32 North America: Market Size By Component, 20152022 (USD Million)

Table 33 North America: Market Size By Service, 20152022 (USD Million)

Table 34 North America: Market Size By Professional Service, 20152022 (USD Million)

Table 35 North America: Market Size By Security Type, 20152022 (USD Million)

Table 36 North America: Market Size By Deployment Type, 20152022 (USD Million)

Table 37 North America: Market Size By Organization Size, 20152022 (USD Million)

Table 38 North America: Market Size By Vertical, 20152022 (USD Million)

Table 39 North America: Market Size By Country, 20152022 (USD Million)

Table 40 US: Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 41 US: Market Size By Service, 20152022 (USD Million)

Table 42 US: Market Size By Professional Service, 20152022 (USD Million)

Table 43 US: Market Size By Security Type, 20152022 (USD Million)

Table 44 US: Market Size By Deployment Type, 20152022 (USD Million)

Table 45 US: Market Size By Organization Size, 20152022 (USD Million)

Table 46 US: Market Size By Vertical, 20152022 (USD Million)

Table 47 Canada: Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 48 Canada: Market Size By Service, 20152022 (USD Million)

Table 49 Canada: Market Size By Professional Service, 20152022 (USD Million)

Table 50 Canada: Market Size By Security Type, 20152022 (USD Million)

Table 51 Canada: Market Size By Deployment Type, 20152022 (USD Million)

Table 52 Canada: Market Size By Organization Size, 20152022 (USD Million)

Table 53 Canada: Market Size By Vertical, 20152022 (USD Million)

Table 54 Europe: Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 55 Europe: Market Size By Service, 20152022 (USD Million)

Table 56 Europe: Market Size By Professional Service, 20152022 (USD Million)

Table 57 Europe: Market Size By Security Type, 20152022 (USD Million)

Table 58 Europe: Market Size By Deployment Type, 20152022 (USD Million)

Table 59 Europe: Market Size By Organization Size, 20152022 (USD Million)

Table 60 Europe: Market Size By Vertical, 20152022 (USD Million)

Table 61 APAC: Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 62 APAC: Market Size By Service, 20152022 (USD Million)

Table 63 APAC: Market Size By Professional Service, 20152022 (USD Million)

Table 64 APAC: Market Size By Security Type, 20152022 (USD Million)

Table 65 APAC: Market Size By Deployment Type, 20152022 (USD Million)

Table 66 APAC: Market Size By Organization Size, 20152022 (USD Million)

Table 67 APAC: Market Size By Vertical, 20152022 (USD Million)

Table 68 MEA: Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 69 MEA: Market Size By Service, 20152022 (USD Million)

Table 70 MEA: Market Size By Professional Service, 20152022 (USD Million)

Table 71 MEA: Market Size By Security Type, 20152022 (USD Million)

Table 72 MEA: Market Size By Deployment Type, 20152022 (USD Million)

Table 73 MEA: Market Size By Organization Size, 20152022 (USD Million)

Table 74 MEA: Market Size By Vertical, 20152022 (USD Million)

Table 75 Latin America: Microsegmentation Market Size, By Component, 20152022 (USD Million)

Table 76 Latin America: Market Size By Service, 20152022 (USD Million)

Table 77 Latin America: Market Size By Professional Service, 20152022 (USD Million)

Table 78 Latin America: Market Size By Security Type, 20152022 (USD Million)

Table 79 Latin America: Market Size By Deployment Type, 20152022 (USD Million)

Table 80 Latin America: Market Size By Organization Size, 20152022 (USD Million)

Table 81 Latin America: Market Size By Vertical, 20152022 (USD Million)

Table 82 Company Ranking in Microsegmentation Market, 2017

Table 83 New Solution Launches, 20152017

Table 84 Partnerships, Agreements, and Collaborations, 20152017

Table 85 Mergers and Acquisitions, 20152017

List of Figures (43 Figures)

Figure 1 Microsegmentation Market Segmentation

Figure 2 Market Research Design

Figure 3 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 4 Data Triangulation

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Microsegmentation Market By Region, 2017-2022

Figure 8 Top 3 Microsegmentation Market Segments, 2017

Figure 9 Market By Organization Size, 2017-2022

Figure 10 Increasing Ransomware Attacks on Connected Devices/Systems and Increasing Use of Security Virtualization and Cloud Computing Driving Market Growth

Figure 11 North America to Hold Largest Market Share During Forecast Period

Figure 12 APAC to Emerge as Best Market for Investments Over Next Five Years

Figure 13 Application Security Type to Grow at Highest CAGR During Forecast Period

Figure 14 Government & Defense and North America to Hold Largest Market Shares in 2017

Figure 15 Microsegmentation Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Software Segment to Dominate Microsegmentation Market During Forecast Period

Figure 17 North America to Dominate Software Segment During Forecast Period

Figure 18 North America Microsegmentation Market to Be Largest in Size During Forecast Period

Figure 19 Managed Services Segment to Record Highest CAGR During Forecast Period

Figure 20 Support and Maintenance Segment to Record Highest CAGR During Forecast Period

Figure 21 Application Security Segment to Record Highest CAGR During Forecast Period

Figure 22 North America to Hold Largest Market Share in 2017

Figure 23 On-Premises Deployment Type to Have Larger Market Size During Forecast Period

Figure 24 Large Enterprises Segment to Have Larger Market Size During Forecast Period

Figure 25 Government and Defense Vertical to Have Largest Market Size During Forecast Period

Figure 26 North America Microsegmentation Market to Be Largest in Size During Forecast Period

Figure 27 APAC Microsegmentation Market to Record Highest CAGR During Forecast Period

Figure 28 North America Market Snapshot

Figure 29 Support and Maintenance Services Segment to Record Highest CAGR During Forecast Period

Figure 30 BFSI Vertical to Record Highest CAGR During Forecast Period

Figure 31 Consulting and Advisory Services Segment to Dominate Market During Forecast Period

Figure 32 APAC: Microsegmentation Market Snapshot

Figure 33 Consulting and Advisory Services Segment to Hold Largest Market Share in 2017

Figure 34 Application Security Segment to Record Highest CAGR During Forecast Period

Figure 35 Healthcare Vertical to Record Highest CAGR During Forecast Period

Figure 36 Support and Maintenance Services Segment to Record Highest CAGR During Forecast Period

Figure 37 Application Security Segment to Record Highest CAGR During Forecast Period

Figure 38 Application Security Segment to Record Highest CAGR During Forecast Period

Figure 39 Vmware: Company Snapshot

Figure 40 Cisco: Company Snapshot

Figure 41 Unisys: Company Snapshot

Figure 42 Juniper Networks: Company Snapshot

Figure 43 Nutanix: Company Snapshot

Growth opportunities and latent adjacency in Microsegmentation Market