Microgrid Control System Market by Grid- Type (On-Grid and Off-grid), Component (Hardware and Software), Ownership (Private and Public), End-User (Utilities, Campuses and institutions, Commercial, and Industrial), and Region - Global Forecast to 2023

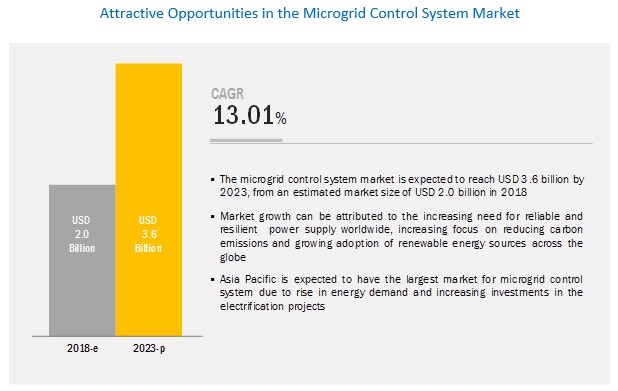

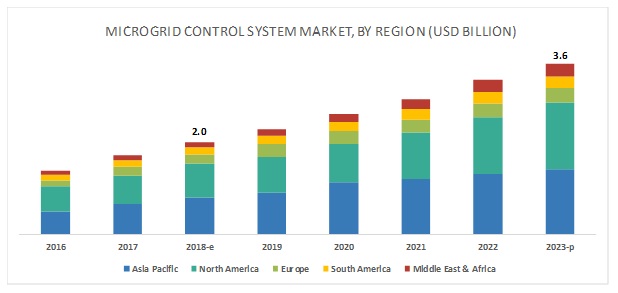

[142 Pages Report] The global microgrid control system market is projected to reach a size of USD 3.6 billion by 2023 at a CAGR of 13.01%, from an estimated USD 2.0 billion in 2018. This growth can be attributed to the growth in renewable power generation, increasing investments in the transmission & distribution infrastructure, rise in the energy demand and limitations of space availability in densely populated urban areas, and government initiatives toward improving electricity access.

By grid-type, the off-grid segment is expected to be the largest contributor in the Microgrid control system market during the forecast period

The report segments the market, by grid-type, into on-grid and off-grid. The off-grid segment is expected to hold the largest market share by 2023. This is due to the increasing electrification of rural and remote areas across the globe, which would lead to the high adoption rate of remote/islanded microgrid control system. Remote/islanded networks are energy self-sufficient and provide power security at the time of electricity failure. This energy self-sufficiency substantiates the high deployment of remote/island microgrid systems.

Private segment holds the largest market share during the forecast period

The private segment, is expected to dominate the microgrid control system market, by ownership, in 2018. Private microgrid control system is normally grid-connected but can also operate in islanded mode. In private utility, the ownership lies with the shareholders or investors. These types of utilities are regulated by certain utility commissions. These private utilities purchase electricity through contracts or operate their own generation facilities. Increased primary energy consumption and governments providing monetary incentives have paved the way for several private players to set up power microgrid control systems to cater to the domestic electricity demand. This growth is attributed to rising investments in electrification projects, in which microgrid technologies are highly deployed.

By components, the hardware segment is expected to grow at the fastest rate during the forecast period

The hardware segment is expected to grow at the fastest rate during the forecast period. The hardware components of the microgrid control system include the physical components such as CPU module, digital input module, digital output module, analog input/output module, local Controller, data logger, data recorder, relays, meters, and communication network. The increasing number of microgrid projects in large power plants and high demand from process industries such as manufacturing, oil & gas sector, mining, steel, and chemical would drive the hardware segment of the microgrid control system market. Developing economies in Asia Pacific are the fastest growing markets for this segment.

Asia Pacific is expected to account for the largest market size during the forecast period

In this report, the microgrid control system market has been analysed with respect to 5 regions, namely, North America, Europe, South America, Asia Pacific, and the Middle East & Africa. Countries such as China and India are heavily investing in electrification projects, moderation & upgradation of existing electric networks to meet the growing demand for electricity. North America is the second most lucrative market for microgrid control systems, as the replacement and refurbishment of the existing infrastructure is the major requirement in the local utility grid scenario. Meanwhile, Europe is another major market for the microgrid control systems. Renewed focus on renewable sources of energy is being developed in countries such as Germany and the UK. Attractive incentives in the form of feed-in tariffs, tax credits, and maturity of the technology on a commercial scale, ensured that investors and project developers embraced the microgrid control system.

Moreover, factors such as increased power consumption; government mandates on energy efficiency; the rising influx of renewable sources in the energy mix; and renovation, modernization, and upgradation of ageing grid infrastructure are to drive the microgrid control system market in the region.

The major players in the global microgrid control system market are ABB (Switzerland), GE (US), Siemens (Germany), Schneider (France), Eaton (Ireland), Emerson (US), Spirae (US), Schweitzer Engineering Laboratories, Inc. (US), ETAP (US), S&C Electric (US), Woodward, Inc. (US), PowerSecure (US), RT SOFT (Germany), and Ontech Electric Corporation (China). Contracts and agreements and new product launches are the most commonly adopted strategies by the top players.

Scope of the report

|

|

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments covered |

|

|

Geographies covered |

|

|

Companies covered |

|

This research report categorizes the microgrid control system market based on grid-type, ownership, component, end-user, and region

On the basis of grid-type, the market has been segmented as follows:

- On-Grid

- Off-Grid

On the basis of component, the market has been segmented as follows:

- Hardware

- Software

On the basis of ownership, the market has been segmented as follows:

- Private

- Public

On the basis of end-user, the market has been segmented as follows:

- Utilities

- Campuses and Institutions

- Commercial and Industrial

- Others (Defense & datacenters)

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Key Questions addressed by the report

- The report identifies and addresses key microgrid control system market for microgrid control system, which would help manufacturers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

- The report addresses the microgrid control system market share analysis of key players in the microgrid control system , and with the help of these companies can enhance their revenues in the respective market.

- The report provides insights about emerging geographies for the microgrid control system, and the entire market ecosystem can gain competitive advantage from such insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Market Size Estimation

2.1.1 Ideal Demand-Side Analysis

2.1.1.1 Assumptions

2.1.2 Supply-Side Analysis

2.1.2.1 Calculation

2.1.3 Forecast

2.2 Some of the Insights of Industry Experts

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Attractive Opportunities in the Market, 20182023

4.2 Microgrid Control System, By Grid Type

4.3 Microgrid Control System , By Ownership

4.4 Microgrid Control System, By Component

4.5 Microgrid Control System , By End-User

4.6 Asia Pacific Market

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Demand for Reliable and Secure Power Supply Worldwide

5.2.1.2 Increasing Government Investments in Microgrid Projects

5.2.1.3 Growing Adoption of Renewable Energy Sources

5.2.2 Restraints

5.2.2.1 Governmental Laws and Regulation Uncertainty

5.2.2.2 High Installation and Maintenance Cost of the Microgrid Control System

5.2.3 Opportunities

5.2.3.1 Rising Electrification Projects

5.2.3.2 Advancement in Iot as Well as Communication Technologies

5.2.4 Challenges

5.2.4.1 Cyber Security Issues

6 Market, By Ownership (Page No. - 43)

6.1 Introduction

6.2 Public

6.3 Private

7 Market, Grid Type (Page No. - 47)

7.1 Introduction

7.2 On-Grid

7.3 Off-Grid

8 Market, By Component (Page No. - 51)

8.1 Introduction

8.2 Hardware

8.3 Software

9 Market, By End-User (Page No. - 55)

9.1 Introduction

9.2 Utilities

9.3 Campuses & Institutions

9.4 Commercial & Industrial

9.5 Others

10 Market, By Region (Page No. - 61)

10.1 Introduction

10.2 Asia Pacific

10.2.1 By Grid Type

10.2.2 By Component

10.2.3 By Ownership

10.2.4 By End-User

10.2.5 By Country

10.2.5.1 China

10.2.5.1.1 Increasing Investment in Grid Expansion

10.2.5.2 India

10.2.5.2.1 Rising Investments in Energy-Efficiency Services

10.2.5.3 Japan

10.2.5.3.1 Reducing Power Dependence From Nuclear Sources After Fukushima Incident and Increased Demand for Grid Infrastructure to Connect Renewables to the Grid

10.2.5.4 Australia

10.2.5.4.1 Increasing Renewable Power Generation and Focus on Improving Energy Efficiency

10.2.5.5 Rest of Asia Pacific

10.3 Europe

10.3.1 By Grid Type

10.3.2 By Component

10.3.3 By Ownership

10.3.4 By Grid Type

10.3.5 By Country

10.3.5.1 Russia

10.3.5.1.1 Increasing Focus on Clean Energy Production and Rising Government Incentives in the Energy Sector

10.3.5.2 Germany

10.3.5.2.1 Highest Electric Vehicle Seller in the Industrial Sector Which Creates Opportunities for More Deployment of A Microgrid Control System

10.3.5.3 UK

10.3.5.3.1 Feed-In Tariff With A Contract for Difference to Encourage Renewable Electricity Generation for Large-Scale Installations

10.3.5.4 France

10.3.5.4.1 Reducing Power Dependence From Nuclear Sources and Increased Demand for Grid Infrastructure to Connect to Distributed Generation Resources78

10.3.5.5 Rest of Europe

10.4 North America

10.4.1 By Grid Type

10.4.2 By Component

10.4.3 By Ownership

10.4.4 By End-User

10.4.5 By Country

10.4.5.1 US

10.4.5.1.1 Increasing Investments for Replacing and Refurbishing the Aged Electric Infrastructure

10.4.5.2 Canada

10.4.5.2.1 Huge Investments in Renewable Energy and Replacement of Aging Power Equipment

10.4.5.3 Mexico

10.4.5.3.1 Increased Focus to Reduce Greenhouse Gas Emissions

10.5 South America

10.5.1 By Grid Type

10.5.2 By Component

10.5.3 By Ownership

10.5.4 By End-User

10.5.5 By Country

10.5.5.1 Brazil

10.5.5.1.1 Increasing Dependence on the Hydroelectric Power Source, Driving the Demand for Microgrid Control Systems

10.5.5.2 Argentina

10.5.5.2.1 Increased Focus on Power Generation From Sources Such as Wind, Solar, Biomass, Biogas, and Small-Scale Hydro

10.5.5.3 Rest of South America

10.6 Middle East & Africa

10.6.1 By Component

10.6.2 By Ownership

10.6.3 By End-User

10.6.4 By Country

10.6.4.1 Saudi Arabia

10.6.4.1.1 Increased Investment in Power Generation Projects and Focus on Altering Its Power Generation Mix to Preserve Its Oil Exports

10.6.4.2 South Africa

10.6.4.2.1 Government Focusing on Reducing Carbon Dioxide Emissions as Well as Its Dependency on Coal for Poer Generation

10.6.4.3 Nigeria

10.6.4.3.1 Significant Investments in Off-Grid Electricity Generation Drive the Market

10.6.4.4 Rest of the Middle East & Africa

11 Competitive Landscape (Page No. - 97)

11.1 Overview

11.2 Ranking of Players and Industry Concentration, 2017

11.3 Competitive Scenario

11.3.1 Mergers & Acquisitions

11.3.2 Contracts & Agreements

11.3.3 New Product Developments

11.3.4 Investments & Expansions

11.3.5 Mergers & Acquisitions

11.3.6 Others

12 Company Benchmarking (Page No. - 103)

(Business Overview, Products Offered, Recent Developments, and MnM View)*

12.1 ABB

12.2 General Electric

12.3 Siemens

12.4 Eaton Corporation

12.5 Emerson

12.6 Schneider Electric

12.7 Spirae

12.8 Schweitzer Engineering Laboratories (Sel)

12.9 Etap

12.1 S&C Electric Company

12.11 Woodward, Inc.

12.12 Powersecure, Inc.

12.13 Rt Soft

12.14 Ontech Electric Corporation

*Details on Business Overview, Products Offered, Recent Developments, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 135)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (64 Tables)

Table 1 Microgrid Control System Market Snapshot

Table 2 Key Microgrid-Related Projects Supported By the Chinese Government in 2018

Table 3 Market Size, By Ownership, 20162023 (USD Million)

Table 4 Public: Market Size, By Region, 20162023 (USD Million)

Table 5 Private: Market Size, By Region, 20162023 (USD Million)

Table 6 Microgrid Control System Market Size, By Grid Type, 20162023 (USD Million)

Table 7 on Grid: Market Size, By Region, 20162023 (USD Million)

Table 8 Off Grid: Market Size, By Region, 20162023 (USD Million)

Table 9 Microgrid Control System Market Size, By Component, 20162023 (USD Million)

Table 10 Hardware: Market Size, By Region, 20162023 (USD Million)

Table 11 Software: Market Size, By Region, 20162023 (USD Million)

Table 12 Microgrid Control System Market Size, By End-User, 20162023 (USD Million)

Table 13 Utilities: Market Size, By Region, 20162023 (USD Million)

Table 14 Campuses & Institutions : Market Size, By Region, 20162023 (USD Million)

Table 15 Commercial & Industrial: Market Size, By Region, 20162023 (USD Million)

Table 16 Others: Market Size, By Region, 20162023 (USD Million)

Table 17 Microgrid Control System Market Size, By Region, 20162023 (USD Million)

Table 18 Asia Pacific: Market Size, By Grid Type, 20162023 (USD Million)

Table 19 Asia Pacific: Market Size, By Component, 20162023 (USD Million)

Table 20 Asia Pacific: Market Size, By Ownership, 20162023 (USD Million)

Table 21 Asia Pacific: Market Size, By End-User, 20162023 (USD Million)

Table 22 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 23 China: Market Size, By Grid Type, 20162023 (USD Million)

Table 24 India: Microgrid Control System Market Size, By Grid Type, 20162023 (USD Million)

Table 25 Japan: Market Size, By Grid Type, 20162023 (USD Million)

Table 26 Australia: Market Size, By Grid Type, 20162023 (USD Million)

Table 27 Rest of Asia Pacific: Market Size, By Grid Type, 20162023 (USD Million)

Table 28 Distributed Generation Policy Support in Selected Eu Countries

Table 29 Europe: Market Size, By Grid Type, 20162023 (USD Million)

Table 30 Europe: Market Size, By Component, 20162023 (USD Million)

Table 31 Europe: Market Size, By Ownership, 20162023 (USD Million)

Table 32 Europe: Market Size, By End-User, 20162023 (USD Million)

Table 33 Europe: Market Size, By Country, 20162023 (USD Million)

Table 34 Russia: Market Size, By Grid Type, 20162023 (USD Million)

Table 35 Germany: Market Size, By Grid Type, 20162023 (USD Million)

Table 36 UK: Market Size, By Grid Type, 20162023 (USD Million)

Table 37 France: Market Size, By Grid Type, 20162023 (USD Million)

Table 38 Rest of Europe: Market Size, By Grid Type, 20162023 (USD Million)

Table 39 North America: Market Size, By Grid Type, 20162023 (USD Million)

Table 40 North America: Market Size, By Component, 20162023 (USD Million)

Table 41 North America: Market Size, By Ownership, 20162023 (USD Million)

Table 42 North America: Market Size, By End-User, 20162023 (USD Million)

Table 43 North America: Market Size, By Country, 20162023 (USD Million)

Table 44 US: Market Size, By Grid Type, 20162023 (USD Million)

Table 45 Canada: Market Size, By Grid Type, 20162023 (USD Million)

Table 46 Mexico: Market Size, By Grid Type, 20162023 (USD Million)

Table 47 South America: Microgrid Control Systems Market Size, By Grid Type, 20162023 (USD Million)

Table 48 South America: Market Size, By Component, 20162023 (USD Million)

Table 49 South America: Market Size, By Ownership, 20162023 (USD Million)

Table 50 South America: Market Size, By End-User, 20162023 (USD Million)

Table 51 South America: Market Size, By Country, 20162023 (USD Million)

Table 52 Brazil: Market Size, By Grid Type, 20162023 (USD Million)

Table 53 Argentina: Microgrid Control Systems Market Size, By Grid Type, 20162023 (USD Million)

Table 54 Rest of South America: Market Size, By Grid Type, 20162023 (USD Million)

Table 55 Middle East & Africa: Market Size, By Grid Type, 20162023 (USD Million)

Table 56 Middle East & Africa: Market Size, By Component, 20162023 (USD Million)

Table 57 Middle East & Africa: Market Size, By Ownership, 20162023 (USD Million)

Table 58 Middle East & Africa: Market Size, By End-User, 20162023 (USD Million)

Table 59 Middle East & Africa : Microgrid Control Systems Market Size, By Country, 20162023 (USD Million)

Table 60 Saudi Arabia: Market Size, By Grid Type, 20162023 (USD Million)

Table 61 South Africa: Market Size, By Grid Type, 20162023 (USD Million)

Table 62 Nigeria: Market Size, By Grid Type, 20162023 (USD Million)

Table 63 Rest of the Middle East & Africa : Market Size, By Grid Type, 20162023 (USD Million)

Table 64 ABB and Schneider Electric Were the Most Active Players in the Market Between 2015 and 2018

List of Figures (31 Figures)

Figure 1 Microgrid Installed Capacity Across Regions and Across Key End-Users is the Major Determining Factor for Microgrid Control Implementation20

Figure 2 Off-Grid Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 3 Private Segment is Expected to Lead the Market During the Forecast Period

Figure 4 Hardware Segment is Expected to Lead the Microgrid Control Systems Market During the Forecast Period

Figure 5 Utility Segment is Expected to Lead the Market During the Forecast Period

Figure 6 Asia Pacific is Expected to Dominate the Market During the Forecast Period

Figure 7 Increasing Demand for Reliable and Secure Power Supply, Globally, is Expected to Drive the Microgrid Control System Market During Period32

Figure 8 Off-Grid Segment Led the Market in 2017

Figure 9 Private Segment Led the Market, By Ownership, in 2017

Figure 10 Hardware Segment is Expected to Lead the Market During the Forecast Period

Figure 11 Utilities Segment is Expected to Grow Globally in the Market During the Forecast Period

Figure 12 China Was the Largest Market in Asia Pacific, in 2017

Figure 13 Microgrid Control Systems Market: Drivers, Restraints, Opportunities, and Challenges

Figure 14 Global Renewable Energy-Based Generation, 20122017 (In Twh)

Figure 15 Microgrid Control Systems Market, By Ownership, 20182023 (USD Million)

Figure 16 Market, By Grid Type, 20182023 (USD Million)

Figure 17 Market, By Component, 20182023 (USD Million)

Figure 18 Microgrid Control Systems Market, By End-User, 20182023 (USD Million)

Figure 19 Asia Pacific Dominated the Market in 2017

Figure 20 MCS Market Size, By Region, 20162023 (USD Million)

Figure 21 Asia Pacific: Market Snapshot

Figure 22 North America: Market Snapshot

Figure 23 Key Developments in the Market, 20152018

Figure 24 MCS Market in 2017

Figure 25 ABB: Company Snapshot

Figure 26 General Electric: Company Snapshot

Figure 27 Siemens: Company Snapshot

Figure 28 Eaton Corporation: Company Snapshot

Figure 29 Emerson: Company Snapshot

Figure 30 Schneider Electric: Company Snapshot

Figure 31 Woodward, Inc: Company Snapshot

The study involved 4 major activities in estimating the current size of the microgrid control system market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global microgrid control system market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The microgrid control system market comprises several stakeholders such as distributed energy generation solution providers , electric utilities ,energy storage vendors , government and research organizations , microgrid control system manufacturers , microgrid solution integrators , microgrid system integrators and developers , power generation companies , raw material suppliers , renewable power generation and equipment manufacturing companies , smart grid software vendors , solar PV companies , and microgrid control system component distributors in the supply chain. The demand side of the market is characterized by the increasing microgrid installed capacity across regions in key end-users such as utilities, commercial & industrial, campuses & institutions, defense & datacenters and increasing demand for reliable and resilient power supply worldwide. Moreover, the demand is also driven by increasing investments in microgrid project and power generation projects rising from renewable sources across the globe.

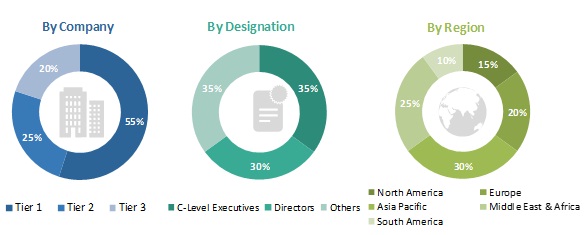

The supply side is characterized by a rising demand for contracts and agreements, and mergers & acquisitions among big players. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the microgrid control system market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying the various factors and trends from both the demand- and supply- sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the global microgrid control system market based on grid-type, ownership, component, end-user, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to major regions (North America, Europe, Asia Pacific, South America, and the Middle East & Africa)

- To profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as mergers & acquisitions, expansions, new product developments, and contracts & agreements in the field of market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Microgrid Control System Market

Can you elaborate on the current market penetration of microgrid control systems in a commercial application?